NIL

Latin America Sports And Energy Drinks Market Share, 2033

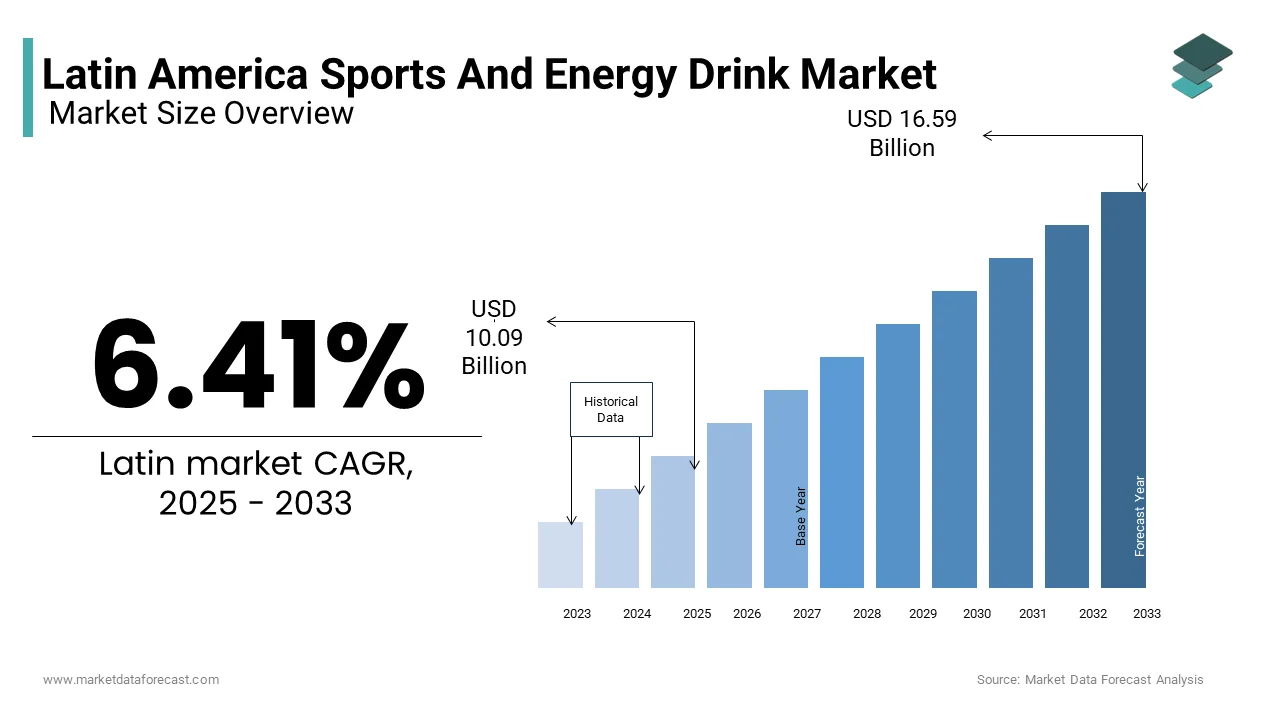

Latin America Sports And Energy Drinks Market Size

The Latin America Sports and energy drinks market size was valued at USD 9.49 billion in 2024 and is anticipated to reach USD 10.09 billion in 2025 from USD 16.59 billion by 2033, growing at a CAGR of 6.41% during the forecast period from 2025 to 2033.

Sports drinks typically contain electrolytes and carbohydrates aimed at rehydration and muscle recovery, while energy drinks are formulated with stimulants such as caffeine, taurine, and B-vitamins to increase mental focus and energy levels. These products are consumed across various settings, ranging from athletic training and gym sessions to daily work routines and social events. Latin America has seen a growing interest in health and fitness, especially among urban youth, which has directly influenced the consumption patterns of these beverages. According to Euromonitor International, increased participation in recreational sports, rising disposable incomes, and exposure to global lifestyle trends have contributed to the expansion of this market. Countries like Brazil, Mexico, and Colombia have witnessed strong brand penetration by both multinational corporations and local manufacturers seeking to capitalize on evolving consumer preferences. Moreover, digital marketing and sponsorship of sporting events have played a crucial role in boosting awareness and demand. As per NielsenIQ, social media campaigns featuring athletes and influencers have significantly impacted purchasing decisions among younger demographics.

MARKET DRIVERS

Rising Health and Fitness Awareness Among Urban Consumers

One of the primary drivers of the Latin American sports and energy drinks market is the increasing emphasis on health, fitness, and active lifestyles, particularly in urban centers. Consumers are actively seeking ways to maintain physical well-being, which is leading to a surge in gym memberships, fitness classes, and outdoor activities. According to the Pan American Health Organization (PAHO), over 45% of urban dwellers in Latin America now engage in regular exercise by creating a direct link between physical activity and the consumption of performance-enhancing beverages.

Brazil and Mexico have experienced a boom in fitness culture, with young professionals integrating workout routines into their daily schedules. A 2023 survey by Ipsos MORI found that nearly 60% of respondents in São Paulo and Mexico City consume sports or energy drinks before or after workouts to replenish energy and stay hydrated. Additionally, boutique gyms and CrossFit centers have become common, often promoting branded hydration and energy products on-site. This shift toward an active lifestyle has prompted beverage companies to launch targeted marketing campaigns highlighting benefits such as endurance support, muscle recovery, and mental alertness.

Increasing Demand for Functional Beverages with Natural Ingredients

A significant driver shaping the Latin American sports and energy drinks market is the growing consumer preference for functional beverages made with natural ingredients, herbal extracts, and clean-label formulations. Excessive sugar content and synthetic stimulants are commonly found in traditional energy drinks. According to Euromonitor International, demand for plant-based and organic variants has surged, prompting major brands to reformulate existing products and introduce new offerings tailored to health-conscious buyers. In countries like Chile and Argentina, where dietary trends align closely with global wellness movements, sales of low-sugar, vitamin-enriched, and botanical-infused sports and energy drinks have risen sharply. A 2023 report by NielsenIQ noted that nearly 55% of surveyed consumers in Santiago and Buenos Aires preferred drinks containing natural caffeine sources such as yerba mate, guarana, and green tea over conventional synthetic formulas.

Additionally, retailers and online platforms have expanded their range of natural and organic beverage options, making them more accessible to a broader audience. Manufacturers are also leveraging certifications such as non-GMO, gluten-free, and vegan labeling to build trust and differentiate their products in a competitive marketplace.

MARKET RESTRAINTS

Growing Concerns Over Health Risks Associated with High Sugar and Caffeine Content

One of the primary restraints affecting the Latin American sports and energy drinks market is the increasing scrutiny surrounding the health risks linked to high sugar and caffeine intake. Public health authorities across the region have raised concerns about the adverse effects of excessive consumption, including obesity, cardiovascular issues, insomnia, and nervous system stimulation. According to the Pan American Health Organization (PAHO), several Latin American countries have reported a rise in emergency room visits related to energy drink consumption among adolescents and young adults.

In response, governments have implemented stricter regulations on advertising, packaging, and ingredient disclosures. For example, Mexico introduced front-of-package warning labels in 2020 for foods and beverages high in sugar, sodium, and saturated fats—a move that significantly impacted consumer perception and purchasing behavior. Similarly, Chile banned the sale of energy drinks in schools and imposed restrictions on marketing to minors.

As a result, some consumers have shifted away from traditional high-caffeine energy drinks in favor of lower-stimulant or herbal alternatives. A 2023 Latinobarómetro survey found that over 50% of respondents in Ecuador and Peru were actively avoiding energy drinks due to health concerns. This trend presents a challenge for manufacturers seeking to balance taste appeal with regulatory compliance and public health expectations.

Regulatory Restrictions and Taxation Policies

Another significant constraint on the growth of the Latin American sports and energy drinks market is the imposition of regulatory restrictions and taxation policies aimed at curbing excessive consumption of sugary and stimulant-based beverages. Governments across the region have increasingly adopted measures to promote healthier diets and reduce the burden of lifestyle-related diseases. According to the World Bank, several Latin American countries have introduced excise taxes on sugar-sweetened beverages, including certain categories of sports and energy drinks.

In Brazil, for instance, federal and state-level tax incentives encourage the production of low-sugar alternatives, indirectly pressuring traditional beverage manufacturers to reformulate their products. Similarly, Argentina implemented a national tax on energy drinks in 2022, citing concerns over youth consumption and long-term health implications. These fiscal policies have led to price hikes, reducing affordability and discouraging repeat purchases among budget-conscious consumers.

Furthermore, labeling requirements mandating clear disclosure of caffeine levels and caloric content have altered consumer perceptions. As per a 2023 study by the Latin American Food Industry Association (IALA), nearly 40% of surveyed consumers in Bolivia and Guatemala indicated they had reduced their energy drink intake following the introduction of mandatory warning labels. These regulatory pressures pose a substantial challenge for market participants navigating an increasingly complex policy landscape.

MARKET OPPORTUNITIES

Expansion of Premium and Organic Sports and Energy Drink Variants

An emerging opportunity for the Latin American sports and energy drinks market lies in the rising demand for premium and organic beverage variants that cater to health-conscious consumers. As awareness around nutrition and wellness increases, consumers are actively seeking out drinks that offer functional benefits without compromising on quality or natural ingredients. According to Euromonitor International, demand for clean-label sports and energy drinks has surged across urban centers, particularly in Brazil and Chile, where affluent millennials and Gen Z consumers form a substantial portion of the market. Supermarkets and specialty stores in São Paulo and Santiago have expanded their selection of premium-priced energy drinks infused with botanical extracts, adaptogens, and nootropics, appealing to consumers looking for cognitive enhancement alongside physical performance. A 2023 report by NielsenIQ indicated that sales of organic and zero-sugar energy drinks in these regions increased by 16% compared to the previous year, driven by partnerships with wellness influencers and targeted digital campaigns. Additionally, government-backed food certification programs in Argentina and Mexico are encouraging manufacturers to adopt healthier formulations, thereby enhancing product credibility.

Growth of E-commerce and Direct-to-Consumer Sales Channels

The rapid development of e-commerce and digital retail platforms presents a significant opportunity for the Latin American sports and energy drinks market. As internet penetration and smartphone usage rise, online grocery and beverage shopping have become increasingly popular, especially among younger and tech-savvy consumers who prefer the convenience of home delivery. According to eMarketer, online food and beverage sales in Latin America are projected to grow by 21% annually through 2026, with sports and energy drinks benefiting from improved accessibility and targeted digital promotions. Platforms such as MercadoLibre, Amazon Fresh, and regional health-focused e-retailers have expanded their offerings, allowing consumers to explore niche and imported beverage brands beyond what is available in traditional retail outlets. In a 2023 survey by Ipsos MORI, 58% of Brazilian and Colombian shoppers stated they had purchased energy drinks online in the past year, appreciating the ease of comparing ingredients, reading reviews, and accessing exclusive deals. Moreover, direct-to-consumer models allow manufacturers to engage with customers through personalized marketing campaigns, loyalty programs, and subscription-based services. As logistics infrastructure improves and last-mile delivery becomes more efficient, the online channel is expected to play a pivotal role in shaping the future of the Latin American sports and energy drinks market.

MARKET CHALLENGES

Intense Competition Between Global Brands and Local Players

One of the most pressing challenges facing the Latin American sports and energy drinks market is the intense competition between multinational corporations and well-established regional brands. The market is highly fragmented, with dominant players such as Red Bull, PepsiCo, and Coca-Cola competing against local manufacturers like Monster Beverage, AmBev, and Grupo Nutresa. According to Euromonitor International, over 200 brands were active in the Latin American sports and energy drinks sector in 2023, each vying for market share through aggressive pricing strategies and extensive marketing efforts. Brand loyalty remains relatively low, with 63% of surveyed consumers in a 2023 NielsenIQ study indicating they frequently switch between energy drink brands based on promotions or store recommendations. This behavior makes it difficult for companies to establish long-term brand equity. Additionally, private-label and store-brand energy drinks have gained ground by offering similar taste profiles at lower price points, further eroding market share from established names.

Volatility in Raw Material Prices and Supply Chain Disruptions

A significant challenge confronting the American sports and energy drinks market is the volatility in raw material prices and frequent supply chain disruptions. Key ingredients such as caffeine, taurine, B-vitamins, and flavoring agents are subject to fluctuations driven by geopolitical instability, climate conditions, and transportation bottlenecks. According to the Food and Agriculture Organization (FAO), global commodity prices for essential beverage inputs rose by an average of 17% in 2023, impacting production costs across the industry. In Brazil, for instance, inflationary pressures and currency devaluation have increased import costs for key raw materials used in energy drink formulations. These supply-side challenges not only elevate manufacturing expenses but also lead to fluctuating retail prices, which can deter regular consumer purchases.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

% |

|

Segments Covered |

By Product Type, Packaging, Distribution Channel, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Argentina, Chile, Mexico, Rest of Latin America |

|

Market Leaders Profiled |

Abbott Nutrition Co., AJE Group, Britvic PLC, Extreme Drinks Co., Fraser & Neave Holdings BHD, GlaxoSmithKline Plc, Red Bull, Rockstar, Inc., Coca-cola, PepsiCo, Arizona Beverage Company, National Beverage Corp, Keurig Dr Pepper Inc., Living Essentials, Cloud 9 Beverages Private Limited, Vitale Beverages Pvt Ltd. |

SEGMENTAL ANALYSIS

By Product Type Insights

The isotonic drinks segment held 58.6% of the Latin America sports and energy drinks market share in 2024 due to its widespread use in hydration and electrolyte replenishment during physical activity, making it a preferred choice among athletes, fitness enthusiasts, and general consumers seeking post-exercise recovery. The popularity of isotonic beverages stems from their balanced formulation containing carbohydrates and electrolytes that help maintain fluid balance and enhance endurance. In countries like Brazil and Argentina, where participation in recreational sports and gym culture has grown significantly, isotonic drinks have become a staple in both urban and rural households. Additionally, multinational brands such as Gatorade (PepsiCo) and Powerade (Coca-Cola) have heavily invested in marketing campaigns aligned with sports events and athlete endorsements, reinforcing consumer trust and brand loyalty. The combination of functional benefits, strong branding, and broad retail availability ensures isotonic drinks remain the most dominant category in the region.

The hypotonic drinks segment is swiftly emerging with a CAGR of 9.4% during the forecast period. Unlike isotonic or hypertonic variants, hypotonic drinks contain lower concentrations of carbohydrates and higher electrolyte content, enabling faster absorption and improved rehydration effi, particularly appealing to endurance athletes and individuals engaging in prolonged physical activity. A 2023 survey by Ipsos MORI found that 51% of surveyed athletes in Chile and Colombia prefer hypotonic drinks for extended training sessions due to perceived health benefits and lighter formulations. Moreover, rising concerns about sugar intake and obesity have prompted manufacturers to introduce hypotonic options with zero added sugars and natural sweeteners. In Brazil, several local brands launched coconut water-based hypotonic drinks, witnessing a 25% sales increase within six months of release, as noted by Kantar Worldpanel.

By Packaging Type Insights

The cans segment was the largest and held 44.3% of the Latin America sports and energy drinks market share in 2024. In countries like Mexico and Brazil, where outdoor activities, festivals, and sporting events are integral to social life, cans offer an ideal format for easy distribution and consumption. According to NielsenIQ, nearly 60% of surveyed consumers in these markets prefer canned energy drinks due to their lightweight design and compatibility with vending machines and coolers.

Additionally, manufacturers benefit from cans’ ability to preserve flavor integrity and extend shelf life without refrigeration, ensuring consistent quality across supply chains.

The PET and glass bottles segment is likely to experience a CAGR of 7.8% during the forecast period. Bottles, especially those made from PET, offer significant advantages such as clear labeling space, stackable storage, and suitability for multi-serve portions by making them popular among families and home users. Furthermore, manufacturers are leveraging bottle formats to introduce premium and organic beverage lines. Brands in Peru have introduced glass-packaged energy drinks with natural ingredients, targeting upscale retailers and specialty stores. Environmental benefits also contribute to their appeal many PET bottles now use recycled materials, reducing carbon footprints and attracting eco-aware consumers.

By Distribution Channel Insights

The supermarkets and hypermarkets dominated the Latin American sports and energy drinks market with 48.3% of the market in 2024. In Brazil and Mexico, major retailers such as Carrefour, Walmart, and Grupo Bimbo operate thousands of outlets, offering a wide range of domestic and international sports and energy drink brands under one roof. Additionally, promotional activities such as multi-buy offers, endcap displays, and seasonal discounts significantly influence purchase decisions.

The online retail segment is expected to grow with a CAGR of 15.2% in the coming years. The growth of the segment is fueled by increasing internet penetration, mobile commerce adoption, and changing consumer behavior toward digital shopping. Platforms such as MercadoLibre, Amazon Fresh, and Rappi have expanded their beverage delivery services, which are allowing consumers to purchase both mainstream and niche brands with just a few clicks. Moreover, younger demographics are driving this shift. In a survey conducted by NielsenIQ in late 2023, 58% of consumers aged 18–34 in Colombia and Chile stated they now prefer buying sports and energy drinks online due to convenience and exclusive deals.

KEY MARKET PLAYERS

Abbott Nutrition Co., AJE Group, Britvic PLC, Extreme Drinks Co., Fraser & Neave Holdings BHD, GlaxoSmithKline Plc, Red Bull, Rockstar, Inc., Coca-cola, PepsiCo, Arizona Beverage Company, National Beverage Corp, Keurig Dr Pepper Inc., Living Essentials, Cloud 9 Beverages Private Limited, Vitale Beverages Pvt Ltd. Are the market players Latin American sports and energy drinks market?

COUNTRY-LEVEL ANALYSIS

Brazil held 32.1% of the Latin American sports and energy drinks market share in 2024. With over 215 million people, Brazil has a vast consumer base that includes a growing number of gym-goers, athletes, and office workers seeking energy boosters. Major cities like São Paulo and Rio de Janeiro serve as hubs for multinational beverage companies such as PepsiCo, Coca-Cola, and AmBev, which leverage local manufacturing capabilities and distribution networks to maximize reach. Additionally, digital marketing and sponsorship of football leagues and marathons have strengthened brand visibility.

Mexico was positioned second in the Latin American sports and energy drinks market with a 26.3% share in 2024. The country’s strong youth demographic profile, coupled with rising participation in fitness and outdoor activities, makes it a key contributor to market growth. Mexican consumers exhibit high per capita consumption of energy drinks, with Red Bull, Monster, and local brand Big Cola dominating both retail and foodservice channels. Urbanization and disposable income growth have also played a role in expanding household-level consumption. With rising refrigerator ownership and increased availability through supermarkets and convenience stores, sports and energy drinks have become a regular part of Mexican lifestyle habits. Additionally, aggressive advertising and point-of-sale promotions have reinforced brand presence in schools, gyms, and entertainment venues.

Argentina’s sports and energy drinks market is likely to grow as the country maintains a stable demand for sports and energy drinks, supported by strong urban consumption patterns and a deep-rooted fitness culture. Buenos Aires and Córdoba serve as primary consumption hubs, where sports drinks are frequently purchased for both personal use and commercial applications such as gyms and sports clubs. Supermarkets such as Carrefour and Jumbo have played a crucial role in boosting retail sales, offering branded and private-label sports and energy drink options that cater to diverse budget segments. Additionally, local food processors have introduced innovative variants, including plant-based and low-sugar formulas, to meet changing dietary preferences.

Chile’s energy drinks market is lucratively to grow with a developed retail landscape and high per capita income,suppor supportingstent demand for packaged beverages, despite regulatory efforts aimed at curbing excessive consumption of sugary and stimulant-based products. Santiago and Valparaíso remain the main centers of sports and energy drink consumption, where working professionals and students frequently opt for quick energy boosters. However, Chile’s stringent front-of-package labeling laws, implemented in 2016, have forced manufacturers to reformulate products to reduce sugar and caffeine content.

Top Players in the Market

Red Bull GmbH

Red Bull is a dominant force in the Latin American sports and energy drinks market, known for its strong brand identity and deep-rooted presence in youth and extreme sports culture. The company has successfully positioned itself as a lifestyle brand rather than just a beverage provider, leveraging event sponsorships, digital marketing, and strategic retail placements to maintain relevance across diverse consumer segments. Red Bull’s influence extends beyond Latin America, which is shaping global trends in the energy drink industry through product innovation and immersive brand engagement.

PepsiCo Inc. (Gatorade)

PepsiCo, through its flagship brand Gatorade, holds a leading position in the Latin American sports drink segment. With a focus on hydration science and athlete endorsements, PepsiCo has established Gatorade as a trusted name among fitness enthusiasts and professional athletes. Its distribution strength and investment in localized marketing campaigns have ensured widespread availability and brand loyalty. Globally, Gatorade remains the benchmark for sports drinks by reinforcing PepsiCo’s dominance in functional beverages.

The Coca-Cola Company (Powerade, Burn)

Coca-Cola plays a crucial role in the Latin American sports and energy drinks market through brands like Powerade and Burn. The company leverages its extensive distribution network and marketing expertise to compete directly with Gatorade and independent energy drink brands. By aligning with local sports leagues and fitness influencers, Coca-Cola maintains strong visibility and relevance in both traditional and emerging market segments, which is contributing to its global portfolio of performance-focused beverages.

Top Strategies Used by Key Market Participants

One of the primary strategies employed by key players in the Latin American sports and energy drinks market is strategic brand positioning through sports and lifestyle ssponsorship where companies align their products with high-profile athletes, teams, and sporting events to enhance credibility and emotional connection with consumers. This approach helps reinforce product association with performance, endurance, and vitality.

Another major tactic involves product diversification and formulation innovation, including the introduction of low-sugar, plant-based, and functional variants tailored to health-conscious consumers. Companies are investing in research and development to meet evolving dietary preferences while maintaining taste appeal and energy-boosting properties.

Digital engagement and influencer-driven marketing have become essential tools for building brand awareness and driving trial usage. Brands are leveraging social media platforms, creating interactive content, and collaborating with fitness influencers to reach younger audiences and strengthen market penetration across urban and semi-urban regions.

COMPETITIVE OVERVIEW

The Latin American sports and energy drinks market is highly competitive, characterized by the presence of global giants and well-established regional players vying for market share. Multinational corporations such as Red Bull, PepsiCo, and The Coca-Cola Company leverage their financial strength, global supply chains, and extensive branding expertise to maintain dominance, while local manufacturers capitalize on cultural insights and consumer familiarity to retain relevance in niche markets.

Competition extends beyond pricing, with companies differentiating themselves through product quality, packaging innovation, and alignment with contemporary wellness trends. The market also experiences frequent product launches and reformulations designed to meet shifting consumer expectations around nutrition, sustainability, and ingredient transparency. Additionally, the rise of e-commerce and direct-to-consumer models has intensified the need for brands to establish a strong digital presence and ensure seamless accessibility across multiple sales channels.

With increasing participation in fitness activities and rising disposable incomes, demand for sports and energy drinks continues to grow, prompting companies to invest in capacity expansion, supply chain optimization, and localized marketing efforts. In this dynamic environment, adaptability and responsiveness to consumer behavior remain critical success factors.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Red Bull launched a new line of zero-sugar energy drinks in Brazil, targeting health-conscious consumers and expanding its portfolio beyond conventional offerings.

- In May 2024, PepsiCo introduced an exclusive digital platform in Mexico that connects directly with retailers to streamline sports drink distribution and improve inventory efficiency across urban and rural locations.

- In August 2024, Coca-Cola expanded its production facility in Argentina to increase the output of locally adapted energy drinks by aiming to meet rising demand and reduce lead times in distribution.

- In October 2024, Monster Beverage entered into a strategic partnership with a leading supermarket chain in Chile to introduce private-label energy drinks, which is enhancing retail presence and improving affordability for budget-conscious shoppers.

- In December 2024, AmBev rolled out a nationwide campaign in Colombia promoting limited-edition isotonic drinks infused with natural electrolytes by leveraging social media influencers to boost engagement and trial rates.

MARKET SEGMENTATION

This research report on the Latin American sports and energy drinks market is segmented and sub-segmented into the following categories.

By Product Type

- Isotonic

- Hypertonic

- Hypotonic

By Packaging Type

- Bottle (Pet/Glass)

- Can

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

By Country

- Brazil

- Argentina

- Chile

- Mexico

- Colombia

NIL

Indiana vs Oregon betting lines

No. 1 seed Indiana and No. 5 seed Oregon played earlier in the season and now meet in the Peach Bowl. The Hoosiers came out with a 30-20 victory Oct. 11 in Eugene, Ore. Since then, Indiana has reeled off eight straight wins, with six of those coming by 20 points or more. Quarterback Fernando Mendoza took home a Heisman then led his team to a CFP win over Alabama.

Oregon bounced back from that October loss by winning eight straight as well, seven by 12 or more points. Quarterback Dante Moore and the Ducks’ defense took down Texas Tech 23-0 after destroying James Madison in the first round.

The winner of the Peach Bowl will play Miami, which came back to dispatch Ole Miss, 31-27, at the Fiesta Bowl. Hurricanes quarterback Carson Beck ran for a touchdown with 18 seconds left and a last-play heave by Ole Miss’ Trinidad Chambliss to the end zone fell incomplete.

The national championship game will be at 6:30 p.m. Jan. 19 in Miami. Here is who experts picked to win Friday’s Indiana-Oregon rematch:

Indiana vs Oregon betting odds

Lines via BetMGM as of Thursday.

Moneyline: Indiana -175, Oregon +145

Spread:Indiana by 3½ points

Oregon vs Indiana football: When is the Peach Bowl?

Place: Mercedes-Benz Stadium in Atlanta.

NIL

College Sports Commission distributes reminder about third-party NIL deals amid transfer portal movement

One week into the college football transfer portal window, the College Sports Commission issued a reminder about its rules regarding third-party NIL deals. Specifically, the guidance mentioned deals with MMR and apparel partners.

The CSC said it received word of schools offering deals that go against terms of the House settlement through the first week of the transfer window. The organization expressed “serious concerns” about some terms of the deals in question and reiterated third-party NIL deals are subject to the NIL Go clearinghouse if they’re worth more than $600.

Advertisement

SUBSCRIBE to the On3 NIL and Sports Business Newsletter

Additionally, the CSC said investigations are progressing with regard to unreported third-party NIL deals. Some schools “should expect to hear from the CSC next week”, the commission said.

Such deals must be reported within five days of execution. Enrolling high school athletes and incoming D-I transfers have up to 14 days in some cases.

“Without prejudging any particular deal, the CSC has serious concerns about some of the deal terms being contemplated and the consequences of those deals for the parties involved,” the guidance reads. “Making promises of third-party NIL money now and figuring out how to honor those promises later leaves student-athletes vulnerable to deals not being cleared, promises not being able to be kept, and eligibility being placed at risk.”

Advertisement

CSC says MMR deals must be reported

Friday’s guidance comes after Yahoo! Sports’ Ross Dellenger reported a $3.5 million offer that LSU made Cincinnati transfer quarterback Brendan Sorsby this week. Sorsby later committed to Texas Tech, where he’s set to receive a deal in the $5 million range, On3’s Pete Nakos reported.

The offer to Sorsby included a third-party marketing deal through LSU’s MMR partner, Playfly Sports Properties, Dellenger reported. LSU also planned to compensate Sorsby through rev-share, which would help make total compensation competitive to Texas Tech’s investment.

The College Sports Commission said deals in place with an MMR partner must be reported, even if the partner intends to find other sponsors to help activate the deal. In addition, deals with an MMR or other partner “must include direct activation of the student-athlete’s NIL rights,” the guidance read.

Advertisement

“The label on the contract (e.g., ‘agency agreement,’ ‘services agreement’) does not change the analysis; if an entity is agreeing to pay a student-athlete for their NIL, the agreement must be reported to NIL Go within the reporting deadline,” the guidance reads.

Third-party NIL deals are viewed as the next “arms race” in college sports in the post-House settlement landscape. Tennessee and Penn State are both set have NIL components in their upcoming apparel deals with adidas, On3 previously reported. LSU was also the first school featured in Nike’s new Blue Ribbon Elite program, and that announcement came at the same time the Tigers announced an extension with The Swoosh.

NIL

Learning football from video games now a legit teaching method for coaches, athletes

The Athletic has live coverage of Oregon vs. Indiana in the 2025 College Football Playoff semifinals.

When David Pollack played linebacker at the University of Georgia from 2001-04, he was considered one of the best defenders in the country: a two-time consensus All-American and a two-time SEC Defensive Player of the Year.

But when he played the game in college, NIL (name, image and likeness) deals didn’t exist, and active players were not named in athletic video games. In the EA Sports College Football series, Pollack knew he was No. 47 for Georgia.

Pollack now sees the video game as more than entertainment or a fun way to pass the time. The game can also be a tool of instruction for coaches at all levels, particularly those coaching young children and adolescents. In addition to being a recognized college football analyst, Pollack is a defensive line coach at North Oconee High in Bogart, Ga.

Also on his resume: He’s one of the voices of EA Sports College Football 26 as an analyst.

Teaching players about schemes and how to react on the field has become reality for him as a coach with the help of video games such as EA Sports College Football 26 and Madden NFL 26. He’s a believer of the method and has seen the return on investment.

“I can’t tell you how many of my kids that I’ve coached (using video games) over these years,” Pollack said, “and they were really little, too — 8, 9, 10, 11, 12 years old.”

EA Sports College Football 26 includes more than 2,800 new plays and 45 new formations. Madden NFL 26 features a playbook expansion of more than 1,000 plays. Football video games have come a long way from the days of Tecmo Bowl, a 1980s-released game featuring only 12 pro teams and four offensive plays per team on the Nintendo 8-bit console.

Because of technology becoming so advanced, studying plays by way of video games can resemble studying in real life to football players of all ages. Coaches can talk football jargon with younger players who are familiar with it from the video games. Players are understanding what offensive schemes work best against certain defenses. Conversely, they are learning multiple defenses and what might be the best option to contain an offense.

“With Madden, with College Football, these kids learn what Cover 2 is, what Cover 3 is, what Cover 4 is,” Pollack said. “The games have gotten to be so detailed that it’s correct.”

David Pollack, now an assistant coach at North Oconee High in Georgia, was a star linebacker for the Georgia Bulldogs. On video games, he knew he was No. 47 for the Bulldogs. (Joshua L. Jones / USA Today)

Statistically, EA Sports College Football 26, released in July, is again among the best-selling games, ranking fifth and trailing only NBA 2K26 among sports games, according to GameStop. College football was brought back to video game consoles in July 2024 with EA Sports College Football 25, the first such game since 2013. EA Sports College Football 25 was the second-highest selling game of 2024, according to GameStop. There were 2.2 million unique players during early access in July 2024, per EA Sports.

Pollack said many young football players he’s worked with who have gravitated toward video games as an entry point to the sport show up with a deeper understanding of the game. And with the College Football Playoff now in full swing, there is a sample size of a fan base that learned about the significance of the tournament through gaming, despite having no connection to any of the 12 teams originally selected for competition. (Miami beat Ole Miss on Thursday to advance to the CFP Championship. The Hurricanes will face the winner of Friday’s semifinal between Indiana and Oregon.)

Young fans as gamers, however, are looking for realism down to the smallest detail. EA Sports creative director Scott O’Gallagher said a lot of the feedback the company receives from gamers goes beyond gameplay. With football video games, there are gamers who want to see players in the right helmet style, the right style of shoe, even the correct number of wristbands. That detail, O’Gallagher said, resonates particularly when young gamers are playing with the team that features certain athletes they admire.

Before becoming immersed in video games as a career, O’Gallagher was an NAIA basketball All-American at Warner Pacific University in Portland, Ore. He played professionally overseas in Europe and Australia. He learned as a professional athlete in Europe that passionate fans care about every aspect of their favorite team.

The details that go into making football video games as real as possible include keeping the playbook updated. EA Sports works throughout the season to add any wrinkles to the playbook that can be added to its games. A young player can follow a team they like and not only understand what plays are used, but also see the changes over the course of the season.

“We’re a live service, so if things are happening during the year, we’re definitely going out there and trying to add them,” O’Gallagher said. “I can talk to one of our playbook guys about what USC was doing and say, ‘Hey, did we get this? It’s a new wrinkle that Lincoln Riley’s put in. Let’s make sure we have it.’”

A more intricate game doesn’t just help Pollack’s young players, but also gives more for Pollack to discuss in his role as an in-game analyst. When recording for the game, it’s no longer about simply saying “first down.” Announcers will record game analysis in studios with tons of energy but without seeing an actual play. They will spend hours preparing to record for several scenarios.

“The technology’s getting so much better that we’re able to do so much more now and give layered concepts,” Pollack said. “It’s crazy how much they can learn about the game and are ahead of the curve on playing the real game.”

Football education by way of video games isn’t limited to a specific squad, either. Evan Dexter, EA Sports vice president of brand and marketing, said data shows football games make a strong connection with young fans who don’t have allegiance to a particular team.

“If you were to pull the analytics of (College Football) 25 and 26, I’m sure Colorado is being used far more than what you might think, based on the population of alumni or people geographically around the school,” Dexter said, referring to the popularity of Heisman Trophy winner Travis Hunter and quarterback Shedeur Sanders, who led Colorado during the 2024 season.

“It’s certainly true that younger sports fans will abandon allegiance in favor of some form of hero worship, some form of individual superstar,” Dexter said. “As the sport becomes a little more superstar driven, the Travis Hunters move through it, and the Arch Mannings (of Texas) and those narratives start to transcend the old-school rivalries.”

Whether rivalries are traditional or budding, the evolution of football video games will continue to be an introduction to the sport for young gamers who ultimately want to become football players. They’ll now have a lot more than four plays to choose from to learn the game.

“It’s definitely raising the football intelligence of kids all around the world by playing the game and understanding what’s going on,” Pollack said.

NIL

Niko sounds off on UW’s Demond and NIL, plus Seahawks boosting Seattle businesses

SEATTLE — In this edition of Inside the Arena, Niko is back from the Seahawks’ huge win in Santa Clara and sounding off on the sudden departure of UW QB Demond Williams and what it means for the future of NIL.

Plus, Chris introduces us to the RailSpur development in Pioneer Square, which has been boosted by bonus Mariners and now Seahawks games in advance of the 2026 World Cup.

RELATED | Seahawks secure No. 1 seed in NFC and division title with dominant 13-3 win over 49ers

The Seahawks will play the lowest remaining seed in the NFC Divisional Round on either Jan. 17 or 18.

You can also watch previous episodes of Inside the Arena on the KOMO News YouTube page.

BE THE FIRST TO COMMENT

Inside the Arena is presented by Snoqualmie Casino and Hotel.

NIL

UCF Knights basketball general manager Chris Wash resigns

Jan. 9, 2026, 1:23 p.m. ET

- Chris Wash has resigned from his position as UCF basketball’s general manager.

- The resignation is effective immediately and was made to prioritize pressing family health matters.

- Wash joined the UCF staff in June 2025 after working as a talent evaluator and NIL agent.

Chris Wash has resigned from his role as UCF basketball’s general manager and special assistant to head coach Johnny Dawkins, effective immediately, according to a press release from OG6 Sports Management.

Wash, who joined the staff in June 2025, made the decision prior to the team’s Jan. 6 game at Oklahoma State in order to “prioritize pressing family matters, including a recent health diagnosis within his immediate family that requires his time, focus and presence.”

Per the statement, Wash is “grateful for the opportunity to have been part of the UCF basketball program and appreciates the understanding and professionalism shown throughout this process. He looks forward to returning to the sport in the future when circumstances allow.”

A former national talent evaluator, Wash previously served as an NIL agent for college football and basketball athletes. He worked for more than a decade as a loan officer prior to entering the college athletics space.

UCF, currently ranked No. 25 in the AP poll, has a 12-2 record on the season and will host Cincinnati at 5 p.m. Sunday, Jan. 11.

NIL

NIL, transfer portal has evened playing field and SEC can’t keep up

Jan. 9, 2026, 3:31 p.m. ET

GLENDALE, AZ — There was some strange symmetry to it all, a torch passing no one saw coming.

Miami, everyone, is built and playing like an SEC team.

The SEC, meanwhile, just polished off a postseason where it lost a conference-record eight games against other conferences.

“We line up, and we want to punish you on offense and defense,” said Miami defensive end Akheem Mesidor. “You’re going to have to play your absolute best game to beat us.”

Well, well. Now who does that sound like?

Here’s a hint: the bully on the block that has fallen, and can’t seem to figure out why or how to get back up.

From dominating college football with 14 national titles since 2003, to the fateful irony of the SEC brought back to the pack by its own greed.

The SEC wanted Texas and Oklahoma, wanted to drastically change the conference footprint of the sport, and then sat and watched while the Big Ten panicked and did the same, while the Pac-12 was eaten and eliminated (it ain’t the same now, people), and while the Big 12 and ACC were relegated to second citizens.

The SEC, along with the Big Ten, then grabbed control of the postseason and threatened to take their ball and go home unless everyone fell in line. They want more access to the postseason, and they’ll surely receive the lion’s share of revenue from what could be a near $2 billion annually expanded College Football Playoff. Like it or not.

They wanted unregulated NIL and free player movement, or at the very least, did next to nothing to stop it. They, along with every other FBS university, knew for 16 months that states of California and Florida had passed bills that would become law in June of 2021 — and did nothing about it.

They punted, and begged Congress for help. Imagine that, two self-interested and wildly dysfunctional entities trying to figure out a massively complex financial and structural problem.

What could go wrong?

The bigger question is, what did they think the rest of college football would do? Certainly not sit and take it.

There are millionaires and billionaires who love their universities and are obsessive about winning. Throw open the doors to NIL and free player movement — and legalized big booster involvement — and watch how quickly the SEC looks like the ACC.

Watch how quickly Alabama comes back to the pack, and Georgia can’t get out of the quarterfinals in the CFP. How quickly LSU and Florida and Texas A&M spend hundreds of millions of dollars to fire coaches and start over.

More to the point, watch how quickly the deep-pocket Cody Campbells of the world begin to simply play by the rules laid out by the SEC and Big Ten ― and build teams that look and play like SEC teams of the past.

Want to know why Texas Tech won the Big 12 for the first time in school history, and won a school-record 12 games? It had one of the best defensive lines in the nation, and a Top 5 scoring defense.

Want to know how Miami has finally found itself again after more than two decades of stumbling around like NC State? The Canes have the best defensive line in the nation, with two edge rushers who will be Top 15 NFL Draft picks.

Remember all of those nasty and dominating defensive lines at Alabama and Georgia, all of those NFL draft picks? Nothing defined SEC dominance, SEC national titles, quite like physical, game-changing defensive linemen.

Now they’re leaving high school and/or the transfer portal for the highest bidder. The idea of playing for the SEC, while certainly tempting, is quickly trumped by another zero at the end of a paycheck.

“More options for players, that’s the big thing,” said Miami safety Keionte Scott. “If it’s not working for whatever reason at another place, there are options.”

It wasn’t working for Scott at Auburn, which hasn’t found an answer since firing Gus Malzahn after the 2020 season. So Scott became one of six transfer starters on Miami’s defense — including the entire secondary — and is now a game away from a national championship.

Meanwhile, the SEC hasn’t looked further away from winning it all ― having gone three straight seasons without playing in the national championship game for the first time since 2000-2002.

Go ahead and expand the CFP to 16 or 20 or 24 teams. Go ahead and continue to declare players don’t want to be employees, and avoid the one thing that could deliver some semblance of control to a player procurement process with no guardrails — just because you don’t want to share more money when collectively bargaining.

And Indiana, with the largest alumni base in college football, will continue to spend its way out of the NCAA cellar. Will beat Georgia to sign Heisman Trophy-winning quarterback Fernando Mendoza.

Miami, with its deep pocket boosters begging for a return to glory, will do the same.

So will Texas Tech and Utah and BYU and SMU and … see where this is headed?

Right to the end of SEC dominance.

Matt Hayes is the senior national college football writer for USA TODAY Sports Network. Follow him on X at @MattHayesCFB.

-

Sports2 weeks ago

Sports2 weeks agoBadgers news: Wisconsin lands 2nd commitment from transfer portal

-

Rec Sports1 week ago

Rec Sports1 week agoFive Youth Sports Trends We’re Watching in 2026

-

Sports3 weeks ago

Sports3 weeks agoIs women’s volleyball the SEC’s next big sport? How Kentucky, Texas A&M broke through

-

Sports2 weeks ago

Sports2 weeks agoKentucky VB adds an All-American honorable mention, loses Brooke Bultema to portal

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoNBA, Global Basketball Community Unite for World Basketball Day Celebration

-

Motorsports2 weeks ago

Motorsports2 weeks agoDr. Patrick Staropoli Lands Full-Time O’Reilly Ride with Big Machine Racing

-

Motorsports3 weeks ago

Motorsports3 weeks agoNASCAR, IndyCar, and F1 Share These Race Days in 2026

-

Sports2 weeks ago

Sports2 weeks agoTexas A&M volleyball’s sweep of Kentucky attracts record viewership

-

Motorsports2 weeks ago

Motorsports2 weeks agoKyle Larson opens door to 24 Hours of Daytona comeback – Motorsport – Sports

-

Motorsports3 weeks ago

Motorsports3 weeks agoBigRock Motorsports Retains Its Championship Title At ISRL Season 2 Grand Finale In Calicut