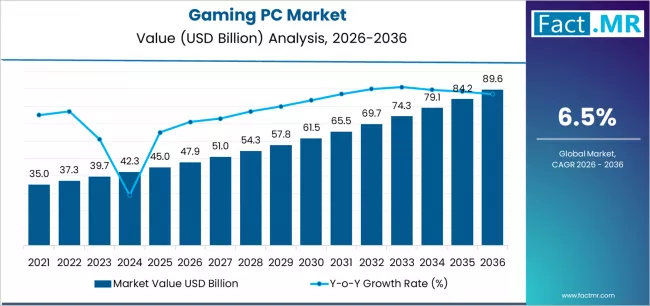

Gaming PC Market Forecast and Outlook 2026 to 2036

The global gaming PC market is valued at USD 47.9 billion in 2026 and is projected to reach USD 89.6 billion by 2036, reflecting an absolute increase of USD 41.7 billion. This represents total growth of 87.1%, with the market expanding at a CAGR of 6.5% over the forecast period.

Growth is driven by rising demand for high-performance gaming systems, increasing esports participation, and growing requirements for advanced gaming experiences across competitive gaming, content creation, and virtual reality applications.

Quick Stats for Gaming PC Market

- Gaming PC Market Value (2026): USD 47.9 billion

- Gaming PC Market Forecast Value (2036): USD 89.6 billion

- Gaming PC Market Forecast CAGR: 6.5%

- Leading System Type in Gaming PC Market: Desktop Gaming PCs (72.3%)

- Key Growth Regions in Gaming PC Market: Asia Pacific, North America, Europe

- Key Players in Gaming PC Market: Dell Technologies Incorporated, Hewlett-Packard Inc., ASUSTeK Computer Inc., Micro-Star International Co. Ltd., Corsair Gaming Incorporated

Desktop gaming PCs are expected to account for 72.3% of market share in 2026, supported by their superior performance capabilities, upgrade flexibility, and thermal management advantages. Competitive gaming applications are projected to hold 48.7% share, driven by demand for high refresh rates, low-latency processing, and stable performance in professional esports and streaming environments.

Between 2026 and 2030, the market is forecast to grow to USD 65.8 billion, contributing 42.9% of total decade growth, supported by advancing hardware standards and immersive gaming demand. From 2030 to 2036, expansion to USD 89.6 billion will be driven by AI-integrated systems, cloud-gaming hybrids, and expanding virtual reality and content creation ecosystems.

Gaming PC Market Key Takeaways

| Metric |

Value |

| Estimated Value in (2026E) |

USD 47.9 billion |

| Forecast Value in (2036F) |

USD 89.6 billion |

| Forecast CAGR (2026 to 2036) |

6.5% |

Category

| Category |

Segments |

| System Type |

Desktop Gaming PCs; Gaming Laptops; Mini Gaming PCs; Workstation Gaming Systems; Other System Configurations |

| Application |

Competitive Gaming; Content Creation; Virtual Reality Gaming; Casual Gaming; Others |

| End-User |

Individual Gamers; Esports Organizations; Content Creators; Gaming Cafes; Others |

| Price Range |

Entry-Level Systems; Mid-Range Systems; High-End Systems; Premium Configurations |

| Region |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Segmental Analysis

By System Type, Which Segment Holds the Dominant Market Share?

Desktop gaming PCs are projected to account for 72.3% of the gaming PC market in 2026, maintaining clear dominance. This reflects their higher processing capability, graphics performance, and upgrade flexibility compared with portable systems. Compatibility with advanced GPUs, cooling solutions, and peripheral ecosystems continues to support adoption among enthusiasts and competitive players.

By Application, Which Segment Registers the Highest Share?

Competitive gaming applications are projected to represent 48.7% of market demand in 2026, driven by the growth of esports and performance-intensive gaming formats. Professional and semi-professional players require stable frame rates, low latency, and hardware customization, reinforcing demand for high-performance gaming PCs. Ongoing improvements in gaming engines and competitive platforms are expected to sustain this segment’s leading position.

What are the Drivers, Restraints, and Key Trends of the Gaming PC Market?

The gaming PC market is expanding due to rising adoption of competitive gaming, growth of esports ecosystems, and increasing demand for high-performance systems across entertainment and professional use cases. Gamers and content creators require powerful hardware to support high frame rates, advanced graphics, and simultaneous gameplay and streaming. However, market growth is restrained by competition from gaming consoles, price sensitivity among mainstream consumers, and the technical complexity associated with system configuration, upgrades, and maintenance.

A key trend shaping the market is the deeper integration of gaming PCs into esports and content creation workflows. Systems are increasingly optimized for competitive play, live streaming, and video production, supporting stable performance and real-time content delivery. Another major trend is the adoption of ray tracing and AI-enhanced technologies. These innovations improve visual realism, optimize system performance, and enable advanced gaming features, strengthening the appeal of gaming PCs among enthusiasts seeking immersive and high-fidelity gaming experiences.

Analysis of the Gaming PC Market by Key Countries

| Country |

CAGR (2026-2036) |

| China |

8.2% |

| USA |

6.8% |

| South Korea |

7.1% |

| Germany |

5.9% |

| Japan |

6.3% |

| UK |

5.7% |

| India |

9.4% |

How are E-sports Expansion and Demographic Momentum Driving India’s Market Leadership?

India’s gaming PC market is projected to grow at a CAGR of 9.4% through 2036, supported by a rapidly expanding gaming population, strong youth demographics, and increasing focus on e-sports development. Rising participation in competitive gaming and greater affordability of high-performance hardware are strengthening demand across urban gaming hubs. Manufacturers and distributors are expanding retail, customization, and after-sales capabilities to address growing performance expectations.

- Growth in e-sports participation and gaming communities is accelerating gaming PC adoption across metropolitan regions.

- Demographic advantages and rising technology adoption are supporting demand for premium performance-oriented systems.

Why is E-sports Infrastructure Investment Strengthening China’s Market Potential?

China’s gaming PC market is expanding at a CAGR of 8.2%, driven by sustained investment in e-sports infrastructure, competitive gaming awareness, and high consumer focus on performance hardware. Growth in professional gaming leagues and streaming platforms is reinforcing demand for advanced gaming systems. Suppliers are scaling distribution and service networks to support high-volume demand.

- Expansion of e-sports ecosystems is sustaining demand for high-performance gaming PCs.

- Advancements in gaming hardware technology support adoption among competitive users.

How do Mature E-sports Standards Support Expansion in South Korea?

South Korea’s gaming PC market is projected to grow at a CAGR of 7.1% through 2036, supported by its established e-sports culture, structured competitive frameworks, and leadership in gaming technology. Competitive precision and system reliability remain key purchase criteria across professional and enthusiast segments.

- Mature competitive gaming environments drive consistent demand for premium gaming PCs.

- Strong regulatory and performance standards support adoption of advanced gaming systems.

Why is Content Creation Driving Gaming PC Demand in the USA?

The USA gaming PC market is expected to grow at a CAGR of 6.8%, supported by expansion of content creation, live streaming, and performance-focused gaming applications. Users increasingly seek systems capable of handling gaming, production, and streaming workloads simultaneously.

- Growth in streaming and content creation is increasing demand for high-performance gaming PCs.

- Emphasis on performance efficiency supports adoption of specialized gaming configurations.

How do Performance Optimization Trends Support Germany’s Market Growth?

Germany’s gaming PC market is projected to grow at a CAGR of 5.9%, supported by strong consumer focus on system reliability, performance optimization, and technical quality. Demand remains steady across enthusiast gaming and professional performance segments.

- Preference for technically optimized systems supports consistent gaming PC demand.

- Strong quality standards reinforce adoption of premium gaming hardware.

Why does Market Maturity Sustain Steady Growth in Japan?

Japan’s gaming PC market is forecast to grow at a CAGR of 6.3%, supported by an established gaming culture, mature technology markets, and steady demand for high-quality systems. Users prioritizing performance consistency and long-term reliability drive adoption.

- Mature gaming markets sustain stable demand for quality gaming PCs.

- Focus on durability and performance supports continued adoption.

How is Competitive Gaming Development Supporting Growth in the UK?

The UK gaming PC market is projected to grow at a CAGR of 5.7%, driven by expanding competitive gaming participation, technology integration, and performance-focused gaming setups. Demand is rising across esports, streaming, and enthusiast gaming segments.

- Expansion of competitive gaming environments is driving demand for advanced gaming PCs.

- Emphasis on technical precision supports adoption of performance-oriented systems.

Competitive Landscape of the Gaming PC Market

The gaming PC market is characterized by competition among established technology companies, specialized gaming manufacturers, and integrated performance solution providers. Companies are investing in advanced gaming technologies, specialized integration platforms, product innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable gaming PC systems. Innovation in component optimization, thermal management advancement, and performance-focused product development is central to strengthening market position and customer satisfaction.

Dell Technologies Incorporated offers a a strong focus on gaming innovation and comprehensive high-performance solutions, offering premium and enthusiast systems with emphasis on performance excellence and gaming heritage through its Alienware brand. Hewlett-Packard Inc. provides integrated gaming solutions with a focus on mainstream market applications and competitive price networks.

ASUSTeK Computer Inc. delivers comprehensive gaming technology solutions with a focus on enthusiast positioning and performance efficiency. Micro-Star International Co. Ltd. specializes in comprehensive gaming systems with an emphasis on competitive applications. Corsair Gaming Incorporated focuses on comprehensive gaming components with advanced design and premium positioning capabilities.

Key Players in the Gaming PC Market

- Dell Technologies Incorporated

- Hewlett-Packard Inc.

- ASUSTeK Computer Inc.

- Micro-Star International Co. Ltd.

- Corsair Gaming Incorporated

- Razer Incorporated

- Origin PC Corporation

- NZXT Incorporated

- CyberPowerPC Systems USA Incorporated

- iBUYPOWER Computer Corporation

- Falcon Northwest Computer Systems

- Digital Storm LLC

- Maingear Voodoo LLC

- System76 Incorporated

Scope of the Report

| Items |

Values |

| Quantitative Units (2026) |

USD 47.9 Billion |

| System Type |

Desktop Gaming PCs, Gaming Laptops, Mini Gaming PCs, Workstation Gaming Systems, Other System Configurations |

| Application |

Competitive Gaming, Content Creation, Virtual Reality Gaming, Casual Gaming, Others |

| End-User |

Individual Gamers, Esports Organizations, Content Creators, Gaming Cafes, Others |

| Price Range |

Entry-Level Systems, Mid-Range Systems, High-End Systems, Premium Configurations |

| Regions Covered |

North America, Europe, Asia Pacific, Latin America, MEA, Other Regions |

| Countries Covered |

China, USA, South Korea, Germany, Japan, UK, India, and 40+ countries |

| Key Companies Profiled |

Dell Technologies Incorporated, Hewlett-Packard Inc., ASUSTeK Computer Inc., Micro-Star International Co. Ltd., Corsair Gaming Incorporated, and other leading gaming PC companies |

| Additional Attributes |

Dollar sales by system type, application, end-user, price range, and region; regional demand trends, competitive landscape, technological advancements in gaming engineering, competitive performance optimization initiatives, system enhancement programs, and premium product development strategies |

Gaming PC Market by Segments

-

System Type :

- Desktop Gaming PCs

- Gaming Laptops

- Mini Gaming PCs

- Workstation Gaming Systems

- Other System Configurations

-

Application :

- Competitive Gaming

- Content Creation

- Virtual Reality Gaming

- Casual Gaming

- Others

-

End-User :

- Individual Gamers

- Esports Organizations

- Content Creators

- Gaming Cafes

- Others

-

Price Range :

- Entry-Level Systems

- Mid-Range Systems

- High-End Systems

- Premium Configurations

-

Region :

-

North America

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Nordic Countries

- BENELUX

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Argentina

- Rest of Latin America

-

MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

A hands-on space for designing, prototyping and building. Users can work with 3D printing,

A hands-on space for designing, prototyping and building. Users can work with 3D printing, A dedicated space for extended reality, mixed reality and AI exploration. Users can

A dedicated space for extended reality, mixed reality and AI exploration. Users can Four spaces for creating high-quality audio and video, including a four-microphon

Four spaces for creating high-quality audio and video, including a four-microphon The Solutions Studio is the Innovation Hub’s walk-up support desk and first stop for

The Solutions Studio is the Innovation Hub’s walk-up support desk and first stop for