Technology

Sports Officiating Technologies Market | Global Market Analysis Report

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

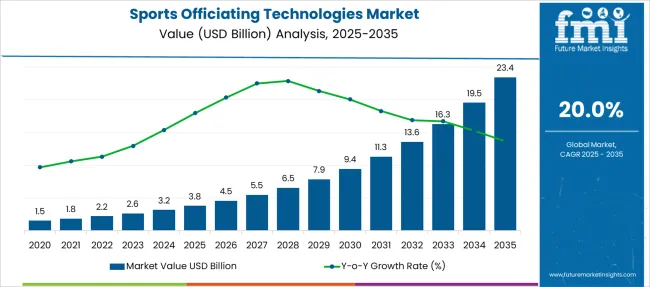

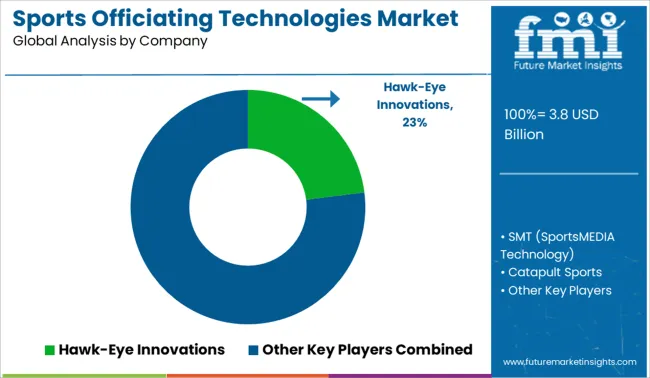

The Sports Officiating Technologies Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 23.4 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

Quick Stats for Sports Officiating Technologies Market

- Sports Officiating Technologies Market Value (2025): USD 3.8 billion

- Sports Officiating Technologies Market Forecast Value (2035): USD 23.4 billion

- Sports Officiating Technologies Market Forecast CAGR: 20.0%

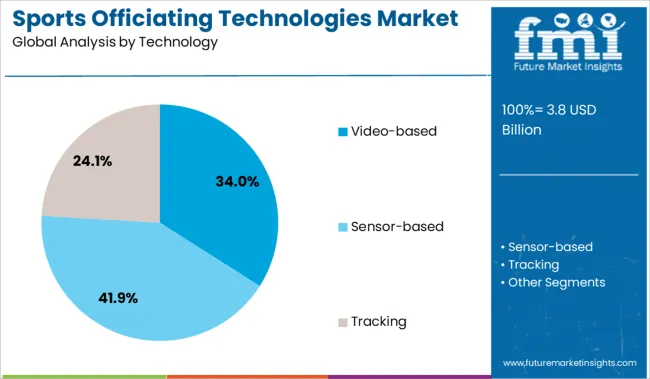

- Leading Segment in Sports Officiating Technologies Market in 2025: Video-based (34.0%)

- Key Growth Regions in Sports Officiating Technologies Market: North America, Asia-Pacific, Europe

- Top Key Players in Sports Officiating Technologies Market: Hawk-Eye Innovations, SMT (SportsMEDIA Technology), Catapult Sports, Zebra Technologies, Stats Perform, ChyronHego, PlaySight, Kinexon, Second Spectrum, ShotTracker

Sports Officiating Technologies Market Key Takeaways

| Metric | Value |

|---|---|

| Sports Officiating Technologies Market Estimated Value in (2025 E) | USD 3.8 billion |

| Sports Officiating Technologies Market Forecast Value in (2035 F) | USD 23.4 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

Why is the Sports Officiating Technologies Market Growing?

The Sports Officiating Technologies market is undergoing significant growth, supported by the rising demand for fairness, accuracy, and consistency in professional and amateur sports. Increasing global investment in competitive sports, along with the proliferation of broadcast partnerships and sponsorships, has elevated the need for transparent and technology-driven officiating systems. The integration of intelligent technologies into officiating processes is being driven by both governing bodies and fans, who expect real-time decision validation and error minimization.

Advances in video processing, data analytics, and sensor technologies have made it possible to implement precise adjudication systems across a wide variety of sports. Regulatory endorsements for technology-based officiating tools are further legitimizing adoption on a global scale.

The growing visibility of high-profile controversies and the reputational risks they pose have also prompted sports organizations to adopt advanced officiating platforms. As emerging technologies mature and stakeholder confidence increases, the market is expected to witness expanded implementation across new regions and sports categories, reinforcing long-term momentum..

Segmental Analysis

The market is segmented by Technology, Application, and Sports Type and region. By Technology, the market is divided into Video-based, High-speed cameras, Multi-angle camera systems, Slow-motion replay systems, Virtual Reality (VR) assisted review, Sensor-based, Wearable sensors, Equipment-embedded sensors, Court/field sensors, Acoustic sensors, Tracking, GPS-based tracking, RFID tracking, Optical tracking systems, Radar-based tracking, Communication, Wireless headsets, In-ear communication devices, Digital signaling systems, and Video conferencing.

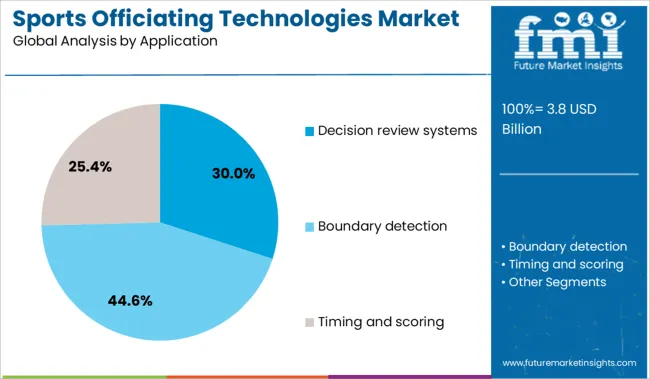

In terms of Application, the market is classified into Decision review systems, Goal-line technology, Ball tracking, Video assistant referee (VAR), Challenge systems, Boundary detection, Automated line calling, Out-of-bounds detection, Touch detection, Timing and scoring, Electronic scoring systems, Precision timekeeping, Photo finish technology, Shot clocks and play clocks, Player/ball tracking, Position tracking, Speed and acceleration measurement, Distance covered analysis, Ball flight analysis, Foul detection, Contact detection, Handball detection, False start detection, Illegal motion detection, Equipment compliance, Automated equipment checks, Material composition analysis, and Size and weight verification.

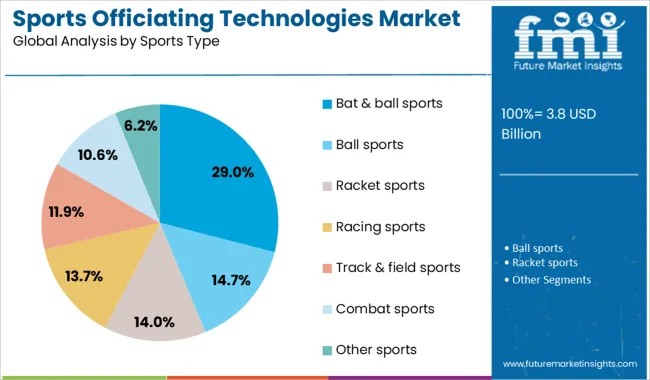

Based on Sports Type, the market is segmented into Bat & ball sports, Ball sports, Racket sports, Racing sports, Track & field sports, Combat sports, and Other sports. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Video-based Technology Segment

The video-based technology segment is projected to account for 34% of the Sports Officiating Technologies market revenue share in 2025, making it the dominant technology segment. This segment has gained traction due to its ability to deliver high-resolution visual evidence that aids in real-time and post-event decision making. The effectiveness of video replay systems in detecting on-field errors, clarifying contentious calls, and enhancing game integrity has driven widespread acceptance across leagues and tournaments.

Advancements in slow-motion capture, multi-angle feeds, and AI-assisted frame analysis have further improved accuracy and efficiency. The technology’s adaptability across diverse sports formats and its compatibility with existing broadcast infrastructure have contributed to its growth.

Adoption has also been encouraged by stakeholders’ focus on minimizing officiating disputes and boosting fan trust. As the demand for transparent and data-supported officiating continues to rise, video-based systems are expected to remain the preferred technological solution across global sporting platforms..

Insights into the Decision Review Systems Application Segment

The decision review systems segment is expected to contribute 30% of the Sports Officiating Technologies market revenue share in 2025, positioning it as the leading application segment. This growth has been supported by the critical role these systems play in validating or overturning referee and umpire decisions during high-stakes matches. As sports become increasingly competitive, the margin for error in officiating has narrowed, making accurate adjudication essential.

Decision review systems have been favored for their ability to reduce human error, support real-time feedback, and ensure procedural fairness. Their adoption has been reinforced by official rule changes in several sports leagues and governing bodies mandating their use for specific decisions.

Technological improvements such as real-time analytics, automated tracking, and enhanced user interfaces have increased system reliability and operator efficiency. As public scrutiny and media coverage intensify, the utility of decision review systems in maintaining credibility and game integrity is expected to sustain their leadership position within the application segment..

Insights into the Bat and Ball Sports Sports Type Segment

The bat and ball sports segment is anticipated to account for 29% of the Sports Officiating Technologies market revenue share in 2025, making it the largest sports type segment. The adoption of officiating technologies in this category has been driven by the high reliance on precise judgment in events such as boundary calls, wicket decisions, and pitch tracking. The complexity and speed of gameplay in bat and ball sports have necessitated the use of accurate decision-support systems to supplement umpire rulings.

Stakeholder investment in preserving the competitive integrity of these sports has led to early and extensive integration of technologies such as video reviews, tracking software, and automated alerts. Broadcast partners and sponsors have also supported adoption, as technology-backed officiating enhances viewer engagement and credibility.

As international tournaments and leagues expand, governing bodies are increasingly mandating uniform implementation of technology to standardize decision making. This has reinforced the dominant position of bat and ball sports in driving the overall market growth..

What are the Drivers, Restraints, and Key Trends of the Sports Officiating Technologies Market?

Sports leagues are adopting AI-driven officiating tools to enhance decision accuracy and reduce human error. Rising media, betting, and sponsorship pressures are driving integration of replay tech with broadcasts for transparency and monetization.

Growing Adoption of Data-Driven Decision-Making in Sports

The demand for real-time, data-supported officiating is fueling adoption of technologies like VAR (Video Assistant Referee), Hawk-Eye, and sensor-integrated wearables across multiple sports. Leagues and federations are increasingly relying on objective evidence to reduce human error and uphold fairness, especially in high-stakes matches. Advanced analytics and frame-by-frame video analysis are being embedded into referee training systems. Increased use of AI-based playback systems is also improving officiating accuracy, particularly in tennis, soccer, and cricket. As sports organizations compete for credibility and viewer trust, data-backed decision tools are becoming foundational to regulatory structures and league operations across national and international levels.

Commercial Pressures and Broadcast Integration

The rising financial stakes in professional sports, from media rights to fan engagement, have turned officiating accuracy into a business imperative. Broadcasters are leveraging officiating tech feeds to enhance viewer experience, while leagues are integrating these systems to protect the integrity of game outcomes. High-definition replay systems and multi-angle feeds are increasingly synchronized with live broadcasting. Pressure from teams, sponsors, and betting stakeholders to ensure transparent decisions is accelerating adoption. Moreover, league partnerships with tech providers for exclusive officiating solutions are becoming standard, creating new revenue channels and standardizing technologies across tournaments to ensure consistency and monetization potential.

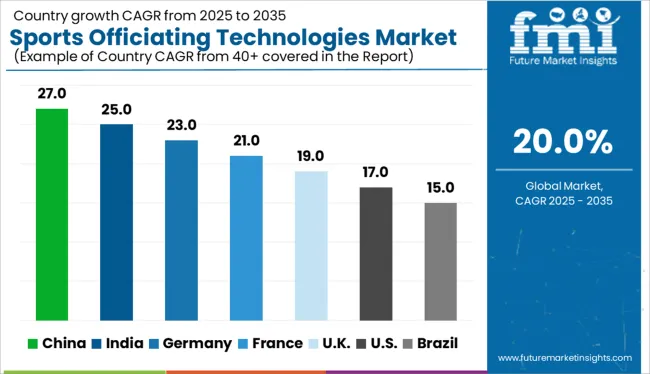

Analysis of Sports Officiating Technologies Market By Key Countries

| Country | CAGR |

|---|---|

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

The global sports officiating technologies market is projected to expand at a CAGR of 20% from 2025 to 2035, driven by heightened demand for fairness, accuracy, and fan engagement across professional and amateur sports. Among BRICS countries, China (27.0%) and India (25.0%) are outperforming the global average due to rapid digitization in sports infrastructure and increased adoption of VAR, AI-based analytics, and sensor technologies in national leagues and grassroots tournaments. This growth is amplified by governmental support to professionalize sports ecosystems and attract international sporting events. Germany (23.0%), as part of the OECD, leads Europe’s technological transformation in officiating, leveraging innovations in precision tracking and real-time analytics across football, athletics, and motorsports. The UK (19.0%) and US (17.0%), though significant players, are slightly below the global average due to legacy systems and differing levels of tech standardization across leagues. ASEAN markets are witnessing a rising trend of officiating tech integration, especially in e-sports and emerging regional tournaments, representing untapped potential.

Market Dynamics of Sports Officiating Technologies in the United Kingdom

The CAGR for the UK sports officiating technologies market was approximately 3.4% during 2020–2024, reflecting limited early-stage investment in officiating tools across lower-tier leagues and resistance from traditional sporting bodies. Based on the 2024 market value of USD 19.0 million and aligning with the global CAGR of 20%, the CAGR for 2020–2024 calculates to around 3.4%, rising sharply to 9.6% from 2025–2035. This upward trajectory is driven by the Football Association and Premier League’s intensified focus on real-time video analytics and referee-assist systems post-2024. Post-Brexit tech partnerships encouraged domestic procurement of officiating tools, while broadcast deals prioritized replay-integrated match coverage. Further, grassroots and amateur leagues started piloting low-cost digital officiating tools via federated funding programs to enhance referee training and performance transparency.

- Hawk-Eye installations expanded across all EPL venues by 2026.

- Grassroots leagues increased officiating tech trials by 3× between 2025 and 2028.

- UK-based suppliers formed 9 broadcast-tech integrations by 2027.

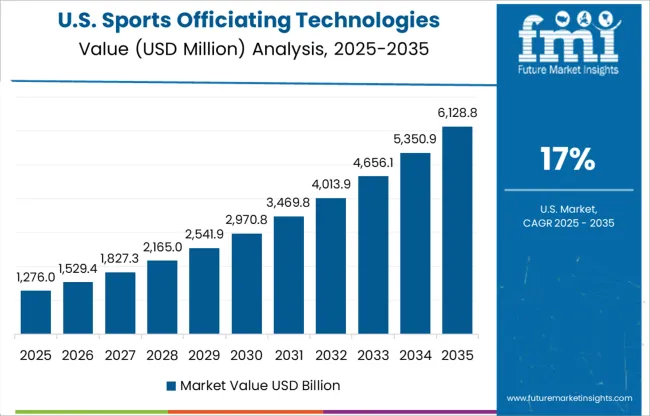

Growth Analysis of Sports Officiating Technologies in the United States

The CAGR of the sports officiating technologies market in the United States was around 4.2% during 2020–2024, limited by fragmented sporting regulations across leagues. From a 2024 value of USD 17.0 million, the CAGR is projected to rise to 8.4% for 2025–2035, fueled by increased pressure from sports betting entities and broadcaster partnerships to minimize human error. NFL and MLB expanded video-assist frameworks, while collegiate leagues piloted automated umpire systems integrated with AI and ball-tracking data. Major sports universities started adopting motion analytics for officiating education. The post-2025 digital transformation of fan engagement, featuring alternate feeds with referee communication, pushed federations to invest in transparency-enhancing technologies.

- NFL’s AI-assisted call reviews expanded to 31 teams by 2027.

- NCAA adopted officiating training systems in 52 universities by 2028.

- Referee mic systems became standard across televised events by 2026.

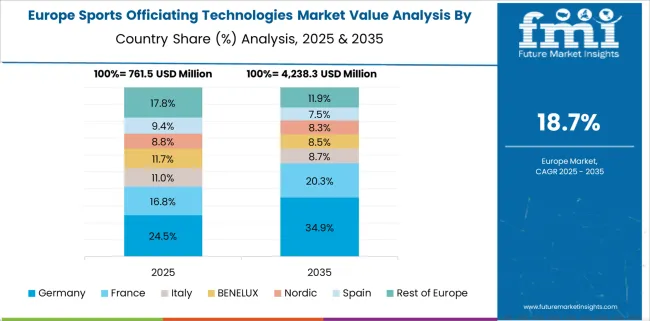

Opportunity Analysis of Sports Officiating Technologies in Germany

Germany’s sports officiating technologies market grew at a 5.1% CAGR from 2020–2024, with adoption limited mostly to Bundesliga-level football. The CAGR is expected to rise to 10.1% for 2025–2035, driven by structured national policies integrating officiating technology into training programs for referees across handball, basketball, and football. Public funding support for federations and high-definition broadcast enhancements by ARD and ZDF also stimulated investments. The German Olympic Sports Confederation pushed for tech standardization, enabling small-to-mid-tier leagues to access bundled replay and motion detection solutions. A rising domestic ecosystem of officiating system developers further enabled scalable and compliant deployment across regional leagues.

- National handball league integrated instant-replay systems in 2026.

- 61% of televised football matches used multi-angle VAR by 2028.

- Germany hosted the first European Officiating Tech Expo in 2025.

Demand Outlook for Sports Officiating Technologies in China

China’s sports officiating technologies market registered a CAGR of 6.3% from 2020–2024, aided by its centralized investments in professional sports infrastructure. The CAGR is expected to accelerate to 12.8% between 2025 and 2035, supported by large-scale national programs for smart stadiums and digital refereeing tools. China’s Football Association mandated AI-assisted line calls and instant replay from 2026 across top-tier matches. High school and university leagues also began piloting referee training tools using motion sensors and augmented reality. Cross-border partnerships with Korean and Japanese tech providers strengthened the hardware and software supply chains. China’s goal to digitize all Tier 1 matches by 2030 is propelling consistent investment.

- Smart referee kits deployed in 17 provinces by 2027./li>

- AI-based foul detection tested in basketball leagues in 2026.

- Tier 1 league compliance with replay standards reached 93% by 2029.

Sales Trends of Sports Officiating Technologies in India

India’s sports officiating technologies market grew at a CAGR of 5.5% during 2020–2024, with adoption primarily centered on cricket. This is expected to rise to 10.6% for 2025–2035, driven by the IPL and Pro Kabaddi League’s adoption of ultra-motion replay systems and third umpire automation. State governments, under Khelo India, began integrating digital officiating tools in school-level tournaments, encouraging widespread familiarity. Rising viewership and monetization potential through OTT platforms such as Hotstar and JioCinema led to integration of referee-audio, real-time foul analysis, and multiple camera angles in live streams. Indian startups, supported by government incubation, began exporting officiating modules to ASEAN countries post-2026.

- IPL’s officiating tech budget grew 2.7× between 2024 and 2027.

- Kabaddi leagues added motion-triggered sensors in 2026.

- 63% of national sports events adopted video-review systems by 2029.

Competitive Landscape of Sports Officiating Technologies Market

In the sports officiating technologies market, key players are revolutionizing the accuracy and transparency of sports through AI, real-time data, and motion-tracking systems. Companies like Hawk-Eye Innovations, SMT (SportsMEDIA Technology), and Catapult Sports are deploying ball-tracking, replay validation, and referee-assist systems across tennis, football, and basketball. Zebra Technologies and Stats Perform are enhancing game intelligence by integrating RFID and predictive analytics into officiating workflows. ChyronHego and PlaySight are equipping venues with multi-angle replay systems to support broadcast-integrated decision-making, while Kinexon, Second Spectrum, and ShotTracker focus on player-positioning tech to aid foul detection and movement-based rulings. These solutions are widely adopted by leagues such as the NBA, EPL, and ATP, ensuring consistency, integrity, and commercial value in sports governance.

Scope of the Report

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Technology | Video-based, High-speed cameras, Multi-angle camera systems, Slow-motion replay systems, Virtual Reality (VR) assisted review, Sensor-based, Wearable sensors, Equipment-embedded sensors, Court/field sensors, Acoustic sensors, Tracking, GPS-based tracking, RFID tracking, Optical tracking systems, Radar-based tracking, Communication, Wireless headsets, In-ear communication devices, Digital signaling systems, and Video conferencing |

| Application | Decision review systems, Goal-line technology, Ball tracking, Video assistant referee (VAR), Challenge systems, Boundary detection, Automated line calling, Out-of-bounds detection, Touch detection, Timing and scoring, Electronic scoring systems, Precision timekeeping, Photo finish technology, Shot clocks and play clocks, Player/ball tracking, Position tracking, Speed and acceleration measurement, Distance covered analysis, Ball flight analysis, Foul detection, Contact detection, Handball detection, False start detection, Illegal motion detection, Equipment compliance, Automated equipment checks, Material composition analysis, and Size and weight verification |

| Sports Type | Bat & ball sports, Ball sports, Racket sports, Racing sports, Track & field sports, Combat sports, and Other sports |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hawk-Eye Innovations, SMT (SportsMEDIA Technology), Catapult Sports, Zebra Technologies, Stats Perform, ChyronHego, PlaySight, Kinexon, Second Spectrum, and ShotTracker |

| Additional Attributes | Dollar sales, share by sport type, league adoption rates, regulatory mandates, broadcaster partnerships, pricing benchmarks, regional growth hotspots, and tech integration trends. |

Technology

Games of the Future 2025 Offers $5M Prize Pool

“Phygital” sports combine traditional athletic competition with its digital counterpart in a unified format that requires competitors to excel in both dimensions. Teams begin the challenge in the digital round before facing off again in the physical arena, with victory determined by the combined results of both performances.

This model reflects the growing convergence of technology and real-world performance, offering a new and immersive form of sporting competition.

More than 850 athletes from 60 countries will participate, representing clubs, emerging talents, and new faces across 11 phygital sports disciplines.

Faisal Al Bannai, Adviser to the UAE President for Strategic Research and Advanced Technology Affairs and Secretary-General of the Advanced Technology Research Council, said:

“Digital sport is not merely a new format; it embodies the mindset of a new generation.

Bridging physical excellence and digital mastery

Abu Dhabi is proud to host this edition of the Games of the Future 2025, providing an environment that brings together physical excellence and digital mastery. Our goal is to empower youth, accelerate innovation, and build communities around the technologies that will shape the future.”

The 2025 edition comes with strong global momentum, bringing together elite athletes from across the phygital sports ecosystem—competitors who demonstrate exceptional physical performance alongside advanced digital skills.

The event will feature professional athletes, esports stars, and rising phygital talents, promising outstanding competitions that showcase the best of both the physical and digital worlds. The championship reflects the rapid transformation of sport in an increasingly interconnected world, positioning the 2025 edition as a pivotal milestone in the global evolution of this growing sector.

Abu Dhabi prepares to deliver an exceptional edition

The draw has determined the opening group-stage matchups across the various disciplines, setting the stage for the first competitive narratives that audiences will follow. As the event progresses, full competitive pathways will unfold, with clubs vying for qualification and top positions in the finals, which will feature a total prize pool of USD 5 million.

In parallel with the tournament, Abu Dhabi will host the Phygital Sports Summit on 17 December 2025. The summit will serve as an intellectual platform bringing together global experts, athletes, innovators, and decision-makers to discuss the evolution of hybrid sports. Its comprehensive program includes keynote addresses, panel sessions, and in-depth discussions on the intersection of sport and technology, human–AI integration, the future of youth engagement, athlete health in hybrid environments, and the sustainable legacy of phygital sports.

Summit sessions will be moderated by Amy Jane Gillingham, Mohamed Al Hosani, and Sabine Sassen, with participation from senior representatives of Phygital International, partners of the Games of the Future, and leading global figures shaping both the digital and physical sports movements.

Distinguished guests expected to attend include H.E. Dr. Ahmad Belhoul Al Falasi, UAE Minister of Sports, and a high-level international delegation featuring H.E. Ilham Aliyev, President of the Republic of Azerbaijan; H.E. Rawan bint Najeeb Tawfiqi, Minister of Youth Affairs of the Kingdom of Bahrain; Sheikha Deena bint Rashid Al Khalifa, Adviser for Planning and Development at Bahrain’s Ministry of Youth Affairs; and Dr. Osman Aşkın Bak, Minister of Youth and Sports of the Republic of Türkiye.

Sport of the next generation

Technology

The evolution of entertainment technology and its business impact – EUbusiness.com

Entertainment has always played a vital role in society, and the ways we access and enjoy it have changed drastically over time. Today, as online platforms, streaming services, and digital applications gain traction, businesses are rethinking their strategies in this evolving landscape.

Innovations in entertainment technology touch everything from live sports to gaming and betting, as seen at bet777, demonstrating how rapidly shifting trends impact the industry as a whole.

From analog to digital: the transformation of entertainment

The transition from analog to digital technology marks one of the most significant changes in entertainment history. In the past, physical media such as vinyl records, VHS tapes, and CDs were the norm. With the rise of digital formats, accessibility and distribution underwent a revolution. Digital streaming made it possible for consumers to access content instantly, eliminating the limitations of geography and physical storage. This convenience not only changed how audiences consume media but also how creators and companies distribute and monetize their content.

As digital solutions expanded, new forms of entertainment began to emerge. Video games, interactive apps, and online casinos grew in popularity, shifting the focus from passive viewing to active participation. The proliferation of high-speed internet and smartphones further fueled this transformation, enabling entertainment anywhere, anytime. Companies operating in this environment had to adapt quickly to user expectations of on-demand, personalized experiences. This ongoing evolution continues to blur the line between creators, distributors, and consumers, changing the entire value chain.

Streaming services and the shift in business models

The introduction of video and music streaming platforms led to fundamental changes in business models across the sector. Subscription services replaced one-time purchases, shifting the focus to long-term customer retention and recurring revenue streams. This not only increased competition among platforms but also gave rise to exclusive content and original productions as key differentiators. The bargaining power shifted to content creators and platforms able to attract large subscriber bases, while traditional broadcasters and physical retailers had to reinvent or risk becoming obsolete.

This transition has also extended to other segments such as live sports, eSports, and iGaming. Businesses are investing in digital infrastructure and user experience, offering everything from artificial intelligence-driven recommendations to interactive live events. The ability to collect and analyze user data allows companies to tailor offerings directly to their audiences, driving engagement and loyalty. Simultaneously, regulatory challenges and data security concerns have emerged, demanding new approaches to compliance and consumer protection in digital entertainment.

Immersive technology and the business of innovation

The latest chapter in entertainment technology is defined by immersive experiences such as virtual reality (VR), augmented reality (AR), and advanced streaming features. As these technologies find mainstream adoption, businesses are leveraging them to create new ways to engage users. For example, VR concerts, AR-enhanced sports statistics, and immersive gaming environments offer fresh revenue opportunities and deepen the user’s connection with content.

To stay competitive, entertainment companies must constantly invest in innovation and understand emerging trends. Cloud gaming and interactive betting platforms exemplify how technology influences entertainment choices and opens up lucrative business channels. The integration of social features, mobile-first strategies, and cross-platform compatibility are now prerequisites for success. As the landscape continues to evolve, keeping pace with technology and user preferences will be crucial for organizations aiming to thrive in the future of entertainment.

Technology

How Light & Wonder sets the bar with gaming innovation

Kennedy Ntire, Gaming Manager at the Grand Palm Casino, has worked in iGaming for over 15 years so has a strong understanding of what makes players keep coming back for more.

In the video above, he explains why Light and Wonder are the leader of the pack in iGaming innovation and have a unique way of entertaining and captivating both new and experienced players.

Technology

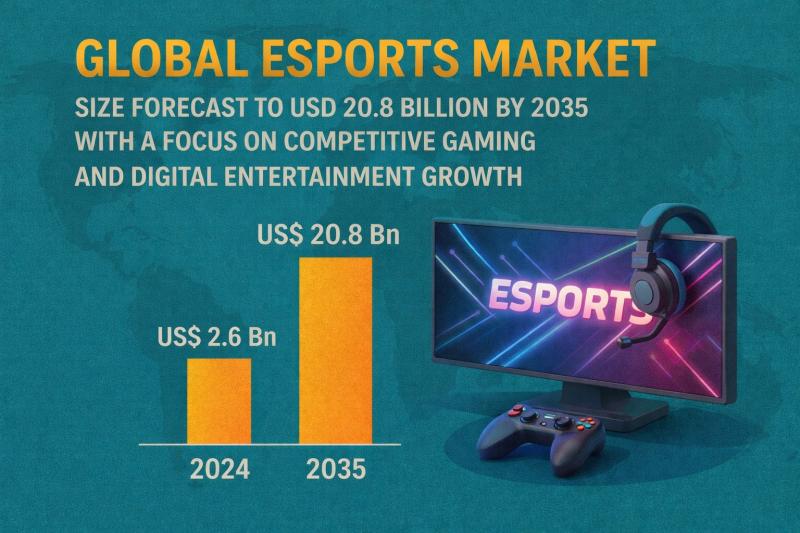

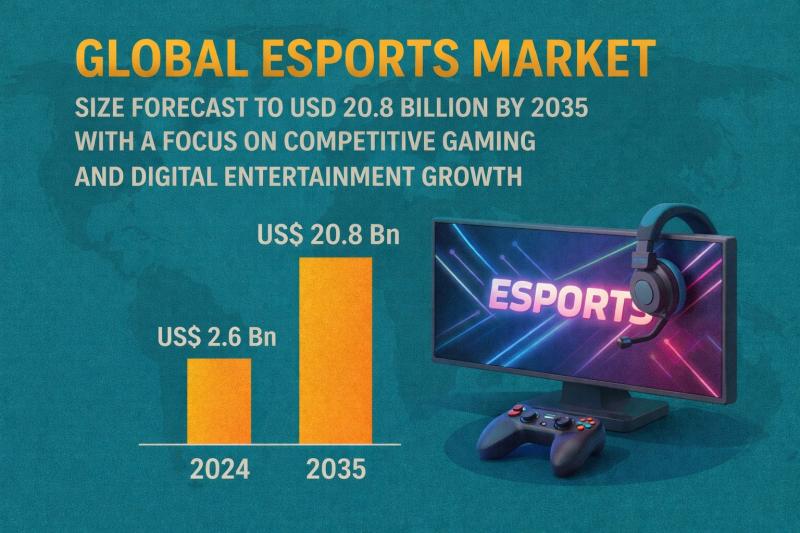

Global Esports Market Size Forecast to USD 20.8 Billion by 2035

Global Esports Market Size Outlook 2035

Global Esports Market Size Outlook 2035

The global Esports market was valued at US$ 2.6 billion in 2024. It is projected to grow at a CAGR of 20.9% from 2025 to 2035, reaching US$ 20.8 billion by 2035. This rapid growth is driven by the surging popularity of competitive gaming, increasing digital connectivity, corporate sponsorships, and expanding live streaming platforms worldwide.

👉 Get your sample market research report copy today@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=54564

Market Overview

Esports refers to competitive gaming at professional levels, where players compete individually or in teams in popular games like League of Legends, Dota 2, Fortnite, Call of Duty, and Overwatch. The market spans across tournaments, leagues, streaming platforms, sponsorships, advertising, and merchandise sales.

Factors contributing to market expansion include:

• Rising internet penetration and smartphone adoption, especially in Asia-Pacific

• Increased viewership via streaming platforms like Twitch, YouTube Gaming, and Facebook Gaming

• Growing corporate investments and sponsorships

• Expansion of Esports tournaments, leagues, and collegiate competitions

• Enhanced engagement through virtual reality (VR) and augmented reality (AR) gaming experiences

North America and Europe are leading markets due to mature gaming ecosystems, while Asia-Pacific is the fastest-growing region driven by a huge gamer population and strong tournament culture.

Key Market Growth Drivers

1. Rising Popularity of Competitive Gaming

Competitive gaming is attracting millions of fans globally, creating a robust ecosystem for tournaments, streaming, and merchandise sales.

2. Growth of Digital Streaming Platforms

Platforms like Twitch, YouTube Gaming, and Trovo are expanding the reach of Esports, enabling real-time engagement and monetization through subscriptions, ads, and donations.

3. Corporate Sponsorships and Advertising

Brands are increasingly investing in Esports teams, tournaments, and influencer marketing, enhancing revenue opportunities and market growth.

4. Technological Advancements

• VR/AR integration for immersive experiences

• Advanced graphics, AI, and game engines enhancing competitive gameplay

• Cloud gaming enabling accessibility without high-end hardware

5. Expanding Professional Leagues and Tournaments

Major tournaments like The International (Dota 2), League of Legends World Championship, and Fortnite World Cup are boosting Esports viewership and attracting global sponsorship.

Analysis of Key Players – Key Strategies

Leading Esports companies focus on technology innovation, strategic partnerships, player acquisition, and global expansion.

1. Player and Team Management

• Investment in professional teams, player training, and coaching

• Acquisition of top-tier players to enhance competitive performance

2. Strategic Partnerships and Sponsorships

• Collaboration with gaming hardware, software, and media companies

• Partnerships with brands for event sponsorships and advertising campaigns

3. Platform Expansion

• Enhancing streaming platforms with interactive features, chat, and monetization options

• Developing mobile apps and cloud-based gaming services

4. Regional Growth

• Expansion into Asia-Pacific and Latin America to capitalize on large gamer populations

• Increasing tournaments in emerging markets to boost fan engagement

Analysis of Key Players in the Esports Market

Leading companies in the global esports market are investing in technological innovations, strategic partnerships, and product diversification to strengthen their market presence and stay ahead in the rapidly evolving competitive gaming industry. Their initiatives aim to enhance gaming experiences, improve precision in competitive play, and expand audience engagement globally.

Key players in the esports market include

• Bandai Namco Entertainment

• Valve Corporation

• PGL

• Overwatch League

• NVIDIA

• Microsoft

• Faceit

• Tencent

• Riot Games

• Epic Games

• Sony Interactive Entertainment

• Take Two Interactive

• Activision Blizzard

• Electronic Arts

• Other Prominent Players.

These companies are profiled in the esports market research report based on company overview, financial performance, business strategies, product portfolio, business segments, and recent developments.

👉 Discuss Implications for Your Industry Request Sample Research Report PDF@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=54564

Key Developments in the Esports Market

• April 2025: Nintendo showcased its esports initiatives during the Nintendo Switch 2 Direct event, introducing new IPs and enhancing Splatoon with esports features such as improved matchmaking and live streaming integration. These efforts aim to strengthen Nintendo’s position in the competitive gaming market through strategic partnerships and global audience engagement.

• March 2025: Gameloft launched a new mobile esports platform for Asphalt 9: Legends, focusing on community-driven tournaments and competitive play. The platform features regular in-app events, live streaming, and player rewards, designed to expand the mobile esports ecosystem and attract a larger audience.

Market Challenges & Opportunities

Challenges

1. High Competition and Saturation

The rapid growth of gaming content and tournaments increases competition for viewership and sponsorships.

2. Regulatory and Legal Issues

Issues like laws, online content regulations, and copyright concerns can affect market expansion.

3. Monetization Challenges

Smaller tournaments and emerging platforms may struggle with sustainable revenue generation.

4. Hardware and Connectivity Requirements

High-performance gaming requires advanced hardware and stable internet, limiting access in some regions.

Opportunities

1. Mobile Esports Expansion

Mobile gaming is driving Esports adoption in Asia-Pacific, Latin America, and the Middle East, creating new revenue streams.

2. Integration of VR/AR

Immersive experiences through VR/AR can attract more viewers and participants.

3. Corporate Sponsorship and Advertising

Expanding partnerships with non-endemic brands in fashion, automotive, and consumer goods sectors.

4. Collegiate and Amateur Esports

Development of school and college leagues can create future professionals and increase fanbase.

Investment Landscape and ROI Outlook

The Esports market offers high growth potential and attractive ROI due to its rapid adoption, global fanbase, and multi-stream revenue model.

Investment Strengths

• Expanding fanbase across platforms, regions, and age groups

• Diverse revenue streams from sponsorships, media rights, merchandising, and ticket sales

• Emerging opportunities in mobile Esports, VR/AR integration, and collegiate leagues

• Supportive infrastructure and increasing internet penetration worldwide

ROI Outlook

With a CAGR of 20.9% through 2035, investments in tournaments, streaming platforms, team ownership, and gaming technology are expected to yield high returns. Early entry into emerging markets and mobile Esports offers a competitive advantage.

Market Segmentations

By Game Genre

• MOBA (Multiplayer Online Battle Arena)

• FPS (First-Person Shooter)

• Battle Royale

• Sports Simulation

• Fighting and Others

By Platform

• PC

• Console

• Mobile

• Cloud Gaming

By Revenue Source

• Sponsorship and Advertising

• Media Rights

• Merchandising and Ticketing

• Streaming Platforms

• Publisher Fees

By Region

• North America

• Europe

• Asia-Pacific

• Latin America

• Middle East & Africa

👉 To buy this comprehensive market research report, click here to inquire@ https://www.transparencymarketresearch.com/checkout.php?rep_id=54564<ype=S

Why Buy This Report?

✔ Detailed market forecast to 2035

✔ Comprehensive analysis of growth drivers, challenges, and opportunities

✔ Competitive landscape and key player strategies

✔ Segmentation by game genre, platform, revenue source, and region

✔ Insights into emerging trends such as mobile Esports, VR/AR, and collegiate leagues

✔ Strategic recommendations for investors, developers, and brands

FAQs

1. What is the projected Esports market size by 2035?

It is expected to reach US$ 20.8 billion by 2035.

2. What is the CAGR from 2025-2035?

The market is projected to grow at a CAGR of 20.9%.

3. Which region dominates the Esports market?

Asia-Pacific is emerging as the fastest-growing region due to high gamer population and mobile gaming adoption.

4. What are the main revenue sources?

Sponsorships, advertising, media rights, streaming subscriptions, merchandising, and ticket sales.

5. What are key market trends?

Growth in mobile Esports, VR/AR integration, streaming platforms, and collegiate leagues are shaping market trends.

More Trending Research Reports-

• Enterprise Connectivity and Networking Market – https://www.transparencymarketresearch.com/enterprise-connectivity-and-networking-market.html

• A2P SMS Market – https://www.transparencymarketresearch.com/global-a2p-sms-market.html

About Us Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. The firm scrutinizes factors shaping the dynamics of demand in various markets. The insights and perspectives on the markets evaluate opportunities in various segments. The opportunities in the segments based on source, application, demographics, sales channel, and end-use are analysed, which will determine growth in the markets over the next decade.

Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers, made possible by experienced teams of Analysts, Researchers, and Consultants. The proprietary data sources and various tools & techniques we use always reflect the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in all of its business reports.

Contact Us

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Blog: https://tmrblog.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.

Technology

How eSports and Gaming Platforms Are Shaping Interactive Digital Communities

The gaming and eSports industries have grown far beyond simple entertainment. Today, they represent a complex ecosystem where competition, social engagement, and technology intersect. Fans don’t just play—they spectate, strategize, and participate in online communities that feel immersive and dynamic.

Competitive gaming has influenced not only game design but also how digital platforms structure engagement. Leaderboards, progression systems, and interactive features once reserved for video games now appear across entertainment, social, and even educational platforms. This approach keeps users invested and encourages continuous interaction.

Platforms like spacehills.de are perfect examples of this trend. While focusing on gaming and eSports experiences, the platform integrates community-driven features, gamified interactions, and real-time engagement tools that resonate with pop-culture and tech-savvy audiences. Users find themselves drawn into a system that feels familiar yet innovative, combining the thrill of competition with interactive platform design.

The Mechanics Behind Engagement

Gamification remains one of the strongest drivers of user engagement in modern digital spaces. Borrowed from video games, these mechanics transform standard interactions into meaningful experiences. Users enjoy clear goals, rewards for skill or participation, and tangible progress that mirrors in-game achievements.

Core Gamification Elements

- Achievement tracking – recognizing user milestones

- Progression bars and levels – visually representing growth

- Daily or weekly challenges – encouraging consistent engagement

- Reward systems – motivating repeated interactions

By leveraging these mechanics, platforms create a sense of investment and personal growth, even outside traditional gaming contexts.

eSports Influence on Platform Design

The structure and intensity of eSports competitions have heavily influenced digital platform design. Just as tournaments require skill, strategy, and adaptability, interactive platforms aim to provide layered experiences that challenge and reward users in meaningful ways.

Key Design Features Inspired by eSports

- Real-time updates – keeping users informed and engaged

- Interactive dashboards – allowing immediate response and action

- Community integration – fostering connection among players

- Performance metrics – tracking progress and achievements

These elements ensure that users feel involved and motivated, replicating the engagement loop found in competitive gaming.

Social Interaction and Community Building

A defining feature of modern gaming and eSports culture is community. Whether it’s clan systems, guilds, or Discord channels, shared experiences amplify engagement. Digital platforms that integrate social features replicate this environment, creating a sense of belonging and collaboration.

Community-Driven Features

- Forums and chat systems for discussion and collaboration

- Leaderboards to encourage friendly competition

- Collaborative challenges or events

- Transparent systems that reward fair play

Strong communities increase retention and make platforms more attractive to both new and experienced users.

Strategy, Skill, and Decision-Making

Gaming and eSports emphasize strategy and skill, which naturally translate into interactive platforms. Users are drawn to experiences that reward decision-making, resource management, and tactical thinking. This dynamic creates depth and keeps users engaged over time.

Strategic Engagement Elements

- Risk versus reward decisions

- Progression-based challenges

- In-game or in-platform resource management

- Analytical decision-making feedback

By incorporating these elements, platforms encourage thoughtful participation rather than passive consumption.

Technology Driving Immersion

Technological advancements have enabled platforms to support high-performance, real-time interaction similar to competitive gaming environments. Cloud computing, low-latency servers, and responsive design ensure that users experience smooth, immersive engagement.

Tech Features Enhancing User Experience

- Mobile-optimized and responsive interfaces

- Low-latency real-time updates

- Secure user accounts and transactions

- Scalable architecture to handle peak traffic

These features make platforms feel modern, reliable, and aligned with user expectations shaped by gaming and eSports experiences.

Personalized Experiences and Adaptive Systems

Modern platforms increasingly rely on data to provide personalized experiences. By monitoring user behavior, preferences, and engagement patterns, platforms can dynamically adapt content, challenges, and rewards to each individual.

Benefits of Personalization

- Tailored challenges and events

- Customized interfaces and dashboards

- Adaptive difficulty and content progression

- Enhanced user satisfaction and retention

This approach mirrors personalized gameplay experiences in video games, where user choices and performance influence outcomes.

The intersection of eSports, gaming, and digital platform design demonstrates how interactive experiences are evolving. Platforms like spacehills.de illustrate how combining community, gamification, and technological innovation creates compelling environments for users, where engagement, strategy, and social interaction coexist seamlessly.

Do You Want to Know More?

Technology

Superbet Group Becomes Super Technologies, Shaping the Future of Digital Entertainment Ecosystems

Our website uses cookies, as almost all websites do, to help provide you with the best experience we can.

Cookies are small text files that are placed on your computer or mobile phone when you browse websites.

Our cookies help us:

– Make our website work as you’d expect

– Remember your settings during and between visits

– Offer you free services/content (thanks to advertising)

– Improve the speed/security of the site

– Allow you to share pages with social networks like Facebook

– Continuously improve our website for you

– Make our marketing more efficient (ultimately helping us to offer the service we do at the price we do)

We do not use cookies to:

– Collect any personally identifiable information (without your express permission)

– Collect any sensitive information (without your express permission)

– Pass personally identifiable data to third parties

– Pay sales commissions

-

Motorsports3 weeks ago

Motorsports3 weeks agoRedemption Means First Pro Stock World Championship for Dallas Glenn

-

Motorsports3 weeks ago

Motorsports3 weeks agoJo Shimoda Undergoes Back Surgery

-

NIL2 weeks ago

NIL2 weeks agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14

-

Motorsports7 days ago

Motorsports7 days agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoHow this startup (and a KC sports icon) turned young players into card-carrying legends overnight

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoRobert “Bobby” Lewis Hardin, 56

-

NIL3 weeks ago

NIL3 weeks agoIndiana’s rapid ascent and its impact across college football

-

Motorsports3 weeks ago

Motorsports3 weeks agoPohlman admits ‘there might be some spats’ as he pushes to get Kyle Busch winning again

-

Sports2 weeks ago

Wisconsin volleyball sweeps Minnesota with ease in ranked rivalry win

-

Motorsports1 week ago

Motorsports1 week agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum