Technology

Gaming Monitors Market Witnesses Robust Growth Driven by Rising

Gaming Monitors Market The global sales of Gaming Monitors are estimated to be worth USD 11,352.9 million in 2025 and anticipated to reach a value of USD 21,511.9 million by 2035. Sales are projected to rise at a CAGR of 6.6% over the forecast period between 2025 and 2035. The revenue generated by Gaming Monitors […]

Gaming Monitors Market

The global sales of Gaming Monitors are estimated to be worth USD 11,352.9 million in 2025 and anticipated to reach a value of USD 21,511.9 million by 2035. Sales are projected to rise at a CAGR of 6.6% over the forecast period between 2025 and 2035.

The revenue generated by Gaming Monitors in 2024 was USD 10,650.0 million. The market is anticipated to exhibit a Y-o-Y growth of 6.5% in 2025.

The Gaming Monitors Market is experiencing significant growth, fueled by the increasing demand for high-performance displays, the expanding gaming industry, and the rising adoption of eSports. Innovations such as high refresh rates, low latency, 4K and curved displays, and adaptive sync technologies are further enhancing the gaming experience and driving market expansion.

Get Ahead with Our Report: Request Your Sample Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-11789

Key Takeaways:

• Increasing demand for high refresh rate and low response time gaming monitors.

• Growth in eSports and professional gaming, fueling demand for high-performance displays.

• Rising popularity of curved and ultra-wide monitors for immersive gaming experiences.

• Technological advancements such as HDR, OLED panels, and adaptive sync (G-Sync & FreeSync).

• Expansion of cloud gaming and gaming console compatibility with high-end monitors.

Key Drivers:

• Growth in eSports & Streaming Platforms – Increasing number of competitive gamers and content creators driving demand for premium gaming displays.

• Rising Popularity of 4K & High-Refresh-Rate Monitors – Enhanced visual quality and smooth performance for competitive gaming.

• Technological Innovations – Adoption of OLED, Mini-LED, and high dynamic range (HDR) technologies improving display quality.

• Increase in Gaming Console & PC Gaming Adoption – Next-gen gaming consoles like PlayStation 5 and Xbox Series X/S driving demand for advanced gaming monitors.

• Availability of Cost-Effective Gaming Monitors – Growing number of budget-friendly options making gaming more accessible.

Growth Opportunities:

• Rising adoption of portable gaming monitors.

• Advancements in AI-driven display optimization and eye-care technologies.

• Increasing demand for dual-purpose monitors for work and gaming.

• Expansion of gaming cafes and eSports arenas worldwide.

Application Areas:

• Professional eSports Gaming – Monitors with high refresh rates (240Hz & above) and ultra-low latency.

• Casual & Home Gaming – Budget-friendly, high-resolution monitors with adaptive sync support.

• Game Development & Content Creation – High-accuracy color displays for designers and developers.

• Streaming & Video Editing – Monitors with high refresh rates and color accuracy for content creators.

Detailed Market Study: Full Report and Analysis

https://www.futuremarketinsights.com/reports/gaming-monitors-market

Key Players:

• ASUS (Republic of Gamers – ROG)

• Acer Inc.

• Dell (Alienware)

• LG Electronics

• Samsung Electronics

• AOC International

• BenQ Corporation

• MSI (Micro-Star International)

• ViewSonic Corporation

• Gigabyte Technology Co., Ltd.

Market Segmentation:

• By Panel Type: IPS, VA, TN, OLED, Mini-LED.

• By Refresh Rate: 60Hz-144Hz, 144Hz-240Hz, Above 240Hz.

• By Resolution: Full HD (1080p), Quad HD (1440p), 4K UHD (2160p), 8K.

• By Size: Below 24 inches, 24-32 inches, Above 32 inches.

• By End-User: Professional Gamers, Casual Gamers, Content Creators.

• By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Electronics & Components Industry Analysis Reports

Micro Display Market outlook 2025 to 2035

https://www.futuremarketinsights.com/reports/micro-display-market

Display Controllers Market Outlook 2025 to 2035

https://www.futuremarketinsights.com/reports/display-controllers-market

Virtual Retinal Display Market Outlook from 2025 to 2035

https://www.futuremarketinsights.com/reports/virtual-retinal-display-market

LED Grow Lights Market Outlook 2025 to 2035

https://www.futuremarketinsights.com/reports/led-grow-lights-market

Touchscreen Controller Market Outlook from 2025 to 2035

https://www.futuremarketinsights.com/reports/touchscreen-controller-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.

Technology

Lawsuit claims discrimination by Workday’s hiring tech prevented people over 40 from getting hired

Together, the plaintiffs, all over the age of 40, claim that they submitted hundreds of job applications through Workday and were rejected each time — sometimes within minutes or hours. They blame Workday’s algorithm, which they claim “disproportionately disqualifies individuals over the age of forty (40) from securing gainful employment” when it screens and ranks […]

Together, the plaintiffs, all over the age of 40, claim that they submitted hundreds of job applications through Workday and were rejected each time — sometimes within minutes or hours. They blame Workday’s algorithm, which they claim “disproportionately disqualifies individuals over the age of forty (40) from securing gainful employment” when it screens and ranks applicants, court documents state.

Technology

I’m a health tech editor. These are the Memorial Day sales fitness enthusiasts should shop

Current price: $200 Original price: $250 The nice thing about buying one of Oura’s earlier model smart rings is you’ll get the same app and software experience — just a different form factor and one less day of battery life. If prospective Oura Ring buyers don’t mind this, they should opt for the Oura Ring […]

- Current price: $200

- Original price: $250

The nice thing about buying one of Oura’s earlier model smart rings is you’ll get the same app and software experience — just a different form factor and one less day of battery life. If prospective Oura Ring buyers don’t mind this, they should opt for the Oura Ring 3, which has reduced its price by around 20% since the Oura Ring 4’s debut.

The Oura Ring tracks your daily sleep, stress, activity, and readiness to deliver scores, insights, and recommendations. It’s a great health tracker for people looking to optimize their sleep and activity routine, but who want gentle recommendations and encouragements that won’t make them feel bad about a poor night of sleep or a day of low activity. It’s constantly innovating with new features, like a Cardiovascular Age feature that tells you if your physiological age is ahead, behind, or at your chronological age. Plus, it partners with other health brands, like Dexcom, so you can keep track of your glucose levels on the Oura app if you use its Stelo continuous glucose monitor.

The smart ring is compatible with Android and iOS phones, so everybody can use it to capture data. The only downside of an Oura Ring is its $70 annual subscription (which is not on sale) to unlock all that data it collects and displays. The Ring Gen 3 is also an sale in select finishes and sizes at Oura.

Technology

OpenAI’s next device won’t be a wearable, says CEO

If you’ve been expecting OpenAI to unveil a smartwatch or smart glasses next, think again. The company behind ChatGPT is planning something quite different. This AI-powered device doesn’t have a screen and isn’t meant to be worn, according to a report from The Wall Street Journal, OpenAI CEO Sam Altman shared with employees on June […]

If you’ve been expecting OpenAI to unveil a smartwatch or smart glasses next, think again. The company behind ChatGPT is planning something quite different. This AI-powered device doesn’t have a screen and isn’t meant to be worn, according to a report from The Wall Street Journal, OpenAI CEO Sam Altman shared with employees on June 5 that the company’s following big product won’t be a wearable.

Instead, the company is working on a compact gadget that fits easily on your desk or in your pocket. Thanks to built-in sensors and AI capabilities, it won’t have a display but will be fully aware of its surroundings. Altman described it as an “AI companion” that could serve as a “third core device” alongside your MacBook and iPhone.

A new kind of AI product is in the works

Altman’s comments came shortly after OpenAI announced a major acquisition. The company is buying a startup called io, founded in 2023 by former Apple designer Jony Ive. The deal, worth US$6.5 billion in equity, brings Ive on board in a key creative and design role. He is expected to play a big part in shaping what this new device will look like and how it will work in everyday life.

The goal is ambitious. Altman believes this new AI device could eventually lead to a brand-new category of technology—neither a phone nor a wearable nor smart glasses. He thinks it could add as much as US$1 trillion to OpenAI’s market value if it succeeds. That’s a bold prediction, but it reflects the scale of the company’s vision.

The device is still under wraps, and details are limited. However, the idea is to create something that blends into your daily routine while offering smart, helpful support—like having your assistant always ready and aware of what’s happening around you.

Tight security, but a leaked recording sparks concern

During the internal meeting, Altman stressed the need for secrecy. With so much riding on this device, he warned employees that it’s crucial to keep details under wraps to avoid tipping off rivals who might try to copy the idea before it launches.

However, despite his warning, Altman’s remarks were recorded in The Wall Street Journal. This has sparked questions about trust within OpenAI’s team. How will the company protect future plans if confidential information leaks this easily?

The leak also raises bigger concerns about how much more Altman will be willing to share with his staff going forward. Trust and internal communication are vital when building a revolutionary product. Now, OpenAI may need to tighten its internal controls to protect what it sees as its next big step in the AI race.

Whether you can see or use this new AI companion remains a mystery. However, one thing is clear: OpenAI is setting its sights beyond the usual tech gadgets. It wants to reshape the way you interact with artificial intelligence—starting not on your wrist or face but from your desk or pocket.

Technology

Brag House, Florida Gators Athletics, and Learfield Launch Inaugural Brag Gators Gauntlet at University of Florida

Brag House, the Gen Z engagement platform at the intersection of gaming, college sports, and digital media, announced the successful launch of the inaugural Brag Gators Gauntlet series. The first activation of this series, in partnership with Florida Gators Athletics and Learfield’s Florida Gators Sports Properties, took place online on Saturday, May 17, 2025, ahead of […]

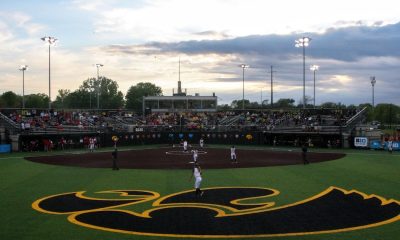

Brag House, the Gen Z engagement platform at the intersection of gaming, college sports, and digital media, announced the successful launch of the inaugural Brag Gators Gauntlet series. The first activation of this series, in partnership with Florida Gators Athletics and Learfield’s Florida Gators Sports Properties, took place online on Saturday, May 17, 2025, ahead of the Gators’ 9–3 college baseball victory over Alabama at Condron Family Ballpark.

The Brag Gators Gauntlet: Baseball Edition featured a Fortnite (private lobbies, no-build) solos tournament and a baseball-inspired scoring format. Open to current students and alumni of both the University of Florida and the University of Alabama, the activation served as a digital gaming tailgate leading into the Florida–Alabama baseball game. The activation, which had capacity for 100 competitors, received nearly 300 gamer registrations ranging from freshman to alumni.

“It was exciting to see so many UF students and alumni participate,” said Lavell Juan Malloy II, CEO and Co-Founder of Brag House. “The activation created a gamified digital tailgate, where they came together around school pride and competition in a Fortnite tournament designed with baseball-themed rules. It added a new layer to game day, especially as the Gators took the series with a commanding 9–3 win.”

Michael Yencik, a third-year student at University of Florida on a pre-med track studying nutritional sciences, was crowned champion of the Brag Gators Gauntlet: Baseball Edition. Competing under the gamertag MrGittyGut, Yencik secured the top spot after consistently high placements across all heats and a standout performance in the final heat. “It was a surreal experience,” said MrGittyGut, when asked about this activation and how it ties into the Gators spirit and college baseball. He added “Gators all the way! We’ve had an unbelievable season, from playing well in football to a National Championship in Basketball. You can’t go wrong with the Gators no matter what.”

The Gauntlet series also reflects Brag House’s broader strategy of integrating Name, Image, and Likeness (NIL) opportunities, loyalty-driven engagement, and scalable digital experiences tailored to Gen Z audiences. This first activation at the University of Florida is what Brag House envisions as the first step in a larger series of campus experiences being planned in collaboration with Learfield, with more activations in the series being planned for select universities across the country in 2025.

“This is the foundation of a broader initiative,” said Lavell Juan Malloy II, CEO and Co-Founder of Brag House. “By merging college sports with interactive digital gaming formats, we’re building a new layer of fan engagement that serves students, alumni, schools, and brand partners alike.”

About Brag House

Brag House is a leading media technology gaming platform dedicated to transforming casual college gaming into a vibrant, community-driven experience. By seamlessly merging gaming, social interaction, and cutting-edge technology, the Company provides an inclusive and engaging environment for casual gamers while enabling brands to authentically connect with the influential Gen Z demographic. The platform offers live-streaming capabilities, gamification features, and custom tournament services, fostering meaningful engagement between users and brands. For more information, please visit www.braghouse.com.

About Learfield

Learfield is the leading media and technology company powering college athletics. Through its digital and physical platforms, Learfield owns and leverages a deep data set and relationships in the industry to drive revenue, growth, brand awareness, and fan engagement for brands, sports, and entertainment properties. With ties to over 1,200 collegiate institutions and over 12,000 local and national brand partners, Learfield’s presence in college sports and live events delivers influence and maximizes reach to target audiences. With solutions for a 365-day, 24/7 fan experience, Learfield enables schools and brands to connect with fans through licensed merchandise, game ticketing, donor identification for athletic programs, exclusive custom content, innovative marketing initiatives, NIL solutions, and advanced digital platforms. Since 2008, it has served as title sponsor for the acclaimed Learfield Directors’ Cup, supporting athletic departments across all divisions.

Technology

Signal adds a new privacy feature to block screenshots on Windows

To protect your privacy, Signal has just rolled out a new update for its Windows app that stops the system from capturing screenshots of your chats. If you’re using Windows 11, this new “screen security” feature is switched on by default. Why Signal added this feature The update directly responds to Microsoft’s Recall tool, which […]

To protect your privacy, Signal has just rolled out a new update for its Windows app that stops the system from capturing screenshots of your chats. If you’re using Windows 11, this new “screen security” feature is switched on by default.

Why Signal added this feature

The update directly responds to Microsoft’s Recall tool, which has raised concerns among privacy-conscious users. Recall, announced last year, is designed to help you find past activity by continuously taking screenshots of what’s happening on your screen. This allows you to scroll back in time and review things you’ve seen or worked on.

However, many people were alarmed by the recording of their every move without clear protections. Microsoft paused the feature after a wave of backlash but started testing it again in April this year via the Windows Preview Channel. This time, Microsoft made Recall opt-in and included a way to pause it anytime.

Despite these changes, Signal says there’s still a risk. “The feature still captures content that may be sensitive,” the company explained. That’s why the screen security update is now in place — to give you more control over what gets saved or shared from your device.

How the screen security setting works

With screen security enabled, if you or anyone else tries to take a screenshot of the Signal app, the result will be a blank screen. This helps ensure that sensitive conversations remain private, even if Recall or other screenshot tools run in the background.

You’ll find this setting under Signal Settings > Privacy > Screen Security. It’s turned on automatically in the latest update, but you can if you need to switch it off for any reason. Just be aware that Signal has made an extra step: you’ll see a warning and must confirm before the setting is disabled. This is to stop you from turning it off by accident.

It’s important to note that some features, like screen readers, might not work correctly when the settings are enabled. So, if you rely on assistive technology, you may need to consider this before deciding whether to keep it on or off.

What Signal hopes this will change

Signal’s team hopes companies developing tools like Recall will think more carefully about privacy in the future. In a blog post, they said: “We hope that the AI teams building systems like Recall will think through these implications more carefully. Apps like Signal shouldn’t have to implement a ‘one weird trick’ to protect privacy and security because developer tools don’t support it.”

The update reflects Signal’s continued commitment to user privacy, even as big tech companies introduce features that can blur the lines between convenience and control. If you value private communication, this latest update is a clear step forward.

Technology

Top Esports Games to Bet On in 2025 and Why They Matter

Join Our Telegram channel to stay up to date on breaking news coverage The global esports betting market continues its meteoric rise, projected to reach a staggering $3.5 billion by 2029 according to recent Statista forecasts. This explosive growth is fueled by a potent combination of surging viewership numbers, technological innovations in betting platforms, and […]

Join Our Telegram channel to stay up to date on breaking news coverage

The global esports betting market continues its meteoric rise, projected to reach a staggering $3.5 billion by 2029 according to recent Statista forecasts. This explosive growth is fueled by a potent combination of surging viewership numbers, technological innovations in betting platforms, and the increasingly sophisticated integration of dynamic wagering markets. As competitive gaming further entrenches itself in mainstream entertainment, certain titles have emerged as dominant forces in driving betting activity and shaping the future of the industry.

Beyond mere popularity, factors such as game structure, tournament frequency, viewership stability, and market diversity significantly influence a title’s betting potential. This comprehensive analysis examines the leading esports betting titles in 2025, their distinctive characteristics, and their broader impact on the global betting ecosystem.

Key Takeaways

- Market Expansion: The global esports betting market is projected to grow from $2.5 billion in 2024 to $3.5 billion by 2029, with 74 million users currently engaged in esports wagering.

- Regional Differences: Asia-Pacific dominates with 55% of global esports betting revenue, while North America shows the fastest growth rate following regulatory changes.

- Title Dominance: Counter-Strike 2 leads with 57% of all esports bets placed, followed by League of Legends (26%) and Valorant (rapidly growing at 175% year-over-year).

- Mobile Emergence: Titles like Mobile Legends: Bang Bang are revolutionizing betting in emerging markets, particularly in Southeast Asia.

- Betting Trends: Live in-play wagering now represents 45% of CS2 bets, while cryptocurrency integration continues to expand across major platforms.

- Growth Drivers: Structured leagues, franchising models, and high-profile tournaments with substantial prize pools are attracting mainstream betting interest.

- Future Contenders: PUBG Mobile, Arena of Valor, and Rocket League show significant potential for betting market growth in their respective regions.

Market Overview: Esports Betting in 2025

The esports betting market has matured significantly in recent years, evolving from a niche activity to a mainstream betting vertical with substantial commercial potential. Understanding the current market context provides essential perspective on which titles matter most to the betting ecosystem.

Revenue and Growth Trajectories

The esports betting market generated approximately $2.5 billion in global revenue during 2024, representing a 32% increase from the previous year. Forecasts from Statista and other industry analysts project continued robust growth:

- 2025: $2.8 billion (projected)

- 2026: $3.0 billion (projected)

- 2027: $3.2 billion (projected)

- 2028: $3.4 billion (projected)

- 2029: $3.5 billion (projected)

This growth curve reflects increasing mainstream acceptance, improved betting products, and expanding regulatory frameworks that are gradually legitimizing esports betting across key markets.

Audience Demographics and Engagement

Over 74 million users engaged in online esports betting during 2024, with distinctive demographic patterns emerging:

- Age Distribution: 68% of esports bettors fall between 18-34 years old, with the fastest growth occurring in the 25-34 segment

- Gender Breakdown: Male bettors still dominate at 78%, though female participation has grown from 14% to 22% since 2022

- Cross-Platform Activity: 63% of esports bettors also wager on traditional sports, indicating significant overlap with conventional betting audiences

- Betting Frequency: 42% bet at least weekly, with major tournaments driving peaks in participation

“The esports betting audience continues to mature,” explains Maria Chen, esports research director at H2 Gambling Capital. “We’re seeing a gradual aging of the demographic as early adopters grow older while maintaining their betting habits, combined with new entrants who are discovering competitive gaming through mainstream channels.”

Key Market Trends

Several significant trends are shaping the esports betting market in 2025:

Live Betting Dominance

In-play wagering has become the dominant form of esports betting, particularly for titles with dynamic, round-based gameplay. For Counter-Strike 2, a remarkable 45% of all bets are now placed after matches begin, allowing bettors to react to live gameplay developments. This represents a significant shift from 2022, when pre-match betting accounted for over 70% of wagering activity.

The rise of live betting has been enabled by advances in data processing and streaming latency reduction, with leading platforms now offering sub-second delays for in-play markets.

Cryptocurrency Integration

Crypto-native betting platforms like BetPanda and Betplay have gained substantial market share by catering to tech-savvy esports enthusiasts. These platforms typically offer:

- Bitcoin, Ethereum, and various altcoin payment options

- Faster withdrawals compared to traditional payment methods

- Reduced KYC requirements in certain jurisdictions

- Exclusive promotions for crypto users

According to industry estimates, approximately 22% of all esports betting transactions now involve cryptocurrency. This figure rises to 35% for certain titles with particularly tech-oriented audiences, such as Counter-Strike 2 and Valorant.

Regional Market Dominance

The geographic distribution of esports betting activity reveals significant regional variations:

- Asia-Pacific: Accounts for 55% of global esports betting revenue, led by China, South Korea, and the Philippines

- Europe: Represents 26% of the market, with strongest participation in Scandinavia, the UK, and Eastern Europe

- North America: Contributes 15% of revenue, with rapid growth following regulatory changes in key states

- Latin America: Fastest-growing region at 42% year-over-year, albeit from a smaller base of 4% of the global market

“Regional preferences heavily influence which titles dominate the betting market,” notes Chen. “Mobile esports betting is practically non-existent in Europe but represents nearly 40% of all esports wagering in Southeast Asia.”

Top Esports Titles for Betting in 2025

While dozens of competitive games attract betting activity, seven titles stand out as the primary drivers of esports wagering in 2025. Each game offers distinct characteristics that shape its betting ecosystem and appeal to different segments of the market.

1. Counter-Strike 2 (CS2)

Counter-Strike 2 maintains its position as the undisputed king of esports betting, accounting for a dominant 57% of all esports wagers placed in 2024. This first-person shooter has cultivated an unparalleled betting ecosystem through its combination of tactical depth, round-based structure, and consistent tournament calendar.

Key Betting Metrics

- Betting Volume: 57% of all esports bets in 2024

- Notable Events: PGL Major Copenhagen (1.85M peak viewers), Shanghai Major 2024 (1.73M peak viewers)

- Market Depth: Average tier-one match offers 70+ betting markets

- In-Play Percentage: 45% of CS2 bets placed during live matches

Why It Matters to Bettors

Counter-Strike 2’s dominance in betting stems from several structural advantages:

Tactical, Round-Based Gameplay

The game’s format of discrete, short rounds creates natural betting units that allow for granular wagering opportunities without requiring deep game knowledge. Common markets include:

- Pistol round winners (first round of each half)

- Total rounds played (over/under formats)

- Map winners in best-of-three or best-of-five series

- First team to reach specific round thresholds (e.g., first to 5 rounds)

This structure is ideally suited for live betting, as each round provides natural pauses for market updates and bet placement.

Tournament Ecosystem and Calendar Stability

CS2 offers an unmatched volume of high-quality competitive play:

- Over 400,000 professional and semi-professional matches annually

- Multiple tier-one tournament organizers (ESL, BLAST, PGL)

- Year-round schedule with limited seasonal downtime

- Regional competitions feeding into international events

This calendar density ensures consistent betting opportunities regardless of season, unlike titles with more concentrated competitive schedules.

Mature Market with Strong Liquidity

The game’s long-standing popularity has created deep betting markets with robust liquidity:

- High betting limits compared to other esports titles

- Tighter margins reflecting bookmaker confidence in pricing models

- Sophisticated statistical modeling enabling complex derivative markets

- Strong correlation between viewership and betting activity

“Counter-Strike has established itself as the most predictable and modelable esport from a bookmaking perspective,” explains David Rotstein, head of esports trading at a major European operator. “The abundance of historical data combined with the game’s relatively stable mechanics allows for more confident pricing and higher limits than we can offer for any other title.”

Betting Opportunities and Challenges

For bettors, CS2 offers several distinct advantages:

- Extensive pre-match and live betting markets

- High-quality broadcasts with expert analysis

- Substantial public data on team and player performance

- Multiple licensed bookmakers competing for market share

However, the maturity of the market presents challenges:

- Sharp pricing with limited value opportunities in main markets

- Sophisticated competition among experienced bettors

- Increasingly specialized knowledge required for profitable betting

2. League of Legends (LoL)

League of Legends maintains its position as the second most popular esports betting title, accounting for 26% of all esports wagers in 2024. The multiplayer online battle arena (MOBA) game has leveraged its massive global following, structured regional leagues, and iconic international tournaments to develop a robust betting ecosystem.

Key Betting Metrics

- Betting Volume: 26% of esports bets in 2024

- Notable Events: World Championship (6.9M peak viewers), Mid-Season Invitational (3.2M peak viewers)

- Market Depth: Average tier-one match offers 50+ betting markets

- Regional Strength: Particularly dominant in South Korea and China

Why It Matters to Bettors

League of Legends offers a distinctive betting proposition through several unique characteristics:

Global Tournament Structure with Regional Leagues

Riot Games’ approach to esports includes structured regional leagues feeding into international competitions:

- Top-tier regional competitions (LPL, LCK, LEC, LCS)

- Mid-season international tournament (MSI)

- Year-culminating World Championship

- Emerging regional leagues in developing markets

This structure creates narratives and progression that bettors can follow throughout the year, with teams building toward major events that generate peak betting activity.

Diverse Betting Markets

League of Legends’ complex gameplay enables a wide variety of betting markets:

- Team-based outcomes (match winner, map winner)

- Objective-based props (first Baron, first Dragon, first tower)

- Player performance markets (kills, deaths, assists)

- Time-based propositions (game duration, first blood timing)

These markets allow bettors to express opinions on specific aspects of gameplay rather than simply predicting match outcomes.

Publisher Support and Game Stability

Riot Games’ active management of the competitive ecosystem provides several advantages for the betting market:

- Consistent gameplay updates with balanced competitive adjustments

- Professional league structures with franchising in major regions

- High production quality broadcasts with detailed statistics

- Long-term stability and publisher commitment to esports

“League of Legends benefits from having the most structured competitive ecosystem in esports,” notes esports consultant Marcus Thompson. “Riot’s franchising model creates stability that benefits betting operators by reducing team volatility and establishing consistent product quality.”

Betting Opportunities and Challenges

League of Legends presents distinct opportunities for bettors:

- Well-established statistical models for match prediction

- Regional knowledge advantages due to play style differences

- Deep markets for major tournaments with competitive odds

- Regular schedule of high-quality competitive play

Challenges include:

- Complex meta changes requiring constant adaptation

- Significant regional variations in game approach

- Limited transparency in lower-tier competitions

- Occasional market suspensions during technical issues

3. Valorant

Valorant has experienced explosive growth in the betting market, with a 175% year-over-year increase in betting volume during 2024. Riot Games’ tactical shooter has rapidly developed into the third most popular esports betting title, leveraging elements familiar to CS2 bettors while attracting a new generation of fans.

Key Betting Metrics

- Betting Growth: 175% YoY increase in betting volume (2024)

- Notable Events: Valorant Champions (1.4M peak viewers), VCT Masters (1.1M peak viewers)

- Market Expansion: Valorant Champions Tour (VCT) now includes leagues in Americas, EMEA, Pacific, and China

- Demographic Strength: Particularly popular among 18-24 year old bettors

Why It Matters to Bettors

Valorant’s rapid ascent in the betting world stems from several key factors:

Accessible Yet Deep Tactical Gameplay

Valorant combines familiar tactical shooter elements with character-based abilities:

- Round-based structure similar to CS2, creating natural betting units

- Character selection (Agents) adding strategic depth and variety

- Clearly defined attacking and defending phases

- Site-focused objectives with multiple strategic approaches

This structure makes Valorant easily understandable for bettors familiar with CS2 while offering additional strategic layers that create betting opportunities.

Riot Games’ Tournament Infrastructure

Building on their experience with League of Legends, Riot has quickly established a comprehensive competitive structure:

- International Valorant Champions Tour with regional qualifying paths

- Partnership program with established organizations

- Regular international LAN competitions

- Consistent broadcast product with high production values

“Valorant has benefited enormously from Riot’s experience in building League of Legends as an esport,” explains Thompson. “They’ve compressed what took years with LoL into an accelerated timeline for Valorant, quickly establishing competition structures that support betting activity.”

Strong Crossover Appeal

Valorant has successfully attracted bettors from multiple gaming communities:

- CS2 players and fans familiar with tactical shooter mechanics

- Overwatch players drawn to the hero-based abilities

- League of Legends fans following Riot’s new esports title

- Mobile gaming enthusiasts transitioning to PC esports

This crossover appeal has helped Valorant rapidly build betting liquidity that would typically take years to develop.

Betting Opportunities and Challenges

Valorant presents several advantages for bettors:

- Rapidly expanding market with ongoing operator investment

- Emerging statistical models still developing efficiency

- Strong correlation between team skill and outcomes

- Clear, accessible viewing experience for casual bettors

Challenges in the Valorant betting ecosystem include:

- Relatively limited historical data compared to established titles

- Evolving meta with regular agent and map adjustments

- Developing talent pipeline with team roster volatility

- Occasional technical challenges in online competitions

4. Dota 2

While Dota 2’s share of the esports betting market has declined from 14% in 2023 to 10% in 2024, it remains a significant force in betting due to its prestigious tournaments and passionate community. Valve’s MOBA title maintains a dedicated betting audience, particularly surrounding its marquee events with massive prize pools.

Key Betting Metrics

- Betting Share: 10% of esports bets in 2024

- Notable Events: The International ($40M+ prize pool), Riyadh Masters ($15M prize pool)

- Regional Strength: Particularly popular in Eastern Europe, Russia, China, and Southeast Asia

- Viewership Concentration: Extreme spikes during major tournaments

Why It Matters to Bettors

Despite its declining overall share, Dota 2 offers unique betting characteristics:

Tournament Prize Pools and Prestige

Dota 2’s crowdfunded tournament model has created unprecedented prize pools:

- The International consistently offers the largest prizes in esports

- Secondary events like Riyadh Masters feature substantial purses

- High stakes create intense competition and betting interest

- Concentrated betting volume during major events

These massive tournaments generate extreme betting volume concentration, with The International alone accounting for approximately 28% of annual Dota 2 betting activity.

Complex Meta and Draft Phase

Dota 2’s strategic depth creates unique betting opportunities:

- Hero draft phase offers specific pre-match betting markets

- Over 120 heroes create countless strategic combinations

- Item builds and timing windows provide specialized prop markets

- High skill ceiling creates potential for upsets and value opportunities

“Dota 2’s complexity is both its greatest strength and challenge from a betting perspective,” notes Rotstein. “The draft phase alone creates dozens of potential betting markets before the match even begins, but modeling these effectively requires exceptional game knowledge.”

Dedicated Core Audience

While smaller than some competitors, Dota 2’s audience shows remarkable characteristics:

- Higher average bet sizes than other esports titles

- Strong loyalty with multi-year betting histories

- Greater willingness to bet on secondary and tertiary tournaments

- Higher proportion of sophisticated, model-driven bettors

Betting Opportunities and Challenges

Dota 2 presents distinct opportunities for knowledgeable bettors:

- Specialized knowledge can provide significant edges

- Draft phase betting offers unique pre-match opportunities

- Regional specialization can reveal value in international matchups

- High liquidity during major tournaments

Challenges in Dota 2 betting include:

- Increasingly top-heavy tournament schedule

- Complex gameplay requiring substantial knowledge

- Occasional dramatic meta shifts following patches

- Declining casual interest outside major events

5. Mobile Legends: Bang Bang (MLBB)

Mobile Legends: Bang Bang represents the vanguard of mobile esports betting, particularly in Southeast Asia where it has become a cultural phenomenon. With 105 million monthly active players, this mobile MOBA has developed a robust betting ecosystem that caters specifically to emerging markets where smartphone penetration exceeds PC gaming.

Key Betting Metrics

- Player Base: 105M monthly active players

- Regional Dominance: Market leader in Indonesia, Philippines, Malaysia, and Thailand

- Tournament Structure: Mobile Legends Professional League (MPL) operates across multiple regions

- Betting Integration: Optimized for mobile-first betting platforms

Why It Matters to Bettors

MLBB has pioneered several important developments in the esports betting ecosystem:

Mobile-First Esports and Betting Integration

The integration between mobile gaming and mobile betting creates a seamless ecosystem:

- Single-device experience for both watching and betting

- Optimized mobile betting interfaces (BetVision, 96.com)

- Micro-transaction payment methods familiar to mobile gamers

- Reduced friction between entertainment and betting activities

This mobile-centric approach has dramatically expanded betting accessibility in regions with limited PC gaming infrastructure.

Regional League Structure with Local Heroes

The MPL tournament structure has created strong regional narratives:

- Country-specific professional leagues (Indonesia, Philippines, Malaysia, Singapore)

- Regional champions advancing to international competitions

- Local stars becoming national celebrities

- Strong national identity and rivalry dynamics

“Mobile Legends has succeeded by building nationalist competitive narratives similar to traditional sports,” explains Chen. “The Philippines vs. Indonesia rivalry in MLBB generates betting interest comparable to traditional sports derbies in these countries.”

Accessibility and Viewers-to-Bettors Conversion

MLBB has achieved remarkably high conversion from viewers to bettors in its core markets:

- Simplified gameplay compared to PC MOBAs

- Lower barriers to entry for both players and viewers

- Cultural integration in key Southeast Asian markets

- Strategic depth sufficient to support diverse betting markets

Betting Opportunities and Challenges

MLBB offers several unique betting propositions:

- Rapidly growing market with expanding betting options

- Regional knowledge can provide significant advantages

- Emerging statistical modeling with market inefficiencies

- Integration with local payment systems in Southeast Asia

Challenges for the MLBB betting ecosystem include:

- Limited global appeal outside core Asian markets

- Relatively smaller average bet sizes than PC titles

- Potential regulatory challenges in key markets

- Tournament integrity concerns in smaller competitions

6. Call of Duty League (CDL)

The Call of Duty League represents one of the most successful examples of a franchised esports competition with strong betting integration. Focusing on the latest title in the franchise, Black Ops 6, the CDL has developed a North American-centric betting ecosystem that benefits from the game’s massive casual player base and mainstream recognition.

Key Betting Metrics

- Structure: 12 franchised teams competing in seasonal format

- Notable Events: CDL Championship ($2M prize pool), Major tournaments ($500K prize pools)

- Regional Focus: 70% of CDL bets originate from the U.S.

- Demographic: Strong appeal to 21-35 age bracket with console gaming background

Why It Matters to Bettors

The CDL offers several distinctive characteristics as a betting proposition:

Franchised League Structure with Mainstream Appeal

The CDL’s approach mirrors traditional sports in several key aspects:

- City-based franchises with established brands

- Regular season leading to playoff structure

- Consistent team rosters with recognized stars

- Professional broadcasts with sophisticated production

This structure has helped attract traditional sports bettors seeking familiar formats in the esports space.

Fast-Paced, Accessible Gameplay

Call of Duty’s gameplay offers natural betting opportunities:

- Multiple game modes (Hardpoint, Search and Destroy, Control)

- Quick rounds with rapid-fire betting opportunities

- Easily understandable objectives for casual viewers

- Momentum swings creating live betting volatility

“The variety of game modes in CDL matches creates natural parlay opportunities,” notes Rotstein. “Bettors can leverage specific team strengths across different modes, similar to betting on different quarters or periods in traditional sports.”

North American Legal Betting Integration

The CDL has benefited from expanding U.S. sports betting legislation:

- Strong presence in key regulated states (New Jersey, Pennsylvania, Michigan)

- Integration with major U.S. sportsbooks (DraftKings, FanDuel, BetMGM)

- Crossover marketing with traditional sports franchises

- Broadcast partnerships incorporating betting content

Betting Opportunities and Challenges

CDL betting offers several opportunities:

- Strong connection to U.S. regulated betting market

- Familiar format for traditional sports bettors

- Regular schedule with consistent competition

- Media coverage providing market-relevant information

Challenges include:

- Annual game changes affecting competitive balance

- Limited international appeal outside North America

- Smaller overall player base compared to top PC titles

- Relatively short competitive season

7. Fortnite

Fortnite has established itself as the premier battle royale title for esports betting, leveraging its massive player base and cultural relevance into a growing betting market. While its overall share remains smaller than the leading titles, Fortnite’s distinctive format and high-profile events draw substantial betting interest, particularly for marquee tournaments.

Key Betting Metrics

- Notable Events: Esports World Cup 2025 ($1M prize pool), FNCS Invitationals, Global Championship

- Format Variety: Solo, duo, and squad competitions with different betting dynamics

- Viewer Demographics: Youngest average viewer age among major betting titles

- Content Integration: Strong connection between streamers and competitive scene

Why It Matters to Bettors

Fortnite’s battle royale format creates unique betting opportunities:

Battle Royale Format Enables Diverse Markets

The last-player-standing format supports specialized betting options:

- Outright winner markets (solo, duo, squad formats)

- Placement betting (top 5, top 10, etc.)

- Elimination totals (over/under formats)

- Head-to-head player matchups independent of overall results

This variety allows bettors to focus on specific aspects of performance rather than simply picking winners in a field of 100 competitors.

Cross-Platform Competition

Fortnite’s cross-platform capabilities expand the competitive ecosystem:

- PC, console, and mobile players in unified competitions

- Platform-specific betting markets available on some books

- Varied play styles creating diverse competitive approaches

- Accessibility expanding the potential talent pool

Cultural Relevance and Celebrity Integration

Fortnite’s position as a cultural phenomenon impacts its betting appeal:

- Mainstream recognition extending beyond gaming audiences

- Celebrity participants in showcase events

- Crossover appeal to traditional sports fans

- Strong connection to youth culture

“Fortnite has succeeded in creating tentpole events that attract casual betting interest similar to major sporting events,” explains Thompson. “The Esports World Cup functions as Fortnite’s equivalent to a Super Bowl, drawing bettors who might not engage with regular competitive play.”

Betting Opportunities and Challenges

Fortnite presents several unique betting propositions:

- High-variance format creating potential value opportunities

- Player-centric betting markets independent of team results

- Strong streaming integration providing market information

- Growing integration with U.S. regulated betting

Challenges in the Fortnite betting ecosystem include:

- Complexity of tracking 100-player competitions

- Significant element of randomness in battle royale format

- Irregular competitive calendar compared to league-based titles

- Format and rule changes between major tournaments

Emerging Titles to Watch

Beyond the established betting leaders, several emerging titles show significant potential for growth in the betting ecosystem. These games are developing the tournament structures, viewership, and competitive depth needed to support robust betting markets.

PUBG Mobile

PUBG Mobile has established itself as a dominant force in mobile esports, particularly in South Asia, the Middle East, and North Africa (MENA) regions. The game’s battle royale format translates well to mobile devices, and its competitive scene has developed substantial infrastructure.

Key Growth Indicators:

- PMGC 2025 (PUBG Mobile Global Championship) expected to draw 2M+ concurrent viewers

- Exponential growth in India following regulatory changes

- Strong integration with local payment systems in developing markets

- Increasing sponsor investment in professional teams and tournaments

“PUBG Mobile has essentially created the mobile esports ecosystem in India and the MENA region,” notes Chen. “Its betting volume in these regions already rivals some established PC titles globally, with substantial room for continued growth.”

Arena of Valor (Honor of Kings)

Arena of Valor (known as Honor of Kings in China) represents one of the world’s most financially successful mobile games, with a particularly dominant position in the Chinese market. Its competitive scene is now expanding internationally, bringing its massive Chinese audience with it.

Key Growth Indicators:

- Integration within Tencent’s extensive gaming and betting ecosystem

- International expansion through AoV International Championship (AIC)

- Server merger between Thai and Vietnamese regions creating larger competitive pool

- Consistent technical and content updates maintaining player interest

The game’s primary betting limitation remains its geographic concentration, with over 90% of its player base located in China. However, international expansion efforts could significantly extend its betting relevance.

Rocket League

Rocket League’s unique “car soccer” concept has created a distinctive niche in the esports ecosystem. The game’s accessibility and visual clarity make it easily understandable for new viewers while maintaining sufficient depth for competitive play and betting engagement.

Key Growth Indicators:

- RLCS restructuring creating more consistent competition

- Growing European betting volume with specialized markets

- Expansion of 3v3, 2v2, and 1v1 competitive formats

- Cross-platform play expanding the player base

“Rocket League offers perhaps the lowest barrier to entry for viewer understanding in all of esports,” explains Thompson. “The core concept – put the ball in the opponent’s goal – is instantly recognizable to anyone who’s watched traditional sports, creating natural crossover appeal for sports bettors.”

Challenges and Considerations

Despite the remarkable growth of esports betting, several significant challenges confront the industry as it continues to mature. Addressing these issues will be crucial for long-term sustainable development.

Regulatory Scrutiny and Compliance

The esports betting industry faces increasing regulatory attention following several high-profile integrity incidents:

- The 2024 CS2 match-fixing investigation implicated players from multiple tier-two teams

- Mobile esports in Southeast Asia has faced persistent allegations of match manipulation

- Underage betting concerns have prompted stricter age verification requirements

- Gray market operators continue to target regulated markets without proper licensing

“Regulatory compliance represents both a challenge and opportunity,” notes gambling compliance expert Jennifer Harris. “Operators that invest in robust compliance systems gain competitive advantages through market access, while those cutting corners face increasing enforcement risks.”

Responsible Gambling Concerns

The demographic profile of esports bettors – skewing younger than traditional sports bettors – raises specific responsible gambling considerations:

- 33% of esports fans report avoiding betting due to lack of understanding of odds and markets

- First-time gambling experiences often occur through esports for younger adults

- Game mechanics and betting can blur in certain formats

- Traditional responsible gambling messaging may not resonate with esports audiences

Industry initiatives to address these concerns include specialized esports-focused responsible gambling programs, tailored educational content, and improved age verification technologies.

Regional Restrictions and Market Access

The global nature of esports contrasts with the fragmented regulatory framework for betting:

- Major esports markets like South Korea maintain strict gambling prohibitions

- Indian states have varying approaches to skill-based gaming and betting

- China’s complex regulatory environment limits official betting despite massive viewership

- Brazil’s recently regulated market creates new opportunities alongside compliance challenges

Navigating these regional variations requires sophisticated legal expertise and often necessitates market-specific business models and partnerships.

Conclusion: The Future of Esports Betting

As the esports betting market continues its trajectory toward $3.5 billion by 2029, several clear trends emerge regarding which titles will shape its future development. Counter-Strike 2, League of Legends, and Valorant will likely maintain their dominant positions, collectively accounting for over 80% of betting volume through their combination of stable competitive ecosystems, publisher support, and betting-friendly game mechanics.

Mobile titles, led by Mobile Legends: Bang Bang and emerging contenders like PUBG Mobile, will increasingly define betting activity in developing markets across Southeast Asia, India, and the MENA region. These games leverage smartphone penetration to reach audiences without access to traditional PC gaming infrastructure, creating new betting markets in regions underserved by conventional operators.

The integration of cryptocurrency and blockchain technology will continue to influence esports betting, with titles having tech-savvy audiences like CS2 and Valorant leading adoption. These technologies offer potential solutions to cross-border transactions, payment processing challenges, and betting market transparency.

For established betting operators, understanding the nuances of these games and their unique audience characteristics will be crucial for successful market entry and growth. Each title presents distinctive opportunities and challenges, requiring specialized knowledge rather than generic approaches to esports as a monolithic category.

References

- Esports Charts. (2025). “Top Games by Peak Viewers.”

- Pley.gg. (2025). “The Rise of Esports Betting and Its Growing Popularity.”

- SIGMA World. (2025). “The Explosive Growth of Esports Betting.”

- EGamers World. (2025). “Esports Betting Trends and Predictions for 2025.”

- Esports Insider. (2025). “Esports Betting Statistics 2025.”

Related Pages

Join Our Telegram channel to stay up to date on breaking news coverage

-

Fashion3 weeks ago

Fashion3 weeks agoHow to watch Avalanche vs. Stars Game 7 FREE stream today

-

High School Sports2 weeks ago

High School Sports2 weeks agoWeb exclusive

-

Sports2 weeks ago

Sports2 weeks agoPrinceton University

-

Sports2 weeks ago

Sports2 weeks ago2025 NCAA softball bracket: Women’s College World Series scores, schedule

-

Motorsports2 weeks ago

Motorsports2 weeks agoBowman Gray is the site of NASCAR’S “Advance Auto Parts Night at the Races” this Saturday

-

NIL2 weeks ago

NIL2 weeks ago2025 Big Ten Softball Tournament Bracket: Updated matchups, scores, schedule

-

NIL2 weeks ago

NIL2 weeks agoPatty Gasso confirms Sophia Bordi will not finish season with Oklahoma softball

-

Motorsports2 weeks ago

Motorsports2 weeks agoMOTORSPORTS: Three local track set to open this week | Sports

-

Motorsports2 weeks ago

Motorsports2 weeks ago$1.5 Billion Legal Powerhouse Announces Multi-Year NASCAR Deal With Kyle Busch

-

Sports2 weeks ago

Sports2 weeks agoUSA Volleyball Announces 2025 Women’s VNL Roster