NIL

2025 predictions

“The ability of these operators to leverage their existing technical and operational capabilities along with their financial muscle and marketing know-how will likely see them quickly shake up the market and grab very significant market share,” he says. Sebastian Lewis, co-founder at Plucky, a free-to-play games and pool betting operator, licensed by the UK Gambling Commission, […]

“The ability of these operators to leverage their existing technical and operational capabilities along with their financial muscle and marketing know-how will likely see them quickly shake up the market and grab very significant market share,” he says.

Sebastian Lewis, co-founder at Plucky, a free-to-play games and pool betting operator, licensed by the UK Gambling Commission, predicts a shift in the psyche of bettors this year. Notably, he believes social betting styles will return but in new forms.

“I expect that the next 12 months will see a shift in the general psyche to engage in more direct ways once again, both in everyday society, but particularly in the betting space. We will realise once again the enhanced emotions and tensions that come with shared wagering experiences,” Lewis explains.

Every year the sector goes wild for the promise of new and novel betting options, understandably considering the legacy betting product has not changed much in years. Stock and crypto trading platform Robinhood revealed in December that it is eyeing an entry into the betting fray in some form or another.

Legal betting market in Brazil will remain fluid in its infancy

Ushering in 2025, the sector has hit the ground running in preparation for ICE Barcelona in a couple of weeks. Across the pond a couple of US states have kicked off their legislative sessions this year with bills supporting online gaming launches. But the holiday period provided enough downtime to reflect on ways the gaming industry evolved in 2024 and then consider what will likely dominate the headlines and earnings calls in the year to come.

While there may be new market launches in 2025, none will have the impact of Brazil, notes Harris. Other LatAm jurisdictions will make significant changes to their gaming regulations and provide opportunities for legal gaming, but the factors that have made Brazil so attractive won’t be found elsewhere at the moment, he believes.

Brazil’s legal online betting launch captured the most eyes in 2024’s news flow, and how the licensed market will navigate its infancy stages will pique the sector’s interest in coming months. Last summer, 113 operators applied for early-stage licences to enter the market, hoping to be among the first to launch on 1 January.

“The circumstances that drive interest in these new products are not about to disappear overnight so don’t expect the demand for these products to disappear either. Until licensed sports betting is an available option [in all US states], or these alternative offerings are removed as an option, there will continue to be a significant market for sweepstakes and binary options.”

“The start of the year saw the ‘end of the beginning’ but definitely not the end of the period of significant change in Brazil. It will take time for the market to settle down and for the effects of all the changes to ripple through. Don’t be surprised to see additional regulations or changes to existing regulations as the authorities keep a close eye on the environment they have created,” Harris adds.

There won’t be another Brazil in 2025

Mick d’Ancona, another Circle Squared partner believes the sector will embrace more new products like this in 2025.

Although prime minister Anthony Albanese has suggested a full ban on online gambling ads and restrictions on radio and TV ads, particularly around live sports streams are in discussion, this review was delayed in 2024.

In France, the gambling regulator has also ordered the four top earning online operators to reduce their planned promotional and marketing spend in 2025 and reconsider their sponsorship deals to help better protect minors. It will be interesting to see how the sector innovates in the face of a renewed approach to sports advertising.

Is 2025 the year we embrace new betting options?

“To achieve profitability and optimise customer acquisition and retention, leading operators will closely evaluate the effectiveness of their sponsorships. Sports teams and leagues must innovate, offering added value to maintain and attract partnerships, ensuring mutual benefits in a scrutinised environment,” Maw tells iGB.

Clyde Harris, partner at tech consultancy Circle Squared, predicts that while Brazil will remain top line news in 2025, it will take time for the regulator to iron out the kinks and enforce all necessary regulations. Ultimately, its first year will likely not be an indication of how the jurisdiction will pan out longer term.

Some markets are soon to pull back and restrict sponsorship allowances for gambling companies, to help protect minors and higher-risk bettors. The UK will enforce its ban on front-of-shirt sponsorships in the Premier League as of the 2025-26 season, which will kick off in August. These measures are already challenging the sector to look for new and innovative ways to market their brands within sports.

FTP and sweepstakes in betting

It’s too early to tell what form a Robinhood betting product might take but its trading products have gained huge popularity for simple and innovative user experiences. It also built a hugely strong brand among novice retail traders.

Of course 2025 will also see the continued fight against the black market’s proliferation. Many are hoping for better enforcement efforts to stamp out illegal operations but these will depend on whether governments and regulators are truly committed to the fight. The year is sure to be another pivotal one for gambling in many ways. Happy New Year!

Harris also believes the entry of international players into Brazil will have a significant impact on how the market plays out over the next 12 months, particularly as players test their loyalty to local brands and dabble in the new products coming online. Both BetMGM and Caesar’s Sportsbook’s Big Brazil entered the fray in the first wave of licensees.

He notes: “Alternative ways to ‘bet’ got a lot of attention in 2024 as the industry sat up and took notice of the volumes being traded on sweepstake products and Robinhood’s binary option market on the US election.

“Sweepstakes (pooled betting to our American friends) and social wagering are so commonplace and much-loved within workplaces, families and friend groups. This could be the year that we harness this segment, empowering bettors with the social wagering opportunities they love, but in a modern day context.

“Brazil is the tenth biggest economy in the world by GDP, has a population of over 200 million and already had a well-established betting industry that was in a very unusual position.

Brazil’s SPA then awarded 66 approvals at the turn of the year, including 14 full and 52 provisional licences. The latter enabling operators to provide services while finalising necessary documents and certifications required by the regulator.

“That confluence won’t be repeated anywhere else in 2025. There will definitely be territories that attract outside interest, including the rest of LatAm, Canada and parts of Africa but there won’t be the same intense ‘gold rush’ focus on one territory,” Harris concludes.

“What’s been forgotten in the chase for ‘what’s next’ is a focus on what already works so well for us as social animals,” he concludes.

“Brazil will be very fluid as the market recalibrates and the impact of new regulations ripple through,” Harris tells iGB.

Outside of these new rules, Betting Hero co-founder and president Jai Maw expects operators and suppliers to consider new ways to innovate on long-term sponsorship deals.

Australia’s government is considering the role of sports sponsorships in its ongoing review and reform of gambling advertising in the country. What exactly this reform will enforce (and when) is still publicly unknown as the government has remained quiet on these details.

Ahead of the US general election in November, prediction markets in the US were able to provide legal wagers on the election for the first time. By 6 November, the day after Trump’s election win, derivatives exchange platform Kalshi had taken in more than 0 million (£542.5 million/€651.5 million) in contracts for the election cycle.

Looking ahead

How will the gambling sector evolve in 2025? We asked the industry to consider how key trends in 2024 will progress into this year

NIL

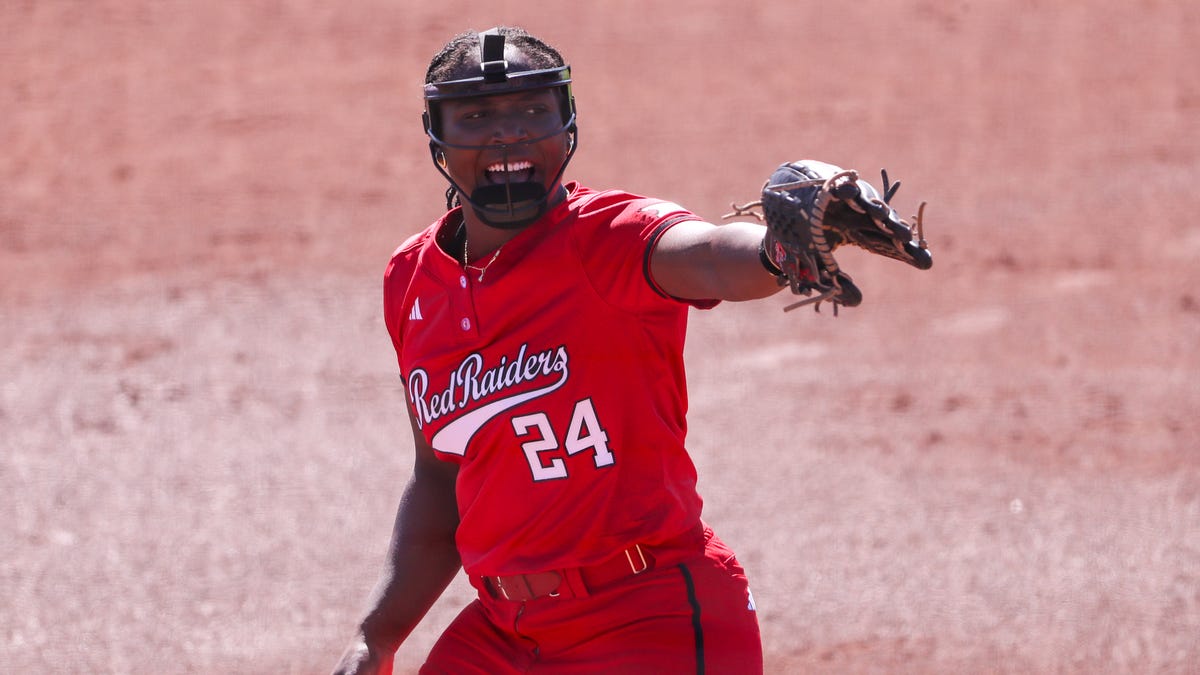

Texas Tech Red Raiders – Official Athletics Website

LUBBOCK, Texas – No. 11 Texas Tech (40-11, 18-3) took down Abilene Christian (15-34, 11-10) in five innings by a score of 9-0 on Tuesday evening to pick up their 20th shutout win of the season – a new program record – and their 40th win of the season. This is the fourth time in […]

This is the fourth time in program history that Tech has reached 40 wins, and the first time since 2012. Tech will also finish with an 18-2 (.900) record at Rocky Johnson Field making it the winningest home season in program history.

How it happened:

Chloe Riassetto improved to 7-2 on the season after throwing 3.0 innings and allowing just two hits. Samantha Lincoln came in relief for the final 2.0 innings, allowing just one hit.

Tech’s offense got going in the second inning with RBI singles from Alana Johnson and Bailey Lindemuth to give the Red Raiders an early 2-0 lead.

The Red Raiders added five more runs in the third inning highlighted by NiJaree Canady’s seventh home run of the season. Johnson and Victoria Valdez also added RBI with a single and double, respectively, while Mihyia Davis scored after tagging up to go to third and then crossing home thanks to an errant throw.

Davis scored again in the fourth inning with her base running after Demi Elder stole second, Davis then sprinted home on the throw to score the eighth run of the game. Lauren Allred capped of a 3-for-3 day with an RBI double to complete the scoring for Tech.

UP NEXT: Tech will close out the regular season on the road in Provo for a three-game series with BYU.

NIL

Longhorns Daily News: When will a 9-game SEC football season actually happen?

For too long, the Southeastern Conference has played an eight-game conference schedule. That was even before the Texas Longhorns and Oklahoma’s additions brought the league’s total members up to 16 total. And yet, the eight-game conference schedule—at times, with decent arguments to remain so—has stayed. However, it seems as though change could be on the […]

For too long, the Southeastern Conference has played an eight-game conference schedule.

That was even before the Texas Longhorns and Oklahoma’s additions brought the league’s total members up to 16 total. And yet, the eight-game conference schedule—at times, with decent arguments to remain so—has stayed.

However, it seems as though change could be on the horizon.

… thanks to the College Football Playoff.

From CBS Sports:

“Following the historic meeting between the two conferences in Nashville back in October, Big Ten and SEC athletic directors and conference leadership met in New Orleans Wednesday to discuss a variety of topics, including changes to the College Football Playoff — and, in the SEC’s case, whether to expand its own conference schedule.

While Wednesday’s outcome didn’t lead to any direct changes, it’s clear the Big Ten and SEC are continuing to make their case for a CFP takeover. …”

WHAT THEY’RE SAYING ABOUT THE LONGHORNS

Austin American-Statesman: Texas had the most players drafted over the past two years. Here’s how.

Dallas Morning News: Is Texas QB Arch Manning the next No. 1 pick in NFL draft? Experts make their predictions

247Sports: Four Downs: Quinn Ewers made the right decision, Texas football’s NFL approach, Ryan Watts and more

Inside Texas: Video Reheat: Texas strengthens RBU legacy and CFB’s wildest offseason storylines

Inside Texas: Steve Sarkisian urges fans to be patiently supportive of Arch Manning as he lives out a lifelong dream

ICYMI IN BURNT ORANGE NATION

Steve Sarkisian: Texas football’s class of 2023 has ‘winning in their DNA’

Don’t underestimate former Texas QB Quinn Ewers’ future role with Miami Dolphins

Former Texas WR Johntay Cook seems likely to land at Syracuse

Former Texas RB Savion Red hits the transfer portal once again, lands at Sacramento State

RECRUITING ROUNDUP

247Sports: Texas makes top six for EDGE target Dre Quinn

247Sports: Top-10 overall 2027 prospect Joshua Dobson feels like Texas could be his home

Inside Texas: K’Adrian Redmond talks Texas visit, Kenny Baker connection, and top schools in 2027 recruitment

Inside Texas: The point guard recruit that could define Sean Miller’s first season at Texas

SEC SHOWDOWN

Austin American-Statesman: How high is Texas softball ranked after losing to Oklahoma?

Rock M Nation: Mizzou baseball falls to KU in Lawrence

Rocky Top Talk: Transfer Portal: Former Louisiana Tech guard Amaree Abram commits to Tennessee

A Sea Of Blue: Kentucky to visit 5-star guard Jordan Smith

WHAT WE’RE READING

SB Nation: Full results, updates for the road to the Stanley Cup

SB Nation: The Browns’ reaction to the Shedeur Sanders pick was subdued, like their other selections

SB Nation: Could Travis Hunter win both Offensive and Defensive Rookie of the Year honors?

NEWS ACROSS LONGHORN NATION AND BEYOND

- Apparently Quinn Ewers never took a dime from Texas Athletics.

Steve Sarkisian says Quinn Ewers never took money from the Texas NIL collective.

Sarkisian said he capitalized on true Name, Image, and Likeness opportunities available to him as opposed to collective deals.

— Inside Texas (@InsideTexas) April 28, 2025

NIL

Cason, Wright named to all-Southland teams

Story Links FRISCO – Two East Texas A&M University softball players have earned all-Southland Conference recognition as both Tatum Wright and Maddie Cason were named to the all-Southland teams on Wednesday morning. Wright (Frisco – Centennial) was named to second team all-Southland as a first baseman, while Cason (Honey Grove) was […]

FRISCO – Two East Texas A&M University softball players have earned all-Southland Conference recognition as both Tatum Wright and Maddie Cason were named to the all-Southland teams on Wednesday morning.

Wright (Frisco – Centennial) was named to second team all-Southland as a first baseman, while Cason (Honey Grove) was named to second team all-Southland outfield.

Leading the conference in home runs during conference play, Wright batted .338 with nine home runs and 26 RBIs in the 25 conference games that she appeared in. Her 26 RBIs put her in fifth and her slugging percentage is also second in the SLC. On the season, she batted .307 with 11 home runs and 32 RBIs as the Lions led the Southland with 35 team home runs. Wright was also the Southland’s Hitter of the Week last week.

Cason was the Lions’ batting average leader, hitting .329 on the season and scored 24 runs, while recording seven RBIs, four triples, and went 11 for 13 in stolen base attempts. She also had a .983 fielding percentage in the outfield, which put her in 17th in the conference. Cason was also top 25 in the conference in batting average and top 20 in stolen bases.

The two Lions on the 2025 Southland Softball All-Conference honors are the most in a single season since moving up to NCAA Division I and joining the conference for the program. East Texas A&M has now had three all-conference honorees in the SLC era.

The Lions clinched their postseason berth in the Division I era and begin the 2025 Southland Conference Tournament on Thursday at top-seed McNeese at 3 p.m.

2025 SOFTBALL ALL-SOUTHLAND TEAMS

Player of the Year — Victoria Altamirano, UIW

Hitter of the Year — Victoria Altamirano, UIW

Pitcher of the Year — Maddie Taylor, McNeese

Freshman of the Year — Kassidy Chance, McNeese

Newcomer of the Year — Macie LaRue, Southeastern

Coach of the Year — James Landreneau, McNeese

FIRST TEAM

| Pos. | Player | School | Year | Hometown |

| 1B | Victoria Altamirano | UIW | Jr. | Los Fresnos, Texas |

| 2B | Claire Sisco | Nicholls | Jr. | College Station, Texas |

| SS | Chloe Magee | Southeastern | So. | Watson, La. |

| 3B | Maria Detillier | Southeastern | Jr. | Gramercy, La. |

| C | Sarah Allen | McNeese | Fr. | Montgomery, Texas |

| UTL | Kassidy Chance | McNeese | Fr. | Mansfield, Texas |

| DP | Veronica Harrison | Lamar | So. | Alvin, Texas |

| OF | Shenita Tucker | Southeastern | Sr. | Richmond, Texas |

| OF | Samantha Mundine | McNeese | So. | Luling, Texas |

| OF | AB Garcia | HCU | Jr. | Cypress, Texas |

| P | Macie LaRue | Southeastern | Jr. | Lovelady, Texas |

| P | Maddie Taylor | McNeese | Fr. | Sterlington, La. |

SECOND TEAM

| Pos. | Player | School | Year | Hometown |

| 1B | Tatum Wright | East Texas A&M | Jr. | Frisco, Texas |

| 2B | Ellie Vance | SFA | Sr. | Victoria, B.C. |

| SS | Reese Reyna | McNeese | Sr. | Santa Fe, Texas |

| 3B | Haylie Savage | HCU | Sr. | Angleton, Texas |

| C | Adelynn Bacerra | SFA | Jr. | Cypress, Texas |

| UTL | Molly VandenBout | Nicholls | Sr. | Temple, Texas |

| DP | Kyi’Marri Ester | SFA | So. | Palestine, Texas |

| OF | Reagan Heflin | Nicholls | Jr. | Richmond, Texas |

| OF | Maddie Cason | East Texas A&M | Gr. | Honey Grove, Texas |

| OF | Nyjah Fontenot | McNeese | R So. | Lake Charles, La. |

| P | Larissa Jacquez | UIW | So. | Eagle Pass, Texas |

| P | Britney Lewinski | Southeastern | Sr. | Shorewood, Ill. |

ALL-DEFENSIVE TEAM

| Pos. | Player | School | Year | Hometown |

| 1B | Cala Wilson | Lamar | Fr. | Ruston, La. |

| 2B | Claire Sisco | Nicholls | Jr. | College Station, Texas |

| SS | Reese Reyna | McNeese | Sr. | Santa Fe, Texas |

| 3B | Trinity Brandon | Lamar | Jr. | Las, Vegas, Nev. |

| C | Jaisy Caceres | UIW | So. | Weslaco, Texas |

| RF | Reagan Heflin | Nicholls | Jr. | Richmond, Texas |

| CF | Sophia Livers | Northwestern State | So. | Bossier City, La. |

| LF | Maddy Bailey | HCU | Sr. | Katy, Texas |

| P | Maddie Taylor | McNeese | Fr. | Sterlington, La. |

-ETAMU-

NIL

Could NiJaree Canady, Texas Tech softball host Stanford in NCAA regional?

Gerry Glasco on Texas Tech softball winning the Big 12 title Gerry Glasco on Texas Tech softball winning the Big 12 title Now that the Texas Tech softball team has secured the first Big 12 Conference title in program history, the Red Raiders can focus on padding their résumé in hopes of hosting an NCAA […]

Gerry Glasco on Texas Tech softball winning the Big 12 title

Gerry Glasco on Texas Tech softball winning the Big 12 title

Now that the Texas Tech softball team has secured the first Big 12 Conference title in program history, the Red Raiders can focus on padding their résumé in hopes of hosting an NCAA regional next month.

The 11th-ranked Red Raiders are 39-11 on the season and moved to 18-3 in Big 12 play last week in the title-clinching series win over Arizona State. They are also 20th in RPI, behind fellow Big 12 teams Arizona and Oklahoma State. The question, though, is whether NiJaree Canady and the Red Raiders will be back at Rocky Johnson Field for the postseason.

Texas Tech closes the regular season with a three-game series at BYU.

Could Texas Tech softball host a regional with NiJaree Canady’s old team Stanford?

College Sports Madness and Softball America each have Texas Tech hosting a Lubbock Regional for the start of the tournament.

The Red Raiders are the No. 15 overall seed at Softball America and 16th overall at College Sports Madness. The top 16 teams each get to host regionals.

Each of these outlets also has a very intriguing visitor to Lubbock in their projections. Both have Stanford as the No. 2 seed in their predicted Lubbock Regionals.

Should that come to fruition, it would add to the drama for Texas Tech. Stanford, of course, is where Canady spent her first two years of college, where she became the most dominant pitcher in the country and took the Cardinal to the Women’s College World Series in both seasons. Canady opted to transfer to Texas Tech this season to try something new — and earn over $1 million in name, image and likeness from the Matador Club, Tech’s NIL arm.

Softball America also has Indiana as the No. 3 seed in its projected Lubbock Regional. The Hoosiers visited Texas Tech earlier this year as part of the Jeannine McHaney Memorial Classic. College Sports Madness has Big Ten school Michigan in its projections.

NIL

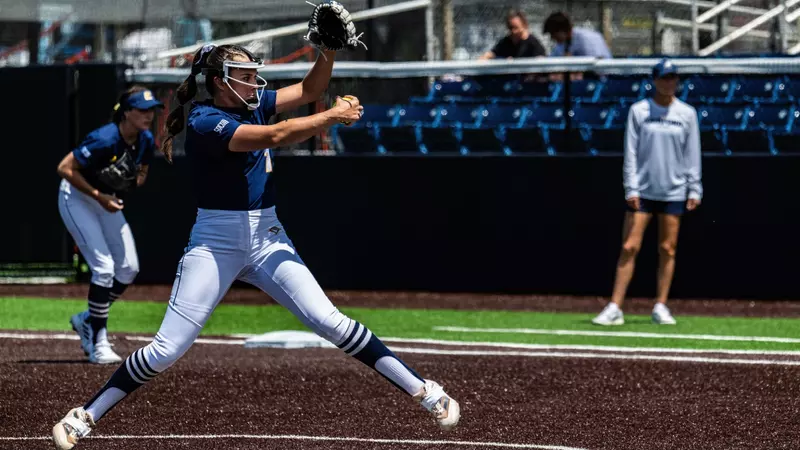

Goold Notches Sixth TSWA Pitcher of the Week Nod

Story Links CHATTANOOGA, Tenn. — Chattanooga’s Peja Goold was named the Tennessee Sports Writers Association (TSWA) Pitcher of the Week for the fourth consecutive week and sixth time this season. She went 2-0 in the Mocs’ series against Samford, striking out 17 total over three games. In her first game, she […]

CHATTANOOGA, Tenn. — Chattanooga’s Peja Goold was named the Tennessee Sports Writers Association (TSWA) Pitcher of the Week for the fourth consecutive week and sixth time this season.

She went 2-0 in the Mocs’ series against Samford, striking out 17 total over three games. In her first game, she struck out eight in a come-from-behind walk-off win. During the second game, the Stockton, Calif., native struck out nine and had a no-hitter going into the sixth. Goold finished allowing two hits and one run in the 5-1 victory.

Goold is third in the NCAA for shutouts with eight and ninth with 207 strikeouts this season. She leads the Southern Conference in complete games, ERA, hits allowed per seven innings, innings pitched, shutouts, strikeouts, strikeouts per seven innings, victories and WHIP.

Chattanooga moved into first place over the weekend, sweeping Samford who was tied for the conference lead heading into the three-game series. UNCG fell in two of three games on the road at Mercer leaving Chattanooga out front by a game-and-a-half over the Spartans. The Mocs entered the D1Softball Mid-Major Top 25 Wednesday with a 36-12 overall record.

The Mocs close out the home slate tonight against non-conference foe Tennessee Tech at 5:00 p.m. at Frost Stadium and finish the regular season on the road at SoCon rival ETSU. The pair will play one game Saturday evening at 5:00 p.m. and a double header Sunday beginning at 1:00 p.m.

FOLLOW CHATTANOOGA SOFTBALL

For the most up-to-date information and news regarding Chattanooga Softball, please follow @GoMocsSB on Twitter & Instagram and ChattanoogaSB on Facebook.

SOFTBALL

Feb. 11 | Player: Danielle Jason (Tusculum); Pitcher: Maya Johnson (Belmont)

Feb. 18 | Player: Abbie Buckner (Sewanee); Pitcher: Reagen Huskey (Sewanee)

Feb. 25 | Player: Brianna Asmondy (Trevecca): Pitcher: Maya Johnson (Belmont)

March 4 | Player: Hayden Dye (Carson-Newman); Pitcher: Peja Goold (Chattanooga)

March 11 | Player: Presley Williamson (Chattanooga); Pitcher: Peja Goold (Chattanooga)

March 18 | Player: Morgan Jennings (Union University); Pitcher: Ashlan Sensing (Trevecca Nazarene)

March 25 | Player: Abbee Klinefelter (Tennessee Tech); Pitcher: Maya Johnson (Belmont)

April 1 | Player: Alyssa Suits (King University); Pitcher: Taylor Long (Chattanooga)

April 8 | Player: Kailey Snell (Chattanooga); Pitcher: Peja Goold (Chattanooga)

April 15 | Player: Kailey Snell (Chattanooga); Pitcher: Peja Goold (Chattanooga)

April 22 | Player: Olivia Lipari (Chattanooga); Pitcher: Peja Goold (Chattanooga)

April 29 | Player: Morgan Jennings (Union); Pitcher: Peja Goold (Chattanooga)

NIL

Will Texas Spend Between $30 To $40 Million On Its College Football Roster? Yes

PublishedApril 30, 2025 12:29 PM EDT•UpdatedApril 30, 2025 12:29 PM EDT Facebook Twitter Email Copy Link Are you surprised to hear that Texas will end up spending between $30 to $40 million on its college football roster this season? If you are, welcome to the current era of college athletics. As we prepare for the […]

Are you surprised to hear that Texas will end up spending between $30 to $40 million on its college football roster this season? If you are, welcome to the current era of college athletics.

As we prepare for the upcoming House Settlement to be approved (maybe), there is going to be a massive shift in how college athletes will be paid. While the majority of the money will come from the university, with contracts signed by the players and schools, there will still be money flowing from these NIL collectives across the country.

On Wednesday, the influence of collectives was put on full display, as Kirk Bohls from the Houston Chronicle reported that Texas will spend upward of $40 million on its football roster for the 2025 season.

While the number might be shocking, it does come with a caveat that fans of the sport are missing out. Right now, we are seeing NIL collectives pour a lot of their money into deals that they will have off the overall books by the time the House Settlement is put into place, with a revenue-cap coming for college football teams.

Shedeur Sanders NFL Draft Saga Wasn’t About Race Or Talent: He Has To Rid Of The Spectacle Around Him

So, when you see a number like $40 million being thrown around, you have to understand that a good chunk of this is being spent by teams who are front-loading deals at the moment. This means that players could receive a majority of their current contract by July 1, which would keep them off the books in regard to the cap that will be put into place once a settlement is agreed to.

You Think A College Football Team Won’t Have Backdoor Payments?

Schools will have around $20.5 million to split up between multiple sports across campus, with a majority going to football in the range of $17.5 million for this upcoming season. So, when you add in the amount of money these NIL collectives are spending, it makes sense that Texas would spend anywhere between $35 to $40 million.

Yes, I know that number is insane. But given that we had schools last year spending upward of $25 million for their football team, this hike in the overall roster budget shouldn’t come as a surprise. Also, let’s not act as if these athletic programs are going to keep everything above board.

While the days of players being paid in duffle bags, or in the dark parking lot of a hotel are over, these boosters will find ways to make sure players are getting paid, even if it’s more than the agreed-upon revenue-share cap.

The fact is that if you want to compete for national championships, you had better be willing to put together a roster that will cost you around $30 million per season.

Welcome to the new era of athletics, or should I say ‘professional’ college football.

-

College Sports2 weeks ago

College Sports2 weeks agoFormer South Carolina center Nick Pringle commits to Arkansas basketball, John Calipari

-

Rec Sports6 days ago

Rec Sports6 days agoDeputies investigating incident that caused panic at Pace youth sports complex

-

Fashion6 days ago

Fashion6 days agoThis is poetry in motion.

-

High School Sports1 week ago

High School Sports1 week agoAppling County football to forfeit all 10 wins from 2024

-

Sports2 weeks ago

Sports2 weeks agoSports Roundup

-

College Sports1 week ago

College Sports1 week agoLehigh wrestlers prepare for wrestling U.S. Open

-

NIL2 weeks ago

NIL2 weeks agoPatriots Legend Rob Gronkowski Makes Surprising Career Move

-

NIL6 days ago

NIL6 days agoSave Like a Pro: NIL money isn’t free cash—taxes take a bite! Set aside part of …

-

Fashion2 weeks ago

Fashion2 weeks agoWatch Saudi Arabian GP free live stream

-

Sports1 week ago

Sports1 week agoHow to watch Yahoo Sports' NFL Draft Live show

– Brian Windhorst | NBA Today

– Brian Windhorst | NBA Today