Technology

The New Running Boom

THE LONELINESS OF the long-distance runner. Forrest Gump’s slog across America. Hitting the wall. For years, when we thought about running, it was a solo pursuit, often involving suffering, sometimes pain, and occasionally glory. Of course people ran for the health benefits, and recent research confirms cardio fitness is critical to longevity, but often, striving […]

THE LONELINESS OF the long-distance runner. Forrest Gump’s slog across America. Hitting the wall. For years, when we thought about running, it was a solo pursuit, often involving suffering, sometimes pain, and occasionally glory. Of course people ran for the health benefits, and recent research confirms cardio fitness is critical to longevity, but often, striving for those benefits felt like an uphill struggle.

Recently, there’s been a vibe shift. And running—jogging with a buddy or two, joining a club, training for a half, gunning for your marathon PR—has started to feel a lot more fun. And it all starts with getting out there. “Consistency trumps all else,” says coach Steve Magness, author of Win the Inside Game. “More than half the battle is just showing up and doing the thing. It doesn’t guarantee success, but it gives you a shot.”

New technology, innovation, and, most important, old-fashioned people power is inspiring this movement. Over the next few pages, you’ll meet running’s change-makers and discover new training tactics, shoe upgrades, and smarter apps. We’re not saying running is easy, but thanks to some kind of social alchemy (and your improving fitness), dread can turn to joy, and the more you run, the easier and more fun it becomes.

Technology

Netflix Co-CEO Greg Peters on Tariffs, Levy, Ads, Sports Team

Netflix co-chief Greg Peters shared some insight into the global streaming giant’s playbook during The Wall Street Journal CEO Council Summit in London on Wednesday, including its thoughts on political proposals in the U.S. and U.K., competition from YouTube, and the streamer’s push into advertising. Asked about a recent proposal from a U.K. parliamentary committee for a […]

Netflix co-chief Greg Peters shared some insight into the global streaming giant’s playbook during The Wall Street Journal CEO Council Summit in London on Wednesday, including its thoughts on political proposals in the U.S. and U.K., competition from YouTube, and the streamer’s push into advertising.

Asked about a recent proposal from a U.K. parliamentary committee for a levy of 5 percent of U.K. subscriber revenue on foreign streaming services, including the likes of Netflix, Amazon, Apple TV+ and Disney+, to help finance British drama production, Peters said: “I think it would be a mistake. … I could list 100 titles that were made here in the U.K. that U.K. audiences loved. Whether it’s Adolescence or Toxic Town, the Harlan Coben stuff, such as Fool Me Once, or, even Black Doves.”

U.S. President Donald Trump’s suggestion of possible tariffs on entertainment produced abroad and the debate about how the U.S. could attract more productions was also brought up. Peters in response pointed to the success of the U.K., Netflix’s second-largest production hub behind the U.S. “One of the reasons that we’ve invested a lot here is because there’s incredible infrastructure, there’s incredible talent, and there’s a great production incentives model,” he said. “So everything is in place to make this ecosystem really, really work. And I think that that’s a great example for the United States as well. We have got good infrastructure in many places. We got a lot of great talent. And states are highly competitive with production incentives that allow us to bring more work to places like New Jersey, where we’re building a whole new production facility, or New Mexico, where we’ve built a new production facility. I think that’s probably the model to think about.”

No tariffs worries then? “We try to focus on the things that we can control,” Peters said. “If we have a specific proposal to respond to, we will, but nothing really material yet.”

Some observers have suggested that AI could help further personalize entertainment options served up to subscribers. “There’s a really interesting question around what entertainment experiences people gravitate towards,” Peters said. “There’s no doubt that highly personalized anchors one end … but a shared, a joint experience anchors another end of that. What I think is happening more and more is that we’re actually going to the sort of bimodal distribution of value. So, that middle is the place that’s getting washed out.”

The co-CEO then outlined what that means for companies and their strategies. “There’ll be companies that do an amazing job in the incredibly micro-personalized and maybe to the point of you’re starring in your own narrative,” he said. “There’s a big center of value that we’re really more focused on, which is how do we present a collective experience that we can all talk about. So, if you and I both watched a show like Adolescence, for example, there’s value in us having that shared experience and being able to talk about it.”

User-generated content as competition was also an area Peters discussed, acknowledging that YouTube, for example, was competition for consumers’ time and attention. “We look at YouTube as a training ground for creators,” he highlighted though. Netflix hopes to attract some of them and “give them the opportunity to tell their story in our model which is different from YouTube,” he added. “We fund the productions rather than relying on the creator to fund it. We can typically fund them at a higher level. We have a more efficient monetization model than YouTube does.”

Asked about Netflix’s push into advertising with its ad tier, Peters said: “We’re really just getting started.” When the firm starts something new, it won’t be great at it right away, the executive tends to tell his team. “There’s ton of opportunities for us to extend the way that ads show up” in new formats, in ways that work for audiences and marketers, he mentioned. “Better targeting and better personalization” are among the other future upside areas.

Does Netflix think about itself more like a family or a soccer team? “We definitely think of ourselves as a sports team rather than a family,” Peters explained. “And the thought there is that we want to have an explicit approach that we seek the best players for every position. That means different skill sets in different positions. But it’s not a family situation which is unconditional love.”

The executive’s appearance, entitled “Borderless by Design: Disruption, Scale, and the Global Netflix Playbook,” was live-streamed. “As the streaming landscape evolves, Netflix continues to lead through disruption and expansion,” a description for it said. “Peters discusses what it takes to guide one of the world’s most recognized consumer brands across markets, technologies, and audiences. From navigating cultural complexity to scaling innovation and building new revenue models, Peters shares how Netflix’s leadership approach is shaping the next phase of global growth – and setting the tone for the future of entertainment.”

Netflix co-CEO Ted Sarandos said on Tuesday during a visit to Madrid to celebrate the streaming giant’s 10-year anniversary in Spain that the company would invest €1 billion ($1.1 billion) in the country by 2029.

Technology

CEIA’s Luca Cacioli on AI, security and leadership

Periodically, SBJ Tech will feature a content series called Leadership Look-In, where C-suiters in sports tech offer thoughts on their companies, experiences and personnel management. Want to be considered for a future installment? Email me at ejoyce@sportsbusinessjournal.com. Luca Cacioli has been the CEO of CEIA USA for more than six years, guiding the security screening […]

Periodically, SBJ Tech will feature a content series called Leadership Look-In, where C-suiters in sports tech offer thoughts on their companies, experiences and personnel management. Want to be considered for a future installment? Email me at ejoyce@sportsbusinessjournal.com.

Luca Cacioli has been the CEO of CEIA USA for more than six years, guiding the security screening provider that serves multiple industries, such as the federal government, schools, airports and sports venues.

While CEIA doesn’t share client information, it works with hundreds of companies and has decades of experience with stadiums and arenas. Cacioli started his professional career in Italy as an electrical engineer, later shifting to business management and making his way to the top chair of the longtime detector manufacturer. He spoke to SBJ about the security growth he’s seen in sports, the role of AI in the process and the early learnings that prepared him for leadership.

Note: These excerpts have lightly edited for clarity.

On the changes he’s observed in sports and entertainment: “More responsible parties running these events have realized that maybe they could become some kind of target if they didn’t do anything. Maybe some security needed to be taken into account with more drive. And over time, the market has grown because of that. While initially it was more of an … isolated approach, it’s become very pervasive these days. There are very few events that don’t do any kind of screening, or they don’t have the security of certain kind. … And with that, what we’ve learned over the last 10 years is that there is a need in the market to make sure that we give fans a safe experience, but also a positive, quick experience.”

On using AI in the screening process: “Artificial intelligence is a tool. … A detector doesn’t do everything. You need to have a layered approach to your security. I’m trying to draw a parallel here: artificial intelligence can be a useful tool as part of a bigger approach to your design process. … I cannot go through too much of our design process, but I can tell you that AI is a tool which we use when we deem it appropriate.”

On competition: “There is a lot of competition. A lot of competition comes because the market in the last 10 years has increased in size. So, more and more competitors come in. Now, competition is not really a negative thing. Actually, competition helps us be better. So, I personally welcome competition from that point of view.”

On the impact of his family’s business on his transition from engineering: “Growing up in Italy, I worked on my family’s small business, and my family has a very typical Italian olive oil business. I was always growing up in front of customers. It’s really because of my experience and instruction and really working in that environment since I was a teenager, I did not feel like I was having difficulties. I have to say that the MBA [he attended SMU] helped me tremendously to think in a certain way. … I was an engineer, so that definitely opened up my mind a little more.”

On his key leadership learnings as CEO: “First, delegating. I’m not good at delegating. I’m working on it more and more. However, I have realized that once you are able to hire the right people and have the right people in place … delegating comes more easily and more naturally. So, that I had to learn as a younger manager — I wasn’t good at all at that. But also at the time, I didn’t even grasp the importance of having the right team in place. And the right team in place, in my opinion, is not a bunch of people who think like you. Actually, I love a healthy discussion and disagreement in the team. … Diversity of opinions is important, as long as the manager, in this case me, takes responsibility for the decisions made at the team level.”

Technology

Walgreens Is Pitching Advertisers a Data Clean Room

Walgreens is working with LiveRamp to give its advertisers hands-on access to data from its 101 million loyalty program members. Through the partnership, Walgreens Advertising Group—or WAG—is offering a clean room solution that lets advertisers target customized groups of Walgreens customers across walled gardens and the open web. Advertisers can then connect that targeting data […]

Walgreens is working with LiveRamp to give its advertisers hands-on access to data from its 101 million loyalty program members.

Through the partnership, Walgreens Advertising Group—or WAG—is offering a clean room solution that lets advertisers target customized groups of Walgreens customers across walled gardens and the open web. Advertisers can then connect that targeting data back to Walgreen’s sales data, giving a clearer picture of which ads work.

Using LiveRamp’s conversion APIs, advertisers can see “real incremental sales—not attributed sales—on over 450 offsite platforms,” said Abishake Subramanian, group vp of customer marketing and media monetization at Walgreens.

WAG is one of many retail media networks partnering with tech companies to improve their pitch to advertisers as the retail media landscape gets more crowded and more competitive.

“For advertisers to want to continue to spend money—or spend money in the first place—they should have access [to] and understanding of who they’re targeting, why they’re targeting them, and the effectiveness,” Kevin Dunn, svp of brands and agencies at LiveRamp, told ADWEEK.

In addition to improving measurement tools to capture incremental return on ad spend, the LiveRamp deal helps WAG get its clients’ ads into the market faster and allows for more efficient audience targeting and secure data integration, Dunn said.

“The power of retail media is they have the transactions, and so they can really show you—at least within WAG—are you growing a category? Are you getting a new buyer?” Dunn said.

Technology

PlayMetrics and Stack Sports Combine to Create Leader in Sports Software

Merger unites two industry innovators to meet customers’ evolving preferences and ushers in a new era for sports technology RALEIGH, N.C., & DALLAS, June 11, 2025–(BUSINESS WIRE)–PlayMetrics, a leading provider of operations management software for youth sports organizations, and Stack Sports, a global technology leader for the sports industry, today announced their merger, creating a […]

Merger unites two industry innovators to meet customers’ evolving preferences and ushers in a new era for sports technology

RALEIGH, N.C., & DALLAS, June 11, 2025–(BUSINESS WIRE)–PlayMetrics, a leading provider of operations management software for youth sports organizations, and Stack Sports, a global technology leader for the sports industry, today announced their merger, creating a best-in-class platform in the sports management technology ecosystem. This strategic combination unites two highly complementary and trusted brands, augmenting PlayMetrics’ modern technology platform with the scale, reach, and capabilities of Stack Sports to better serve the evolving needs of sports organizations worldwide. Michael Doernberg, CEO of PlayMetrics, will lead the combined organization as CEO, and Jeff Young, CEO of Stack Sports, will transition to a strategic role as advisor to the board of directors.

Genstar Capital, a leading private equity firm, supported the combination and will be the majority owner of the combined company. As part of the transaction, Genstar acquired PlayMetrics from Blue Star Innovation Partners (“BSIP”), which had been the company’s lead investor since 2023.

PlayMetrics helps customers streamline and modernize every facet of their operations, serving over 2,700 youth sports organizations across a variety of sports. Following a successful expansion beyond its flagship club operating system into governing bodies, leagues, and tournaments – including the acquisition of Crossbar in 2023 – PlayMetrics has experienced unprecedented levels of growth and customer retention over the last few years. Stack Sports is a global technology leader in SaaS platform offerings for the sports industry.

“Sports organizations are increasingly seeking a single, cohesive platform to manage their daily operations and complex business needs,” said Mr. Doernberg. “PlayMetrics has been transformational in delivering a one-stop solution for members, coaches, directors, and administrators. By joining forces with Stack Sports, we further enhance our ability to serve our customers with innovative, reliable, and intuitive software.”

“This merger marks an exciting new chapter for the sports technology industry,” said Mr. Young. “We have long admired the PlayMetrics brand, and by combining our strengths, we will accelerate the speed at which new products are released, customer service is delivered, and industry relationships are forged.”

“The combination of PlayMetrics and Stack Sports creates one of the largest sports technology platforms delivering comprehensive, market-leading solutions to clubs, leagues, tournaments, state associations, and governing bodies,” said Eli Weiss, Managing Partner of Genstar. “We are thrilled to support this transformative combination.”

Technology

College sports settlement sure to entice private equity; Verlinvest and Mistral increase Insomnia Cookies stake

Good morning, Hubsters! Rafael Canton here with the US edition of the Wire from the New York newsroom. Let’s kick off the Wire with college sports. After a settlement in the House vs. NCAA, college athletes can be directly compensated by schools. That could open opportunities for PE firms to invest. We’ll dive into what […]

Good morning, Hubsters! Rafael Canton here with the US edition of the Wire from the New York newsroom.

Let’s kick off the Wire with college sports. After a settlement in the House vs. NCAA, college athletes can be directly compensated by schools. That could open opportunities for PE firms to invest. We’ll dive into what we know so far.

We’ll look at how deal value has risen so far despite deal count dropping according to HarbourVest’s 2025 Midyear Market Outlook.

Also, in a deal announced yesterday, Verlinvest and Mistral Equity Partners have increased their investment in Insomnia Cookies. The focus for both firms has been about expansion both nationwide and internationally.

Finally, we’ll dig into restaurant deals and why they are attractive. Houlihan Lokey has its US Restaurant Industry update.

Pay day

On Friday, a federal judge approved a settlement in the House vs. NCAA. The settlement will allow college athletes to be directly compensated by NCAA institutions for their name, image, and likeness (NIL) rights.

Private equity is expected to have interest in the college sports arena. In April, Buyouts reporter Alfie Crooks covered how the eventual settlement could lead to PE investment. In 2024, RedBird Capital Partners and Weatherford Capital created Collegiate Athletic Solutions, a capital- and business-building provider for public and private university athletic departments across the US.

“The paradigm shift we are seeing in the collegiate athletics ecosystem is similar to the ones we’ve seen with media distribution models, collective bargaining rights, and premium hospitality – they’re all centered around the need to create long-term growth by bridging the gap between premium IP and optimizing revenue streams,” Gerry Cardinale, founder of RedBird, said in a statement at the time of the CAS formation.

Under the new rules that could arise from the settlement in the antitrust case, universities would be allowed to distribute up to 22 percent of gameday revenue with student athletes, with each school subject to a $21 million per-year cap that grows by 4 percent each year.

The pool of capital distributed can be derived from revenue streams including ticket sales, broadcasting rights and sponsorships, shifting the college model closer to a professional model. It would not include NIL payments from outside sources or scholarships.

PE Hub has been following the college sports interest from PE firms since 2024. Before, the only deals that could be done involved NIL. Harlan Capital Partners invested in Nilly, which is a financial technology company with an online marketplace that allows college student athletes to maximize the value of their NIL.

At the end of the year, I highlighted college sports as one of the growing trends in PE’s interest in the overall sports ecosystem.

Increased deal value

Despite economic uncertainty, global private equity buying activity held up well in the first three months of 2025 according to HarbourVest’s 2025 Midyear Market Outlook. Private equity deal values rose to $495 billion in Q1 2025, surpassing the Q4 2024 total of $462 billion and a near-40 percent YoY increase ($345 billion).

Deal count in the first quarter was down slightly from Q4 2024 but also above Q1 2024. The report notes that there has been a slowdown in dealmaking in recent months and it seems unlikely that Q2 figures will show sustained momentum.

The report also highlights how US private equity had a 25 percent increase in Q1 value invested over the previous quarter and a jump of 36 percent on Q1 2024. One reason for the increase was take-private transactions.

The quarter’s total public to private deal value was $51 billion, or around one third of the total for full-year 2024 and 2023. In April, I highlighted how take-private deals in software have held their own and what makes take-privates in software attractive to PE firms.

Sweet progress

Verlinvest and Mistral Equity Partners have increased their investment in Insomnia Cookies, a New York and Philadelphia-based late-night bakery brand. Both firms are acquiring Krispy Kreme’s remaining stake in the deal.

Insomnia Cookies is now on track to scale to 1,800 bakeries globally over the next decade. Seth Berkowitz serves as CEO and founder of Insomnia Cookies.

“We believe Insomnia Cookies has all the ingredients to become a global icon in quality indulgence: a visionary founder, a cult-like following, and a clear edge in digital convenience,” said Clément Pointillart, managing director at Verlinvest in a statement. “We’re proud to deepen our commitment to Seth and the team as we help take Insomnia across the globe.”

In 2024, I spoke to both Verlinvest and Mistral about the initial deal which saw Krispy Kreme break off pieces of its majority stake to both PE firms. Expansion both nationwide and internationally was a focus for both firms with the deal at the time. Insomnia had 293 locations in 2024, so 1,800 locations is a huge step. Pointillart pointed to Verlinvest’s past investments in brands like Oatly and Tony’s Chocolonely as examples of its history in taking brands international.

Rapid expansion

Restaurant franchise assets continue to command premium valuations, driven by their asset-light economics, predictable cash-flow profiles, and ability to scale rapidly through multi-unit development according to Houlihan Lokey’s US Restaurant Industry update.

Recent premium multiples have favored platforms with 200-plus locations, reflecting investor preference for concepts with proven operating models, geographic diversity, and runway for continued unit expansion.

Private equity has consistently had interest in restaurants. Roark Capital announced an investment in Dave’s Hot Chicken. Several media outlets reported the value of the deal was $1 billion. The chain specializes in Nashville style hot chicken and expects to end the year with more than 400 restaurants according to a statement. In November, Blackstone took a majority stake in Jersey Mike’s Subs in November.

The report said that the year began with several large owned and franchised brands preparing to enter the market. While early signs point to a strong pipeline, market appetite will be tested in the months ahead as buyers and investors navigate a complex economic and global environment.

I’ve been covering PE’s interest in franchises for a few years and shared insights from dealmakers back in 2023.

That’s it for me. If you have any questions, thoughts, or want to chat about deals in the tech, consumer or sports sectors, please email me at rafael.c@pei.group.

Tomorrow, Nina Lindholm will be with you for the Europe edition of the Wire and Michael Schoeck will bring you the US edition.

Cheers,

Rafael

Technology

UT Dallas Researchers Create Low-Cost ‘Artificial Muscles’ That Could Power the Future of Smart Clothing and Robotics » Dallas Innovates

Mengmeng Zhang, left, a research scientist at UT Dallas’ NanoTech Institute and lead author of the study, wears a U.S. Olympic team jacket embedded with artificial muscles created using an earlier, mandrel-wrapped process. At right is Ray Baughman, director of the NanoTech Institute. [Photo: UTD] Researchers at UT Dallas’ NanoTech Institute have developed a low-cost […]

Mengmeng Zhang, left, a research scientist at UT Dallas’ NanoTech Institute and lead author of the study, wears a U.S. Olympic team jacket embedded with artificial muscles created using an earlier, mandrel-wrapped process. At right is Ray Baughman, director of the NanoTech Institute. [Photo: UTD]

Researchers at UT Dallas’ NanoTech Institute have developed a low-cost method to fabricate artificial muscles that could open new doors for robotics, energy harvesting, and smart clothing.

But these “muscles” aren’t biological—they’re engineered fibers that behave something like them. When triggered by heat or electricity, the fibers contract, expand, or twist, producing motion without motors.

In this case, polymer yarns are a type of smart material that respond to temperature changes. The UT Dallas team’s advance could move this lab innovation closer to real-world use in clothing, robotics, and other systems that need quiet, energy-efficient movement.

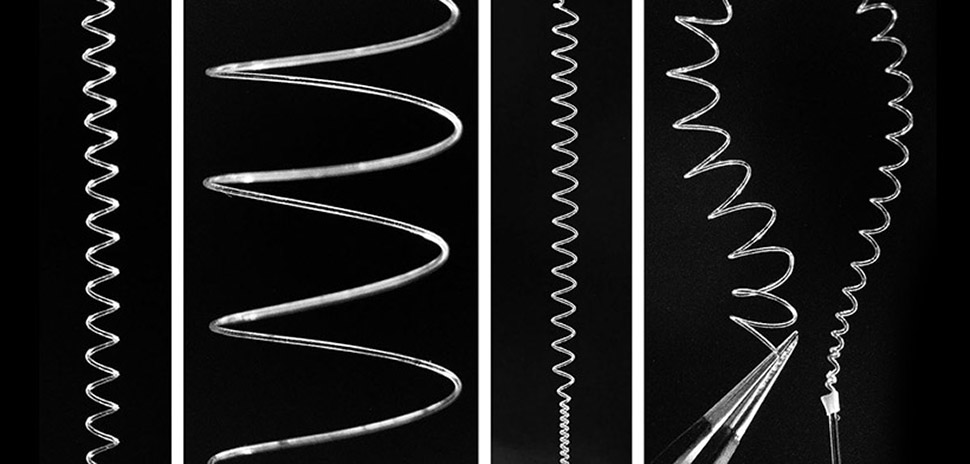

In a study published March 7 in Science, the team describes a mandrel-free technique for making the springlike, thermally driven polymer muscles that can stretch up to 97% of their original length and achieve a spring index over 50.

“High-spring-index yarns can be made much less expensively by this mandrel-free method,” said Dr. Mengmeng Zhang, a research scientist at UT Dallas’ Alan G. MacDiarmid NanoTech Institute and lead author of the study. “When heated and cooled, these muscles can significantly contract and elongate due to their large spring index.”

Mandrel-free-fabricated coiled polymer fibers: Springs with a small spring index are tightly wound and stiffer than those with a higher index, which are more loosely wound and more flexible, such as a Slinky toy. Individual fiber diameter is 0.28 millimeters.

[Photo: UTD]

Innovation enables movement without motors

Traditionally, high-spring-index artificial muscles are made by wrapping fibers around a mandrel, then dissolving it—a costly process that wastes materials. The new method eliminates the mandrel altogether.

“The problem has been that there are no process reports for making mandrel-free, large-spring-index yarns other than to dissolve the mandrel after muscle coiling, which wastes the large-diameter polymer fiber that is typically used as a mandrel and creates a waste stream,” said Dr. Ray Baughman, senior and co-corresponding author and director of the NanoTech Institute.

Using dynamic covalent chemistry, the team created fibers that twist and ply themselves into springlike coils—each fiber acting as a mandrel for another. The resulting artificial muscles vary in stiffness and flexibility and can be tuned for different uses.

The research was funded by the Office of Naval Research, the Air Force Office of Scientific Research, and The Welch Foundation.

From Olympic jackets to energy harvesters

The same team previously licensed mandrel-wrapped artificial muscle technology to a clothing manufacturer, which integrated the fibers into jackets worn by the U.S. team during the 2022 Winter Olympics. But the process was too costly for commercial rollout.

“Our new mandrel-free method for making high-spring-index coiled fiber avoids this major problem, so it may soon enable the commercialization of new comfort-adjusting jackets,” Baughman said.

Beyond clothing, the muscles could be used in devices that harvest mechanical energy or function as self-powered strain sensors. Zhang said the method even allows for variable spring indexes along a single fiber, enhancing adaptability.

The strokes of contraction and expansion are heat-driven, either through electricity, solvents, or electrochemical methods.

Broad team

Other co-authors include:

-

Dr. Shaoli Fang, associate research professor and co-corresponding author

-

Chemistry doctoral student Ishara Ekanayake

-

Former researchers Dr. Jiyoung Oh and Zhong Wang (PhD ’21)

-

Researchers from Texas State University, Tekirdağ Namık Kemal University, and Lintec of America

The team has applied for a patent on the technology.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.

-

NIL2 weeks ago

NIL2 weeks ago2025 NCAA Softball Tournament Bracket: Women’s College World Series bracket, schedule set

-

Health7 days ago

Health7 days agoOregon track star wages legal battle against trans athlete policy after medal ceremony protest

-

Professional Sports7 days ago

Professional Sports7 days ago'I asked Anderson privately'… UFC legend retells secret sparring session between Jon Jones …

-

College Sports2 weeks ago

College Sports2 weeks agoIU basketball recruiting

-

Professional Sports7 days ago

Professional Sports7 days agoUFC 316 star storms out of Media Day when asked about bitter feud with Rampage Jackson

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoScott Barker named to lead CCS basketball • SSentinel.com

-

Youtube3 weeks ago

Youtube3 weeks agoAnt greets A-Rod & Barry Bonds before Game 3

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoJ.W. Craft: Investing in Community Through Sports

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Penalty Report: Charlotte Motor Speedway (May 2025)

-

College Sports1 week ago

College Sports1 week agoOKC’s Mark Daigneault knows what it takes to win championships. His wife has won a ton of them