Technology

Sports Broadcasting Technology Market Size

Report Overview

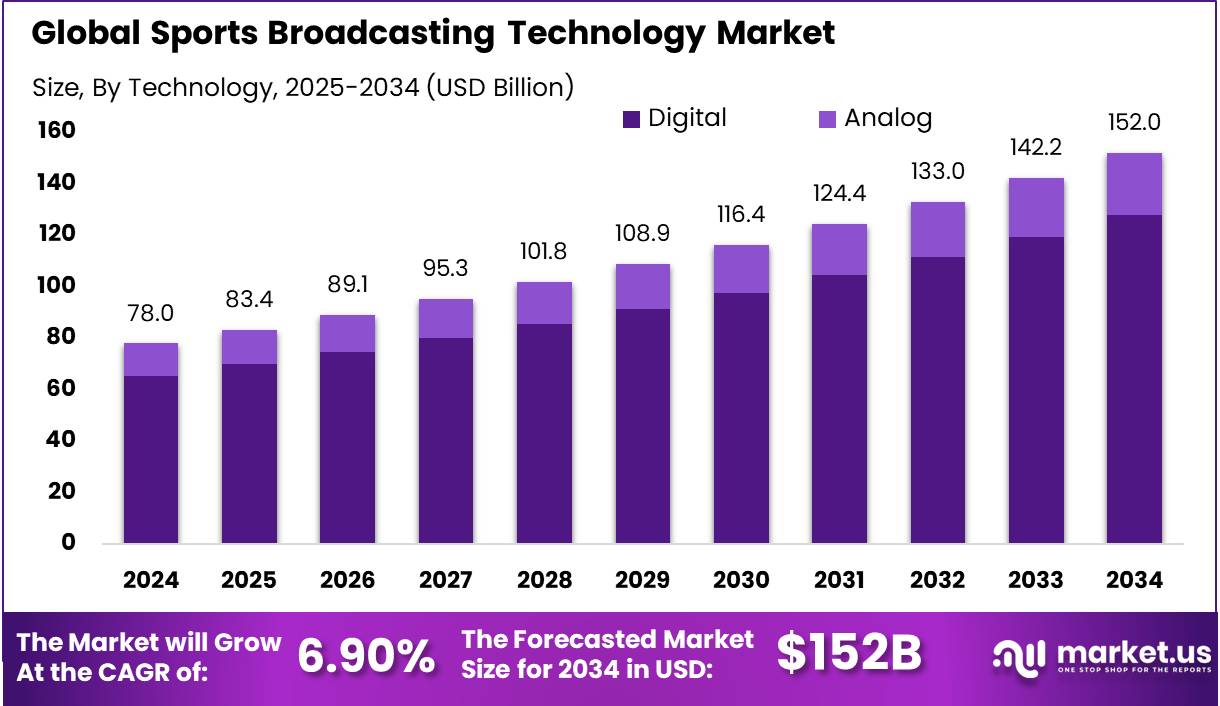

The Global Sports Broadcasting Technology Market size is expected to be worth around USD 152 Billion By 2034, from USD 77.98 Billion in 2024, growing at a CAGR of 6.90% during the forecast period from 2025 to 2034. In 2024, North America held over 34% of the global sports broadcasting technology market, with a revenue of approximately USD 26.5 billion. The U.S. market was valued at USD 25.1 billion, growing at a steady CAGR of 4.3%.

Sports broadcasting technology encompasses the tools and systems used to capture, produce, and distribute live and recorded sports content across various platforms. This includes HD cameras, drones, VR/AR setups, and advanced graphics systems, designed to bring fans closer to the action and provide immersive, interactive experiences beyond traditional viewing.

The growth of sports broadcasting technology is driven by the demand for real-time, high-quality content across multiple platforms. Audiences engage through second-screen apps, live stats, and social media, prompting investment in low-latency streaming, edge computing, and 5G. OTT platforms have disrupted traditional cable models, making sports content more accessible and fueling global demand for mobile streaming and flexible subscriptions.

![]()

![]()

Investors are seizing lucrative opportunities in the sports tech sector, with significant capital flowing into startups and established companies. The growth of OTT services and e-sports is opening new markets and revenue streams, with companies forming partnerships and making acquisitions to enhance technology and expand reach, highlighting a strong investment climate in sports broadcasting.

The integration of advanced broadcasting technologies boosts viewer engagement, advertising revenues, and premium services. Features like real-time stats and multiple camera angles enhance the experience, increasing customer satisfaction and loyalty. Data analytics help broadcasters tailor content and marketing strategies based on audience preferences.

Emerging trends in broadcasting include AR and VR to enhance fan immersion, with AR providing tactical insights and VR offering courtside or behind-the-goal experiences. AI-based player tracking and data visualization enrich live commentary, while NFTs and blockchain are being explored for digital collectibles and interactive fan engagement.

The sports broadcasting market is expanding globally, with regions like Southeast Asia, Africa, and Latin America seeing growth in digital infrastructure and smartphone use. This fuels demand for localized content as fan bases strengthen. Partnerships between sports franchises, media companies, and tech firms are also increasing to create tailored broadcasting ecosystems.

Key Takeaways

- The global sports broadcasting technology market size is projected to reach USD 152 billion by 2034, up from USD 77.98 billion in 2024, growing at a CAGR of 6.90% during the forecast period from 2025 to 2034.

- In 2024, the Solutions segment held a dominant market position, capturing more than 72% of the global sports broadcasting technology market share.

- The Digital segment held a dominant market position in 2024, commanding more than 84% of the global sports broadcasting technology market.

- The Television segment dominated the sports broadcasting technology market in 2024, accounting for more than 55% of the total market share.

- In 2024, the broadcaster segment led the sports broadcasting technology market, holding over 48% of the total market share, owing to their direct influence over content transmission and viewer engagement.

- North America held a dominant market position in 2024, capturing over 34% of the global sports broadcasting technology market, translating to a revenue of approximately USD 26.5 billion.

- The U.S. sports broadcasting technology market was valued at USD 25.1 billion in 2024 and is growing at a steady CAGR of 4.3%.

Analyst’s Viewpoint

The increasing demand for immersive and interactive viewing experiences has opened avenues for investment in technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI). These technologies enhance fan engagement by providing real-time statistics, personalized content, and immersive experiences.

Several factors are influencing the sports broadcasting landscape. The proliferation of high-speed internet and mobile devices has shifted viewer preferences towards on-demand and streaming services. This change necessitates broadcasters to adapt their content delivery methods. Moreover, the integration of data analytics allows for personalized content, catering to individual viewer preferences and enhancing engagement.

Technological innovations are at the forefront of transforming sports broadcasting. The deployment of 5G networks facilitates seamless streaming of high-definition content, reducing latency issues. AI-powered tools assist in automating production workflows, enabling real-time analytics and enhancing storytelling.

AI Impact On The Market

- Smarter Camera Work: AI helps cameras follow the action automatically, choosing the best angles without human control. This means smoother coverage and less chance of missing important moments.

- Personalized Viewing: With AI, broadcasts can be tailored to individual preferences. Fans can receive real-time updates about their favorite teams or players, making the viewing experience more relevant and exciting.

- Real-Time Highlights: AI can quickly identify exciting moments and create highlight clips almost instantly. This allows fans to catch up on key plays without waiting.

- Global Accessibility: With AI-driven translation, broadcasts can be understood by audiences worldwide, breaking down language barriers. This makes sports more inclusive and accessible to a global audience.

- Supporting All Levels of Sports: AI makes it easier to broadcast games that might not have had coverage before, like local or amateur matches. This brings attention to more athletes and events, promoting inclusivity in sports.

U.S. Market Analysis

In 2024, the U.S. Sports Broadcasting Technology Market reached a substantial valuation of USD 25.1 billion, reflecting the growing influence of digital innovation in the way sports content is delivered, consumed, and monetized. This expansion has been largely fueled by a rising demand for immersive viewing experiences, multi-platform content delivery, and the integration of real-time data and analytics into live broadcasts.

The market is progressing at a steady compound annual growth rate (CAGR) of 4.3%, indicating consistent momentum in the adoption of smart broadcasting tools across the industry. Innovations such as augmented reality (AR), virtual reality (VR), 5G-enabled streaming, and AI-powered production are transforming traditional sports broadcasting into a highly personalized and data-rich experience.

This growth reflects broader trends like greater collaboration between sports leagues and tech firms, and rising investment in proprietary content platforms. The U.S. leads in sports media thanks to its strong infrastructure, diverse sports landscape, and high consumer spending. Evolving regulations and legal support for digital broadcasting are also attracting more private and institutional investment.

![]()

![]()

In 2024, North America held a dominant market position in the global Sports Broadcasting Technology Market, capturing over 34% share, which translated to a revenue of approximately USD 26.5 billion. This leadership is driven by the region’s mature sports ecosystem, widespread digital infrastructure, and high consumer demand for premium, interactive content.

Major leagues like the NFL, NBA, and MLB are driving innovation through tech partnerships, using tools like ultra-HD streaming, AR, and AI-powered content. With strong media and tech support, 5G rollout, and high smartphone use, North American fans gain early access to cutting-edge broadcast experiences.

North America’s lead in sports media stems from strong sports viewership and high media consumption. Growing use of streaming and OTT platforms drives investment in cloud-based and real-time tech. Enhanced live feeds with player stats, automation, and immersive graphics boost fan engagement and open new revenue streams through personalized ads and data insights.

Well-established media rights and regulations in North America provide a clear path for content licensing and monetization. Ongoing investment in sports tech startups and R&D by firms like ESPN, Amazon, and NBCUniversal drives innovation, reinforcing the region’s role as a global leader in sports media technology.

![]()

![]()

Component Analysis

In 2024, the Solutions segment held a dominant market position, capturing more than a 72% share of the global sports broadcasting technology market. This dominance is largely due to the rising demand for integrated broadcasting systems that streamline production, transmission, and distribution workflows.

Software is key to the Solutions segment, driving improvements in content quality and delivery. Tools for editing, analytics, and cloud-based playout enable AI commentary, instant replays, and automated workflows. This has led to rising software investment, especially from OTT and digital-first broadcasters seeking scalable, infrastructure-light solutions.

On the hardware side, advancements in encoders, modulators, and transmitters support more mobile and flexible broadcasting. Compact, modular designs lower costs and maintain signal quality, enabling mid-sized and regional broadcasters to deliver professional-grade live sports coverage affordably.

The services subsegment lags behind Solutions in market share, as many organizations opt for in-house operations using advanced tools. However, demand for managed services and consulting is growing in emerging markets and among smaller firms, driven by the need for scalable, end-to-end support and adaptability to evolving sports content formats.

Technology Analysis

In 2024, the Digital segment held a dominant market position, capturing more than an 84% share in the global Sports Broadcasting Technology market. This overwhelming dominance is largely due to the rapid shift from traditional analog systems to high-definition, internet-enabled broadcasting solutions.

A key reason why the Digital segment leads the market is its compatibility with OTT (Over-the-Top) streaming platforms and mobile-first delivery models. Sports fans today consume content not just on television, but across smartphones, tablets, and laptops. Digital broadcasting allows content to be customized, localized, and delivered on demand.

Another contributing factor to the digital segment’s dominance is its ability to support advanced technologies such as 4K/8K resolution, augmented reality overlays, AI-powered analytics, and real-time player tracking. These features enrich the fan experience and are only possible through digital frameworks. Broadcasters are increasingly integrating cloud-based editing, remote production workflows, and AI-led camera systems, all of which require digital capabilities.

The shift to digital is accelerating as analog signals are phased out, especially in North America and Europe. With sports leagues launching their own platforms and broadcasters adopting digital-first strategies, analog use is now limited to rural or legacy systems. Digital broadcasting is clearly shaping the future of global sports media.

Platform Analysis

In 2024, the Television segment held a dominant position in the Sports Broadcasting Technology Market, capturing more than a 55% share. This dominance reflects the continued reliance on traditional broadcast mediums for live sports content across both developed and developing nations.

Television’s lead is also supported by the deep-rooted infrastructure and high household penetration of cable and satellite connections, particularly in North America and parts of Europe. These platforms offer reliable high-definition content delivery with minimal latency, a key requirement for live sports where viewer experience depends on real-time broadcast quality.

Television maintains its lead due to long-term contracts and exclusive broadcasting rights with sports leagues, keeping marquee content out of digital-only platforms. TV broadcasters have also evolved, integrating enhanced graphics, multi-angle replays, and interactive features, merging traditional delivery with a modern viewing experience.

While OTT platforms and IPTV are growing, especially among younger audiences, they face challenges like bandwidth dependency, content rights issues, and regional restrictions. Television remains the backbone of sports broadcasting, offering broad accessibility and reliable coverage of major events, ensuring its continued dominance alongside the rise of digital channels.

End-User Analysis

In 2024, the broadcaster segment led the sports broadcasting technology market, holding over 48% of the total market share, due to their direct influence over content transmission and viewer engagement. Broadcasters, especially major networks and sports channels, have long-standing contracts with sports leagues and federations, giving them priority access to live games and exclusive rights.

Moreover, broadcasters have been the first to integrate hybrid transmission models blending traditional satellite or cable with IP-based delivery systems to reach wider and more diverse audiences. This strategic move has helped them stay ahead of content developers and distributors, as they are not only transmitting games but also actively shaping how fans consume them.

Mega events like the Super Bowl and Olympics give broadcasters a competitive edge by driving massive viewership spikes. With scalable infrastructure, broadcasters control the entire delivery process from content acquisition to final output ensuring better monetization and performance optimization compared to digital distributors relying on third-party platforms.

Broadcasters have adapted by forming strategic partnerships with OTT platforms and social media, expanding their reach while retaining control over content rights. This combination of traditional strength and digital flexibility keeps broadcasters at the forefront of the sports broadcasting technology landscape, leading in both technology adoption and market revenue.

![]()

![]()

Key Market Segments

By Component

- Solutions

- Software

- Hardware

- Dish Antennas

- Amplifiers

- Switches

- Encoders

- Video Servers

- Transmitters/Repeaters

- Modulators

- Others

- Services

By Technology

By Platform

- OTT

- Radio

- Television

- Satellite Direct-to-Home

- Digital Terrestrial Television (DTT)

- Cable Television

- IPTV

By End-user

- Broadcaster

- Studios & Content Developer

- Distributors

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

The Rise of Immersive and Interactive Fan Experiences

In today’s digital age, fans crave a front-row seat to the action. This drive has sparked a wave of innovation in sports broadcasting, creating immersive and interactive experiences that bring the game closer than ever before.

Technologies like AR and VR have turned passive viewing into active participation, engaging tech-savvy, younger audiences with video game-like avatars and interactive broadcasts. These broadcasts blend animation and STEM education to captivate younger viewers.

Ultra-low-latency streaming, as seen with platforms like Panasonic Connect, enables real-time interactions like live chats and instant replays. These innovations enhance viewer engagement and create new monetization opportunities through personalized content and targeted advertising.

Restraint

The Complexity of Broadcasting Rights and Licensing

While technology offers numerous possibilities, the intricate web of broadcasting rights and licensing poses significant challenges. Securing rights to broadcast sports events often involves complex negotiations, with rights holders, leagues, and broadcasters each seeking favorable terms.

The complexity of rights and licensing can hinder the adoption of new technologies in sports broadcasting, as integrating innovative features may require renegotiating existing agreements. The entry of big tech companies has intensified competition, raising rights costs and creating uncertainty for traditional broadcasters. This competitive landscape may deter investment in new technologies due to the high risks and licensing fees.

Opportunity

Expanding into Emerging Markets with Tailored Content

Emerging markets present a vast opportunity for sports broadcasters to expand their reach and tap into new audiences. In regions like India, Africa, and Southeast Asia, there’s a growing appetite for sports content, driven by increasing internet penetration and smartphone usage.

By tailoring content to local preferences and languages, broadcasters can better engage their audiences. For instance, the NRL is expanding into the U.S. market, aiming to introduce its content to American fans. Leveraging platforms like social media enables broadcasters to connect with younger demographics, offering highlights, behind-the-scenes content, and interactive features that resonate with local cultures. By embracing localization and regional preferences, sports broadcasters can unlock new revenue streams and build global fan communities.

Challenge

Ensuring Technological Infrastructure and Accessibility

Technological advancements bring many benefits, but ensuring the infrastructure to support them is a major challenge. In many developing regions, limited access to high-speed internet and advanced devices can impede the adoption of new broadcasting technologies. The digital divide creates disparities, with some audiences enjoying ultra-HD streams and interactive features, while others struggle with basic access.

The global variation in 5G implementation also affects the consistency of viewer experiences, particularly for low-latency streaming and real-time interactions. Addressing these challenges requires collaboration between broadcasters, governments, and tech companies to invest in connectivity solutions and ensure sports broadcasting innovations are accessible to all.

Emerging Trends

Sports broadcasting has transformed with the adoption of new technologies. A key change is the shift from traditional TV to digital streaming, enabling fans to watch live sports on various devices. These platforms enhance the experience with interactive features like real-time stats and multiple camera angles.

AI is transforming sports broadcasting by personalizing content based on viewer preferences, offering custom highlights and player-focused views. Meanwhile, AR and VR enhance broadcasts with immersive features like virtual stadium tours and interactive replays, bringing fans closer to the game.

Another growing trend in sports broadcasting is the rise of alternative broadcasts, or “altcasts,” which feature unique perspectives, such as commentary from celebrities or former athletes, for a more casual and entertaining experience. Additionally, social media platforms like Instagram and Twitter are transforming fan engagement through short clips, behind-the-scenes content, and interactive polls, keeping fans connected beyond the live game.

Business Benefits

Sports broadcasting technology offers key business benefits, including the ability for fans to watch games anytime, anywhere through online streaming. Modern tools allow viewers to customize their experience with features like different camera angles, real-time stats, and language options. This personalization boosts viewer satisfaction, increases engagement, and provides greater value for advertisers and sponsors.

Advanced technologies enable broadcasters to insert virtual ads tailored to specific regions or audiences. For example, the NHL uses digitally enhanced dasherboards to display different ads to viewers in various locations during the same game. This targeted approach increases ad effectiveness and revenue potential.

By analyzing viewer data, broadcasters and teams can understand what content resonates most with fans. This insight allows them to tailor programming, improve marketing strategies, and enhance overall fan engagement. For instance, data analytics help in determining the best times to air games or which highlights to promote on social media.

Key Player Analysis

The sports broadcasting technology market is growing fast, driven by the rising demand for high-quality live sports coverage and immersive viewing experiences.

NEC Corporation is a global tech leader known for integrating AI and 5G in broadcasting solutions. In sports broadcasting, NEC stands out with its biometric recognition systems and advanced data analytics. This gives broadcasters tools to offer personalized content and targeted advertising.

Rohde & Schwarz is a powerhouse in signal transmission and broadcast infrastructure. They stand out for ultra-reliable transmitters and encoding solutions that support 4K and HDR, with a focus on broadcast resilience and low-latency live feeds for smooth viewing during major sports events.

Evertz Microsystems Ltd. is a key innovator in live video production and media transport. Their IP-based solutions and cloud production tools allow broadcasters to manage and switch between multiple live feeds with ease. Evertz’s strength lies in flexibility and scalability, supporting everything from small events to major leagues.

Top Key Players in the Market

- IBM Corporation

- NEC Corporation

- Rohde & Schwarz

- Evertz Microsystems Ltd.

- NEP Group Inc.

- ESPN Sports Media Ltd.

- NBC Universal

- Fox Corporation

- Sportradar AG

- Muvi

- Deltatre

- Pixellot

- PlaySight Interactive

- Hawk-Eye Innovations

- Genius Sports

- Others

Top Opportunities for Players

- Personalized Viewing Experiences: Viewers now expect content tailored to their preferences. AI-driven tools are enabling broadcasters to offer customizable camera angles, real-time stats, and interactive features. This personalization enhances engagement and opens avenues for targeted advertising.

- Expansion of OTT and Streaming Platforms: The shift from traditional TV to over-the-top (OTT) platforms is accelerating. Streaming services are investing heavily in live sports rights, recognizing the demand for flexible, on-the-go viewing options. This trend offers broadcasters opportunities to reach wider audiences and explore new revenue models.

- Integration of Immersive Technologies: Augmented reality (AR) and virtual reality (VR) are transforming the sports viewing experience. By providing immersive replays and interactive features, these technologies are enhancing fan engagement and offering new sponsorship opportunities.

- Data-Driven Advertising and Sponsorship: Advanced analytics are enabling broadcasters to offer targeted advertising, maximizing sponsor ROI. Virtual advertising overlays allow for region-specific promotions during live events, increasing the value of ad slots.

- Cloud-Based Production and Remote Workflows: The adoption of cloud technologies is streamlining production processes. Remote workflows reduce costs and increase flexibility, allowing for efficient content creation and distribution. This shift is particularly beneficial for covering multiple events simultaneously.

Recent Developments

- In February 2025, Kudan Inc., a global SLAM technology pioneer, is teaming up with FOX Sports to revolutionize AR in live sports broadcasting. Debuting at Super Bowl LIX, Kudan’s cutting-edge 3D LiDAR SLAM software will drive next-gen AR visuals, bringing fans an immersive viewing experience.

- In March 2024, Sportradar announced its plan to buy IMG ARENA, a company known for global sports betting rights and data services. This move aims to strengthen Sportradar’s position in the sports technology and betting industry.

Report Scope

Technology

Where Is India’s Gaming Industry Headed Next?

India’s gaming industry is rapidly evolving into one of the largest and most dynamic markets in the world. Driven by the increasing adoption of smartphones, affordable internet, and a tech-savvy youth population, gaming is becoming a mainstream form of entertainment. With mobile gaming leading the charge, the India gaming market is also witnessing significant growth in esports, cloud gaming, and immersive technologies like augmented reality (AR) and virtual reality (VR).

Unlocking New Realms: The Evolution and Key Opportunities in India’s Gaming Sector

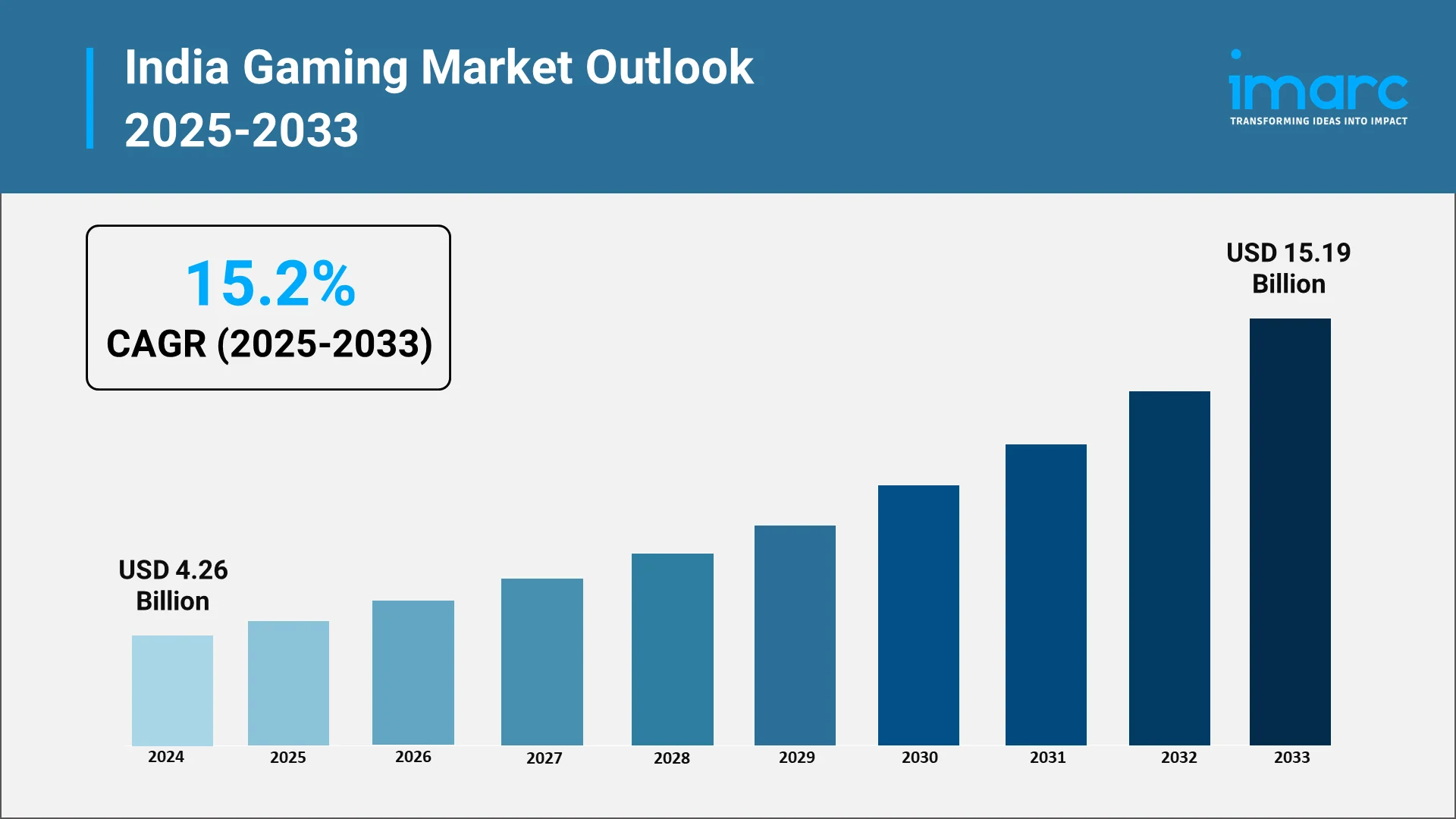

The gaming sector is transitioning from a specialized sector to a dynamic and swiftly growing market, fueled by the rising use of smartphones, accessible internet, and a young, tech-oriented demographic. The rise of mobile gaming is at the heart of this transformation, with millions of people in India engaging in gaming on their smartphones daily. With the nation’s gaming industry growing, a variety of gamers, covering mobile, console, and PC platforms, are shaping the industry. Quantifying this rapid expansion, the IMARC Group reported that the gaming market size in India reached USD 4.26 Billion in 2024.

The primary opportunities ahead are in the rising need for localized content, as developers are concentrating on designing games that connect with Indian cultural and regional tastes. This presents substantial potential to reach a broader audience, especially in tier-2 and tier-3 cities. Moreover, the growth of esports, cloud gaming, AR, and VR technologies offers new opportunities for expansion. With the growing investment and support from both the government and private sectors, there is significant potential to establish India as a worldwide center for gaming development and creativity.

With the market’s maturation, the advancement of monetization strategies, enhanced infrastructure, and stronger regulations will continue to contribute to the increase in India gaming market share, unlocking untapped potential and fostering global competitiveness.

Explore in-depth findings for this market, Request Sample

Game On: Current Trends and Market Drivers Shaping India’s Gaming Future

According to IMARC Group’s projections, the India gaming market is projected to grow at a CAGR of around 15.2% from 2025 to 2033, reaching USD 15.19 Billion by 2033. The growth will be supported by the following factors:

- Smartphone and Internet Penetration

India’s increasing number of affordable smartphones, coupled with the expansion of high-speed internet access, is significantly broadening the market reach. As rural and non-metro areas gain improved connectivity, companies can target new user segments beyond urban centers. This growing accessibility enables casual, on-the-go gaming, contributing to a surge in user numbers and expanding the market. As of March 2024, India had 954.40 million total internet subscribers, with 398.35 million rural subscribers. Furthermore, by April 2024, 95.15% of India’s 644,131 villages were equipped with 3G/4G mobile connectivity, underscoring the increasing digital penetration across the country and creating vast opportunities for gaming expansion in rural areas.

- Monetization Evolution: In–App, Subscription & Cloud

The monetization models in the gaming market in India are evolving beyond basic in-app purchases. Traditional in-app purchases are being complemented by subscription models, cloud streaming, and cross-platform play, providing new revenue streams and catering to players seeking more flexibility and value. This shift allows gaming companies to offer premium experiences while enhancing player lifetime value. A prime example of this trend is Nvidia’s announcement in 2025 that its GeForce NOW cloud gaming service will launch in India, offering high-end gaming experiences on various devices. Premium members can access over 4,500 games, including popular titles like Borderlands 4 and Call of Duty: Black Ops 7, solidifying cloud gaming’s potential in India.

- Esports Partnerships and Innovation

A key factor driving the growth of the market is the increasing investment in esports partnerships and innovation. Realme’s collaboration with Krafton India as the official smartphone partner for the BattleGrounds Mobile Series (BGIS) 2025 and BGMI Pro Series (BMPS) 2025 highlights this trend. By using its GT 7 Pro for the tournaments, Realme is directly supporting both professional and grassroots players. This partnership not only boosts esports visibility but also strengthens the gaming ecosystem in India. As esports continues to gain traction, such collaborations enhance the gaming experience and contribute to market expansion.

- Localized Product Offerings and Market Tailoring

The growing availability of localized products tailored to the needs of Indian gamers is positively influencing the market. Acer’s announcement in 2025 to launch “Make in India” gaming laptops is a prime example. By customizing its Aspire/ALG, Nitro, and Predator series for the Indian market, Acer is addressing the performance, pricing, and usage patterns unique to Indian gamers. This move not only supports the rising demand for gaming PCs across casual, competitive, and creator segments but also taps into the rising interest in AI-ready devices, contributing to the rapid expansion of India’s gaming ecosystem.

The rise of accelerator programs and funding initiatives is helping local developers access advanced technology, mentorship, and global networks. The adoption of AI tools is particularly transformative, enhancing game development, player experiences, and monetization strategies. These AI-driven innovations improve gameplay mechanics, automate processes, and offer personalized content, making Indian games more competitive globally. A prime example is Meta’s India-focused Gaming Accelerator, launched in 2025, which supports 20–30 emerging studios with AI tools like Llama, along with mentorship and investor access to scale their games for global markets.

The Game Plan: Conquering Challenges and Unlocking New Opportunities

The Indian gaming industry encounters challenges like regulatory ambiguity, with many states lacking clear rules for online gaming, creating confusion for developers and players. The country’s vast and diverse population also requires significant investment in localization and culturally relevant content. Additionally, piracy and data security concerns remain persistent threats.

Despite these obstacles, the rapid increase in internet access and smartphone adoption, particularly in tier-2 and tier-3 cities, presents a large untapped market. Mobile gaming is becoming popular because of affordable smartphones and data plans, while localization offers a chance to engage diverse user bases. The growing momentum of the India Mobile Gaming Market further highlights how digital engagement is expanding across demographic groups. Esports and online competitions are also gaining traction, creating new opportunities for competitive gaming and sponsorships.

Masters of the Game: Who’s Leading India’s Gaming Industry

Major figures in the market are progressively concentrating on broadening their reach and enhancing user interaction by utilizing mobile-first approaches and integrating localized content. These firms are focusing on creating games that align with local tastes, providing content in various languages and crafting gameplay that reflects India’s rich cultural diversity. Numerous developers are investigating fresh monetization strategies, such as in-app purchases, subscription models, and live events, while incorporating social and multiplayer elements to promote community engagement. To remain competitive, they are significantly investing in technology like AI and cloud gaming to improve user experiences and provide smooth cross-platform play. Directly illustrating the investment in technology like cloud gaming to improve user experiences and provide smooth cross-platform play, Xbox launched cloud gaming in India for Game Pass subscribers in 2025, allowing high-end games to stream on mobiles, tablets, and PCs.

.webp)

The Game Changers: How Investment and Government Support Are Elevating the Gaming Sector

The gaming market in India is influenced by government-backed initiatives and a clear regulatory framework that foster innovation and growth. These programs support game design, development, and talent, attracting both local and global investments. The regulatory system ensures fair practices and transparency, building market trust and safeguarding user interests.

- Government-backed programs are essential in driving innovation and creating a vibrant gaming ecosystem in India. By supporting game design, development, and talent nurturing, these initiatives provide infrastructure, networking, and industry collaboration that attract both local and global investments. They also focus on cultivating local talent, ensuring the sector’s sustainability and competitiveness. The government’s commitment is evident in major initiatives like the Create in India Challenge and the AVGC-XR Mission, launched in 2025, which aim to foster original creation and collaboration across gaming, animation, VFX, and immersive technologies. These efforts strengthen India’s creative economy and position the country as a global hub for AVGC-XR innovation.

- A coherent regulatory system is vital for driving the gaming market in India. By establishing clear rules and categories for different game types, such as esports and online gaming, the framework ensures transparency and fair practices, fostering trust among investors and participants. This organized approach enhances market security for both developers and users, promoting sustainable growth. In 2025, the Ministry of Electronics and Information Technology (MeitY) addressed the need for such a framework with the release of the Draft Promotion and Regulation of Online Gaming Rules under the PROG Act. This created India’s first unified framework, with the Online Gaming Authority overseeing compliance, classification, and registration.

Leveling Up: IMARC’s Playbook for Navigating India’s Thriving Gaming Market

IMARC Group empowers stakeholders in India’s gaming industry with data-driven insights to succeed in one of the world’s fastest-growing entertainment markets. Our research and consulting services help clients identify untapped opportunities, navigate market uncertainties, and drive innovation in game design, marketing, and retail strategy.

- Market Insights: Track trends shaping India’s gaming market, including the rise in mobile gaming, increasing demand for esports, and the growing popularity of educational and strategy-based games. We also explore the emergence of local developers and the expanding gaming ecosystem.

- Strategic Forecasting: Predict future developments in the integration of digital and physical gaming experiences, the growth of online gaming platforms, evolving user preferences, and the impact of regional content and culturally relevant game narratives.

- Competitive Intelligence: Analyze strategies and offerings from leading game publishers and emerging startups, including how they are redefining gaming experiences with local themes, storytelling, and sustainable production practices.

- Policy and Regulatory Analysis: Understand trade regulations, intellectual property protection, licensing, and safety compliance standards crucial to the production and distribution of games in India.

- Tailored Consulting Solutions: Benefit from customized advice on market entry strategies, distribution models, branding, and game localization. IMARC’s expertise supports businesses in developing scalable, client-centric growth strategies in an expanding gaming ecosystem.

Technology

New Nevada Gaming Board Chairman Knows The Importance Of Getting Technology OK’d Quickly

The New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, signaling a clear focus on modernizing how gaming innovations move from development to casino floors. This approach reflects an understanding that technology now plays a central role in the gaming industry and that regulatory systems must evolve to keep Nevada competitive while maintaining its high standards.

New Chairman Knows the Importance of Approving Technology

Gaming technology is advancing at a rapid pace, from new slot machine platforms to cashless systems and enhanced security tools. When approvals take too long, Nevada risks seeing new products debut elsewhere first. The New Nevada Gaming Board Chairman knows the importance of getting technology approved quickly because delays can affect manufacturers, casino operators, and ultimately the state’s position as a leader in regulated gaming.

Industry Experience Shaping Regulatory Priorities

Leadership matters in regulatory agencies, especially in industries as complex as gaming. The new chairman brings experience that bridges regulation and technology, offering insight into how long approval timelines can impact innovation. This background helps explain why the New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, not as a shortcut, but as a way to make processes more efficient and predictable.

How Faster Approvals Benefit Nevada’s Gaming Industry

Timely technology approvals help casinos remain competitive and allow players to experience the latest advancements sooner. When Nevada can approve new gaming systems without unnecessary delays, it strengthens relationships with manufacturers and reinforces the state’s reputation as the global standard for gaming regulation.

Maintaining Integrity While Moving Faster

Speed does not mean sacrificing oversight. Nevada’s gaming regulators are still responsible for ensuring fairness, security, and compliance. The emphasis is on refining internal processes, improving communication, and reducing bottlenecks. This balanced approach explains why the Nevada Gaming Board Chairman knows the importance of getting technology approved quickly while continuing to uphold strict regulatory safeguards.

What This Means for the Future of Gaming Regulation

Looking ahead, a more responsive approval process could encourage greater innovation within Nevada’s gaming sector. Developers may be more inclined to launch new technologies in the state, and operators can adapt more quickly to player expectations.

By aligning regulatory efficiency with technological progress, Nevada positions itself to remain both a trusted regulator and an innovation-friendly environment in an increasingly competitive global gaming market.

Looking for Legal Guidance in Gaming?

If you follow SCCG content and have inquiries about your gaming business, connect with Lazarus Crystal Law Firm—formed by SCCG Management and Lazarus Legal to unite top-tier gaming law with commercialization and market-entry strategy.

Our Areas of Expertise Include:

• Nevada and multi-state gaming licensing

• Regulatory compliance and audit services

• International market entry and cross-border advisory

• Gaming M&A legal due diligence

• Tribal gaming legal and strategic support

• iGaming and sports betting regulatory guidance

Follow us on LinkedIn: Lazarus Crystal Law Firm

Technology

Page not found

Technology

Samsung to showcase world’s first 1,040Hz gaming monitor at CES 2026

Samsung Electronics has unveiled its new most advanced Odyssey gaming monitor lineup. The lineup includes five new models that push the boundaries of resolution, refresh rates, and immersive visual performance.

Led by Samsung’s first 6K 3D Odyssey G9, the 2026 lineup debuts world-first display technologies for gamers and creators, including the next-generation Odyssey G6 and three new Odyssey G8 models.

First 6K glasses-free 3D monitor

“With this year’s Odyssey lineup, we’re introducing display experiences that simply weren’t possible even a year ago,” said Hun Lee, Executive Vice President of the Visual Display (VD) Business at Samsung Electronics.

“From the industry’s first 6K glasses-free 3D monitor to breakthrough 1,040Hz speed, we designed these monitors to meet the ambitions of today’s gamers and deliver a level of immersion that fundamentally changes how content looks and functions on screen.”

The 32-inch Odyssey 3D (G90XH model) debuts the world’s first 6K display with glasses-free 3D, introducing a new way to experience games on a monitor. Powered by real-time eye tracking, it adjusts depth and perspective in response to the viewer’s position, creating a layered sense of dimension for smooth, uninterrupted gameplay without the need for a headset, according to a press release.

PC gamers can enjoy high-quality expanded lineup

With 6K resolution, a 165Hz refresh rate boosted to 330Hz through Dual Mode, and 1ms response time, fast action stays sharp and smooth, according to Samsung.

The company claims that PC gamers can enjoy a high-quality expanded lineup of supported titles with optimized 3D effects developed in collaboration with game studios. Featured games such as The First Berserker: Khazan, Lies of P: Overture, and Stellar Blade will offer added dimensionality, enhancing terrain, distance, and object separation beyond standard 2D gameplay.

The South Korean company has also highlighted that the 27-inch Odyssey G6 (G60H model) gaming monitor advances competitive gaming with the world’s first 1,040Hz gaming monitor through Dual Mode and native QHD support up to 600Hz, delivering esports-level motion clarity to help players track targets and see fine details during high-speed movement.

When needed, the Odyssey G6 can boost performance in an instant, providing ultra-sharp resolution so viewers can experience breathtaking worlds and ultra-high speeds that fuel competitive adrenaline. With support from both AMD FreeSync Premium and NVIDIA G-Sync Compatible, the Odyssey G6 ensures that every frame is smooth, every color pops, and every moment feels responsive.

The Odyssey G8 series is expanding in 2026 with three distinct models, each offering a different balance of resolution and speed. Leading the lineup, the 32-inch Odyssey G8 (G80HS model), the industry’s first 6K gaming monitor, delivers native 165Hz performance with Dual Mode that supports up to 330Hz in 3K mode.

The 27-inch Odyssey G8 (G80HF model) offers a sharper 5K option with native support up to 180Hz, and Dual Mode boosts to 360Hz in QHD for smoother motion.

For users who want deeper contrast, the 32-inch Odyssey OLED G8 (G80SH model) pairs a 4K QD-OLED panel with a 240Hz refresh rate, Glare Free viewing, 300-nit brightness, and VESA DisplayHDR True Black 500 certification. Its DisplayPort 2.1 (UHBR20) supports up to 80 Gbps of bandwidth for seamless HDR and VRR playback, according to Samsung.

The complete Odyssey 2026 lineup will be on display at CES 2026 in Las Vegas from January 6-9.

Technology

Games of the Future Abu Dhabi 2025 Rewrites the Playbook for Sports with Phygital Innovation

Published on

December 25, 2025

By: Tuhin Sarkar

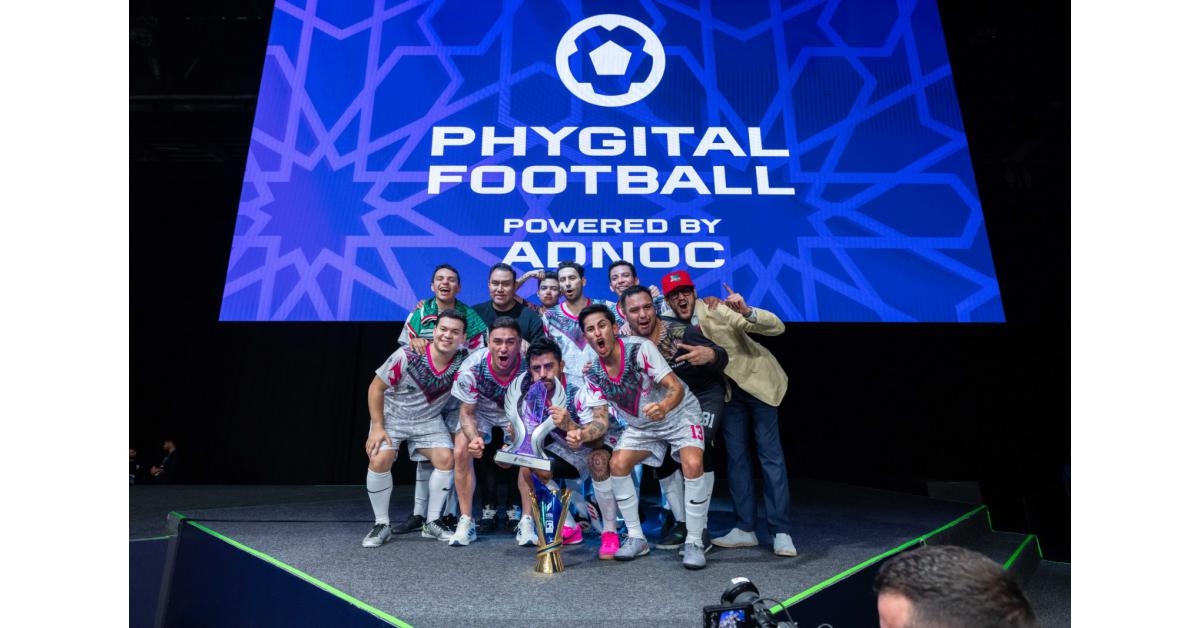

The Games of the Future Abu Dhabi 2025 have closed an unforgettable chapter in the evolution of phygital sports. Hosted under the patronage of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, the event marked an unparalleled fusion of physical and digital competition. Over six action-packed days, Abu Dhabi hosted more than 850 participants from 60+ countries, with fierce battles across 11 disciplines including Phygital Football, Phygital Basketball, esports, Phygital Fighting, drone racing, and VR gaming.

Games of the Future Abu Dhabi 2025 was not just a sporting event; it was a vision of the future. It set a global standard for what sports can look like in the digital age, where technology and human skill come together to create immersive and multi-dimensional experiences. The competition showed the world that the future of sports isn’t confined to a physical arena, but seamlessly integrates both the physical and digital.

The Champions of Tomorrow: Phygital Sports Takes Centre Stage

The Games of the Future Abu Dhabi 2025 featured 11 disciplines that blended traditional sports with futuristic technologies, including Phygital Football, Phygital Basketball, esports, Phygital Fighting, and Phygital Shooter. These unique formats tested competitors in both the physical and digital realms. For example, Phygital Football powered by ADNOC saw the México Quetzales – Armadillos FC clinch the Phygital Football title, defeating Troncos FC 2-4 in a thrilling final that captivated crowds throughout the week. Likewise, in Phygital Basketball, the LIGA PRO TEAM triumphed in a 29-23 victory over Moscowsky.

Other high-stakes competitions included Phygital Fighting.FATAL FURY: City of the Wolves, where Kuznya dominated, winning all four of their matches. Meanwhile, xGoat emerged victorious in the Phygital Shooter.CS 2 final, overcoming Dontsu Esports 2-0 in an intense digital shootout.

In the drone racing category, Drone Racing One wowed spectators by completing 50 laps of a challenging circuit, showcasing the high-tech thrill of phygital racing.

A Digital Revolution: The Rise of VR Gaming and Esports

Beyond traditional sports, Games of the Future Abu Dhabi 2025 brought esports and VR gaming into the spotlight. The esports events featured top teams and intense matches across a variety of games, including MOBA Mobile.MLBB and MOBA PC.Dota 2. In a thrilling final, ONIC defeated Aurora Gaming in the Mobile.MLBB championship, while teamWin overcame Vikings 2-0 in Dota 2.

The Battle Royale tournament, featuring Fortnite, saw Kami + Swizzy crush their opponents ZYRO + RAPID in the final. In VR gaming, the HADO competition proved to be one of the most exciting events, where Team Rock claimed the victory.

The digital revolution didn’t stop there—Phygital Dancing.Just Dance was an engaging crowd favorite, with Ivan “myakekcya” Vlasov taking home the crown. These events proved that esports and VR gaming are no longer just niche interests but are now integral parts of mainstream competition.

The Future is Phygital: Tech and Sport in Perfect Harmony

Games of the Future Abu Dhabi 2025 perfectly illustrated how technology and sports are converging to form an entirely new ecosystem. With events such as Phygital Football, Phygital Basketball, and drone racing, the Games were a showcase of the groundbreaking possibilities that arise when sports embrace digital innovations. Technology was not merely an accessory at this event—it was the cornerstone upon which the competitions were built.

With immersive experiences that brought together digital avatars, VR environments, and physical action, the event revealed a new way of experiencing and consuming sports. It also showcased how athletes and fans alike can now engage with sports in ways that were unimaginable just a decade ago.

Abu Dhabi Leads the Way: A Global Hub for Next-Generation Sports

As the host city, Abu Dhabi solidified its position as a global leader in the future of sports. This landmark event wasn’t just about showcasing phygital sports, but also about demonstrating the UAE’s commitment to innovation and technology. The event was a triumph of vision, execution, and global collaboration, bringing together athletes, clubs, and partners from around the world.

In his remarks, Saif Al Noaimi, CEO of Ethara, remarked on the complexity of delivering an event on such a grand scale: “Delivering an event of this scale and complexity required close coordination across multiple disciplines, venues, and partners. The Games of the Future Abu Dhabi 2025 showcased competitive excellence, but also operational innovation and audience engagement at the highest level.”

Similarly, Nis Hatt, CEO of Phygital International, praised the event’s impact: “What we saw over six days was not just competition, but the emergence of a global ecosystem where sport, esports, technology, and innovation coexist on one stage. Abu Dhabi set a new benchmark for scale, delivery, and ambition.”

A Glimpse into the Future: The Global Impact of Phygital Sports

The success of Games of the Future Abu Dhabi 2025 is not just about the event itself. It signals a transformative shift in how we view and experience sports in the 21st century. By embracing phygital sports, the UAE is not just shaping the future of competition, but also setting the stage for the next generation of athletes, fans, and sports industries.

The Phygital Sports Summit, which took place during the event, provided a platform for discussing the future of sports, technology, and innovation. The summit brought together industry leaders, athletes, and tech visionaries to discuss the convergence of physical and digital realms. The dialogue held here will help define the future trajectory of phygital sports and shape the policies that govern it.

Looking Ahead: The Future of Phygital Sports is Now

The Games of the Future Abu Dhabi 2025 wasn’t just a flash in the pan; it was a statement. The event demonstrated how sports and technology can work in harmony, paving the way for the next generation of competition. As Abu Dhabi continues to innovate and lead the way in phygital sports, the rest of the world is watching closely, eager to follow in the footsteps of this global hub for next-generation sports and entertainment.

As Stephane Timpano, CEO of ASPIRE, pointed out, “The success of this edition shows what is possible when vision, technology, and execution align.” The Games of the Future Abu Dhabi 2025 will undoubtedly serve as a springboard for even bigger, more ambitious events in the years to come, setting a new standard for what’s possible in the world of sports.

Technology

The Games of the Future Abu Dhabi 2025 Closes Landmark Edition, Setting New Benchmark for Phygital Sports

GOTF 1

Concludes GOTF.2

Concludes GOTF .3

ABU DHABI, UNITED ARAB EMIRATES, December 25, 2025 /EINPresswire.com/ — The Games of the Future Abu Dhabi 2025 powered by ADNOC concluded on Tuesday after six days of elite competition, innovation, and global participation, marking a milestone moment in the evolution of phygital sports.

Held under the patronage of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, the landmark event brought together more than 850 participants from over 60 countries and featured 11 disciplines, spanning Phygital Football, Phygital Basketball, esports, Phygital Fighting, Phygital Shooter, Phygital drone racing, and VR Game.HADO. Across arenas, stages, and digital battlegrounds, the event showcased how technology and sport are converging to shape the future of competition.

During the globally-watched event, champions were crowned in each discipline, delivering their own defining moments and reinforcing the unique multi-sport identity of the Games of the Future.

Phygital Football powered by ADNOC and Phygital Basketball.3on3 FreeStyle brought to you by M42 both drew vocal crowds throughout the week, with MÉXICO QUETZALES – ARMADILLOS FC taking the Phygital Football title in a thrilling 2-4 final win over Troncos FC, and LIGA PRO TEAM secured the Phygital Basketball title with a 29-23 victory over Moscowsky. Meanwhile, in Phygital Fighting.FATAL FURY: City of the Wolves, Kuznya finished top of the leaderboard after winning all four of their fights, dominating both on the digital stage and in the octagon, and xGoat won the Phygital Shooter.CS 2 final, beating Dontsu Esports 2-0 in the digital world to avoid the need for a deciding round of physical laser tag.

Tasting glory in the esports-focused disciplines, ONIC won the MOBA Mobile.MLBB final against Aurora Gaming, while the aptly-named teamWin beat Vikings 2-0 in the championship game of MOBA PC.Dota 2, and Kami + Swizzy conquered ZYRO + RAPID in the final of the Battle Royale.Featuring Fortnite. In the Phygital Drone Racing presented by InsuranceMarket.ae, which tasked clubs to complete 50 laps of a testing circuit filled with loops, hoops, and straights, Drone Racing One proved fastest on the final day ahead of Team BDS.

A pair of events taking place in the Atrium at ADNEC Centre drew plenty of attention as Ivan “myakekcya” Vlasov triumphed in the Phygital Dancing.Just Dance final, while Team Rock took the title in VR-game.HADO. Lastly, in Battle of Robots, proving itself one of the most spectacular disciplines of the week, Fierce Roc’s menacing Deep Sea Shark machine annihilated Team Cobalt’s Cobalt in a spectacularly destructive finale.

In parallel with the competitive program, the event week also featured an eye-catching and engaging Opening Ceremony and the inaugural Phygital Sports Summit, reinforcing Abu Dhabi’s position as a global hub for next-generation sport, innovation, and immersive entertainment.

Saif Al Noaimi, CEO of Ethara, reflected on intricacy of the Games: “Delivering an event of this scale and complexity required close coordination across multiple disciplines, venues, and partners. The Games of the Future Abu Dhabi 2025 showcased competitive excellence, but also operational innovation and audience engagement at the highest level. We are proud to have played a role in bringing this landmark event to life and in supporting its growth on the global stage.”

Nis Hatt, CEO of Phygital International, said: “The Games of the Future Abu Dhabi 2025 demonstrated how far this movement has come in a short space of time. What we saw over six days was not just competition, but the emergence of a global ecosystem where sport, esports, technology, and innovation coexist on one stage. Abu Dhabi set a new benchmark for scale, delivery, and ambition, and this edition has reinforced the Games of the Future as a defining platform for next-generation competition worldwide.”

Stephane Timpano, CEO of ASPIRE, added: “Hosting the Games of the Future in Abu Dhabi reflects the UAE’s commitment to shaping the future of sport and innovation. This event brought together athletes, clubs, partners, and audiences from around the world. The success of this edition shows what is possible when vision, technology, and execution align, and it positions Abu Dhabi firmly at the forefront of emerging sport formats.”

The Games of the Future Abu Dhabi 2025 is organized by ASPIRE, the Local Delivery Authority, in collaboration with Ethara, the Event Delivery Partner, and Phygital International, the Global Rights Holder. The event is supported by key partners, including Abu Dhabi Sports Council, ADNOC, EDGE, M42, Solutions+, The Galleria, Abu Dhabi Gaming, du Infra, InsuranceMarket.ae, Ministry of Sports, Advanced Technology Research Council, and ADNEC Group.

Deepra Ahluwalia

Action Global Communications

+971 56 477 0995

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

-

Sports3 weeks ago

Sports3 weeks ago#11 Volleyball Practices, Then Meets Media Prior to #2 Kentucky Match

-

Motorsports3 weeks ago

Motorsports3 weeks agoNascar legal saga ends as 23XI, Front Row secure settlement

-

Motorsports3 weeks ago

Motorsports3 weeks agoSunoco to sponsor No. 8 Ganassi Honda IndyCar in multi-year deal

-

Sports3 weeks ago

Sports3 weeks agoMaine wraps up Fall Semester with a win in Black Bear Invitational

-

Motorsports2 weeks ago

Motorsports2 weeks agoRoss Brawn to receive Autosport Gold Medal Award at 2026 Autosport Awards, Honouring a Lifetime Shaping Modern F1

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoWNBA’s Caitlin Clark, Angel Reese and Paige Bueckers in NC, making debut for national team at USA camp at Duke

-

Motorsports3 weeks ago

NASCAR, 23XI Racing, Front Row Motorsports announce settlement of US monopoly suit | MLex

-

Motorsports3 weeks ago

Motorsports3 weeks agoRick Hendrick comments after the NASCAR lawsuit settlement

-

NIL3 weeks ago

NIL3 weeks agoNike Signs 10 LSU Athletes to NIL deals

-

Sports3 weeks ago

Wisconsin defeats Stanford in NCAA regional semifinals: Updates, recap