Report Overview

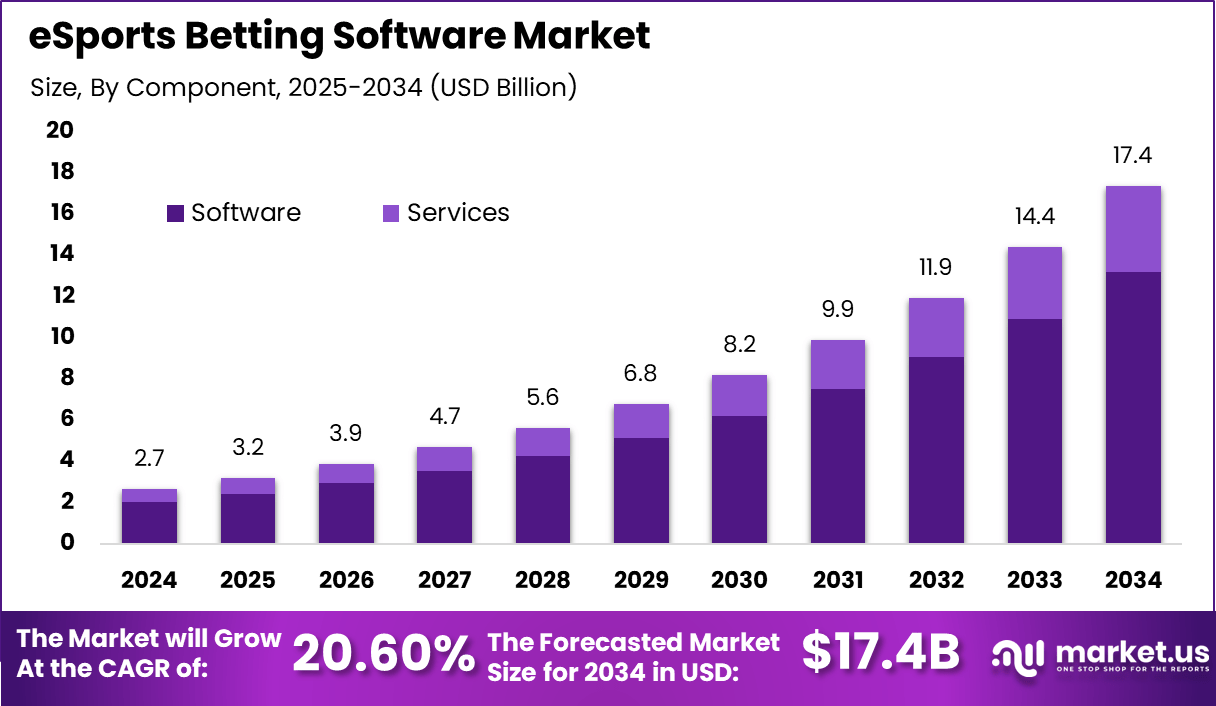

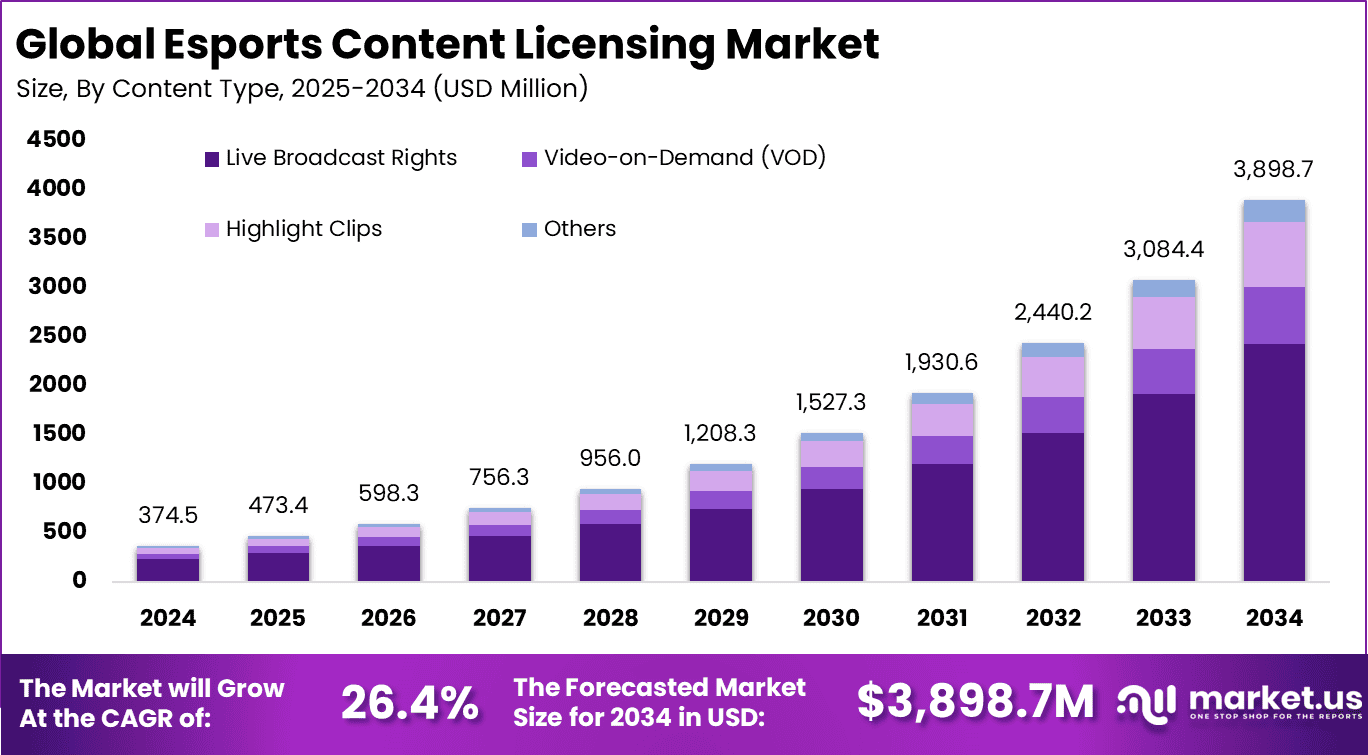

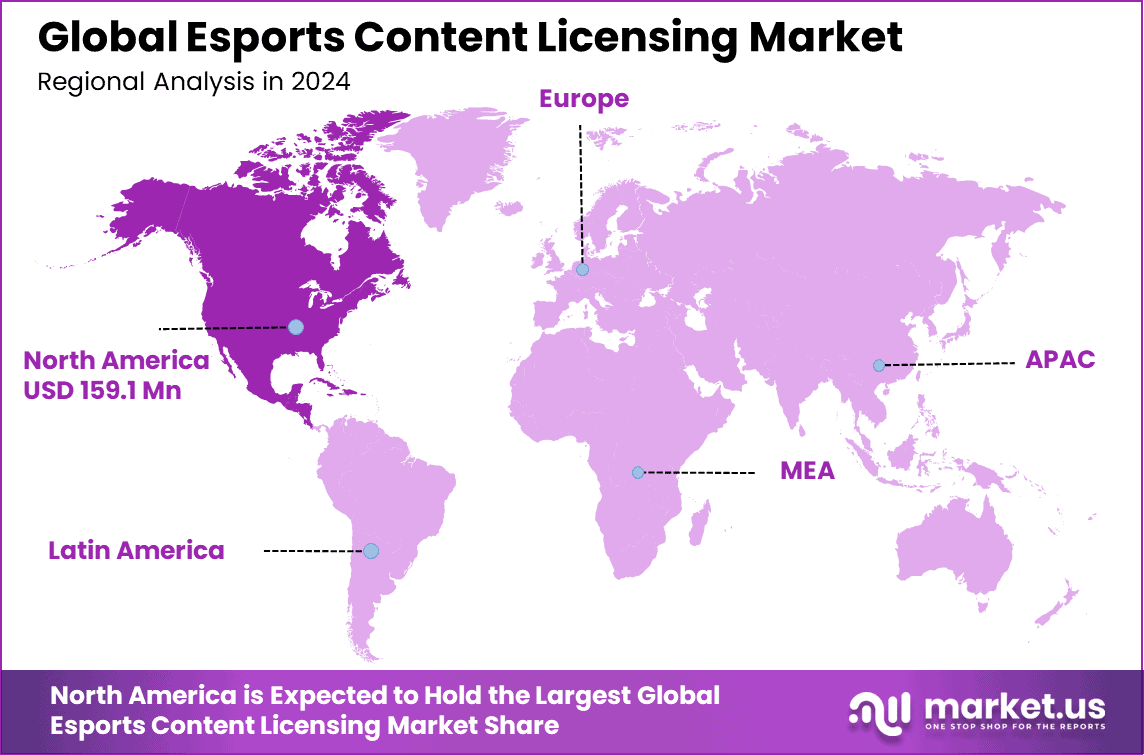

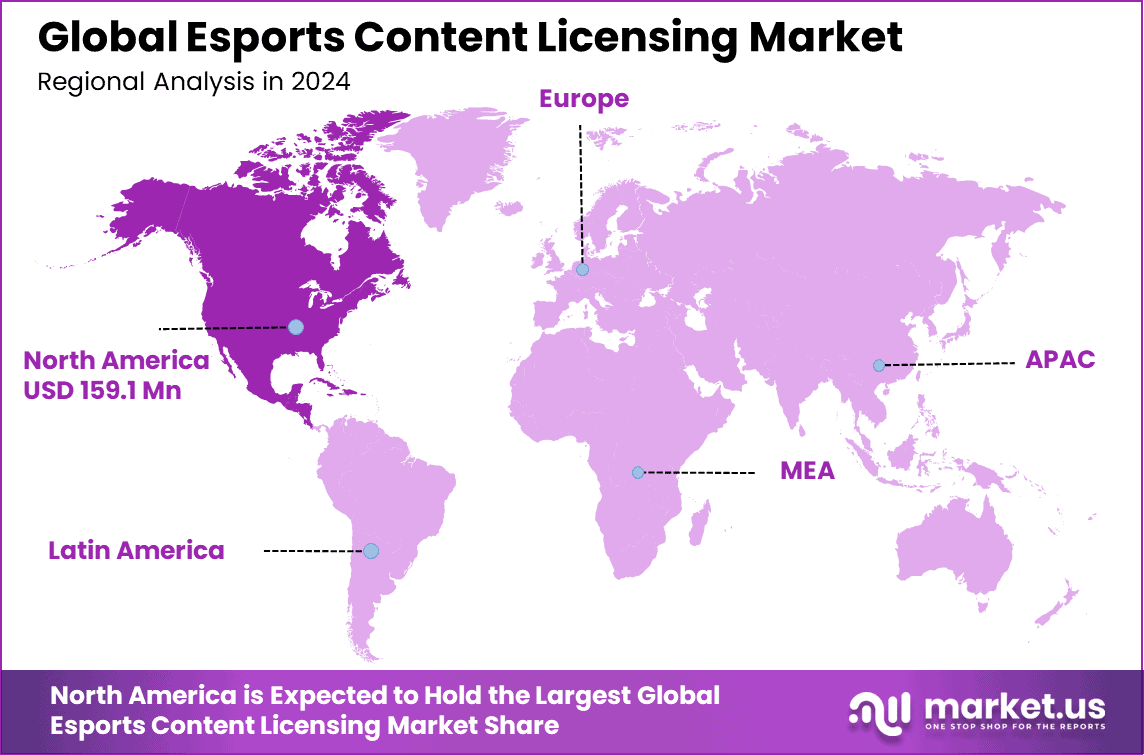

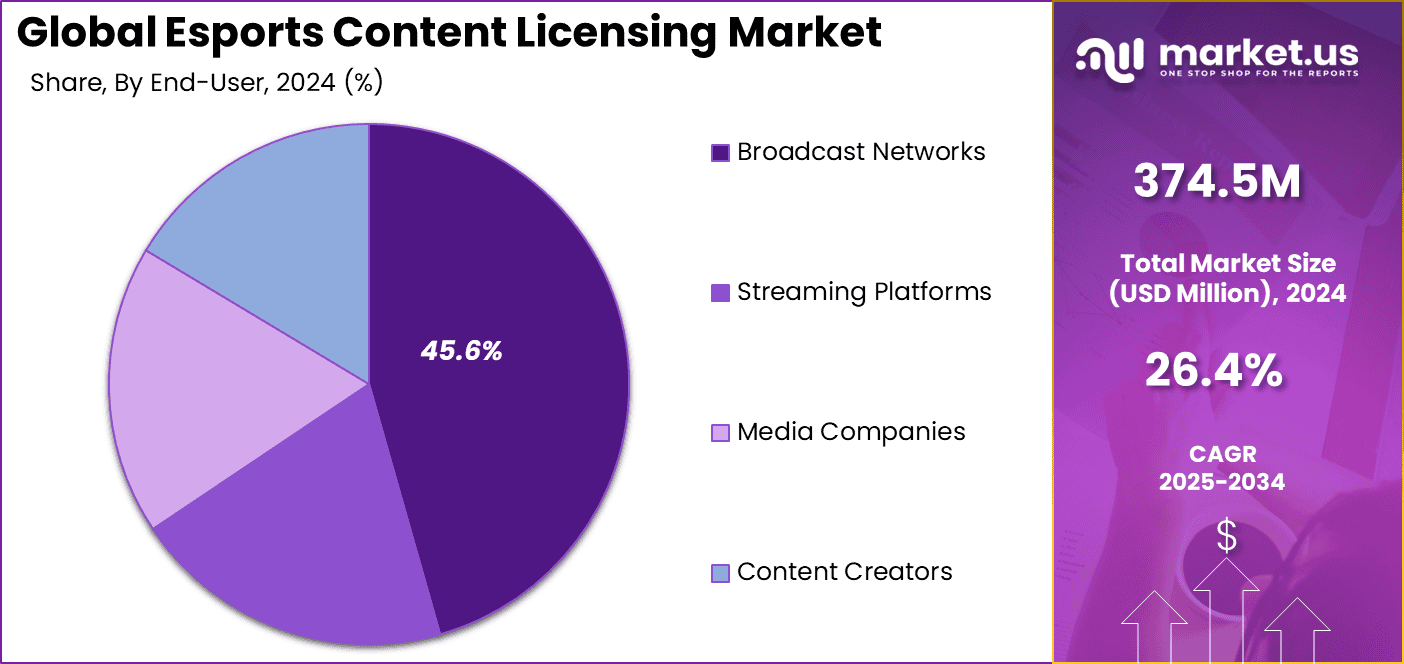

The Global Esports Content Licensing Market size is expected to be worth around USD 3,898.7 million by 2034, from USD 374.5 million in 2024, growing at a CAGR of 26.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.5% share, holding USD 159.1 million in revenue.

The esports content licensing market has expanded as publishers, tournament organisers and media platforms monetise competitive gaming content through structured licensing agreements. Growth reflects rising global viewership, increasing commercial value of esports broadcasts and stronger interest from digital streaming platforms. The market now covers rights for live matches, highlights, player content, archival footage and exclusive broadcasting packages.

Top driving factors include rising global esports popularity, the growing number of esports viewers and participants, and the increasing presence of esports in mainstream culture. The youth demographic, who engage heavily in digital platforms, is a key audience fueling this demand. Advancements in technology like high-speed internet, augmented reality, and virtual reality create fresh opportunities for licensed esports content.

According to Market.us analysis, The global esports market is projected to reach USD 16.7 billion by 2033, rising from USD 2.3 billion in 2023 with a 21.9% CAGR from 2024 to 2033. In 2023, North America held the lead with more than 36.3% share, generating about USD 0.83 billion in revenue. This strong regional position reflected high audience engagement, strong sponsorship activity, and advanced digital infrastructure.

Demand analysis reveals strong interest in licensed esports content spanning live event broadcasts, player and team branding, in-game assets, and merchandise rights. Streaming platforms such as Twitch, YouTube, and Facebook Gaming dominate the content distribution channels with over 50% market share for esports broadcasting. The licensing of player likeness and tournament footage are growing segments as audiences seek exclusive and personalized experiences.

For instance, in November 2025, Epic Games announced a major partnership with Unity to enable Unity games publishing within Fortnite, expanding the Fortnite ecosystem. This move creates new licensing and content monetization avenues by integrating diverse game engines and communities under the Fortnite metaverse economy.

Key Takeaway

- In 2024, the Live Broadcast Rights segment held 62.3%, showing strong demand for real time esports coverage.

- In 2024, the Exclusive Rights segment reached 54.8%, reflecting the rise of controlled and unique content access.

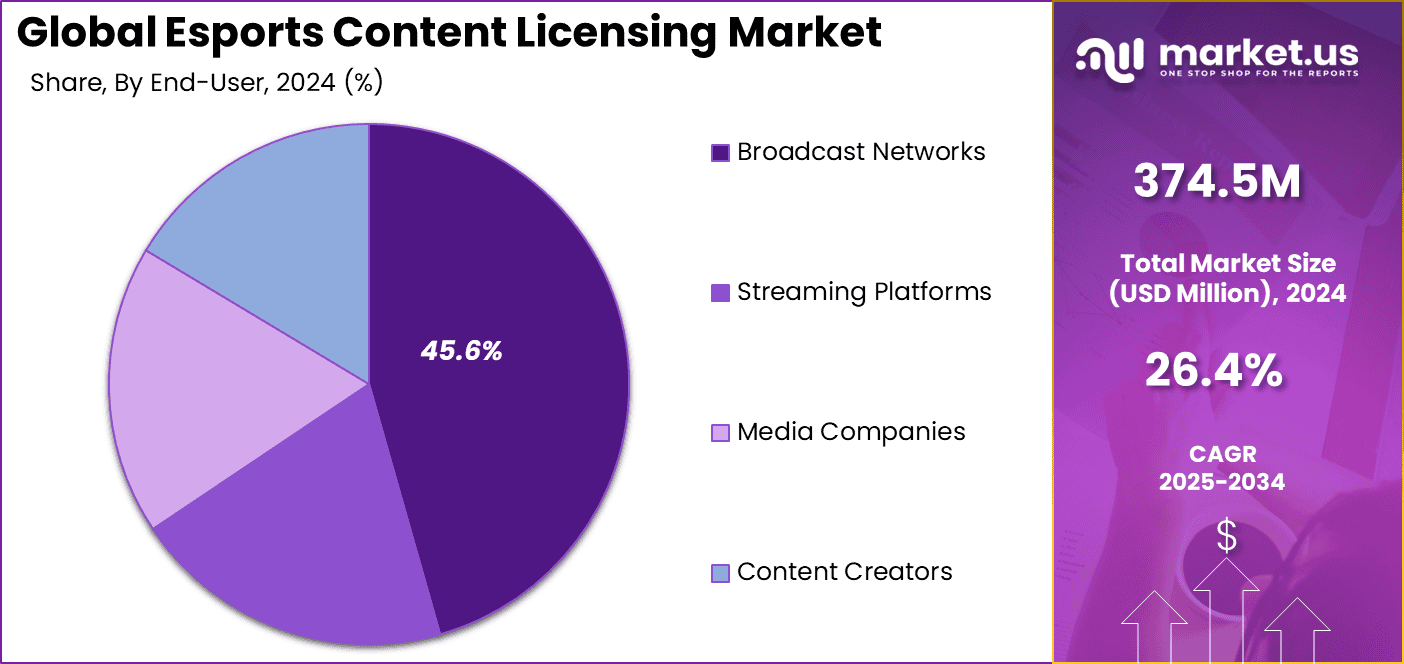

- In 2024, the Broadcast Networks segment captured 45.6%, indicating steady reliance on established media channels.

- In 2024, the Television Networks segment achieved 63.1%, confirming the continued strength of linear TV in esports distribution.

- In 2024, North America maintained 42.5%, showing its firm position as a leading region in esports content licensing.

Adoption and Usage Statistics

- The global esports audience continues to expand, supported by rising digital engagement and stronger mobile penetration in emerging markets.

- The total audience in 2025 is estimated at 641 million, including around 320 million core fans who engage deeply with esports content.

- The total esports user base is projected to reach 896 million in 2025, reflecting strong mainstream adoption.

- Live-streaming remains the primary consumption format, with platforms such as Twitch and YouTube Gaming leading global viewership.

- Co-streaming by influencers significantly contributes to audience growth, helping expand reach and diversify content.

- Mobile esports is the fastest-growing segment, particularly in Asia-Pacific, Latin America, and South Asia.

Esports Demographics

- The esports audience shows a strong concentration among younger age groups, with about 65% of viewers aged 18 to 34.

- Male viewers account for roughly 72% of the global esports audience, while female viewership represents approximately 28% and is rising steadily.

- Asia-Pacific accounts for more than 55% of global esports fans, making it the primary hub of global audience growth.

- Key esports cities in 2025 include Shanghai, Los Angeles, and Seoul, reflecting their strong infrastructure, events, and community ecosystems.

Role of Generative AI

Generative AI is playing an important role in esports content licensing by dramatically changing how content is created and personalized. It helps automate the generation of game assets, narratives, and visuals, which speeds up production and enhances the viewer experience.

Around 64% of media and entertainment companies have already moved generative AI applications into production, showing their widespread adoption. AI-driven tools also improve fan engagement by increasing watch times by approximately 35% and boosting merchandising sales by 15%, which adds significant value to esports content licensing.

The use of generative AI also presents challenges around intellectual property, especially concerning ownership and licensing rights for AI-created assets. This has created a need for clearer contracts and licensing agreements that clarify who owns the rights to AI-generated content within games. Despite these legal complexities, generative AI offers esports content creators a new level of creativity while making licensing deals more dynamic and tailored to audience preferences.

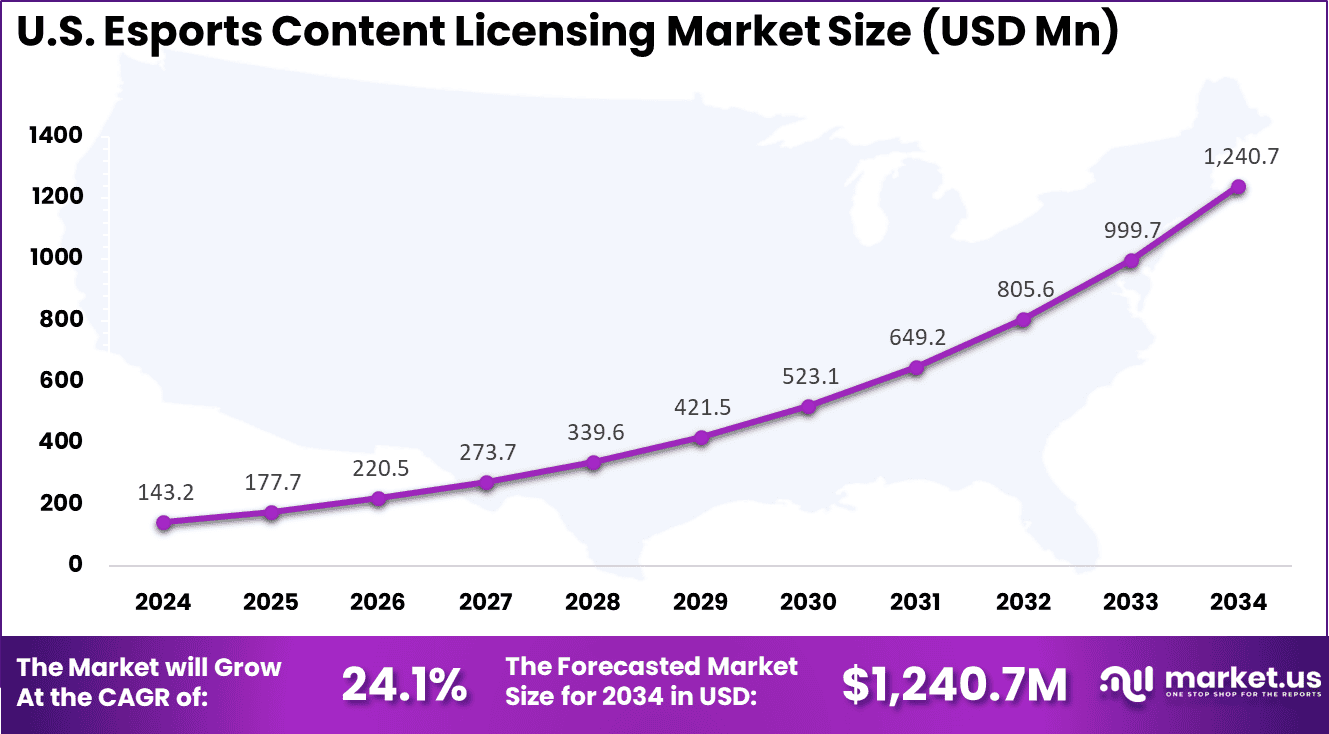

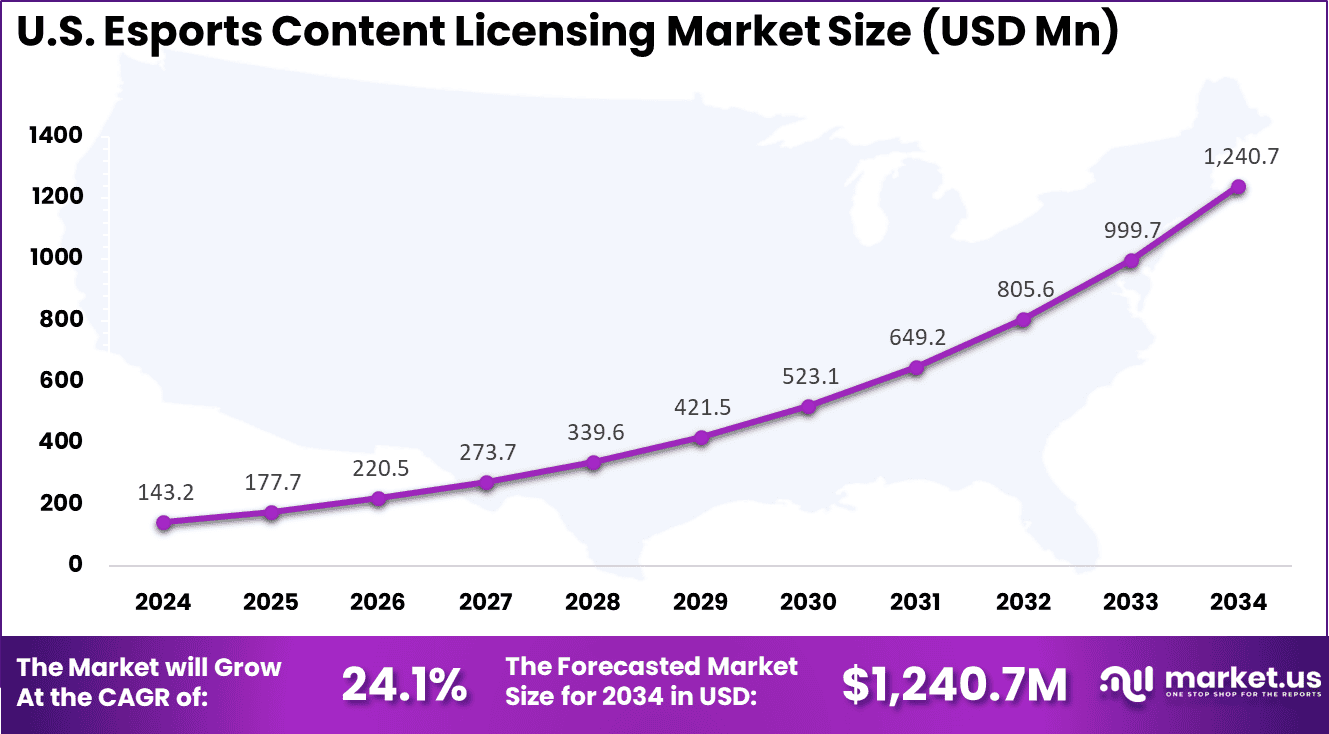

U.S. Market Size

The market for Esports Content Licensing within the U.S. is growing tremendously and is currently valued at USD 143.2 million, the market has a projected CAGR of 24.1%. This growth is driven by increasing consumer demand for live esports broadcasts and exclusive content across various platforms.

Major investments from broadcasters and digital streaming services are also fueling market expansion. Additionally, the rise of professional esports leagues, sponsorship deals, and partnerships with traditional media companies is contributing to the market’s strong momentum, making the U.S. a key hub for esports content licensing innovation and revenue growth.

For instance, in November 2025, Riot Games announced a three-year licensing deal granting the Esports World Cup Foundation rights to League of Legends, Teamfight Tactics, and VALORANT, enhancing their global esports presence with sponsored events and integrated advertising during major tournaments. This move underlines Riot’s strategic approach to expand licensed esports content and fan engagement worldwide, reinforcing U.S. dominance in esports content licensing.

In 2024, North America held a dominant market position in the Global Esports Content Licensing Market, capturing more than a 42.5% share, holding USD 159.1 million in revenue. This leadership is mainly driven by the United States, which accounts for most of the region’s market due to its large population of online gamers and strong esports infrastructure. The presence of major esports leagues and events also contributes to this dominance.

The market growth in North America benefits from advanced internet infrastructure, increased investments in esports media rights, and the involvement of key industry players like Activision Blizzard and Riot Games. Strategic partnerships, sponsorships, and broad adoption of esports across multiple platforms further boost content licensing demand, making North America a vital hub in the global esports landscape.

For instance, in June 2025, the Esports World Cup Foundation partnered with Amazon Ads to broadcast tournaments across Twitch, Prime Video, Alexa, and Wondery podcasts, leveraging Amazon’s vast streaming platforms to bring esports entertainment to mainstream audiences and deepen North American influence in esports content creation and licensing.

Content Type Analysis

In 2024, The Live Broadcast Rights segment held a dominant market position, capturing a 62.3% share of the Global Esports Content Licensing Market. This segment reflects the growing importance of live streaming and broadcasting of esports events, which draws in vast audiences and creates an essential revenue stream for stakeholders.

The demand for live content is rising, driven by the fact that fans prefer real-time coverage of tournaments, competitions, and league events, which enhances viewer engagement and excitement. This segment’s dominance highlights the central role of media rights in esports, where securing live broadcasting permissions is crucial for platforms and networks aiming to capture and retain audiences.

For Instance, in June 2025, the Esports World Cup Foundation (EWCF) partnered with Amazon to broadcast tournaments live across platforms like Twitch and Prime Video, exemplifying the growing value of live broadcast rights in esports, focused on major event coverage with wide-reaching digital and traditional distribution.

License Type Segment Analysis

In 2024, the Exclusive Rights segment held a dominant market position, capturing a 54.8% share of the Global Esports Content Licensing Market. Exclusive rights give license holders the ability to be the sole distributors of premier esports content, which attracts a dedicated and loyal audience base. This exclusivity often translates to premium pricing, making it highly profitable for both licensors and buyers.

This model also drives healthy competition among broadcasters and streaming platforms, intensifying efforts to secure valuable content. Exclusive rights can help platforms build strong brand identities and user communities by providing unique access to sought-after esports events and content. The increased demand for exclusivity reflects how central it is to the business strategies of content distributors in esports.

For instance, in August 2025, the Global Gaming League secured multiple exclusive licensing deals with publishers, including Activision Blizzard and Electronic Arts, showcasing the importance of exclusive content rights, enabling them to operate and stream competitions featuring popular games.

End-User Analysis

In 2024, the Broadcast Networks segment held a dominant market position, capturing a 45.6% share of the Global Esports Content Licensing Market. These networks benefit from their established broadcast infrastructure and widespread reach, allowing them to extend esports into traditional media channels alongside digital platforms. Their involvement brings a mix of professional production techniques and accessibility that enriches the viewing experience.

The participation of broadcast networks also reflects esports’ growing mainstream acceptance and integration into conventional entertainment. By tapping into esports, broadcast networks can attract younger, tech-savvy demographics while retaining their existing audience. This hybrid approach is expanding the market reach of esports content licensing beyond digital-native viewers alone.

For Instance, in October 2025, Disney expanded its esports presence by airing major esports tournament finals on its channels, including Disney XD and ESPN, demonstrating the significant role of traditional broadcast networks in delivering esports to broad audiences.

Distribution Platform Analysis

In 2024, The Television Networks segment held a dominant market position, capturing a 63.1% share of the Global Esports Content Licensing Market. Even with the rise of online streaming, television remains a preferred medium for many viewers, especially those who consume esports as part of broader entertainment habits.

TV networks provide a stable, familiar platform that helps esports content reach more diverse and less digitally-focused audiences. The strong positioning of television as a distribution channel emphasizes esports’ evolution into mainstream media.

Television networks actively secure broadcasting rights to esports content and develop complementary programming such as event highlights and analysis shows. This ensures steady visibility of esports and broadens its demographic footprint across various viewer segments.

For Instance, in October 2025, Disney’s move to air esports tournaments live on television networks highlighted television’s strong share in esports content distribution, especially for reaching viewers beyond the typical digital audience.

Investment and Business Benefits

Investment opportunities in esports content licensing are varied and promising. Investors are interested in supporting emerging streaming platforms, esports tournaments, and merchandise licensing operations that capitalize on audience growth. The rise of subscription models for exclusive esports content creates steady revenue flows attractive to investors.

Startups focusing on VR/AR experiences, data-driven licensing, and blockchain-based digital collectibles are also drawing significant capital. Furthermore, sponsoring esports teams and leagues offers additional returns through brand visibility, fan loyalty, and media rights exploitation.

Business benefits from esports content licensing include diversified revenue streams through merchandise, media rights, sponsorships, and digital content sales. Licensed content helps build strong brand identities for teams and players while ensuring legal protection of intellectual property.

It allows esports organizations and publishers to control content distribution and quality, enhancing fan experience and engagement. Proper licensing also reduces infringement risks and supports professionalization of the esports industry, making it attractive for mainstream advertisers and sponsors.

Emerging trends

Among emerging trends in esports content licensing, the rise of mobile gaming stands out as a driving factor. Mobile esports titles are expanding the audience base and increasing content licensing demand across streaming and broadcasting platforms. Integration of AR and VR technologies is also gaining ground, creating more immersive viewing experiences and opening new revenue channels in content licensing.

Another trend is the shift to cross-platform licensing, where esports content is licensed for use in streaming services, social media, and traditional television. This diversification broadens the reach and monetization potential of esports content. Additionally, local content production is growing, targeting regional audiences and aligning with cultural preferences, which helps expand the licensing market globally.

Growth Factors

Growth in esports content licensing is fueled by several factors. The increasing global popularity of esports boosts demand for licensed products across multiple formats, including live broadcasts, merchandise, and digital content.

The younger, tech-savvy audience attracts brands eager to partner with esports, leading to lucrative licensing deals and brand collaborations. Enhancements in streaming technology and high-speed internet availability have also made esports content more accessible, encouraging greater consumption and licensing opportunities.

Technological innovation continues to support growth, with blockchain and AI advancing digital rights management and content personalization. These tools improve content security and fan engagement, encouraging licensors and rights holders to invest more heavily in esports content. Strategic partnerships between game publishers, esports teams, and brands further contribute to expanding licensing revenues.

Key Market Segments

By Content Type

- Live Broadcast Rights

- Video-on-Demand (VOD)

- Highlight Clips

- Others

By License Type

- Exclusive Rights

- Non-Exclusive Rights

- Territorial Rights

- Platform-Specific Rights

By End-User

- Streaming Platforms

- Broadcast Networks

- Media Companies

- Content Creators

By Distribution Platform

- Television Networks

- Social Media

- Others

Regional Analysis and Coverage

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Popularity of Esports Globally

The global surge in esports popularity is a key driver directly boosting demand for content licensing. More viewers and participants worldwide are engaging with esports through tournaments, live streams, and competitive gaming. This popularity encourages game developers and esports organizations to license content such as media rights, merchandise, player likenesses, and event branding to monetize this expanding audience.

The involvement of streaming platforms like Twitch and YouTube makes esports content highly accessible, driving further engagement and licensing potential. Moreover, increased brand interest in targeting the young, tech-savvy esports demographic is propelling licensing deals. Strategic partnerships between esports entities and brands create diverse licensing streams, fueling market expansion.

For instance, in November 2025, Riot Games announced a major policy shift by allowing its partnered esports teams in VALORANT and League of Legends to partner with betting sponsors, unlocking new revenue streams for organizations. These sponsorships come with strict guidelines to maintain competitive integrity and protect the viewing experience, reflecting Riot’s strategic effort to grow the esports ecosystem through additional licensing channels while balancing ethical concerns.

Restraint

Intellectual Property Rights Complexity

One major restraint in the esports content licensing market is the complexity and challenges linked to intellectual property (IP) rights. The ownership of game titles, player likenesses, tournament footage, and other content forms is often fragmented among multiple stakeholders. This fragmented ownership complicates licensing agreements, requiring intensive negotiations and stringent IP management.

Violations and unauthorized use of licensed content, such as piracy, further restrict market potential and revenue security. Additionally, the lack of standardized regulations across global jurisdictions hinders smooth licensing transactions. These regulatory uncertainties and enforcement difficulties can slow market growth, as rights holders remain cautious.

For instance, In July 2025, Valve Corporation introduced new transparency rules for AI generated content on its Steam platform, which increased oversight on ownership and asset origin. These requirements added more complexity to licensing agreements for esports content that uses AI created materials. The shift showed how intellectual property control and content authenticity are becoming difficult issues for the esports ecosystem.

Opportunities

Expansion into Emerging Markets and New Technologies

Expanding esports content licensing into emerging regions like Latin America, Africa, and parts of Asia offers significant growth opportunities. These markets have rising internet penetration, growing esports communities, and increasing disposable incomes, which create new audiences hungry for licensed esports content. Catering to these diverse regions with localized content can unlock fresh revenue streams and broaden the esports ecosystem.

On the technology front, innovations such as virtual and augmented reality (VR/AR) and blockchain offer creative licensing formats. These technologies enable interactive fan experiences, new merchandise models via digital assets or NFTs, and improved rights management. Leveraging these technological advances alongside geographic expansion can drive long-term market growth and diversification.

For instance, In June 2025, Amazon Ads entered a three year collaboration with the Esports World Cup Foundation to promote tournaments across platforms such as Twitch and Prime Video. This move introduced major investment and strengthened the global visibility of esports content through advanced fan engagement features. The partnership demonstrated how alliances with large digital platforms can support the expansion of esports content licensing into new international markets.

Challenges

Market Fragmentation and Licensing Complexity

A key challenge inhibiting esports content licensing is the market’s fragmented and siloed nature. Different game publishers maintain exclusive control over their titles’ broadcast and licensing rights, limiting cross-title collaborations or bundled content offerings. This fragmentation creates a complex landscape for sponsors, broadcasters, and content distributors, hampering scalability and cohesive market development.

Furthermore, the varied competitive formats, schedules, and licensing terms lead to audience fatigue and inconsistent revenue flows for licensees. Without unified licensing frameworks or collective bargaining mechanisms, consolidating licensing deals and maximizing audience reach remains difficult. Addressing this market fragmentation through regulatory or industry-standard initiatives is crucial for unlocking the full potential of esports content licensing.

For instance, In August 2025, Global Gaming League secured licensing agreements with several publishers, including Activision Blizzard and Electronic Arts, to run competitive events. The need for individual contracts with each publisher reflected a fragmented structure where IP control remains tightly held. This fragmentation limited unified content distribution and created barriers for scalable growth in esports content licensing.

Future Outlook

New opportunities in Esports Content Licensing lie in:

- Expanding partnerships between game developers and streaming platforms to offer exclusive esports content rights

- Licensing deals for virtual and augmented reality esports experiences to enhance viewer engagement

- Monetization through regional broadcasting rights tailored for growing international esports markets

- Use of AI-driven content customization to license personalized highlights and replays for fans and teams

- Collaborations with brands and advertisers to create co-branded licensed content for targeted marketing

- Development of licensed esports archives and historical content for subscription-based services

- Licensing of original esports documentaries, player stories, and behind-the-scenes footage to new media outlets

- Growth in mobile esports content licensing to capture the expanding mobile gamer base globally

Key Players Analysis

Riot Games, Valve, Activision Blizzard, Epic Games, and Electronic Arts lead the esports content licensing market through ownership of major competitive titles and large-scale event rights. Their control over game IP, tournament formats, and media distribution enables strong negotiation power with broadcasters and digital platforms. These companies focus on structured leagues, exclusive streaming partnerships, and global audience expansion.

Amazon, Google, Disney, and Warner Bros. Discovery strengthen the competitive landscape with large distribution networks and streaming ecosystems. Their platforms secure broadcasting rights for major esports events, offering live coverage, highlights, and monetization through subscriptions and advertising. These companies invest in enhancing viewer engagement with personalized recommendations and interactive features.

BLAST, ESL FACEIT Group, Esports Engine, Pandora TV, Caffeine, Huya, and other participants expand the market by managing tournament production, regional leagues, and localized content rights. Their services support publishers, teams, and broadcasters with high-quality event operations and tailored licensing agreements. These organizations focus on scalable production, audience engagement, and cross-platform distribution.

Top Key Players in the Market

- Riot Games

- Valve Corporation

- Activision Blizzard

- Epic Games

- Electronic Arts

- Amazon

- Google

- Disney

- Warner Bros. Discovery

- BLAST

- ESL FACEIT Group

- Esports Engine

- Pandora TV

- Caffeine

- Huya

- Others

Recent Developments

- In August 2025, Riot Games launched its First Impact program, sponsoring 22 community tournaments for the year. The company’s League of Legends Worlds 2025 event secured a broad lineup of commercial partners, with enhanced media rights and direct-to-consumer retail strategies expected to diversify revenue streams significantly. This demonstrates Riot’s strong focus on integrating licensing with fan engagement and merchandising.

- In August 2025, Amazon collaborated with the Esports World Cup Foundation to launch advanced tech at the Riyadh event. The “Hero’s Corner” livestream and on-ground activations in Saudi Arabia and the UAE showcased Amazon’s blend of e-commerce, cloud tech (AWS), and esports content, enhancing streaming and retail licensing integration.

Report Scope