Rec Sports

Ex

Former NBA star Rajon Rondo is starring at another sport in his post-basketball career, but maybe not as much as touted.

Rondo, now 39, won two NBA championships in his 16-year career. First, with the Boston Celtics in 2008 along with the Big Three of Paul Pierce, Kevin Garnett, and Ray Allen. Then, with LeBron James and Anthony Davis with the 2020 Los Angeles Lakers in the NBA Bubble.

Rondo’s daughter Ryelle is an Alabama Crimson Tide volleyball player, while his son Rajon Jr. is younger and playing basketball.

Dad’s professional hoops days may be done, but he’s taken up flag football. There was even a report he’s the top ranked flag football quarterback in the U.S. right now. You can see the highlights before we get into that.

Rajon Rondo is officially the top ranked flag football QB in the United States.

Yes, you read that right.

(h/t @LeagueAlerts, via @Frankie_Vision) pic.twitter.com/47lDEfaGDC

— Legion Hoops (@LegionHoops) August 26, 2025

While that’s awesome and it looks like he has a canon for an arm, and no doubt as we’ve seen on the basketball court he has quick feet, the report of him being No. 1 isn’t substantiated. In fact, the official USA Flag account questioned it.

They also tagged Rondo and said, “We would love to see your skills in action!”

The media is certainly running with the narrative of Rondo being No. 1, but it may not be true.

He’s certainly a great athlete, but also who is the competition he is playing there?

Good for Rondo, though. Will he try for the 2028 Olympics with Team USA in flag? He certainly has the athletic ability for it.

— Enjoy free dish of rich and fabulous players with The Athlete Lifestyle on SI —

Death Star 2.0: Raiders owner’s new $14M mansion looks like Allegiant Stadium’s twin

Uh oh: Deshaun Watson, new wife will be Browns worst nightmare with $131M leverage

Glory days: Livvy Dunne turns heads in miniskirt fit during Jersey club duo dance

Proud mama: Shedeur Sanders’ mom Pilar flexes Browns ‘12’ eye-catching fit

What a catch: Megan Thee Stallion stuns in fishing fit on Klay Thompson’s boat

Rec Sports

A Look Inside IU’s New Sports Memorabilia Exhibit – WFHB

Podcast: Play in new window | Download (Duration: 29:27 — 40.5MB)

Subscribe:

WFHB Sports Correspondent Chase Dodson takes a look at an IU sports memorabilia exhibit on display at the McCalla School. The exhibit, titled “Outfitting IU Athletics: Who’s Your Champion?” showcases various artifacts from IU’s sports history, including championship trophies, jerseys and personal items from notable athletes. Dodson speaks with curator Jeremy Hackerd who walks us through the exhibit.

Rec Sports

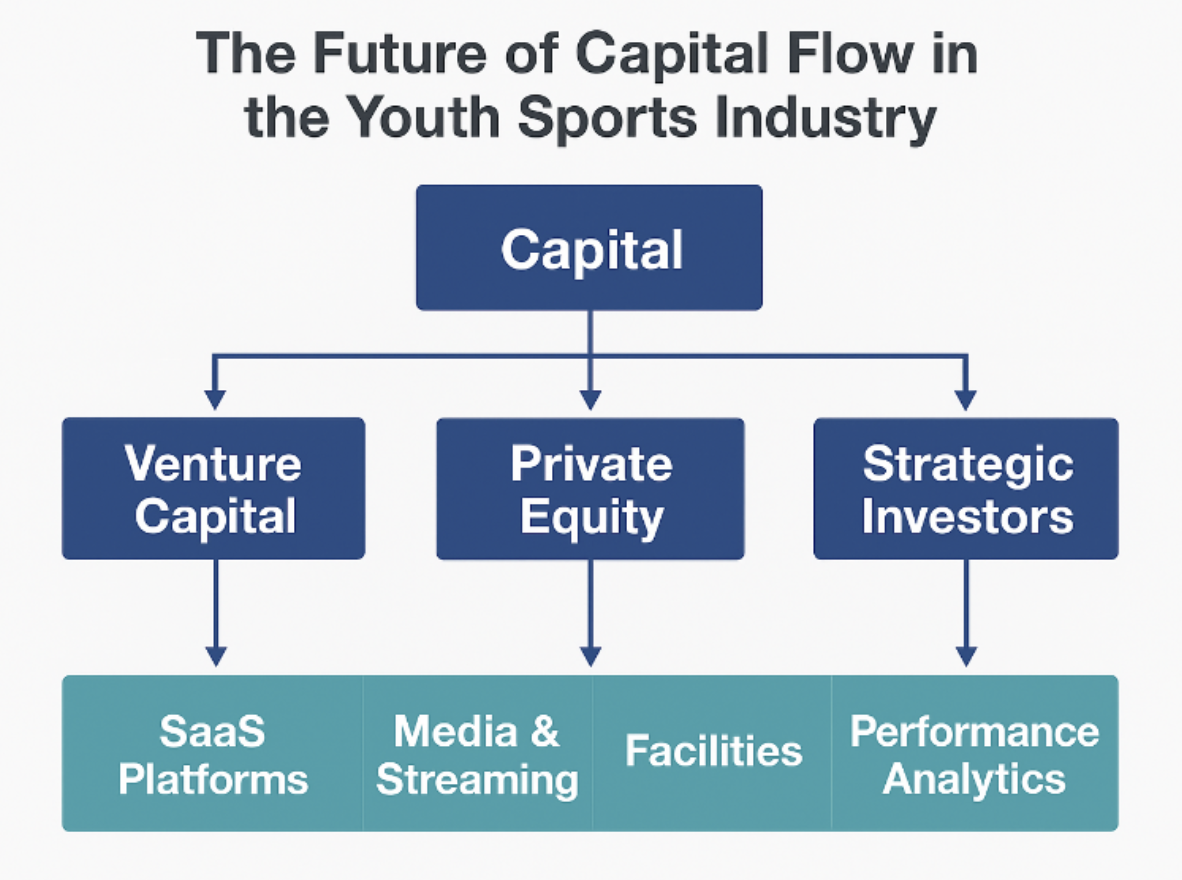

How Youth Sports Became a Magnet for Private Equity

Matthew Gravelle – Director, Stout

The U.S. youth sports industry has quietly become a multi-billion-dollar ecosystem and continues to grow at 8–10% per year. Beneath this expansion lies a rare convergence of fragmentation, predictable recurring spend, and accelerating digital transformation that together make youth sports a highly investable category. The sector is evolving from a cottage industry into a scalable, tech-powered platform economy. For investors, this represents a rare opportunity to capture growth in an emotionally durable, economically resilient, and still largely untapped market.

Since 2020, the youth sports industry has gone through a dramatic, two-stage transformation: an initial, painful contraction driven by pandemic lockdowns followed by a rapid rebound and structural acceleration that has attracted significant institutional capital.

The Last Five Years

The early shock of 2020 forced cancellations of leagues, camps, and tournaments, shuttered training facilities, and sent participation plunging. That shock was acute but short lived in many segments.

By 2022–2023, consumer demand returned and in several sub-segments, travel tournaments, specialized elite training, tech platforms that enable registration/communications/streaming, and event operators, the business model grew larger and more monetizable than before COVID.

Global spending on youth sports, which fell sharply in 2020, reached record levels by 2023 with the U.S. accounting for most of the rebound; one data point summarizing this trajectory shows global spending reaching roughly $64 billion in 2023 with the U.S. portion topping $43 billion.

Why the Resurgence?

Household economics explain much of this resurgence. Parents have demonstrated a greater willingness to pay for organized youth sports, and per-family spend increased noticeably in the post-COVID years.

The Aspen Institute’s Project Play family survey found that the average U.S. sports family spent about $1,016 on their child’s primary sport in 2024, an increase of roughly 46% compared with 2019, while total annual outlays per child (counting multiple sports and ancillary costs) commonly reach significantly higher levels.

This change in parental spending behavior has translated directly into more stable revenue streams for clubs, tournament operators, camps, and specialty service providers such as private coaches and skills academies.

Institutional and Private Equity Interest

Institutional and private equity interest has followed the money. Large, well-publicized transactions make the trend obvious. For example:

- The acquisition of IMG Academy by BPEA EQT in partnership with Nord Anglia in 2023 at approximately $1.25 billion signaled an appetite for premium training and campus-based sports education assets that combine real estate, seasonal programming and recurring tuition revenue

- KKR’s agreement to acquire Varsity Brands from Bain Capital for about $4.75 billion in 2024 underlined private equity attraction to vertically integrated apparel, uniform, competition and event businesses that generate steady order flows and have strong product line margins

Growth equity and PE have been equally active in the tech stack, for example:

- TeamSnap took a majority growth partner (Waud Capital) in 2021 to accelerate product development and M&A

- In 2025, Genstar Capital backed the combination of PlayMetrics and Stack Sports to create a consolidated leader in sports-management software, an explicit roll-up of registration, league management, and club services

These deals reflect two simultaneous investment theses: buy premium consumer experiences (camps, academies, large event brands) and consolidate high-margin technology platforms that can scale and provide operating leverage across local businesses.

Revenue Dynamics

Revenue dynamics within the sector vary by sub-segment.

Tech/SaaS

Technology platforms and SaaS products that enable registration, scheduling, communications, and live/video services can show high revenue growth and attractive gross margins. Platform play and streaming investments are a good example, like the growth of Dick’s Sporting Goods’ GameChanger, which by some accounts was projected to produce meaningful revenue and engage millions of users annually.

Events/Tournaments

Event and tournament operators capture registration fees, sponsorships and travel-driven ancillary revenue that scale quickly when national or regional circuits are built.

Franchises/Programs

Franchise and program businesses (multi-location academies, camps and enrichment brands) generate relatively predictable tuition and membership revenue. When those companies consolidate, they unlock procurement benefits, centralized marketing, and cross-sell of higher-margin services.

Apparel/Equipment

Meanwhile, apparel and equipment companies such as Varsity/BSN retain steady product revenue with the added upsell of uniforms and competition merchandise throughout the season.

Competition in the Sector

Competition is fragmented and multi-layered. At the local level, there are thousands of clubs, recreational leagues, small academies, and independent coaches competing primarily on price, convenience, and perceived coaching quality.

At the regional and national level, event organizers and tournament circuits compete for prestige, ideal dates/venues, and travel teams. National incumbents include tech platform companies (TeamSnap, Stack Sports/PlayMetrics, SportsEngine/NBC Sports Next) that provide the plumbing for many smaller operators and therefore benefit from network effects and stickiness.

Apparel and equipment providers (BSN/Varsity and large retailers) compete on wholesale distribution and brand relationships with schools and clubs. Newer entrants, such as start-up platforms focused on livestreaming, automated highlights, analytics, and sponsorship marketplaces, are attacking adjacent revenue pools and creating new monetization pathways for clubs and parents.

This landscape means that scale matters: larger platforms can bundle services (registration, payments, streaming, sponsorship sales) and present a one-stop experience that is harder for a single local club to replicate.

Looking Ahead

Looking ahead three to ten years, the market is likely to follow several intertwined trajectories.

The Near-Term

In the near term (three years), consolidation of service providers and platforms will accelerate. Private equity and strategic buyers will continue to pursue roll-ups of regional club networks, tournament operators, and tech platforms to extract cost synergies and centralize functions such as payments, procurement, and marketing.

Platform consolidation will create a smaller set of robust SaaS providers that serve as the operating systems for youth sports. Investors will prize companies that demonstrate recurring revenue, low churn, disciplined customer acquisition (CAC) and strong unit economics.

Evidence for this near-term consolidation thesis is already visible in recent transactions where private equity firms have combined or invested in platform plays and event portfolios.

The Next 5-10 Years

Over a slightly longer horizon (5–10 years), the sector will bifurcate between commoditized participation offerings and premium, differentiated experiences. Commoditized activities (basic recreational leagues and local clubs) will face price pressure and margin compression because of competition and lower barriers to market entry. Premium camps, elite academies, and branded national tournament circuits will consolidate higher spending families and sponsors and will be valued more highly by investors.

Technology will be a force multiplier: analytics, athlete development platforms, automated highlights and content monetization will enable companies to extract additional lifetime value from athletes and their families, and to create new sponsorship and media revenue.

Digital products that drive engagement (streaming, highlights, coaching content) will play a growing role in monetization and fan development.

Risks Shaping Outcome

Two risks will shape outcomes. First, affordability and access remain politically and socially sensitive; continued increases in per-child cost risk participation substitution or attrition among lower-income families, which could limit top-line growth if left unaddressed.

Second, regulatory, safety and liability issues (coach background checks, concussion protocols, and facility standards) will require sustained investment and can slow roll-up velocity if integration cannot quickly meet compliance thresholds. Companies that can demonstrate both inclusive pathways (scholarships, lower-cost offerings) and robust compliance frameworks will be advantaged in M&A processes.

Outlook

Youth sports is evolving from a local, fragmented pastime into a digitally monetized, media-rich ecosystem. The convergence of NIL rights, streaming technology, AI analytics, and platform consolidation is expanding the market’s economic ceiling and accelerating professionalization.

Investors positioned at this inflection point can capture value from an industry moving beyond participation fees into content, data, and technology-driven monetization a structural evolution that mirrors the early-stage digitization of traditional sports, fitness, and entertainment sectors.

Matthew Gravelle has over 20 years of experience integrating finance and accounting departments from pure numbers toward an operational and strategic model. He has been successful in business transformations through his ability and willingness to collaborate with all functions within a business, think strategically, display strong leadership instincts, and exhibit solid interpersonal skills. He believes the future of finance is about expanding beyond the historical data and analysis to providing real-time, actionable insights that are valuable across all parts of a business.

Matt has deep experience across a number of strategic finance functions (specifically FP&A, financial planning, business partnering, strategic decision support, and growth analysis) in both well-developed finance organizations and private equity-backed organizations that are moving from infancy to mature stages. He has stood up finance departments, overhauled people and systems, and redesigned what good reporting and analysis can be. He also has expertise in strategic business support in the areas of cost optimization, revenue management, budget and long-range plan development, developing KPIs, value creation, and operational finance.

Throughout his career, Matt has worked with executive leadership teams to ensure that finance has a presence across all functions of an organization to make better decisions. Examples of these are when he worked on relocating customer services centers from three international sites to one centralized location, converted the majority of office-based setting outpatient centers to ambulatory surgical centers to recapture reimbursement loss from a significant CMS decision, and reimagined a company’s value proposition by shifting away from a historically safe low margin vertical to a higher margin vertical that had more competitors and barriers to entry. Matt has helped businesses evaluate risks and rewards as well as understand which risks are worth taking and how they can be mitigated.

Prior to joining Stout, Matt held several senior finance positions spanning the industries of government contracting, financial services, publishing, and data analytics. Matt spent the past 10 years focused on the multisite healthcare industry: first at Azura Vascular Care (a division of Fresenius) and then two CFO stints with private equity-backed companies. Matt began his career at Lockheed Martin, where he completed their Financial Leadership Development Program.

YSBR provides this content on an “as is” basis without any warranties, express or implied. We do not assume responsibility for the accuracy, completeness, legality, reliability, or use of the information, including any images, videos, or licenses associated with this article. For any concerns, including copyright issues or complaints, please contact YSBR directly.

About Youth Sports Business Report

Youth Sports Business Report is the largest and most trusted source for youth sports industry news, insights, and analysis covering the $54 billion youth sports market. Trusted by over 50,000 followers including industry executives, investors, youth sports parents and sports business professionals, we are the premier destination for comprehensive youth sports business intelligence.

Our core mission: Make Youth Sports Better. As the leading authority in youth sports business reporting, we deliver unparalleled coverage of sports business trends, youth athletics, and emerging opportunities across the youth sports ecosystem.

Our expert editorial team provides authoritative, in-depth reporting on key youth sports industry verticals including:

- Sports sponsorship and institutional capital (Private Equity, Venture Capital)

- Youth Sports events and tournament management

- NIL (Name, Image, Likeness) developments and compliance

- Youth sports coaching and sports recruitment strategies

- Sports technology and data analytics innovation

- Youth sports facilities development and management

- Sports content creation and digital media monetization

Whether you’re a sports industry executive, institutional investor, youth sports parent, coach, or sports business enthusiast, Youth Sports Business Report is your most reliable source for the actionable sports business insights you need to stay ahead of youth athletics trends and make informed decisions in the rapidly evolving youth sports landscape.

Join our growing community of 50,000+ industry leaders who depend on our trusted youth sports business analysis to drive success in the youth sports industry.

Stay connected with the pulse of the youth sports business – where industry expertise meets actionable intelligence.

Sign up for the biggest newsletter in Youth Sports – Youth Sports HQ – The best youth sports newsletter in the industry

Follow us on LinkedIn

Follow Youth Sports Business Report Founder Cameron Korab on LinkedIn

Are you a brand looking to tap into the world’s most passionate fanbase… youth sports?

Introducing Play Up Partners, a leading youth sports marketing agency connecting brands with the power of youth sports. We specialize in youth sports sponsorships, partnerships, and activations that drive measurable results.

About Play Up Partners

Play Up Partners is a leading youth sports marketing agency connecting brands with the power of youth sports. We specialize in youth sports sponsorships, partnerships, and activations that drive measurable results.

Why Sponsor Youth Sports?

Youth sports represents one of the most engaged and passionate audiences in sports marketing. With over 70 million young athletes and their families participating annually, the youth sports industry offers brands unparalleled access to motivated communities with strong purchasing power and loyalty.

What Does Play Up Partners Do?

We’ve done the heavy lifting to untangle the complex youth sports landscape so our brand partners can engage with clarity, confidence, and impact. Our vetted network of accredited youth sports organizations (from local leagues to national tournaments and operators) allows us to create flexible, scalable programs that evolve with the market.

Our Approach

Every partnership we build is rooted in authenticity and value creation. We don’t just broker deals. We craft youth sports marketing strategies that:

- Deliver measurable ROI for brand partners

- Create meaningful experiences for athletes and families

- Elevate the youth sports ecosystem

Our Vision

We’re positioning youth sports as the most desirable and effective platform in sports marketing. Our mission is simple: MAKE YOUTH SPORTS BETTER for athletes, families, organizations, and brand partners.

Common Questions About Youth Sports Marketing

Where can I sponsor youth sports? How do I activate in youth sports? What is the ROI of youth sports marketing? How much does youth sports sponsorship cost?

We have answers. Reach out to info@playuppartners.com to learn how Play Up Partners can help your brand navigate the youth sports landscape.

Youth sports organizations: Interested in partnership opportunities? Reach out to learn about our accreditation process.

Rec Sports

How Penguins prospect Will Horcoff grew from young ‘rink rat’ into the NCAA’s leading scorer

Rec Sports

November eclipses October for 2nd best sports gambling month – North Carolina

(The Center Square) – Gamblers wagered more and won less than a month earlier on the way to delivering a new second-highest month of tax proceeds through legal sports wagering in North Carolina.

In its report Thursday, the State Lottery Commission said more than $16.7 million went to state coffers – topping the $14,066,124 from October that was previously second best. The rate of $557,617 per day was third highest all-time and pushed the total since inception past $222.6 million ($353,346 per day).

The first five months of fiscal year 2026 has generated $56.6 million, or about $370,000 per day.

The calculation for state coffers is 18% of the gross wagering revenue. That sum is the amounts received by interactive sports wagering operators from sports wagers as authorized under state law, less the amounts paid as winnings before any deductions for expenses, fees or taxes.

Total gambled exceeded $791.6 million in November and total won by bettors topped $717.5 million. The gross wagering revenue was $92,936,199 factoring in adjustments. Promotional revenue was $22.2 million.

– Advertisement –

The best months for the state’s total take are April 2024 ($18,945,301), last month ($16,728,516), October ($14,066,214), November 2024 ($14,057,587) and January ($13,415,424).

The fiscal year 2025 take for the state was $116.5 million and this year’s 12-month pace, at $135.9 million, is 16.6% higher. Year over year for the first five months, 2026 is 15.3% higher – with football season figuring to weigh into that equation.

Five things, per Session Law 2023-42, can happen with the proceeds. There’s $2 million annually to the Department of Health and Human Services for gambling addiction education and treatment programs; and there’s $1 million annually to the North Carolina Amateur Sports to expand youth sports opportunities.

Also annually, a third element is $300,000 to each of 13 state public school collegiate athletic departments. Fourth is $1 million annually to the N.C. Youth Outdoor Engagement Commission, which awards grants.

About 30% goes to help North Carolina attract major sporting events.

Rec Sports

MORE THAN 770 ECNL GIRLS ALUMNI NAMED TO NCAA CONFERENCE TEAMS

RICHMOND, Va. (December 4, 2025) – The ECNL is proud to celebrate the sizable impact its alumni had on the college soccer landscape this season, as hundreds of former ECNL Girls players were named to their respective conferences’ end of season teams and received conference accolades.

In total, more than 770 alumni were named to all-conference teams this season, with an average of 25 alumni per conference. More than 200 of those alumni were named to their conferences’ First Team, accounting for 61 percent of all first-team members. When examining the Power 4 conferences, 77 percent of all conference team players were ECNL alumni. In addition to the conference teams, ECNL alumni received 91 end of season individual awards from their conferences.

View the full list of ECNL alumni receiving end-of-season awards below.

America East

Defensive Player of the Year: Sophia Garofalo, Binghamton (PDA)

Co-Midfielder of the Year: Abbi Maier, New Hampshire (Ohio Elite SA)

View the full list of America East award winners here.

American Athletic

Defensive Player of the Year: Finley Lavin, Memphis (Pipeline SC)

Goalkeeper of the Year: Abby Kudla, Memphis (Internationals SC)

Co-Freshman of the Year: Ellis Kelly, Memphis (Wilmington Hammerheads)

Co-Freshman of the Year: Jadyn Jaeger, Rice (Sting Austin)

View the full list of American Athletic award winners here.

ACC

Offensive Player of the Year: Izzy Engle, Notre Dame (Minnesota Thunder Academy)

Midfielder of the Year: Lia Godfrey, Virginia (Jacksonville FC)

Goalkeeper of the Year: Caroline Birkel, Stanford (SLSG)

Freshman of the Year: Kylie Maxwell, Wake Forest (Philadelphia Ukrainian Nationals)

View the full list of ACC award winners here.

Atlantic Sun

Unanimous Player of the Year & Unanimous Midfielder of the Year: Erika Zschuppe, FGCU (Internationals SC)

Goalkeeper of the Year: Madison Vukas, North Alabama (Pittsburgh Riverhounds)

Freshman of the Year: Skylar Cole, Lipscomb (Florida Premier FC)

View the full list of Atlantic Sun award winners here.

Atlantic 10

Midfielder of the Year: Liv Grenda, Dayton (FC Bucks)

Co-Rookies of the Year: Renata Mercedes, Fordham (Connecticut FC)

Co-Rookies of the Year: Caroline Cheir, St. Louis (SLSG)

View the full list of Atlantic 10 award winners here.

Big 12

Forward of the Year: Hope Leyba, Colorado (Utah Royals FC-AZ)

Defender of the Year: Macy Blackburn, Texas Tech (Solar SC)

Midfielder of the Year: Tyler Isgrig, Baylor (Solar SC)

Goalkeeper of the Year & Scholar Athlete of the Year: Jordan Nytes, Colorado (Real Colorado)

Freshman of the Year: Kamdyn Fuller, TCU (Solar SC)

Scholar Athlete of the Year: Caroline Castans, Kansas (DKSC)

Scholar Athlete of the Year: Seven Castain, TCU (Utah Avalanche)

View the full list of Big 12 award winners here.

Big East

Offensive Player of the Year: Maja Lardner, Georgetown (Sting Dallas)

Defensive Player of the Year: Natalie Bain, Xavier (Kings Hammer)

Co-Midfielder of the Year: Samantha Erbach, Xavier (Ohio Elite SA)

Goalkeeper of the Year: Cara Martin, Georgetown (Arlington SA)

View the full list of Big East award winners here.

Big Sky

Co-Offensive MVP: Micala Boex, Northern Arizona (Real Colorado)

Freshman of the Year: Lauren Butorac, Weber State (Oregon Surf)

View the full list of Big Sky award winners here.

Big South

Forward of the Year: Riley O’Bryan, USC Upstate (Racing Louisville Academy)

Defender of the Year & Newcomer of the Year: Amani Green, Radford (Pipeline SC)

View the full list of Big South award winners here.

Big Ten

Offensive Player of the Year: Kennedy Bell, Michigan State (Charlotte SA)

Defensive Player of the Year: Kolo Suliafu, Washington (SoCal Blues)

Midfielder of the Year: Maribel Flores, USC (Slammers FC HB Køge)

Goalkeeper of the Year: Molly Pritchard, Ohio State (Atlanta Fire United)

Rookie of the Year: Bella Winn, UCLA (World Class FC)

View the full list of Big Ten award winners here.

Big West

Forward of the Year: Annika Smith, Cal Poly (Utah Royals FC-AZ)

Defender of the Year: Brennan Cole, Cal Poly (LA Breakers FC)

Freshman of the Year: Ava Tibor, UC San Diego (LAFC So Cal)

View the full list of Big West award winners here.

CAA

Defender of the Year: Grace Gelhaus, Elon (FC Stars Blue)

Goalkeeper of the Year: Eliza Teplow, Northeastern (FC Stars)

Rookie of the Year: Ellie Leffler, William & Mary (Reading Rage)

View the full list of CAA award winners here.

Conference USA

Player of the Year & Offensive Player of the Year: Ivy Garner, Liberty (NC Fusion)

Goalkeeper of the Year: Peyton Huber, Liberty (FC Alliance)

View the full list of Conference USA award winners here.

Horizon League

Freshman of the Year: Kamryn Rosa, Youngstown State (De Anza Force)

View the full list of Horizon League award winners here.

Ivy League

Defensive Player of the Year: Drew Coomans, Princeton (Beach FC (CA))

View the full list of Ivy League award winners here.

MAAC

Golden Boot: Maddy Theriault, Fairfield (Scorpions SC)

Defensive Player of the Year: Meghan Carragher, Fairfield (PDA Blue)

Golden Glove: Katie Wright, Fairfield (FC Stars)

Rookie of the Year: Kylie Fuller, Merrimack (Scorpions SC)

View the full list of MAAC award winners here.

MAC

Forward of the Year: Addie Chester, Ball State (FC Pride)

Midfielder of the Year: Drew Martin, Western Michigan (Liverpool FC IA Michigan)

Goalkeeper of the Year: Lexie Thompson, Buffalo (SUSA)

Freshman of the Year: Reagan Sulaver, Western Michigan (Eclipse Select SC)

View the full list of MAC award winners here.

Missouri Valley

Player of the Year: Mary Hardy, Murray State (SLSG)

Freshman of the Year: Kiara Desiderio, Valparaiso (Indiana Elite FC)

View the full list of Missouri Valley award winners here.

Mountain West

Offensive Player of the Year: Annika Jost, Air Force (San Diego Surf)

Defensive Player of the Year & Newcomer of the Year: Ava de Leest, Boise State (Legends FC)

View the full list of Mountain West award winners here.

Northeast Conference

Offensive Player of the Year: Hannah Anselmo, Stonehill (Scorpions SC)

Goalkeeper of the Year: Melina Ford, CCSU (FSA FC)

Rookie of the Year: Gabrielle Smith, CCSU (Connecticut FC)

View the full list of Northeast Conference award winners here.

Ohio Valley

Defender of the Year: Claire Palya, Tennessee Tech (FC Alliance)

Co-Freshman of the Year: Camylle Graves, Eastern Illinois (KC Athletics)

View the full list of Ohio Valley award winners here.

Patriot League

Goalkeeper of the Year: Aubrey Haesche, Holy Cross (World Class FC)

Rookie of the Year: Sophia Henry, Army (Fairfax VA Union)

View the full list of Patriot League award winners here.

SEC

Forward of the Year: Sydney Watts, Vanderbilt (Sporting Blue Valley)

Defender of the Year: Gracie Fella, South Carolina (Alabama FC)

Midfielder of the Year: Ally Perry, Mississippi State (Sting SC)

Goalkeeper of the Year: Sara Wojdelko, Vanderbilt (Michigan Hawks)

Freshman of the Year: Ava McDonald, Texas (FC Dallas)

Newcomer of the Year: Larkin Thomason, Alabama (Utah Royals FC-AZ)

View the full list of SEC award winners here.

SoCon

Player of the Year: Sam De Luca, Samford (Arkansas Rising)

View the full list of SoCon award winners here.

Southland Conference

Defender of the Year: Jessica Spitzer, Northwestern State (DKSC)

Goalkeeper of the Year: Sierra McCluer, SFA (Albion Hurricanes FC)

View the full list of Southern Conference award winners here.

SWAC

Defensive Player of the Year: Kaylen Jankans, Grambling State (Slammers FC)

View the full list of SWAC award winners here.

Summit League

Midfielder of the Year: Hannah Tate, Denver (Sporting Nebraska)

View the full list of Summit League award winners here.

Sun Belt

Player of the Year: Skylar Blaise, Louisiana Monroe (MVLA)

Newcomer of the Year: Salma Elhaimer, Louisiana Lafayette (Challenge SC)

Freshman of the Year: Carson Glenn, Louisiana Lafayette (Sting SC)

View the full list of Sun Belt award winners here.

West Coast Conference

Defensive Player of the Year: Keeley Dockter, Portland (Seattle United)

Midfielder of the Year: Tabitha LaParl, Pepperdine (SoCal Blues)

Goalkeeper of the Year: Kate Plachy, Saint Mary’s (San Juan SC)

Freshman of the Year: Samantha Snorsky, Gonzaga (XF Academy)

View the full list of West Coast Conference award winners here.

WAC

Offensive Player of the Year: Ruby Hladek, Utah Valley (SoCal Blues)

Defensive Player of the Year: Mia Owens, Utah Valley (SoCal Blues)

Goalkeeper of the Year: Mikayla O’Brien, California Baptist (Sporting CA USA)

View the full list of WAC award winners here.

###

About the ECNL:

The ECNL is the nation’s leading youth soccer development platform for America’s top soccer players. The ECNL mission to provide the best youth sports experience in the world drives constant innovations in competitions and experiences for players, parents, families, coaches, referees, and partners. The ECNL has questioned convention and challenged the status quo of youth sport since 2009, pushing boundaries and striving for unmatched excellence. Together with its clubs and club leaders, the ECNL creates unforgettable memories and supports the development of youth players into college stars, professionals, world champions, and leaders.

www.TheECNL.com

Rec Sports

Love named Packers nominee for 2025 Walter Payton Man of the Year Award

GREEN BAY, Wis. — The Green Bay Packers selected quarterback Jordan Love as the team’s nominee for the Walter Payton Man of the Year Award, which recognizes NFL players who excel on the field while demonstrating a commitment to making a positive impact beyond the game.

Love, who entered the league in 2020, launched his foundation in May 2024 — Hands of 10ve. His foundation focuses on empowering children, regardless of their backgrounds, to participate in sports while raising awareness about mental health. It also emphasizes fostering stronger connections between law enforcement and communities.

Through 10ve for Cleats, a Hands of 10ve initiative, Love has donated cleats to a youth sports team for every touchdown scored during the season. This initiative will even expand to Bakersfield, Calif., Love’s hometown.

“We are pleased to name Jordan Love as our club winner for the prestigious Walter Payton Man of the Year Award,” said Packers President and CEO Ed Policy. “It’s been a privilege to watch him grow as a leader during his time with the Packers, both in the locker room and in the community. We have been proud to support his dedication to giving back.”

Love and the 32 club winners will wear a special Walter NFL Man of the Year helmet through the end of the season.

All club winners will be recognized in the week leading up to Super Bowl LX, and the national winner of the 2025 Walter Payton NFL Man of the Year will be announced during NFL Honors, a primetime awards special set to air on Feb. 5.

For more information about the award, please visit NFL.com/ManOfTheYear.

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoFirst Tee Winter Registration is open

-

Rec Sports1 week ago

Rec Sports1 week agoFargo girl, 13, dies after collapsing during school basketball game – Grand Forks Herald

-

Sports2 weeks ago

Sports2 weeks agoVolleyball Recaps – November 18

-

Motorsports1 week ago

Motorsports1 week agoCPG Brands Like Allegra Are Betting on F1 for the First Time

-

Motorsports2 weeks ago

Motorsports2 weeks agoF1 Las Vegas: Verstappen win, Norris and Piastri DQ tighten 2025 title fight

-

Sports1 week ago

Sports1 week agoTwo Pro Volleyball Leagues Serve Up Plans for Minnesota Teams

-

Sports1 week ago

Sports1 week agoUtah State Announces 2025-26 Indoor Track & Field Schedule

-

Sports1 week ago

Sports1 week agoTexas volleyball vs Kentucky game score: Live SEC tournament updates

-

Sports1 week ago

Sports1 week agoSycamores unveil 2026 track and field schedule

-

NIL4 days ago

NIL4 days agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14