Interest in prediction markets surged significantly during the recent US election cycle. A month after Trump’s victory, platforms like Kalshi are experiencing increased engagement in non-political trades as well. Analysts foresee ongoing growth in the sector as major brokerages enter the arena with more relaxed regulations. Prediction markets have existed for quite some time, but […]

- Interest in prediction markets surged significantly during the recent US election cycle.

- A month after Trump’s victory, platforms like Kalshi are experiencing increased engagement in non-political trades as well.

- Analysts foresee ongoing growth in the sector as major brokerages enter the arena with more relaxed regulations.

Prediction markets have existed for quite some time, but it was during the most recent election that they truly entered mainstream consciousness, with betting on figures like Donald Trump and Kamala Harris reaching new heights.

Following Trump’s election success, betting organizations such as Kalshi are now pondering the future of the industry.

The increase in user engagement is starting to impact a variety of markets, from entertainment and celebrity happenings to weather-related bets.

Betting analysts anticipate that the market will continue its upward trajectory.

Industry observers note a race among brokerages and new ventures to take advantage of the heightened interest following the election, a trend likely to intensify as regulations loosen.

Trickle-down effects

According to Kalshi co-founder Tarek Mansour, his platform noted a significant uptick in user engagement after obtaining approval for political trades with US users following a legal victory against the Commodity Futures Trading Commission in October.

This spike in activity has not only boosted political betting but has also spurred interest in non-political outcomes, he explained.

“Once you’re registered, you comprehend the process, develop the habit of checking, you’re likely to trade more, correct?” he mentioned to Business Insider.

Political bets still dominate the platform, with substantial volumes seen in wagers related to Trump’s cabinet selections. Users have placed $6.5 million on the nominee for Secretary of Defense, while bets on his FBI Director choice reached $1.8 million as of Friday afternoon.

Other political matters, like the Federal Reserve’s upcoming rate cuts, are also attracting significant attention from traders, with approximately $6.3 million wagered on the total rate cuts expected in 2024 and another $2.3 million on the Fed’s December decision.

Thomas Miller from Northwestern University, who closely analyzes prediction markets and manages the election forecasting model, The Virtual Tout, explains that there is a logical basis for the growing interest in these markets. Investors may not only be motivated by the prospect of profit from accurate predictions but could also be utilizing economic markets to hedge related risks in their portfolios.

“They act as a hedging mechanism. Some investors resemble those in political markets, just trying to forecast outcomes, but others in economic markets are focused on hedging,” he told Business Insider.

Wagers on entertainment have also surged, with bets placed on the Game of the Year winner and the Grammy Song of the Year exceeding around $500,000 each. Moreover, Rotten Tomatoes scores for various films and the Oscars’ Best Picture winner are becoming well-favored betting markets.

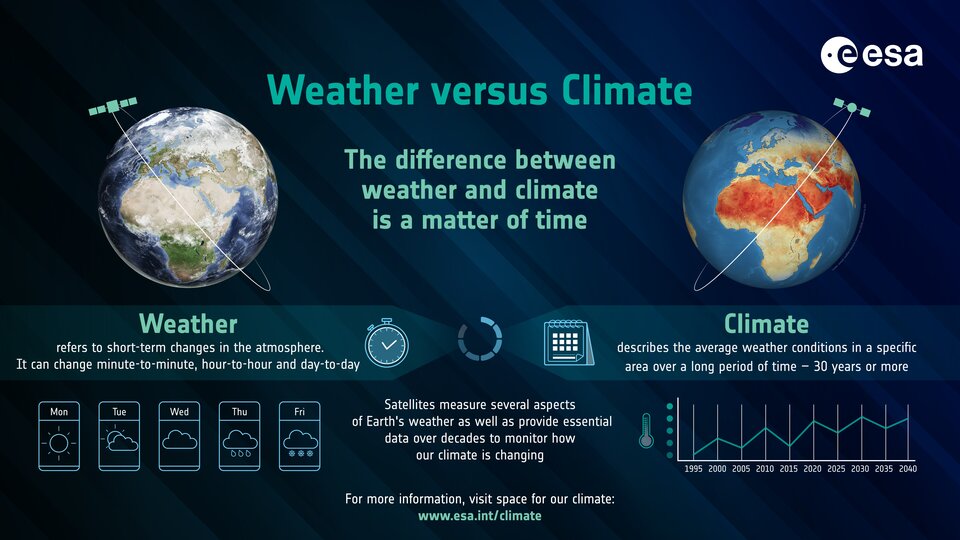

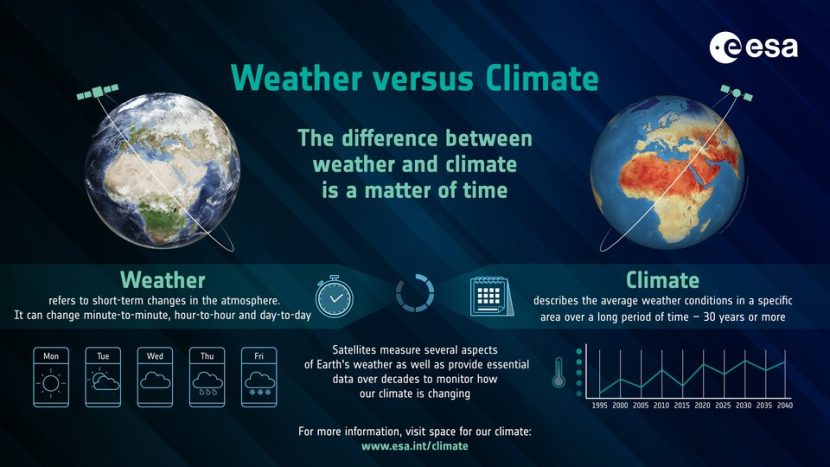

The weather is not being left out of the action either, with a bet regarding the highest temperature recorded in New York City for that Friday landing among the top 10 trending trades as of Friday afternoon.

However, betting volumes in other categories still lag significantly behind political wagers on the platform.

Harry Crane, a statistics professor at Rutgers University who researches prediction markets, suggests that if allowed, sports betting could provide an excellent opportunity to increase volumes in non-political trading.

“Sports betting is exceedingly popular. Elections pique interest every few years, but not daily,” Crane noted.

Kalshi’s accelerated market listing process may also contribute to the growing fascination with quicker resolution trades in sectors such as entertainment and weather.

“In October alone, we launched more markets than we did in the entirety of the past year combined,” Mansour stated, revealing that it now takes less than 24 hours to introduce a new market. Their inaugural market took a lengthy 18 months to launch.

Looser regulation and emerging competition

Crane and Miller indicated that the anticipated Trump administration’s more relaxed regulatory stance could further benefit prediction markets.

Miller predicts that diminished regulations could attract larger brokerages and new platforms eager to benefit from the escalating interest in prediction markets, joining retail brokers like Robinhood.

“This will undoubtedly emerge as a new sector for securities and financial services. We’re just beginning to witness it,” Miller remarked, adding, “We are on the cusp of a new cycle.”

New competitors will likely find support from Kalshi’s favorable court ruling earlier this year, he noted.

“That serves as a signal to other businesses,” he continued. “It is now permissible; therefore, I need not worry about regulatory issues as long as I conduct my operations fairly, transparently, and according to the contracts I offer.”

Crane contends that a more permissive regulatory environment will help prediction markets become more accurate, especially in forecasting political events. Increased volumes make market manipulation schemes significantly more difficult to execute, he claims.

“Everything influences everything else, and attempting to restrict one component or enforce policing on one aspect can often undermine the entire market’s functioning,” Crane shared with BI during a previous conversation in August.

Mansour likewise embraces the prospect of relaxed regulations and heightened competition within the sector, emphasizing that it will only contribute to the expansion of prediction markets.

“I believe additional players will expedite the growth of this asset class. That’s beneficial,” he stated, adding, “I don’t see any reason why prediction markets shouldn’t one day surpass the stock market. It’s quite straightforward. Yes, people are interested in stocks, but they care even more about politics, COVID, economics, or weather. Thus, they should be engaging with it,” he concluded.

“Is it just me, or does predicting the weather sound more exciting than checking the forecast now? 🌦️ Who knew the weather could be the next hot betting topic! Don’t forget to place your bets on sunshine vs. rain for this weekend! ☀️🌧️ #WeatherOrNot”