Rec Sports

Shai Gilgeous-Alexander, Tyrese Haliburton and becoming one in a million — Andscape

OKLAHOMA CITY — Vaughan Alexander makes no bones about how wonderful he’s felt about watching his oldest son, Shai Gilgeous-Alexander, living his dream. Indeed, living an entire family’s dream.

His 26-year-old son is the All-Star guard for the Oklahoma City Thunder, the NBA Most Valuable Player and has the Thunder one game away from winning the franchise’s first NBA championship.

What’s not to love? Life is good.

“This is going to be a year that is going down in the books,” Vaughn Alexander said during a recent conversation with Andscape.

As long as I’ve covered sports and watched young people and their parents, what has fascinated me more than anything is the one-in-a-million phenomenon. Out of tens of thousands of aspiring basketball players around the world, how does a player who grows up in Canada — like Shai Gilgeous-Alexander, for example — find his way through the youth sports maze, the high school gauntlet, receive a college scholarship, find his way to the NBA, becomes a league MVP and put himself on the verge of winning an NBA championship?

How did he beat the odds? How much is talent? How much is drive?

“It’s more drive,” Vaughan said. “It’s more mental, it’s more who you are, its more discipline. There are so many talented people out there. You can lead a horse to water, but you can’t force them to drink. They just won’t take the teaching you give them. It’s more about making that kid be a receptive, principled, respectful-minded person; they’ll probably listen to their teachers, they’ll listen to other elders besides you.

“Who wants to be that one who does what people don’t want to do? It’s hard work, it’s not easy. You’re going to have to do some stuff that most people don’t want to do. If you’re comfortable in your own skin, and comfortable with saying, ‘I’m not going to parties, I’m not going to do this, I’m not going to do that.’ That’s one way to get yourself in that elite space.”

Adam Pantozzi/NBAE via Getty Images

How do you become that one in a million?

I suppose you can ask the same question about anyone in any profession who has achieved success. There is something admirable and challenging about climbing the pyramid, especially in the bloodsports of basketball and football. Black athletes often, not always, have to traverse a minefield of a less-than-ideal environment and the lack of family wealth and connections.

“It’s more about being that sponge, being humble, understanding that you’re a kid and you don’t know anything,” Vaughan said. “Kids today know everything. I’d say eight out of 10 think they know everything because of social media.

“Be that two out of 400, be that kid who’s really humble, realizing, ‘I got to listen, ask a lot of questions.’ See the people who are doing the things you want to do and be around them.”

Vaughn and his former wife, Charmaine Gilgeous, were born in Antigua. Charmaine participated in the 1992 Summer Olympics in Barcelona. Vaughn played high school basketball in Toronto, Canada. In addition to Shai, Vaughan and Charmaine’s youngest son also plays college basketball.

What advice does Alexander give parents as they put their children in the youth sports cauldron. Most simply want their children to have a good experience. Many want their kids to become pros.

He encourages parents to have their children embrace the qualities that make them different rather than aspiring to fit in with the crowd. Most of all, he advises parents to develop an unshakeable sense of self in their children.

They’ll need it.

“Sometimes you’ll see your kid moving around and you’ll say, ‘Hey, chill. Who do you think you are?’ But you’d rather that than under-confidence, not being confident in yourself. It’s hard to build that back up.”

Petre Thomas-Imagn Images

My frame of reference for the one-in-a-million question is Bronx-born Rod Strickland, the former point guard who enjoyed an All-America college career at DePaul and a 13-year NBA career. Strickland is currently the head men’s basketball coach at Long Island University.

You never know where young people you’re involved with will end up. For the last 25 years, I’ve run a sports and recreation program at the Church of the Intercession in Harlem. A number of years ago, when Strickland was with the Washington Wizards, I happened to mention the program.

His eyes lit up. He said that when he was 10, Intercession was where he played in youth basketball tournaments at halftime of the older kids’ games. I’m sure back then if we asked the kids on his team how many of them wanted to play in the NBA, everyone would have raised their hands. Then the adults in the room would recite the familiar refrain about how nearly impossible it is to become that one in a million who reaches the league.

After Strickland told me he was one of the 10-year-olds in the gym, I changed my perspective from lecturing about the insurmountable odds of being that one in a million to preaching that somebody has to be that one in a million and it might as well be you.

The question then becomes how do you get to be one of those needles in a haystack? How do you get to be that one in a million?

Fact is, no one thought Strickland would be the one. After Strickland reached college, one of his early mentors told him there were other 10-year-olds who were favored.

“He was like, ‘Back then, there were other people that they might’ve thought was the one,’ ” Strickland recalled during a recent phone conversation. ” ‘Nobody thought you were the one at that time.’ At 10 years old, I probably was one of the better kids, but then at some point between 10 and 15, I might’ve dropped off a little bit and had to recover.”

Strickland, 58, said the difference between his journey and more recent generations is that his aspirations were different.

“I think now, everybody thinks they’re going to be a pro, like it’s automatic,” he said. “I didn’t think I was going to be a pro. I admired guys; I wanted to be like Magic [Johnson] and pass, I wanted to be like Dr. [Julius Erving] with the layups. I wanted to be George Gervin with the finger rolls. I had all these idols, I had this vision, I had a creative mind and I wanted to be something, but I never knew what I was. I kept trying to attain the goal of being good and then getting better and then being able to compete against people, so there were steps to it.”

Because he always played against older competition, Strickland said he spent most of his early life trying to prove himself — in junior high and even college.

“There was never a time where I just thought I was a pro,” he said.

Then there was a game against Georgetown when he was a freshman at DePaul when he made one of his patented drives, showing the ball then going to his other hand to finish. The late Al McGuire, who was broadcasting the game exclaimed, ‘A star is born.’ At that point, Strickland felt he had a chance.

“So, for me, being that one in a million was a journey,” Strickland said. “I was just trying to figure myself out.”

Joe Patronite/Getty Images

Before getting the LIU head coaching job, Strickland spent several years as an assistant coach where he worked in the youth basketball space.

Many young players never had to go through a journey. Some received too much too soon.

“There’s a lot of kids who are the chosen ones, but they are the outliers,” he said. “There’s these other kids who everybody puts in play to be the next pro. Sometimes they don’t make it because you’re telling them they’re there already, so they don’t get to go through the journey. It’s almost like you already know.

“I never knew until I knew.”

The secret to being that one in a million is a combination of confidence and humility; resilience and defiance.

“People can throw you off so easily, you have got to have some ‘F-you’ in you,” Strickland said.

I began covering Strickland when he was at Truman High School in the Bronx. As a junior, he led Truman to the New York State High School Championship. Strickland transferred to Oak Hill Academy (Va.) for his senior year, then went to DePaul University where he was a first-team All-American as a junior.

Strickland was drafted in the first round (19th overall) by the New York Knicks in the 1988 NBA draft and played 13 NBA seasons. He knew how to play the point guard position. He understood at an early age that the essence of the position was giving, sharing and putting teammates in a position to be successful.

“You have to be talented, but you have to be self-aware, you have to know how to make others feel good,” Strickland said.

That’s what impresses him about Gilgeous-Alexander and Indiana Pacers guard Tyrese Haliburton. They are star players—one in a million—who made the journey by making their teammates better.

Gilgeous-Alexander has created space that’s allowed a teammate like Jalen Williams to break out and become a star. Haliburton, while not a prolific scorer like Gilgeous-Alexander, knows how to put his teammates in position to be successful.

“All you got to do is listen to them talk,” Strickland said. “Their sophistication and their maturity and their thought process of the game and their teammates. You got two unselfish dudes, and they play differently. Shai is scoring that ball. You could see how his teammates love him and how he embraces them and all that.

“And then you watch Tyrese play in the way he plays; he’s about everybody else. But they’re mature, articulate, they have creative minds and their thought process is just different.”

Before I ended the conversation with Vaughan Alexander, I wondered how he has maintained the father-son relationship with a son who is not only well known but wealthy. He admires his son, admits that he enjoys being in the limelight, but he is not his son’s employee or a groupie along for the ride.

“The upbringing, the product of his environment, it just doesn’t change because he’s got hair on his chest,” he said. “I’m still going to give you advice, whether you want to take in or not. They can tune me out, I’m going to tell them the right thing. That’s just how you’ve got to move with your kid.

“You’ve got to deal with them like men from early on. When they become men, you let them go do their own thing, make their own decisions. But at the end of the day, I’ll always be his father.”

There are myriad formulas for a young athlete to become that discovered needle in a haystack. Vaughan Alexander and Charmaine Gilgeous had a formula for Shai and it has worked fabulously.

The formula is rooted in a tenacious belief in possibility. Someone has to be that on in a million. It might as well be you.

Rec Sports

Visit Eau Claire and Sonnentag Center host 2026 Flag Football tournament

EAU CLAIRE, Wis. (VISIT EAU CLAIRE PRESS RELEASE) – Visit Eau Claire, in partnership with the Sonnentag Center, has secured a major national sporting event for 2026, bringing the Pylon 7on7 Flag Football Tournament to the Sonnentag Field House on March 14–15, 2026.

Pylon 7on7 is a premier traveling flag football tournament that attracts elite high school athletes from across the country. The Eau Claire stop is expected to welcome more than 30 teams and over 1,000 athletes, coaches, families, and spectators, generating direct economic impact for the community.

While Pylon 7on7 features high-level flag football competition, the event is widely recognized as a critical exposure platform for student-athletes pursuing collegiate opportunities. Over the past two decades, Pylon has helped produce over three thousand Division I college commits and over 300 NFL alumni, establishing itself as a proven pathway for athletic development, competition, and visibility.

“We’re extremely excited to welcome Pylon 7on7 to Eau Claire,” said Lucas Connolly, Sports Relationship Manager for Visit Eau Claire. “This event brings elite competition to our community and provides young athletes with a platform to compete, be seen, and develop, while highlighting the Sonnentag Center as a top-tier venue for national sporting events.”

Scheduled between Pylon 7on7 events in Philadelphia and Los Angeles, Eau Claire’s inclusion reflects the growing reputation of the region as an attractive host for large-scale sporting events.

“This tournament is another example of how Eau Claire continues to grow as a destination for youth sports, and we are excited to partner with Visit Eau Claire to welcome Pylon 7on7 Football and the many athletes, families, and visitors who will experience our community,” said Steve Kirk, Interim General Manager of the Sonnentag Center.

The event was secured through a collaborative effort between Visit Eau Claire’s sales team and the Sonnentag Center. This partnership reinforces a shared commitment to attracting impactful sporting events that drive visitation, showcase local facilities, and elevate Eau Claire’s profile on a national stage.

Copyright 2025 WEAU. All rights reserved.

Rec Sports

Midweek Matinee A Celebration for Community’s Kids

With Matthew Knight Arena packed with school kids for a midweek matinee, the viral “6-7” trend created a moment of joyous jubilation late in the third quarter when Jacobs completed a three-point play for the Ducks’ 67th point, on the way to an 85-59 win over Portland. After making the free throw, Jacobs backpedaled down the court making the ubiquitous hand gesture associated with “6-7,” as did hundreds of kids in the arena.

“I don’t know why it’s a thing but it is, and the kids love it,” said Jacobs, who passed up a three-pointer that would have gotten the Ducks to 67 points, instead driving to the hoop and scoring while absorbing contact. “I didn’t know that it was the point to get six-seven. And then they fouled me and I realized, you have to make a free throw. So it was kind of funny.”

Jacobs finished the game with 21 points and 10 rebounds for her second straight double-double, and Katie Fiso finished one rebound shy of a triple-double, tallying 10 points, 11 assists and nine boards. Amina Muhammad added 12 points, while Avary Cain and Sarah Rambus added 11 each.

And the Ducks teamed up to create a core memory for the kids in attendance, peaking with the free throw by Jacobs for the 67th point of the game. UO coach Kelly Graves immediately called timeout, allowing for an extended celebration by the young fans in the stands.

“I just think it’s important to have a game like this for the kids,” Graves said. “That’s a memory that they had today. It was a fun, fun atmosphere. They got to be around their friends, and they were exposed to our basketball team. And you never know what kind of impact it makes.”

The UO women mostly executed with aplomb in the atmosphere, shooting 44.9 percent for the game and committing just 14 turnovers while forcing 24.

“I feel like when we’re having fun, we’re playing the best type of basketball,” Fiso said. “I keep mentioning it — like, we compete in practice, and that’s where we get our sense of joy. We know there’s a fine line, when to be serious and then when to be goofy. I feel like that’s gonna take us far, because we know when to switch that.”

How It Happened: The Ducks took control early by scoring the first seven points of the game, though the start seemed a bit uneven given that the UO women only had three field goals over the first seven minutes of the day. Then Fiso hit a three-pointer and Cain followed with another, and Oregon took a 19-7 lead into the second quarter.

It was 22-9 in the second when the Ducks put together a 9-0 run, with all nine points scored by Muhammad and Cain. Muhammad ended up with 10 points in the period, helping the Ducks take a 44-19 lead into halftime.

“They’re great and they’re amazing,” Fiso said of Muhammad and Cain’s play off the bench. “They came out with a lot of energy, a lot of sense of urgency, too. Just creating the right plays, making the right shots.”

The opening minutes of the second half went back and forth. Portland cut Oregon’s 25-point halftime lead down to 19 a couple of times, the last at 56-37.

“We’re still a pretty young team, all things considered,” Graves said. “We’ve got to learn to come out in that second half and play with the same kind of intensity, and not just trade basket for basket.”

Jacobs, one of Oregon’s most veteran players, led the way out of that span. From the point Portland got within 56-37, Jacobs scored Oregon’s next 11 points, the capper the three-point play for a 67-39 lead.

By the fourth quarter, about the only remaining drama pertained to Fiso’s triple-double chase. She came up just short, but it seems only a matter of time before she notches one.

“I’m happy I can be that person for my team,” Fiso said. “And I know that in order to be great, yes, the assists are cool, but if I want to get to that next level, I gotta start filling up all the other stats. My coaches are on me in film, like, if you want to be great, you got to fill up all the other stuff as well. So that was kind of my initiative.”

Up Next: The Ducks face Stanford at the Women’s Bay Area Classic in San Francisco on Sunday (3 p.m., ESPN).

Rec Sports

More Than 550 Boys Volleyball Teams Gather in Los Angeles for SoCal Cup ‘Winter Formal’ Event and College Combine

More Than 550 Boys Volleyball Teams Gather in Los Angeles for SoCal Cup ‘Winter Formal’ Event and College Combine

AIM Sports Group Further Demonstrates its Commitment to Boys Volleyball with Three Days of Unparalleled Competition, Plus a High School College Combine and Junior College Tournament

One of the nation’s leading tournament series for boys volleyball, SoCal Cup, hosted its latest ‘Winter Formal’ tournament at the Los Angeles Convention Center (LACC) this past weekend.

Despite construction at LACC, the three-day event, owned and operated by AIM Sports Group, drew more than 550 club volleyball teams of various age groups (12U through 18U) from across the nation. The three-day Winter Formal event packed the Los Angeles Convention Center floor with volleyball courts and a unique fan experience, while drawing a crowd of more than 19,000 daily attendees including athletes, coaches, families, and spectators.

This year’s event also featured a high profile College Combine the day prior, drawing coaches and scouts from more than 25 universities from across the country. With more than 350 young athletes and about 50 coaches participating in the College Combine, the day leading up to the Winter Formal became a unique opportunity for players to get noticed and take their talents to the next level.

In addition, the Winter Formal event provided a venue for a Junior College tournament for 16 Jr. College programs. Many of the recruiting scouts and athletes from that tournament also participated in the Combine.

“The College Combine we had at this year’s SoCal Cup Winter Formal event was an added bonus to what was already an amazing event,” said AIM Sports Group Founder John Gallegos. “The Combine exceeded expectations and further demonstrated our commitment to the development of the sport at all levels. It all ties in with our overarching mission to advance sports performance and enjoyment for youth athletes. AIM Sports Group is all-in on the growth of boys volleyball for generations to come.”

Founded by AIM Sports Group to provide elite competition, developmental playing opportunities, and training for young athletes, the SoCal Cup has grown exponentially over the last five years and is now one of the largest and best-attended youth volleyball event series in the country. The next event, the SoCal Cup Open Championship, will take place January 17-19 in Salt Lake City.

Balboa Bay was the overall tournament-winning club this year, capturing titles in three divisions. The full list of boys volleyball clubs that achieved bragging rights this year by winning their divisions at the Winter Formal event included:

Open:

18 Open: MB Surf 18’s Asics

17 Open: Coast 17-1 Victor/Berkley

16 Open: Balboa Bay 16 Blue

15 Open: Indoor

14 Open: MB Surf 14’s Asics

13 Open: Bay to Bay 13-1

12 Open: Aspire 12 Thanos

Club:

18 Club: Bravo 18-X

17 Club: Balboa Bay 17 White

16 Club: Balboa Bay 16 White

15 Club: Liv 15’s Royal

14 Club: Bay to Bay 14-Club

AIM Sports Group is a premier youth sports enterprise that owns and operates a state-of-the-art facility, premier youth boys volleyball league, regional and national events, and tech & media platforms. AIM is focused on enhancing the journey of youth athletes through innovation and elite competition in sports. Learn more at aimsportsgroup.com.

Learn more about upcoming SoCal Cup events at SoCalCupVolleyball.com.

MEDIA CONTACT:

Paul Williams, paul@medialinecommunications.com, 310/569-0023

View source version on businesswire.com: https://www.businesswire.com/news/home/20251218108284/en/

Rec Sports

Trump administration moves to cut off transgender care for children

WASHINGTON (AP) — The U.S. Department of Health and Human Services on Thursday unveiled a series of regulatory actions designed to effectively ban gender-affirming care for minors, building on broader Trump administration restrictions on transgender Americans.

The sweeping proposals — the most significant moves this administration has taken so far to restrict the use of puberty blockers, hormone therapy and surgical interventions for transgender children — include cutting off federal Medicaid and Medicare funding from hospitals that provide gender-affirming care to children and prohibiting federal Medicaid dollars from being used to fund such procedures.

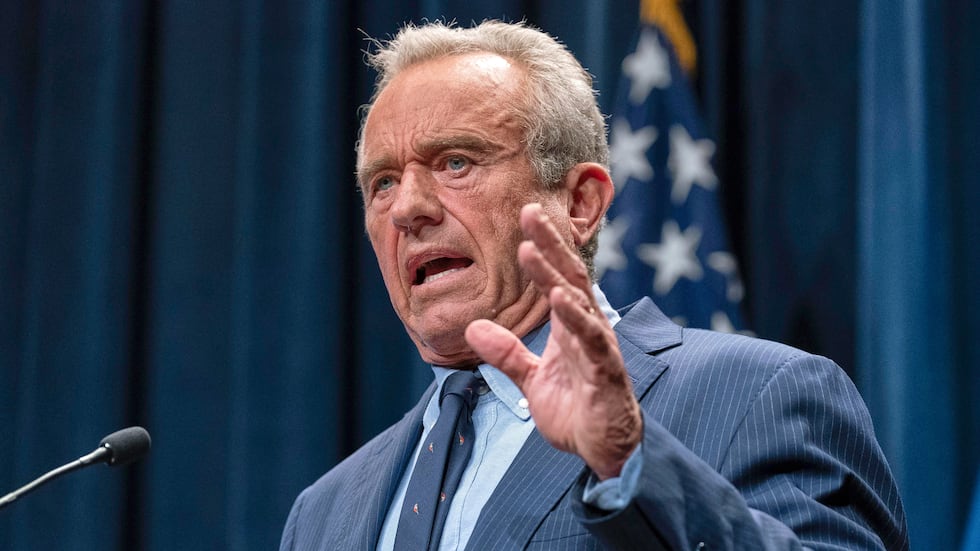

“This is not medicine, it is malpractice,” Health Secretary Robert F. Kennedy Jr. said of gender-affirming procedures on children in a news conference on Thursday. “Sex-rejecting procedures rob children of their futures.”

Kennedy also announced Thursday that the HHS Office of Civil Rights will propose a rule excluding gender dysphoria from the definition of a disability.

In a related move, the Food and Drug Administration issued warning letters to a dozen companies that market chest-binding vests and other equipment used by people with gender dysphoria. Manufacturers include GenderBender LLC of Carson, California and TomboyX of Seattle. The FDA letters state that chest binders can only be legally marketed for FDA-approved medical uses, such as recovery after mastectomy surgery.

Proposed rules would threaten youth gender-affirming care in states where it remains legal

Medicaid programs in slightly less than half of states currently cover gender-affirming care. At least 27 states have adopted laws restricting or banning the care. The Supreme Court’s recent decision upholding Tennessee’s ban means most other state laws are likely to remain in place.

Thursday’s announcements would imperil access in nearly two dozen states where drug treatments and surgical procedures remain legal and funded by Medicaid, which includes federal and state dollars.

The proposals announced by Kennedy and his deputies are not final or legally binding. The federal government must go through a lengthy rulemaking process, including periods of public comment and document rewrites, before the restrictions becoming permanent. They are also likely to face legal challenges.

But the proposed rules will likely further intimidate health care providers from offering gender-affirming care to children and many hospitals have already ceased such care in anticipation of federal action.

Nearly all U.S. hospitals participate in the Medicare and Medicaid programs, the federal government’s largest health plans that cover seniors, the disabled and low-income Americans. Losing access to those payments would imperil most U.S. hospitals and medical providers.

The same funding restrictions would apply to a smaller health program when it comes to care for people under the age of 19, the State Children’s Health Insurance Program, according to a federal notice posted Thursday morning.

Moves contradict advice from medical organizations and transgender advocates

Dr. Mehmet Oz, the administrator of the Centers for Medicare and Medicaid Services, on Thursday called transgender treatments “a Band-Aid on a much deeper pathology,” and suggested children with gender dysphoria are “confused, lost and need help.”

Polling shows many Americans agree with the administration’s view of the issue. An Associated Press-NORC Center for Public Affairs Research survey conducted earlier this year found that about half of U.S. adults approved of how Trump was handling transgender issues.

Chloe Cole, a conservative activist known for speaking about her gender-transition reversal, spoke at the news conference to express appreciation. She said cries for help from her and others in her situation, “have finally been heard.”

But the approach contradicts the recommendations of most major U.S. medical organizations, including the American Medical Association, which has urged states not to restrict care for gender dysphoria.

Advocates for transgender children strongly refuted the administration’s claims about gender-affirming care and said Thursday’s moves would put lives at risk.

“In an effort to strongarm hospitals into participating in the administration’s anti-LGBTQ agenda, the Trump Administration is forcing health care systems to choose between providing lifesaving care for LGBTQ+ young people and accepting crucial federal funding,” Dr. Jamila Perritt, a Washington-based OB/GYN and president and CEO of Physicians for Reproductive Health, said in a statement. “This is a lose-lose situation where lives are inevitably on the line. “

Rodrigo Heng-Lehtinen, senior vice president at The Trevor Project, a nonprofit suicide prevention organization for LBGTQ+ youth, called the changes a “one-size-fits-all mandate from the federal government” on a decision that should be between a doctor and patient.

“The multitude of efforts we are seeing from federal legislators to strip transgender and nonbinary youth of the health care they need is deeply troubling,” he said.

Actions build on a larger effort to restrict transgender rights

The announcements build on a wave of actions President Donald Trump, his administration and Republicans in Congress have taken to target the rights of transgender people nationwide.

On his first day in office, Trump signed an executive order that declared the federal government would recognize only two immutable sexes: male and female. He also has signed orders aimed at cutting off federal support for gender transitions for people under age 19 and barring transgender athletes from participating in girls’ and women’s sports.

On Wednesday, a bill that would open transgender health care providers to prison time if they treat people under the age of 18 passed the U.S. House and heads to the Senate. Another bill under consideration in the House on Thursday aims to ban Medicaid coverage for gender-affirming care for children.

Young people who persistently identify as a gender that differs from their sex assigned at birth are first evaluated by a team of professionals. Some may try a social transition, involving changing a hairstyle or pronouns. Some may later also receive hormone-blocking drugs that delay puberty, followed by testosterone or estrogen to bring about the desired physical changes in patients. Surgery is rare for minors.

___

Shastri reported from Milwaukee. Associated Press writer Geoff Mulvihill contributed to this report.

Copyright 2025 The Associated Press. All rights reserved.

Rec Sports

LEIFRAS Co., Ltd. Reports Financial Results for the Nine Months Ended September 30, 2025

TOKYO, Dec. 18, 2025 /PRNewswire/ — LEIFRAS Co., Ltd. (Nasdaq: LFS) (the “Company” or “Leifras”), a sports and social business company dedicated to youth sports and community engagement, today announced its unaudited financial results for the nine months ended September 30, 2025.

Financial Highlights for the Nine Months Ended September 30, 2025

- Revenue was JPY8.6 billion ($57.8 million) for the nine months ended September 30, 2025, an increase of 15.3% from JPY7.4 billion for the same period last year.

- Gross profit was JPY2.4 billion ($16.3 million) for the nine months ended September 30, 2025, an increase of 18.1% from JPY2.0 billion for the same period last year.

- Gross margin was 28.2% for the nine months ended September 30, 2025, which increased from 27.5% for the same period last year.

- Net income was JPY226.7 million ($1.5 million) for the nine months ended September 30, 2025, an increase of 0.7% from JPY225.1 million for the same period last year.

- Basic and diluted earnings per share was JPY9.1 ($0.06) for the nine months ended September 30, 2025, compared to basic earnings per share of JPY9.0 and diluted earnings per share of JPY8.3 for the same period last year.

Operational Highlights for the Nine Months Ended September 30, 2025

- Number of members in the sports school business was 71,529 for the nine months ended September 30, 2025, an increase of 2.3% from 69,924 for the same period last year.

- Average membership duration in the sports school business was 1.84 years for the nine months ended September 30, 2025, an increase of 1.1% from 1.82 years for the same period last year.

- Revenue per capita in the sport school business, which we define as the sales revenue of the sports school business divided by the number of employees involved in that business, was JPY9.6 million ($0.06 million) for the nine months ended September 30, 2025, an increase of 6.2% from JPY9.0 million for the same period last year.

- Number of schools served under the social business segment was 360 for the nine months ended September 30, 2025, an increase of 53.2% from 235 for the same period last year.

- Revenue per capita in the social business, which we define as the sales revenue of the social business divided by the number of employees involved in that business, was JPY7.6 million ($0.05 million) for the nine months ended September 30, 2025, an increase of 18.6% from JPY6.4 million for the same period last year.

Mr. Kiyotaka Ito, the Representative Director and Chief Executive Officer of Leifras, commented, “We delivered solid financial results in the first nine months of fiscal year 2025, with meaningful growth across our key financial and operational metrics. Revenue increased 15.3% and net income grew 0.7% from the same period last year. By segment, sports school business achieved revenue growth of 8.9% and social business revenue increased by 36.4% year over year. Our performance shows continued strength of our sports school business and expanding demand for our social business. Notably, revenue per capita in our social business rose by 18.6% year over year, highlighting the increasing value and impact of our community-based services. Looking ahead, we see meaningful opportunities in Japan’s shifting policy landscape. The government’s ongoing Club Activity Reform, which focuses on shifting school-based club activity management to regional and private organizations, is expected to create an important long-term growth pathway for Leifras. We recently secured a new contract with the City of Nagoya, Aichi Prefecture, to manage facilities at municipal junior high schools in Nagoya, marking an important step in our expansion strategy. We intend to actively pursue additional opportunities as municipalities seek specialized partners to deliver high-quality sports and community programs. In the future, we remain committed to cultivating the non-cognitive skills of children, strengthening community well-being, enhancing our service offerings, and delivering sustainable value to our shareholders and society.”

Financial Results for the Nine Months Ended September 30, 2025

Revenue

Total revenue was JPY8.6 billion ($57.8 million) for the nine months ended September 30, 2025, an increase of 15.3% from JPY7.4 billion for the same period last year.

Sports school business revenue was JPY6.2 billion ($41.9 million) for the nine months ended September 30, 2025, an increase of 8.9% from JPY5.7 billion for the same period last year. The increase in revenue was mostly driven by: (i) an increase in the number of members by 1,605, from 69,924 as of September 30, 2024 to 71,529 as of September 30, 2025, resulting in an increase in revenue of JPY315.7 million ($2.1 million) and (ii) an increase in the number of customers who joined events hosted by the Company from 136,695 for the nine months ended September 30, 2024 to 142,843 for the nine months ended September 30, 2025, leading to an increase in the sports school business revenue by JPY112.6 million ($0.8 million).

Social business revenue was JPY2.4 billion ($15.9 million) for the nine months ended September 30, 2025, an increase of 36.4% from JPY1.7 billion for the same period last year. The increase in revenue was mostly driven by: (i) an increase in the number of schools by 125, from 235 as of September 30, 2024 to 360 as of September 30, 2025, resulting in an increase in revenue of JPY505.1 million ($3.4 million), and (ii) an increase in after-school daycare service revenue by JPY86.1 million ($0.6 million).

Cost of Revenue

Cost of revenue was JPY6.1 billion ($41.5 million) for the nine months ended September 30, 2025, an increase of 14.2% from JPY5.4 billion for the same period last year.

Gross Profit

Gross profit was JPY2.4 billion ($16.3 million) for the nine months ended September 30, 2025, an increase of 18.1% from JPY2.0 billion for the same period last year.

Gross margin was 28.2% for the nine months ended September 30, 2025, which increased from 27.5% for the same period last year.

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses were JPY2.1 billion ($13.9 million) for the nine months ended September 30, 2025, an increase of 14.0% from JPY1.8 billion for the same period last year. The increase was attributed to (i) the increase in salaries and welfare expenses of JPY137.5 million ($0.9 million) due to business expansion as well as an increase in headquarters personnel in preparation for the Company’s initial public offering (“IPO”), (ii) the increase in promotion fees of JPY8.2 million ($0.06 million) due to business expansion, (iii) the increase in office rental fees of JPY14.1 million ($0.1 million) due to business expansion, (iv) the increase in system maintenance fee expenses of JPY17.3 million ($0.1 million) incurred due to the increase in the number of employees, and (v) the increase in recruitment fees of JPY53.8 million ($0.4 million) due to business expansion as well as an increase in headquarters personnel in preparation for the Company’s IPO.

Other Income (Expenses), Net

Other expenses, net were JPY1.9 million ($0.01 million) for the nine months ended September 30, 2025, compared to other income, net of JPY28.7 million for the same period last year. The decrease was attributed to: (i) net franchise income collected (returned) of JPY27.4 million ($0.02 million), which was the payments refunded to the franchisees in connection with the transfer of certain business rights, (ii) an eviction compensation of JPY5.5 million ($0.04 million) received in connection with the vacating of a leased building. Interest expenses, net were JPY9.7 million ($0.07 million) for the nine months ended September 30, 2025, a decrease of 21.8% from JPY12.4 million for the same period last year.

Net Income

Net income was JPY226.7 million ($1.5 million) for the nine months ended September 30, 2025, an increase of 0.7% from JPY225.1 million for the same period last year.

Basic and Diluted Earnings per Share

Basic earnings per share was JPY9.10 ($0.06) for the nine months ended September 30, 2025, compared to JPY9.04 for the same period last year.

Diluted earnings per share was JPY9.10 ($0.06) for the nine months ended September 30, 2025, compared to JPY8.32 for the same period last year.

Financial Condition

As of September 30, 2025, the Company had cash of JPY2.4 billion ($16.5 million), compared to JPY2.5 billion as of December 31, 2024.

Net cash provided by operating activities was JPY326.7 million ($2.2 million) for the nine months ended September 30, 2025, compared to net cash used in operating activities of JPY105.4 million for the same period last year.

Net cash used in investing activities was JPY48.5 million ($0.3 million) for the nine months ended September 30, 2025, compared to JPY45.7 million for the same period last year.

Net cash used in financing activities was JPY380.1 million ($2.6 million) for the nine months ended September 30, 2025, compared to JPY224.1 million for the same period last year.

Financial Guidance

The Company is projecting total revenue to be between JPY11.6 billion and JPY11.9 billion ($78.1 million and $80.5 million) for the fiscal year ending December 31, 2025, an increase of approximately 11.9% to 15.3% from JPY10.3 billion ($69.8 million) for the fiscal year ended December 31, 2024.

Income from operations is projected to be between JPY580.0 million and JPY696.5 million ($3.9 million and $4.7 million) for the fiscal year ending December 31, 2025, an increase of 11.6% to 34.0% from JPY519.8 million ($3.5 million) for the fiscal year ended December 31, 2024.

These projections are based on the assumption that no business acquisitions, restructuring activities, or legal settlements will take place during the period.

Exchange Rate Information

This announcement contains translations of certain Japanese Yen (“JPY”) amounts into U.S. dollars (“USD,” or “$”) for the convenience of the reader. Translations of amounts from JPY into USD have been made at the exchange rate of JPY147.97 = $1.00, the exchange rate on September 30, 2025 set forth in the H.10 statistical release of the United States Federal Reserve Board.

About LEIFRAS Co., Ltd.

Headquartered in Tokyo, Leifras is a sports and social business company dedicated to youth sports and community engagement. The Company primarily provides services related to the organization and operations of sports schools and sports events for children. As of December 31, 2024, Leifras was recognized as one of Japan’s largest operators of children’s sports schools in terms of both membership and facilities by Tokyo Shoko Research. The Company’s approach to sports education emphasizes the development of non-cognitive skills, following the teaching principle “acknowledge, praise, encourage, and motivate.” The holistic approach that integrates physical and mental development sets Leifras apart in the industry. Building upon deep experience and know-how in sports education, Leifras also operates a robust social business sector, dispatching sports coaches to meet various community needs with the aim to promote physical health, social inclusion, and community well-being across different demographics. For more information, please visit the Company’s website: https://ir.leifras.co.jp/.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may,” or other similar expressions in this press release. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. These statements are subject to uncertainties and risks, including, but not limited to, the uncertainties related to market conditions, and other factors discussed in the “Risk Factors” section of the registration statement filed with the U.S. Securities and Exchange Commission (the “SEC”). Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the registration statement and other filings with the SEC. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov.

For more information, please contact:

LEIFRAS Co., Ltd.

Investor Relations Department

Email: [email protected]

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: [email protected]

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||||||

|

December 31, |

September 30, |

September 30, |

||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

(Unaudited) |

(Unaudited) |

|||||||||||

|

ASSETS |

||||||||||||

|

CURRENT ASSETS |

||||||||||||

|

Cash |

2,538,554,638 |

2,436,675,605 |

16,467,362 |

|||||||||

|

Accounts receivable, net |

518,398,551 |

555,775,583 |

3,756,002 |

|||||||||

|

Short-term investments |

4,935,000 |

5,075,000 |

34,297 |

|||||||||

|

Inventories, net |

24,468,188 |

20,757,063 |

140,279 |

|||||||||

|

Prepaid expenses |

182,278,232 |

201,888,793 |

1,364,390 |

|||||||||

|

Other current assets |

34,381,843 |

57,886,907 |

391,207 |

|||||||||

|

TOTAL CURRENT ASSETS |

3,303,016,452 |

3,278,058,951 |

22,153,537 |

|||||||||

|

NON-CURRENT ASSETS |

||||||||||||

|

Property and equipment, net |

53,805,279 |

99,293,143 |

671,035 |

|||||||||

|

Finance lease right-of-use assets |

208,611,550 |

228,794,098 |

1,546,219 |

|||||||||

|

Operating lease right-of-use assets |

337,330,750 |

513,349,897 |

3,469,284 |

|||||||||

|

Intangible assets, net |

39,250,078 |

27,980,475 |

189,096 |

|||||||||

|

Goodwill |

27,999,994 |

27,999,994 |

189,228 |

|||||||||

|

Deferred tax assets, net |

214,671,578 |

189,283,332 |

1,279,201 |

|||||||||

|

Deferred initial public offering (“IPO”) costs |

157,482,065 |

254,764,117 |

1,721,728 |

|||||||||

|

Long-term deposits |

150,407,276 |

150,210,192 |

1,015,140 |

|||||||||

|

Other non-current assets |

3,090,205 |

9,784,796 |

66,127 |

|||||||||

|

TOTAL NON-CURRENT ASSETS |

1,192,648,775 |

1,501,460,044 |

10,147,058 |

|||||||||

|

TOTAL ASSETS |

4,495,665,227 |

4,779,518,995 |

32,300,595 |

|||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||

|

CURRENT LIABILITIES |

||||||||||||

|

Short-term loans |

700,000,000 |

700,000,000 |

4,730,689 |

|||||||||

|

Current portion of long-term loans |

230,785,000 |

169,252,000 |

1,143,826 |

|||||||||

|

Bond payable, current |

40,000,000 |

40,000,000 |

270,325 |

|||||||||

|

Accounts payable |

168,281,568 |

114,243,578 |

772,073 |

|||||||||

|

Accrued liabilities |

1,109,740,581 |

1,184,636,104 |

8,005,921 |

|||||||||

|

Income tax payable |

75,374,800 |

3,301,800 |

22,314 |

|||||||||

|

Contract liabilities, current |

147,628,310 |

267,364,483 |

1,806,883 |

|||||||||

|

Amount due to a director |

1,000,000 |

– |

– |

|||||||||

|

Finance lease liabilities, current |

71,681,545 |

83,549,523 |

564,638 |

|||||||||

|

Operating lease liabilities, current |

110,889,134 |

132,923,377 |

898,313 |

|||||||||

|

Other current liabilities |

195,952,191 |

156,907,705 |

1,060,403 |

|||||||||

|

TOTAL CURRENT LIABILITIES |

2,851,333,129 |

2,852,178,570 |

19,275,385 |

|||||||||

|

NON-CURRENT LIABILITIES |

||||||||||||

|

Long-term loans, net of current portion |

175,452,000 |

38,568,000 |

260,648 |

|||||||||

|

Bond payable, non-current |

56,807,020 |

37,833,335 |

255,682 |

|||||||||

|

Contract liabilities, non-current |

10,615,635 |

14,507,411 |

98,043 |

|||||||||

|

Finance lease liabilities, non-current |

140,333,247 |

143,881,183 |

972,367 |

|||||||||

|

Operating lease liabilities, non-current |

207,353,977 |

364,551,378 |

2,463,684 |

|||||||||

|

Assets retirement obligations |

12,914,758 |

30,671,626 |

207,283 |

|||||||||

|

TOTAL NON-CURRENT LIABILITIES |

603,476,637 |

630,012,933 |

4,257,707 |

|||||||||

|

TOTAL LIABILITIES |

3,454,809,766 |

3,482,191,503 |

23,533,092 |

|||||||||

|

COMMITMENTS AND CONTINGENCIES |

||||||||||||

|

SHAREHOLDERS’ EQUITY |

||||||||||||

|

Ordinary shares |

80,500,000 |

80,500,000 |

544,029 |

|||||||||

|

Additional paid-in capital |

748,840,080 |

778,624,844 |

5,262,045 |

|||||||||

|

Treasury shares |

(100,012,265) |

(100,012,265) |

(675,896) |

|||||||||

|

Retained earnings |

311,527,646 |

538,214,913 |

3,637,325 |

|||||||||

|

TOTAL SHAREHOLDERS’ EQUITY |

1,040,855,461 |

1,297,327,492 |

8,767,503 |

|||||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

4,495,665,227 |

4,779,518,995 |

32,300,595 |

|||||||||

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

||||||||||||

|

For the nine months ended |

||||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

NET REVENUE |

7,419,460,643 |

8,556,096,390 |

57,823,183 |

|||||||||

|

Cost of revenue |

(5,378,876,612) |

(6,145,159,916) |

(41,529,769) |

|||||||||

|

GROSS PROFIT |

2,040,584,031 |

2,410,936,474 |

16,293,414 |

|||||||||

|

Selling, general, and administrative expenses |

(1,802,047,253) |

(2,055,180,818) |

(13,889,172) |

|||||||||

|

INCOME FROM OPERATIONS |

238,536,778 |

355,755,656 |

2,404,242 |

|||||||||

|

OTHER INCOME (EXPENSE) |

||||||||||||

|

Interest income |

325,182 |

3,801,610 |

25,691 |

|||||||||

|

Interest expense |

(12,751,685) |

(13,514,164) |

(91,330) |

|||||||||

|

Grant income |

14,205,788 |

14,902,919 |

100,716 |

|||||||||

|

Unrealized (loss) gain on short-term investment |

(168,000) |

140,000 |

946 |

|||||||||

|

Loss on disposal of long-lived assets |

– |

(168,973) |

(1,142) |

|||||||||

|

Loss on disposal of a subsidiary |

(753,900) |

– |

– |

|||||||||

|

Other income (expense), net |

15,438,598 |

(16,773,644) |

(113,358) |

|||||||||

|

Total other income (expense), net |

16,295,983 |

(11,612,252) |

(78,477) |

|||||||||

|

INCOME BEFORE INCOME TAX PROVISION |

254,832,761 |

344,143,404 |

2,325,765 |

|||||||||

|

PROVISION FOR INCOME TAXES |

||||||||||||

|

Current |

(69,425,173) |

(92,067,891) |

(622,206) |

|||||||||

|

Deferred |

39,664,246 |

(25,388,246) |

(171,577) |

|||||||||

|

Total provision for income taxes |

(29,760,927) |

(117,456,137) |

(793,783) |

|||||||||

|

NET INCOME |

225,071,834 |

226,687,267 |

1,531,982 |

|||||||||

|

WEIGHTED AVERAGE NUMBER OF ORDINARY SHARES |

||||||||||||

|

Basic |

24,910,660 |

24,910,619 |

24,910,619 |

|||||||||

|

Diluted |

27,066,715 |

24,913,619 |

24,913,619 |

|||||||||

|

EARNINGS PER SHARE |

||||||||||||

|

Basic |

9.04 |

9.10 |

0.06 |

|||||||||

|

Diluted |

8.32 |

9.10 |

0.06 |

|||||||||

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||||||

|

For the nine months ended |

||||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

Cash flows from operating activities |

||||||||||||

|

Net income |

225,071,834 |

226,687,267 |

1,531,982 |

|||||||||

|

Adjustments to reconcile net income to net cash provided by operating activities |

||||||||||||

|

Depreciation and amortization expense |

90,057,762 |

96,233,315 |

650,357 |

|||||||||

|

Loss on disposal of a subsidiary |

753,900 |

– |

– |

|||||||||

|

Provision for expected credit loss |

2,771,782 |

9,208,096 |

62,229 |

|||||||||

|

Loss on disposal of property and equipment |

– |

168,973 |

1,142 |

|||||||||

|

Accounts receivable written off as uncollectible |

– |

28,558 |

193 |

|||||||||

|

Provision for inventory impairment |

3,403,261 |

424,180 |

2,867 |

|||||||||

|

Unrealized loss (gain) on short-term investment |

168,000 |

(140,000) |

(946) |

|||||||||

|

Other non-cash expenses (income) |

1,100,148 |

29,173,060 |

197,155 |

|||||||||

|

Deferred tax expense (benefit) |

(39,664,246) |

25,388,246 |

171,577 |

|||||||||

|

Changes in operating assets and liabilities |

||||||||||||

|

Accounts receivable, net |

(1,051,687) |

(46,613,686) |

(315,021) |

|||||||||

|

Inventories |

(13,808,125) |

3,286,945 |

22,214 |

|||||||||

|

Prepaid expenses |

(105,900,505) |

(19,854,842) |

(134,182) |

|||||||||

|

Long-term deposits |

(6,998,055) |

197,084 |

1,332 |

|||||||||

|

Amount due from a director |

33,577,065 |

– |

– |

|||||||||

|

Other current assets |

(25,969,080) |

(23,505,064) |

(158,850) |

|||||||||

|

Other non-current assets |

(10,722,988) |

(6,694,591) |

(45,243) |

|||||||||

|

Accounts payable |

(61,359,477) |

(54,037,990) |

(365,196) |

|||||||||

|

Accrued liabilities |

(204,167,728) |

74,895,523 |

506,153 |

|||||||||

|

Contract liabilities |

121,711,898 |

123,627,949 |

835,493 |

|||||||||

|

Operating lease liabilities |

(400,151) |

3,212,497 |

21,710 |

|||||||||

|

Income tax payable |

(149,952,500) |

(72,073,000) |

(487,078) |

|||||||||

|

Amount due to a director |

– |

(1,000,000) |

(6,758) |

|||||||||

|

Other current liabilities |

36,020,082 |

(41,875,805) |

(283,002) |

|||||||||

|

Net cash (used in) provided by operating activities |

(105,358,810) |

326,736,715 |

2,208,128 |

|||||||||

|

Cash flows from investing activities |

||||||||||||

|

Cash outflow due to reduction in consolidated entities |

(17,257,489) |

– |

– |

|||||||||

|

Purchase of property and equipment |

(11,926,248) |

(42,598,215) |

(287,884) |

|||||||||

|

Purchase of intangible assets |

(16,521,500) |

(5,880,000) |

(39,738) |

|||||||||

|

Net cash used in investing activities |

(45,705,237) |

(48,478,215) |

(327,622) |

|||||||||

|

Cash flows from financing activities |

||||||||||||

|

Payment of finance lease liabilities |

(43,259,590) |

(64,438,481) |

(435,483) |

|||||||||

|

Proceeds from bank loans |

250,000,000 |

– |

– |

|||||||||

|

Repayment of bank loans |

(280,815,000) |

(198,417,000) |

(1,340,927) |

|||||||||

|

Repayment of bond payable |

(20,000,000) |

(20,000,000) |

(135,163) |

|||||||||

|

Payment of deferred IPO costs |

(129,983,403) |

(97,282,052) |

(657,445) |

|||||||||

|

Net cash used in financing activities |

(224,057,993) |

(380,137,533) |

(2,569,018) |

|||||||||

|

Net decrease in cash |

(375,122,040) |

(101,879,033) |

(688,512) |

|||||||||

|

Cash at the beginning of period |

2,729,282,346 |

2,538,554,638 |

17,155,874 |

|||||||||

|

Cash at the end of the period end |

2,354,160,306 |

2,436,675,605 |

16,467,362 |

|||||||||

|

Supplementary cash flow information |

||||||||||||

|

Cash paid for income taxes |

202,070,573 |

115,154,307 |

778,227 |

|||||||||

|

Cash paid for interest expenses |

11,651,537 |

12,325,868 |

83,300 |

|||||||||

SOURCE LEIFRAS Co., Ltd.

Rec Sports

Upcoming events: Lights, shows and Christmas dinner | News, Sports, Jobs

photo by: Contributed

Volunteers serve hot meals Wednesday, Dec. 25, 2024, for Lawrence’s annual Community Christmas Dinner.

Friday, Dec. 19

Christmas Through the Ages: Historic Lecompton’s Annual Christmas Tree Display, 10 a.m.-4 p.m., Territorial Capital Museum, 640 E. Woodson Ave., Lecompton.

“Holiday Reflections” walk-through village, 10 a.m.-8 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

“Adornment” Holiday Art Show & Sale, 1-6 p.m., Van Go, 715 New Jersey St.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Knights of Lights, 5:30-10 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Moving screening: “Trading Places” (1983), 7 p.m., Liberty Hall Little Theater, 644 Massachusetts St. See liberty-hall.com for ticket information.

Kansas City Symphony Presents: Christmas Festival, 7 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Wine and Carols, 7-9 p.m., Trivedi Wine, 1826 E. 1150 Road. $5 cover charge.

Kansas City Ballet Presents: “The Nutcracker,” 7:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 8 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Saturday, Dec. 20

Festivus Fun Run, 9 a.m., Ad Astra Running, 837 Massachusetts St. See connect.garmin.com/modern/course/239297421 for course.

“Holiday Reflections” walk-through village, 9 a.m.-7 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Christmas Through the Ages: Historic Lecompton’s Annual Christmas Tree Display, 10 a.m.-4 p.m., Territorial Capital Museum, 640 E. Woodson Ave., Lecompton.

“Adornment” Holiday Art Show & Sale, 10 a.m.-5 p.m., Van Go, 715 New Jersey St.

Silent Book Club meeting, 10:30 a.m., Tous les Jours, 525 Wakarusa Drive. Bring whatever book you’re reading. No assigned reading; readers quietly gather to enjoy their various books in silent companionship.

Festival of Nativities, noon-4 p.m., Centenary United Methodist Church, 245 N. Fourth (corner of Fourth and Elm), North Lawrence.

Holiday Bake Sale to benefit Sunrise Project, noon-4 p.m., 245 N. Fourth St.

Kansas City Symphony Presents: Christmas Festival, 1 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 2 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Kansas City Ballet Presents: “The Nutcracker,” 2 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Winter Wonderland, 5-8 p.m., Prairie Park Nature Center, 2730 Harper St. Pre-register at lprd.org.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Knights of Lights, 5:30-10 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Miller Marley Performing Companies: “Clara’s Dream and a Holiday Musical Revue,” 6 p.m., Lied Center, 1600 Stewart Drive. See lied.ku.edu for tickets.

Kansas Ballet Presents “The Nutcracker” featuring the Topeka Symphony, 7 p.m., Topeka Performing Arts Center, 214 SE 8th St., Topeka.

Kansas City Symphony Presents: Christmas Festival, 7 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Kansas City Ballet Presents: “The Nutcracker,” 7:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Movie screening: “Spaceballs” (1987), 8 p.m., Liberty Hall, 644 Massachusetts St. See liberty-hall.com for tickets.

KC Rep: “A Christmas Carol,” 8 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Sunday, Dec. 21

“Holiday Reflections” walk-through village, 9 a.m.-7 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Festival of Nativities, noon-4 p.m., Centenary United Methodist Church, 245 N. 4th (corner of 4th and Elm), North Lawrence.

Holiday Bake Sale to benefit Sunrise Project, noon-4 p.m., 245 N. Fourth St.

“Adornment” Holiday Art Show & Sale, 1-5 p.m., Van Go, 715 New Jersey St.

Miller Marley Performing Companies: “Clara’s Dream and a Holiday Musical Revue,” 2 p.m., Lied Center, 1600 Stewart Drive. Tickets at lied.ku.edu.

Knights of Lights, 5:30-9 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Kansas Ballet Presents “The Nutcracker” featuring the Topeka Symphony, 7 p.m., Topeka Performing Arts Center, 214 SE 8th St., Topeka.

KC Rep: “A Christmas Carol,” 1 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Kansas City Ballet Presents: “The Nutcracker,” 1 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Christmas Through the Ages: Historic Lecompton’s Annual Christmas Tree Display, 1-5 p.m., Territorial Capital Museum, 640 E. Woodson Ave., Lecompton.

Kansas City Symphony Presents: Christmas Festival, 2 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Drunken Fiddles Holiday Music, 3 p.m., Lucia’s, 1016 Massachusetts St.

Kansas City Ballet Presents: “The Nutcracker,” 5:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

KC Rep: “A Christmas Carol,” 6 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Movie screening: “Home Alone” (1990), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. See liberty-hall.com for tickets.

Kansas City Symphony Presents: Christmas Festival, 7 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Monday, Dec. 22

“Holiday Reflections” walk-through village, 10 a.m.-8 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Kansas City Ballet Presents: “The Nutcracker,” 2 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Knights of Lights, 5:30-9 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Movie screening: “Holiday” (1938), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. Tickets at liberty-hall.com.

Kansas City Ballet Presents: “The Nutcracker,” 7:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Tuesday, Dec. 23

“Holiday Reflections” walk-through village, 10 a.m.-8 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Kansas City Ballet Presents: “The Nutcracker,” 2 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Knights of Lights, 5:30-9 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Kansas City Symphony Presents: It’s a Wonderful Life in Concert, 7 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 7 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Movie screening: “Gremlins” (1984), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. See liberty-hall.com for tickets.

Kansas City Ballet Presents: “The Nutcracker,” 7:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Wednesday, Dec. 24

“Holiday Reflections” walk-through village, 10 a.m.-2 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Christmas Through the Ages: Historic Lecompton’s Annual Christmas Tree Display, 10 a.m.-4 p.m., Territorial Capital Museum, 640 E. Woodson Ave., Lecompton.

Kansas City Symphony Presents: It’s a Wonderful Life in Concert, 11 a.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 1 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Kansas City Ballet Presents: “The Nutcracker,” 1 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 5 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Knights of Lights, 5:30-9 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Movie screening: “The Shop Around the Corner” (1940), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. See liberty-hall.com for tickets.

Thursday, Dec. 25

Community Christmas Dinner, 11 a.m.-2 p.m., First United Methodist Church, 946 Vermont St. Home deliveries also available.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Movie screening: “While You Were Sleeping” (1995), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. Tickets at liberty-hall.com.

-

Motorsports1 week ago

Motorsports1 week agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Motorsports3 weeks ago

Motorsports3 weeks agoJo Shimoda Undergoes Back Surgery

-

NIL3 weeks ago

NIL3 weeks agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoHow this startup (and a KC sports icon) turned young players into card-carrying legends overnight

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoRobert “Bobby” Lewis Hardin, 56

-

Sports3 weeks ago

Wisconsin volleyball sweeps Minnesota with ease in ranked rivalry win

-

Motorsports1 week ago

Motorsports1 week agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Motorsports3 weeks ago

Motorsports3 weeks agoIncreased Purses, 19 Different Tracks Highlight 2026 Great Lakes Super Sprints Schedule – Speedway Digest

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw

-

Sports2 weeks ago

Sports2 weeks agoMen’s and Women’s Track and Field Release 2026 Indoor Schedule with Opener Slated for December 6 at Home