Report Overview

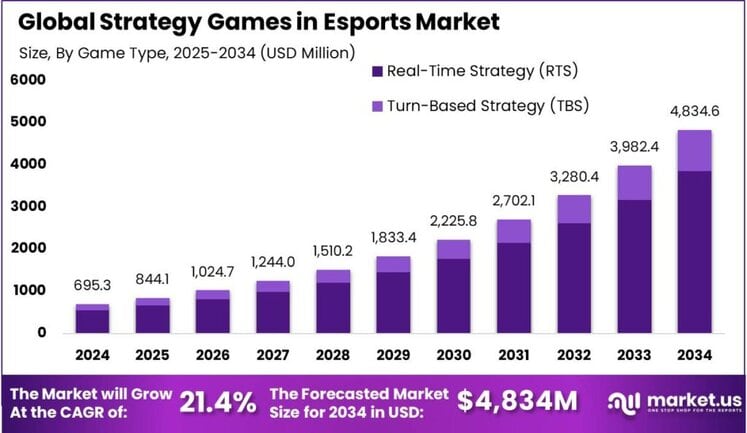

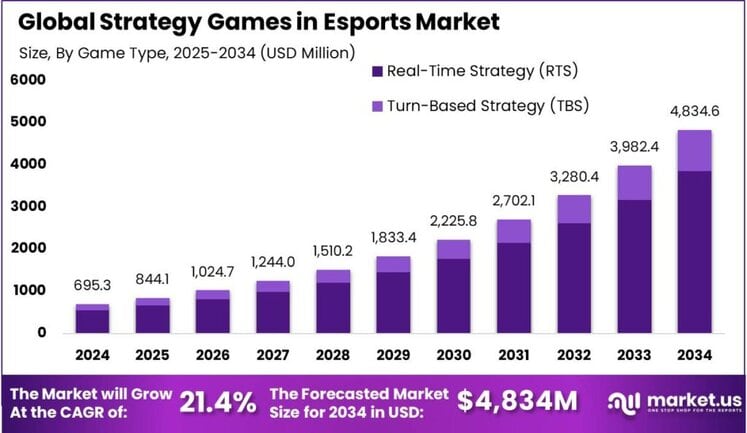

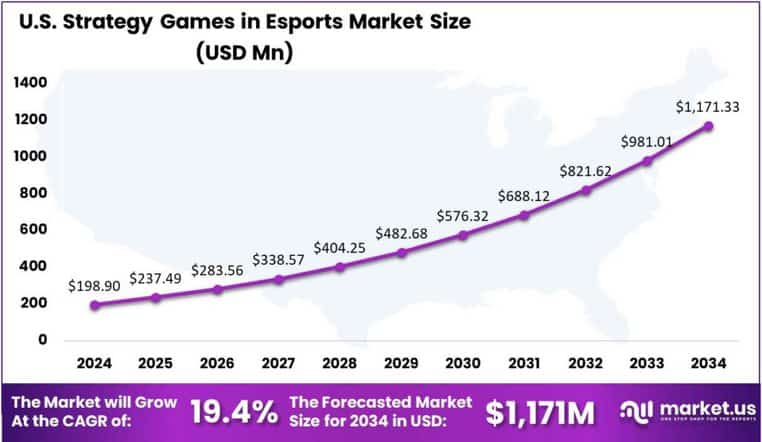

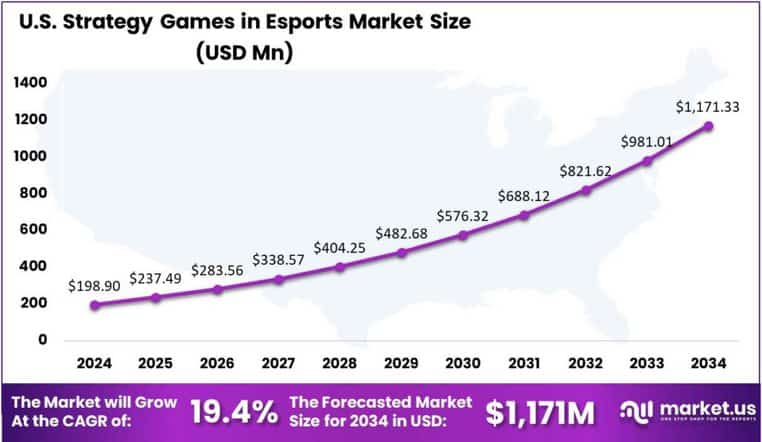

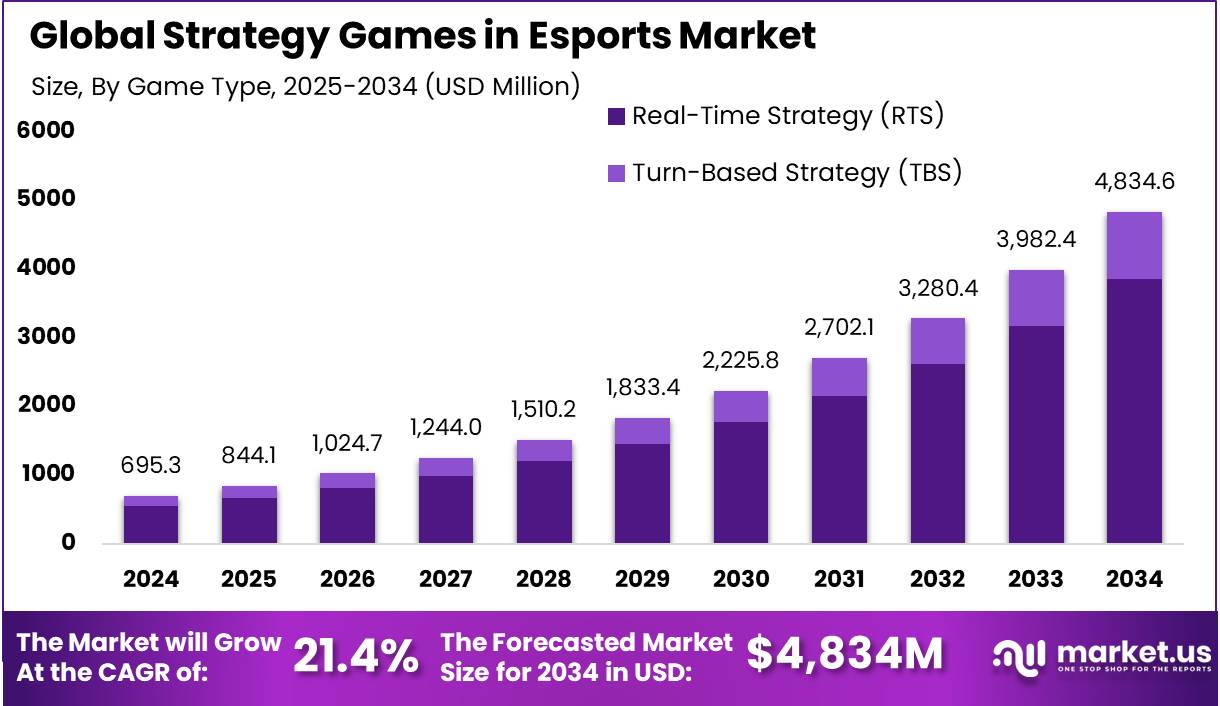

The Global Strategy Games in Esports Market size is expected to be worth around USD 4,834 Million By 2034, from USD 695.3 Million in 2024, growing at a CAGR of 21.40% during the forecast period from 2025 to 2034. In 2024, North America dominated the global strategy games esports market with over 31.8% share and around USD 221 million in revenue. The U.S. market was valued at USD 198.9 million and is projected to grow at a 19.4% CAGR.

The strategy games segment within the esports market has experienced significant growth, driven by the increasing popularity of competitive gaming and the rise of online streaming platforms. Several key factors are driving the demand for strategy games within the esports sector. The rise of live streaming platforms has broadened access and engagement, allowing fans to watch and learn from top-tier gameplay.

Technological advancements are playing a pivotal role in the evolution of strategy games in esports. The adoption of AR and VR technologies is creating more immersive and interactive gaming experiences, attracting a broader audience and offering new avenues for engagement. Furthermore, the integration of artificial intelligence is enhancing gameplay by providing more sophisticated and adaptive opponents, thereby increasing the challenge and appeal of strategy games .

The strategy esports segment offers growth opportunities through educational partnerships, cognitive-focused sponsorships, and regional tournaments. Hybrid formats mixing turn-based and real-time play are gaining interest. Developers can create scalable, viewer-friendly multiplayer modes for pro leagues. Mobile strategy games like Clash of Clans also help connect casual and competitive players.

According to the findings from Market.us, The global esports market is projected to witness robust expansion, reaching a value of USD 16.7 billion by 2033, registering an impressive compound annual growth rate of 21.9% during the forecast period from 2024 to 2033.

Investment opportunities in strategy esports are growing, driven by rising sponsorships, advertising, and media rights. Teams and organizations attract funding through tournament winnings, merchandise, and brand deals. The development of esports arenas and training facilities highlights industry commitment to talent growth and infrastructure expansion.

Businesses in strategy esports gain strong brand exposure and access to diverse, dedicated audiences. Partnering with teams and events creates unique marketing opportunities to reach younger, tech-savvy consumers. The interactive nature of esports also supports real-time engagement, boosting brand loyalty and community growth.

Key Takeaways

- The Global Strategy Games in Esports Market size is expected to reach around USD 4,834 million by 2034, up from USD 695.3 million in 2024, growing at a CAGR of 21.40% between 2025 and 2034.

- In 2024, the Real-Time Strategy (RTS) segment dominated the market, capturing more than 79.6% share of the Strategy Games in Esports market.

- The Sponsorships segment held a leading position in 2024, accounting for over 39.7% share of the global Strategy Games in Esports market.

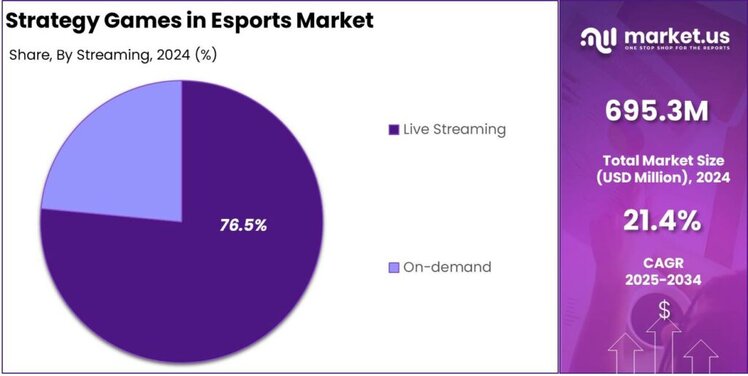

- The Live Streaming segment dominated the market in 2024, with a share exceeding 76.5% in the Strategy Games in Esports market.

- In 2024, North America held a dominant position, capturing more than 31.8% of the market share and generating approximately USD 221 million in revenue within the global strategy games segment of esports.

- The U.S. Strategy Games in Esports Market was valued at about USD 198.9 million in 2024 and is expected to grow at a strong CAGR of 19.4%.

U.S. Market Leadership

In 2024, the U.S. Strategy Games in Esports Market was valued at approximately USD 198.9 million, underscoring a significant position within the broader competitive gaming landscape. Strategy games, which require critical thinking, tactical planning, and real-time decision-making, have gained substantial traction among esports audiences and players.

The market is projected to grow at a robust compound annual growth rate (CAGR) of 19.4% during the forecast period, driven by increasing investments in esports infrastructure, growing sponsorship deals, and the rising popularity of multiplayer online battle arenas (MOBAs) and real-time strategy (RTS) games.

Additionally, the expansion of collegiate esports programs and the integration of esports in high schools are nurturing a new generation of strategic game players and fans, boosting grassroots engagement across the country.

In 2024, North America held a dominant position in the global strategy games segment of the esports market, capturing over 31.8% of the market share and generating approximately USD 221 million in revenue. This leadership is attributed to a robust esports infrastructure, high internet penetration, and a large, engaged audience base.

The U.S. plays a key role in esports growth, driven by a large gamer base and strong tech innovation. Major players like Activision Blizzard and Riot Games boost the market through investments in platforms and tournaments. High-tech training centers and growing esports programs further fuel demand for infrastructure and services.

Moreover, the North American market benefits from a diverse revenue stream, including sponsorships, advertising, media rights, and merchandise sales. Sponsorship is the top revenue source in North American esports, while media rights are growing fastest, highlighting the rising value of competitive gaming broadcasts. This strong monetization reflects the region’s mature and advanced market landscape.

North America’s esports market is expected to maintain its leading position, driven by continuous technological advancements, strategic investments by key players, and a growing base of engaged gamers and viewers. The region’s commitment to fostering a supportive environment for esports will likely sustain its growth trajectory and influence in the global market.

Game Type Analysis

In 2024, the Real-Time Strategy (RTS) segment held a dominant market position, capturing more than a 79.6% share of the Strategy Games in Esports market. This dominance can be attributed to the immersive, high-stakes nature of RTS games, which demand real-time decision-making, fast reflexes, and deep tactical planning.

RTS games are favored in esports due to their scalable tournament formats and strong streaming compatibility. Their fast-paced, real-time action offers engaging viewing experiences and shorter matches, allowing more games per event. These factors boost RTS games’ commercial appeal, content potential, and sponsorship opportunities.

Technological advances in game engines and AI have enhanced competitive balance and fairness in RTS games, ensuring smoother gameplay with less lag. Improved spectator modes and in-game analytics also help broadcasters explain complex strategies, increasing their appeal to esports fans and analysts.

Turn-Based Strategy (TBS) games have seen slower esports growth due to longer matches and less viewer engagement. Although titles like Civilization and XCOM have loyal fans, they’re better suited for casual or single-player play and lack the fast-paced tension needed for competitive tournaments. Therefore, RTS games are expected to stay dominant, thanks to their speed, depth, and wide appeal.

Revenue Stream Analysis

In 2024, the Sponsorships segment held a dominant market position, capturing more than a 39.7% share of the global Strategy Games in Esports market. This leadership can be attributed to the strong involvement of major gaming brands, tech companies, and non-endemic sponsors aiming to gain visibility among a young and digitally engaged audience.

The growing popularity of real-time strategy and multiplayer online battle arena (MOBA) games has made sponsorships more attractive due to the high engagement levels among viewers. Companies across hardware, software, telecom, and even food and beverage industries are increasingly investing in brand placements, logo integration, and exclusive content collaborations during live events.

Sponsorships thrive in esports due to its global reach and scalability. Live streams on platforms like Twitch and YouTube offer sponsors international exposure and targeted marketing. Data-driven tools track engagement and ROI in real time, boosting confidence in partnerships. Collaborations also enable in-game branding, expanding traditional advertising methods.

Esports’ growing credibility and mainstream recognition have attracted bigger budgets from traditional sponsors. As strategy games develop professional leagues and franchises, sponsorship models are maturing. Long-term partnerships between teams and brands now resemble traditional sports, signaling strong, sustained growth for esports sponsorships.

Streaming Analysis

In 2024, Live Streaming segment held a dominant market position, capturing more than a 76.5% share in the Strategy Games in Esports Market. This dominance can be attributed to the immersive and real-time viewing experience offered by live broadcasts, which significantly enhances audience engagement.

Live streaming allows fans to witness esports competitions as they unfold, creating a dynamic environment that mimics traditional sports viewership. The interactive elements such as live chat, audience polls, and instant reactions further amplify viewer involvement, making it a preferred choice among esports audiences globally.

The widespread popularity of streaming platforms such as Twitch, YouTube Gaming, and Facebook Gaming has contributed to the rising preference for live streaming. These platforms have heavily invested in infrastructure and monetization features that support high-quality live broadcasts, fostering an ecosystem that benefits both streamers and viewers.

Moreover, the live streaming model supports diverse monetization avenues including subscriptions, donations, sponsorships, and real-time advertisements. Tournament organizers and professional players are able to generate sustainable revenue through live viewer contributions and partnerships with brands seeking real-time visibility.

Key Market Segments

By Game Type

- Real-Time Strategy (RTS)

- Turn-Based Strategy (TBS)

By Revenue Stream

- Sponsorships

- Advertising

- Merchandise & Tickets

- Publisher Fees

- Media Rights

By Streaming

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Cognitive Engagement and Skill Mastery

The primary driver propelling strategy games in esports is their demand for high-level cognitive engagement and skill mastery. These games challenge players to think critically, plan strategically, and execute decisions under pressure, fostering a competitive environment that rewards mental acuity and adaptability.

The complexity inherent in strategy games cultivates a dedicated player base that values the depth and learning curve these games offer. This depth not only enhances player satisfaction but also enriches the viewing experience, as audiences appreciate the nuanced strategies and tactical plays exhibited during competitions.

Restraint

Accessibility and Learning Curve

Despite their strengths, strategy games face the restraint of accessibility due to their steep learning curves. The intricate mechanics and complex systems can be daunting for new players, potentially limiting the genre’s growth and inclusivity. This barrier to entry may deter casual gamers who are unwilling or unable to invest the time required to achieve proficiency.

Furthermore, the complexity can also impact spectator engagement, as understanding the nuances of gameplay may require a certain level of familiarity with the game. This limits audience growth beyond core fans. To address it, developers and organizers should add better tutorials and viewer-friendly features to make the game more accessible.

Opportunity

Integration of Educational and Professional Development

An emerging opportunity for strategy games in esports lies in their integration into educational and professional development contexts. The skills honed through playing strategy games such as critical thinking, resource management, and strategic planning are transferable to various real-world scenarios.

Educational institutions and corporate training programs can leverage these games as tools for developing problem-solving abilities and teamwork among students and employees. By positioning strategy games as platforms for skill development, the esports industry can tap into new markets and audiences, fostering broader acceptance and support for the genre.

Challenge

Balancing Competitive Integrity and Entertainment

A significant challenge facing strategy games in esports is maintaining a balance between competitive integrity and entertainment value. While the strategic depth of these games is a core appeal, it can also lead to gameplay that is less visually dynamic compared to other genres, potentially affecting spectator engagement.

Ensuring that matches remain exciting and accessible to viewers without compromising the strategic complexity requires careful game design and presentation. This involves creating spectator modes that spotlight key moments and offering commentary that explains players’ tactics. Balancing depth and accessibility is key to keeping core fans engaged while attracting new viewers.

Emerging Trends

Strategy games are becoming more prominent in esports, signaling a shift toward intellectually engaging gameplay. With a focus on planning, resource management, and tactical decisions, they attract players who enjoy complex problem-solving. The growth of mobile strategy games has also broadened the audience, making esports more accessible to a wider demographic.

AI is playing a growing role in strategy games, offering adaptive challenges, personalized experiences, and performance insights to support player improvement. At the same time, “phygital” sports are merging physical and digital elements, creating innovative hybrid competitions that blend traditional sports with esports.

The esports industry is also witnessing a surge in community-driven content, with players and fans contributing to game development and strategy discussions. This collaborative environment encourages innovation and keeps the gaming experience dynamic and engaging .

Business Benefits

Investing in strategy games within the esports sector offers several advantages for businesses. These games attract a dedicated and intellectually engaged audience, providing a platform for brands to connect with consumers who value strategic thinking and problem-solving. Sponsorships and partnerships in this space can enhance brand perception and loyalty.

The educational potential of strategy games is another avenue for business growth. By supporting initiatives that integrate esports into educational programs, companies can contribute to skill development in areas such as critical thinking, teamwork, and digital literacy.

Furthermore, the data generated from strategy games can provide valuable insights into consumer behavior and preferences. Analyzing gameplay patterns and engagement metrics allows businesses to tailor their products and marketing strategies effectively. This data-driven approach can lead to more targeted campaigns and improved customer experiences.

Key Player Analysis

Strategy games play a key role in esports, challenging players’ thinking and decision-making skills. Leading companies like Riot Games, Valve, and Blizzard drive success through innovation and by setting high industry standards. Riot Games is the creator of League of Legends, one of the most watched esports titles in the world. Riot is a leading esports company known for high-quality tournaments and strong community engagement, creating a sustainable global model in strategy esports.

Valve Corporation is best known in the strategy esports world for Dota 2. Valve has set records with crowd-funded prize pools, especially through The International. Its strength is empowering players and fans, using an open tournament model that lets third parties host events, boosting the game’s longevity despite a more hands-off approach than Riot.

Blizzard Entertainment brought strategy gaming to esports with classics like StarCraft and StarCraft II. These games were especially popular in South Korea and helped shape the early days of competitive gaming. Blizzard’s deep, balanced games have kept its titles relevant for years. Though its esports presence has slowed recently, Blizzard’s role in shaping modern strategy esports is unmatched.

Top Key Players in the Market

- Riot Games

- Valve Corporation

- Blizzard Entertainment

- Tencent Games

- Epic Games

- Supercell

- Nintendo

- Microsoft Studios

- Paradox Interactive

- Ubisoft Entertainment

- Gfinity Esports

- ESL FACEIT Group

- Others

Top Opportunities for Players

The strategy games segment within the esports industry is experiencing notable growth, presenting several opportunities for players and industry stakeholders.

- Expansion of Competitive Platforms: The increasing popularity of esports has led to a surge in competitive platforms dedicated to strategy games. This expansion provides players with more avenues to showcase their skills and for organizers to host diverse tournaments. The rise in competitive gaming is a significant driver for the strategy games market.

- Integration of Advanced Technologies: Advancements in artificial intelligence and real-time analytics are being integrated into strategy games, enhancing gameplay and spectator experience. These technologies offer players tools for performance analysis and provide audiences with deeper insights into game strategies.

- Growth in Mobile Strategy Gaming: The proliferation of smartphones has made strategy games more accessible, leading to a growing mobile gaming segment. This trend allows players to engage in competitive gaming on-the-go and opens up new markets for developers and advertisers. The mobile gaming sector is a significant contributor to the overall growth of esports.

- Emergence of Educational and Training Programs: Educational institutions and training programs are increasingly incorporating esports, particularly strategy games, into their curricula. This development provides players with structured pathways to develop their skills and pursue careers in esports.

- Diversification of Revenue Streams: The esports industry is witnessing diversification in revenue streams, including sponsorships, media rights, and merchandise sales. Strategy games, with their dedicated fan bases, are well-positioned to capitalize on these opportunities, benefiting players, teams, and organizers alike.

Recent Developments

- In March 2024, Riot Games introduced a new business model for its League of Legends esports leagues (LCS, LEC, LCK) to provide more predictable revenues for teams. This model includes financial incentives tied to in-game digital items, aiming to reflect the support of LoL Esports fans globally.

- In January 2024, Blizzard and ESL FACEIT Group (EFG) signed a multi-year exclusive esports deal to launch the Overwatch Champions Series (OWCS). This aims to create a more open and inclusive competitive ecosystem, giving more opportunities for players to become professionals and introducing new community platforms for Overwatch 2 esports.

Report Scope

Stephen A.

Stephen A.