The Sports Facilities Companies (SFC), a manager of municipal and collegiate sports venues across the U.S., announced that it will manage 13 new ice rinks as it builds its growing ice division.

The firm added rinks located across 11 states, including the Breslow Ice Hockey Center at the University of Nebraska, home to the Huskers’ men’s and women’s club hockey programs; and Indianapolis’ Elevance Health Rink at Bicentennial Plaza, which is next door to Gainbridge Fieldhouse, the home arena for the NBA’s Pacers and WNBA’s Fever.

In addition to an athletic center in Romulus, Mich., and a community center in Waconia, Minn., the new venues represent approximately $20 million in annual revenue.

Formerly operated by Rink Management Services, the new barns represent SFC’s deeper investment into ice hockey after the firm purchased Firland Management, a longtime operator of hockey and skating rinks, in September.

Youth hockey participation across North America is trending up again after a few years of decline. Jason Clement, the founding partner and CEO of SFC, said that while the NHL, USA Hockey and others have done a great job in turning the tide against the participation slide, rinks in the U.S. and Canada aren’t meeting the moment just yet.

“When you looked at the landscape of facilities across North America, ice facilities in general are going down,” he said in a video interview. “The numbers are going down. They’re aging. There are a lot built in the 60s, 70s and 80s, and they now need a refresh. And these communities are relying on their ice facilities, so we recognize that we had a role to play.”

SFC operates more than 90 venues for various municipalities, universities and private companies. A company representative said that the venues collectively generate more than $1 billion in economic impact in the communities served. Twenty of these assets are hockey rinks, but the rest represent a wide range of indoor and outdoor sports.

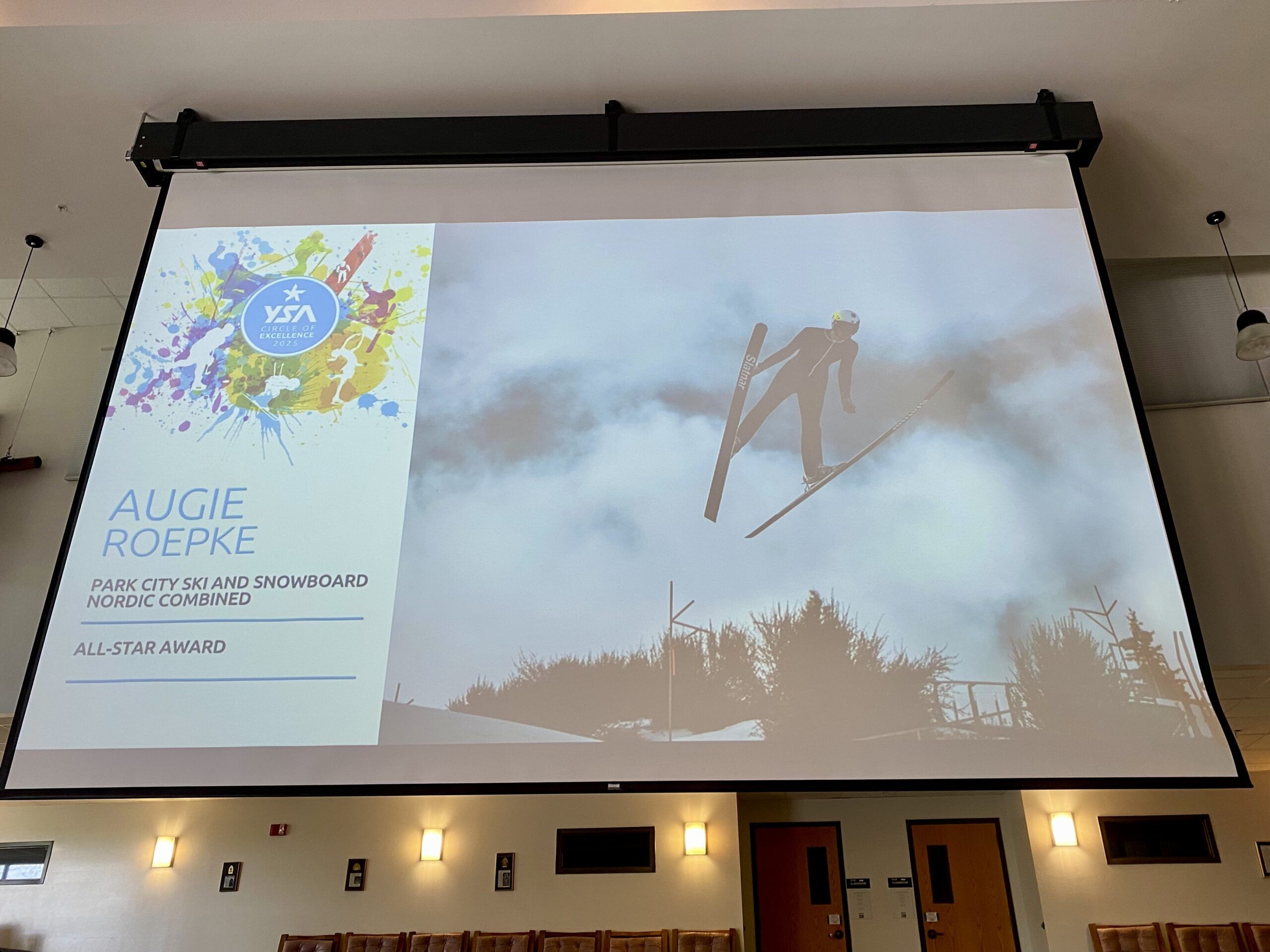

The SFC portfolio is quite large compared to that of Unrivaled Sports, the Josh Harris and David Blitzer-owned outfit that launched in 2024. The billionaire-backed player largely operates in sports played outdoors like baseball, football, soccer, snowboarding and other action sports. According to its website, it operates 15 venues and properties that are used by more than 635,000 youth athletes and have over 1.7 million visitors a year.

In early May, Unrivaled Sports picked up a $150 million investment led by Dick’s Sporting Goods, with participation from Miller Sports + Entertainment, Dynasty Equity, LionTree and The Chernin Group. The company is currently valued at around $650 million.

The youth sports industry also includes companies like Soccer Shots, which is backed by Susquehanna Growth Equity and is pulling in revenue upwards of $100 million a year. Soccer Shots, the largest company of its kind in the world, brings soccer to childcare centers, churches and parks for kids aged 2 to 8 years old.

Clement noted that the opportunities for these youth sports businesses stem from families willing to do all they can to keep their kids in sports, even in times of economic uncertainty.

“We like to say that we’ve been through a couple of cycles economically here,” he said, “and it’s been recession-resistant because families will cut a lot of things before they cut their kids’ activities and opportunities to grow.

“We didn’t just drop a bunch of capital in because we saw a financial opportunity to go monetize an industry. Instead, what we did is we said, ‘hey, we think this matters.’ We think it matters in communities. We believe in the impact that it makes, and we’re going to invest in it and we have over time.”

Capital isn’t just being invested in the fields of play but the cameras and microphones that capture the action of youth sports. On Wednesday, LiveBarn, a youth sports streaming service with investments from Susquehanna Growth Equity and Ares Capital, announced that it brought on Raymond James as an adviser for a potential sale. In April, PlayOn purchased MaxPreps from Paramount/CBS Sports for an undisclosed sum.

SFC isn’t a media company, but in the increasingly lucrative youth sports landscape, Clement said that its objectives remain clear: to help communities achieve whatever goals they’re aiming for, whether it’s sports tourism, hitting financial targets or increasing community usage of the properties it manages.

“We’ve created a custom approach to serve these communities well. And the reality is by our marketing teams’ effort, 70% of municipalities still don’t even know our services exist. So every town—from New York City to Marshalltown, Iowa, where I’m from—is trying to figure out how to serve their kids and their families better and leverage the assets and the resources that they have to do it.”

Despite the professed anonymity of SFC, millions of people are engaged with its properties. The company said that it has nearly 30 million annual guest visits across its venues. The new ice properties will account for 2-3 million combined guest visits per year.

SFC’s highest-profile project just opened in April in New York, where it already operates several venues. The $160 million Davis Center at the Harlem Meer in Central Park opened to the public as the centerpiece of the city’s decades-long effort to revitalize the northern reaches of the park. Replacing Lasker Rink and Pool, the new facility includes the Harlem Oval, which features a riser system that can transform the space from an ice rink to greenspace to a pool than can hold up to 1,000 people.

DAY AWAY! Peter Schrager’s MOCK DRAFT

DAY AWAY! Peter Schrager’s MOCK DRAFT  Shedeur Sanders to FALL TO NO. 21?!

Shedeur Sanders to FALL TO NO. 21?!  | Get Up

| Get Up