This is the first chapter of our 2025 Media & Entertainment Industry Predictions Report. You can find the full report here. Pay TV is (nearly) dead; long live Pay TV The global television industry is undergoing a seismic transformation as streaming’s rise accelerates the decline of traditional Pay TV. However, the streaming market is still […]

This is the first chapter of our 2025 Media &

Entertainment Industry Predictions Report. You can find the full

report here.

Pay TV is (nearly) dead; long live Pay TV

The global television industry is undergoing a seismic

transformation as streaming’s rise accelerates the decline of

traditional Pay TV. However, the streaming market is still evolving

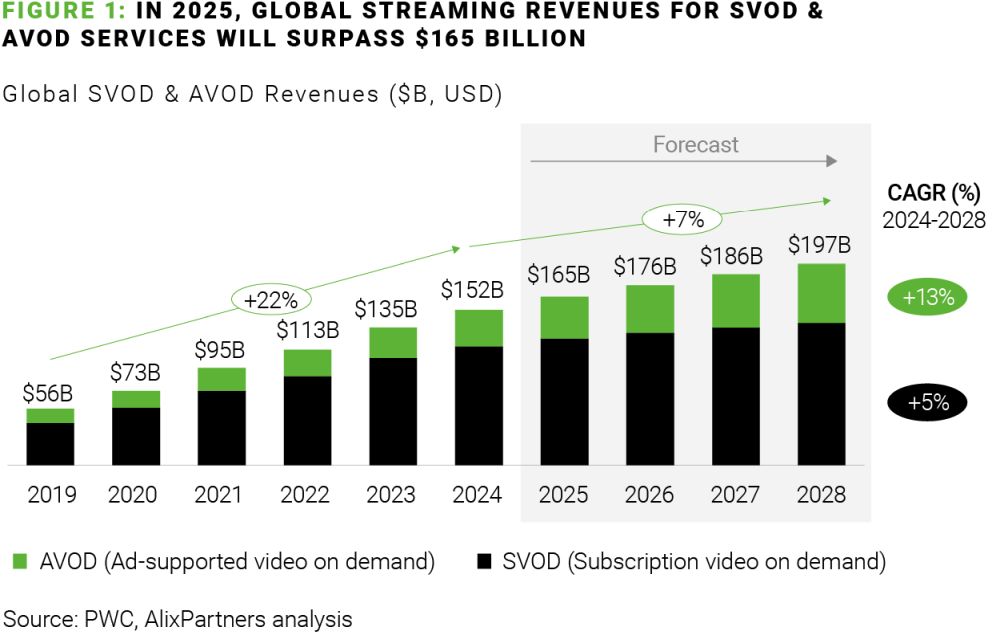

toward a more stable state. In 2025, global subscription video on

demand (SVOD) and advertising-supported video on demand (AVOD)

revenues will surpass $165 billion worldwide. But the current

ecosystem is highly fragmented with more than 200 streaming

platforms, far more than the market can sustain in the long

run.

Despite major direct-to-consumer (DTC) streaming platforms like

Disney+ and Paramount+ reporting profitability in 2024, the

economics of streaming remain a challenge. Platforms face a complex

landscape, driven by:

- Subscriber churn: Fragmentation has fostered

serial churning, with 42% of subscribers regularly

subscribing, canceling, and resubscribing to streaming services.

These churn cycles directly impact revenue stability, subscriber

growth, and long-term profitability for streaming platforms. - Rising content costs: Disney, Comcast,

YouTube, Warner Bros. Discovery, Netflix, and Paramount Global will collectively spend $126 billion on

content in 2024, a year-over-year increase of 9%. - High subscriber acquisition costs: Streamers

face significant costs in acquiring new subscribers through

marketing, promotions, and partnerships, making it increasingly

essential to achieve greater scale. - Platform taxes: Third-party billing systems

like Apple App Store or Google Play take a 15-30% cut of

subscription revenue for SVOD transactions that are managed through

their ecosystems.

Infinite choice is really no choice at all

Streaming, once celebrated for its promise of choice and

freedom, has become a double-edged sword for many consumers.

Increasing pain points related to the user journey, content

discovery, and pricing are limiting convenience for users.

This dissatisfaction is underscored by the “paradox of

choice”: With a plethora of content fragmented across

platforms, viewers spend excessive time—more than 11 minutes on

average—deciding what to watch, often unaware of

the full breadth of content available. Alarmingly, only 28% of

Americans and 21% of Europeans feel they can easily find something

to watch, according to Comcast’s “Content Discovery in a

Multiscreen TV World” report. This indicates a

deeper issue of content discoverability, both within individual

apps and across multiple streaming services, leaving users

frustrated and overwhelmed.

Fragmented customer relationships across multiple services make

it challenging for consumers to keep track of their subscriptions,

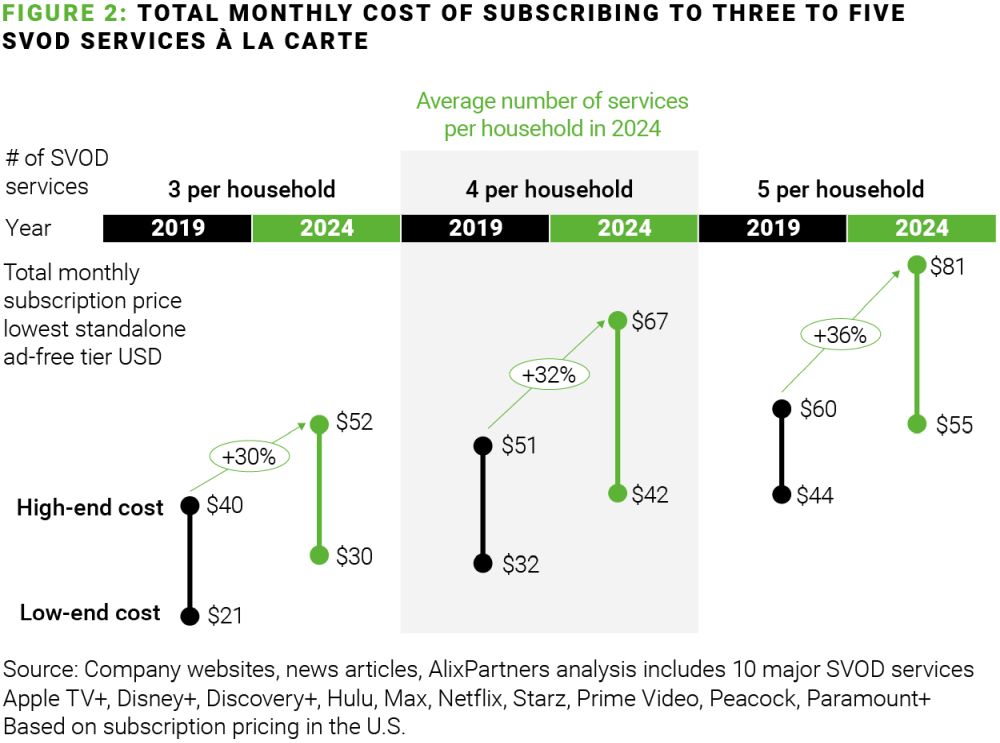

further eroding viewer satisfaction—especially as major SVOD

services have raised prices by more than 50% on average since their

launch. These hikes have led to an increase in the à la

carte price of subscribing to three or more premium SVOD services

by more than 30% in recent years.

In response to these challenges, streaming services are

experimenting with various promotional pricing strategies, bundles,

and a turn back to wholesale distribution models. These strategies

may be new to streaming, but they increasingly resemble the

tried-and-true traditional Pay TV models they sought to

disrupt.

Yet, despite pain points with streaming, consumers haven’t

forgotten about the shortcomings of rigid

“all-in-or-nothing” Pay TV bundles, including long-term

contracts and paying for hundreds of largely unwatched channels.

Traditional Pay TV is declining for a reason, but for consumers to

move forward into the future, they need a solution that combines

the freedom and flexibility of streaming with the simplicity and

ease of the past.

Momentum for streaming bundles is a step, but not the final

destination

Streaming bundles and wholesale distribution partnerships surged

in 2024 as players sought to expand their reach and improve

subscriber retention. In our 2024 predictions

report, we projected that subscriptions

purchased through telco and aggregator bundles would surpass 50% in

mature markets like the U.S.

The streaming distribution ecosystem is increasingly complex,

comprising various bundles and third-party aggregation services. In 2024, the number of documented telco

and online video distribution partnerships worldwide rose to more

than 2,000, up from 1,200 a year ago.

While this growth highlights the importance of bundling and

aggregating content for subscription video economics, it has also

added complexity for consumers in the near term.

Consumers must now navigate numerous distribution options for

streaming, which come with a wide range of value propositions to

consider:

- Single-company bundles combine multiple

services owned by the same parent company, offering them at a

discounted rate through a unified bill. Most have become integrated

platforms like Paramount+ with Showtime or Hulu on Disney+. - Co-subscription bundles include two or more

competing DTC streaming services in a single discounted package

billed together. However, they do not provide a unified user

interface. As a result, consumers must navigate between individual

apps to access content from different services. - Operator bundles, offered through telecom

operators, combine streaming subscriptions with traditional cable,

broadband, or mobile services, often at a discounted rate or

included as complementary perks. These bundles are typically

available only to existing customers and feature a limited

selection of streaming providers, often restricting access to their

ad-supported tiers. - Third-party aggregators like Amazon Prime

Channels and YouTube Primetime Channels act as resellers of premium

DTC streaming services, consolidating multiple apps into a single

interface. Unlike other bundles, super-aggregators generally

don’t offer discounted rates compared to purchasing services

directly. Instead, their primary value lies in convenience, with

unified subscription management and no need to switch between

multiple apps.

In 2025, the streaming ecosystem will continue to lean into

wholesale distribution

We predict that subscriptions purchased through

wholesale distribution will rise, reaching as much as 60-70% of

streaming subscriptions in mature markets—up from our 50-60%

prediction last year.

This growth will include subscribers gained through third-party

aggregation services led by Amazon Prime Channels and Roku

Channels, as well as broadband operators like Comcast (Xfinity,

Sky) and Spectrum (Charter), and mobile operators like Verizon.

Over time, we expect to see three to five winners emerge as

“central hubs” for the next generation of TV. In

the meantime, 2025 will reveal several new deals as the industry

experiments with consolidating streaming platforms through bundling

and aggregation.

Simultaneously, rising tension between content owners and

third-party distributors will persist, driving DTC players to push

back against platform taxes and the rise of third party

gatekeepers. As a result, we expect to see more co-subscription

bundles—similar to the Disney+, Hulu, and Max

bundle—emerge in 2025.

These “frenemy” bundles enable DTC players to offer

greater value and convenience to consumers without sacrificing

critical competitive advantages. By partnering directly with other

DTC platforms, they can retain direct control over the consumer

relationship, a larger share of subscription revenues, and access

to valuable viewer data— tradeoffs they might forgo through

wholesale partnerships with third-party aggregators.

However, while current bundling efforts are a step in the right

direction toward a more simplified and streamlined viewing

experience, they are not enough to be game-changing for the

industry. We believe that experimental streaming bundles

are early indicators of consolidation, which we expect will begin

to play out in 2025. Bundling allows streamers to test for

potential revenue synergies and operational alignment in a

controlled, lower-risk environment before committing to large-scale

integrations.

The market can realistically support only a limited number of

profitable distributors, creating increasing competition as DTC

platforms, telco operators, and third-party aggregators all vie to

deliver the ultimate streaming experience.

Winning players will combine flexibility and choice with the

simplicity that consumers crave—such as seamless user

experiences, unified search and discoverability, and a single

interface and billing system.

As we head into 2025, the streaming wars are only

heating up. We will be watching closely as new developments unfold

in the battle over the next generation of TV.

Traditional MVPDs aim to transform into next-generation

streaming hubs

Traditional multichannel video programming distributors (MVPDs)

are at a critical crossroads as the decline of legacy TV

subscriptions accelerates.

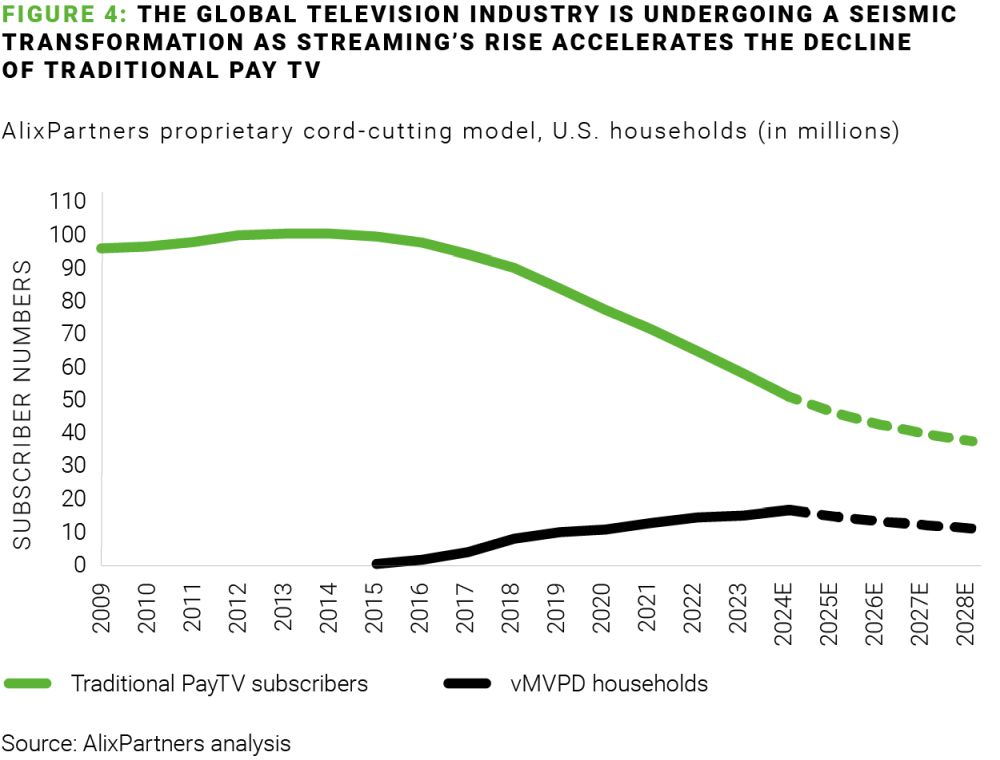

According to AlixPartners’ proprietary cord-cutting

model, U.S. Pay TV subscribers are projected to decline by 10% in

2025, shrinking the total number of subscribers below 50

million—half of what it was just a decade ago.

As the decline of legacy TV subscriptions accelerates,

traditional MVPDs are taking aggressive steps to adapt.

We predict that traditional MVPDs will reinvent

themselves as leading wholesale distributors in a streaming-centric

world, becoming go-to hubs for the next generation of

TV.

To adapt to shifting consumer preferences, MVPDs will need to

dismantle the traditional Pay TV bundle and embrace a new role that

prioritizes flexibility, personalization, and streaming content

variety. Early initiatives like Xfinity’s StreamSaver

bundle—which offers internet customers Netflix with ads,

Peacock with ads, and Apple TV+ for $15 a month— illustrate

this strategic pivot.

By combining high-speed internet connectivity with access to

multiple streaming platforms at competitive price points, MVPDs can

leverage their existing infrastructure and customer relationships

to provide a seamless, integrated streaming experience. This

approach will help them compete against major digital distributors

like Roku and Amazon.

We may also see the rise of highly customizable packages that

allow customers to tailor their bundles by selecting preferred

streaming services alongside broadband, wireless, or mobile

offerings. An early example is Verizon’s myPlan, which offers

the Disney bundle of Hulu, Disney+, and ESPN+ for $10 a month,

providing significant savings compared to subscribing to these

services individually.

2025 will mark the peak of virtual multichannel video

programming distributors (vMVPDs)

Our cord-cutting model predicts that 2025 will mark the

peak of vMVPDs before entering a period of decline. This projection

is driven by several transformative shifts in the television

landscape.

The waning competitive advantage of

vMVPDs

Initially, vMVPDs attracted viewers by providing a cable-like

experience at a lower cost and with greater flexibility. They

provided an essential alternative for viewers seeking live content,

such as sports and news, not available on SVOD platforms. However,

as more content, particularly sports and news, moves toward

streaming platforms, the vMVPD value proposition will begin to

erode.

The disruption of DTC sports streaming

We anticipate that the launch of ESPN’s flagship

streaming service in early fall 2025 will significantly disrupt

both traditional cable providers and virtual MVPDs.

As one of the last mainstays of live content exclusive to Pay

TV, sports have been a critical driver of vMVPD subscriptions. Upon

its launch, ESPN’s direct-to-consumer offering will allow fans

to access premium sports content independently of vMVPDs or

traditional cable subscriptions, undermining one of Pay TV’s

last remaining value propositions.

Beyond ESPN, deep-pocketed tech companies like Amazon, Google,

and Apple are actively acquiring sports broadcasting rights, often

paying premium prices to secure exclusive deals. Prime Video, for

instance, recently landed alandmark 11-year deal to

stream NBA and WNBA games, becoming the exclusive streaming service

for 66 regular-season NBA games beginning in 2025. This deal and

ones alike pose a direct challenge to vMVPDs like YouTube TV, which

has built a significant portion of its growth on sports

content.

YouTube TV, with an estimated 18 million subscribers and a 40%

share of the vMVPD market, owes much of its growth to its $2

billion annual deal for NFL Sunday Ticket, which allows streaming

of out-of-market games across the U.S. Approximately 41% of Sunday

Ticket subscribers who purchase the add-on also become new YouTube

TV customers. However, as more sports content shifts to DTC

platforms, YouTube TV and other vMVPDs will face growing challenges

in retaining subscribers and maintaining their market share.

The rise of vMVPD alternatives is further accelerated by

broadcasters like CBS and NBC, who are partnering with their

respective streaming platforms, such as Paramount+ and Peacock, to

provide live sports and other premium content. With the combination

of over-the-air (OTA) broadcasts and streaming services, consumers

can increasingly assemble their own content packages, focusing on

what matters most to them.

In 2025, vMVPD will peak

We project that vMVPDs will experience moderate growth in 2025,

driven primarily by ongoing cord-cutting trends. However, the rapid

shift of live sports to DTC platforms like ESPN’s flagship

service, coupled with changing consumer preferences and rising

costs, will mark a tipping point. Beyond 2025, vMVPDs are expected

to decline as their competitive edge continues to diminish.

For vMVPDs to remain competitive, they must innovate their

offerings to align with the demands of a rapidly evolving media

landscape.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.