Technology

Awful Announcing’s 2025 streaming service rankings for sports fans

Streaming platforms have never been more critical in the life of a sports fan.

The past several years have seen more sports go to streamers than ever before. Big tech companies have become entrenched in sports rights deals, picking up packages alongside traditional linear networks. Sports are just as likely to link up with Amazon or Netflix as they are with ESPN or Fox.

Not to be outdone or left behind, all the major linear networks now have their own streaming services, or will be launching them shortly. August 21, 2025, is a seminal day in the history of ESPN as the Worldwide Leader in Sports finally launches their streaming platform for cord-cutters. And even Fox, long the a holdout alongside ESPN in the digital race, will be launching their Fox One streaming service the same day.

Much of the exponential rise in streaming has been built on the supply and demand of sports fans. Each streaming platform has counted on live sports to draw subscriptions and raise revenue by airing exclusive sporting events. Sports is by far the most effective carrot a media company can hang to get sign-ups and, even more importantly, keep them on board.

But that reliance has also led sports fans to a number of subscriptions and paywalls that feel like taking on the most difficult American Ninja Warrior course. It’s almost impossible to keep track of what sport is going on where, what the best value propositions are, and the true cost of being a sports fan.

So if you’re looking for a way to navigate through the maze of streaming platforms as a sports fan, this list is for you. It is a list of every major streaming platform ranked by the best value provided to fans. Like any internet list, it’s subjective. So you won’t see any FAST channels or free services here. And the sports you desire may be higher or lower than our list. For instance, if you’re a UFC megafan, Paramount+ will soon be your go-to streaming service. But we’ve tried to rank these by the best overall popularity of the sports provided, matched up with their monthly subscription costs.

9) DAZN

Cost: $29.99 per month, or $19.99 per month for an annual contract.

Live Sports: Soccer, boxing, combat sports

DAZN is a much bigger platform internationally than in America, where it hardly registers in the greater sports ecosystem. Perhaps its biggest deal was found in televising the recent Club World Cup, but that entire tournament was hardly a must-see, even from hardcore soccer fans. Their flagship sports are found in boxing and MMA, but the vast majority of those events are far from headliners. The rest of the DAZN schedule reads like what ESPN would show during their Ocho marathons at a cost that anyone outside of the most diehard combat sports fans would find insane to consider.

8) Apple

Cost: $9.99 for Apple TV+ per month, $99 for MLS Season Pass, $79 with Apple TV+ subscription

Live Sports: MLS, MLB Friday Night Baseball, potentially F1

While other tech giants have dived head-first into the deep waters of competing with major media companies for live sports rights, Apple has taken a far different approach. Apple’s portfolio revolves around the landmark MLS Season Pass deal. We finally gained some insight into just how well MLS Season Pass is doing on Apple this year after a total lack of transparency. MLS is getting a good amount of money from Apple and benefiting from global exposure (especially with Lionel Messi), but it’s sacrificing accessibility on the home front. Overall, Season Pass is a very good and dedicated product for MLS fans.

Son Heung-Min has made in immediate impact for @LAFC 🇰🇷@kev_egan, @BWPNINENINE and @kev_egan break it down. pic.twitter.com/upVAnuYjN3

— MLS on Air (@MLSonAir) August 18, 2025

Beyond the MLS deal, Apple is a non-factor in live sports. Its Friday Night Baseball package may go by the wayside soon. And while they are thought to be the future home for American F1 rights after the success of their movie starring Brad Pitt in theaters, it runs completely counter to their MLS strategy. Instead of owning global rights for an American league, Apple would take a worldwide series and air it only for an American audience. Even with F1’s growing fanbase stateside, it’s hard to see fans rejoicing that the series would go behind a streaming paywall after airing successfully for years on ESPN, especially with no other live sports to offer.

7) Netflix

Cost: $7.99 per month with ads, $17.99 per month standard

Live Sports: Christmas Day NFL, WWE Monday Night Raw, boxing, potentially Home Run Derby

Let’s be honest, if you’re subscribing to Netflix, you better not be doing it just for live sports. The truth is the portfolio here is only slightly above Apple in terms of content offered, but at least it’s of a premium quality. Netflix entered into a relationship with the NFL to air its Christmas Day games, which was a monumental milestone for both sides. Additionally, the global deal to televise WWE Raw was a watershed moment for the streamer, entering into live weekly sports entertainment for the first time.

Real. Rebellious. Raw.

Welcome to WWE Raw on @Netflix. pic.twitter.com/WqfnX733oJ

— Triple H (@TripleH) December 16, 2024

Otherwise, Netflix is committed to their event-focused model by being very selective with their rights and making a move for one-time events that have wide appeal, like Jake Paul vs. Mike Tyson or their reported interest in the Home Run Derby. That reputation will only be enhanced in the upcoming years with rights to the 2027 and 2031 Women’s World Cups.

6) Fox One

Cost: $19.99 per month, $199.99 annually

Live Sports: MLB, NASCAR, college sports

At first glance, Fox’s entry into the market with a streaming platform featuring all of their channels seems like a big development for sports fans. But in actuality, almost all of the major Fox Sports events air on network television, which could already be accessed for free with an antenna.

For years, Fox has favored the reach of its broadcast network over placing its most valuable inventory on cable. In an era of increasing cost, that is certainly a welcome development for fans who have seen prices rising all over the place. But the flip side of that equation is it leaves little appetite for what is to come through Fox One on the sports side.

What you would really be paying for here is FS1, FS2, and the Big Ten Network. And once you look only at the cable options, suddenly your viewing options become a lot thinner, unless you are a dedicated viewer of Colin Cowherd or Nick Wright.

The FS1 live sports schedule is not the strongest, especially once you go beyond MLB playoff games and some NASCAR races. You would miss the odd college football or basketball game and soccer tournament here and there, but those all seem like things you could live without, especially given the high cost. FS2 has been a complete non-factor unless you like horse racing and Australian Rules Football.

5) Paramount+

Cost: $7.99 per month with ads, $12.99 per month ad-free

Live Sports: International soccer, future UFC

Come back in a year, and it’s likely that Paramount+ will move up this list once it gains UFC rights in 2026 after their $7.7 billion megadeal. Featuring every UFC card without being upcharged for PPV events (we think) would be a massive win for fight fans. But for now, Paramount+ is almost exclusively a soccer platform.

That said, the CBS streamer does have some heavy hitters with all the major UEFA club competitions, including the Champions League, Italy’s Serie A, and England’s Championship and League Cup. But this is where the draw for Paramount+ ends because NFL and college football games on the platform could be accessed for free with an antenna in your local market. And if you were a soccer fan, you could just sign up for games in-season and then sign off for the summer time without losing anything.

4) HBO Max

Cost: $9.99 per month/$99.99 per year with ads, $16.99 per month/$169.99 standard

Live Sports: March Madness, MLB, NASCAR driver cams, NHL, U.S. Soccer, French Open

The newly rechristened HBO Max suffers from the loss of TNT’s most valuable sports property in the NBA on TNT. But beyond that, there is still a solid list of live sports on offer under the Warner Bros. Discovery umbrella… for now. It includes NHL and MLB rights, U.S. Soccer matches, and, of course, the NCAA Tournament. TNT has also been active in adding more content since losing the NBA, whether it be Unrivaled, the French Open (sorry, Roland-Garros), and various college sports rights.

Like Netflix, the true value in HBO Max probably lies in its entertainment properties versus what it offers in live sports. But the tonnage, depth, and variety at least make it a legitimate option for sports fans. And as far as something unique goes, the best sports offering on HBO Max may just be the NASCAR driver cams available for every car, complete with spotter radio, that has transformed how you can watch races each week.

And here’s Chase Elliott’s onboard as he gets hooked head on in the fence.

This crash ended up ending Elliott’s chances of winning the regular season championship. https://t.co/Qq1PMslDSs pic.twitter.com/9KenD1XWnU

— Steven Taranto (@STaranto92) August 17, 2025

All of these properties will soon move off the HBO Max platform when Discovery Global, the spinoff which will include TNT Sports, launches its own streamer. But for now, HBO Max has a wide range of sports properties that aren’t available on broadcast, which puts them at a solid fourth place on the list.

3) Amazon Prime Video

Cost: $8.99 per month, $14.99 per month/$139 annual for overall Amazon Prime subscription

Live Sports: NFL Thursday Night Football, NBA, WNBA, NASCAR

When it comes to tech companies, Amazon has quickly leapt up to the top of the ladder in the live sports scene and now occupies the same space as the likes of ESPN, NBC, and other traditional network powers. That began with the historic deal to stream a full season of NFL games through Thursday Night Football, and the company’s sports library has only continued to grow ever since then.

Of course, Amazon wants you to get the overall Prime subscription so you can shop through their site as well. But as a standalone service, the $8.99 monthly rate is still a great value compared to the other options on the list. When you also add in the massive amount of NBA and WNBA content that will be on the Prime Video platform this fall, with the launch of the league’s new media deals, it looks even better.

2025-26 NBA Season Watch Guide 📺✍️

Through the NBA’s partnership renewal with Disney and new agreements with NBCUniversal and Amazon, the 2025-26 schedule of national games will generally feature Mondays on Peacock, Tuesdays on NBC/Peacock, Wednesdays on ESPN/ESPN App,… pic.twitter.com/4KVpP76Vtq

— NBA (@NBA) August 14, 2025

Amazon will have loads of regular season NBA action, NBA Cup action, and serious postseason rights, including six Conference Finals over 11 years. Its WNBA rights have expanded to include select years broadcasting the Finals series. Additionally, a new NASCAR midseason package has only gone to bolster Amazon’s live sports collection further.

2) Peacock

Cost: $10.99 per month/$109.99 per year, $16.99 per month/$169.99 per year Premium

Live Sports: NFL, college sports, Olympics, NBA, EPL, WWE

From the outset, NBC was the most aggressive network by far when it came to using live sports to boost Peacock subscriptions. It’s almost hard to imagine now, but there were nearly riots in the streets when the NFL announced that the streamer would have its own exclusive playoff game that fans would have to fork over extra dollars for back in January 2024.

Since that time, NBC has been even more forceful in putting live sports exclusively on Peacock. And while it has undoubtedly been off-putting for some, there’s no question that the strategy has made it one of the most valuable streaming platforms for sports fans. While other companies have been caught in a tug of war between linear and streaming, or just dipping their toes into the live sports world, Peacock has been living and breathing live sports.

An exclusive NFL game, a substantial new NBA package, every Premier League game, the WWE library, college sports, and maybe the best recent sports broadcasting innovation in the Olympic Gold Zone all live on Peacock. That’s a fantastic lineup. Not to mention, Peacock is a likely landing spot for the soon-to-be spunoff Versant properties, which includes a ton of live golf rights.

The concerning thing for Peacock is that the sports-centric strategy may not be working in the long run. If Peacock were still priced at $7.99, it would be at the top of this list. But the 40% price hike for consumers to help pay for all of these deals has to be taken into account. The streamer could also drop in importance should NBC opt to launch a linear channel that simulcasts Peacock-exclusive games.

1) ESPN

Cost: $29.99 per month/$299.99 per year

Live Sports: Everything?

This is where your definition of value is probably going to vary, as it’s an incredibly tough call between the top two places. The new ESPN DTC service is as close to a must-have for sports fans as you can ever imagine. If there is one thing ESPN has done incredibly well since the turn of the century, it is building out a roster of live sports that makes its presence in the lives of sports fans an absolute necessity.

ESPN televises everything from Monday Night Football to the NBA and NHL playoffs to the College Football Playoff, Women’s NCAA Tournament, tennis and golf majors, and much much more.

Check out 5 things fans should know about ESPN’s new direct-to-consumer offering

Read: https://t.co/vWDrNqjW1m pic.twitter.com/Pxh1TPjxjd

— ESPN Front Row (@ESPNFrontRow) May 13, 2025

But the question here is value. At $29.99 per month, the ESPN DTC service is by far the most expensive offering on this list. ESPN knows it has a premium product and is asking you to pay a premium price. The good news for most sports fans is that you can access them through a cable subscription. But this list is for cord-cutters. Many of these streaming services aren’t all that relevant if you’re already paying for cable.

If you’ve survived for this long without ESPN, are you going to be willing to take the plunge now? The network is working hard to add exclusive content, like their surprising new deal with WWE for their premium live events. And it looks like more is coming in the future.

But at that price point, are you better off just going with a cable or satellite subscription that has ESPN DTC included? Or are you better off getting the ESPN DTC product and then piecing together other sports streaming subscriptions elsewhere? The answer to that question likely depends on what you value as a sports fan. If you’re able to mix-and-match for a price cheaper than cable, this could be a good option for you. If not, ESPN is more than happy to take your money from a cable subscription as well.

A world without ESPN, however, seems untenable as a sports fan. And that’s why they rank first on this list.

Technology

High-Performance Monitor Lineups : HKC Corporation

HKC Corporation’s showcase is anchored by the introduction of several flagship products. The HKC M10 Ultra is promoted as the first monitor to utilize an RGB MiniLED backlight system for enhanced color and brightness control. It would appeal to professional graphic designers, video editors, and game developers. The KOORUI S4941XO is a large-format OLED screen with a high refresh rate aimed at immersive simulation gaming. Finally, the ANTGAMER ANT275PQ Ultra stands as an LCD monitor with an exceptionally high refresh rate for competitive esports.

Collectively, HKC Corporation’s display products demonstrate the company’s technical focus on advancements in panel construction, backlight engineering, and integrated image processing software.

Image Credit: HKC Corporation

Technology

Innovative Gaming Peripheral Ecosystems : gaming peripheral

At CES 2026, Akko calls attention to three distinct series — the Nest, the Dash, and the Framer. The brand highlights the Dash as its “most advanced mouse to date.” This computer peripheral weighs just 39 grams and boasts the PixArt 3950 sensor for ro-grade precision and stability. Nest, on the other hand, is a right-hand ergonomic style, while the Framer is for entry-level gaming.

In addition to the high-performance computer mice, Akko is also highlighting new keyboards — including the aluminum rapid assembly magnetic-switch keyboard MOD007v5 HE and the Year of the Snake Keyboard — as well as the M1 V5 TMR technology by Akko’s sister brand MonsGeek.

Image Credit: Akko

Technology

Gambling Industry Trends And Predictions For 2026

Gambling Industry Trends and Predictions for 2026

The global gambling industry enters 2026 on a rapid growth trajectory and at the cusp of transformative change. After reaching an estimated $99 billion in 2024, the global betting and gaming market is projected to nearly double by 2033 (approaching $182 billion) as digital platforms, mobile betting, and AI-driven innovations reshape how people gamble. This boom is fueled not only by technological leaps, but also by evolving consumer behaviors and shifting regulatory landscapes. By 2026, the industry will be more connected, data-driven, and consumer-focused than ever, blurring the line between gambling and broader digital entertainment.

Global Focus, Local Moves: North America and Europe currently dominate gambling revenue (about three-quarters of the market), but Asia-Pacific and Latin America are emerging as the next frontiers. In particular, Asia-Pacific’s liberalizing regulations, rising incomes, and mobile adoption are accelerating participation across the region. At the same time, the United States – which ignited a sports betting boom after 2018 – continues to expand state-by-state. Meanwhile, Europe’s mature markets are prioritizing sustainability and responsibility, and Latin America and Africa are opening up new opportunities. Across the world, stakeholders are “going all-in” on innovation and expansion, while bracing for greater oversight to ensure gambling grows safely.

In this outlook for 2026, we highlight the key trends shaping the iGaming (online gambling) sector and its convergence with traditional brick-and-mortar casinos. From new markets and regulations to tech breakthroughs and changing player expectations, the year ahead promises high stakes and big opportunities.

New Markets and Regulatory Shifts on the Horizon

Legalization Wave Continues

The map of regulated gambling is set to expand further in 2026. Several countries and jurisdictions are transitioning from gray markets to fully legal, competitive industries. Notably, Brazil – long considered a “sleeping giant” of gaming – is rolling out regulations for online sports betting and casino gaming, creating one of the world’s largest new markets. In Europe, Finland has decided to end its state monopoly and move toward a competitive licensing model by 2026, opening its lucrative market to private iGaming operators. These moves follow the trend of governments seeking tax revenue and consumer protection through licensing rather than prohibition.

United States Focus

In the U.S., the sports betting frenzy that spread to 35+ states is settling into a mature phase, but there are still holdouts and new opportunities. Major states like Texas and California remain unresolved – Texas lawmakers are weighing another push for sportsbooks (though realistically not before 2027) and California’s tribal vs. commercial interests make legalization challenging. Still, the pressure is mounting as Americans in nearly every region have gained access to legal betting.

Meanwhile, online casino gaming (iGaming) – currently legal in only seven states – is gaining traction. In 2025, multiple U.S. states saw legislative efforts to legalize online casinos, eyeing the success of pioneers like New Jersey, Michigan, and Pennsylvania. The record-breaking revenues reported by existing iGaming states underscore the opportunity: several markets have posted all-time monthly records, and year-over-year growth in iGaming has significantly outpaced growth in brick-and-mortar casinos. This momentum is likely to push more U.S. states to consider regulating online casinos in 2026 and beyond, especially as they watch neighbors reap tax windfalls.

Stricter Rules and Compliance

As new markets open, regulators everywhere are also tightening the rules in existing markets. Governments in major jurisdictions are introducing tougher measures for consumer protection, anti-money-laundering (AML), and advertising. The United Kingdom’s regulatory overhaul is a prime example – from stricter ad guidelines to potential online slot stake limits and affordability checks, UK operators face a more controlled environment. Other countries have gone so far as to heavily restrict or ban gambling advertising. Across Europe, compliance is king: the era of “grey area” operations is fading as authorities push operators to either go fully legal or get out.

In the U.S., regulators are aggressively enforcing rules to ensure a safe market. Several states have intensified enforcement against unlicensed platforms, increased cease-and-desist activity, and introduced new rule updates emphasizing tighter licensing standards, identity verification, AML protocols, and mandatory responsible gambling tools. This reflects a broader North American trend: as the online market matures, regulators are shifting from simply enabling new industries to rigorously policing them for compliance and strengthening player protections.

Tax and Policy Changes

Policymakers are also adjusting the financial rules around gambling. In the U.S., a notable change takes effect in 2026: recreational gamblers will lose a portion of their tax deductions on losses, with federal law capping deductible losses at 90% of winnings (down from 100%). This tax tweak may discourage some high-volume bettors or at least complicate their accounting. At the same time, U.S. reporting thresholds for certain jackpots have been modernized in recent years, reflecting a slow but steady effort to update outdated compliance burdens.

Overall, 2026’s regulatory landscape will be defined by expansion paired with vigilance: more markets opening up and more scrutiny to ensure gambling growth comes with strong consumer safeguards. Next, we look at one of the most intriguing regulatory battles brewing – the clash between traditional gambling operators and a new breed of betting platform known as prediction markets.

A major storyline heading into 2026 is the rise of prediction markets and their collision with traditional sports betting. Once a niche idea, prediction markets allow users to wager on practically any real-world outcome – from elections and economic indicators to pop culture outcomes – treating events like stocks to be traded. In the past two years, this segment expanded rapidly in the United States, blurring the line between gambling and financial trading. A growing roster of platforms has launched or gone mainstream, and major sports and gaming brands are experimenting with prediction-style products.

This flurry of innovation points to demand for new forms of interactive wagering. Younger bettors especially enjoy the stock-market-like experience of trading event outcomes, and volumes have surged across several platforms. These numbers have not gone unnoticed by the traditional gaming industry – or by its regulators.

Regulatory Crossfire

Prediction markets currently operate in a legal gray area in the U.S., often falling under federal commodities oversight rather than state gambling law. This has triggered backlash from established gambling stakeholders who argue these products resemble sports betting without the same level of licensing, consumer protection, and responsible gaming guardrails.

On the other side, prediction market companies and allied fintech firms are organizing and pushing for clearer frameworks that legitimize these markets nationwide. They argue that the legal system hasn’t kept pace with modern products, and that a patchwork of rules will create confusion and drive demand to offshore alternatives. The stage is set for a significant confrontation in 2026: federal regulators vs. state gaming authorities, and innovative platforms vs. incumbent casino and sportsbook ecosystems.

Why This Matters in 2026

Whether prediction markets are integrated into the regulated gaming system, restricted, or forced into separate lanes will shape everything from taxation and consumer protections to how sportsbooks innovate. The industry may be moving toward a reality where traditional operators either (1) partner into this category, (2) fight it aggressively, or (3) watch parts of wagering demand shift outside classic sportsbook rails. The outcome won’t just impact the U.S.; it will influence global regulators as they face similar fintech-gambling convergence pressures.

The Great Convergence: Merging iGaming with Brick-and-Mortar Casinos

The year 2026 will also highlight the convergence between online and land-based gambling, often dubbed the “omnichannel” approach. While online iGaming is booming, traditional physical casinos are not standing idle – many are leveraging technology and cross-platform strategies to stay relevant and connected to digital audiences. The central question for casino operators has become: How can we integrate the on-site casino experience with online play?

Omnichannel Strategies

Some forward-thinking casino companies are embracing hybrid innovations that turn brick-and-mortar resorts into content engines for digital channels. New live dealer concepts, broadcast-style casino content, and in-property studios are becoming a real strategy: they extend a casino brand beyond physical walls while turning on-site foot traffic into marketing reach.

Another critical driver of convergence is the integration of loyalty programs and currencies across channels. Big operators are linking loyalty points so that players earn and spend rewards whether they’re at a slot machine in Vegas or betting on an app at home. Increasingly, these rewards behave more like digital ecosystems than simple points programs. Over time, this may evolve toward a portable digital identity where engagement across sportsbook, casino, social gaming, and entertainment can be recognized and rewarded holistically.

Physical Casinos Go Digital

Brick-and-mortar casinos are also adopting more digital infrastructure: cashless wagering options, mobile wallets, app-driven player experiences, and increasing experimentation with biometrics for identity and loyalty recognition. These upgrades align with younger customers’ expectations and help casinos enhance operational efficiency while reducing certain fraud and compliance risks.

It’s worth noting that not all casino operators are on board. Some U.S. regional casino companies and tribal stakeholders remain cautious, citing cannibalization concerns and social impacts. Still, the broader revenue picture continues to pressure the industry toward convergence, especially as online channels deliver faster growth and higher scalability.

The “Phygital” Casino Experience

In 2026, expect to see more crossover initiatives that make gambling an anytime, anywhere activity. The convergence is also evident in content: casino games increasingly borrow features from video games (missions, rewards loops, community events), while physical casinos adopt attractions influenced by digital culture. For operators, the strategic advantage goes to whoever can unify experiences across platforms while respecting the regulatory and responsible gaming frameworks required in each market.

Tech Innovations: AI, Apps, and Immersive Betting

Technology has always been a driving force in iGaming, but heading into 2026, it’s clear the industry is entering another innovation cycle. Several tech trends are set to redefine how gambling products are built and how players engage:

Mobile 2.0 – Faster and More Immersive

Mobile betting is the primary channel for many consumers, and in 2026 mobile platforms are leveling up. Expect smoother UX, deeper personalization, more embedded live content, and early-stage applications of AR to create more immersive experiences. The smartphone is not just a portal to betting anymore; it’s becoming the interface layer for entertainment, payments, community, and identity.

Artificial Intelligence Everywhere

AI has moved from experimentation to operational core. It is now embedded in risk management, fraud detection, dynamic promotions, personalization, customer support, and even content generation. The next stage in 2026 is “industrialized AI”: measurable ROI, tighter governance, and clearer outcomes. In regulated markets, AI will increasingly be paired with compliance expectations – including systems designed to detect problem gambling behaviors earlier and deliver better interventions.

Fintech and Payments Innovation

Payments are becoming a strategic battleground. Open banking capabilities, faster payouts, improved fraud detection, and easier onboarding are changing player expectations. In parallel, crypto rails remain relevant, especially for international markets and certain user segments. For regulated operators, the key is not crypto hype, but crypto’s utility: faster settlement, transparent transaction trails, and optionality for global payments where traditional banking remains restrictive.

New Game Formats – eSports, Virtuals, and Microbets

New formats continue to expand the addressable audience. eSports betting is growing, virtual sports offer always-on wagering, and micro-betting is becoming a major engagement driver as operators refine the latency, data feeds, and in-play UX that this product demands. Major global sporting events in 2026 will likely accelerate micro-betting adoption as consumers learn to treat a match not as one bet, but as dozens of moment-to-moment decision points.

Gamification and Social Play

Gamification is now a baseline expectation in modern apps: missions, rewards, leaderboards, community challenges, and social layers that borrow heavily from video games. Meanwhile, streaming culture continues to collide with iGaming, as content creators, live casino formats, and interactive “watch and play” mechanics become more common acquisition channels. As these experiences scale, expect regulators to sharpen the rules around marketing, affiliate behavior, and ensuring responsible gaming protections extend into creator-led environments.

Cybersecurity and Reliability

As platforms scale, cybersecurity becomes existential. Attacks, phishing, and platform reliability issues can quickly damage trust. In 2026, regulators and major partners will increasingly treat security readiness and resilience as non-negotiable. Operators will invest further in multi-cloud uptime strategies, monitoring, and stronger identity protections to ensure stable, compliant operations at scale.

Responsible Gambling and the Social License

Amid all the growth and innovation, the industry in 2026 is putting a sharper focus on responsible gambling (RG). As gambling becomes more accessible digitally, the expectations rise: operators must prevent harm, regulators must protect consumers, and stakeholders must prove that industry growth can be sustainable.

Real-Time Intervention

One of the most important evolutions is the use of AI and behavioral analytics to detect harmful patterns earlier. Instead of relying solely on players to self-report or set limits, modern systems can identify risk signals and trigger interventions such as dynamic messaging, cooling-off prompts, or structured friction in the user journey.

Mandatory Measures and Culture Change

More jurisdictions are tightening requirements: deposit and time limits, self-exclusion enforcement, clear loss/win displays, enhanced KYC checks, and more robust proof-of-source-of-funds rules in higher-risk cases. The direction is clear: responsible gambling is no longer optional, and the companies that build it into product design will find it easier to keep market access, maintain brand trust, and partner with mainstream institutions.

The challenge is that responsible gambling messaging must be effective, not performative. Generic slogans are losing impact. The next phase is more personalized, contextual, and integrated into product design without creating a punitive experience for recreational users.

Conclusion: 2026 and Beyond – A High-Tech, High-Responsibility Future

The year 2026 is poised to be a pivotal chapter for iGaming and the casino industry, marked by convergence and innovation on one hand, and heightened responsibility and regulation on the other. We will see new markets expand, the U.S. inch closer to broader iGaming adoption, and regulators increasingly demand stronger safeguards as online access becomes ubiquitous.

Technology

Where Is India’s Gaming Industry Headed Next?

India’s gaming industry is rapidly evolving into one of the largest and most dynamic markets in the world. Driven by the increasing adoption of smartphones, affordable internet, and a tech-savvy youth population, gaming is becoming a mainstream form of entertainment. With mobile gaming leading the charge, the India gaming market is also witnessing significant growth in esports, cloud gaming, and immersive technologies like augmented reality (AR) and virtual reality (VR).

Unlocking New Realms: The Evolution and Key Opportunities in India’s Gaming Sector

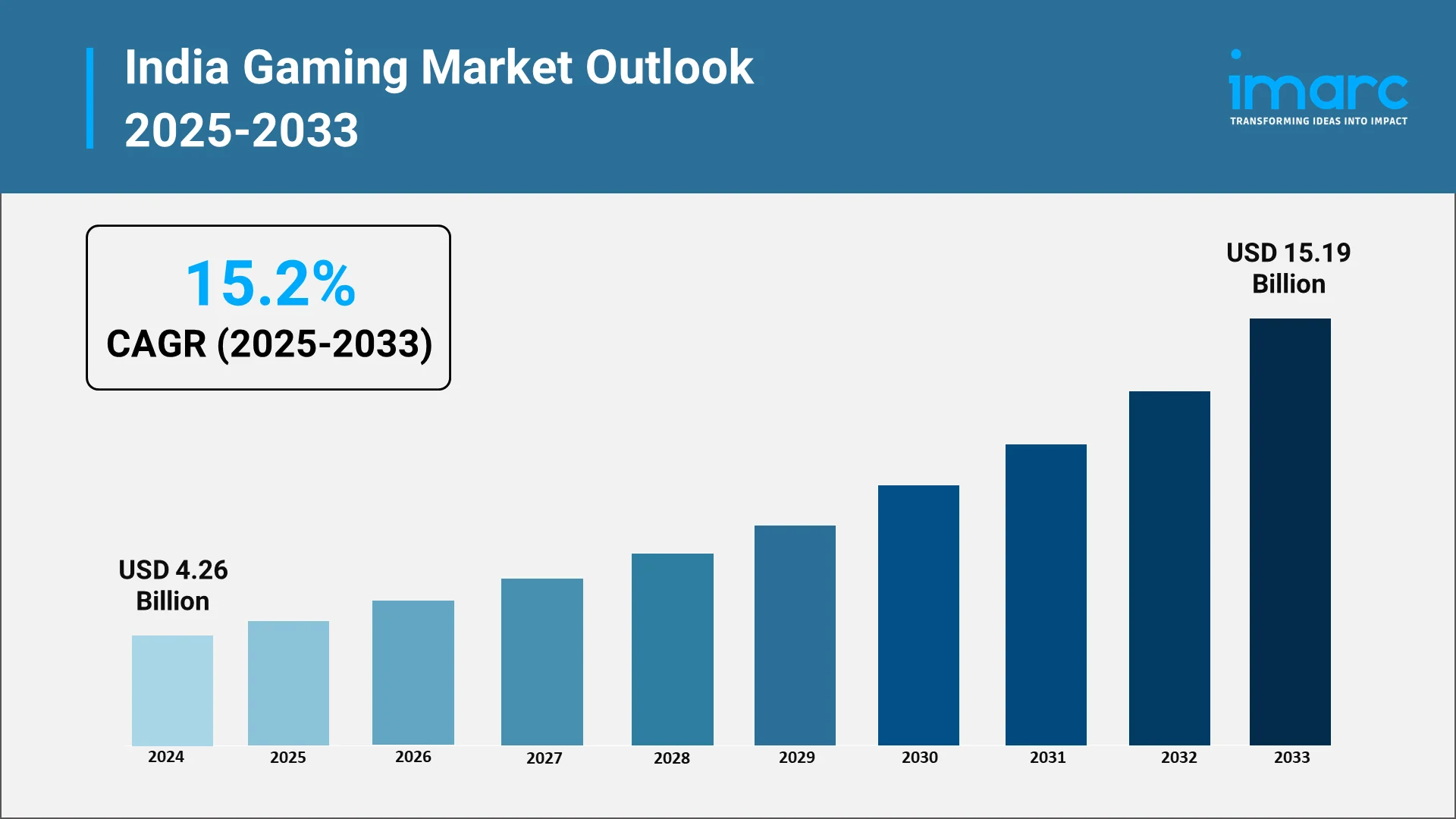

The gaming sector is transitioning from a specialized sector to a dynamic and swiftly growing market, fueled by the rising use of smartphones, accessible internet, and a young, tech-oriented demographic. The rise of mobile gaming is at the heart of this transformation, with millions of people in India engaging in gaming on their smartphones daily. With the nation’s gaming industry growing, a variety of gamers, covering mobile, console, and PC platforms, are shaping the industry. Quantifying this rapid expansion, the IMARC Group reported that the gaming market size in India reached USD 4.26 Billion in 2024.

The primary opportunities ahead are in the rising need for localized content, as developers are concentrating on designing games that connect with Indian cultural and regional tastes. This presents substantial potential to reach a broader audience, especially in tier-2 and tier-3 cities. Moreover, the growth of esports, cloud gaming, AR, and VR technologies offers new opportunities for expansion. With the growing investment and support from both the government and private sectors, there is significant potential to establish India as a worldwide center for gaming development and creativity.

With the market’s maturation, the advancement of monetization strategies, enhanced infrastructure, and stronger regulations will continue to contribute to the increase in India gaming market share, unlocking untapped potential and fostering global competitiveness.

Explore in-depth findings for this market, Request Sample

Game On: Current Trends and Market Drivers Shaping India’s Gaming Future

According to IMARC Group’s projections, the India gaming market is projected to grow at a CAGR of around 15.2% from 2025 to 2033, reaching USD 15.19 Billion by 2033. The growth will be supported by the following factors:

- Smartphone and Internet Penetration

India’s increasing number of affordable smartphones, coupled with the expansion of high-speed internet access, is significantly broadening the market reach. As rural and non-metro areas gain improved connectivity, companies can target new user segments beyond urban centers. This growing accessibility enables casual, on-the-go gaming, contributing to a surge in user numbers and expanding the market. As of March 2024, India had 954.40 million total internet subscribers, with 398.35 million rural subscribers. Furthermore, by April 2024, 95.15% of India’s 644,131 villages were equipped with 3G/4G mobile connectivity, underscoring the increasing digital penetration across the country and creating vast opportunities for gaming expansion in rural areas.

- Monetization Evolution: In–App, Subscription & Cloud

The monetization models in the gaming market in India are evolving beyond basic in-app purchases. Traditional in-app purchases are being complemented by subscription models, cloud streaming, and cross-platform play, providing new revenue streams and catering to players seeking more flexibility and value. This shift allows gaming companies to offer premium experiences while enhancing player lifetime value. A prime example of this trend is Nvidia’s announcement in 2025 that its GeForce NOW cloud gaming service will launch in India, offering high-end gaming experiences on various devices. Premium members can access over 4,500 games, including popular titles like Borderlands 4 and Call of Duty: Black Ops 7, solidifying cloud gaming’s potential in India.

- Esports Partnerships and Innovation

A key factor driving the growth of the market is the increasing investment in esports partnerships and innovation. Realme’s collaboration with Krafton India as the official smartphone partner for the BattleGrounds Mobile Series (BGIS) 2025 and BGMI Pro Series (BMPS) 2025 highlights this trend. By using its GT 7 Pro for the tournaments, Realme is directly supporting both professional and grassroots players. This partnership not only boosts esports visibility but also strengthens the gaming ecosystem in India. As esports continues to gain traction, such collaborations enhance the gaming experience and contribute to market expansion.

- Localized Product Offerings and Market Tailoring

The growing availability of localized products tailored to the needs of Indian gamers is positively influencing the market. Acer’s announcement in 2025 to launch “Make in India” gaming laptops is a prime example. By customizing its Aspire/ALG, Nitro, and Predator series for the Indian market, Acer is addressing the performance, pricing, and usage patterns unique to Indian gamers. This move not only supports the rising demand for gaming PCs across casual, competitive, and creator segments but also taps into the rising interest in AI-ready devices, contributing to the rapid expansion of India’s gaming ecosystem.

The rise of accelerator programs and funding initiatives is helping local developers access advanced technology, mentorship, and global networks. The adoption of AI tools is particularly transformative, enhancing game development, player experiences, and monetization strategies. These AI-driven innovations improve gameplay mechanics, automate processes, and offer personalized content, making Indian games more competitive globally. A prime example is Meta’s India-focused Gaming Accelerator, launched in 2025, which supports 20–30 emerging studios with AI tools like Llama, along with mentorship and investor access to scale their games for global markets.

The Game Plan: Conquering Challenges and Unlocking New Opportunities

The Indian gaming industry encounters challenges like regulatory ambiguity, with many states lacking clear rules for online gaming, creating confusion for developers and players. The country’s vast and diverse population also requires significant investment in localization and culturally relevant content. Additionally, piracy and data security concerns remain persistent threats.

Despite these obstacles, the rapid increase in internet access and smartphone adoption, particularly in tier-2 and tier-3 cities, presents a large untapped market. Mobile gaming is becoming popular because of affordable smartphones and data plans, while localization offers a chance to engage diverse user bases. The growing momentum of the India Mobile Gaming Market further highlights how digital engagement is expanding across demographic groups. Esports and online competitions are also gaining traction, creating new opportunities for competitive gaming and sponsorships.

Masters of the Game: Who’s Leading India’s Gaming Industry

Major figures in the market are progressively concentrating on broadening their reach and enhancing user interaction by utilizing mobile-first approaches and integrating localized content. These firms are focusing on creating games that align with local tastes, providing content in various languages and crafting gameplay that reflects India’s rich cultural diversity. Numerous developers are investigating fresh monetization strategies, such as in-app purchases, subscription models, and live events, while incorporating social and multiplayer elements to promote community engagement. To remain competitive, they are significantly investing in technology like AI and cloud gaming to improve user experiences and provide smooth cross-platform play. Directly illustrating the investment in technology like cloud gaming to improve user experiences and provide smooth cross-platform play, Xbox launched cloud gaming in India for Game Pass subscribers in 2025, allowing high-end games to stream on mobiles, tablets, and PCs.

.webp)

The Game Changers: How Investment and Government Support Are Elevating the Gaming Sector

The gaming market in India is influenced by government-backed initiatives and a clear regulatory framework that foster innovation and growth. These programs support game design, development, and talent, attracting both local and global investments. The regulatory system ensures fair practices and transparency, building market trust and safeguarding user interests.

- Government-backed programs are essential in driving innovation and creating a vibrant gaming ecosystem in India. By supporting game design, development, and talent nurturing, these initiatives provide infrastructure, networking, and industry collaboration that attract both local and global investments. They also focus on cultivating local talent, ensuring the sector’s sustainability and competitiveness. The government’s commitment is evident in major initiatives like the Create in India Challenge and the AVGC-XR Mission, launched in 2025, which aim to foster original creation and collaboration across gaming, animation, VFX, and immersive technologies. These efforts strengthen India’s creative economy and position the country as a global hub for AVGC-XR innovation.

- A coherent regulatory system is vital for driving the gaming market in India. By establishing clear rules and categories for different game types, such as esports and online gaming, the framework ensures transparency and fair practices, fostering trust among investors and participants. This organized approach enhances market security for both developers and users, promoting sustainable growth. In 2025, the Ministry of Electronics and Information Technology (MeitY) addressed the need for such a framework with the release of the Draft Promotion and Regulation of Online Gaming Rules under the PROG Act. This created India’s first unified framework, with the Online Gaming Authority overseeing compliance, classification, and registration.

Leveling Up: IMARC’s Playbook for Navigating India’s Thriving Gaming Market

IMARC Group empowers stakeholders in India’s gaming industry with data-driven insights to succeed in one of the world’s fastest-growing entertainment markets. Our research and consulting services help clients identify untapped opportunities, navigate market uncertainties, and drive innovation in game design, marketing, and retail strategy.

- Market Insights: Track trends shaping India’s gaming market, including the rise in mobile gaming, increasing demand for esports, and the growing popularity of educational and strategy-based games. We also explore the emergence of local developers and the expanding gaming ecosystem.

- Strategic Forecasting: Predict future developments in the integration of digital and physical gaming experiences, the growth of online gaming platforms, evolving user preferences, and the impact of regional content and culturally relevant game narratives.

- Competitive Intelligence: Analyze strategies and offerings from leading game publishers and emerging startups, including how they are redefining gaming experiences with local themes, storytelling, and sustainable production practices.

- Policy and Regulatory Analysis: Understand trade regulations, intellectual property protection, licensing, and safety compliance standards crucial to the production and distribution of games in India.

- Tailored Consulting Solutions: Benefit from customized advice on market entry strategies, distribution models, branding, and game localization. IMARC’s expertise supports businesses in developing scalable, client-centric growth strategies in an expanding gaming ecosystem.

Technology

New Nevada Gaming Board Chairman Knows The Importance Of Getting Technology OK’d Quickly

The New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, signaling a clear focus on modernizing how gaming innovations move from development to casino floors. This approach reflects an understanding that technology now plays a central role in the gaming industry and that regulatory systems must evolve to keep Nevada competitive while maintaining its high standards.

New Chairman Knows the Importance of Approving Technology

Gaming technology is advancing at a rapid pace, from new slot machine platforms to cashless systems and enhanced security tools. When approvals take too long, Nevada risks seeing new products debut elsewhere first. The New Nevada Gaming Board Chairman knows the importance of getting technology approved quickly because delays can affect manufacturers, casino operators, and ultimately the state’s position as a leader in regulated gaming.

Industry Experience Shaping Regulatory Priorities

Leadership matters in regulatory agencies, especially in industries as complex as gaming. The new chairman brings experience that bridges regulation and technology, offering insight into how long approval timelines can impact innovation. This background helps explain why the New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, not as a shortcut, but as a way to make processes more efficient and predictable.

How Faster Approvals Benefit Nevada’s Gaming Industry

Timely technology approvals help casinos remain competitive and allow players to experience the latest advancements sooner. When Nevada can approve new gaming systems without unnecessary delays, it strengthens relationships with manufacturers and reinforces the state’s reputation as the global standard for gaming regulation.

Maintaining Integrity While Moving Faster

Speed does not mean sacrificing oversight. Nevada’s gaming regulators are still responsible for ensuring fairness, security, and compliance. The emphasis is on refining internal processes, improving communication, and reducing bottlenecks. This balanced approach explains why the Nevada Gaming Board Chairman knows the importance of getting technology approved quickly while continuing to uphold strict regulatory safeguards.

What This Means for the Future of Gaming Regulation

Looking ahead, a more responsive approval process could encourage greater innovation within Nevada’s gaming sector. Developers may be more inclined to launch new technologies in the state, and operators can adapt more quickly to player expectations.

By aligning regulatory efficiency with technological progress, Nevada positions itself to remain both a trusted regulator and an innovation-friendly environment in an increasingly competitive global gaming market.

Looking for Legal Guidance in Gaming?

If you follow SCCG content and have inquiries about your gaming business, connect with Lazarus Crystal Law Firm—formed by SCCG Management and Lazarus Legal to unite top-tier gaming law with commercialization and market-entry strategy.

Our Areas of Expertise Include:

• Nevada and multi-state gaming licensing

• Regulatory compliance and audit services

• International market entry and cross-border advisory

• Gaming M&A legal due diligence

• Tribal gaming legal and strategic support

• iGaming and sports betting regulatory guidance

Follow us on LinkedIn: Lazarus Crystal Law Firm

Technology

Page not found

-

Motorsports2 weeks ago

Motorsports2 weeks agoRoss Brawn to receive Autosport Gold Medal Award at 2026 Autosport Awards, Honouring a Lifetime Shaping Modern F1

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoStempien to seek opening for Branch County Circuit Court Judge | WTVB | 1590 AM · 95.5 FM

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoPrinceton Area Community Foundation awards more than $1.3 million to 40 local nonprofits ⋆ Princeton, NJ local news %

-

NIL3 weeks ago

NIL3 weeks agoDowntown Athletic Club of Hawaiʻi gives $300K to Boost the ’Bows NIL fund

-

NIL3 weeks ago

NIL3 weeks agoKentucky AD explains NIL, JMI partnership and cap rules

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoTeesside youth discovers more than a sport

-

Sports3 weeks ago

Sports3 weeks agoYoung People Are Driving a Surge in Triathlon Sign-Ups

-

Motorsports3 weeks ago

Motorsports3 weeks agoPRI Show revs through Indy, sets tone for 2026 racing season

-

Sports3 weeks ago

Sports3 weeks agoThree Clarkson Volleyball Players Named to CSC Academic All-District List

-

Sports2 weeks ago

Sports2 weeks agoBeach Volleyball Unveils 2026 Spring Schedule – University of South Carolina Athletics