Technology

Security, Sports, and Skiing | The Motley Fool

In this podcast, Motley Fool analysts Jason Moser and Matt Argersinger discuss:

- Okta‘s good quarter versus the market’s glass-half-empty reaction.

- Dick’s Sporting Goods brings the goods, though the acquisition of Foot Locker leaves some questions.

- Vail Resorts has new “old” leadership, but will it be enough?

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. When you’re ready to invest, check out this top 10 list of stocks to buy.

A full transcript is below.

This podcast was recorded on May 28, 2025.

Jason Moser: We’ve got security and sports. You’re listening to Motley Fool Money. Welcome to Motley Fool Money. I’m Jason Moser and joining me today is senior analyst in dividend aficionado Thanks for being here, man.

Matt Argersinger: You bet, Jason. Thanks for having me.

Jason Moser: Well, we’ve got an earnings stacked show today. We’re going to talk about Dick Sporting Goods as well as Vail Resorts. But we’ll begin with identity solutions expert Okta. The company reported earnings yesterday after the market closed, and the stock is down, Matty, on what seems like a pretty solid report.

Matt Argersinger: Well, Jason, that’s what double digit revenue growth, record up profits, and reaffirming full year guidance will get you this earning season,[laughs] double digit town dater stock. Now, the stock is down sharply, but it actually is just back to levels we saw at the end of March, less than two months ago. I think it hit like a post 2022 bear market high recently. The stock has been on absolute tear. I don’t think investors should get worried here. I don’t follow the company as closely as other analysts here at the fool, but I think expectations for a company like Okta are always going to be very high just because of the growth it tends to put up.

Jason Moser: I wonder, too, how many out there maybe think that management might be sandbagging just a little bit. Revenue growth of 12%, remaining performance obligations, up 21%. The company continues to grow profits and cash flow. Matty, I can think of worse things. Now, that’s said. I absolutely pulled forward a lot of growth in 2020 and 2021, as many did. It does seem reasonable that things would level off a bit with this business. Now, I want to dig into some of the metrics that matter for companies like these. Now, metric, with a lot of these SAS businesses, it’s one that matters a lot, I think. It’s large customers. All of the companies, they define this a little bit differently. It’ll be customers that spend $100,000 or more per year or maybe it’s 300,000.

But then you see these companies start pointing out those million dollar plus customers, and in the call, they noted in the quarter, the number of customers spending $1 million or more in annual recurring revenue with Okta grew 20%. Now, when you couple that with what some of their customers look like, this is a pretty impressive client roster. Some of these companies you may have heard of Amazon Web Services, DocuSign, Google, SalesForce, Zoom Video Communications, you get where I’m going here. How important is the large customer for Oktas business today?

Matt Argersinger: I think it’s key, and like you said, it’s key for a lot of these software companies. That’s where a company like Okta can really scale its offerings and earn higher margins. You mentioned the number, the $1 million spend, growing 20% or more, and that’s why I think CEO Tom McKinnon said on the call that I think the single biggest opportunity for the company is that large enterprise customer base, and he thinks Okta has wide market opportunity within the fortune, I guess, 2,000 or the top 5,000 companies that would potentially be Okta customers. He thinks they’re far from reaching that potential within that customer segment. If they keep putting up 20% numbers, with customers that are spending $1 million or more in annual recurring revenue, that is going to look very good for Okta going forward.

Jason Moser: It seems it would be the case. Now, we talk a lot about competition in this space, obviously, very competitive in cybersecurity. Some of the obvious names that we continue to talk about here at the fool, companies like CrowdStrike, ZScaler or even Palo Alto Networks. But one that I think probably most investors don’t initially connect the dots to is Microsoft. I think part of that is because, Microsoft does so many different things and does a lot of it well. But Microsoft, in this case, is a formidable competitor, and they can do it all, and they can bundle these identity solutions at competitive prices. We’ve seen them pull that off with teams to an extent. That’s certainly threatened Zoom to a degree, and I think Slack, as well. How effectively are they competing in this space? Particularly in regard to larger enterprise customers. How big of a threat really is Microsoft, in this case?

Matt Argersinger: I think Microsoft is always a big threat, weirdly, it’s not going to be a threat to the larger customers that Okta is going after. If you think about companies like Amazon, Alphabet, Salesforce, Okta customers, they don’t want to go anywhere near Microsoft, which is a major competitor in a lot of their markets. If they’re going to avoid it, they can. So I like that Okta doesn’t compete even directly with most of its large customers. It’s singularly focused on identity and security solutions versus Microsoft, which, of course, does everything. I think that’s compelling. When you’re a software company that is a leader in a specific vertical and you don’t have these tentacles going out in so many different places that could potentially encroach on your customers markets, you’re going to have a lot easier time selling and growing your solution. I do think as long as Okta does a great job within its own market and verticals, it should have no problem competing against Microsoft, which it’s saying a lot just how big Microsoft is. But I do think Okta can continue to succeed.

Jason Moser: I think that makes a lot of sense, what you’re saying too, is a lot of these companies, they don’t want to put all of their eggs in one basket and management spoke to that last quarter. They acknowledge that Microsoft is this big competitor out there, but by the same token, they also acknowledge that most of their customers, they don’t want to just wrap everything up with Microsoft because then you get in that single point of failure risk, and that could be a big problem, especially for these bigger customers. To me, I also look at Okta. It’s business as I follow somewhat closely. I’ve recommended it in our Next Gen Supercycle service several years back. It’s a founder led business. Feels like we need to talk about leadership here a little bit. Tom McKinnon, co founder and CEO of the business. He’s been the CEO of the company since they went public in 2017. I have to say, it seems to me he’s done a very good job. There was the Of Zero acquisition a little while back that brought some questions up. They paid a heavy price for that one, but it sounds like Of Zero is working out well. Have you take on leadership there? How much do you value that founder led dynamic?

Matt Argersinger: I think it’s always important, it’s always positive. If you have the founder and visionary at the helm. You mentioned the IPO in 2017. Well, Okta is up 400% since that IPO. I think investors are pretty pleased. Now, I know the stock is down quite a bit from its 2021 high. It still hasn’t gotten back to that.

Jason Moser: A lot of them are, Matty.

Matt Argersinger: No, of course. We just know the bloodbath that 2022 was for technology companies. Many of them haven’t reclaimed those previous highs. But still, even with that, 400% up since 2017, crushing the market. I think that’s a pretty good testament to how McKinnon is running the business, for sure.

Jason Moser: Absolutely. Well, Dick Sporting Goods reported earnings this morning as well. Diving in here, it’s a fairly muted reaction from the market stocks up a little bit today. You look at this report, it seemed like a pretty good report in the face of a very tricky retail environment these days. I think that we look at Dick Sporting Goods. The numbers they’ve lobbed up here, revenue up 5.2% from a year ago, comps up 4.5%. I think even more encouraging leadership maintained guidance for the full year, which in the current tariff environment, could be considered a big win. Now, we’ve seen a variety of responses from the market, but it comes to retail these days, specifically how exposed they are, of course, to the current tariff environment. Do you think Dick Sporting Goods is at greater risk than others here?

Matt Argersinger: I would think they are, Jason, only because, well, management hasn’t really disclosed, at least as far as I could find exactly how much inventory they source from places like China that had been subjected to the higher tariffs. But we do know that a competitor like Academy Sports and Outdoors gets about 50% of its inventory from China. I would expect it’s in that ballpark for Dick’s as well. The good news is that I think management has done a good job of diversifying its Dick’s sourcing in recent years. Like you said, the fact that management is reaffirming full year guidance, even factory the higher 30% tariff on Chinese goods right now that we know is still in place, I think that shows how far they’ve come, and on top of that, they’re actually calling for a 75 basis point increase in gross margins this year. Now, price increases will almost certainly play a role in that, but it doesn’t sound like it’s going to be high enough to really impact customer spending, at least they don’t think it will. Just something to keep in mind for investors. Management’s guidance is based on the existing tariff policy.

Jason Moser: I was going to bring that up.

Matt Argersinger: In this 90 day pause. I think people forget we’re in this 90 day pause period as these reciprocal trade agreements, especially Visa V China are being negotiated. Who knows what will come in July once that all comes to a head. I think the picture could still change significantly over the next couple of months, but it is nice to see that Management is reaffirming guidance.

Jason Moser: I had to bring a little snip in from the call there because I’m glad you referred to that because that’s exactly what I was thinking. They said on the call, with all of this in mind, we are reaffirming the guidance we provided for 2025, which includes the expected impact from all tariffs currently in effect. That’s the key phrase can change on a dime. We know this is just a very headline driven market, and tomorrow we will probably another headline that changes the calculus completely. But I guess for now at least, it seems like the company is going in the right direction. Now, I think the big news with Dick Sporting Goods here recently, the company made a big announcement a few weeks back. It’s going to acquire Foot Locker. Did you notice anything on the call? What did management have to say about that on the call? Because one of the things I found interesting in this deal is that Foot Locker shareholders can either take an all cash offer or they can take shares in Dick Sporting Goods. You don’t often see shareholders getting those types of options. It’s usually one or the other, isn’t it?

Matt Argersinger: I do like that shareholders are getting the option there, because clearly, there are some investors who are going to be less favorable to the acquisition and rather just take the cash and move on. Others probably see the opportunity to own shares in Dicks going forward, which has obviously been a real superior operator in the Sporting Goods space. I kind of like that Dick’s is giving that option. I hope other companies do that, as well. Turning to the acquisition itself, Dick’s management is obviously pretty high on it. They think it gives them access to new markets, a different customer base. They think they can drive scale and efficiency across the Foot Locker business, capturing somewhere they think on the order of 100 million and 125 million in cost synergies. There’s that word I don’t like, but they think they can get it. they think the deal will be accretive to earnings per share in the first full fiscal year after the acquisition is closed. I don’t know, Jason. My problem is, I just can’t get over the disparity here in the real estate footprint for one.

Dick’s has specialized and succeeded with this big box stand-alone store concept. Heck, it’s even expanded on that in recent years with its massive House of sports concept. I don’t know if you’ve ever been to any of these, but these are massive stores. They’ve got climbing gyms, batting cages. I think even have ice rinks in them. But now you’re taking on this massive new network of smaller stores. In some cases, less than a tenth of the size of your average store, they’re largely located in malls, and of course, Foot Locker is much more focused on shoes. Yes, it’s still sports. It’s still within that overall category, but it just feels like a very different concept and business model. I’m not sure how excited I would be about the deal if I was a Dick shareholder. I just feel like a reach.

Jason Moser: They are two very different concepts, playing in the same sandbox, but very different concepts. I think you’re right in that it’s going to be something to pay close attention to how they manage that smaller store footprint because it gives them a lot of additional stores, but these are much, much smaller stores. Like you said, they focus on shoes. I think in regard to pricing, like you mentioned earlier, we saw news recently that Nike is going to be passing through some price increases, mostly on higher end items. They’re going to forgo price increases on things like kids apparel and goods and whatnot. But it’ll be interesting to see how companies like Dick Sporting Goods and in footlocker of handle those price increases and how sensitive consumers really are in regard to those. Matty, let’s wrap it up with your well, I don’t want to call it your favorites, but it’s a company you followed for a long time, and I’ve spoken with you a lot about it before. Vail Resorts, having a great day today, it seems like that’s at least partly due to a change in leadership. But on a semi related note, Matty, I’ve noticed it’s still a wee bit chilly here in Northern Virginia as we prepare to enter June. It begs the question, is Vail benefiting from a longer season this year?

Matt Argersinger: It was a little bit of a better ski season than they’ve had in recent years. that is a positive takeaway. Let’s get to the leadership change. That’s the real reason the stock is moving. Let me first give a shout out to Anthony Shavon. He’s my partner in crime on our Dividend Investor Service. He’s been on this story for the better part of a year. In fact, we put Vail Resorts on hold in our service a while ago, feeling the company had just expanded too fast, taken on a lot of debt. Bought back billions of dollars worth of stock at prices, in some cases are 100% higher to where Vail was trading at earlier this week. We just didn’t like the direction the company was going. We did eventually bring the stock back to a buy on the idea that Vail is probably going to make a change at CEO, and sure enough, that is exactly what happened. I think the reason the stock is getting such a positive reaction is because of who they are bringing back. It’s Rob Katz. He’s the executive chairman of the board. He was the CEO from 2006-2021, 15 years where Vail’s business boomed, its stock delivered at a total return of more than 1,100%, almost triple the S&P 500. I think what the market sees in Katz is someone who obviously had a very successful tenure as CEO.

He’s probably going to pull back the reins on Vail’s expansion, really focus on making the business more efficient and profitable, and someone who could just solve some of those vexing problems that Vails had at some of its resorts, including overcrowding, a lot of its lifts, the labor challenges that ran to this past season where they had strikes, which was not a great experience for obviously, visitors of the resort. It’s a tall order, but I think he knows the company in and out. He’s been with Vail since 1991, yet he’s only 58-years-old. I think investors are right to be enthusiastic. It was also encouraging to see that Vail did reaffirm its guidance that it gave back in April. That guidance was lower than what Vail gave coming into the year. But the fact that results weren’t lowered is a good sign, I think, and we’ll get the full picture when Vail reports fiscal third quarter results next week. One thing to watch. However, Anthony and I do think there’s a reasonable chance that Vail cuts the dividend or even suspends it. Prior to the announcement and the jump in the stock price, Vail was yielding more than 6.5%, and the current dividend payout that it’s promising this year exceeds what Vail is expecting to earn this year, which, of course, is usually a red flag. As dividend investors, we hate when companies cut their dividend. I hate it, but I think it almost is inevitable now, and I could see Katz wanting to preserve cash flow, strengthen the balance sheet, have capital to reinvest back in some of its resorts. There might be a short term negative reaction when that happens, but it probably is the right long term call for the business.

Jason Moser: It’s a nice tip of the cat there to Ant. We love Van here. Nice job. Mattie, before we go, last thing, talking about this leadership change with Vail Resorts, it got me thinking, and given the success that Rob Katz has had to this point, given the response we’re seeing from the market today, is it possible? Do you feel like Vail could have a cat’s problem like Disney or Starbucks with Iger and Schultz?

Matt Argersinger: I think it’s a great question, Jason. I will say this. I think the fact that he’s only 58-years-old, I feel like the succession questions can be put off a little bit. I don’t know how long he’s intending to come back, but he’s still relatively young. He was the CEO for a long time. He’s been the executive chairman since he stepped down in 2021, so he’s intimately familiar with the business. It’s not like he’s coming back in from being somewhere else. I just I don’t think those questions will come up as frequently as they have for, you know, for Bob Iger or Schultz over at Starbucks. So we’ll see how this turns out, but I think Katz is here to stay for a while.

Jason Moser: We’ll leave it there. Matt Argersinger, thanks so much for being here.

Matt Argersinger: Thanks, Jason

Jason Moser: As always, people on the program may have interest in the stocks they talk about, and the Motley Fool may have formal recommendations for or against, so don’t buy or sell stocks based solely on what you hear. All personal finance content follows Motley Fool editorial standards and/ or not approved by advertisers. Advertisements or sponsored content are provided for informational purposes only. To see our full advertising disclosure, please check out our show notes. I’m Jason Moser. Thanks for listening. We’ll see you tomorrow.

Technology

Phygital Baseball Board Games : Base on Board 2.0

Purely digital games lack tactile, social play, while classic board games can’t adapt probabilities, stream competition, or evolve with live data. Base on Board 2.0 delivers the best of both with dynamic E-ink smart dice that shift probabilities in real time using MLB stats, plus AI commentary and visual effects. Altogether, Base on Board 2.0 delivers authentic baseball drama and supports competitions in a physical-digital gaming hybrid experience.

Technology

Gaming PC Market | Global Market Analysis Report

Gaming PC Market Forecast and Outlook 2026 to 2036

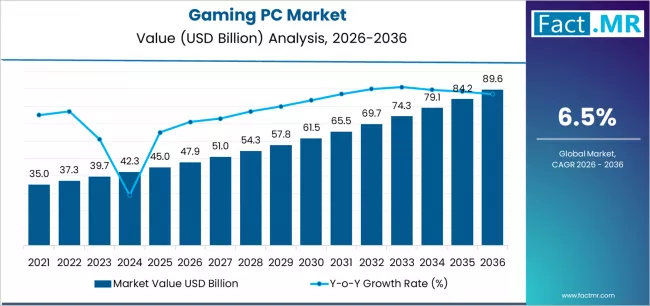

The global gaming PC market is valued at USD 47.9 billion in 2026 and is projected to reach USD 89.6 billion by 2036, reflecting an absolute increase of USD 41.7 billion. This represents total growth of 87.1%, with the market expanding at a CAGR of 6.5% over the forecast period.

Growth is driven by rising demand for high-performance gaming systems, increasing esports participation, and growing requirements for advanced gaming experiences across competitive gaming, content creation, and virtual reality applications.

Quick Stats for Gaming PC Market

- Gaming PC Market Value (2026): USD 47.9 billion

- Gaming PC Market Forecast Value (2036): USD 89.6 billion

- Gaming PC Market Forecast CAGR: 6.5%

- Leading System Type in Gaming PC Market: Desktop Gaming PCs (72.3%)

- Key Growth Regions in Gaming PC Market: Asia Pacific, North America, Europe

- Key Players in Gaming PC Market: Dell Technologies Incorporated, Hewlett-Packard Inc., ASUSTeK Computer Inc., Micro-Star International Co. Ltd., Corsair Gaming Incorporated

Desktop gaming PCs are expected to account for 72.3% of market share in 2026, supported by their superior performance capabilities, upgrade flexibility, and thermal management advantages. Competitive gaming applications are projected to hold 48.7% share, driven by demand for high refresh rates, low-latency processing, and stable performance in professional esports and streaming environments.

Between 2026 and 2030, the market is forecast to grow to USD 65.8 billion, contributing 42.9% of total decade growth, supported by advancing hardware standards and immersive gaming demand. From 2030 to 2036, expansion to USD 89.6 billion will be driven by AI-integrated systems, cloud-gaming hybrids, and expanding virtual reality and content creation ecosystems.

Gaming PC Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2026E) | USD 47.9 billion |

| Forecast Value in (2036F) | USD 89.6 billion |

| Forecast CAGR (2026 to 2036) | 6.5% |

Category

| Category | Segments |

|---|---|

| System Type | Desktop Gaming PCs; Gaming Laptops; Mini Gaming PCs; Workstation Gaming Systems; Other System Configurations |

| Application | Competitive Gaming; Content Creation; Virtual Reality Gaming; Casual Gaming; Others |

| End-User | Individual Gamers; Esports Organizations; Content Creators; Gaming Cafes; Others |

| Price Range | Entry-Level Systems; Mid-Range Systems; High-End Systems; Premium Configurations |

| Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Segmental Analysis

By System Type, Which Segment Holds the Dominant Market Share?

Desktop gaming PCs are projected to account for 72.3% of the gaming PC market in 2026, maintaining clear dominance. This reflects their higher processing capability, graphics performance, and upgrade flexibility compared with portable systems. Compatibility with advanced GPUs, cooling solutions, and peripheral ecosystems continues to support adoption among enthusiasts and competitive players.

By Application, Which Segment Registers the Highest Share?

Competitive gaming applications are projected to represent 48.7% of market demand in 2026, driven by the growth of esports and performance-intensive gaming formats. Professional and semi-professional players require stable frame rates, low latency, and hardware customization, reinforcing demand for high-performance gaming PCs. Ongoing improvements in gaming engines and competitive platforms are expected to sustain this segment’s leading position.

What are the Drivers, Restraints, and Key Trends of the Gaming PC Market?

The gaming PC market is expanding due to rising adoption of competitive gaming, growth of esports ecosystems, and increasing demand for high-performance systems across entertainment and professional use cases. Gamers and content creators require powerful hardware to support high frame rates, advanced graphics, and simultaneous gameplay and streaming. However, market growth is restrained by competition from gaming consoles, price sensitivity among mainstream consumers, and the technical complexity associated with system configuration, upgrades, and maintenance.

A key trend shaping the market is the deeper integration of gaming PCs into esports and content creation workflows. Systems are increasingly optimized for competitive play, live streaming, and video production, supporting stable performance and real-time content delivery. Another major trend is the adoption of ray tracing and AI-enhanced technologies. These innovations improve visual realism, optimize system performance, and enable advanced gaming features, strengthening the appeal of gaming PCs among enthusiasts seeking immersive and high-fidelity gaming experiences.

Analysis of the Gaming PC Market by Key Countries

| Country | CAGR (2026-2036) |

|---|---|

| China | 8.2% |

| USA | 6.8% |

| South Korea | 7.1% |

| Germany | 5.9% |

| Japan | 6.3% |

| UK | 5.7% |

| India | 9.4% |

How are E-sports Expansion and Demographic Momentum Driving India’s Market Leadership?

India’s gaming PC market is projected to grow at a CAGR of 9.4% through 2036, supported by a rapidly expanding gaming population, strong youth demographics, and increasing focus on e-sports development. Rising participation in competitive gaming and greater affordability of high-performance hardware are strengthening demand across urban gaming hubs. Manufacturers and distributors are expanding retail, customization, and after-sales capabilities to address growing performance expectations.

- Growth in e-sports participation and gaming communities is accelerating gaming PC adoption across metropolitan regions.

- Demographic advantages and rising technology adoption are supporting demand for premium performance-oriented systems.

Why is E-sports Infrastructure Investment Strengthening China’s Market Potential?

China’s gaming PC market is expanding at a CAGR of 8.2%, driven by sustained investment in e-sports infrastructure, competitive gaming awareness, and high consumer focus on performance hardware. Growth in professional gaming leagues and streaming platforms is reinforcing demand for advanced gaming systems. Suppliers are scaling distribution and service networks to support high-volume demand.

- Expansion of e-sports ecosystems is sustaining demand for high-performance gaming PCs.

- Advancements in gaming hardware technology support adoption among competitive users.

How do Mature E-sports Standards Support Expansion in South Korea?

South Korea’s gaming PC market is projected to grow at a CAGR of 7.1% through 2036, supported by its established e-sports culture, structured competitive frameworks, and leadership in gaming technology. Competitive precision and system reliability remain key purchase criteria across professional and enthusiast segments.

- Mature competitive gaming environments drive consistent demand for premium gaming PCs.

- Strong regulatory and performance standards support adoption of advanced gaming systems.

Why is Content Creation Driving Gaming PC Demand in the USA?

The USA gaming PC market is expected to grow at a CAGR of 6.8%, supported by expansion of content creation, live streaming, and performance-focused gaming applications. Users increasingly seek systems capable of handling gaming, production, and streaming workloads simultaneously.

- Growth in streaming and content creation is increasing demand for high-performance gaming PCs.

- Emphasis on performance efficiency supports adoption of specialized gaming configurations.

How do Performance Optimization Trends Support Germany’s Market Growth?

Germany’s gaming PC market is projected to grow at a CAGR of 5.9%, supported by strong consumer focus on system reliability, performance optimization, and technical quality. Demand remains steady across enthusiast gaming and professional performance segments.

- Preference for technically optimized systems supports consistent gaming PC demand.

- Strong quality standards reinforce adoption of premium gaming hardware.

Why does Market Maturity Sustain Steady Growth in Japan?

Japan’s gaming PC market is forecast to grow at a CAGR of 6.3%, supported by an established gaming culture, mature technology markets, and steady demand for high-quality systems. Users prioritizing performance consistency and long-term reliability drive adoption.

- Mature gaming markets sustain stable demand for quality gaming PCs.

- Focus on durability and performance supports continued adoption.

How is Competitive Gaming Development Supporting Growth in the UK?

The UK gaming PC market is projected to grow at a CAGR of 5.7%, driven by expanding competitive gaming participation, technology integration, and performance-focused gaming setups. Demand is rising across esports, streaming, and enthusiast gaming segments.

- Expansion of competitive gaming environments is driving demand for advanced gaming PCs.

- Emphasis on technical precision supports adoption of performance-oriented systems.

Competitive Landscape of the Gaming PC Market

The gaming PC market is characterized by competition among established technology companies, specialized gaming manufacturers, and integrated performance solution providers. Companies are investing in advanced gaming technologies, specialized integration platforms, product innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable gaming PC systems. Innovation in component optimization, thermal management advancement, and performance-focused product development is central to strengthening market position and customer satisfaction.

Dell Technologies Incorporated offers a a strong focus on gaming innovation and comprehensive high-performance solutions, offering premium and enthusiast systems with emphasis on performance excellence and gaming heritage through its Alienware brand. Hewlett-Packard Inc. provides integrated gaming solutions with a focus on mainstream market applications and competitive price networks.

ASUSTeK Computer Inc. delivers comprehensive gaming technology solutions with a focus on enthusiast positioning and performance efficiency. Micro-Star International Co. Ltd. specializes in comprehensive gaming systems with an emphasis on competitive applications. Corsair Gaming Incorporated focuses on comprehensive gaming components with advanced design and premium positioning capabilities.

Key Players in the Gaming PC Market

- Dell Technologies Incorporated

- Hewlett-Packard Inc.

- ASUSTeK Computer Inc.

- Micro-Star International Co. Ltd.

- Corsair Gaming Incorporated

- Razer Incorporated

- Origin PC Corporation

- NZXT Incorporated

- CyberPowerPC Systems USA Incorporated

- iBUYPOWER Computer Corporation

- Falcon Northwest Computer Systems

- Digital Storm LLC

- Maingear Voodoo LLC

- System76 Incorporated

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2026) | USD 47.9 Billion |

| System Type | Desktop Gaming PCs, Gaming Laptops, Mini Gaming PCs, Workstation Gaming Systems, Other System Configurations |

| Application | Competitive Gaming, Content Creation, Virtual Reality Gaming, Casual Gaming, Others |

| End-User | Individual Gamers, Esports Organizations, Content Creators, Gaming Cafes, Others |

| Price Range | Entry-Level Systems, Mid-Range Systems, High-End Systems, Premium Configurations |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, MEA, Other Regions |

| Countries Covered | China, USA, South Korea, Germany, Japan, UK, India, and 40+ countries |

| Key Companies Profiled | Dell Technologies Incorporated, Hewlett-Packard Inc., ASUSTeK Computer Inc., Micro-Star International Co. Ltd., Corsair Gaming Incorporated, and other leading gaming PC companies |

| Additional Attributes | Dollar sales by system type, application, end-user, price range, and region; regional demand trends, competitive landscape, technological advancements in gaming engineering, competitive performance optimization initiatives, system enhancement programs, and premium product development strategies |

Gaming PC Market by Segments

-

System Type :

- Desktop Gaming PCs

- Gaming Laptops

- Mini Gaming PCs

- Workstation Gaming Systems

- Other System Configurations

-

Application :

- Competitive Gaming

- Content Creation

- Virtual Reality Gaming

- Casual Gaming

- Others

-

End-User :

- Individual Gamers

- Esports Organizations

- Content Creators

- Gaming Cafes

- Others

-

Price Range :

- Entry-Level Systems

- Mid-Range Systems

- High-End Systems

- Premium Configurations

-

Region :

-

North America

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Nordic Countries

- BENELUX

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Argentina

- Rest of Latin America

-

MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

-

Technology

Games of the Future 2025 Offers $5M Prize Pool

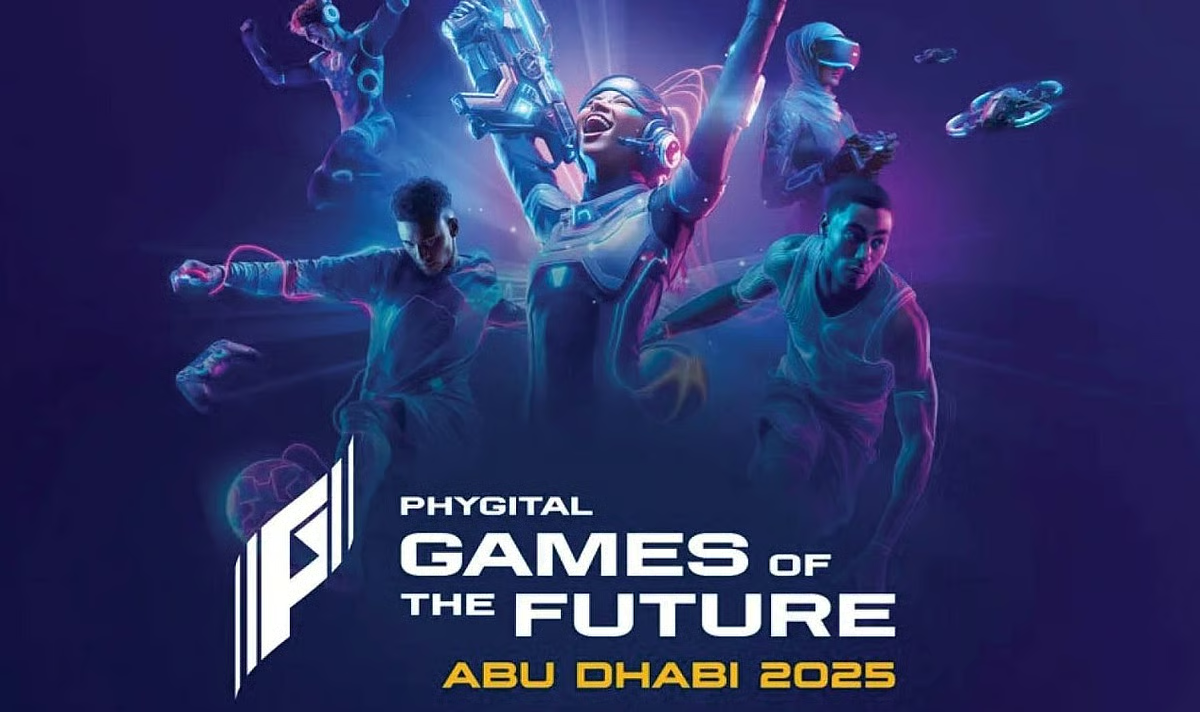

“Phygital” sports combine traditional athletic competition with its digital counterpart in a unified format that requires competitors to excel in both dimensions. Teams begin the challenge in the digital round before facing off again in the physical arena, with victory determined by the combined results of both performances.

This model reflects the growing convergence of technology and real-world performance, offering a new and immersive form of sporting competition.

More than 850 athletes from 60 countries will participate, representing clubs, emerging talents, and new faces across 11 phygital sports disciplines.

Faisal Al Bannai, Adviser to the UAE President for Strategic Research and Advanced Technology Affairs and Secretary-General of the Advanced Technology Research Council, said:

“Digital sport is not merely a new format; it embodies the mindset of a new generation.

Bridging physical excellence and digital mastery

Abu Dhabi is proud to host this edition of the Games of the Future 2025, providing an environment that brings together physical excellence and digital mastery. Our goal is to empower youth, accelerate innovation, and build communities around the technologies that will shape the future.”

The 2025 edition comes with strong global momentum, bringing together elite athletes from across the phygital sports ecosystem—competitors who demonstrate exceptional physical performance alongside advanced digital skills.

The event will feature professional athletes, esports stars, and rising phygital talents, promising outstanding competitions that showcase the best of both the physical and digital worlds. The championship reflects the rapid transformation of sport in an increasingly interconnected world, positioning the 2025 edition as a pivotal milestone in the global evolution of this growing sector.

Abu Dhabi prepares to deliver an exceptional edition

The draw has determined the opening group-stage matchups across the various disciplines, setting the stage for the first competitive narratives that audiences will follow. As the event progresses, full competitive pathways will unfold, with clubs vying for qualification and top positions in the finals, which will feature a total prize pool of USD 5 million.

In parallel with the tournament, Abu Dhabi will host the Phygital Sports Summit on 17 December 2025. The summit will serve as an intellectual platform bringing together global experts, athletes, innovators, and decision-makers to discuss the evolution of hybrid sports. Its comprehensive program includes keynote addresses, panel sessions, and in-depth discussions on the intersection of sport and technology, human–AI integration, the future of youth engagement, athlete health in hybrid environments, and the sustainable legacy of phygital sports.

Summit sessions will be moderated by Amy Jane Gillingham, Mohamed Al Hosani, and Sabine Sassen, with participation from senior representatives of Phygital International, partners of the Games of the Future, and leading global figures shaping both the digital and physical sports movements.

Distinguished guests expected to attend include H.E. Dr. Ahmad Belhoul Al Falasi, UAE Minister of Sports, and a high-level international delegation featuring H.E. Ilham Aliyev, President of the Republic of Azerbaijan; H.E. Rawan bint Najeeb Tawfiqi, Minister of Youth Affairs of the Kingdom of Bahrain; Sheikha Deena bint Rashid Al Khalifa, Adviser for Planning and Development at Bahrain’s Ministry of Youth Affairs; and Dr. Osman Aşkın Bak, Minister of Youth and Sports of the Republic of Türkiye.

Sport of the next generation

Technology

The evolution of entertainment technology and its business impact – EUbusiness.com

Entertainment has always played a vital role in society, and the ways we access and enjoy it have changed drastically over time. Today, as online platforms, streaming services, and digital applications gain traction, businesses are rethinking their strategies in this evolving landscape.

Innovations in entertainment technology touch everything from live sports to gaming and betting, as seen at bet777, demonstrating how rapidly shifting trends impact the industry as a whole.

From analog to digital: the transformation of entertainment

The transition from analog to digital technology marks one of the most significant changes in entertainment history. In the past, physical media such as vinyl records, VHS tapes, and CDs were the norm. With the rise of digital formats, accessibility and distribution underwent a revolution. Digital streaming made it possible for consumers to access content instantly, eliminating the limitations of geography and physical storage. This convenience not only changed how audiences consume media but also how creators and companies distribute and monetize their content.

As digital solutions expanded, new forms of entertainment began to emerge. Video games, interactive apps, and online casinos grew in popularity, shifting the focus from passive viewing to active participation. The proliferation of high-speed internet and smartphones further fueled this transformation, enabling entertainment anywhere, anytime. Companies operating in this environment had to adapt quickly to user expectations of on-demand, personalized experiences. This ongoing evolution continues to blur the line between creators, distributors, and consumers, changing the entire value chain.

Streaming services and the shift in business models

The introduction of video and music streaming platforms led to fundamental changes in business models across the sector. Subscription services replaced one-time purchases, shifting the focus to long-term customer retention and recurring revenue streams. This not only increased competition among platforms but also gave rise to exclusive content and original productions as key differentiators. The bargaining power shifted to content creators and platforms able to attract large subscriber bases, while traditional broadcasters and physical retailers had to reinvent or risk becoming obsolete.

This transition has also extended to other segments such as live sports, eSports, and iGaming. Businesses are investing in digital infrastructure and user experience, offering everything from artificial intelligence-driven recommendations to interactive live events. The ability to collect and analyze user data allows companies to tailor offerings directly to their audiences, driving engagement and loyalty. Simultaneously, regulatory challenges and data security concerns have emerged, demanding new approaches to compliance and consumer protection in digital entertainment.

Immersive technology and the business of innovation

The latest chapter in entertainment technology is defined by immersive experiences such as virtual reality (VR), augmented reality (AR), and advanced streaming features. As these technologies find mainstream adoption, businesses are leveraging them to create new ways to engage users. For example, VR concerts, AR-enhanced sports statistics, and immersive gaming environments offer fresh revenue opportunities and deepen the user’s connection with content.

To stay competitive, entertainment companies must constantly invest in innovation and understand emerging trends. Cloud gaming and interactive betting platforms exemplify how technology influences entertainment choices and opens up lucrative business channels. The integration of social features, mobile-first strategies, and cross-platform compatibility are now prerequisites for success. As the landscape continues to evolve, keeping pace with technology and user preferences will be crucial for organizations aiming to thrive in the future of entertainment.

Technology

How Light & Wonder sets the bar with gaming innovation

Kennedy Ntire, Gaming Manager at the Grand Palm Casino, has worked in iGaming for over 15 years so has a strong understanding of what makes players keep coming back for more.

In the video above, he explains why Light and Wonder are the leader of the pack in iGaming innovation and have a unique way of entertaining and captivating both new and experienced players.

Technology

Global Esports Market Size Forecast to USD 20.8 Billion by 2035

Global Esports Market Size Outlook 2035

Global Esports Market Size Outlook 2035

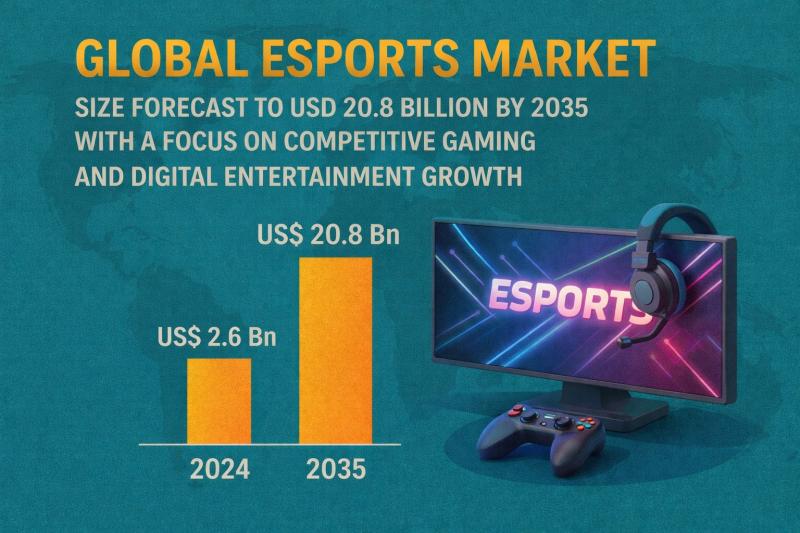

The global Esports market was valued at US$ 2.6 billion in 2024. It is projected to grow at a CAGR of 20.9% from 2025 to 2035, reaching US$ 20.8 billion by 2035. This rapid growth is driven by the surging popularity of competitive gaming, increasing digital connectivity, corporate sponsorships, and expanding live streaming platforms worldwide.

👉 Get your sample market research report copy today@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=54564

Market Overview

Esports refers to competitive gaming at professional levels, where players compete individually or in teams in popular games like League of Legends, Dota 2, Fortnite, Call of Duty, and Overwatch. The market spans across tournaments, leagues, streaming platforms, sponsorships, advertising, and merchandise sales.

Factors contributing to market expansion include:

• Rising internet penetration and smartphone adoption, especially in Asia-Pacific

• Increased viewership via streaming platforms like Twitch, YouTube Gaming, and Facebook Gaming

• Growing corporate investments and sponsorships

• Expansion of Esports tournaments, leagues, and collegiate competitions

• Enhanced engagement through virtual reality (VR) and augmented reality (AR) gaming experiences

North America and Europe are leading markets due to mature gaming ecosystems, while Asia-Pacific is the fastest-growing region driven by a huge gamer population and strong tournament culture.

Key Market Growth Drivers

1. Rising Popularity of Competitive Gaming

Competitive gaming is attracting millions of fans globally, creating a robust ecosystem for tournaments, streaming, and merchandise sales.

2. Growth of Digital Streaming Platforms

Platforms like Twitch, YouTube Gaming, and Trovo are expanding the reach of Esports, enabling real-time engagement and monetization through subscriptions, ads, and donations.

3. Corporate Sponsorships and Advertising

Brands are increasingly investing in Esports teams, tournaments, and influencer marketing, enhancing revenue opportunities and market growth.

4. Technological Advancements

• VR/AR integration for immersive experiences

• Advanced graphics, AI, and game engines enhancing competitive gameplay

• Cloud gaming enabling accessibility without high-end hardware

5. Expanding Professional Leagues and Tournaments

Major tournaments like The International (Dota 2), League of Legends World Championship, and Fortnite World Cup are boosting Esports viewership and attracting global sponsorship.

Analysis of Key Players – Key Strategies

Leading Esports companies focus on technology innovation, strategic partnerships, player acquisition, and global expansion.

1. Player and Team Management

• Investment in professional teams, player training, and coaching

• Acquisition of top-tier players to enhance competitive performance

2. Strategic Partnerships and Sponsorships

• Collaboration with gaming hardware, software, and media companies

• Partnerships with brands for event sponsorships and advertising campaigns

3. Platform Expansion

• Enhancing streaming platforms with interactive features, chat, and monetization options

• Developing mobile apps and cloud-based gaming services

4. Regional Growth

• Expansion into Asia-Pacific and Latin America to capitalize on large gamer populations

• Increasing tournaments in emerging markets to boost fan engagement

Analysis of Key Players in the Esports Market

Leading companies in the global esports market are investing in technological innovations, strategic partnerships, and product diversification to strengthen their market presence and stay ahead in the rapidly evolving competitive gaming industry. Their initiatives aim to enhance gaming experiences, improve precision in competitive play, and expand audience engagement globally.

Key players in the esports market include

• Bandai Namco Entertainment

• Valve Corporation

• PGL

• Overwatch League

• NVIDIA

• Microsoft

• Faceit

• Tencent

• Riot Games

• Epic Games

• Sony Interactive Entertainment

• Take Two Interactive

• Activision Blizzard

• Electronic Arts

• Other Prominent Players.

These companies are profiled in the esports market research report based on company overview, financial performance, business strategies, product portfolio, business segments, and recent developments.

👉 Discuss Implications for Your Industry Request Sample Research Report PDF@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=54564

Key Developments in the Esports Market

• April 2025: Nintendo showcased its esports initiatives during the Nintendo Switch 2 Direct event, introducing new IPs and enhancing Splatoon with esports features such as improved matchmaking and live streaming integration. These efforts aim to strengthen Nintendo’s position in the competitive gaming market through strategic partnerships and global audience engagement.

• March 2025: Gameloft launched a new mobile esports platform for Asphalt 9: Legends, focusing on community-driven tournaments and competitive play. The platform features regular in-app events, live streaming, and player rewards, designed to expand the mobile esports ecosystem and attract a larger audience.

Market Challenges & Opportunities

Challenges

1. High Competition and Saturation

The rapid growth of gaming content and tournaments increases competition for viewership and sponsorships.

2. Regulatory and Legal Issues

Issues like laws, online content regulations, and copyright concerns can affect market expansion.

3. Monetization Challenges

Smaller tournaments and emerging platforms may struggle with sustainable revenue generation.

4. Hardware and Connectivity Requirements

High-performance gaming requires advanced hardware and stable internet, limiting access in some regions.

Opportunities

1. Mobile Esports Expansion

Mobile gaming is driving Esports adoption in Asia-Pacific, Latin America, and the Middle East, creating new revenue streams.

2. Integration of VR/AR

Immersive experiences through VR/AR can attract more viewers and participants.

3. Corporate Sponsorship and Advertising

Expanding partnerships with non-endemic brands in fashion, automotive, and consumer goods sectors.

4. Collegiate and Amateur Esports

Development of school and college leagues can create future professionals and increase fanbase.

Investment Landscape and ROI Outlook

The Esports market offers high growth potential and attractive ROI due to its rapid adoption, global fanbase, and multi-stream revenue model.

Investment Strengths

• Expanding fanbase across platforms, regions, and age groups

• Diverse revenue streams from sponsorships, media rights, merchandising, and ticket sales

• Emerging opportunities in mobile Esports, VR/AR integration, and collegiate leagues

• Supportive infrastructure and increasing internet penetration worldwide

ROI Outlook

With a CAGR of 20.9% through 2035, investments in tournaments, streaming platforms, team ownership, and gaming technology are expected to yield high returns. Early entry into emerging markets and mobile Esports offers a competitive advantage.

Market Segmentations

By Game Genre

• MOBA (Multiplayer Online Battle Arena)

• FPS (First-Person Shooter)

• Battle Royale

• Sports Simulation

• Fighting and Others

By Platform

• PC

• Console

• Mobile

• Cloud Gaming

By Revenue Source

• Sponsorship and Advertising

• Media Rights

• Merchandising and Ticketing

• Streaming Platforms

• Publisher Fees

By Region

• North America

• Europe

• Asia-Pacific

• Latin America

• Middle East & Africa

👉 To buy this comprehensive market research report, click here to inquire@ https://www.transparencymarketresearch.com/checkout.php?rep_id=54564<ype=S

Why Buy This Report?

✔ Detailed market forecast to 2035

✔ Comprehensive analysis of growth drivers, challenges, and opportunities

✔ Competitive landscape and key player strategies

✔ Segmentation by game genre, platform, revenue source, and region

✔ Insights into emerging trends such as mobile Esports, VR/AR, and collegiate leagues

✔ Strategic recommendations for investors, developers, and brands

FAQs

1. What is the projected Esports market size by 2035?

It is expected to reach US$ 20.8 billion by 2035.

2. What is the CAGR from 2025-2035?

The market is projected to grow at a CAGR of 20.9%.

3. Which region dominates the Esports market?

Asia-Pacific is emerging as the fastest-growing region due to high gamer population and mobile gaming adoption.

4. What are the main revenue sources?

Sponsorships, advertising, media rights, streaming subscriptions, merchandising, and ticket sales.

5. What are key market trends?

Growth in mobile Esports, VR/AR integration, streaming platforms, and collegiate leagues are shaping market trends.

More Trending Research Reports-

• Enterprise Connectivity and Networking Market – https://www.transparencymarketresearch.com/enterprise-connectivity-and-networking-market.html

• A2P SMS Market – https://www.transparencymarketresearch.com/global-a2p-sms-market.html

About Us Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. The firm scrutinizes factors shaping the dynamics of demand in various markets. The insights and perspectives on the markets evaluate opportunities in various segments. The opportunities in the segments based on source, application, demographics, sales channel, and end-use are analysed, which will determine growth in the markets over the next decade.

Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers, made possible by experienced teams of Analysts, Researchers, and Consultants. The proprietary data sources and various tools & techniques we use always reflect the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in all of its business reports.

Contact Us

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Blog: https://tmrblog.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.

-

Motorsports3 weeks ago

Motorsports3 weeks agoJo Shimoda Undergoes Back Surgery

-

NIL2 weeks ago

NIL2 weeks agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14

-

Motorsports1 week ago

Motorsports1 week agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoHow this startup (and a KC sports icon) turned young players into card-carrying legends overnight

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoRobert “Bobby” Lewis Hardin, 56

-

NIL3 weeks ago

NIL3 weeks agoIndiana’s rapid ascent and its impact across college football

-

Sports3 weeks ago

Wisconsin volleyball sweeps Minnesota with ease in ranked rivalry win

-

Motorsports3 weeks ago

Motorsports3 weeks agoPohlman admits ‘there might be some spats’ as he pushes to get Kyle Busch winning again

-

Motorsports1 week ago

Motorsports1 week agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Motorsports3 weeks ago

Motorsports3 weeks agoIncreased Purses, 19 Different Tracks Highlight 2026 Great Lakes Super Sprints Schedule – Speedway Digest