Technology

DraftKings the Exception to Sports SPAC’s Dire Track Record

DraftKings, the company that sparked the sports SPAC craze in 2020, still stands as the best of the blank-check sports deals. The result for some 200 other sports-related special purpose acquisition companies is largely failure, as last week’s decision by football theme-park operator Hall of Fame Resort and Entertainment’s decision to sell itself for pennies on the dollar demonstrates.

If you buried your memories of SPACs along with your COVID-19 face masks, here’s a refresher: SPACs are so-called blank check businesses that raise money at an IPO with the stated intent of finding another business to merge with, taking it public. DraftKings wasn’t the first sports-related SPAC—Hank Aaron helped lead an unsuccessful one to buy a sports franchise in the 2007—but it easily was the most successful. Its April 2020 emergence as a publicly traded company was an unexpected and resounding success: Six months after debuting, DraftKings stock had run up more than 600% from its initial price.

Whether you consider SPACs part of the meme stock madness of the pandemic or just another cyclical market mania, DraftKings’ success nevertheless helped the sector boom: During 2020 and 2021, some 466 SPACs held IPOs, according to data from the University of Florida’s Jay Ritter, who tracks IPOs. Hundreds more registered to come public during that time. Sports, driven by DraftKings’ success, was at the forefront: 184 sports-related SPACs were formed after DraftKings’ stock market debut.

Sports SPACs, broadly defined, are entities seeking to merge with a sports business, such as a team or sports tech, or one that has the management or advisory participation of an athlete, team owner or sports executive. The names involved could form the basis of a dominant starting five: NBA veterans Shaquille O’Neal, Kevin Durant, Shane Battier and Baron Davis all were part of a SPAC. Or if baseball is your thing, anchor your lineup with Alex Rodriguez, Dave Winfield and Justin Verlander. Quarterbacks were particularly popular participants in SPACs: Roger Staubach, Eli Manning, Steve Young, Patrick Mahomes, Oliver Luck and Colin Kaepernick had theirs too. More common were the presence of team owners, leaning on their business background: Jon Ledecky, Todd Boehly, Vivek Ranadivé and Tilman Fertitta were among the dozens of owners in SPACs. One of the vehicle’s biggest (or notorious, depending on your view) cheerleaders during the boom was Chamath Palihapitiya, who was a minority owner of the Golden State Warriors.

Despite all that talent, sports SPACs were mostly flops. Of 200 sports SPACs Sportico identified as being formed since 2005, just 70 ever completed a merger while another 70 couldn’t close a merger after having their IPO—by rule they dissolved and returned their capital back to shareholders. Another 51 never got to hold their IPO: Most formed during the height of the SPAC craze and got stuck when the bubble burst. Nine sports SPACs continue to persist, having received shareholder approved extensions to locate or close deals. Among them, the A-Rod-led Slam Corp., which raised $500 million in 2021 to seek a sports or media business. It’s now trying to close a merger with satellite phone company it’s had in the works for 18 months now.

It’s probably unfair to hang sports SPAC failures solely at the feet of their participants: after all, the state of the overall market is a tide that’s hard to swim against. After a run of spectacular implosions of SPAC deals, like EV maker Lordstown Motors and WeWork, both of which went into bankruptcy, investor appetite dried up for even quality SPAC mergers.

But the decision by Hall of Fame Resort last week to accept a 90-cents per share take-private offer shines light on just how bad sports SPACs deals have been overall. Hall of Fame, which seeks to popularize a football real estate and entertainment development at the Pro Football Hall of Fame in Canton, Ohio, is one of 23 sports SPACs that now trade under $1 a share. Vegas Knights owner Bill Foley took internet ad platform System1 public with a SPAC, it’s now at 51 cents. Islanders co-owner Jon Ledecky’s deal for data software KLD Discovery now trades at two cents. Two of Palihapitiya’s are also penny stocks. Others trade at fractions of a penny after being delisted by their stock exchange.

Another 10 sports SPACs are total losses for investors, having gone belly up or been sold for losses over 99% from their $10 merger price, the typical SPAC share valuation. Seven SPAC deals trade below $10, but at less than a 50% loss, our arbitrary cutoff. They include Betway parent Super Group, bowling alley and PBA Tour owner Lucky Strike Entertainment and theme park developer Falcon’s Beyond. Most of the balance trade between $1 and $5.

In fact, only eight sports SPACs can be considered successes, meaning shareholders received or sit on a profit, according to data compiled by Sportico. Three were acquired at a premium, including Fertitta’s Golden Nugget Online Gaming, which DraftKings acquired for a stock swap, now worth $14 today. Another is bad credit lender OppFi, taken public through a Joe Moglia SPAC, while a third is cruise ship line Lindblad Expeditions, taken public by tennis executive Mark Ein. Betting related Rush Street Interactive and Genius Sports are two more. Still, the share prices of those seven have spent significant time underwater at some point since going public. By comparison, DraftKings stock spent a few minutes trading below $10 one single day three years ago. Having closed trading Monday at $37.93, SPAC investors sit on a 279% profit.

Last year, 72 SPACs had an IPO, according to Ritter. None of those were sports related. Despite hundreds of SPACs formed and billions of dollars raised, DraftKings remains the best of the sports SPACs. That likely means it’s also the last.

Technology

New Nevada Gaming Board Chairman Knows The Importance Of Getting Technology OK’d Quickly

The New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, signaling a clear focus on modernizing how gaming innovations move from development to casino floors. This approach reflects an understanding that technology now plays a central role in the gaming industry and that regulatory systems must evolve to keep Nevada competitive while maintaining its high standards.

New Chairman Knows the Importance of Approving Technology

Gaming technology is advancing at a rapid pace, from new slot machine platforms to cashless systems and enhanced security tools. When approvals take too long, Nevada risks seeing new products debut elsewhere first. The New Nevada Gaming Board Chairman knows the importance of getting technology approved quickly because delays can affect manufacturers, casino operators, and ultimately the state’s position as a leader in regulated gaming.

Industry Experience Shaping Regulatory Priorities

Leadership matters in regulatory agencies, especially in industries as complex as gaming. The new chairman brings experience that bridges regulation and technology, offering insight into how long approval timelines can impact innovation. This background helps explain why the New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, not as a shortcut, but as a way to make processes more efficient and predictable.

How Faster Approvals Benefit Nevada’s Gaming Industry

Timely technology approvals help casinos remain competitive and allow players to experience the latest advancements sooner. When Nevada can approve new gaming systems without unnecessary delays, it strengthens relationships with manufacturers and reinforces the state’s reputation as the global standard for gaming regulation.

Maintaining Integrity While Moving Faster

Speed does not mean sacrificing oversight. Nevada’s gaming regulators are still responsible for ensuring fairness, security, and compliance. The emphasis is on refining internal processes, improving communication, and reducing bottlenecks. This balanced approach explains why the Nevada Gaming Board Chairman knows the importance of getting technology approved quickly while continuing to uphold strict regulatory safeguards.

What This Means for the Future of Gaming Regulation

Looking ahead, a more responsive approval process could encourage greater innovation within Nevada’s gaming sector. Developers may be more inclined to launch new technologies in the state, and operators can adapt more quickly to player expectations.

By aligning regulatory efficiency with technological progress, Nevada positions itself to remain both a trusted regulator and an innovation-friendly environment in an increasingly competitive global gaming market.

Looking for Legal Guidance in Gaming?

If you follow SCCG content and have inquiries about your gaming business, connect with Lazarus Crystal Law Firm—formed by SCCG Management and Lazarus Legal to unite top-tier gaming law with commercialization and market-entry strategy.

Our Areas of Expertise Include:

• Nevada and multi-state gaming licensing

• Regulatory compliance and audit services

• International market entry and cross-border advisory

• Gaming M&A legal due diligence

• Tribal gaming legal and strategic support

• iGaming and sports betting regulatory guidance

Follow us on LinkedIn: Lazarus Crystal Law Firm

Technology

Page not found

Technology

Samsung to showcase world’s first 1,040Hz gaming monitor at CES 2026

Samsung Electronics has unveiled its new most advanced Odyssey gaming monitor lineup. The lineup includes five new models that push the boundaries of resolution, refresh rates, and immersive visual performance.

Led by Samsung’s first 6K 3D Odyssey G9, the 2026 lineup debuts world-first display technologies for gamers and creators, including the next-generation Odyssey G6 and three new Odyssey G8 models.

First 6K glasses-free 3D monitor

“With this year’s Odyssey lineup, we’re introducing display experiences that simply weren’t possible even a year ago,” said Hun Lee, Executive Vice President of the Visual Display (VD) Business at Samsung Electronics.

“From the industry’s first 6K glasses-free 3D monitor to breakthrough 1,040Hz speed, we designed these monitors to meet the ambitions of today’s gamers and deliver a level of immersion that fundamentally changes how content looks and functions on screen.”

The 32-inch Odyssey 3D (G90XH model) debuts the world’s first 6K display with glasses-free 3D, introducing a new way to experience games on a monitor. Powered by real-time eye tracking, it adjusts depth and perspective in response to the viewer’s position, creating a layered sense of dimension for smooth, uninterrupted gameplay without the need for a headset, according to a press release.

PC gamers can enjoy high-quality expanded lineup

With 6K resolution, a 165Hz refresh rate boosted to 330Hz through Dual Mode, and 1ms response time, fast action stays sharp and smooth, according to Samsung.

The company claims that PC gamers can enjoy a high-quality expanded lineup of supported titles with optimized 3D effects developed in collaboration with game studios. Featured games such as The First Berserker: Khazan, Lies of P: Overture, and Stellar Blade will offer added dimensionality, enhancing terrain, distance, and object separation beyond standard 2D gameplay.

The South Korean company has also highlighted that the 27-inch Odyssey G6 (G60H model) gaming monitor advances competitive gaming with the world’s first 1,040Hz gaming monitor through Dual Mode and native QHD support up to 600Hz, delivering esports-level motion clarity to help players track targets and see fine details during high-speed movement.

When needed, the Odyssey G6 can boost performance in an instant, providing ultra-sharp resolution so viewers can experience breathtaking worlds and ultra-high speeds that fuel competitive adrenaline. With support from both AMD FreeSync Premium and NVIDIA G-Sync Compatible, the Odyssey G6 ensures that every frame is smooth, every color pops, and every moment feels responsive.

The Odyssey G8 series is expanding in 2026 with three distinct models, each offering a different balance of resolution and speed. Leading the lineup, the 32-inch Odyssey G8 (G80HS model), the industry’s first 6K gaming monitor, delivers native 165Hz performance with Dual Mode that supports up to 330Hz in 3K mode.

The 27-inch Odyssey G8 (G80HF model) offers a sharper 5K option with native support up to 180Hz, and Dual Mode boosts to 360Hz in QHD for smoother motion.

For users who want deeper contrast, the 32-inch Odyssey OLED G8 (G80SH model) pairs a 4K QD-OLED panel with a 240Hz refresh rate, Glare Free viewing, 300-nit brightness, and VESA DisplayHDR True Black 500 certification. Its DisplayPort 2.1 (UHBR20) supports up to 80 Gbps of bandwidth for seamless HDR and VRR playback, according to Samsung.

The complete Odyssey 2026 lineup will be on display at CES 2026 in Las Vegas from January 6-9.

Technology

Games of the Future Abu Dhabi 2025 Rewrites the Playbook for Sports with Phygital Innovation

Published on

December 25, 2025

By: Tuhin Sarkar

The Games of the Future Abu Dhabi 2025 have closed an unforgettable chapter in the evolution of phygital sports. Hosted under the patronage of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, the event marked an unparalleled fusion of physical and digital competition. Over six action-packed days, Abu Dhabi hosted more than 850 participants from 60+ countries, with fierce battles across 11 disciplines including Phygital Football, Phygital Basketball, esports, Phygital Fighting, drone racing, and VR gaming.

Games of the Future Abu Dhabi 2025 was not just a sporting event; it was a vision of the future. It set a global standard for what sports can look like in the digital age, where technology and human skill come together to create immersive and multi-dimensional experiences. The competition showed the world that the future of sports isn’t confined to a physical arena, but seamlessly integrates both the physical and digital.

The Champions of Tomorrow: Phygital Sports Takes Centre Stage

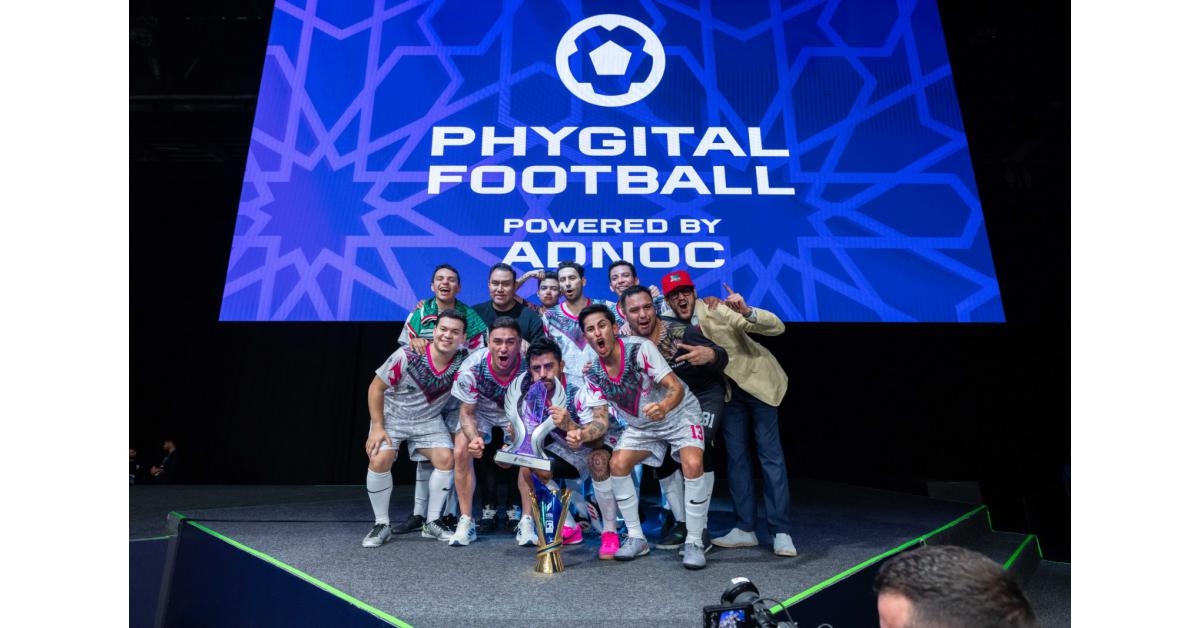

The Games of the Future Abu Dhabi 2025 featured 11 disciplines that blended traditional sports with futuristic technologies, including Phygital Football, Phygital Basketball, esports, Phygital Fighting, and Phygital Shooter. These unique formats tested competitors in both the physical and digital realms. For example, Phygital Football powered by ADNOC saw the México Quetzales – Armadillos FC clinch the Phygital Football title, defeating Troncos FC 2-4 in a thrilling final that captivated crowds throughout the week. Likewise, in Phygital Basketball, the LIGA PRO TEAM triumphed in a 29-23 victory over Moscowsky.

Other high-stakes competitions included Phygital Fighting.FATAL FURY: City of the Wolves, where Kuznya dominated, winning all four of their matches. Meanwhile, xGoat emerged victorious in the Phygital Shooter.CS 2 final, overcoming Dontsu Esports 2-0 in an intense digital shootout.

In the drone racing category, Drone Racing One wowed spectators by completing 50 laps of a challenging circuit, showcasing the high-tech thrill of phygital racing.

A Digital Revolution: The Rise of VR Gaming and Esports

Beyond traditional sports, Games of the Future Abu Dhabi 2025 brought esports and VR gaming into the spotlight. The esports events featured top teams and intense matches across a variety of games, including MOBA Mobile.MLBB and MOBA PC.Dota 2. In a thrilling final, ONIC defeated Aurora Gaming in the Mobile.MLBB championship, while teamWin overcame Vikings 2-0 in Dota 2.

The Battle Royale tournament, featuring Fortnite, saw Kami + Swizzy crush their opponents ZYRO + RAPID in the final. In VR gaming, the HADO competition proved to be one of the most exciting events, where Team Rock claimed the victory.

The digital revolution didn’t stop there—Phygital Dancing.Just Dance was an engaging crowd favorite, with Ivan “myakekcya” Vlasov taking home the crown. These events proved that esports and VR gaming are no longer just niche interests but are now integral parts of mainstream competition.

The Future is Phygital: Tech and Sport in Perfect Harmony

Games of the Future Abu Dhabi 2025 perfectly illustrated how technology and sports are converging to form an entirely new ecosystem. With events such as Phygital Football, Phygital Basketball, and drone racing, the Games were a showcase of the groundbreaking possibilities that arise when sports embrace digital innovations. Technology was not merely an accessory at this event—it was the cornerstone upon which the competitions were built.

With immersive experiences that brought together digital avatars, VR environments, and physical action, the event revealed a new way of experiencing and consuming sports. It also showcased how athletes and fans alike can now engage with sports in ways that were unimaginable just a decade ago.

Abu Dhabi Leads the Way: A Global Hub for Next-Generation Sports

As the host city, Abu Dhabi solidified its position as a global leader in the future of sports. This landmark event wasn’t just about showcasing phygital sports, but also about demonstrating the UAE’s commitment to innovation and technology. The event was a triumph of vision, execution, and global collaboration, bringing together athletes, clubs, and partners from around the world.

In his remarks, Saif Al Noaimi, CEO of Ethara, remarked on the complexity of delivering an event on such a grand scale: “Delivering an event of this scale and complexity required close coordination across multiple disciplines, venues, and partners. The Games of the Future Abu Dhabi 2025 showcased competitive excellence, but also operational innovation and audience engagement at the highest level.”

Similarly, Nis Hatt, CEO of Phygital International, praised the event’s impact: “What we saw over six days was not just competition, but the emergence of a global ecosystem where sport, esports, technology, and innovation coexist on one stage. Abu Dhabi set a new benchmark for scale, delivery, and ambition.”

A Glimpse into the Future: The Global Impact of Phygital Sports

The success of Games of the Future Abu Dhabi 2025 is not just about the event itself. It signals a transformative shift in how we view and experience sports in the 21st century. By embracing phygital sports, the UAE is not just shaping the future of competition, but also setting the stage for the next generation of athletes, fans, and sports industries.

The Phygital Sports Summit, which took place during the event, provided a platform for discussing the future of sports, technology, and innovation. The summit brought together industry leaders, athletes, and tech visionaries to discuss the convergence of physical and digital realms. The dialogue held here will help define the future trajectory of phygital sports and shape the policies that govern it.

Looking Ahead: The Future of Phygital Sports is Now

The Games of the Future Abu Dhabi 2025 wasn’t just a flash in the pan; it was a statement. The event demonstrated how sports and technology can work in harmony, paving the way for the next generation of competition. As Abu Dhabi continues to innovate and lead the way in phygital sports, the rest of the world is watching closely, eager to follow in the footsteps of this global hub for next-generation sports and entertainment.

As Stephane Timpano, CEO of ASPIRE, pointed out, “The success of this edition shows what is possible when vision, technology, and execution align.” The Games of the Future Abu Dhabi 2025 will undoubtedly serve as a springboard for even bigger, more ambitious events in the years to come, setting a new standard for what’s possible in the world of sports.

Technology

The Games of the Future Abu Dhabi 2025 Closes Landmark Edition, Setting New Benchmark for Phygital Sports

GOTF 1

Concludes GOTF.2

Concludes GOTF .3

ABU DHABI, UNITED ARAB EMIRATES, December 25, 2025 /EINPresswire.com/ — The Games of the Future Abu Dhabi 2025 powered by ADNOC concluded on Tuesday after six days of elite competition, innovation, and global participation, marking a milestone moment in the evolution of phygital sports.

Held under the patronage of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, the landmark event brought together more than 850 participants from over 60 countries and featured 11 disciplines, spanning Phygital Football, Phygital Basketball, esports, Phygital Fighting, Phygital Shooter, Phygital drone racing, and VR Game.HADO. Across arenas, stages, and digital battlegrounds, the event showcased how technology and sport are converging to shape the future of competition.

During the globally-watched event, champions were crowned in each discipline, delivering their own defining moments and reinforcing the unique multi-sport identity of the Games of the Future.

Phygital Football powered by ADNOC and Phygital Basketball.3on3 FreeStyle brought to you by M42 both drew vocal crowds throughout the week, with MÉXICO QUETZALES – ARMADILLOS FC taking the Phygital Football title in a thrilling 2-4 final win over Troncos FC, and LIGA PRO TEAM secured the Phygital Basketball title with a 29-23 victory over Moscowsky. Meanwhile, in Phygital Fighting.FATAL FURY: City of the Wolves, Kuznya finished top of the leaderboard after winning all four of their fights, dominating both on the digital stage and in the octagon, and xGoat won the Phygital Shooter.CS 2 final, beating Dontsu Esports 2-0 in the digital world to avoid the need for a deciding round of physical laser tag.

Tasting glory in the esports-focused disciplines, ONIC won the MOBA Mobile.MLBB final against Aurora Gaming, while the aptly-named teamWin beat Vikings 2-0 in the championship game of MOBA PC.Dota 2, and Kami + Swizzy conquered ZYRO + RAPID in the final of the Battle Royale.Featuring Fortnite. In the Phygital Drone Racing presented by InsuranceMarket.ae, which tasked clubs to complete 50 laps of a testing circuit filled with loops, hoops, and straights, Drone Racing One proved fastest on the final day ahead of Team BDS.

A pair of events taking place in the Atrium at ADNEC Centre drew plenty of attention as Ivan “myakekcya” Vlasov triumphed in the Phygital Dancing.Just Dance final, while Team Rock took the title in VR-game.HADO. Lastly, in Battle of Robots, proving itself one of the most spectacular disciplines of the week, Fierce Roc’s menacing Deep Sea Shark machine annihilated Team Cobalt’s Cobalt in a spectacularly destructive finale.

In parallel with the competitive program, the event week also featured an eye-catching and engaging Opening Ceremony and the inaugural Phygital Sports Summit, reinforcing Abu Dhabi’s position as a global hub for next-generation sport, innovation, and immersive entertainment.

Saif Al Noaimi, CEO of Ethara, reflected on intricacy of the Games: “Delivering an event of this scale and complexity required close coordination across multiple disciplines, venues, and partners. The Games of the Future Abu Dhabi 2025 showcased competitive excellence, but also operational innovation and audience engagement at the highest level. We are proud to have played a role in bringing this landmark event to life and in supporting its growth on the global stage.”

Nis Hatt, CEO of Phygital International, said: “The Games of the Future Abu Dhabi 2025 demonstrated how far this movement has come in a short space of time. What we saw over six days was not just competition, but the emergence of a global ecosystem where sport, esports, technology, and innovation coexist on one stage. Abu Dhabi set a new benchmark for scale, delivery, and ambition, and this edition has reinforced the Games of the Future as a defining platform for next-generation competition worldwide.”

Stephane Timpano, CEO of ASPIRE, added: “Hosting the Games of the Future in Abu Dhabi reflects the UAE’s commitment to shaping the future of sport and innovation. This event brought together athletes, clubs, partners, and audiences from around the world. The success of this edition shows what is possible when vision, technology, and execution align, and it positions Abu Dhabi firmly at the forefront of emerging sport formats.”

The Games of the Future Abu Dhabi 2025 is organized by ASPIRE, the Local Delivery Authority, in collaboration with Ethara, the Event Delivery Partner, and Phygital International, the Global Rights Holder. The event is supported by key partners, including Abu Dhabi Sports Council, ADNOC, EDGE, M42, Solutions+, The Galleria, Abu Dhabi Gaming, du Infra, InsuranceMarket.ae, Ministry of Sports, Advanced Technology Research Council, and ADNEC Group.

Deepra Ahluwalia

Action Global Communications

+971 56 477 0995

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Technology

3D Glasses-Free Gaming Monitors : Samsung Odyssey 3D G90XH

The Samsung Odyssey 3D G90XH gaming monitor features a 165Hz refresh rate that can be boosted to 330Hz in Dual Mode. The monitor is slated to arrive in 2026 and is expected to be a hit amongst avid gamers.

-

Sports3 weeks ago

Sports3 weeks ago#11 Volleyball Practices, Then Meets Media Prior to #2 Kentucky Match

-

Motorsports3 weeks ago

Motorsports3 weeks agoNascar legal saga ends as 23XI, Front Row secure settlement

-

Motorsports3 weeks ago

Motorsports3 weeks agoSunoco to sponsor No. 8 Ganassi Honda IndyCar in multi-year deal

-

Sports3 weeks ago

Sports3 weeks agoMaine wraps up Fall Semester with a win in Black Bear Invitational

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoWNBA’s Caitlin Clark, Angel Reese and Paige Bueckers in NC, making debut for national team at USA camp at Duke

-

Motorsports2 weeks ago

Motorsports2 weeks agoRoss Brawn to receive Autosport Gold Medal Award at 2026 Autosport Awards, Honouring a Lifetime Shaping Modern F1

-

Motorsports3 weeks ago

NASCAR, 23XI Racing, Front Row Motorsports announce settlement of US monopoly suit | MLex

-

Sports3 weeks ago

Sports3 weeks agoHope College Tops MIAA Commissioner’s Cup Fall Update

-

Sports3 weeks ago

Sports3 weeks agoPinterest predicts the biggest Gen Z trends of 2026 | News

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoRiverhead hires Melissa Edwards as its new athletic director