Technology

Europe Sports Sponsorship Market Size, Share, Growth Trends,

sports-sponsorship-market

The Sports Sponsorship Market is experiencing a period of robust growth, driven by a confluence of factors that extend beyond traditional advertising. Technological advancements are reshaping how brands engage with fans, creating more immersive and personalized experiences. The proliferation of digital platforms, including social media, streaming services, and mobile apps, has significantly expanded the reach and impact of sponsorships. Brands are increasingly leveraging data analytics to optimize their investments, ensuring that sponsorships align with their target audiences and deliver measurable returns. Beyond brand awareness, sports sponsorships are playing an increasing role in addressing global challenges. Companies are partnering with sports organizations to promote sustainability, social responsibility, and healthy lifestyles. This strategic alignment not only enhances brand reputation but also contributes to positive social impact. The evolving landscape of sports consumption, with a growing emphasis on digital engagement and personalized experiences, is further fueling the demand for innovative sponsorship strategies. The market is also being influenced by increasing investments in sports infrastructure and the growing popularity of sports in emerging economies, creating new opportunities for brands to connect with consumers worldwide. In essence, the Sports Sponsorship Market is a dynamic and evolving ecosystem that reflects the changing dynamics of brand marketing, consumer engagement, and social responsibility. The market continues to embrace innovation and technology that is unlocking unprecedented opportunities for brands to engage with consumers and drive tangible results.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/3062

Market Size:

The Sports Sponsorship Market size is estimated to reach over USD 115.38 Billion by 2032 from a value of USD 62.40 Billion in 2024. The market is projected to grow by USD 66.30 Billion in 2025, growing at a CAGR of 8.8% from 2025 to 2032.

Definition of Market:

The Sports Sponsorship Market encompasses the financial and resource support provided to sports organizations, teams, athletes, events, and related activities by businesses or other entities in exchange for brand visibility, marketing opportunities, and association with the sponsored property. It involves a diverse range of components, including:

Products: Sponsorship deals can include tangible benefits such as prominent branding on team jerseys, stadium signage, or event materials. This also covers any branded merchandise distributed or sold in relation to the sponsored property.

Services: This involves the execution of marketing campaigns, advertising initiatives, and promotional activities leveraging the sponsorship. Services may include hospitality provisions, media rights access, and public relations efforts.

Systems: The market also involves the systems that facilitate the management, measurement, and optimization of sponsorship investments. This includes data analytics platforms, sponsorship valuation tools, and digital engagement technologies.

Key Terms:

Sponsor: The entity providing the financial or resource support.

Sponsee: The sports organization, team, athlete, or event receiving the sponsorship.

Activation: The process of bringing a sponsorship to life through marketing and promotional activities.

Hospitality: Providing exclusive experiences and amenities to clients, partners, or employees at sports events.

Branding: Displaying the sponsor’s logo, trademarks, and other brand elements to create visibility and association.

Media Rights: Access to broadcast, digital, and social media coverage of the sponsored property.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/3062

Market Scope and Overview:

The Sports Sponsorship Market encompasses a wide array of technologies, applications, and industries. From a technology perspective, the market is increasingly driven by digital advancements, including data analytics, artificial intelligence (AI), and virtual reality (VR). These technologies enable sponsors to gain deeper insights into fan behavior, personalize marketing messages, and create more immersive experiences. In terms of applications, sports sponsorships span across various categories, including brand awareness, customer engagement, employee motivation, and corporate social responsibility. Companies use sports sponsorships to reach specific target audiences, build brand loyalty, generate leads, and enhance their reputation. The industries served by the Sports Sponsorship Market are diverse, encompassing consumer goods, financial services, technology, automotive, and many others. Any industry looking to connect with a broad and passionate audience can benefit from strategic investments in sports sponsorships. The sports industry itself, from professional leagues to individual athletes, relies heavily on sponsorship revenue to fund operations, develop talent, and enhance the fan experience.

The importance of the Sports Sponsorship Market extends beyond mere financial transactions. It plays a crucial role in shaping global trends in marketing, entertainment, and social impact. In a world where consumers are increasingly skeptical of traditional advertising, sports sponsorships offer a unique opportunity for brands to build authentic connections with their target audiences. By aligning themselves with the values and passion associated with sports, sponsors can create a positive brand image and foster long-term loyalty. Furthermore, the Sports Sponsorship Market is increasingly being used as a platform for promoting social causes and addressing global challenges. Companies are partnering with sports organizations to raise awareness about issues such as environmental sustainability, gender equality, and mental health. This trend reflects a growing expectation from consumers that brands should be socially responsible and contribute to the well-being of society. As the global sports industry continues to grow and evolve, the Sports Sponsorship Market will remain a vital component of its ecosystem, driving innovation, fostering engagement, and contributing to positive social change.

Top Key Players in this Market

Adidas AG (Germany) Hyundai Motor Company (South Korea) Monster Beverage Corporation (USA) Nike Inc. (USA) Nissan Motor Co. Ltd (Japan) PepsiCo Inc. (USA) Puma SE (Germany) Qatar Airways (Qatar) Red Bull GmbH (Austria) Samsung Electronics Co. Ltd (South Korea)

Market Segmentation:

The Sports Sponsorship Market is segmented based on several key factors:

By Type:

Club and Venue Activation: Involves branding and promotional activities within sports venues and club facilities.

Signage: Includes prominent advertising displays within stadiums, arenas, and other sports-related locations.

Digital Activation: Focuses on online marketing campaigns, social media engagement, and digital content creation.

Others: Encompasses various other forms of sponsorship, such as athlete endorsements and community outreach programs.

By Sports:

Football: Sponsorships related to soccer leagues, teams, and events.

Hockey: Sponsorships within professional and amateur hockey.

Cricket: Encompasses sponsorship activities related to cricket tournaments and teams.

Others: Includes sponsorships in other sports such as basketball, baseball, golf, and motorsports.

By Application:

Competition Sponsorship: Supporting specific sports competitions or tournaments.

Training Sponsorship: Providing resources and funding for athlete training and development.

Others: Encompasses various other forms of sponsorship, such as grassroots programs and community initiatives.

These segments contribute to market growth by catering to diverse needs and preferences within the sports industry.

Market Drivers:

Technological Advancements: Digital platforms, data analytics, and virtual reality are enhancing sponsorship opportunities and measurability.

Increasing Demand for Sustainability: Brands are partnering with sports organizations to promote environmental and social responsibility.

Growing Popularity of Sports in Emerging Economies: Rising interest in sports in developing countries is creating new sponsorship opportunities.

Evolving Landscape of Sports Consumption: The shift towards digital engagement and personalized experiences is driving demand for innovative sponsorship strategies.

Government Policies: Government support for sports infrastructure and initiatives can attract sponsors and stimulate market growth.

Market Key Trends:

Personalized Sponsorship Experiences: Brands are leveraging data to create tailored engagements with fans, increasing sponsorship effectiveness.

Rise of eSports Sponsorships: The growing popularity of eSports is attracting significant investment from sponsors looking to reach younger audiences.

Integration of Technology: Virtual reality, augmented reality, and other technologies are enhancing the fan experience and creating new sponsorship opportunities.

Focus on Social Impact: Sponsors are increasingly prioritizing partnerships with organizations that align with their values and contribute to social causes.

Emphasis on Data-Driven Decision Making: Sponsors are using data analytics to measure the ROI of their investments and optimize their sponsorship strategies.

Market Opportunities:

The Sports Sponsorship Market presents numerous growth prospects. Firstly, emerging technologies like AI and VR offer new avenues for interactive and immersive fan experiences, boosting engagement and brand visibility. Secondly, the rising popularity of eSports creates opportunities for sponsors to tap into a younger, digitally-savvy demographic. Thirdly, an increased focus on social responsibility enables brands to align with causes and enhance their reputation, appealing to socially conscious consumers. Lastly, data-driven insights allow for the creation of more targeted and effective campaigns, optimizing ROI and ensuring that sponsorships resonate with the right audiences.

Innovations within the Sports Sponsorship Market also offer substantial opportunities. These include:

AI-Powered Personalization: Using AI to analyze fan data and deliver customized content, offers, and experiences.

VR/AR Integration: Employing virtual and augmented reality to create immersive brand experiences at games or at home.

Blockchain Technology: Leveraging blockchain for secure and transparent sponsorship transactions and fan engagement programs.

Dynamic Sponsorship Assets: Utilizing digital displays that can be updated in real-time based on performance metrics, fan feedback, or marketing objectives.

Market Restraints:

The Sports Sponsorship Market faces several challenges. High initial costs associated with securing premier sponsorships can deter smaller businesses. Geographic limitations restrict the reach of certain sponsorships to specific regions, hindering global exposure. Additionally, the fluctuating performance of sponsored teams or athletes can impact brand perception, creating uncertainty for sponsors. Furthermore, the risk of controversies involving athletes or teams can damage brand reputation, posing a significant challenge to sustained sponsorship success.

Market Challenges:

The Sports Sponsorship Market, while exhibiting significant growth potential, faces a complex web of challenges that demand careful navigation. One of the most prominent challenges is the ever-increasing cost of securing high-profile sponsorships. As the market becomes more competitive, rights holders are able to command higher fees, making it difficult for smaller brands or those with limited marketing budgets to participate. This can create an uneven playing field, where only the largest corporations can afford to associate themselves with top-tier sporting events and athletes.

Another significant challenge is the increasing scrutiny of sponsorship deals by consumers and advocacy groups. Brands are under pressure to ensure that their sponsorships align with their values and contribute to positive social outcomes. Sponsoring activities that are perceived as unethical or harmful can lead to reputational damage and consumer backlash. This requires brands to conduct thorough due diligence and carefully consider the potential impact of their sponsorships on society.

The evolving media landscape also presents a challenge for sponsors. With the fragmentation of media consumption and the rise of digital platforms, it is becoming increasingly difficult to reach target audiences through traditional sponsorship channels. Brands need to adapt their strategies to leverage digital technologies and create engaging content that resonates with fans across multiple platforms. This requires a deep understanding of consumer behavior and the ability to create personalized experiences that drive engagement and build brand loyalty.

Furthermore, the performance of sponsored athletes or teams can have a significant impact on the value of a sponsorship. Unexpected injuries, scandals, or poor performance can diminish the brand association and reduce the return on investment for sponsors. This requires brands to carefully assess the risks associated with each sponsorship opportunity and to develop contingency plans to mitigate potential negative impacts.

Finally, the Sports Sponsorship Market is subject to various regulatory and legal challenges. Issues such as ambush marketing, intellectual property infringement, and data privacy can pose significant risks for sponsors. Brands need to ensure that their sponsorship activities comply with all applicable laws and regulations to avoid costly legal disputes and reputational damage. In conclusion, the Sports Sponsorship Market is a dynamic and complex environment with a range of challenges that require careful planning, strategic decision-making, and a commitment to ethical and sustainable practices. By addressing these challenges proactively, brands can maximize the value of their sponsorships and build long-term relationships with fans and stakeholders.

Market Regional Analysis:

The Sports Sponsorship Market exhibits distinct regional dynamics influenced by cultural preferences, economic conditions, and the popularity of specific sports. In North America, the market is driven by major professional leagues like the NFL, NBA, and MLB, with a strong emphasis on data-driven sponsorship activations and technology integration. Europe benefits from the widespread popularity of football (soccer), and rugby, fostering significant sponsorship investments, particularly in club and venue branding. Asia-Pacific is experiencing rapid growth due to the increasing interest in sports like cricket, badminton, and football, coupled with rising disposable incomes and expanding digital infrastructure. Emerging markets in Latin America and Africa present untapped potential, fueled by a passion for football and growing economies, but require tailored strategies to address local market nuances and infrastructure limitations. Each region demands a unique approach to sponsorship, considering local regulations, consumer behavior, and the specific sports that resonate most with the population.

Frequently Asked Questions:

Q: What are the growth projections for the Sports Sponsorship Market?

A: The Sports Sponsorship Market is projected to grow at a CAGR of 8.8% from 2025 to 2032, reaching over USD 115.38 Billion by 2032.

Q: What are the key trends in the Sports Sponsorship Market?

A: Key trends include personalized sponsorship experiences, the rise of eSports sponsorships, the integration of technology, a focus on social impact, and an emphasis on data-driven decision-making.

Q: What are the most popular Market types?

A: The most popular market types include Club and Venue Activation, Signage, and Digital Activation, driven by their effectiveness in enhancing brand visibility and fan engagement.

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra – 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web – https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn – https://www.linkedin.com/company/consegic-business-intelligence/

YouTube – https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook – https://www.facebook.com/profile.php?id=61575657487319

X – https://x.com/Consegic_BI

Instagram – https://www.instagram.com/cbi._insights/

This release was published on openPR.

Technology

High-Performance Monitor Lineups : HKC Corporation

HKC Corporation’s showcase is anchored by the introduction of several flagship products. The HKC M10 Ultra is promoted as the first monitor to utilize an RGB MiniLED backlight system for enhanced color and brightness control. It would appeal to professional graphic designers, video editors, and game developers. The KOORUI S4941XO is a large-format OLED screen with a high refresh rate aimed at immersive simulation gaming. Finally, the ANTGAMER ANT275PQ Ultra stands as an LCD monitor with an exceptionally high refresh rate for competitive esports.

Collectively, HKC Corporation’s display products demonstrate the company’s technical focus on advancements in panel construction, backlight engineering, and integrated image processing software.

Image Credit: HKC Corporation

Technology

Innovative Gaming Peripheral Ecosystems : gaming peripheral

At CES 2026, Akko calls attention to three distinct series — the Nest, the Dash, and the Framer. The brand highlights the Dash as its “most advanced mouse to date.” This computer peripheral weighs just 39 grams and boasts the PixArt 3950 sensor for ro-grade precision and stability. Nest, on the other hand, is a right-hand ergonomic style, while the Framer is for entry-level gaming.

In addition to the high-performance computer mice, Akko is also highlighting new keyboards — including the aluminum rapid assembly magnetic-switch keyboard MOD007v5 HE and the Year of the Snake Keyboard — as well as the M1 V5 TMR technology by Akko’s sister brand MonsGeek.

Image Credit: Akko

Technology

Gambling Industry Trends And Predictions For 2026

Gambling Industry Trends and Predictions for 2026

The global gambling industry enters 2026 on a rapid growth trajectory and at the cusp of transformative change. After reaching an estimated $99 billion in 2024, the global betting and gaming market is projected to nearly double by 2033 (approaching $182 billion) as digital platforms, mobile betting, and AI-driven innovations reshape how people gamble. This boom is fueled not only by technological leaps, but also by evolving consumer behaviors and shifting regulatory landscapes. By 2026, the industry will be more connected, data-driven, and consumer-focused than ever, blurring the line between gambling and broader digital entertainment.

Global Focus, Local Moves: North America and Europe currently dominate gambling revenue (about three-quarters of the market), but Asia-Pacific and Latin America are emerging as the next frontiers. In particular, Asia-Pacific’s liberalizing regulations, rising incomes, and mobile adoption are accelerating participation across the region. At the same time, the United States – which ignited a sports betting boom after 2018 – continues to expand state-by-state. Meanwhile, Europe’s mature markets are prioritizing sustainability and responsibility, and Latin America and Africa are opening up new opportunities. Across the world, stakeholders are “going all-in” on innovation and expansion, while bracing for greater oversight to ensure gambling grows safely.

In this outlook for 2026, we highlight the key trends shaping the iGaming (online gambling) sector and its convergence with traditional brick-and-mortar casinos. From new markets and regulations to tech breakthroughs and changing player expectations, the year ahead promises high stakes and big opportunities.

New Markets and Regulatory Shifts on the Horizon

Legalization Wave Continues

The map of regulated gambling is set to expand further in 2026. Several countries and jurisdictions are transitioning from gray markets to fully legal, competitive industries. Notably, Brazil – long considered a “sleeping giant” of gaming – is rolling out regulations for online sports betting and casino gaming, creating one of the world’s largest new markets. In Europe, Finland has decided to end its state monopoly and move toward a competitive licensing model by 2026, opening its lucrative market to private iGaming operators. These moves follow the trend of governments seeking tax revenue and consumer protection through licensing rather than prohibition.

United States Focus

In the U.S., the sports betting frenzy that spread to 35+ states is settling into a mature phase, but there are still holdouts and new opportunities. Major states like Texas and California remain unresolved – Texas lawmakers are weighing another push for sportsbooks (though realistically not before 2027) and California’s tribal vs. commercial interests make legalization challenging. Still, the pressure is mounting as Americans in nearly every region have gained access to legal betting.

Meanwhile, online casino gaming (iGaming) – currently legal in only seven states – is gaining traction. In 2025, multiple U.S. states saw legislative efforts to legalize online casinos, eyeing the success of pioneers like New Jersey, Michigan, and Pennsylvania. The record-breaking revenues reported by existing iGaming states underscore the opportunity: several markets have posted all-time monthly records, and year-over-year growth in iGaming has significantly outpaced growth in brick-and-mortar casinos. This momentum is likely to push more U.S. states to consider regulating online casinos in 2026 and beyond, especially as they watch neighbors reap tax windfalls.

Stricter Rules and Compliance

As new markets open, regulators everywhere are also tightening the rules in existing markets. Governments in major jurisdictions are introducing tougher measures for consumer protection, anti-money-laundering (AML), and advertising. The United Kingdom’s regulatory overhaul is a prime example – from stricter ad guidelines to potential online slot stake limits and affordability checks, UK operators face a more controlled environment. Other countries have gone so far as to heavily restrict or ban gambling advertising. Across Europe, compliance is king: the era of “grey area” operations is fading as authorities push operators to either go fully legal or get out.

In the U.S., regulators are aggressively enforcing rules to ensure a safe market. Several states have intensified enforcement against unlicensed platforms, increased cease-and-desist activity, and introduced new rule updates emphasizing tighter licensing standards, identity verification, AML protocols, and mandatory responsible gambling tools. This reflects a broader North American trend: as the online market matures, regulators are shifting from simply enabling new industries to rigorously policing them for compliance and strengthening player protections.

Tax and Policy Changes

Policymakers are also adjusting the financial rules around gambling. In the U.S., a notable change takes effect in 2026: recreational gamblers will lose a portion of their tax deductions on losses, with federal law capping deductible losses at 90% of winnings (down from 100%). This tax tweak may discourage some high-volume bettors or at least complicate their accounting. At the same time, U.S. reporting thresholds for certain jackpots have been modernized in recent years, reflecting a slow but steady effort to update outdated compliance burdens.

Overall, 2026’s regulatory landscape will be defined by expansion paired with vigilance: more markets opening up and more scrutiny to ensure gambling growth comes with strong consumer safeguards. Next, we look at one of the most intriguing regulatory battles brewing – the clash between traditional gambling operators and a new breed of betting platform known as prediction markets.

A major storyline heading into 2026 is the rise of prediction markets and their collision with traditional sports betting. Once a niche idea, prediction markets allow users to wager on practically any real-world outcome – from elections and economic indicators to pop culture outcomes – treating events like stocks to be traded. In the past two years, this segment expanded rapidly in the United States, blurring the line between gambling and financial trading. A growing roster of platforms has launched or gone mainstream, and major sports and gaming brands are experimenting with prediction-style products.

This flurry of innovation points to demand for new forms of interactive wagering. Younger bettors especially enjoy the stock-market-like experience of trading event outcomes, and volumes have surged across several platforms. These numbers have not gone unnoticed by the traditional gaming industry – or by its regulators.

Regulatory Crossfire

Prediction markets currently operate in a legal gray area in the U.S., often falling under federal commodities oversight rather than state gambling law. This has triggered backlash from established gambling stakeholders who argue these products resemble sports betting without the same level of licensing, consumer protection, and responsible gaming guardrails.

On the other side, prediction market companies and allied fintech firms are organizing and pushing for clearer frameworks that legitimize these markets nationwide. They argue that the legal system hasn’t kept pace with modern products, and that a patchwork of rules will create confusion and drive demand to offshore alternatives. The stage is set for a significant confrontation in 2026: federal regulators vs. state gaming authorities, and innovative platforms vs. incumbent casino and sportsbook ecosystems.

Why This Matters in 2026

Whether prediction markets are integrated into the regulated gaming system, restricted, or forced into separate lanes will shape everything from taxation and consumer protections to how sportsbooks innovate. The industry may be moving toward a reality where traditional operators either (1) partner into this category, (2) fight it aggressively, or (3) watch parts of wagering demand shift outside classic sportsbook rails. The outcome won’t just impact the U.S.; it will influence global regulators as they face similar fintech-gambling convergence pressures.

The Great Convergence: Merging iGaming with Brick-and-Mortar Casinos

The year 2026 will also highlight the convergence between online and land-based gambling, often dubbed the “omnichannel” approach. While online iGaming is booming, traditional physical casinos are not standing idle – many are leveraging technology and cross-platform strategies to stay relevant and connected to digital audiences. The central question for casino operators has become: How can we integrate the on-site casino experience with online play?

Omnichannel Strategies

Some forward-thinking casino companies are embracing hybrid innovations that turn brick-and-mortar resorts into content engines for digital channels. New live dealer concepts, broadcast-style casino content, and in-property studios are becoming a real strategy: they extend a casino brand beyond physical walls while turning on-site foot traffic into marketing reach.

Another critical driver of convergence is the integration of loyalty programs and currencies across channels. Big operators are linking loyalty points so that players earn and spend rewards whether they’re at a slot machine in Vegas or betting on an app at home. Increasingly, these rewards behave more like digital ecosystems than simple points programs. Over time, this may evolve toward a portable digital identity where engagement across sportsbook, casino, social gaming, and entertainment can be recognized and rewarded holistically.

Physical Casinos Go Digital

Brick-and-mortar casinos are also adopting more digital infrastructure: cashless wagering options, mobile wallets, app-driven player experiences, and increasing experimentation with biometrics for identity and loyalty recognition. These upgrades align with younger customers’ expectations and help casinos enhance operational efficiency while reducing certain fraud and compliance risks.

It’s worth noting that not all casino operators are on board. Some U.S. regional casino companies and tribal stakeholders remain cautious, citing cannibalization concerns and social impacts. Still, the broader revenue picture continues to pressure the industry toward convergence, especially as online channels deliver faster growth and higher scalability.

The “Phygital” Casino Experience

In 2026, expect to see more crossover initiatives that make gambling an anytime, anywhere activity. The convergence is also evident in content: casino games increasingly borrow features from video games (missions, rewards loops, community events), while physical casinos adopt attractions influenced by digital culture. For operators, the strategic advantage goes to whoever can unify experiences across platforms while respecting the regulatory and responsible gaming frameworks required in each market.

Tech Innovations: AI, Apps, and Immersive Betting

Technology has always been a driving force in iGaming, but heading into 2026, it’s clear the industry is entering another innovation cycle. Several tech trends are set to redefine how gambling products are built and how players engage:

Mobile 2.0 – Faster and More Immersive

Mobile betting is the primary channel for many consumers, and in 2026 mobile platforms are leveling up. Expect smoother UX, deeper personalization, more embedded live content, and early-stage applications of AR to create more immersive experiences. The smartphone is not just a portal to betting anymore; it’s becoming the interface layer for entertainment, payments, community, and identity.

Artificial Intelligence Everywhere

AI has moved from experimentation to operational core. It is now embedded in risk management, fraud detection, dynamic promotions, personalization, customer support, and even content generation. The next stage in 2026 is “industrialized AI”: measurable ROI, tighter governance, and clearer outcomes. In regulated markets, AI will increasingly be paired with compliance expectations – including systems designed to detect problem gambling behaviors earlier and deliver better interventions.

Fintech and Payments Innovation

Payments are becoming a strategic battleground. Open banking capabilities, faster payouts, improved fraud detection, and easier onboarding are changing player expectations. In parallel, crypto rails remain relevant, especially for international markets and certain user segments. For regulated operators, the key is not crypto hype, but crypto’s utility: faster settlement, transparent transaction trails, and optionality for global payments where traditional banking remains restrictive.

New Game Formats – eSports, Virtuals, and Microbets

New formats continue to expand the addressable audience. eSports betting is growing, virtual sports offer always-on wagering, and micro-betting is becoming a major engagement driver as operators refine the latency, data feeds, and in-play UX that this product demands. Major global sporting events in 2026 will likely accelerate micro-betting adoption as consumers learn to treat a match not as one bet, but as dozens of moment-to-moment decision points.

Gamification and Social Play

Gamification is now a baseline expectation in modern apps: missions, rewards, leaderboards, community challenges, and social layers that borrow heavily from video games. Meanwhile, streaming culture continues to collide with iGaming, as content creators, live casino formats, and interactive “watch and play” mechanics become more common acquisition channels. As these experiences scale, expect regulators to sharpen the rules around marketing, affiliate behavior, and ensuring responsible gaming protections extend into creator-led environments.

Cybersecurity and Reliability

As platforms scale, cybersecurity becomes existential. Attacks, phishing, and platform reliability issues can quickly damage trust. In 2026, regulators and major partners will increasingly treat security readiness and resilience as non-negotiable. Operators will invest further in multi-cloud uptime strategies, monitoring, and stronger identity protections to ensure stable, compliant operations at scale.

Responsible Gambling and the Social License

Amid all the growth and innovation, the industry in 2026 is putting a sharper focus on responsible gambling (RG). As gambling becomes more accessible digitally, the expectations rise: operators must prevent harm, regulators must protect consumers, and stakeholders must prove that industry growth can be sustainable.

Real-Time Intervention

One of the most important evolutions is the use of AI and behavioral analytics to detect harmful patterns earlier. Instead of relying solely on players to self-report or set limits, modern systems can identify risk signals and trigger interventions such as dynamic messaging, cooling-off prompts, or structured friction in the user journey.

Mandatory Measures and Culture Change

More jurisdictions are tightening requirements: deposit and time limits, self-exclusion enforcement, clear loss/win displays, enhanced KYC checks, and more robust proof-of-source-of-funds rules in higher-risk cases. The direction is clear: responsible gambling is no longer optional, and the companies that build it into product design will find it easier to keep market access, maintain brand trust, and partner with mainstream institutions.

The challenge is that responsible gambling messaging must be effective, not performative. Generic slogans are losing impact. The next phase is more personalized, contextual, and integrated into product design without creating a punitive experience for recreational users.

Conclusion: 2026 and Beyond – A High-Tech, High-Responsibility Future

The year 2026 is poised to be a pivotal chapter for iGaming and the casino industry, marked by convergence and innovation on one hand, and heightened responsibility and regulation on the other. We will see new markets expand, the U.S. inch closer to broader iGaming adoption, and regulators increasingly demand stronger safeguards as online access becomes ubiquitous.

Technology

Where Is India’s Gaming Industry Headed Next?

India’s gaming industry is rapidly evolving into one of the largest and most dynamic markets in the world. Driven by the increasing adoption of smartphones, affordable internet, and a tech-savvy youth population, gaming is becoming a mainstream form of entertainment. With mobile gaming leading the charge, the India gaming market is also witnessing significant growth in esports, cloud gaming, and immersive technologies like augmented reality (AR) and virtual reality (VR).

Unlocking New Realms: The Evolution and Key Opportunities in India’s Gaming Sector

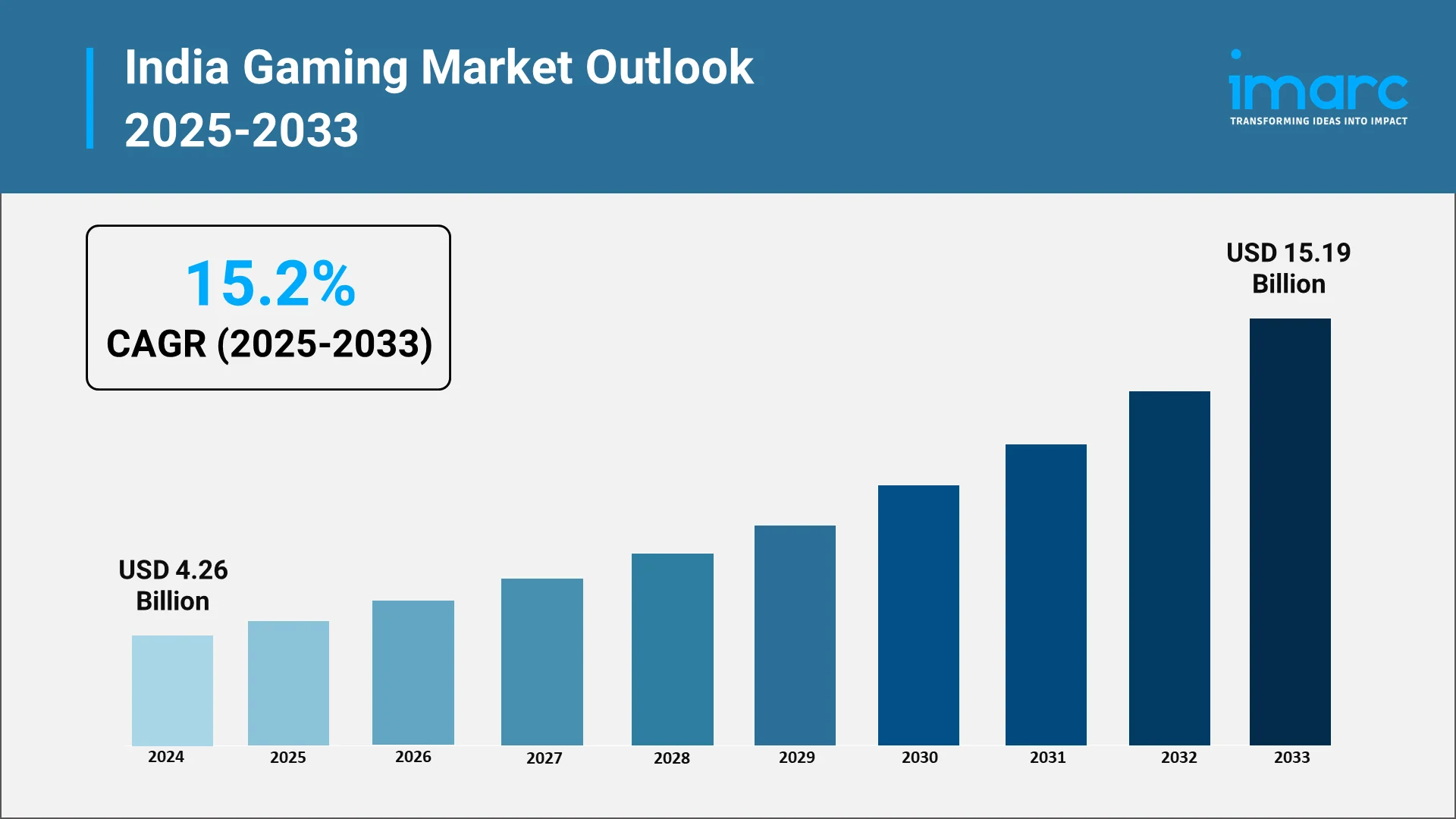

The gaming sector is transitioning from a specialized sector to a dynamic and swiftly growing market, fueled by the rising use of smartphones, accessible internet, and a young, tech-oriented demographic. The rise of mobile gaming is at the heart of this transformation, with millions of people in India engaging in gaming on their smartphones daily. With the nation’s gaming industry growing, a variety of gamers, covering mobile, console, and PC platforms, are shaping the industry. Quantifying this rapid expansion, the IMARC Group reported that the gaming market size in India reached USD 4.26 Billion in 2024.

The primary opportunities ahead are in the rising need for localized content, as developers are concentrating on designing games that connect with Indian cultural and regional tastes. This presents substantial potential to reach a broader audience, especially in tier-2 and tier-3 cities. Moreover, the growth of esports, cloud gaming, AR, and VR technologies offers new opportunities for expansion. With the growing investment and support from both the government and private sectors, there is significant potential to establish India as a worldwide center for gaming development and creativity.

With the market’s maturation, the advancement of monetization strategies, enhanced infrastructure, and stronger regulations will continue to contribute to the increase in India gaming market share, unlocking untapped potential and fostering global competitiveness.

Explore in-depth findings for this market, Request Sample

Game On: Current Trends and Market Drivers Shaping India’s Gaming Future

According to IMARC Group’s projections, the India gaming market is projected to grow at a CAGR of around 15.2% from 2025 to 2033, reaching USD 15.19 Billion by 2033. The growth will be supported by the following factors:

- Smartphone and Internet Penetration

India’s increasing number of affordable smartphones, coupled with the expansion of high-speed internet access, is significantly broadening the market reach. As rural and non-metro areas gain improved connectivity, companies can target new user segments beyond urban centers. This growing accessibility enables casual, on-the-go gaming, contributing to a surge in user numbers and expanding the market. As of March 2024, India had 954.40 million total internet subscribers, with 398.35 million rural subscribers. Furthermore, by April 2024, 95.15% of India’s 644,131 villages were equipped with 3G/4G mobile connectivity, underscoring the increasing digital penetration across the country and creating vast opportunities for gaming expansion in rural areas.

- Monetization Evolution: In–App, Subscription & Cloud

The monetization models in the gaming market in India are evolving beyond basic in-app purchases. Traditional in-app purchases are being complemented by subscription models, cloud streaming, and cross-platform play, providing new revenue streams and catering to players seeking more flexibility and value. This shift allows gaming companies to offer premium experiences while enhancing player lifetime value. A prime example of this trend is Nvidia’s announcement in 2025 that its GeForce NOW cloud gaming service will launch in India, offering high-end gaming experiences on various devices. Premium members can access over 4,500 games, including popular titles like Borderlands 4 and Call of Duty: Black Ops 7, solidifying cloud gaming’s potential in India.

- Esports Partnerships and Innovation

A key factor driving the growth of the market is the increasing investment in esports partnerships and innovation. Realme’s collaboration with Krafton India as the official smartphone partner for the BattleGrounds Mobile Series (BGIS) 2025 and BGMI Pro Series (BMPS) 2025 highlights this trend. By using its GT 7 Pro for the tournaments, Realme is directly supporting both professional and grassroots players. This partnership not only boosts esports visibility but also strengthens the gaming ecosystem in India. As esports continues to gain traction, such collaborations enhance the gaming experience and contribute to market expansion.

- Localized Product Offerings and Market Tailoring

The growing availability of localized products tailored to the needs of Indian gamers is positively influencing the market. Acer’s announcement in 2025 to launch “Make in India” gaming laptops is a prime example. By customizing its Aspire/ALG, Nitro, and Predator series for the Indian market, Acer is addressing the performance, pricing, and usage patterns unique to Indian gamers. This move not only supports the rising demand for gaming PCs across casual, competitive, and creator segments but also taps into the rising interest in AI-ready devices, contributing to the rapid expansion of India’s gaming ecosystem.

The rise of accelerator programs and funding initiatives is helping local developers access advanced technology, mentorship, and global networks. The adoption of AI tools is particularly transformative, enhancing game development, player experiences, and monetization strategies. These AI-driven innovations improve gameplay mechanics, automate processes, and offer personalized content, making Indian games more competitive globally. A prime example is Meta’s India-focused Gaming Accelerator, launched in 2025, which supports 20–30 emerging studios with AI tools like Llama, along with mentorship and investor access to scale their games for global markets.

The Game Plan: Conquering Challenges and Unlocking New Opportunities

The Indian gaming industry encounters challenges like regulatory ambiguity, with many states lacking clear rules for online gaming, creating confusion for developers and players. The country’s vast and diverse population also requires significant investment in localization and culturally relevant content. Additionally, piracy and data security concerns remain persistent threats.

Despite these obstacles, the rapid increase in internet access and smartphone adoption, particularly in tier-2 and tier-3 cities, presents a large untapped market. Mobile gaming is becoming popular because of affordable smartphones and data plans, while localization offers a chance to engage diverse user bases. The growing momentum of the India Mobile Gaming Market further highlights how digital engagement is expanding across demographic groups. Esports and online competitions are also gaining traction, creating new opportunities for competitive gaming and sponsorships.

Masters of the Game: Who’s Leading India’s Gaming Industry

Major figures in the market are progressively concentrating on broadening their reach and enhancing user interaction by utilizing mobile-first approaches and integrating localized content. These firms are focusing on creating games that align with local tastes, providing content in various languages and crafting gameplay that reflects India’s rich cultural diversity. Numerous developers are investigating fresh monetization strategies, such as in-app purchases, subscription models, and live events, while incorporating social and multiplayer elements to promote community engagement. To remain competitive, they are significantly investing in technology like AI and cloud gaming to improve user experiences and provide smooth cross-platform play. Directly illustrating the investment in technology like cloud gaming to improve user experiences and provide smooth cross-platform play, Xbox launched cloud gaming in India for Game Pass subscribers in 2025, allowing high-end games to stream on mobiles, tablets, and PCs.

.webp)

The Game Changers: How Investment and Government Support Are Elevating the Gaming Sector

The gaming market in India is influenced by government-backed initiatives and a clear regulatory framework that foster innovation and growth. These programs support game design, development, and talent, attracting both local and global investments. The regulatory system ensures fair practices and transparency, building market trust and safeguarding user interests.

- Government-backed programs are essential in driving innovation and creating a vibrant gaming ecosystem in India. By supporting game design, development, and talent nurturing, these initiatives provide infrastructure, networking, and industry collaboration that attract both local and global investments. They also focus on cultivating local talent, ensuring the sector’s sustainability and competitiveness. The government’s commitment is evident in major initiatives like the Create in India Challenge and the AVGC-XR Mission, launched in 2025, which aim to foster original creation and collaboration across gaming, animation, VFX, and immersive technologies. These efforts strengthen India’s creative economy and position the country as a global hub for AVGC-XR innovation.

- A coherent regulatory system is vital for driving the gaming market in India. By establishing clear rules and categories for different game types, such as esports and online gaming, the framework ensures transparency and fair practices, fostering trust among investors and participants. This organized approach enhances market security for both developers and users, promoting sustainable growth. In 2025, the Ministry of Electronics and Information Technology (MeitY) addressed the need for such a framework with the release of the Draft Promotion and Regulation of Online Gaming Rules under the PROG Act. This created India’s first unified framework, with the Online Gaming Authority overseeing compliance, classification, and registration.

Leveling Up: IMARC’s Playbook for Navigating India’s Thriving Gaming Market

IMARC Group empowers stakeholders in India’s gaming industry with data-driven insights to succeed in one of the world’s fastest-growing entertainment markets. Our research and consulting services help clients identify untapped opportunities, navigate market uncertainties, and drive innovation in game design, marketing, and retail strategy.

- Market Insights: Track trends shaping India’s gaming market, including the rise in mobile gaming, increasing demand for esports, and the growing popularity of educational and strategy-based games. We also explore the emergence of local developers and the expanding gaming ecosystem.

- Strategic Forecasting: Predict future developments in the integration of digital and physical gaming experiences, the growth of online gaming platforms, evolving user preferences, and the impact of regional content and culturally relevant game narratives.

- Competitive Intelligence: Analyze strategies and offerings from leading game publishers and emerging startups, including how they are redefining gaming experiences with local themes, storytelling, and sustainable production practices.

- Policy and Regulatory Analysis: Understand trade regulations, intellectual property protection, licensing, and safety compliance standards crucial to the production and distribution of games in India.

- Tailored Consulting Solutions: Benefit from customized advice on market entry strategies, distribution models, branding, and game localization. IMARC’s expertise supports businesses in developing scalable, client-centric growth strategies in an expanding gaming ecosystem.

Technology

New Nevada Gaming Board Chairman Knows The Importance Of Getting Technology OK’d Quickly

The New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, signaling a clear focus on modernizing how gaming innovations move from development to casino floors. This approach reflects an understanding that technology now plays a central role in the gaming industry and that regulatory systems must evolve to keep Nevada competitive while maintaining its high standards.

New Chairman Knows the Importance of Approving Technology

Gaming technology is advancing at a rapid pace, from new slot machine platforms to cashless systems and enhanced security tools. When approvals take too long, Nevada risks seeing new products debut elsewhere first. The New Nevada Gaming Board Chairman knows the importance of getting technology approved quickly because delays can affect manufacturers, casino operators, and ultimately the state’s position as a leader in regulated gaming.

Industry Experience Shaping Regulatory Priorities

Leadership matters in regulatory agencies, especially in industries as complex as gaming. The new chairman brings experience that bridges regulation and technology, offering insight into how long approval timelines can impact innovation. This background helps explain why the New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, not as a shortcut, but as a way to make processes more efficient and predictable.

How Faster Approvals Benefit Nevada’s Gaming Industry

Timely technology approvals help casinos remain competitive and allow players to experience the latest advancements sooner. When Nevada can approve new gaming systems without unnecessary delays, it strengthens relationships with manufacturers and reinforces the state’s reputation as the global standard for gaming regulation.

Maintaining Integrity While Moving Faster

Speed does not mean sacrificing oversight. Nevada’s gaming regulators are still responsible for ensuring fairness, security, and compliance. The emphasis is on refining internal processes, improving communication, and reducing bottlenecks. This balanced approach explains why the Nevada Gaming Board Chairman knows the importance of getting technology approved quickly while continuing to uphold strict regulatory safeguards.

What This Means for the Future of Gaming Regulation

Looking ahead, a more responsive approval process could encourage greater innovation within Nevada’s gaming sector. Developers may be more inclined to launch new technologies in the state, and operators can adapt more quickly to player expectations.

By aligning regulatory efficiency with technological progress, Nevada positions itself to remain both a trusted regulator and an innovation-friendly environment in an increasingly competitive global gaming market.

Looking for Legal Guidance in Gaming?

If you follow SCCG content and have inquiries about your gaming business, connect with Lazarus Crystal Law Firm—formed by SCCG Management and Lazarus Legal to unite top-tier gaming law with commercialization and market-entry strategy.

Our Areas of Expertise Include:

• Nevada and multi-state gaming licensing

• Regulatory compliance and audit services

• International market entry and cross-border advisory

• Gaming M&A legal due diligence

• Tribal gaming legal and strategic support

• iGaming and sports betting regulatory guidance

Follow us on LinkedIn: Lazarus Crystal Law Firm

Technology

Page not found

-

Motorsports3 weeks ago

Motorsports3 weeks agoRoss Brawn to receive Autosport Gold Medal Award at 2026 Autosport Awards, Honouring a Lifetime Shaping Modern F1

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoStempien to seek opening for Branch County Circuit Court Judge | WTVB | 1590 AM · 95.5 FM

-

NIL3 weeks ago

NIL3 weeks agoDowntown Athletic Club of Hawaiʻi gives $300K to Boost the ’Bows NIL fund

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoPrinceton Area Community Foundation awards more than $1.3 million to 40 local nonprofits ⋆ Princeton, NJ local news %

-

NIL3 weeks ago

NIL3 weeks agoKentucky AD explains NIL, JMI partnership and cap rules

-

Sports3 weeks ago

Sports3 weeks agoThree Clarkson Volleyball Players Named to CSC Academic All-District List

-

Sports3 weeks ago

Sports3 weeks agoYoung People Are Driving a Surge in Triathlon Sign-Ups

-

Sports3 weeks ago

Sports3 weeks agoBeach Volleyball Unveils 2026 Spring Schedule – University of South Carolina Athletics

-

NIL3 weeks ago

NIL3 weeks agoWhy the NIL era will continue to force more QB transfers

-

Sports2 weeks ago

Sports2 weeks agoBadgers news: Wisconsin lands 2nd commitment from transfer portal