Advertisement

Finance

Maine residents losing money on community solar subscriptions

In Maine, utility customers can subscribe to community solar projects to help fund solar production across the state. Some solar subscription companies advertise big savings for supporting clean energy production, but 8 Investigates found that sometimes the offers are too good to be true. Lisa Cloutier and her wife, Jennifer Fudge-Cloutier, thought they were doing something good for the environment. When a salesperson for Arcadia came to their door offering a solar subscription, they ended up signing up on the spot.”We thought we were going to help the planet. We didn’t know it would take half of a paycheck,” said Lisa. They signed up at the end of 2023, and their bills started going up a few months into their contract. It didn’t seem to align with how much electricity they were using. By January 2025, they were facing a nearly $600 bill for their small single-family apartment. “They make it look good on the pamphlet,” said Jennifer. “They really do, and it’s — it’s not,” added Lisa. “It’s not what you sign up for. It’s sad.”When you sign up for a solar subscription, Central Maine Power will still deliver your electricity (Versant if you live in Northern Maine), and you’ll start getting two separate bills: one from CMP and another from the company that handles your solar subscription. Whatever you pay on your solar bill will be translated into credits on your CMP bill. Then you’ll pay CMP for the difference, plus a small delivery cost. The part that catches consumers off guard is that your solar bill isn’t based on your energy usage. It’s based on how much energy the solar farm produced during that cycle and what percentage of the farm you’re subscribed to. If someone is oversubscribed, they end up paying for more credits than they could possibly use, which is what happened to Lisa and Jennifer. Based on an analysis of their bills and their energy usage, 8 Investigates calculated that, on average, Lisa and Jennifer were paying more than triple what they would have been spending without a solar subscription. By the time they canceled their contract, they had 7,232 unused credits. After one year, those credits expire. “So, you’re paying for electricity that you can’t even use,” said Jennifer. “If they expire, then it’s gone. You paid for it.””It’s a loss of money,” added Lisa. “It’s not fair to the customers.”PHNjcmlwdCBpZD0iaW5mb2dyYW1fMF8xNmE4MjlmNC1kNjllLTQ5MTUtODgzYS02YTEwMGJiYjYzOGUiIHRpdGxlPSJFbGVjdHJpYyBtb250aGx5IGNvc3QgY29tcGFyaXNvbiIgc3JjPSJodHRwczovL2UuaW5mb2dyYW0uY29tL2pzL2Rpc3QvZW1iZWQuanM/YllYIiB0eXBlPSJ0ZXh0L2phdmFzY3JpcHQiPjwvc2NyaXB0Pg==Using Public Utility Commission filings, 8 Investigates found that in 2023, CMP customers enrolled in community solar programs lost $2.28 million in expired credits. Seventy-three percent of those credits belonged to residential customers. Mainers like Lisa and Jennifer lost $1.67 million in one year. “If they’re going to be allowed to come into this state and offer these things, then there should be someone to look into them,” said Jennifer. When we reached out to Arcadia for comment, the vice president and general manager of energy services, Joel Gamoran, said, “Arcadia always intends to align subscribers with the appropriate subscription size, and we take our customers’ concerns seriously whenever we hear of any misalignment. As these instances have surfaced, we’ve worked to remedy them as quickly as possible. We have already resolved several of these issues for customers in Maine and are actively working to resolve the rest.”Arcadia Community Solar recently went through a merger with Boston-based company Perch Energy. 8 Investigates connected Lisa and Jennifer to the Maine Office of Public Advocate, where a consumer advocate was able to work with Arcadia to save them close to $1,000 that they still owed after canceling their solar subscription. A consumer advisor for the OPA says Arcadia has been willing to work with them to resolve similar issues for other customers as well. If you think you may be overpaying for your subscription, check your CMP bill. On the second or third page, you can see how many credits are going unused. Then, call your solar provider and tell them you want to reduce your subscription, or you’ll have to cancel your account. If you’re still having trouble, reach out to the OPA for help. A consumer advisor for the OPA says 38% of their consumer complaints in the last six months, have been related to solar. If you end up choosing to cancel your account, you may be on the hook for a few months of bills following the cancellation since most solar companies are on a different billing cycle than CMP.If you’re thinking about signing up for a solar subscription, don’t sign up without looking at a contract first and be sure to read the fine print. Many of these contracts allow the provider to increase your subscription without notice.

In Maine, utility customers can subscribe to community solar projects to help fund solar production across the state.

Some solar subscription companies advertise big savings for supporting clean energy production, but 8 Investigates found that sometimes the offers are too good to be true.

Lisa Cloutier and her wife, Jennifer Fudge-Cloutier, thought they were doing something good for the environment. When a salesperson for Arcadia came to their door offering a solar subscription, they ended up signing up on the spot.

“We thought we were going to help the planet. We didn’t know it would take half of a paycheck,” said Lisa.

They signed up at the end of 2023, and their bills started going up a few months into their contract.

It didn’t seem to align with how much electricity they were using.

By January 2025, they were facing a nearly $600 bill for their small single-family apartment.

“They make it look good on the pamphlet,” said Jennifer.

“They really do, and it’s — it’s not,” added Lisa. “It’s not what you sign up for. It’s sad.”

When you sign up for a solar subscription, Central Maine Power will still deliver your electricity (Versant if you live in Northern Maine), and you’ll start getting two separate bills: one from CMP and another from the company that handles your solar subscription.

Whatever you pay on your solar bill will be translated into credits on your CMP bill. Then you’ll pay CMP for the difference, plus a small delivery cost.

The part that catches consumers off guard is that your solar bill isn’t based on your energy usage. It’s based on how much energy the solar farm produced during that cycle and what percentage of the farm you’re subscribed to.

If someone is oversubscribed, they end up paying for more credits than they could possibly use, which is what happened to Lisa and Jennifer.

Based on an analysis of their bills and their energy usage, 8 Investigates calculated that, on average, Lisa and Jennifer were paying more than triple what they would have been spending without a solar subscription. By the time they canceled their contract, they had 7,232 unused credits.

After one year, those credits expire.

“So, you’re paying for electricity that you can’t even use,” said Jennifer. “If they expire, then it’s gone. You paid for it.”

“It’s a loss of money,” added Lisa. “It’s not fair to the customers.”

Using Public Utility Commission filings, 8 Investigates found that in 2023, CMP customers enrolled in community solar programs lost $2.28 million in expired credits. Seventy-three percent of those credits belonged to residential customers. Mainers like Lisa and Jennifer lost $1.67 million in one year.

“If they’re going to be allowed to come into this state and offer these things, then there should be someone to look into them,” said Jennifer.

When we reached out to Arcadia for comment, the vice president and general manager of energy services, Joel Gamoran, said, “Arcadia always intends to align subscribers with the appropriate subscription size, and we take our customers’ concerns seriously whenever we hear of any misalignment. As these instances have surfaced, we’ve worked to remedy them as quickly as possible. We have already resolved several of these issues for customers in Maine and are actively working to resolve the rest.”

Arcadia Community Solar recently went through a merger with Boston-based company Perch Energy.

8 Investigates connected Lisa and Jennifer to the Maine Office of Public Advocate, where a consumer advocate was able to work with Arcadia to save them close to $1,000 that they still owed after canceling their solar subscription.

A consumer advisor for the OPA says Arcadia has been willing to work with them to resolve similar issues for other customers as well.

If you think you may be overpaying for your subscription, check your CMP bill. On the second or third page, you can see how many credits are going unused. Then, call your solar provider and tell them you want to reduce your subscription, or you’ll have to cancel your account.

If you’re still having trouble, reach out to the OPA for help. A consumer advisor for the OPA says 38% of their consumer complaints in the last six months, have been related to solar.

If you end up choosing to cancel your account, you may be on the hook for a few months of bills following the cancellation since most solar companies are on a different billing cycle than CMP.

If you’re thinking about signing up for a solar subscription, don’t sign up without looking at a contract first and be sure to read the fine print. Many of these contracts allow the provider to increase your subscription without notice.

Finance

A Week In St. Petersburg, FL On A $45,000 Salary

Today: a server who makes $45,000 per year and who spends some of her money this week on a dry sheet mask from Ulta (she added it to her cart so she could get free shipping for her face wash).

Industry: Service industry

Age: 30

Location: St. Petersburg, FL

Salary: $45,000

Assets: Checking: $2,588.54; savings: $4,000.88; brokerage account: $65,000 (from my parents, given to me when I was 25). I have an undisclosed amount of Bitcoin in a Coinbase account (more than the brokerage), several pieces of Cartier jewelry that would probably hold their value if I had to sell them, and I own my own car but have been driving it since 2013, so it is worth very little.

Debt: $0

Paycheck Amount (2x/Month): $900-$2,000

Pronouns: She/her

Monthly Expenses

Housing Costs: My half of $1,800 rent (I live with a roommate in a two-bedroom, one-bathroom. Water is included, so it fluctuates by $50 or so per month).

Loan Payments: $0

Phone: $40

Internet: $60

Electricity: $227 this month (summer in Florida. I live on the second floor of a 40-year-old wooden structure).

Hello Fresh: ~$60 for two meals a month.

Streaming Services: $35.45 (I split some subscriptions with my brother).

Frame.io: $15 (for video editing work).

Apple & Google Storage: ~$5

There was definitely an expectation to go to college. I chose a college based on how much money they gave me in scholarships. I wanted to owe my parents as little as possible. I wanted to study marine biology and move out of my home state, so I only applied to coastal schools. My tuition was fully paid for through scholarships that the school gave me. My parents gave me an account of $35,000 when I graduated high school and that was basically the extra money I had to live on throughout college, although my parents paid for my dorm housing and meal plan the first two years. I worked in a marine bio lab all four years, but it was for career experience more than the very small amount of money I earned. Halfway through my undergraduate degree, I applied for and won a nationally competitive marine biology scholarship. It was enough to pay for my living expenses for the rest of college. After undergrad, I attended a PhD program for environmental/cultural anthropology for a year. It was fully funded, and I paid for living expenses through being a teaching assistant and doing private admissions test tutoring. My PhD program wasn’t what I thought it would be and I became disillusioned with academia, so I dropped out. The rest of my twenties were a very circuitous adventure. At the age of 30, I am running up against some pretty persistent depression and really evaluating what my values and goals are at this point in my life.

Growing up, what kind of conversations did you have about money? Did your parent(s) educate you about finances?

Although my dad made a decent amount of money in the finance industry, he emphasized that I would be expected to pay my own way as an adult. I went to a private Christian school and we watched Dave Ramsey videos in class. That was my financial education, and although both myself and my parents use credit cards, I still probably derive a lot of my money habits from Dave Ramsey. It works fine as a money philosophy for personal finances. Hasn’t steered me wrong, anyway.

What was your first job and why did you get it?

The summer after I graduated high school, I worked as a teaching assistant at a sailing day camp on a lake in Tennessee. Best summer of my life. I got the job because I wanted to keep going to the camp but I’d aged out of being a camper, so being a teaching assistant was the next logical step.

Did you worry about money growing up?

No. I was privileged. Really privileged. When I was 10 we went on vacation to Hawaii and England in one year. I learned how to ski at Deer Valley and Steamboat Springs. Then 2008 hit and my parents had to downsize their house, and it caused a lot of tension in the household. But at the end of the day, we always had more than enough money.

Do you worry about money now?

Yeah, kinda. But since I am secretly sitting on a lot of emergency cash in accounts that are under my name, I don’t ever really worry about money. I just don’t want to fuck up and have to use my brokerage account or Coinbase account for some kind of preventable money emergency.

At what age did you become financially responsible for yourself and do you have a financial safety net?

Since age 20, when I won a big scholarship. I started paying for my own housing and living expenses after that. While my parents expect me to take care of myself, I know they would step in if I had an emergency.

Do you or have you ever received passive or inherited income? If yes, please explain.

My dad handed over brokerage accounts totaling about $60,000 to my younger brother and me when we were 25 and 22 respectively. It was money he’d invested in some sort of tax-free inheritance account. I think it is supposed to be our inheritance from him: He said it was to pay for my wedding, a graduate degree, a down payment on a house, or whatever expenses I’d need as a young person. I’ve been sitting on it so far. I have held onto my Bitcoin money throughout years of ups and downs, and the result is that now my Coinbase account is my biggest asset. HODL.

Day One: Monday

Day Two: Tuesday

Day Three: Wednesday

Day Four: Thursday

Day Five: Friday

Day Six: Saturday

Day Seven: Sunday

The Breakdown

Food & Drink: $342.41

Entertainment: $0

Home & Health: $12.50

Clothes & Beauty $41.24

Transportation $65.54

Other $0.00

Conclusion

Finance

How to save money as grocery prices climb

We all know food prices are not what they used to be, but some items in your grocery cart have jumped more than others.The latest Consumer Price Index reveals food prices have risen 2.9% from July 2024, with some items seeing double-digit percentage increases. The cost of ground beef has risen by 11.5%, while steak prices are up 12.4%. Coffee drinkers are also feeling the pinch, with overall coffee prices increasing by 14.5%. Egg prices have seen the steepest hike, soaring 16.4% since July 2024.Not all grocery items are more expensive. Tomatoes are down 5.2%, the overall cost of fats and oils like butter and peanut butter has dropped 2.3%, and frozen vegetables are 2.2% cheaper. Ways to save on groceries Plan meals around sales and stick to a list Instead of deciding what you want to eat and then buying ingredients, flip the script: check the weekly ad first and build meals around what is on sale. Then, write a shopping list that covers only those meals, plus household staples and do not deviate. This reduces impulse buys and ensures you are buying with purpose, not just stocking random ingredients.Buy store brands over name brands Stores have the ability to discount their own brands further. Swapping things like cereal, pasta, canned goods and cleaning supplies for the store version can slash your bill with no noticeable difference. If you are unsure, start with one or two swaps per week and compare.Limit prepackaged foods Convenience foods may feel like time-savers, but they quietly drive up your grocery bill. Precut veggies and shredded cheese are priced higher to cover extra labor and packaging. Choosing the whole version and taking just a few minutes to prep at home delivers the same result for far less money. Try to use everything you buy The U.S. Department of Agriculture estimates the average family of four loses $1,500 annually due to wasted food. Make it a habit to freeze extras, repurpose leftovers into new meals and store produce properly so it lasts longer. Using up every ingredient you buy is one of the simplest ways to stretch your grocery budget.

We all know food prices are not what they used to be, but some items in your grocery cart have jumped more than others.

The latest Consumer Price Index reveals food prices have risen 2.9% from July 2024, with some items seeing double-digit percentage increases. The cost of ground beef has risen by 11.5%, while steak prices are up 12.4%. Coffee drinkers are also feeling the pinch, with overall coffee prices increasing by 14.5%. Egg prices have seen the steepest hike, soaring 16.4% since July 2024.

Advertisement

Not all grocery items are more expensive. Tomatoes are down 5.2%, the overall cost of fats and oils like butter and peanut butter has dropped 2.3%, and frozen vegetables are 2.2% cheaper.

Ways to save on groceries

Plan meals around sales and stick to a list

Instead of deciding what you want to eat and then buying ingredients, flip the script: check the weekly ad first and build meals around what is on sale. Then, write a shopping list that covers only those meals, plus household staples and do not deviate. This reduces impulse buys and ensures you are buying with purpose, not just stocking random ingredients.

Buy store brands over name brands

Stores have the ability to discount their own brands further. Swapping things like cereal, pasta, canned goods and cleaning supplies for the store version can slash your bill with no noticeable difference. If you are unsure, start with one or two swaps per week and compare.

Limit prepackaged foods

Convenience foods may feel like time-savers, but they quietly drive up your grocery bill. Precut veggies and shredded cheese are priced higher to cover extra labor and packaging. Choosing the whole version and taking just a few minutes to prep at home delivers the same result for far less money.

Try to use everything you buy

The U.S. Department of Agriculture estimates the average family of four loses $1,500 annually due to wasted food. Make it a habit to freeze extras, repurpose leftovers into new meals and store produce properly so it lasts longer. Using up every ingredient you buy is one of the simplest ways to stretch your grocery budget.

Finance

US Open 2025

The final Grand Slam event of the season is upon us. Main-draw action at the US Open starts on Sunday, Aug. 24 at the USTA Billie Jean King National Tennis Center in New York.

The top three seeds are also the last three players to win the tournament. Defending champion Aryna Sabalenka is No. 1, 2022 champion Iga Swiatek is No. 2 and 2023 champion Coco Gauff is No. 3.

The first U.S. Open women’s singles champion was crowned in 1887. This year marks the 139th edition, with the champion earning $5 million for winning seven matches.

Here are some key facts:

When does the tournament start?

Main-draw play at the US Open kicks off on Sunday, Aug. 24. The tournament ends on Sunday, Sept. 7.

The singles qualifying began on Monday, Aug. 18 and ended on Thursday, Aug. 21.

The US Open is on Eastern Daylight Time (GMT -4).

How big are the fields?

There are 128 players competing in the women’s singles main draw, with 104 receiving direct entry. Eight players received wild cards into the main draw and 16 more claimed the remaining spots by winning three qualifying matches. One lucky loser will also be in the main draw.

There are 32 seeded players in the singles draw and no byes. The women’s singles champion will have to navigate through seven rounds before hoisting the trophy.

The women’s doubles main draw will feature 64 teams — 49 duos with advance direct entry, eight with on-site entry (deadline Tuesday, Aug. 26, based on that week’s doubles rankings) and seven wild cards. There will be 16 seeded teams in the doubles draw and no byes. The champion team must make it through six rounds before clinching the women’s doubles title.

When are the finals?

The women’s singles final will take place on Arthur Ashe Stadium on Saturday, Sept. 6 at 4 p.m. local time.

The women’s doubles final is scheduled to take place on Friday, Sept. 5.

When are the draws?

The women’s singles draw was released on Thursday, Aug. 21 at 12 p.m. The projected fourth-round matches are as follows:

US Open draw: Rising stars Mboko and Eala face tough early competition

[1] Aryna Sabalenka vs. [14] Clara Tauson

[9] Elena Rybakina vs. [7] Jasmine Paolini

[4] Jessica Pegula vs. [16] Belinda Bencic

[10] Emma Navarro vs. [5] Mirra Andreeva

[6] Madison Keys vs. [11] Karolina Muchova

[15] Daria Kasatkina vs. [3] Coco Gauff

[8] Amanda Anisimova vs. [12] Elina Svitolina

[13] Ekaterina Alexandrova vs. [2] Iga Swiatek

Notable first-round matches include:

Alexandra Eala vs. [14] Clara Tauson

Barbora Krejcikova vs. [22] Victoria Mboko

Alycia Parks vs. [5] Mirra Andreeva

[SR] Petra Kvitova vs. Diane Parry

[WC] Venus Williams vs. [11] Karolina Muchova

Ajla Tomljanovic vs. [3] Coco Gauff

Maria Sakkari vs. Tatjana Maria

[13] Ekaterina Alexandrova vs. [SR] Anastasija Sevastova

Laura Siegemund vs. [20] Diana Shnaider

Emiliana Arango vs. [2] Iga Swiatek

Who are the defending champions?

- Aryna Sabalenka won her third and most recent Grand Slam title at the 2024 US Open, defeating Jessica Pegula 7-5, 7-5 in last year’s singles final. It was Sabalenka’s first US Open crown after losing in the 2023 final and the 2021-22 semifinals.

- Lyudmyla Kichenok and Jelena Ostapenko won their first Grand Slam doubles title as a team at the 2024 US Open, defeating Kristina Mladenovic and Zhang Shuai 6-4, 6-3 in the final. They will not be defending their title together this year: Kichenok will be partnering Ellen Perez, while Ostapenko has teamed up with Barbora Krejcikova.

- Sara Errani and Andrea Vavassori won their first Grand Slam mixed doubles title as a team at the 2024 US Open, defeating Taylor Townsend and Donald Young 7-6(0), 7-5 in the final. The Italian duo successfully defended their title in the competition’s new format, defeating Iga Swiatek and Casper Ruud 6-3, 5-7, [10-6] in the 2025 final on Wednesday, August 20.

What are the ranking points and prize money on offer in the singles main draw?

First round: 10 points | $110,000

Second round: 70 points | $154,000

Third round: 130 points | $237,000

Round of 16: 240 points | $400,000

Quarterfinals: 430 points | $660,000

Semifinals: 780 points | $1,260,000

Finalist: 1300 points | $2,500,000

Champion: 2000 points | $5,000,000

Who is playing?

The six US Open champions in the main draw are:

Venus Williams (2000, 2001)

Naomi Osaka (2018, 2020)

Emma Raducanu (2021)

Iga Swiatek (2022)

Coco Gauff (2023)

Aryna Sabalenka (2024)

Williams, 45, received a wild card. She made her US Open debut in 1997, reaching the final and will be making her 25th appearance at the tournament.

The eight other Grand Slam champions in the main draw:

Petra Kvitova (Wimbledon 2011, 2014)

Victoria Azarenka (Australian Open 2012, 2013)

Jelena Ostapenko (Roland Garros 2017)

Sofia Kenin (Australian Open 2020)

Barbora Krejcikova (Roland Garros 2021, Wimbledon 2024)

Elena Rybakina (Wimbledon 2022)

Marketa Vondrousova (Wimbledon 2023)

Madison Keys (Australian Open 2025)

The seven former Grand Slam finalists in the main draw:

Anastasia Pavlyuchenkova (Roland Garros 2021)

Leylah Fernandez (US Open 2021)

Danielle Collins (Australian Open 2022)

Karolina Muchova (Roland Garros 2023)

Jasmine Paolini (Roland Garros 2024, Wimbledon 2024)

Jessica Pegula (US Open 2024)

Amanda Anisimova (Wimbledon 2025)

Five teenagers have gained direct entry to the main draw:

Dubai and Indian Wells champion Mirra Andreeva, 18

Montreal champion Victoria Mboko, 18

Rabat and Eastbourne champion Maya Joint, 19

Ilkley WTA 125 champion Iva Jovic, 17

Grado WTA 125 and Porto WTA 125 champion Tereza Valentova, 18

They have been joined by wild cards Alyssa Ahn, 18, Valerie Glozman, 18, and Julieta Pareja, 16.

What are the scenarios for the World No. 1 ranking?

The PIF WTA World No. 1 ranking will be on the line in both singles and doubles at the US Open.

Singles World No. 1 Aryna Sabalenka will remain in the top spot if she reaches the quarterfinals. If she loses before the quarterfinals, either Iga Swiatek or Coco Gauff would move to No. 1 if they win the title. Swiatek was last ranked No. 1 in October 2024. Gauff would become No. 1 for the first time.

Doubles World No. 1 Taylor Townsend owns a slim 140-point lead over No. 2 Katerina Siniakova, with whom she has entered the doubles competition. The players who could potentially take the top spot from Townsend after the US Open are:

- Sara Errani and Jasmine Paolini, who need to reach at least the semifinals (the Italians would be co-No. 1s)

- Veronika Kudermetova, Jelena Ostapenko or Erin Routliffe, all of whom would need to win the title

Errani was ranked No. 1 for 87 weeks between September 2012 and April 2015, and Routliffe for eight weeks between July and September 2024. Paolini, Kudermetova and Ostapenko would be first-time No. 1s.

How has this summer’s hard-court swing played out so far?

Here are the champions and finalists from the hard-court events of July and August so far:

Washington, D.C. (WTA 500): Leylah Fernandez def. Anna Kalinskaya 6-1, 6-2

Prague (WTA 250): Marie Bouzkova def. Linda Noskova 2-6, 6-1, 6-3

Montreal (WTA 1000): Victoria Mboko def. Naomi Osaka 2-6, 6-4, 6-1

Cincinnati (WTA 1000): Iga Swiatek def. Jasmine Paolini 7-5, 6-4

Monterrey (WTA 500): TBD

Cleveland (WTA 250): TBD

What are the key stats for the Top 16 seeds?

1. Aryna Sabalenka

Age: 27

Career high ranking: 1

Career singles titles: 20 (3 this year)

Win-loss record in 2025: 50-10

Career main-draw win-loss record at US Open: 28-6

Best US Open result: Champion (2024)

Last US Open result: Champion (2024)

2. Iga Swiatek

Age: 24

Career high ranking: 1

Career singles titles: 24 (2 this year)

Win-loss record in 2025: 49-12

Career main-draw win-loss record at US Open: 20-5

Best US Open result: Champion (2022)

Last US Open result: Quarterfinals (2024)

3. Coco Gauff

Age: 21

Career high ranking: 2

Career singles titles: 10 (1 this year)

Win-loss record in 2025: 35-12

Career main-draw win-loss record at US Open: 17-5

Best US Open result: Champion (2023)

Last US Open result: Fourth round (2024)

4. Jessica Pegula

Age: 31

Career high ranking: 3

Career singles titles: 9 (3 this year)

Win-loss record in 2025: 37-16

Career main-draw win-loss record at US Open: 18-8

Best US Open result: Final (2024)

Last US Open result: Final (2024)

5. Mirra Andreeva

Age: 18

Career high ranking: 5

Career singles titles: 3 (2 this year)

Win-loss record in 2025: 36-12

Career main-draw win-loss record at US Open: 2-2

Best US Open result: Second round (2023-24)

Last US Open result: Second round (2024)

6. Madison Keys

Age: 30

Career high ranking: 5

Career singles titles: 10 (2 this year)

Win-loss record in 2025: 37-12

Career main-draw win-loss record at US Open: 33-13

Best US Open result: Final (2017)

Last US Open result: Third round (2024)

7. Jasmine Paolini

Age: 29

Career high ranking: 4

Career singles titles: 3 (1 this year)

Win-loss record in 2025: 33-14

Career main-draw win-loss record at US Open: 4-5

Best US Open result: Fourth round (2024)

Last US Open result: Fourth round (2024)

8. Amanda Anisimova

Age: 23

Career high ranking: 7

Career singles titles: 3 (1 this year)

Win-loss record in 2025: 34-15 (32-14 in tour-level main draws)

Career main-draw win-loss record at US Open: 3-5

Best US Open result: Third round (2020)

Last US Open result: First round (2024)

9. Elena Rybakina

Age: 26

Career high ranking: 3

Career singles titles: 9 (1 this year)

Win-loss record in 2025: 41-16 (including Billie Jean King Cup)

Career main-draw win-loss record at US Open: 5-5

Best US Open result: Third round (2021, 2023)

Last US Open result: Second round (2024)

10. Emma Navarro

Age: 24

Career high ranking: 8

Career singles titles: 2 (1 this year)

Win-loss record in 2025: 25-21

Career main-draw win-loss record at US Open: 5-3

Best US Open result: Semifinals (2024)

Last US Open result: Semifinals (2024)

11. Karolina Muchova

Age: 29

Career high ranking: 8

Career singles titles: 1 (0 this year)

Win-loss record in 2025: 16-12

Career main-draw win-loss record at US Open: 17-7

Best US Open result: Semifinals (2023, 2024)

Last US Open result: Semifinals (2024)

12. Elina Svitolina

Age: 30

Career high ranking: 3

Career singles titles: 18 (1 this year)

Win-loss record in 2025: 35-13 (including Billie Jean King Cup)

Career main-draw win-loss record at US Open: 24-11

Best US Open result: Semifinals (2019)

Last US Open result: Third round (2024)

13. Ekaterina Alexandrova

Age: 30

Career high ranking: 14

Career singles titles: 5 (1 this year)

Win-loss record in 2025: 33-17 (as of the Monterrey quarterfinals this week)

Career main-draw win-loss record at US Open: 9-8

Best US Open result: Third round (2023, 2024)

Last US Open result: Third round (2024)

14. Clara Tauson

Age: 22

Career high ranking: 15

Career singles titles: 3 (1 this year)

Win-loss record in 2025: 33-17

Career main-draw win-loss record at US Open: 3-4

Best US Open result: Second round (2021, 2023, 2024)

Last US Open result: Second round (2024)

15. Daria Kasatkina

Age: 28

Career high ranking: 8

Career singles titles: 8 (0 this year)

Win-loss record in 2025: 17-19

Career main-draw win-loss record at US Open: 12-10

Best US Open result: Fourth round (2017, 2023)

Last US Open result: Second round (2024)

16. Belinda Bencic

Age: 28

Career high ranking: 4

Career singles titles: 9 (1 this year)

Win-loss record in 2025: 27-13 (25-13 in tour-level main draws)

Career main-draw win-loss record at US Open: 21-8

Best US Open result: Semifinals (2019)

Last US Open result: Fourth round (2023)

Finance

Luxury items seized in $3b money laundering case handed over to Deloitte for liquidation

SINGAPORE – A total of 466 luxury items and 58 pieces of gold bars from the

$3 billion money laundering case

have been handed over by police to professional services firm Deloitte to manage and liquidate.

They include Patek Philippe and Richard Mille watches, multiple pieces of diamond-encrusted jewellery, and Hermes and Louis Vuitton handbags. The gold bars weigh between 999g and 1kg each.

The items were among assets seized in an anti-money laundering operation that saw

10 foreigners arrested in multiple raids

on Aug 15, 2023, and 17 other suspects flee Singapore amid the probe.

The police said they would progressively hand over all the remaining non-cash assets to Deloitte to manage and liquidate.

In total, the police seized or took control of around $1.25 billion in non-cash assets – including cars, properties, art, watches, jewellery, gold bars, handbags and bottles of alcohol – during investigations.

Some of the items, including 54 properties, were liquidated earlier in 2024.

The police incurred costs of $2.65 million in the 2023 and 2024 financial years to maintain and manage the assets, a spokesman told The Straits Times.

On Aug 12, the police said they had formally appointed Deloitte & Touche Financial Advisory Services for the management and liquidation of the remaining non-cash assets.

“To facilitate this, police are progressively handing over all remaining non-cash assets that have yet to be liquidated to Deloitte. Between Aug 11 and 12, police handed over 466 luxury goods items and 58 pieces of gold bars to Deloitte,” said the police spokesman.

Deloitte will submit its proposals for the sale of the assets in due time, and the proceeds will be paid into the Consolidated Fund, the police spokesman said. “These could include auctions and direct selling. Deloitte will commence the realisation of the assets upon the Government’s approval of the proposals.”

Revenues of Singapore are paid into the Consolidated Fund, which is similar to a bank account held by the Government, out of which government expenditures are made.

The nine men and one woman arrested were convicted in 2024 and jailed for between 13 and 17 months for offences including money laundering, forgery and resisting arrest.

They were deported and barred from entering Singapore after completing their jail terms.

In total, the police seized or took control of around $1.25 billion in non-cash assets during investigations.

ST PHOTO: KUA CHEE SIONG

The 27 foreigners had spent lavishly in Singapore, with many living in good class bungalows and joining Sentosa Golf Club, where membership for foreigners cost around $950,000 at its peak.

It came to an end when more than 400 officers, including those from the Criminal Investigation Department, Commercial Affairs Department, Special Operations Command or riot police, and Police Intelligence Department, raided their homes.

When they received news of the blitz, 17 suspects fled the country, leaving behind assets such as luxury cars, watches and jewellery in their haste.

The gold bars each weigh between 999g and 1kg.

ST PHOTO: KUA CHEE SIONG

Home Affairs Minister K. Shanmugam, who was then also Law Minister, told Parliament in a written response on Feb 26 that as at December 2024, around $2.79 billion out of the $3 billion linked to the case had been surrendered to the state. This included $1.54 billion in cash and financial assets.

Mr Shanmugam, who is now also Coordinating Minister for National Security, said that 54 properties, 33 vehicles and 11 country club memberships were liquidated by the

end of December 2024

.

He added that about $1.8 million had been paid into the Consolidated Fund by the end of 2024, with another $390 million to be paid within the 2024 financial year.

Luxury watches from Patek Philippe and Richard Mille are among the non-cash assets seized during investigations.

ST PHOTO: KUA CHEE SIONG

As for the items linked to the case, The Straits Times had reported in January 2024 that the Government confiscated 207 properties, 77 vehicles, more than $1.45 billion in bank accounts and more than $76 million in cash of various currencies.

Alongside these assets, thousands of bottles of liquor and wine, cryptocurrency worth more than $38 million, 68 gold bars, 483 luxury bags, 169 branded watches and 580 pieces of jewellery were also seized.

Luxury handbags from Hermes and Louis Vuitton are among the non-cash assets seized during investigations.

ST PHOTO: KUA CHEE SIONG

As a result of the case,

penalties amounting to $27.45 million

were imposed on nine financial institutions on July 4, after the scandal exposed critical weaknesses in the banks, which included shortcomings in the assessment of a customer’s risk and source of wealth and the monitoring of suspicious transactions, as well as inadequate risk-mitigation measures.

The Ministry of Law also penalised three law firms for anti-money laundering breaches over the purchase of properties linked to the case.

Another three law practices were reprimanded for their involvement in the property deals, and five lawyers were referred to the Law Society of Singapore for potential disciplinary action.

The police said they would progressively hand over all the remaining non-cash assets to Deloitte to manage and liquidate.

ST PHOTO: KUA CHEE SIONG

Inquiries into 11 other firms are ongoing.

Action was also taken against two property agents, who were fined for their failure to carry out customer due diligence measures on clients linked to the case.

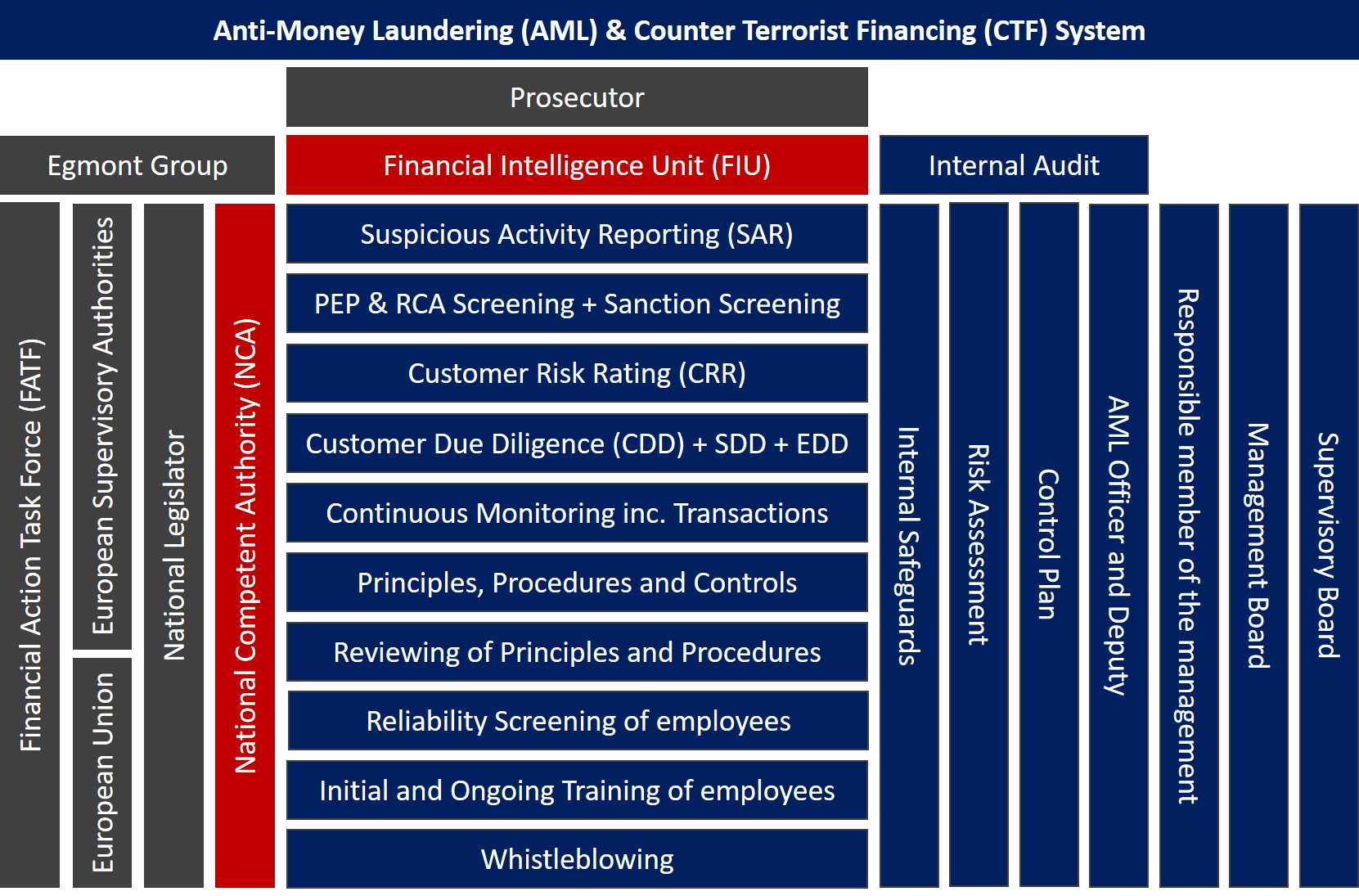

As a result of the investigations, there were legislative changes and enhanced measures to strengthen anti-money laundering laws in Singapore, such as the Anti-Money Laundering and Other Matters Bill that was passed in Parliament on Aug 6, 2024.

The 27 foreigners spent lavishly in Singapore.

ST PHOTOS: KUA CHEE SIONG

An Inter-Ministerial Committee on Anti-Money Laundering was also

formed in November 2023,

to look into Singapore’s anti-money laundering framework.

Meanwhile, the Corporate Service Providers Bill and the Companies and Limited Liability Partnerships (Miscellaneous Amendments) Bill were both

passed in Parliament in July 2024

, requiring all business entities providing corporate services to register with the Accounting and Corporate Regulatory Authority.

The Anti-Money Laundering and Other Matters (Estate Agents and Developers) Bill, passed in April, has resulted in

stricter compliance requirements and enhanced deterrents

being placed on estate agents, salespersons and developers.

Finance

Do It For The Money

Do It For The Money by Brutus VIII is an intense listen. It certainly isn’t a record made for fun, or even for an audience, necessarily. Just kind of something he had to get out of his system before it ate him alive. In a compelling way, the EP is hard to sit with and a little emotionally messing. My Eating Disorder is already a fucking heavy name that mirrors the cacaphony that of the EP. Distorted synths crash over blown-out drum machines. His voice slips between monotone and manic, whispering the line “I just wanna be someone else.” Someone who has lived in his own head for too long, he’s expressing the longing and loneliness, mirroring the internal chaos through his music.

“Do It for the Money” keeps the same pressure. Bass-heavy and disoriented, it rides a dark techno groove while he confesses, “I did it for the money, I did it for the friendships I thought I’d get.” An honest mix of bitter cynicism and a clear connection between performance, commodification. By the time he reaches “The Chant” and murmurs, “I got a discotech, but I want to disconnect,” the message is clear.

Then comes “Eichmann on Trial Again,” the EP’s strangest and most fascinating moment. It slows everything down. The spoken word delivery is more pointed, more deliberate. Underneath, electronic organs swell while bursts of saxophone bleed through the cracks. The title references Adolf Eichmann, tried for his role in the Holocaust, and the line “He knows all the words to our favorite hip-hop songs” is bitter irony at the uncomfortable situation he resides in. The whole track feels like a collapse: historical trauma, personal disillusionment, cultural critique, all crumbling together in a wash of jazz and electro.

Brutus VIII builds a world out of broken machines. Blown-out drum loops and twisted synths, bass lines and intense percussion all swirl around vocals that drift from deadpan to desperate. The songwriting balances irony with despair, humor with horror, like someone trying to stay composed while everything is collapsing inside. It’s honestly a little ugly. But it’s also honest, and occasionally beautiful in an authentic way.

Order Do It For The Money by Brutus lll HERE

Finance

Jake Paul has made an incredible amount of money from his boxing career ahead of Julio …

Jake Paul has made himself richer than he ever expected after moving from the world of YouTube into professional boxing.

The YouTuber is set to take on Julio Cesar Chavez Jr on June 28 in his toughest test yet.

Jake Paul’s planned fight with Canelo Alvarez fell apart, but his opponent was replaced by Chavez Jr in the main event of a blockbuster card in California.

This could be one of Paul’s biggest paydays yet, adding to the incredible amount of money he’s made in his career so far.

Jake Paul has made over $60 million since starting his boxing career

Paul has made an astronomical amount of money since beginning his career in professional boxing.

The former Disney Channel actor made his boxing debut in 2020. Paul beat fellow YouTuber AnEsonGib in a quick and easy knockout victory, which earned him a reported payday of $1 million.

His pay for the next few fights varied, going as low as $600,000 for his win over Nate Robinson and over $3 million for his defeat to Tommy Fury in 2023.

| # | Opponent | Date | Reported Base Purse | Notes |

| 1 | AnEsonGib | Jan 30, 2020 | $1 million | Pro debut |

| 2 | Nate Robinson | Nov 28, 2020 | $600,000 | Undercard of Tyson vs. Roy Jones Jr. |

| 3 | Ben Askren | Apr 17, 2021 | $690,000 | 500k PPV buys |

| 4 | Tyron Woodley I | Aug 29, 2021 | $2 million | 500k PPV buys |

| 5 | Tyron Woodley II | Dec 18, 2021 | $2 million | Short-notice rematch |

| 6 | Anderson Silva | Oct 29, 2022 | $1.5 million | 200–300k PPV buys |

| 7 | Tommy Fury | Feb 26, 2023 | $3.2 million | $8.6M total incl. PPV revenue share |

| 8 | Nate Diaz | Aug 5, 2023 | $1.6 million | 450k PPV buys, reported $27 million in revenue |

| 9 | Andre August | Dec 15, 2023 | $2.9 million | Fought on DAZN card |

| 10 | Ryan Bourland | Mar 2, 2024 | $2.9 million | Light heavyweight bout |

| 11 | Mike Perry | Jul 20, 2024 | $3 million | 67k PPV buys |

| 12 | Mike Tyson (TBD) | Nov 15, 2024 | $40 million (claimed) | Paul’s “biggest payday” to date |

Paul’s paydays stayed around the $2 million to $3 million mark until his blockbuster fight with Mike Tyson shattered his records for their November 2024 bout.

Despite claims that Paul was paid up to $90 million for the bout, he claimed in the months before the fight that he earned a more modest $40 million for beating the former World Heavyweight champion.

MORE BLOODY ELBOW NEWS

“I’m here to make $40 million and knock out a legend,” Paul told a press conference in the build-up to the fight.

Looking at the reported figures, Paul has earned an estimated $61.4 million from his boxing career alone. This will increase with the Chavez Jr fight, although it is missing the split of the pay-per-view revenue he will have earned.

That will add even more millions to his purse, making Paul one of the most successful boxers in recent years.

Jake Paul is unlikely to make more on his next bout than the Mike Tyson fight

While Paul’s upcoming bout with Chavez Jr is garnering huge interest, he is unlikely to make as much money on the fight as his last one.

The bout with Tyson in November 2024 earned Paul a reported $40 million. However, the interest in that bout was incredible, which was helped by it being broadcast live on Netflix instead of pay-per-view.

This earned Paul a huge fee, although that made up for a lack of PPV revenue share.

The bout with Chavez Jr is being broadcast on DAZN, which means he will only earn a huge fee if the fight sells a lot of pay-per-views.

While his purse for fighting will be in the millions, it would need to be a massively popular bout to hit the $40 million mark to take his total fight earnings to over $100 million for his career.

-

Motorsports3 weeks ago

Motorsports3 weeks agoJo Shimoda Undergoes Back Surgery

-

Motorsports1 week ago

Motorsports1 week agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

NIL2 weeks ago

NIL2 weeks agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoHow this startup (and a KC sports icon) turned young players into card-carrying legends overnight

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoRobert “Bobby” Lewis Hardin, 56

-

Motorsports3 weeks ago

Motorsports3 weeks agoPohlman admits ‘there might be some spats’ as he pushes to get Kyle Busch winning again

-

Sports3 weeks ago

Wisconsin volleyball sweeps Minnesota with ease in ranked rivalry win

-

Motorsports1 week ago

Motorsports1 week agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Motorsports3 weeks ago

Motorsports3 weeks agoIncreased Purses, 19 Different Tracks Highlight 2026 Great Lakes Super Sprints Schedule – Speedway Digest

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw