Technology

WHOOP 5.0 and WHOOP MG redefine wearable health tracking

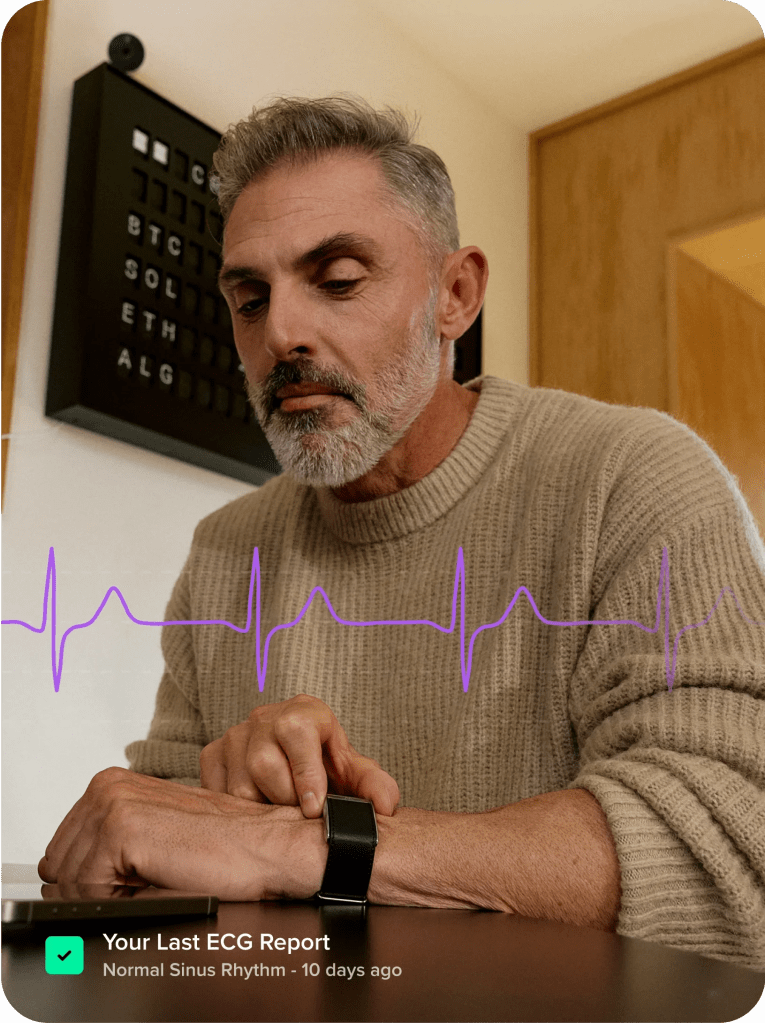

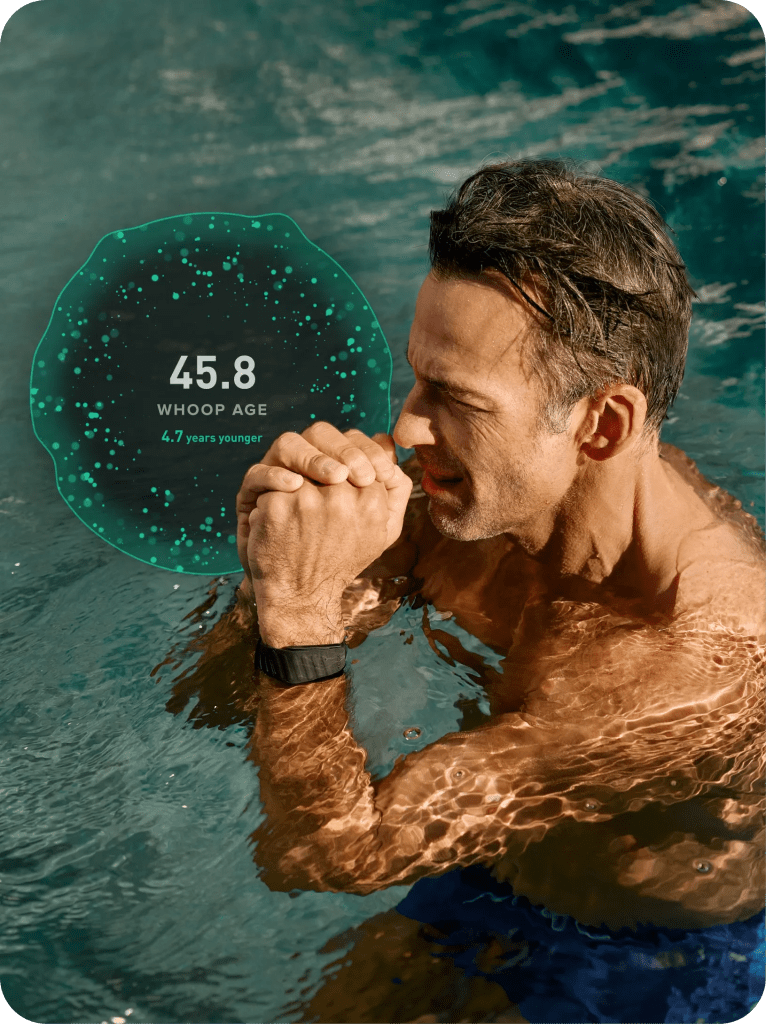

Whoop has officially unveiled the next evolution in wearable health technology with the launch of the WHOOP 5.0 and the all-new WHOOP MG. Both devices push the boundaries of what performance wearables can offer, combining advanced biometrics, a sleeker form factor, and new upgrade paths that cater to serious athletes and wellness-minded individuals alike.

7% smaller, 14+ day battery, same powerful insights

The WHOOP 5.0 and WHOOP MG are 7% smaller than their predecessor, making them more comfortable than ever for 24/7 wear. But size is just the start; the upgraded battery delivers over 14 days of life on a single charge, one of the longest battery durations in the wearable market.

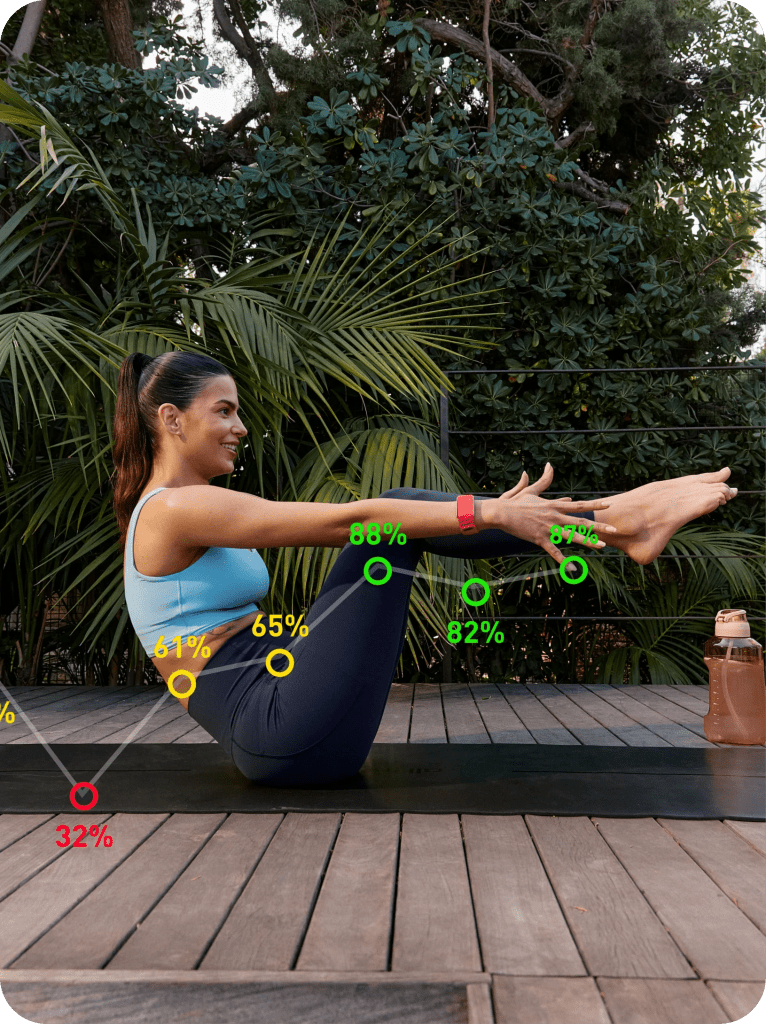

These enhancements come without sacrificing the continuous monitoring WHOOP is known for. You’ll still get round-the-clock tracking of strain, recovery, sleep quality, HRV, skin temperature, respiratory rate, and more; all analyzed with WHOOP’s proprietary performance algorithms.

Smarter health insights, reimagined membership tiers

Alongside the hardware refresh, WHOOP is introducing new membership tiers and upgrade options to deliver more value to members at every level.

- Upgrade to WHOOP 5.0 for free by extending your membership by 12 months and get early access to new features as they roll out.

- Upgrade to WHOOP MG—a premium magnesium-body version, for an additional $120, and step into the brand’s new Peak and Life membership experiences.

WHOOP MG isn’t just a cosmetic upgrade. It’s designed with durability and performance in mind, built to deliver longevity while pairing seamlessly with the new Life membership; offering deeper analytics, personalized coaching, and the earliest possible access to feature updates and partner integrations.

What’s new with WHOOP 5.0?

While WHOOP continues to keep some upcoming features close to the chest, early adopters of the 5.0 and MG models will receive priority access to beta features and enhanced data breakdowns. WHOOP has long emphasized its software-first philosophy, and the 5.0 models are clearly built to future-proof that mission.

Expect improvements in:

- Sleep stage tracking accuracy

- Daily strain and recovery scoring

- Stress monitoring and resilience scoring (a feature in testing)

- In-app coaching and goal tracking based on evolving health data

The new device architecture is designed to handle more complex biometric calculations, meaning WHOOP is investing in long-term innovation, allowing new features to arrive without needing new hardware.

Why it matters

As fitness wearables flood the market with flashy features, WHOOP continues to focus on meaningful health insights. There are no screens. No distractions. Just pure physiological data that helps you optimize performance, prevent overtraining, and fine-tune your recovery.

For athletes, health-focused professionals, and longevity enthusiasts, WHOOP’s insight-driven platform is built to empower better daily decisions. With WHOOP 5.0 and WHOOP MG, that power is now wrapped in a more refined, more durable, and more energy-efficient package.

How to upgrade

Ready to step into the next generation of wearable tech?

- Visit whoop.com and log in to your account

- Choose to extend your membership by 12 months to receive the WHOOP 5.0 for free

- Or upgrade to WHOOP MG for $120 and receive access to the new Life tier experience

Related

FTC: We use income earning auto affiliate links. More.

Technology

Xpoint secures new growth funding to supercharge geolocation innovation for real money gaming

Our website uses cookies, as almost all websites do, to help provide you with the best experience we can.

Cookies are small text files that are placed on your computer or mobile phone when you browse websites.

Our cookies help us:

– Make our website work as you’d expect

– Remember your settings during and between visits

– Offer you free services/content (thanks to advertising)

– Improve the speed/security of the site

– Allow you to share pages with social networks like Facebook

– Continuously improve our website for you

– Make our marketing more efficient (ultimately helping us to offer the service we do at the price we do)

We do not use cookies to:

– Collect any personally identifiable information (without your express permission)

– Collect any sensitive information (without your express permission)

– Pass personally identifiable data to third parties

– Pay sales commissions

Technology

HDMI Gaming Technology Lines : HDMI Licensing Administrator

At CES 2026, visitors to the HDMI Licensing Administrator’s booth can witness prototypes of the Ultra96 HDMI Cable, which was “introduced in the recently released HDMI 2.2 Specification,” alongside the Ultra High Speed HDMI Cable and the Premium High Speed HDMI Cable. The organization will highlight the high-refresh performance rate of its products, as well as their compatibility with popular portable gaming consoles and retro-style gaming systems. Supportive features like variable refresh rate and auto low latency mode will be highlighted, as well.

Technology

Expandable eSports Laptop Models : Lenovo Legion Pro Rollable

The Lenovo Legion Pro Rollable laptop will reportedly be based on the brand’s Legion Pro 7i platform with an Intel Core Ultra processor and NVIDIA GeForce RTX 5090 GPU. The additional tech specs for the laptop are yet to be announced.

Image Credit: Lenovo

Technology

Driving Digital Innovation: Sultan Almasoud on the Top Trends in Technology and Esports in Saudi Arabia | Morgan Lewis – Tech & Sourcing

Dr. Sultan Almasoud, managing partner of Morgan Lewis’s Riyadh office, has been closely involved in the Kingdom of Saudi Arabia’s rapid evolution into a global hub for innovation. His insights on the questions below shed light on the trends reshaping technology and esports—and the opportunities they unlock for investors and operators entering the market.

Q&A: SULTAN ALMASOUD

1. What are the most significant technology trends currently driving growth in Saudi Arabia?

Saudi Arabia is undergoing one of the most ambitious digital transformation journeys in the world. The most significant trend is the rapid adoption of AI across government, financial services, healthcare, and industrial sectors. Vision 2030 has accelerated investment in AI-ready infrastructure, digital identity, automation, and data platforms that support new digital services at scale.

We also are seeing strong momentum in cloud migration, driven by hyperscaler expansions, data localization policies, and new solutions that make it easier for public and private entities to adopt cloud-native technologies. In parallel, fintech innovation, digital payments, and open banking are creating a dynamic ecosystem of startups, investors, and regulators working together to modernize the financial landscape.

In addition, Saudi Arabia’s giga projects are acting as large-scale accelerators for advanced technologies, while strong regulatory frameworks around data, cloud, and cybersecurity are providing international investors with clarity and confidence. Combined with significant investment in digital talent and localization, this is enabling sustainable, long-term technology-driven growth across the Kingdom.

2. How is Saudi Arabia positioning itself as a global hub for esports?

Saudi Arabia has made esports a national priority, fundamentally reshaping the sector. The launch of the Saudi Esports Federation (SEF) and the Esports World Cup, supported by major public investment commitments, has placed the Kingdom at the center of global competitive gaming.

But the strategy extends beyond events. The country is developing training academies, production studios, esports arenas, and digital platforms that sustain year-round player and audience engagement. This ecosystem-driven approach is drawing global publishers, teams, and content creators who now view Saudi Arabia as a foundational market for long-term esports growth.

3. What opportunities do you see emerging for investors and companies entering the Saudi tech and esports market?

There is tremendous opportunity at the intersection of technology, entertainment, and digital infrastructure. For technology companies, opportunities are especially strong in AI solutions, cybersecurity, cloud services, digital identity, and smart city platforms.

In esports, the most compelling opportunities lie in content creation, talent development, gaming studios, tournament production, and technologies supporting broadcasting, analytics, and community engagement. Investors who understand the regulatory environment and align with the Kingdom’s long-term vision will find a market eager for strategic partnerships.

4. What challenges should companies keep in mind when operating in these fast-evolving sectors?

These sectors are evolving quickly, which makes regulatory navigation an important challenge. Companies need to stay aligned with requirements around licensing, content regulation, data protection, and foreign investment—areas that are developing alongside the industry itself.

Another key challenge is specialized talent. Whether it’s game design, AI engineering, or esports event management, building local capability is essential. Companies that invest early in training programs, knowledge transfer, and local partnerships will be best positioned for sustainable growth.

Ultimately, success requires a long-term commitment to the market, strong local relationships, and an understanding of national priorities as the Kingdom advances its digital transformation goals.

KEY TAKEAWAYS

Saudi Arabia is positioning itself at the forefront of global innovation, with technology and esports playing central roles in the nation’s economic transformation. As investment accelerates and new digital ecosystems emerge, companies that build strategic partnerships and engage deeply with local priorities will be poised to lead.

Technology

Fast Switches, RGB Customization, and Next-Gen Gaming Precision

Mechanical keyboard 2026models integrate ultra-fast switches that achieve 0.1ms actuation with under 1mm travel, allowing competitive gamers to press keys 20% faster in FPS and MOBA titles. RGB keyboards now feature 16.8 million per-key zones, enabling dynamic lighting that reacts to game events, killstreaks, or ability cooldowns. Hall-effect magnetic switches dominate the premium segment, offering adjustable actuation points from 0.1mm to 4.0mm while lasting 100 million keypresses with no physical wear. Together, these innovations deliver both tactile precision and immersive customization, making mechanical keyboards a vital tool for high-level competitive play.

Mechanical keyboard 2026 designs also focus on durability, ergonomics, and modularity. Hot-swappable switches allow players to fine-tune the feel without soldering. Aluminum chassis and gasket-mounted plates reduce finger fatigue while maintaining solid stability for marathon gaming sessions. Modern firmware supports thousands of macros, rapid polling rates, and dual-PC setups, ensuring that esports players experience consistent input across multiple platforms.

Fast Switches and Key Feel

Fast switches like Gateron KS-20 reduce actuation force to 35g at just 0.2mm depth, while optical variants eliminate debounce delays, registering inputs at 8,000Hz natively. Mechanical keyboard 2026 boards include hot-swappable sockets, allowing players to swap magnetic, linear, or tactile stems without soldering. PBT double-shot keycaps resist shine after five years of heavy use, and gasket-mounted designs reduce bottom-out impact, lowering finger fatigue by up to 30% during marathon sessions. Combined, these features enhance responsiveness, durability, and ergonomic comfort for both competitive and casual gamers.

Other innovations include per-key actuation calibration via onboard OLED displays, letting players fine-tune each switch’s sensitivity individually. Fast switches allow remapping for advanced trigger modes, such as assigning jump or crouch to rapid keypresses, boosting movement efficiency in FPS titles. Firmware support like VIA and QMK provides up to 1,000 macro layers, ensuring fluid execution of complex combos. NKRO (N-Key Rollover) maintains accurate detection of 100 simultaneous inputs, preventing ghosting during intense gameplay.

RGB Keyboards and Lighting Customization

RGB Gaming keyboards in 2026 employ addressable LEDs beneath every key, responding instantly to in-game actions, music beats, or voice chat activity. Fast switches synchronize with lighting effects to create visual feedback for ability activation or kill confirmations. VIA and QMK support advanced lighting macros across 16.8 million colors, letting players design immersive themes and reactive effects. RGB keyboards also integrate USB passthrough hubs, enabling controller charging or peripheral connections without latency interruptions.

Premium gaming screens emphasize both aesthetic and functional benefits. Aluminum chassis with acoustic foam layers tune sound profiles from soft, creamy thocks to sharp, clicky clacks, complementing per-key lighting for sensory immersion. RGB keyboards combined with modular keycaps allow instant visual recognition of critical keys, enhancing reaction times in high-pressure matches. Firmware updates maintain compatibility with new software and games, ensuring that RGB functionality evolves alongside gaming trends.

Build Quality and Advanced Features

Mechanical keyboard 2026 models focus on robust materials and ergonomic design to support competitive play. Aluminum top plates weigh around 1.2kg, stabilizing 60% or full-size layouts, while foam and gasket mounting reduce vibration and noise. Fast switches with Hall-effect sensors allow precise calibration and onboard memory, storing personalized actuation and lighting settings.

Other features include multi-device support, 8,000Hz polling across dual-PC setups, and modular layouts for hybrid gaming and productivity. High-end models provide long-term durability, with switches rated for 100 million keypresses and chassis built to withstand sustained pressure. These designs ensure that both casual players and esports professionals can maintain peak performance over years of intense use.

Key Features:

- Aluminum top plates provide stability and long-lasting structural integrity.

- Foam and gasket-mounted designs reduce vibration, noise, and finger fatigue.

- Hall-effect fast switches allow precise per-key calibration and storage.

- Modular layouts and multi-device support enhance versatility for gaming and work.

- 8,000Hz polling ensures sub-ms latency across dual-PC or multi-system setups.

- Switches rated for 100 million keypresses guarantee long-term durability.

Conclusion

Mechanical keyboard 2026 models with fast switches and RGB keyboards redefine both competitive precision and immersive gameplay experiences. Adjustable actuation, ultra-fast response times, and reactive per-key lighting provide measurable advantages in esports, allowing players to execute rapid combos and maintain visual awareness under intense pressure. Durable materials, modular layouts, and advanced firmware ensure 10+ years of relevance, keeping performance consistent even as switch technology evolves. Combined, these innovations set a new benchmark for gaming keyboards, making them an indispensable tool for casual enthusiasts and professional gamers alike.

Frequently Asked Questions

1. What makes mechanical keyboard 2026 switches faster than older models?

Mechanical keyboard 2026 switches achieve 0.1ms actuation with minimal travel, reducing input delay. Optical switches eliminate debounce entirely. Hot-swappable designs allow users to optimize each switch type. Together, they improve reaction times in competitive gaming.

2. How do RGB keyboards enhance gaming performance?

RGB keyboards provide per-key lighting for instant visual cues on ability cooldowns, killstreaks, or critical keys. Reactive effects improve reaction speed in high-pressure scenarios. Custom macros allow lighting to indicate complex input sequences. This combination merges aesthetics with functional gameplay advantages.

3. Are fast switches durable enough for long-term use?

Yes, Hall-effect and magnetic switches are rated for 100 million keypresses. Gasket-mounted designs reduce mechanical wear and finger fatigue. PBT double-shot keycaps resist shine and degradation. Long-term durability ensures consistent performance for years.

4. Can mechanical keyboard 2026 models support multi-device setups?

Many models integrate USB passthrough hubs for peripherals and dual-PC support. 8,000Hz polling ensures sub-ms latency across connected devices. Firmware allows separate profiles per device. This setup guarantees smooth operation for both gaming and productivity tasks.

Technology

How Schools Are Powering the Future of Competitive Gaming Education

The world of esports has rapidly shifted from a niche form of entertainment to a central component of competitive gaming education. As 2026 approaches, academic institutions across the globe are embracing the opportunities that digital competition presents.

From high school classrooms to university campuses, structured gaming programs in schools are transforming how students learn, collaborate, and prepare for the digital economy.

The Explosive Rise of Esports in Education

Esports, once dismissed as mere gaming, now attracts millions of players and spectators around the world. Educational institutions have taken notice. The steady growth in digital engagement, streaming culture, and student interest has pushed schools to formally integrate esports into their extracurricular and academic offerings.

By 2026, experts project that school-based esports participation will surpass that of traditional high school sports in some regions. The digitization of competitive gaming aligns with broader trends in modern education, where technology, inclusivity, and creativity intersect to form new learning pathways.

What Is Esports and Why Is It So Popular Among Students?

Esports refers to organized, competitive video gaming, often involving professional players and teams. Unlike casual gaming, esports involves structured tournaments, ranked leagues, and strategy-based team play across popular titles such as League of Legends, Valorant, and Rocket League.

For students, esports blends entertainment with purpose. It enables individuals who may not participate in traditional athletics to compete, build communities, and express creativity. The widespread availability of gaming hardware, streaming tools, and online platforms has lowered the entry barrier, making esports more accessible than ever.

Moreover, the social component is powerful. Online tournaments and school leagues foster connection across diverse backgrounds, helping students develop coordination, leadership, and interpersonal skills, traits that are increasingly valuable in both academic and corporate environments.

How Are Schools Launching Esports Programs?

Many schools have already launched formal esports programs, driven by student demand and institutional recognition of esports’ educational potential. Universities in the United States, South Korea, and the Philippines are establishing dedicated esports departments that oversee teams, manage scholarships, and organize intercollegiate competitions.

High schools are following suit. Some districts are converting computer labs into esports arenas equipped with high-performance PCs, ergonomic setups, and broadcast equipment. Others collaborate with gaming companies to create mentorship and training initiatives, blending classroom theory with real-world competition.

These gaming programs in schools go beyond playing. They involve curriculum design, technical training, and content creation workshops that align esports with the broader educational framework. Students learn not only how to compete but also how to analyze performance data, manage teams, and produce digital media.

What Do Students Learn from Competitive Gaming Education?

The rise of competitive gaming education is reshaping the skillsets associated with modern learning. Students gain more than just gaming proficiency, they develop critical thinking, multitasking, and collaboration abilities. These programs emphasize transferrable skills such as problem-solving, adaptability, and emotional regulation under pressure.

Esports also complements existing curricular areas. Game strategy mirrors elements of mathematics and physics, while coding and hardware management connect directly to STEM learning. Instructors use esports to teach topics such as network infrastructure, software development, and game design.

Beyond academics, competitive gaming encourages inclusivity. Students of all genders, backgrounds, and physical abilities can participate on equal footing, fostering school pride and teamwork in digital spaces.

How Big Will Esports Be by 2026?

Industry analysts predict that esports in 2026 will be valued at over $2 billion globally, with an audience exceeding 800 million. This rapid growth is fueled by live-streaming platforms, increasing sponsorship deals, and more educational integration.

Esports’ reach continues to expand beyond traditional entertainment. Virtual reality and augmented reality are enhancing gameplay engagement, while blockchain-based tournament systems are adding transparency to competition and prize distribution.

The integration of AI analytics is also reshaping coaching methods. Educators and team managers are using data-driven insights to assess player performance, optimize team composition, and develop customized training regimens. As schools adopt these same analytical tools, competitive gaming education enters a new era, where digital literacy and innovation drive progress.

What Challenges Do Schools Face in Running Esports Programs?

Despite the enthusiasm surrounding esports, schools still face practical and ethical challenges. One major concern is balancing academics with gaming commitments. Without structured supervision, students may risk excessive screen time or burnout.

Institutions are addressing this by introducing strict schedules, physical activity requirements, and mental health counseling. Another challenge involves funding. Setting up professional-grade arenas and securing reliable hardware demand significant investment. Public schools in particular rely on sponsors or partnerships with tech firms to maintain program sustainability.

Finally, schools must train or hire qualified esports coaches who understand both the educational context and the competitive scene. This dual expertise ensures that gaming remains an avenue for learning, not just recreation.

Success Stories: Schools Leading the Way in Esports Education

Several schools around the world have already demonstrated how esports can enhance education. In the United States, the High School Esports League (HSEL) connects thousands of students nationwide, fostering academic engagement and teamwork. Schools such as Miami University and the University of Utah became early adopters of varsity esports teams, setting benchmarks for collegiate competition.

In Asia, South Korea remains a trailblazer. Its government has integrated esports into youth programs, emphasizing both technical training and player well-being. Meanwhile, in the Philippines, some universities have begun offering esports courses as part of information technology programs, mirroring global trends toward curriculum innovation.

These examples prove that when implemented responsibly, esports programs can increase student enrollment, improve school visibility, and create bridges between education and industry.

The Future of Competitive Gaming Education Beyond 2026

Beyond esports 2026, the intersection of competitive gaming and education will likely deepen. Analysts foresee a future where esports becomes as normalized as traditional athletics, with intramurals, leagues, and international tournaments structured at school and university levels.

The global shift toward online learning has also paved the way for hybrid esports education models, combining remote play with in-person coaching. Additionally, certifications in health and psychology related to esports are expected to emerge, helping educators manage player wellness and team dynamics effectively.

Cross-border collaborations may soon unite students from different regions in global esports competitions, promoting cultural exchange and digital diplomacy through gameplay.

Frequently Asked Questions

1. Can esports help improve students’ academic performance?

Yes. Organized esports can boost focus, strategic thinking, and time management. Students in competitive gaming education often show stronger problem-solving and teamwork skills that support academic success.

2. What are the career opportunities for students who study esports?

Students can pursue careers in event management, broadcasting, analytics, marketing, and game design. Many esports 2026 programs also prepare graduates for tech and media-related fields.

3. How do schools choose which games to include in their esports programs?

Schools select games that promote teamwork, critical thinking, and inclusivity. Titles like Rocket League and League of Legends are common in gaming programs in schools due to their balance of strategy and accessibility.

4. Do esports programs promote diversity and inclusion in education?

Yes. Esports welcomes students from all backgrounds, offering equal opportunities regardless of physical ability or gender. Many schools use competitive gaming education to foster inclusivity and community.

-

Motorsports2 weeks ago

Motorsports2 weeks agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoBlack Bear Revises Recording Policies After Rulebook Language Surfaces via Lever

-

Motorsports2 weeks ago

Motorsports2 weeks agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoDavid Blitzer, Harris Blitzer Sports & Entertainment

-

Motorsports2 weeks ago

Motorsports2 weeks agoJR Motorsports Confirms Death Of NASCAR Veteran Michael Annett At Age 39

-

Motorsports2 weeks ago

Motorsports2 weeks agoRick Ware Racing switching to Chevrolet for 2026

-

Sports2 weeks ago

Elliot and Thuotte Highlight Men’s Indoor Track and Field Season Opener

-

Sports2 weeks ago

West Fargo volleyball coach Kelsey Titus resigns after four seasons – InForum

-

Sports1 week ago

Sports1 week ago#11 Volleyball Practices, Then Meets Media Prior to #2 Kentucky Match