Wearable Inertial Sensors Market Size and Forecast 2025 to 2034

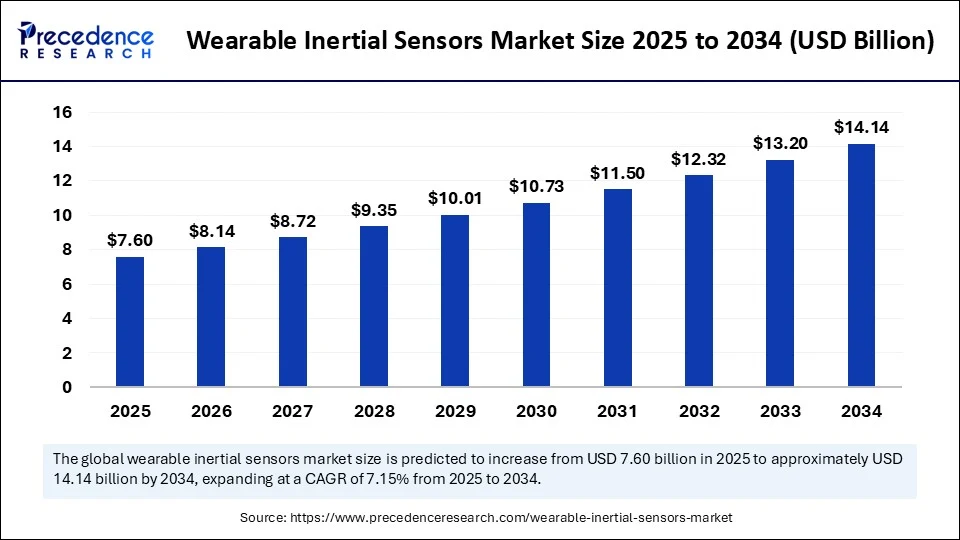

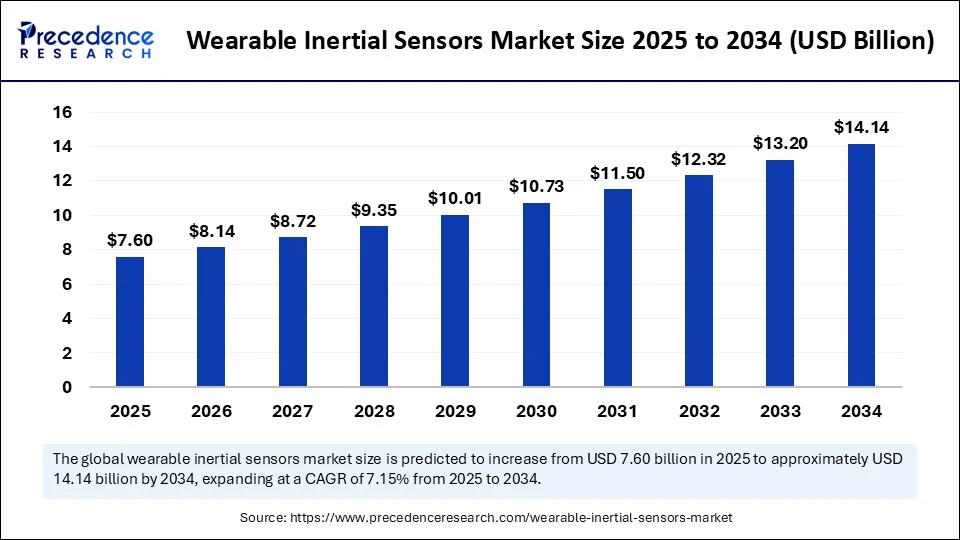

The global wearable inertial sensors market size was estimated at USD 7.09 billion in 2024 and is predicted to increase from USD 7.60 billion in 2025 to approximately USD 14.14 billion by 2034, expanding at a CAGR of 7.15% from 2025 to 2034. The growth of the market is attributed to the rising demand for fitness and health tracking devices, driven by increased health and wellness awareness. Ongoing advancements in sensor technologies are contributing to the market growth.

Wearable Inertial Sensors Market Key Takeaways

- In terms of revenue, the global wearable inertial sensors market was valued at USD 7.09 billion in 2024.

- It is projected to reach USD 14.14 billion by 2034.

- The market is expected to grow at a CAGR of 7.15% from 2025 to 2034.

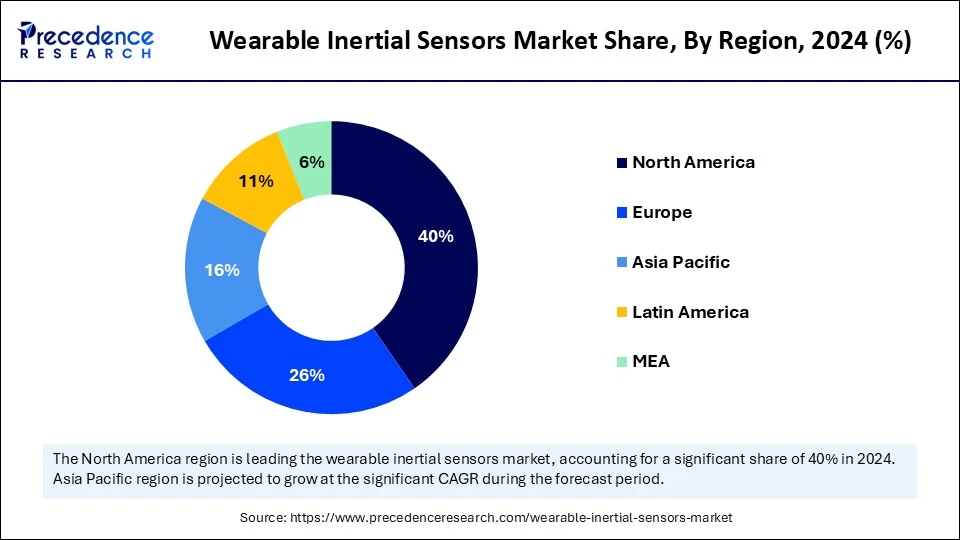

- North America dominated the global wearable inertial sensors market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By sensor type, the accelerometers segment held a major market share in 2024.

- By sensor type, the inertial measurement units (IMUs) segment is expected to grow at the highest CAGR between 2025 and 2034.

- By axis configuration, the 3-axis sensors segment contributed the largest biggest market share in 2024.

- By axis configuration, the 9-axis sensor (Accel + Gyro + Magneto) segment is expected to grow at a significant CAGR between 2025 and 2034.

- By connectivity, the wireless sensors (Bluetooth, Wi-Fi, ANT+) segment generated a highest market share in 2024.

- By connectivity, the wired sensors (USB, serial interfaces) segment will grow at a significant CAGR between 2025 and 2034.

- By application, the sports & fitness tracking segment captured the largest market share in 2024.

- By application, the elderly monitoring & fall detection segment is expected to expand at a significant compound annual growth rate (CAGR) between 2025 and 2034.

- By form factor, the wearable bands and watches segment generated the largest market share in 2024.

- By form factor, the sensor patches & clip-ons segment will expand at a significant CAGR between 2025 and 2034.

- By end-use sector, the consumer electronics segment accounted for major market share in 2024.

- By end-use sector, the industrial & occupational safety segment is expected to expand at a significant CAGR between 2025 and 2034.

How is AI Impacting the Wearable Inertial Sensors Market?

Artificial intelligence (AI) is significantly impacting the market for wearable inertial sensors by enhancing data analysis and providing more accurate activity tracking. Integrating AI algorithms into wearable inertial sensor devices is transforming various industrial applications, particularly healthcare. The demand for AI-powered wearable inertial sensors has increased due to their enhanced accuracy, efficiency, and personalization capabilities. AI algorithms can analyze a large amount of data, enhance accuracy by correcting errors, reduce noise, provide predictive analytics, and provide real-time feedback. AI-powered wearable inertial sensors provide significant advantages in early disease detection, health monitoring, and personalized treatment plans, making them an ideal option.

- In May 2025, STMicroelectronics launched the inertial measurement unit with embedded AI processing, LSM6DSV320X, for activity tracking and high-g impact measurements in a single and space-saving package. This device enables the full reconstruction of any event with exceptional accuracy, providing an enhanced user experience.

(Source: https://www.bisinfotech.com)

U.S. Wearable Inertial Sensors Market Size and Growth 2025 to 2034

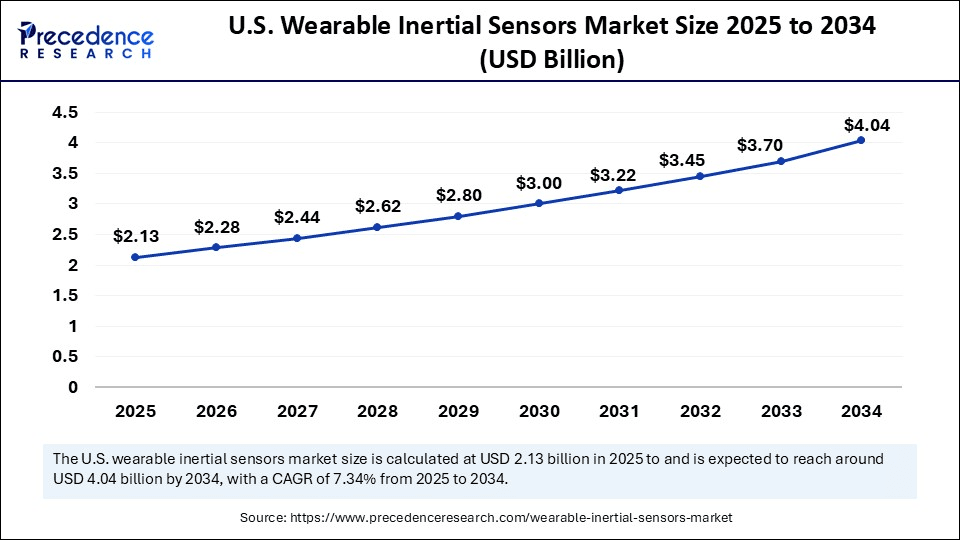

The U.S. wearable inertial sensors market size was exhibited at USD 1.99 billion in 2024 and is projected to be worth around USD 4.04 billion by 2034, growing at a CAGR of 7.34% from 2025 to 2034.

What Made North America the Dominant Region in the Wearable Inertial Sensors Market?

North America dominated the market for wearable inertial sensors in 2024, capturing the largest share, driven by robust technology infrastructure and substantial investments in boosting wearable device production. There is a high adoption of novel wearable technologies, including variable inertial sensors. The well-established healthcare sector, combined with the high adoption of smart consumer electronics, has bolstered the market. The region is home to a large number of medical device manufacturers, which drive innovation. The growing development of miniature, more efficient wearable inertial sensors is expected to ensure long-term market growth within the region.

The U.S. is a major player in the regional market, driven by its robust healthcare, automotive, consumer electronics, and entertainment & gaming sectors. The U.S. is a hub of technological advancements, driving innovations, developments, and the adoption of integrated wearable inertial sensors in AI, VR, AR, and internet of things (IoT) technologies. The country has a high adoption rate of novel wearable technologies, including wearable inertial sensors. The presence of key market players, such as Garmin, Fitbit, and Apple, is further contributing to market growth.

Asia Pacific Wearable Inertial Sensors Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the upcoming period. This is mainly due to the increased adoption of wearable devices and consumer electronics. The growing middle-class population and increasing disposable income are driving the adoption of wearable inertial sensors. The adoption of connected devices and the growing reliance on data-driven insights are also contributing to market expansion. Moreover, government initiatives such as Industry 4.0 and the rapid adoption of robotics and automation are fueling the demand for wearable inertial sensors.

China is a major player in the regional market, driven by a large consumer base for wearable technology, a strong manufacturing sector, and a strong emphasis on technological innovations. China is well-known for the production of cost-effective electronic devices, including wearable inertial sensors. The increasing production of smart electronics is driving the demand for MEMS (micro-electro-mechanical systems) and IMUs (inertial measurement units), thereby contributing to market growth. Moreover, government initiatives like “Make in China” are likely to foster market expansion.

India is emerging as a significant player in the market due to the rising middle-class population, disposable income, and government initiatives promoting digitalization. The rising adoption of convenient and innovative technologies, as well as health and fitness tracking devices, is driving the adoption of wearable inertial sensors. Moreover, the growing tech-savvy population and interest in wearable technologies support market growth.

Europe Wearable Inertial Sensors Market Trends

Europe is considered to be a significantly growing area. The region’s robust research and development ecosystem, along with its expanding healthcare industry, drives the market’s growth. There is rising adoption of wearable devices for fitness tracking and health monitoring, driven by the increased awareness of health and wellness. The trend of combining sensors with cutting-edge technologies, such as GPS, is gaining significant traction. Germany is a major player in the regional market. This is primarily due to its well-established automotive and aerospace sectors, which boosts demand for electronic components. The use of wearable inertial sensors in applications like autonomous and aircraft navigation has been increasing in Germany, contributing to market growth.

Market Overview

The wearable inertial sensors market consists of miniaturized motion-sensing components, primarily accelerometers, gyroscopes, and magnetometers, integrated into wearable devices for tracking body movement, posture, orientation, and activity levels. These sensors enable real-time monitoring and analysis in applications across healthcare, sports, rehabilitation, military, industrial safety, and consumer electronics. Wearable inertial sensors are key enablers of inertial measurement units (IMUs) and motion capture systems, supporting both standalone tracking and sensor fusion with GPS, EMG, or optical systems.

Awareness of health and fitness monitoring and tracking has increased, driving demand for smart wearable inertial sensor devices. The growing advancements in sensor technologies and the integration of cutting-edge technologies, such as AI and IoT, are creating significant opportunities for market growth. The healthcare industry is the major adopter of these devices. However, the growing use of inertial sensors as informative devices in the consumer electronics and automotive industries is boosting the growth of the market. Companies are investing heavily in the development of innovative sensors that are more efficient and effective, enabling them to demonstrate their market competitiveness.

Several Innovative Wearable Sensors have been demonstrated at CES 2025

| Company |

Innovative Sensors |

| Novosound Ultrasound |

Blood Pressure Monitor |

| Withings Omnia |

Health Scanner |

| Nutrix AG |

Cortisense |

| Aabo |

AaboRing Smart Ring Sensor |

| identifyHer |

Peri AI-enabled Tracker |

| FlowBeams |

BoldJet, At-home needle-free injector |

| Wis Medical |

Tedaid, a biometric monitoring device |

| STMicroelectronics |

ST1VAFE3BX bio-sensing chip |

What are the Major Factors Boosting the Growth of the Wearable Inertial Sensors Market?

- Growing Health Awareness: The demand for health and fitness monitoring devices has increased in recent years due to the increased awareness about health monitoring. The adoption of wearable inertial sensors is increasing for real-time health tracking.

- Growing Healthcare Adoption: The adoption of wearable inertial sensors has increased in the healthcare sector for remote patient monitoring, patient activity tracking, and disease detection, leading to more efficient and effective healthcare.

- Other Industrial Demands: The adoption of wearable inertial sensors is increasing in industries such as consumer electronics and automotive for innovative applications.

- Smartphone Penetration: The rapid use of smartphones and their integration with wearable devices are providing significant opportunities.

Market Scope

| Report Coverage |

Details |

| Market Size by 2034 |

USD 14.14 Billion |

| Market Size in 2025 |

USD 7.60 Billion |

| Market Size in 2024 |

USD 7.09 Billion |

| Market Growth Rate from 2025 to 2034 |

CAGR of 7.15% |

| Dominating Region |

North America |

| Fastest Growing Region |

Asia Pacific |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Sensor Type, Axis Configuration, Connectivity, Application, Form Factor, End-Use Sector, and Region |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Popularity of Wearable Devices

With the increasing awareness of health, wellness, and fitness, the adoption of wearable devices is on the rise, which is a major factor driving the growth of the wearable inertial sensors market. Inertial sensors are heavily embedded in smartwatches and fitness trackers, enabling the tracking of user activity, movement, and health metrics. Ongoing advancements in sensor technologies are enhancing accuracy and power efficiency, making them ideal for devices like smartwatches and fitness trackers. People are prioritizing the use of smartwatches and fitness tracker wearable devices for seamless tracking of their fitness, health monitoring, and sports performance. These devices are an excellent choice for enhancing user experiences and providing great accuracy and personalization.

Restraint

Concerns Over Data Privacy and Security

Concerns over data privacy and security, including data breaches, misuse of sensitive information, and unauthorized access, are restraining the growth of the wearable inertial sensors market. These sensors collect sensitive user data, which can lead to potential cyber security risks and hamper user trust. These devices require more robust data protection measures. Additionally, manufacturing industries are required to meet regular requirements, leading to complex and time-consuming launches of devices, which hampers market competition.

Opportunity

Growing Adoption in the Entertainment and Gaming Sectors

The adoption of wearable inertial sensors is increasing in the entertainment and gaming sectors to enhance immersive experiences and interaction. These sensors are used to enhance gaming controls and track players’ gestures, movements, and activities. The adoption of sensors with tracking capabilities for motion and orientation has increased in VR, AR, and other entertainment applications. The growth is gaining traction due to the increased use of AR and VR in the entertainment and gaming industry. The integration of wearable inertial sensors with smartwatches and fitness trackers is also enhancing entertainment and gaming experiences.

Sensor Type Insights

Which Sensor Type Segment Dominate the Wearable Inertial Sensors Market?

The accelerometers segment dominated the market with a major revenue share in 2024. This is primarily due to the increased adoption of these sensors in various applications, such as smartwatches, activity monitors, and fitness trackers. The accelerometer sensor provides high accuracy for tracking users’ physical activity, such as cycling, running, and walking, making it essential for motion tracking. The accelerometer sensors require less power consumption compared to other sensors, making them ideal for battery-powered wearable devices.

The inertial measurement units (IMUs) segment is expected to grow at the fastest rate over the forecast period, driven by their high accuracy, compact design, and versatility. Inertial measurement units (IMUs) are used in various applications, including smartwatches, sports monitoring devices, and fitness trackers. Inertial measurement units (IMUs) combine gyroscopes, accelerometers, and sometimes magnetometers, making them ideal for measuring motion and orientation in wearable devices.

Axis Configuration Insights

What Made 3-Axis Sensors the Dominant Segment in the Market in 2024?

The 3-axis sensors segment dominated the wearable inertial sensors market with the largest share in 2024. This is mainly due to their increased application in accurately tracking user movements, such as steps and distance. The use of 3-axis sensors, particularly 3-axis magnetometers, in combination with gyroscopes and accelerometers, is high for orientation and gesture recognition. The 3-axis sensors are widely known for their enhanced accuracy and reliability. The demand for 3-axis sensors has increased in various applications, including healthcare devices, consumer electronics, and automobiles.

The 9-axis sensors (Accel + Gyro + Magneto) segment is expected to grow at the fastest CAGR during the projection period, driven by the ability of these sensors to offer more accuracy and stable movement tracking. 9-axis sensors find applications in fitness tracking, healthcare monitoring, VR&AR, navigation, and gaming. Advancements in sensor technology, which enhance performance by providing high accuracy and low power consumption, are contributing to the segment’s growth.

Connectivity Insights

Why Did the Wireless Sensors Segment Dominate the Wearable Inertial Sensors Market in 2024?

The wireless sensors (Bluetooth, Wi-Fi, ANT+) segment dominated the market in 2024 due to their low power consumption, easy integration, and ability to provide seamless data transmission. Wireless sensors are convenient and portable, facilitating excellent connectivity and data transmission. The popularity of wireless sensors, which use Bluetooth, Wi-Fi, and ANT+, is high due to their great flexibility and mobility.

The wired sensors (USB, serial interfaces) segment is expected to grow at a significant CAGR in the upcoming period, driven by their high adoption in specialized applications where data transfer speed and reliability are prioritized. The simplicity and cost-effectiveness of wired sensors make them ideal for budget-conscious consumers. The use of wired sensors is widespread in simple applications, which leads the segment to witness steady growth in the market.

Application Insights

How Does the Sports & Fitness Tracking Segment Dominate the Market in 2024?

The sports & fitness tracking segment dominated the wearable inertial sensors market, holding the largest share in 2024, driven by increased demand for smartwatches and fitness trackers. The increased awareness of health and fitness and the adoption of advanced technology-based devices in sports bolstered the segmental growth. Additionally, the rise of personalized fitness regimes, technological advancements in sensor manufacturing, and the adoption of fitness apps are driving the segment’s growth.

The elderly monitoring & fall detection segment is expected to grow at a significant rate in the coming years, driven by the increasing use of wearable sensors in health monitoring and assistive technologies for seniors. The demand for user-friendly and convenient wearable sensor devices has increased for early monitoring and detection applications. Additionally, the manufacturers’ efforts in developing innovative devices to detect and monitor diseases are contributing to the segment’s growth.

For instance, smart gloves that combine flexible piezoelectric and inertial sensors, developed by Italian and Mexican researchers, are gaining popularity. These gloves help track symptoms and evaluate motor dysfunction in people with Parkinson’s disease.

Form Factors Insights

What Made Wearable Bands & Watches the Dominant Segment in the Wearable Inertial Sensors Market in 2024?

The wearable bands & watches segment led the market, holding the largest revenue share in 2024. This is mainly due to the increased adoption of fitness bands and smartwatches for health and fitness tracking. These bands and smartwatches often facilitate multifunctionality and excellent connectivity with cutting-edge technologies and motion sensors. Additionally, the growing consumer preference for customized and fashionable devices is expected to facilitate the long-term growth of the segment.

The sensor patches & clip-ons segment is likely to grow at the fastest CAGR during the forecast period. Their versatility and ability to provide continuous, real-time data for various applications are major factors boosting their adoption. The use of sensor patches & clip-ons is high in wearable medical devices and continuous health monitoring devices. The rising need for remote health monitoring devices is fostering the adoption of sensor patches & clip-ons.

End-Use Sector Insights

Which End-Use Sector Dominated the Wearable Inertial Sensors Market in 2024?

The consumer electronics segment dominated the market with the largest share in 2024. This is primarily due to the increased integration of wearable inertial sensors in consumer electronics, such as smartwatches, fitness trackers, and other devices. The Increased health and fitness consciousness has contributed to the segment’s growth. Additionally, the continuous demand for consumer electronics due to expanding urbanization and the growing need for portable and compact devices is contributing to the segment’s growth.

The industrial & occupational safety segment is expected to expand at the highest CAGR over the projection period, driven by the increasing adoption of wearable technology for monitoring employees’ health and wellness. Industries are focusing on enhancing workplace safety, driving the adoption of wearable inertial sensors. The manufacturing and construction industries are the major adopters of these sensors.

Wearable Inertial Sensors Market Companies

- Xsens (Movella Inc.)

- STMicroelectronics

- Analog Devices, Inc.

- InvenSense (TDK Corporation)

- Bosch Sensortec GmbH

- Noraxon USA Inc.

- Shimmer Sensing

- MBientLab Inc.

- iMotion (IMeasureU)

- mCube Inc.

- ActiGraph LLC

- TE Connectivity

- Kinexon GmbH

- Notch Interfaces Inc.

- Thales Group

- Stryd

- Hexoskin (Carré Technologies)

- Vicon Motion Systems

- Somaxis Inc.

- Trigno (Delsys Inc.)

Recent Developments

- In June 2025, a developer of wearable gesture control technology, Doublepoint Technologies, unveiled its gesture input system, which is running on Snap’s Spectacles 5 AR glasses. The company has demoed the impact of its ‘Doublepoint Kit’ hardware on enhancing advancements and natural gesture inputs for AR.

(Source: https://www.auganix.org)

- In June 2025, Bosh Sensortec showcases its BMV080, a novel tool and platform for supporting the integration of the world’s smallest particulate matter sensor, at Sensors Converge 2025. This sensor is 450 times smaller compared to any other device in the current market.

(Source: https://www.fierceelectronics.com)

- In December 2023, Panasonic Life Solutions India’s Industrial Devices Division (INDD) announced the launch of an innovative 6-in-1, 6DoF (Degrees of Freedom) Inertial Sensor. This sensor measures vehicle acceleration and angular rate across three axes (X, Y, and Z), providing critical information that enhances vehicle safety and stability.

(Source: https://www.panasonic.com)

Segments Covered in the Report

By Sensor Type

- Accelerometers

- Gyroscopes

- Magnetometers

- Inertial Measurement Units (IMUs)

- (Integrated 3- or 6-axis units)

- Pressure & Force Sensors

- Temperature & Biosensors (when integrated into motion sensors)

By Axis Configuration

- 3-Axis Sensors

- 6-Axis Sensors (3 Accel + 3 Gyro)

- 9-Axis Sensors (Accel + Gyro + Magneto)

By Connectivity

- Wireless Sensors (Bluetooth, Wi-Fi, ANT+)

- Wired Sensors (USB, serial interfaces)

By Application

- Sports & Fitness Tracking

- Healthcare & Rehabilitation Monitoring

- Industrial & Worker Safety Monitoring

- Military & Defense Training Systems

- AR/VR & Motion Gaming

- Elderly Monitoring & Fall Detection

By Form Factor

- Wearable Bands & Watches

- Smart Garments & E-textiles

- Footwear & Insoles

- Headgear & Helmets

- Sensor Patches & Clip-ons

By End-Use Sector

- Consumer Electronics

- Healthcare & Medical

- Sports & Athletics

- Military & Defense

- Industrial & Occupational Safety

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa