Technology

Future Scope of Gaming Monitors Market Expects to See

Gaming Monitors Market “ The global Gaming Monitors Market is experiencing significant growth, propelled by a confluence of factors including advancements in display technology, increasing demand from the burgeoning esports and gaming industry, and evolving consumer preferences for immersive and high-performance visual experiences. Key drivers include the development of higher refresh rate panels, faster response […]

Gaming Monitors Market

“

The global Gaming Monitors Market is experiencing significant growth, propelled by a confluence of factors including advancements in display technology, increasing demand from the burgeoning esports and gaming industry, and evolving consumer preferences for immersive and high-performance visual experiences. Key drivers include the development of higher refresh rate panels, faster response times, and improved color accuracy, all contributing to more fluid and visually appealing gameplay. Technological advancements such as HDR (High Dynamic Range), adaptive sync technologies like AMD FreeSync and NVIDIA G-Sync, and the integration of advanced features like curved screens and ultra-wide aspect ratios, are further fueling market expansion. Moreover, the growing accessibility of gaming hardware and software, coupled with the increasing popularity of online gaming platforms and streaming services, is expanding the addressable market. The gaming monitors market plays a critical role in supporting the broader gaming ecosystem, enabling developers to showcase their games at their full potential and empowering gamers to achieve peak performance and enjoyment. By pushing the boundaries of visual fidelity and responsiveness, gaming monitors not only enhance the gaming experience but also contribute to the overall advancement of display technology, impacting other sectors such as content creation, professional graphics, and even general-purpose computing. The market’s ongoing innovation is therefore essential in meeting the evolving demands of a diverse and rapidly expanding user base.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/1433

Market Size:

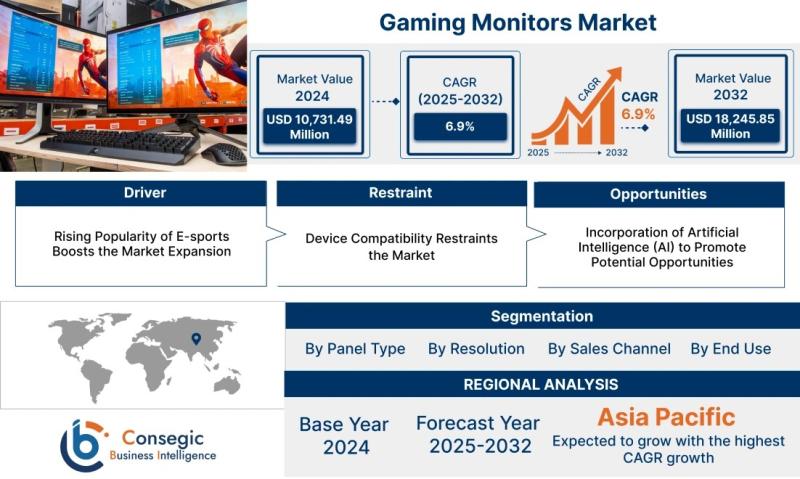

The Gaming Monitors Market size is estimated to reach over USD 18,245.85 Million by 2032 from a value of USD 10,731.49 Million in 2024 and is projected to grow by USD 11,276.45 Million in 2025, growing at a CAGR of 6.9% from 2025 to 2032.

Definition of Market:

The Gaming Monitors Market encompasses the production, distribution, and sales of display devices specifically designed and optimized for video gaming. These monitors are characterized by features that enhance the gaming experience, such as high refresh rates (typically 120Hz or higher), low response times (often 1ms to 5ms), adaptive synchronization technologies (like FreeSync and G-Sync) to eliminate screen tearing, and high resolutions (Full HD, QHD, and 4K).

Key components within this market include:

Products: Various types of gaming monitors, differentiated by panel technology (TN, IPS, VA, OLED), resolution, screen size, aspect ratio (standard, ultrawide), and features like curved displays, HDR support, and built-in speakers.

Services: Related services include warranty, technical support, and after-sales services provided by manufacturers and retailers.

Key Terms:

Refresh Rate: The number of times per second the monitor redraws the image on the screen, measured in Hertz (Hz). Higher refresh rates result in smoother motion.

Response Time: The time it takes for a pixel to change from one color to another, measured in milliseconds (ms). Lower response times reduce motion blur.

Adaptive Sync: Technologies like FreeSync and G-Sync that synchronize the monitor’s refresh rate with the graphics card’s output to eliminate screen tearing and stuttering.

Resolution: The number of pixels displayed on the screen, affecting image sharpness and detail (e.g., Full HD, QHD, 4K).

Panel Technology: Different types of LCD panels (TN, IPS, VA, OLED) offering varying levels of color accuracy, viewing angles, and response times. Each panel type has its own advantages and disadvantages for gaming applications.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/1433

Market Scope and Overview:

The Gaming Monitors Market’s scope spans across various technologies, applications, and industries, all centered around providing optimal visual experiences for gamers. The market encompasses a wide range of display technologies, from traditional LCD panels (TN, IPS, VA) to emerging OLED displays. Applications include PC gaming, console gaming, esports, and related activities like game streaming and content creation. The industries served include gaming hardware manufacturers, retailers, esports organizations, and the broader gaming community. The market’s reach extends beyond consumer electronics, influencing the development of display technologies in other sectors.

The gaming monitors market is crucial in the context of global trends such as the increasing popularity of esports, the growing demand for immersive entertainment experiences, and the convergence of gaming and other forms of digital content consumption. As esports continues to gain mainstream recognition and attract larger audiences, the demand for high-performance gaming monitors will continue to rise. Moreover, the trend towards higher resolutions, faster refresh rates, and more immersive display technologies aligns with broader consumer preferences for enhanced visual experiences across various applications, including movies, TV shows, and virtual reality. The market also contributes to the development of innovative display technologies that can be applied to other industries, such as healthcare, education, and industrial design. Therefore, the gaming monitors market plays a significant role in shaping the future of display technology and influencing the evolution of the digital entertainment landscape.

Top Key Players in this Market

Acer Inc (Taiwan) Asus (Taiwan) Lenovo (Hong Kong) Dell (US) Samsung Electronics (South Korea) Phillips (Netherlands) HP (US) Alienware (US) AOC (Taiwan) GIGABYTE (Taiwan) LG (South Korea)

Market Segmentation:

The Gaming Monitors Market is segmented based on several key factors. By Panel Type: Twisted Nematic (TN) panels offer fast response times but may have inferior color accuracy and viewing angles. In-Plane Switching (IPS) panels provide better color accuracy and viewing angles but may have slower response times than TN panels. Vertical Alignment (VA) panels offer a compromise between TN and IPS panels, with good contrast ratios and viewing angles. OLED (Organic Light-Emitting Diode) panels provide excellent contrast ratios, color accuracy, and response times, but are generally more expensive. By Resolution: Full HD (1920×1080) is the standard resolution for gaming, offering a balance between performance and visual quality. QHD (2560×1440) provides a sharper image than Full HD and is becoming increasingly popular among gamers. 4K (3840×2160) offers the highest level of detail and visual clarity, but requires more powerful hardware to run games smoothly. By Sales Channel: Online Retail is a significant channel as customers enjoy shopping online. Specialty Stores is a great options for those who want to check product physically. Enterprises is a B2B channel and Others channel includes small retail stores. By End-User: Gaming Professionals such as esports player demands high-end gaming monitors while Casual Gamers requires budget-friendly gaming monitors. Content Creators focuses on color accuracy and Others includes normal gamers.

Market Drivers:

Technological Advancements: Continuous innovation in display technology, such as higher refresh rates, faster response times, and improved color accuracy, drives demand for gaming monitors.

Growing Esports Industry: The increasing popularity of esports and competitive gaming fuels the need for high-performance monitors that provide a competitive edge.

Increasing Disposable Incomes: Rising disposable incomes in emerging markets enable more consumers to afford gaming monitors and other gaming peripherals.

Demand for Immersive Gaming Experiences: Gamers seek more immersive and visually appealing gaming experiences, driving demand for monitors with features like curved screens, ultra-wide aspect ratios, and HDR support.

Accessibility of Gaming Hardware and Software: The growing accessibility of gaming hardware and software, coupled with the increasing popularity of online gaming platforms and streaming services, is expanding the addressable market.

Market Key Trends:

Adoption of Higher Refresh Rate Panels: Demand for monitors with refresh rates of 144Hz, 240Hz, and even 360Hz is increasing, as gamers seek smoother and more responsive gameplay.

Shift Towards Higher Resolutions: The adoption of QHD and 4K gaming monitors is growing, driven by the desire for sharper and more detailed visuals.

Integration of Adaptive Sync Technologies: Adaptive sync technologies like AMD FreeSync and NVIDIA G-Sync are becoming increasingly common in gaming monitors, as they eliminate screen tearing and stuttering.

Rise of OLED Gaming Monitors: OLED panels are gaining traction in the gaming monitor market, offering superior contrast ratios, color accuracy, and response times compared to traditional LCD panels.

Increasing Popularity of Curved and Ultrawide Monitors: Curved and ultrawide monitors provide a more immersive gaming experience, and their popularity is growing among gamers.

Market Opportunities:

Development of More Affordable OLED Gaming Monitors: Making OLED technology more accessible to a wider range of gamers could significantly boost market growth.

Innovation in Adaptive Sync Technologies: Further development and refinement of adaptive sync technologies could lead to even smoother and more responsive gameplay.

Integration of Advanced Features like AI: Integrating artificial intelligence (AI) to optimize monitor settings based on game type and user preferences could enhance the gaming experience.

Expansion into Emerging Markets: Targeting emerging markets with affordable and feature-rich gaming monitors could unlock significant growth opportunities.

Creating monitors dedicated to Console Gaming: With new generation console games with impressive graphics create monitors especially built for them.

Market Restraints:

High Initial Costs: High-end gaming monitors, particularly those with advanced features like OLED panels and high refresh rates, can be expensive, limiting their accessibility to some consumers.

Technological Limitations: Certain display technologies, such as OLED, may be susceptible to burn-in or image retention, which could deter some potential buyers.

Competition from Other Display Devices: Gaming monitors face competition from other display devices, such as TVs and virtual reality headsets, which offer alternative gaming experiences.

Supply Chain Disruptions: Disruptions to the global supply chain can impact the availability and pricing of gaming monitors.

Dependence on Graphics Card Performance: High-resolution and high-refresh-rate gaming monitors require powerful graphics cards to deliver optimal performance, which can add to the overall cost of a gaming setup.

Market Challenges:

The Gaming Monitors Market faces several significant challenges that could impact its growth trajectory. One primary challenge is the continuous need for innovation to meet the ever-increasing expectations of gamers. As gaming technology evolves, gamers demand displays with higher resolutions, faster refresh rates, and lower response times. Meeting these demands requires significant investments in research and development, as well as the adoption of new manufacturing processes. Another challenge is the increasing competition in the market. The entry of new players and the expansion of existing players’ product portfolios are intensifying competition and putting pressure on prices. This can make it difficult for smaller manufacturers to compete and may lead to consolidation in the market.

Furthermore, the market faces challenges related to supply chain disruptions and component shortages. Fluctuations in the availability and pricing of key components, such as display panels and semiconductors, can impact the production costs and profitability of gaming monitor manufacturers. These disruptions can be caused by factors such as geopolitical events, natural disasters, and changes in government regulations.

Another challenge is the need to address environmental concerns related to the production, use, and disposal of gaming monitors. Manufacturers are under increasing pressure to adopt sustainable manufacturing practices, reduce energy consumption, and minimize electronic waste. This requires investments in green technologies and the implementation of responsible recycling programs.

Finally, the market faces challenges related to consumer awareness and education. Many gamers are not fully aware of the benefits of high-performance gaming monitors and may be reluctant to invest in them. Manufacturers need to educate consumers about the features and benefits of gaming monitors and how they can enhance the gaming experience. This requires effective marketing and communication strategies, as well as partnerships with gaming influencers and esports organizations.

Market Regional Analysis:

The Gaming Monitors Market exhibits varying dynamics across different regions due to factors like economic conditions, gaming culture, and technological infrastructure. North America and Europe are established markets with high disposable incomes and a strong gaming culture, driving demand for high-end gaming monitors. Asia-Pacific is a rapidly growing market, fueled by the increasing popularity of esports and the growing middle class in countries like China and India. The market in Latin America and the Middle East & Africa is relatively smaller but is expected to grow at a faster pace in the coming years, driven by increasing internet penetration and the growing adoption of gaming consoles and PCs.

Each region has its unique characteristics. For instance, North America and Europe are characterized by a preference for high-end gaming monitors with advanced features and higher resolutions. Asia-Pacific is witnessing strong demand for affordable gaming monitors with good performance and features. Latin America and the Middle East & Africa are primarily driven by price-sensitive consumers who seek value for money.

The competitive landscape also varies across regions. In North America and Europe, the market is dominated by established brands. In Asia-Pacific, there is a mix of established brands and local players. In Latin America and the Middle East & Africa, the market is fragmented with a large number of small players.

Frequently Asked Questions:

What is the projected growth of the Gaming Monitors Market?

The Gaming Monitors Market is projected to grow at a CAGR of 6.9% from 2025 to 2032.

What are the key trends in the Gaming Monitors Market?

Key trends include the adoption of higher refresh rate panels, the shift towards higher resolutions, and the integration of adaptive sync technologies.

What are the most popular Gaming Monitors types?

Monitors with IPS panels, 144Hz or higher refresh rates, and QHD or 4K resolutions are among the most popular types.

Follow Us on:

https://www.linkedin.com/company/deeptech-news/

https://www.linkedin.com/company/insights-futures/

https://www.linkedin.com/company/market-techpulse/

https://www.linkedin.com/company/market-radar-report/

https://www.linkedin.com/company/surveypulse-trends/

https://www.linkedin.com/company/market-insight-digest/

https://www.linkedin.com/company/diamonds-market-research-analytics/

https://www.linkedin.com/company/diamonds-business-intelligence-consulting/

https://www.linkedin.com/company/data-grid25/

https://www.linkedin.com/company/campaign-insight-grid/

https://www.linkedin.com/company/novaedge-market-consulting/

https://www.linkedin.com/company/data-craft-studio/

https://www.linkedin.com/company/searchsavvy-solutions/

https://www.linkedin.com/company/optisphere-seo/

https://www.linkedin.com/company/stratos-edge-consulting/

https://www.linkedin.com/company/news-insight/

https://www.linkedin.com/company/tech-disrupts-insight/

https://www.linkedin.com/company/tech-network25/“

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra – 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web – https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn – https://www.linkedin.com/company/consegic-business-intelligence/

YouTube – https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook – https://www.facebook.com/profile.php?id=61575657487319

X – https://x.com/Consegic_BI

Instagram – https://www.instagram.com/cbi._insights/

This release was published on openPR.

Technology

LADbible co-founder Arian Kalantari launches Plus1 Assembly

LADbible co-founder Arian Kalantari is launching Plus1 Assembly, a global innovation agency designed for brands that want to lead culture, not follow it. United by a shared sense of deep frustration with the legacy agency model, the new agency’s co-founders have designed Plus1 to be the agency they all wished existed: agile, adaptive and engineered […]

LADbible co-founder Arian Kalantari is launching Plus1 Assembly, a global innovation agency designed for brands that want to lead culture, not follow it.

United by a shared sense of deep frustration with the legacy agency model, the new agency’s co-founders have designed Plus1 to be the agency they all wished existed: agile, adaptive and engineered for results.

While most agencies are still built around old structures that leave them fragmented and backfooted, Plus1 has a new operating model that helps brands grow by combining creative firepower, real-time intelligence to get ahead of culture and AI-powered systems to deliver measurable commercial impact.

All projects run in clearly defined sprints, each focused on actionable insights, instead of rigid retainers that tie clients into out-dated strategies.

The new agency has secured a £5m backing from Simba Investments and launches with clients including sports, tech, and gaming company Rezzil; sports media company The Stomping Ground; and AI-powered tech consulting and delivery company CodeBlaze. It has also acquired Layfe, a strategic AI consultancy, which will help further power its work shaping and building tomorrow’s leading brands.

Plus1 Assembly is led by four co-founders with deep industry credentials:

*Arian Kalantari, Co-founder – former Co-founder of LADbible, one of the world’s biggest youth media networks and part of global digital entertainment business LBG Media.

*Jax Davey, Co-founder and CEO – former CEO of Nuevo, a creative agency known for promoting industry standards on purpose, sustainability and innovation.

(Kalantari (right) and Davey,co-founders)

(Kalantari (right) and Davey,co-founders)

*Lee Humphreys, Co-founder – former CEO of HH Global Creative + Digital, where he scaled global brand operations across FMCG, retail and tech.

*Jake Brocklesby Co-founder – is Founder and CEO of Simba Investments, a venture capital firm with $170m+ assets under management.

The Plus1 offering is built around three specialist hubs:

Halo: A live cultural intelligence system that cuts through the chaos of Reddit threads, Twitch streams, TikTok trends and conversation. It doesn’t just track where culture is going, it tells brands when to act, and how.

Layfe: An AI consultancy that powers business growth through intelligent AI and automation systems. With deep expertise in business transformation, Layfe sits at the intersection of strategy and technology.

Rise: An insight-led investment arm backing early-stage companies with capital, infrastructure, and access to Plus1’s network. Rise doesn’t just invest – it builds.

Plus1 clients can engage with any or all these hubs depending on their goals; and can expect workflows and automations designed to enable quality at pace and scale.

Curated squads of talent are assembled for each client according to the particular business challenge being addressed – and designed to deliver the best outcome.

Clients also benefit from built-in accountability and focus on sustainable growth. Individually set up Halo Programmes provide clients with access to their own insights and KPIs that will positively impact brand value.

To support its launch, Plus1 Assembly has created a social film about how the unreality of the AI-powered world in which we now live creates significant opportunities for brands with substance, value and authenticity to grow in faster, newer, smarter ways. It is also running a sticker ‘drop’ campaign around London poking fun at outdated marketing thinking and tactics.

“The market needs a new type of business. For too long, agencies have been built around old structures and misaligned incentives and chase culture from behind,” says Arian Kalantari, Plus1 Assembly Co-founder. “Jax has the vision for what will work now. So, I’ve joined with him to help define a new world where technology meets creativity, all underpinned by a commercial model that shares success with our clients. We’re not doing everything; we’re doing what works.”

“In the old world, if you believed social media was the key to growth you’d hire a social media agency. But with AI reshaping how people search and new platforms changing brand discovery, markets are shifting fast and many of the old ways of doing things no longer make sense,” adds Jax Davey, Plus1 Assembly Co-founder and CEO. “Today, we’re in a place where strategy needs to evolve. Despite this, a lot of brands are locked into a rigid model built for yesterday. Plus1 is different. We bring in the right capabilities at the right time. We stay fluid and responsive to what our clients actually need in a world that’s changing fast.”

Technology

Guy Bar on Hygear’s Omni-Channel Journey in Connected Fitness

The landscape of personal wellness is rapidly evolving. Connected fitness hardware is moving from a niche market to a mainstream phenomenon. Consumers are increasingly seeking integrated experiences that blend the physical and digital realms. Guy Bar, a globally recognized entrepreneur and visionary product innovator, stands at the forefront of this shift. As the founder and […]

The landscape of personal wellness is rapidly evolving. Connected fitness hardware is moving from a niche market to a mainstream phenomenon. Consumers are increasingly seeking integrated experiences that blend the physical and digital realms.

Guy Bar, a globally recognized entrepreneur and visionary product innovator, stands at the forefront of this shift. As the founder and CEO of Argox and Habeats by Hygear, he has redefined the intersection of technology and physical performance through groundbreaking smart fitness products. His strategic success in omni-channel retail adoption is notably exemplified by Hygear’s partnerships with major retailers like Best Buy and Dick’s Sporting Goods.

These collaborations featured Hygear’s connected fitness devices prominently in both physical stores and online platforms. Guy Bar focused on integrating in-store demonstrations with the HyfitGear App’s personalized coaching features, aiming to provide a seamless customer experience across channels.

This approach not only boosted Hygear’s visibility and global reach but also fostered long-term customer engagement. It turned initial interactions into sustained online subscriptions and drove the widespread adoption of connected fitness technology.

Guy Bar is a pioneer in AI-powered fitness technology, with its ventures leaving a footprint in over 30 countries. His leadership has been instrumental in transforming these ventures into industry-leading brands celebrated at major global fitness and tech events. He played a key role in launching smart resistance training tools now used by elite athletes, rehabilitation professionals, and everyday consumers seeking high-performance outcomes.

His companies have secured strategic partnerships with premier retailers and have raised over $1 million in revenue, proving their market viability and international appeal. Beyond fitness, Guy Bar also brings deep expertise in strategic business development, investment negotiation, and scaling operations across multiple industries. He serves as Chief Strategy Officer at Afik Group, where he drives corporate growth and cross-sector innovation.

Fluent in English and Hebrew, Guy Bar is not only a serial entrepreneur but also a respected thought leader shaping the future of fitness technology and smart wellness on a global scale. His work with Hygear, often highlighted in publications like iMore and Garage Gym Reviews, underscores his impact.

The connected fitness industry has seen exponential growth, particularly as consumers demand more personalized and accessible workout solutions. This market, which includes smart exercise equipment, wearables, and fitness apps, thrives on innovation and the ability to meet users where they are. Omni-channel retail—providing a unified customer experience across online and offline touchpoints—has become crucial.

For brands like Hygear, this means not just selling a product, but offering an ecosystem that supports the user’s fitness journey comprehensively. This support extends from initial purchase through to daily engagement and long-term results. The challenge and opportunity lie in seamlessly blending the convenience of e-commerce with the tangible benefits of physical retail and the continuous engagement of a digital platform.

Retail Partnership Motivations

The decision to collaborate with established retail giants was a strategic move for Hygear. It aimed at accelerating market penetration and building brand legitimacy in the competitive connected fitness sector. For Guy Bar, these partnerships were pivotal in democratizing access to smart fitness technologies.

He explains, “At Hygear, our mission has always been to democratize smart, personalized fitness to everyone—anywhere, anytime. To achieve that, we needed to reach people not just online, but where they already shop.” This philosophy underscores the drive to make sophisticated fitness solutions more mainstream.

The impact of aligning with names like Best Buy and Dick’s Sporting Goods extended beyond mere distribution. “Partnering with retail giants like Best Buy and Dick’s Sporting Goods gave us instant credibility and nationwide reach,” Guy Bar notes. “These partnerships allowed us to bring connected fitness out of the niche tech and wellness circles and into the mainstream.”

He further emphasizes the significance of this validation: “For me, it wasn’t just about distribution—it was about validation. It signaled that our innovation was not only technologically advanced but also commercially viable and in demand.”

This recognition from major retailers provided a powerful platform for Hygear to scale its vision globally, confirming that the market was ready for its advanced yet accessible fitness solutions. The presence in such stores can significantly boost consumer trust and perceived product quality.

Online Retail Integration and Challenges

Hygear’s strategy for its partnerships with Best Buy and Dick’s Sporting Goods was decisively focused on leveraging the power of e-commerce. Guy Bar recognized the efficiency and scalability of online channels from the outset.

“Our partnerships with Best Buy and Dick’s Sporting Goods were focused entirely on online distribution,” he states. “From the start, we recognized that e-commerce was the fastest path to scale and reach.”

This digital-first approach meant concentrating efforts on optimizing the online presentation of Hygear’s offerings. It avoided heavy investment in physical retail displays.

The primary challenge lay in translating a highly interactive, technology-driven product into a compelling online narrative. This was especially true without the benefit of in-person demonstrations.

Guy Bar elaborates on this hurdle: “The main challenge was to bring a highly interactive, tech-driven product into a compelling online offering. We had to rethink how to educate and engage customers without in-person demos—so we leaned heavily on video content, app walkthroughs, and user testimonials to bring the technology to life online.”

This reliance on rich digital content was crucial for conveying the value and functionality of Hygear’s connected fitness experience through platforms like Best Buy Canada’s blog, where the product was featured. Effectively educating consumers online about complex products is a common challenge, as highlighted by discussions on marketing complex products and startup failure.

App-Enhanced Customer Experience

Even with an exclusively online sales strategy through major retailers, the HYGEAR App was central to delivering a rich and engaging customer experience. Guy Bar emphasizes the app’s transformative role: “While our sales with Best Buy and Dick’s Sporting Goods were exclusively online, the HYGEAR App played a key role in bringing the customer experience. It transformed our equipment from a static product into a smart, interactive fitness solution.” This transformation was key to user adoption and long-term engagement.

The app’s personalized coaching features were instrumental in enhancing this experience. It provided users with tailored guidance and real-time feedback. “Personalized coaching, real-time feedback, and adaptive workout plans helped users stay engaged and see faster results,” Guy Bar explains.

He further highlights the competitive advantage this offered: “This level of customization not only improved retention but also helped us stand out in a crowded market, giving customers a connected experience that felt tailored to their goals from day one.” The focus on a personalized journey, as detailed in reviews of the Hyfit Gear 1 Home Gym System, helped bridge the gap often felt in purely online transactions for experiential products. The ability of fitness apps to offer personalized plans is a significant factor in the growth of the fitness app market.

Customer Journey Consistency and Loyalty

Maintaining a consistent customer journey was paramount for Hygear, especially given its digital sales focus. This consistency spanned every interaction point. It started from the initial product discovery on retail partner websites to the unboxing experience and subsequent engagement with the app.

Guy Bar underscores this holistic approach: “Since our sales were digital, consistency meant aligning every part of the online journey—from product pages to unboxing to the in-app experience. We focused on clear messaging, seamless onboarding, and personalized app features that deliver immediate value.”

This commitment to a cohesive experience directly impacts user trust and long-term engagement. “This consistency builds trust, reduces friction, and keeps users engaged over time,” Guy Bar states.

He connects this to tangible outcomes: “When customers feel supported and see real results, it drives both loyalty and long-term retention.” Research consistently shows that a consistent customer journey is a key driver of customer satisfaction and loyalty statistics. For a technology-driven product like Hygear, ensuring that the digital touchpoints are intuitive and supportive is crucial for building lasting customer relationships.

Omni-Channel’s Role in Fitness Success

Guy Bar firmly believes in the strategic importance of omni-channel approaches for success in the competitive connected fitness market. While Hygear’s initial retail partnerships were digitally focused, the broader vision encompasses meeting users across various platforms. “Omni-channel strategies are key for building integrity and visibility in a competitive space like connected fitness,” he asserts.

“Even though Hygear focused on digital sales, partnering with major retailers gave us brand credibility and access to a broader audience.” This highlights the multifaceted benefits of an omni-channel presence, extending beyond direct sales to brand building.

The long-term vision for Hygear involves a flexible and user-centric approach to distribution and engagement. Guy Bar elaborates, “Long-term, success depends on meeting users wherever they are—whether that’s online, in-app, or through future retail experiences. The key is delivering a consistent, high-value experience across every channel, so the brand feels unified and user-focused at every touchpoint.”

This perspective aligns with broader trends in omnichannel fitness marketing, where a seamless integration of channels is essential for reaching and retaining customers in a digital-first world. The ability to provide a cohesive experience across channels is a hallmark of successful omnichannel marketing strategies.

Evaluating Strategy and KPIs

Given Hygear’s digital-first strategy with its retail partners, the metrics for success were carefully chosen. They needed to reflect both product performance and user engagement within the digital ecosystem.

Guy Bar details the key performance indicators (KPIs) they monitored: “Since our strategy was fully digital, we tracked KPIs that reflected both product performance and user engagement. Key metrics included customer acquisition cost (CAC), conversion rates on retail partner platforms, app downloads post-purchase, user retention, and average session frequency.”

These metrics provide a comprehensive view of the customer journey, from initial acquisition to ongoing interaction. Beyond these quantitative measures, qualitative feedback also played a crucial role in assessing product-market fit and overall strategy effectiveness. “We also monitored customer reviews and return rates closely—they’re strong indicators of product-market fit,” Guy Bar notes.

“Ultimately, success was measured by how well we turned one-time buyers into long-term, engaged users of the HYGEAR ecosystem.” Tracking metrics like CAC for gym businesses is vital for understanding marketing efficiency and profitability in the fitness industry.

Global Reach and Expansion Plans

The strategic partnerships with major U.S. retailers like Best Buy and Dick’s Sporting Goods served as a crucial launchpad for Hygear’s global ambitions. The credibility gained from these associations was instrumental in opening doors to international markets. Guy Bar explains, “Partnering with major U.S. retailers like Best Buy and Dick’s Sporting Goods gave Hygear instant credibility, which helped open doors with international distributors.”

“Seeing our products listed with trusted global retailers signaled quality and market validation, making it easier to negotiate with partners in Europe, Asia, and beyond.” This demonstrates how domestic success can be leveraged for international expansion.

Looking forward, Hygear plans to build on this foundation. The company intends to implement a more deeply integrated omni-channel strategy on a global scale. Guy Bar outlines the future direction: “Looking ahead, we plan to build on that foundation through a more integrated omni-channel strategy—combining digital marketplaces, localized distributor networks, and direct-to-consumer platforms.”

“The goal is to create a seamless global presence while tailoring the experience to local markets through content, partnerships, and tech integrations.” This approach reflects an understanding of the need for both global consistency and local adaptation, a key consideration as the connected fitness market grows internationally.

Advice for Fitness Tech Companies

Drawing from his experience with Hygear, Guy Bar offers valuable advice for other fitness technology companies. This advice is aimed at those looking to successfully integrate their products into both physical retail spaces and online platforms to drive sustained consumer interest and adoption. A clear and easily understandable value proposition is paramount.

“Focus on delivering a clear value proposition that’s easy to understand both in-store and online,” he advises. “Whether a customer sees your product on a shelf or a screen, they need to immediately think about what makes it different and how it improves their life.” This clarity is essential for cutting through the noise in a crowded market.

Beyond the initial purchase, Guy Bar emphasizes the importance of ongoing customer engagement and building a comprehensive ecosystem. “Also, invest early in customer education and post-purchase engagement, because adoption doesn’t end at checkout. Build an ecosystem around your product, not just hardware.”

He concludes with a reminder of the foundational elements of success: “And finally, strong retail partnerships can unlock scale, but credibility and retention come from delivering real results users can feel every day.” This counsel underscores that technology, while critical, must ultimately translate into tangible benefits and a supportive user experience to foster lasting adoption.

Guy Bar’s leadership at Hygear illustrates a forward-thinking approach to navigating the connected fitness market. By strategically leveraging online retail partnerships, prioritizing a sophisticated and personalized app experience, and maintaining a keen focus on customer journey consistency, Hygear has aimed to democratize smart fitness. Guy Bar’s insights reveal the critical interplay between technological innovation, strong retail collaborations, and a deep understanding of consumer needs.

As the fitness technology landscape continues its rapid evolution, the principles of delivering clear value, fostering an engaged ecosystem, and ensuring accessibility across multiple channels will remain paramount. These factors are crucial for brands striving for sustained growth and impact on a global scale.

Technology

Apple’s Formula 1 Bid Plays Long-Game For TV Sports Rights

ABU DHABI, UNITED ARAB EMIRATES – DECEMBER 08: Tim Cook, CEO of Apple, walks on the grid prior to … More the F1 Grand Prix of Abu Dhabi at Yas Marina Circuit on December 08, 2024 in Abu Dhabi, United Arab Emirates. (Photo by Mark Thompson/Getty Images) Getty Images Apple TV+ will likely win Formula […]

ABU DHABI, UNITED ARAB EMIRATES – DECEMBER 08: Tim Cook, CEO of Apple, walks on the grid prior to … More

Getty Images

Apple TV+ will likely win Formula 1’s U.S. broadcast rights, according to a report from The Athletic.

That fact isn’t so surprising given the backdrop of Apple Original Films’ F1: The Movie racing to theaters this summer. But the rumored (per The Athletic) $120-150 million per year bid is still a significant step up from ESPN’s current $75-90 million rate, and indicative of what Apple’s willing to pay in its slow-but-steady quest to reshape sports rights.

Apple’s Sports Approach

To-date, Apple hasn’t been as splashy as streaming cohorts like Amazon Prime Video and Netflix when it comes to sports. But its investments have still generated attention via their perceived niche focus.

Right now, Apple TV+ airs all Major League Soccer matches as part of a $2.5 billion, 10-year deal. The service also airs Friday Night Baseball for $85 million per.

Both deals could be evaluated as potential overpays relative to what legacy media companies were willing to spend on those rights. But that’s an understood part of doing business anytime you’re the perceived “upstart” in a space. You’re paying more to become a proven commodity.

Where Apple’s zigged a bit in that regard while Amazon Prime and Netflix has zagged, though, is in regard to what the service is paying those larger sums for.

There’s little data out there around Apple TV+ subscribers or audience, but it’s fair to guess that Friday Night Baseball’s audience is no more than half of Fox’s Saturday night MLB slate (an average of 2.14 million viewers this season). In December, The Guardian reported that the 2024 MLS Cup Final – between the Los Angeles Galaxy and New York Red Bulls – had just 65,000 viewers on Apple TV+.

Assuming Formula 1 would see a dropoff on Apple TV+ as well from its 1.3 million-viewer average on ESPN this season, it’s clear that the service is aiming to hone its sports chops with niche events in a similar fashion to its more niche scripted programming approach. And while the returns may be questionable for Apple today from an audience perspective, the increased media revenues can help fuel growth for these sports that makes the investments a net win in the end.

FORT LAUDERDALE, FLORIDA – FEBRUARY 22: A detailed view of the Apple TV and MLS logo on an Inter … More

Getty Images

Growing Investment Value Over Time

For instance, by outbidding any other suitors for MLS, Apple injected significant value into the league and its clubs, helped MLS acquire more talent and ultimately, improved the quality of the product. In February 2025, Forbes valued three different MLS clubs at over $1 billion (and 25 at $500 million or more), and that number is likely to climb. By the end of the original 10-year deal, MLS rights may very well be worth at least what Apple paid for them – especially as sports increasingly dominate live TV.

Formula 1 is in a different boat globally, as MLB is both globally and domestically, but both can still strategically leverage the extra dollars from Apple TV+. For Formula 1, it comes in the form of growing and eventizing its existing U.S. investments (including three races in the county now). For MLB, the Apple TV+ revenues help offset some of the league’s ongoing regional TV struggles.

The proof’s already there that the MLB investment, in particular, is already worth it for both sides. Recent reports from Sports Business Journal indicate that Apple is among the leading suitors to land some of the TV package currently with ESPN. If the Friday Night Baseball deal wasn’t paying dividends for baseball and/or Apple was truly bothered by the “low” audience relative to major live sports, they wouldn’t be interested in allocating even more money there.

Next Up For Apple

The end-goal for Apple, then, becomes how to eventually turn all of this sports interest into more subscribers and more streaming-related revenues.

Now, Apple doesn’t necessarily “need” its TV+ venture to be profitable given the size and success of the company overall.

The most cynical view of Apple TV+ is that it’s a nice-to-have for Apple; somewhere for the company to spend money that helps it sell some devices, get invites to entertainment and sports industry conversations, and just add another potential revenue stream.

But if it perfects its sports broadcasts as a way to draw in key audiences, leverages those into an increased footprint for scripted shows, and really turns on the potential power of its targeted advertising? There’s a potentially exciting long game here for the streaming service that truly delivers on (and profits from) the idea that it’s just become “expensive NBC.”

Whether the sports and entertainment space are ready for that future is a different story. The vision is starting to come together, though, despite the immediate doubts on Apple’s cadre of sports versus the bigger live TV picture.

Technology

XO Life Appoints Sergey Vasilyev as New Chief Technology Officer

MUNICH, July 15, 2025 /PRNewswire/ — XO Life, one of Europe’s leading digital health platforms, is pleased to announce the appointment of Sergey Vasilyev as its new Chief Technology Officer (CTO) as of June 2025. XO Life logo Sergey brings extensive experience from the global health tech space. Prior to joining XO Life, he served […]

MUNICH, July 15, 2025 /PRNewswire/ — XO Life, one of Europe’s leading digital health platforms, is pleased to announce the appointment of Sergey Vasilyev as its new Chief Technology Officer (CTO) as of June 2025.

Sergey brings extensive experience from the global health tech space. Prior to joining XO Life, he served as VP of Engineering at Flo Health, the world’s most downloaded women’s health app with over 80 million monthly active users. Since joining Flo in 2019, he played a critical role in scaling the company from a small team to a triple-digit workforce, helping it become the first femtech unicorn. In 2024, Flo closed a $200 million Series C round, and under Sergey’s leadership, the platform expanded globally while innovating in personalized content and data-driven user insights.

His expertise in scalable architecture, machine learning, big data, and international platform growth makes him a strong fit for XO Life’s mission. As CTO, he will lead the development and expansion of XO Life’s brite™ meta-platform, which delivers digital therapy and product support to patients across a broad spectrum of conditions.

“I joined XO Life because I believe in its potential to transform how patients are supported across treatments, medications, and health products,” says Vasilyev. “What Flo achieved in women’s health, XO Life can bring to the broader healthcare ecosystem — creating scalable, personalized support for millions.”

Dr. Friderike Bruchmann, Founder and CEO of XO Life, adds: “We’re thrilled to welcome Sergey to our leadership team. His experience in building globally scaled health platforms and personalized user experiences will help take XO Life to the next level. Together, we aim to make XO Life the leading digital companion for patients around the world.”

About XO Life:

XO Life’s brite™ platform serves as a shared digital companion for patients across all types of therapies — from prescription drugs to over-the-counter and natural products. It allows manufacturers to offer branded, personalized digital support within a unified app. Patients receive verified information, tailored insights, and expert guidance without needing a separate app for each product.

XO Life is the market leader in Germany, partnering with 30+ manufacturers across 40+ indications. The platform is available globally and is redefining digital patient engagement at scale.

www.xo-life.com

XO Life on LinkedIn

View original content to download multimedia:https://www.prnewswire.com/news-releases/xo-life-appoints-sergey-vasilyev-as-new-chief-technology-officer-302504706.html

SOURCE XO Life

Technology

NBCU Says Surge in Sports Ads Boosts Upfront Sales Haul

People still want to watch sports on TV, and that means — at least for now — advertisers still need to spend on it. NBCUniversal said Tuesday that its new 11-year deal for NBA rights resulted in a 15% increase in “upfront” ad commitments across its core broadcast offerings of news, sports and entertainment, with […]

People still want to watch sports on TV, and that means — at least for now — advertisers still need to spend on it.

NBCUniversal said Tuesday that its new 11-year deal for NBA rights resulted in a 15% increase in “upfront” ad commitments across its core broadcast offerings of news, sports and entertainment, with a quarter of its NBA sponsors new to traditional linear TV. The Comcast-backed media conglomerate also said it saw “record sales commitments overall,” and “delivered its largest digital Upfront in history,” though it offered no estimates on the amount of volume it secured. The value of its commitments across its media holdings is expected to be in excess of $7 billion — a total NBCU last made public in 2022.

In the “upfront,” U.S. media companies vie to sell the bulk of their commercial inventory for their next cycle of programming, and there has been concern that tariff negotiations by the Trump White House might dampen Madison Avenue’s appetite to spend on TV. Traditional TV companies are also contending with the rise of digital giants such as YouTube, Netflix and Amazon’s Prime Video, along with other one-time upstarts.

NBCU moved early this year to win ad support for a massive cache of sports inventory tied to 2026 telecasts of the Milan Cortina Olympics, Super Bowl LX and the FIFA World Cup. NBC was asking for $7 million for a 30-second spot in the Super Bowl, according to people familiar with the sales process, and is likely sold out of much of its inventory tied to the gridiron classic.

Many of the company’s properties benefitted from the company’s sports-heavy offering. NBCU said its Peacock streaming service saw a 20% increase in volume, and now represents “nearly 1/3 of NBCUniversal’s total Upfront commitments.” The Telemundo Spanish-language network also saw new levels of volume, NBCU said, with ad revenue committed to next year’s Spanish-language World Cup telecast already exceeding the revenue for the previous World Cup with over 10 months until kickoff.”

“The response has been extraordinary, and we are incredibly grateful for our partners’ trust and collaboration,” said Mark Marshall, chairman of NBCU’s ad-sales and partnerships operations, in a prepared statement. “With a cross-platform strategy supercharged by cutting-edge technology, we’re proud to engage 286 million people monthly — setting a new standard and delivering the most successful Upfront in our company’s history.”

The upfront sports marketplace has been particularly “aggressive,” says one media buyer familiar with recent negotiations, with ad slots in many top events scheduled for the fourth quarter largely out of sale at many of the TV companies. This executive says demand was particularly intense for NFL inventory, with NBA interest heightened for digital games. The move from Warner to NBC, says this buyer, offers some complications, as advertisers may want to consider whether the new slates of games on broadcast will capture the bigger potential audience that tunes into the medium. This buyer suggested that most networks with NBA rights will likely have more inventory to sell, while media companies with NFL events — including Amazon’s “Black Friday” game stream or Netflix’s Christmas game — probably have less time on their hands.

Sports has been key to the ad-sales game so far this year. There is no other programming format that continues to dependably generate the large, simultaneous viewing audiences that advertisers and distributors crave. NBCU was likely able to use demand for its sports properties to generate sales and deals tied to other kinds of programming.

Indeed, the company revealed Tuesday that advertisers even contributed more money to the cable networks tied to Versant, the portion of NBCU that is expected to be spun off into a separate, publicly traded entity by Comcast later in 2025. The portfolio of networks tied to the new company, which include MSNBC, CNBC and USA, saw a nearly 10% increase “in clients investing in its brands,” NBCU said. In recent years, media companies have used cable properties, increasingly falling out of favor in the streaming era as more viewers stream dramas and comedies at times of their own choosing, as “sweeteners” in negotiations, giving favorable deals in order to secure better rates for sports and broadcast events.

Whether NBCU’s performance is indicative of the industry as a whole remains to be seen. A good chunk of its new upfront wealth — NBCU said it saw a 45% increase in ad commitments tied to sports programming — may simply be the result of a transfer of dollars once earmarked for Warner Bros. Discovery’s NBA schedule, which aired for years on TNT. Some portion of that money may also be coming from rivals that are more heavily dependent on cable.

NBCU disclosed that more of its advertising base is tied to new types of sales. The company said it saw an uptick in deals from small- and medium-sized advertisers that have typically not struck deals with media companies heavily reliant on national TV media. In the streaming era, these same companies can sell digital inventory that shows up in specific geographic regions or alongside viewers with specific interests or buying traits. Indeed, NBCU said nearly 60% of ad investments are being made against so-called “advanced audiences.” The company said its programmatic business — ads that rely on algorithms to snatch up specific kinds of inventory tied to the type of viewers an advertiser seeks — came to $1 billion.

Top categories included retail, restaurants, auto, travel and financial services, NBCU said, each of which increased ad commitments by about 12%. Movie and TV studios also played a significant role in the sales process.

Executives on both sides of the table say media companies have been able to win increases in certain kinds of CPMs, a measure of how much it costs for an ad to reach 1,000 viewers — a metric that is central in these discussions between media companies and advertisers. Sports ads were generating what has been estimated to be CPMs in the high-single-digit percentage range, while CPM increase were projected to be the low-single-digit percentage range for commercials tied to traditional linear broadcast. Some of the uptick in linear CPMs isn’t driven by a robust market, but by the fact that the networks have less traditional entertainment to sell and smaller audiences projected to watch what remains.

There have been some expectations that many of the media companies would agree to “rollbacks” in digital CPMs, owing to the introduction of massive amounts of streaming inventory from Amazon and Netflix, among other venues.

TV networks favor the upfront market because it allows them to build support for their programs well ahead of their debut. Still, the advertising bazaar has been tougher to navigate in recent years as more people gravitate to streaming video and other means of accessing their favorite programs, movies, news and sports events.

Ad commitments for the most recent cycle of primetime broadcast TV fell 3.5% in 2024’s upfront market, to $9.34 billion, according to Media Dynamics Inc., while commitments for primetime on cable tumbled 4.8%, to $9.065 billion. Meanwhile, ad commitments to streaming video hubs rose a noticeable 35.3%, hiking to $11.1 billion from $8.2 billion in the previous market. The amount committed to streaming video for the most recent TV season was greater than that devoted to primetime broadcast or primetime cable — a first for the industry.

Technology

Fitbit’s Charge 6 fitness tracker is at its lowest price ever at Walmart

The Fitbit Charge 6 is one of the best fitness trackers we’ve tested, and down to an all-time low price of $93 ($66.95 off) at Walmart. The deal includes a six-month subscription to Fitbit Premium, a service that includes guided workouts, a wellness report, and other perks, and usually costs $10 per month or $80 […]

The Fitbit Charge 6 is one of the best fitness trackers we’ve tested, and down to an all-time low price of $93 ($66.95 off) at Walmart. The deal includes a six-month subscription to Fitbit Premium, a service that includes guided workouts, a wellness report, and other perks, and usually costs $10 per month or $80 per year. You can get the Charge 6 for $99.95 ($60 off), along with the same six-month subscription, at Amazon.

The Charge 6 is the only fitness tracker under $200 with an FDA-cleared EKG reader, and it’s better at measuring your heart rate than its predecessor. It can also track your blood oxygen level, sleep, and activity. Fitbit made strides to reach feature parity with fitness smartwatches by adding Bluetooth compatibility with exercise equipment and an NFC chip to the Charge 6, which allows you to use Google Wallet. It also has apps for Google Maps and YouTube Music, so you can use those services without reaching for your phone.

Verge reviewer Victoria Song’s chief complaint with the Charge 6 was that enabling its always-on display reduced its battery life from seven days to two. You’ll also need to have an active Google account because Fitbit has migrated away from its own account system. For an in-depth view of the Charge 6, you can read our review.

Three more deals we think you’ll like

-

Technology3 weeks ago

Technology3 weeks agoPet fitness and wellness trends for a healthier and happier dog

-

College Sports3 weeks ago

College Sports3 weeks agoWAC to Rebrand to UAC, Add Five New Members in 2026

-

College Sports3 weeks ago

College Sports3 weeks agoA new era of Dickinson hockey begins behind the bench – The Dickinson Press

-

Motorsports2 weeks ago

Motorsports2 weeks agoWhy Cosmetics are Making Up for Lost Time in Women’s Sports

-

Health3 weeks ago

Health3 weeks agoFlorida assault survivor shares hope for change with new mental health law

-

Motorsports2 weeks ago

Motorsports2 weeks agoTeam Penske names new leadership

-

Sports7 days ago

Sports7 days agoNew 'Bosch' spin

-

Motorsports3 weeks ago

Motorsports3 weeks agoNASCAR This Week – Patriot Publishing LLC

-

Youtube2 weeks ago

Youtube2 weeks agoBREAKING: NBA MVP Shai Gilgeous-Alexander signs the RICHEST annual salary in league history

-

Sports1 week ago

Sports1 week agoE.l.f Cosmetics Builds Sports Marketing Game Plan Toward Bigger Goals