Technology

SportsVisio Secures $3.2M Additional Funding to Scale AI Sports Solution

Investment fuels expansion across basketball and volleyball markets with funding from Sapphire Sport, Hyperplane, and new partners including Mighty Capital and Sony Innovation Fund BOSTON, June 18, 2025 /PRNewswire/ — SportsVisio, putting the power of advanced AI technology into the hands of every athlete, coach, and fan, today announced $3.2 million incremental funding, bringing its […]

Investment fuels expansion across basketball and volleyball markets with funding from Sapphire Sport, Hyperplane, and new partners including Mighty Capital and Sony Innovation Fund

BOSTON, June 18, 2025 /PRNewswire/ — SportsVisio, putting the power of advanced AI technology into the hands of every athlete, coach, and fan, today announced $3.2 million incremental funding, bringing its total capital raised to $9M. The round includes continued support from existing investors Sapphire Sport, Hyperplane and Sovereign’s Capital, and welcomes Mighty Capital, Sony Innovation Fund, Alumni Ventures, Waterstone Impact Fund and new strategic angels.

The addition of Sony Innovation Fund is of particular importance. With their deep expertise at the intersection of content, entertainment, and emerging technology, Sony Innovation Fund brings a unique perspective that aligns with SportsVisio’s vision to reimagine how sports are captured, analyzed, and shared.

“At Sony Innovation Fund, we invest in technologies with the potential to reshape industries — and SportsVisio is a perfect example of that,” said Austin Noronha, Managing Director, Sony Ventures in the U.S. “Their AI-driven platform delivers professional-grade tools to youth and amateur athletes, transforming how sports moments are captured and shared. We’re excited to back a team that’s expanding access to high-quality sports content and empowering the next generation of athletes.”

“At Mighty Capital, we invest in products that people love — and SportsVisio is a perfect example. They’ve combined cutting-edge AI with an intuitive user experience to create a product that athletes, coaches, and leagues rely on. Their rapid adoption and deep engagement are clear signals of long-term value, and we’re thrilled to partner with them as they transform how sports are experienced and shared,” shared Jennifer Vancini, General Partner at Mighty Capital.

This funding will power sales and marketing growth initiatives, as SportsVisio scales its offerings across basketball and volleyball and new sports like baseball for amateur, youth and professional sports organizations around the world.

“We’re thrilled to have the continued backing of Sapphire Sport and Hyperplane, and to bring on these new partners,” said Jason Syversen, SportsVisio Founder and CEO. “This funding and strategic guidance will help us to expand on our mission to provide smarter, AI-driven solutions that help teams and players win—on and off the court.”

The announcement follows three major product milestones recently achieved: the launch of SportsVisio’s Coach Mode, designed to deliver deeper insights into player performance, team trends, and game flow for the coaching audience; the release of its fully featured volleyball platform, now providing AI-powered stats and automated highlights to one of the fastest-growing sports globally; and the addition of a 3×3 product to enable the fast growing and fast paced format. These innovations reinforce SportsVisio’s commitment to building sport-specific tools that empower coaches and players with actionable data and access to video.

SportsVisio is trusted by more than 150 leagues, clubs, and teams and 16,000 users throughout 16 countries, empowering coaches, athletes, and teams to elevate their game through data-driven decision-making and video highlights and content.

About SportsVisio

SportsVisio is revolutionizing sports analytics through its AI-powered platform that delivers real-time stats, video highlights, and performance insights. The platform supports basketball and volleyball, with plans to expand into additional sports. For more information, find SportsVisio online at www.sportsvisio.com or on social media at facebook.com/SportsVisioAI, instagram.com/sportsvisio/, tiktok.com/@sportsvisio, and linkedin.com/company/sportsvisio.

About Mighty Capital

Mighty Capital is an early-stage venture capital firm that capitalizes on the growing influence of product management in corporate success. Founded by SC Moatti, a former Facebook mobile tech expert, and Jennifer Vancini, a seasoned professional with over 20 years in tech investments and M&A, the firm taps into Moatti’s Products That Count network of over 600,000 product managers and CPOs to gain insights into startups and corporate needs. The real “Why now?” is the AI revolution, which has reshaped corporate power structures, accelerating the shift towards digital products and services, thereby elevating the role of product managers. As a result, Fortune 1000 companies with CPOs have increased 10x in 3 years and are outperforming their peers. Mighty Capital’s focus on this product management revolution has led to high returns and minimized risk. Notable investments include Amplitude, Groq, and Canela. Founders and institutional investors praise the firm for its exceptional value, rapid execution, and ability to spot trends early. Learn more at Mighty.Capital.

About Sony Ventures Corporation

Sony Ventures Corporation manages the Sony Innovation Fund (SIF), which invests in all stages of emerging technology companies, as well as in startups solving global environmental challenges. SIF engages with pioneering startups to help fuel the development of disruptive technologies, launch new businesses, and contribute to the environment while seeking return on investment. Sony Ventures Corporation is headquartered in Japan. Learn more at www.sonyinnovationfund.com.

About Waterstone Impact Fund

WaterStone Impact Fund is a venture capital fund dedicated to accelerating world-class companies that fuel and amplify faith, hope, and love. Targeting companies that utilize AI and robotics, the WaterStone Impact Fund seeks to support ventures that align with its mission of integrating faith-based values with technological innovation. The majority of the fund’s carried interest is directed to the Tim Tebow Foundation, supporting initiatives against human trafficking, child exploitation, orphan care, profound medical needs, and special needs ministry in over 100 countries worldwide. Learn more at waterstoneimpactfund.com.

About Alumni Ventures

Alumni Ventures is America’s largest venture capital firm for individual investors. The firm has raised over $1.4 billion from a community of more than 11,000 accredited investors and built a diversified portfolio of 1,600+ current and historical companies across sectors and stages. Alumni Ventures offers individuals unique access to professionally managed venture capital and backs innovative founders building the future. Learn more at www.av.vc.

SOURCE SportsVisio

Technology

Japan Video Game Market Size, Share Report Forecast 2035

Japan Video Game Market Overview As per MRFR analysis, the Japan Video Game Market Size was estimated at 6.48 (USD Billion) in 2023. The Japan Video Game Market Industry is expected to grow from 6.76(USD Billion) in 2024 to 11.42 (USD Billion) by 2035. The Japan Video Game Market CAGR (growth rate) is expected to […]

Japan Video Game Market Overview

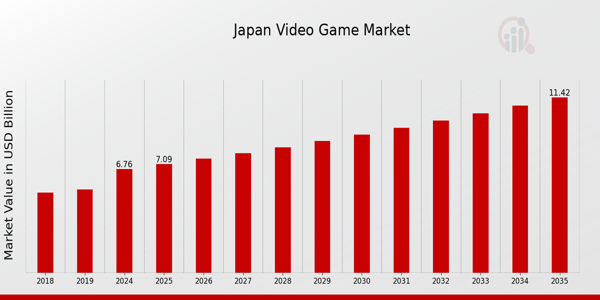

As per MRFR analysis, the Japan Video Game Market Size was estimated at 6.48 (USD Billion) in 2023. The Japan Video Game Market Industry is expected to grow from 6.76(USD Billion) in 2024 to 11.42 (USD Billion) by 2035. The Japan Video Game Market CAGR (growth rate) is expected to be around 4.882% during the forecast period (2025 – 2035).

Key Japan Video Game Market Trends Highlighted

The distinctive cultural landscape and technological advancements of Japan in the video game market are driving significant trends. The increasing popularity of mobile gaming is a significant market driver, predominantly due to the widespread use of smartphones and tablets among the population. The proliferation of app-based games is a result of the preference of many Japanese consumers for the convenience of playing games on the go. Furthermore, the adoption of eSports is generating interest and investment in competitive gaming, thereby attracting the attention of younger audiences and facilitating the establishment of professional gaming leagues in Japan.

The continued integration of augmented reality (AR) and virtual reality (VR) technologies presents opportunities to create immersive gaming experiences that resonate with consumers. Local developers are investigating these technologies to improve storytelling and engagement, thereby appealing to the technologically sophisticated population. The adaptation of renowned anime and manga franchises into gaming formats is another emerging opportunity that reflects Japan’s rich heritage in these artistic fields and caters to a passionate fanbase.

In recent years, there has been a noticeable trend toward inclusive gaming experiences and more diverse content. The demand for games that depict a diverse array of cultures and characters is increasing as societal perspectives evolve, thereby broadening the allure to a broader range of demographics.

Furthermore, the increasing prevalence of digital distribution has revolutionized the manner in which games are sold and accessed, thereby facilitating the discovery and playability of a broader selection of titles. Collectively, these trends demonstrate a dynamic and changing landscape for the Japanese video game market, which is influenced by technological innovation and cultural relevance.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Japan Video Game Market Drivers

Increasing Mobile Gaming Penetration

The Japan Video Game Market is experiencing significant growth due to the increasing penetration of mobile gaming. In recent years, mobile gaming has comprised over 50% of the overall gaming revenue in Japan, showing a substantial shift in consumer preferences. According to the Mobile Marketing Association Japan, there were approximately 70 million mobile gamers in Japan as of the latest report, indicating that nearly 55% of the population engages in mobile gaming.

The widespread use of smartphones and tablets has made gaming more accessible than ever, leading to a burgeoning market for mobile game developers. Companies like Nintendo and Bandai Namco have capitalized on this trend by developing user-friendly mobile games that appeal to a broader audience. This consistent growth underscores the potential for the Japan Video Game Market to expand even further, driven by mobile applications, microtransactions, and in-game purchases.

Expanding Esports Ecosystem

The expanding esports ecosystem significantly drives the Japan Video Game Market. Major tournaments and competitions have seen a steady increase in participation and viewership. For instance, the Japan Esports Union has reported that the audience for esports events has surged to over 7 million viewers in Japan, indicating a promising growth trajectory.

The rise of local esports teams and sponsorships from various brands has bolstered this sector, attracting additional investment and attention.Major game developers like Riot Games and Capcom have been actively involved in promoting tournaments, further fueling interest among gamers and audiences alike.

Growth of Virtual Reality Innovations

Another vital driver for the Japan Video Game Market Industry is the growth of Virtual Reality (VR) innovations. The adoption of VR technology in gaming is rapidly increasing, with projections suggesting that the VR gaming segment in Japan could reach over USD 600 million by 2025, according to data from the Ministry of Internal Affairs and Communications.

Companies like Sony Interactive Entertainment are pioneering advancements in VR gaming, developing hardware such as the PlayStation VR that has gained considerable traction among gamers.The immersive experience offered by VR is compelling more players to invest in this technology, contributing to market expansion.

Rise of Digital Distribution Platforms

The rise of digital distribution platforms is revolutionizing the Japan Video Game Market by changing how consumers purchase and access games. Platforms like Nintendo eShop and PlayStation Store have reported significant growth in digital sales, reflecting a move away from physical copies.

The Interactive Entertainment Association of Japan reported an increase in digital game sales to approximately 72% of total game sales in the last fiscal year.This shift is encouraged by the convenience of online purchasing and the availability of a wide range of titles, making it easier for players to access new games. The impact of established companies in the digital sales arena drives continuous growth in the market, demonstrating the shift towards seamless gaming experiences.

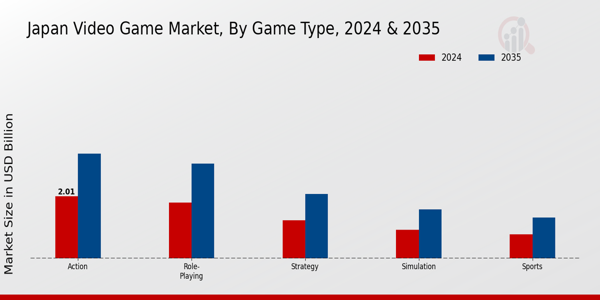

Video Game Market Game Type Insights

The Japan Video Game Market has shown a remarkable diversity in its game type segmentation, with various categories playing critical roles in driving the overall industry forward. The demand for immersive experiences has led to an increase in popularity for action-based games, which captivate players with dynamic narratives and adrenaline-pumping gameplay. Role-playing games have similarly gained traction, allowing players to engage in rich storylines and character development, fostering a strong sense of community among gamers in Japan. This segment significantly contributes to player experiences, encouraging engagement through online multiplayer options that enhance social interactions and competition.

Furthermore, strategy games have carved out a substantial niche within this market, appealing to gamers who enjoy critical thinking and tactical gameplay. The growth of mobile gaming has particularly bolstered the strategy segment, facilitating access for a wider audience. Simulation games are also significant in Japan, providing players with opportunities to experience real-life scenarios and activities in a virtual environment, which has proven popular among various demographics. Games simulating aspects of life, city-building, and even historical events invite players to explore complex systems while enjoying interactive gameplay.

Sports games dominate a considerable portion of the demographic, allowing fans to engage with their favorite sports and teams through an interactive platform, bringing an entirely new level to their sports experiences. This category not only reflects the passion for sports in Japan but also bridges the gap between reality and gaming, making it a vital part of the nation’s cultural identity. The compelling narratives and exhilarating gameplay in these game types are vital in fueling the Japan Video Game Market, as they continuously evolve to meet the changing preferences of Japanese consumers.

The increasing investment in Research and Development within these themes highlights a constant pursuit to innovate, ensuring that these segments remain relevant in an ever-competitive landscape. Collectively, these game types not only generate significant revenue but also contribute to the vibrant and dynamic ecosystem of the Japan Video Game Market. As the industry evolves, keeping an eye on emerging trends and player preferences in these segments will be crucial for stakeholders aiming to harness growth opportunities and drive further innovation across the gaming landscape in Japan.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Video Game Market Platform Insights

The Platform segment of the Japan Video Game Market is a critical component driving the industry’s evolution, showcasing a diverse array of gaming experiences. With a strong emphasis on innovation and user engagement, the market encompasses various platforms such as PC, Console, Mobile, Web, and Virtual Reality. The Console segment often represents a significant share of the market, fuelled by exclusive titles and immersive gaming experiences that enhance consumer loyalty.

Meanwhile, Mobile gaming continues to gain traction, leveraging Japan’s advanced smartphone penetration and the popularity of casual games, making it a dominant force in the market landscape.PC gaming remains vital, attracting a dedicated community of players through competitive esports and richly designed titles. Furthermore, Web-based gaming is evolving due to the increasing popularity of browser games, while Virtual Reality is gradually establishing its presence, captivating gamers with unique immersive experiences. Collectively, the Platform segment reflects the diverse preferences and habits of gamers in Japan, influenced by cultural trends and advancements in technology, contributing significantly to the overall growth and dynamism of the Japan Video Game Market.

Video Game Market Distribution Channel Insights

The Distribution Channel segment within the Japan Video Game Market reveals significant dynamics and trends shaping the industry. Digital Download has gained substantial traction among gamers due to the convenience and immediacy it offers, enabling players to access their favorite titles instantly without the need for physical storage. In contrast, Physical Retail remains vital, providing tangible products that appeal to collectors and those who value the experience of in-store shopping. The rise of Subscription Services has also changed the landscape, allowing gamers to access a wide array of games for a fixed price, which fosters exploration and engagement with a diverse catalogue that might otherwise be overlooked.

Meanwhile, Online Streaming is emerging as a dominant force, leveraging cloud-based technology to deliver high-quality gaming experiences without the need for powerful hardware, thereby democratizing access to gaming. Together, these channels contribute to the evolving structure of the Japan Video Game Market, each playing a unique role in catering to varying consumer preferences and behaviors, indicative of the broader trends in digital consumption and retail adaptation in Japan. This complex interplay creates opportunities and challenges, as industry players must continually innovate to meet the shifting demands of a highly competitive market.

Video Game Market Target Audience Insights

The Target Audience within the Japan Video Game Market showcases a diverse classification that reflects the varying preferences and behaviors of gamers. Casual Gamers form a significant portion of this market, engaging with games mainly for relaxation and entertainment, and their broad appeal drives many game developers to create user-friendly titles. Core Gamers represent a more committed group that seeks immersive experiences, often investing time in more complex gameplay and narratives.

Hardcore Gamers, on the other hand, demonstrate an intense passion and competitiveness, frequently participating in community events and discussions, which contributes to a thriving gaming culture.Additionally, Esports Enthusiasts are rapidly gaining traction, drawn by high-stakes tournaments and the opportunity to engage in competitive play, which has led to the growth of a dedicated fan base. With Japan being a hub for gaming innovation and technology, the importance of these segments in shaping market trends and driving revenue is undeniable, as they collectively contribute to the evolving landscape of the gaming industry, emphasizing community, competition, and creativity.

Japan Video Game Market Key Players and Competitive Insights

The Japan Video Game Market is one of the most dynamic and influential markets in the gaming industry, characterized by a strong blend of traditional gaming experiences and innovative digital content. The competition in this space is fierce, with numerous players vying for consumer attention through unique offerings ranging from console and handheld games to mobile applications. The richness of content creation, coupled with a deep cultural understanding of local gaming preferences, sets Japan apart from other regions. Companies operating within this landscape must navigate a complicated ecosystem of consumer expectations, technological advancements, and regulatory frameworks, all while leveraging their unique strengths to maintain a competitive edge.

The growth of online gaming and eSports has further complicated this situation, driving companies to explore new avenues and strategies to capture market share.Atlus has carved out a notable niche within the Japan Video Game Market through its focus on role-playing games (RPGs) and unique storytelling, which resonate deeply with Japanese consumers. Known for its strong character development and engaging narratives, Atlus boasts a loyal following that eagerly anticipates each new release. The company has effectively utilized its rich legacy to maintain a robust market presence, often incorporating unique game mechanics and innovative designs that set its titles apart from competitors. Atlus has also harnessed collaborations and licensing agreements, enhancing its product offerings and allowing for cross-promotional opportunities that benefit its reputation and visibility in the highly competitive landscape.

Their ability to engage fans through character-driven marketing and community involvement significantly contributes to their enduring success in Japan’s gaming scene.DeNA stands as a formidable player in the Japan Video Game Market, particularly recognized for its contributions to mobile gaming and social networking services. The company’s portfolio includes key products such as mobile titles and partnerships with prominent franchises, which have bolstered its status in the industry. DeNA’s strength lies in its ability to innovate within the mobile gaming space, utilizing technology to create engaging, user-friendly experiences that appeal to a wide demographic of players. The Company’s strategic mergers and acquisitions have expanded its market reach, and collaborations with other studios have allowed for continuity of popular franchises, while also fostering the creation of new titles tailored specifically for Japanese audiences.

DeNA’s commitment to leveraging data analytics and user feedback to refine its gaming experiences further positions it favorably against competitors, ensuring its products resonate with consumers in Japan. Additionally, the focus on community-building through social features has differentiated DeNA’s offerings, establishing strong connections with users and enhancing player retention.

Key Companies in the Japan Video Game Market Include:

- Atlus

- DeNA

- Koei Tecmo

- Square Enix

- Level5

- Nintendo

- Filter

- Yokai Watch

- Konami

- Gree

- Sony

- Bandai Namco

- Sega Sammy

- Capcom

- Marvelous

Japan Video Game Market Industry Developments

Recent developments in the Japan Video Game Market include a significant uptick in demand for both mobile and console games. In particular, Sony has reported growth due to the launch of new titles and consoles, showing resilience in market valuation despite global economic challenges. Meanwhile, Nintendo continues to thrive with popular franchises, notably influencing the market landscape.

Atlus, under Sega Sammy, has emphasized its focus on developing role-playing games, which have been well-received. Level5’s Yokai Watch franchise has also seen a resurgence, contributing to the growth in the youth segment of the market. Additionally, there are ongoing expansion efforts by DeNA and Gree in mobile gaming, enhancing user engagement through innovative technology.

Noteworthy is the acquisition of a subsidiary by Bandai Namco in September 2023, indicating an active consolidation trend within the industry. Overall, major players like Capcom and Koei Tecmo are investing heavily in Research and Development to advance gaming experiences. At the same time, the overall market has demonstrated a strong recovery trajectory since the pandemic’s initial impact in 2020.

Japan Video Game Market Segmentation Insights

Video Game Market Game Type Outlook

- Action

- Role-Playing

- Strategy

- Simulation

- Sports

Video Game Market Platform Outlook

- PC

- Console

- Mobile

- Web

- Virtual Reality

Video Game Market Distribution Channel Outlook

- Digital Download

- Physical Retail

- Subscription Services

- Online Streaming

Video Game Market Target Audience Outlook

- Casual Gamers

- Core Gamers

- Hardcore Gamers

- Esports Enthusiasts

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2023 | 6.48(USD Billion) |

| MARKET SIZE 2024 | 6.76(USD Billion) |

| MARKET SIZE 2035 | 11.42(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 4.882% (2025 – 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 – 2035 |

| HISTORICAL DATA | 2019 – 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Atlus, DeNA, Koei Tecmo, Square Enix, Level5, Nintendo, Filter, Yokai Watch, Konami, Gree, Sony, Bandai Namco, Sega Sammy, Capcom, Marvelous |

| SEGMENTS COVERED | Game Type, Platform, Distribution Channel, Target Audience |

| KEY MARKET OPPORTUNITIES | Mobile gaming growth potential, VR integration in gaming, Esports expansion and investment, Localization of global titles, Cloud gaming adoption increase |

| KEY MARKET DYNAMICS | Mobile gaming dominance, Strong youth engagement, Robust eSports ecosystem, High consumer spending, Innovative game technology |

| COUNTRIES COVERED | Japan |

Frequently Asked Questions (FAQ):

The Japan Video Game Market is expected to be valued at 6.76 billion USD in 2024.

By 2035, the Japan Video Game Market is projected to reach a value of 11.42 billion USD.

The expected CAGR for the Japan Video Game Market from 2025 to 2035 is 4.882%.

The Action game segment of the Japan Video Game Market is valued at 2.01 billion USD in 2024.

The Role-Playing game segment is expected to reach a value of 3.06 billion USD by 2035.

The Strategy game segment is valued at 1.24 billion USD in the Japan Video Game Market for the year 2024.

Key players in the market include Nintendo, Sony, Square Enix, Bandai Namco, and Capcom.

The Simulation game segment of the Japan Video Game Market is valued at 0.93 billion USD in 2024.

The Sports game segment is expected to grow from 0.78 billion USD in 2024 to 1.32 billion USD by 2035.

The market faces challenges such as evolving consumer preferences and increasing competition from mobile gaming.

Technology

Stock Analysis | Dayforce Outlook

Market Snapshot – Mixed Signals, Cautious Outlook Dayforce (DAY) is in a tricky spot, with weak technical signals and a 16.09% price drop recently. Our internal diagnostic score for technical conditions is 4.25, indicating a volatile and unclear direction. Analysts remain neutral, and while earnings could spark a rebound, bearish patterns dominate the recent chart. […]

Market Snapshot – Mixed Signals, Cautious Outlook

Dayforce (DAY) is in a tricky spot, with weak technical signals and a 16.09% price drop recently. Our internal diagnostic score for technical conditions is 4.25, indicating a volatile and unclear direction. Analysts remain neutral, and while earnings could spark a rebound, bearish patterns dominate the recent chart. Investors should proceed with caution.

News Highlights – Legal, Sports, and Tech News Abound

Dayforce isn’t the only story in the headlines. Here are some notable news items that could impact the broader market:

- May 30, 2025: A class-action lawsuit was filed against the UFC by non-UFC MMA fighters. While not directly related to Dayforce, such antitrust news can create a cautious atmosphere for tech and SaaS stocks.

- May 30, 2025: Major League Baseball announced a strategic investment in a new professional softball league. This is a sign of growing interest in professional sports — potentially a positive for tech companies serving the sports sector.

- May 28, 2025: Biolage announced Pamela Anderson as its new face. While seemingly unrelated, consumer branding moves can boost investor sentiment in growth sectors like SaaS and digital services.

Analyst Views & Fundamentals – Neutral Sentiment, Mixed Financial Signals

Currently, Barclays is the only active analyst covering Dayforce, issuing a Neutral rating on August 7, 2025. The simple average rating score is 3.00, while the weighted rating is 3.30, showing a slight tilt toward caution. The ratings are consistent, but they don’t align with the recent 16.09% price drop, which suggests some disconnect between expectations and performance.

Here are the key fundamentals and their internal diagnostic scores (0-10):

- Shareholders’ equity / Total liabilities (%): 46.60% – Score: 1.00 (poor)

- Total operating revenue (YoY %): 10.73% – Score: 1.00 (poor)

- Operating cycle: 50.97 days – Score: 1.00 (poor)

- Equity multiplier: 3.15 – Score: 3.00 (average)

- Equity ratio (Total liabilities / Equity %): 2.15% – Score: 3.00 (average)

- Current assets turnover ratio: 0.17% – Score: 1.00 (poor)

- Operating revenue (YoY %): 10.73% – Score: 1.00 (poor)

- Total assets turnover ratio: 0.11% – Score: 1.00 (poor)

- Current assets / Total assets (%): 62.52% – Score: 3.00 (average)

- Cash-Market Value ratio: 0.11 – Score: 2.00 (low)

The fundamental picture is mixed — with weak liquidity and operating efficiency scores, but some stability in equity ratios.

Money-Flow Trends – Bearish Across Most Sectors

The fund-flow score for Dayforce is 7.87, which is considered “good” in our scoring system. However, the actual flow trends tell a different story:

- Small money inflow ratio: 49.98% – negative trend

- Medium inflow: 48.72% – negative trend

- Large inflow: 47.62% – negative trend

- Extra-large inflow: 51.08% – positive trend

- Block inflow ratio: 49.63% – negative trend

Despite the high fund-flow score, big money (block and extra-large investors) are mixed — with extra-large investors showing a positive tilt. However, the overall trend is negative, indicating that most big players are not confident in the short-term outlook.

Key Technical Signals – Bearish Patterns, One Bullish Event

Our internal diagnostic scores (0-10) for key technical indicators over the last 5 days are as follows:

- Long Lower Shadow: 6.36 – Bullish bias, appeared on August 6.

- WR Oversold: 2.48 – Neutral bias, seen on August 4, 5, 8.

- Bearish Engulfing: 1.74 – Biased bearish, appeared on August 7.

- Earnings Release Date: 7.60 – Strong bullish, appeared on August 6.

- RSI Oversold: 3.05 – Neutral bias, seen on August 5, 7, 8.

Key insights from the technical analysis include:

- Bearish indicators outnumber bullish ones (3 vs. 1)

- The RSI and Williams %R are both in oversold territory, but their low internal diagnostic scores suggest weak conviction in a rebound.

- The Earnings Release on August 6 was a strong bullish signal, but it hasn’t yet reversed the bearish trend.

Overall, the chart is mixed but leans bearish — with no clear momentum and volatile conditions.

Conclusion – Proceed with Caution, Watch for Earnings

Dayforce (DAY) is in a volatility trap right now, with mixed signals across technicals, fundamentals, and money flows. While the earnings release on August 6 offered some hope (internal diagnostic score of 7.60), the bearish indicators remain dominant. Investors should wait for a clearer trend before committing to long-term positions.

Actionable takeaway: Consider waiting for a pullback or a strong positive signal from the next earnings report before making any large moves. In the meantime, keep an eye on August 7 and 8 for potential breakout opportunities as the bearish engulfing and oversold indicators continue to play out.

Technology

Cactus Gaming announces Thiago Garrides as new CFO (Chief Financial Officer)

With more than 20 years of experience holding leadership positions at institutions such as Inter, Stellantis, ArcelorMittal, and Mercantil do Brasil, Thiago joins the team with the mission of driving the company’s strategic transformation, strengthening financial performance with a focus on revenue diversification, supporting global expansion starting in Latin America, and structuring the finance department […]

With more than 20 years of experience holding leadership positions at institutions such as Inter, Stellantis, ArcelorMittal, and Mercantil do Brasil, Thiago joins the team with the mission of driving the company’s strategic transformation, strengthening financial performance with a focus on revenue diversification, supporting global expansion starting in Latin America, and structuring the finance department to operate in new regulated markets.

Garrides commented: “Taking on the role of CFO at Cactus is a great opportunity to contribute to the company’s growth and financial strength. I bring 20 years of corporate experience focused on finance and management, where I had the opportunity to build a distinguished track record across various sectors, delivering significant results.”

“My mission is to drive the company’s strategic transformation, strengthen financial performance with a focus on revenue diversification, support global expansion starting in Latin America, and structure the finance department for operations in new regulated markets, building a globally scalable organization while preserving Cactus’s innovative and entrepreneurial DNA,” he adds.

Cactus Gaming, along with the founder of Grupo Cactus, Nickolas Ribeiro, recognizes the importance of bringing in renowned professionals to strengthen the company. “Thiago’s arrival marks an important step forward in our executive structure. We are in a period of consolidation and international expansion, and having a CFO with his experience and strategic vision reinforces our commitment to solid, responsible management aligned with the challenges of the iGaming sector,” he highlighted.

Responsible and sustainable iGaming ecosystem

The new CFO believes that in iGaming, technology within a responsible and sustainable ecosystem must go beyond simply offering games and platforms — it must balance innovation, compliance, security, user experience, and social responsibility.

Garrides stated: “With the significant growth of our operations, we reinforce our commitment to building a safe and conscious environment, investing in awareness for the responsible use of our platforms.”

Cactus is a strategic partner for operators, offering the highest global standards of security, transparency, and innovation, within a complete ecosystem of products and services for the market, with the trust that comes from being certified by international standards.

“The combination of creating high-performance financial models and the ability to navigate complex regulatory environments ensures my contribution to solid growth, full compliance, and a focus on sustainable results,” he concluded.

Cactus Gaming

Cactus Gaming is a Brazilian technology company specializing in the development of innovative solutions for the sports betting and online gaming market, offering a complete ecosystem of services for operators seeking high-performance technological solutions with high conversion rates.

A certified company operating in full regulatory compliance, reinforcing its reliability and security for operators and users, it has established itself as a powerhouse in the sector with a background of over 25 years of experience in the digital market. It has achieved market leadership by combining advanced technology, security, 24/7 support, and local expertise.

Awarded as Best Platform of the Year for two consecutive years, winning the Best White Label award at the SiGMA Awards 2024 and Best Platform at the BiS Awards 2024 and 2025, it is also competing for the C-Level Executive of the Year award with its CBO, Tiago Silva.

Present at the main global events of the sector such as ICE, SiGMA Americas, SBC Summit, SiGMA Europe, iGB, among others, and in the midst of international expansion, Cactus Gaming reinforces its leadership by expanding its presence in Latin America and other markets.

Source: GMB

Technology

Wicket goes to college — and sees plenty of opportunities

Periodically, SBJ Tech will feature a content series called Leadership Look-In, where C-suiters in sports tech offer thoughts on their companies, experiences and personnel management. Want to be considered for a future installment? Email me at ejoyce@sportsbusinessjournal.com. Jordy Leiser has accepted that Alex Rodriguez’s picture will always pop up with any Jump coverage. It’s a […]

Technology

Esportes Gaming Brasil boosts senior management to sustain expansion, governance and innovation

Among the new hires is Hugo Baungartner, Director of Institutional Relations and Strategic Partnerships. With nearly three decades in gaming and technology, including experience at Yolo and RTC, Baungartner will manage relations with the Secretariat of Prizes and Bets (SPA), Federal Revenue, Central Bank, and COAF, overseeing federal authorization processes and evaluating mergers and acquisitions […]

Among the new hires is Hugo Baungartner, Director of Institutional Relations and Strategic Partnerships. With nearly three decades in gaming and technology, including experience at Yolo and RTC, Baungartner will manage relations with the Secretariat of Prizes and Bets (SPA), Federal Revenue, Central Bank, and COAF, overseeing federal authorization processes and evaluating mergers and acquisitions to accelerate the group’s entry into new regulated niches.

The Compliance department gains strength with Ana Carolina Luna Maçães, a lawyer specializing in corporate governance, financial crime prevention, and data protection. With experience in digital entertainment and NSX Brasil, she will enhance responsible gaming policies, including the implementation and improvement of self-exclusion systems, risk pattern monitoring, and educational campaigns for players.

In the organic growth pillar, Rita Cunha, the new Growth Director, leads the expansion of the group’s brands focusing on user experience and data intelligence. With a track record in e-commerce and financial services at companies like Buscapé and PicPay, she will enhance customer engagement and optimize acquisition costs through predictive analytics and ongoing media investment management, always guided by customer lifecycle insights.

Heading the Customer Service area, Maria Neves Rocha has elevated the group’s support excellence with a human-centric model — a key principle of Esportes Gaming Brasil. Since joining, she has implemented processes that significantly reduced wait times and increased first-contact resolution rates. With experience as a director in leading CX BPOs, she brings solid team management and operational optimization expertise, aiming to ensure faster, more efficient, and satisfying customer journeys in iGaming.

Customer service, people, and legal drive expansion

Sophia Serak, leading the People Directorate, manages strategic initiatives for internal development and strengthening organizational culture. In 2025, the company hired over 130 new employees, bringing the total direct workforce to more than 400. She previously gained experience at major companies like Stone and BRF.

In the Legal Directorate, Gabriel Oliveira manages all legal matters for the group, playing a key role in aligning operations with the new sector regulations. With extensive experience in risk prevention, complex contracts, and regulatory monitoring, Oliveira has led negotiations and legal analyses that ensured the company’s compliance with Law 14.790/2023, providing stability and legal security for growth.

For Darwin Filho, CEO of Esportes Gaming Brasil, the new executive composition marks a turning point in the company’s history. “We are facing a structural redesign of the sector, driven by regulation and higher compliance and competitiveness standards. We have built an executive board with regulatory expertise, analytical skills, and operational excellence — essential competencies to sustain scalable, safe growth aligned with global iGaming best practices. This setup positions us to operate with technical rigor, anticipate market trends, and lead with consistency and institutional responsibility,” he says.

Marcela Campos, Vice President of Esportes Gaming Brasil, emphasizes the importance of diverse experiences in top leadership: “Bringing together leaders with strategic vision, technical knowledge, and customer insight strengthens our competitive position and reaffirms our commitment to sustainable growth, always with integrity and excellence in every delivery.”

Esportes Gaming Brasil

Esportes Gaming Brasil is one of the country’s leading betting groups, with a 100% national operation and official licensing granted by the Ministry of Finance via SPA/MF. The license covers its two brands, Esportes da Sorte and OnaBet, operating throughout Brazil.

A reference in innovation and a supporter of market regulation, the group prioritizes responsible gaming and continuous investment in user well-being and control technologies, while also generating hundreds of jobs.

Esportes da Sorte goes beyond betting, supporting sports and cultural projects like the Corinthians, Ceará, Ferroviária, and Náutico clubs, as well as major initiatives such as Galo da Madrugada, Recife and Olinda Carnival, and the Parintins Festival.

OnaBet expands the group’s digital reach with creative campaigns and influencer partnerships, strengthening connections with audiences on online platforms.

Source: GMB

Technology

Goodell, Triple H Address ESPN

The Portland Trail Blazers are being sold to a group led by Carolina Hurricanes owner Tom Dundon, the Hurricanes confirmed in a statement to Front Office Sports. “We can confirm Tom Dundon is in the process of buying the Portland Trail Blazers and is excited about the opportunity,” a Hurricanes spokesperson said. ESPN’s report that […]

The Portland Trail Blazers are being sold to a group led by Carolina Hurricanes owner Tom Dundon, the Hurricanes confirmed in a statement to Front Office Sports.

“We can confirm Tom Dundon is in the process of buying the Portland Trail Blazers and is excited about the opportunity,” a Hurricanes spokesperson said.

ESPN’s report that the team was sold at a valuation north of $4 billion is accurate, according to a source familiar with the matter.

The news of the deal was first reported by Sportico.

That valuation is higher than the most recent Forbes estimate of $3.5 billion for the Blazers, though it is a far cry from the records recently set by rival organizations. NBA team valuations have skyrocketed lately, as evidenced by the Lakers sale at a $10 billion valuation and the Celtics sale at a $6.1 billion valuation.

The buying group—which also includes Marc Zahr, co-president of asset manager Blue Owl Capital, and Portland-based Sheel Tyle, co-CEO of venture capital firm Collective Global—intends to keep the team in Portland, the source confirms.

In July, NBA commissioner Adam Silver said at a press conference, “It is our preference that that team remains in Portland,” and noted the team “likely needs a new arena, so that will be part of the challenge for any new ownership group coming in.”

The Blazers have played in the Moda Center since 1995. It was supposed to be upgraded ahead of hosting the 2030 women’s Final Four, but those plans are reportedly on hold until the team is sold.

The estate of Paul G. Allen put the Blazers up for sale in May, hiring Allen & Company and law firm Hogan Lovells as financial and legal advisers, respectively.

The sale of the Blazers is in line with the wishes of the late Microsoft cofounder Paul Allen, who bought the Blazers for $70 million in 1988 and died in 2018. Since then, Jody Allen has served as her late brother’s executor and trustee of his estate. She has been the chair of both the Blazers and NFL’s Seahawks during that span.

The Seahawks and Allen’s 25% stake in the Seattle Sounders MLS club—the other pro teams Paul Allen requested be posthumously sold—were not put up for sale. Representatives for the NBA and Allen & Co. declined to comment. A representative for the Blazers did not immediately respond to a request for comment.

Dundon is a major player in U.S. pro sports. In addition to the Hurricanes—which in 2018 he bought a majority stake in before taking over the team in its entirety in 2021—he leads investment firms Dundon Capital Partners and Southpaw Capital Partners. He also has a number of other major sports holdings, including a significant investment in Topgolf Callaway Brands and is among the owners of Major League Pickleball.

He was also a backer of the short-lived Alliance of American Football and has become embroiled in controversy over the league’s bankruptcy. There have been two lawsuits filed in the wake of the AAF bankruptcy, one of which was against Dundon. It alleges he fraudulently bought the league in February 2019 from the founder with a pledge to invest $250 million that he had no intention of spending. Instead, the trustee alleges in court filings, Dundon wanted a tax credit to offset gains elsewhere in his portfolio and bought the league to kill it.

Dundon in turn has sued Charlie Ebersol, the AAF cofounder and son of legendary NBC executive Dick Ebersol. The AAF needed a cash infusion in February 2019 when Fowler abruptly pulled out, and Dundon claims Ebersol fraudulently induced him to buy the floundering league and the AAF was a financial basket case.

Those suits are still ongoing.

-

Technology2 weeks ago

Technology2 weeks agoAlly Runs New Game Plan in WNBA All-Star Rookie Debut

-

Health2 weeks ago

Health2 weeks agoThe Women Driving A New Era In U.S. Ski & Snowboard

-

High School Sports3 weeks ago

High School Sports3 weeks ago100 days to men's college basketball

-

NIL2 weeks ago

NIL2 weeks agoESPN Announces 'dont wait run fast' by mgk as New College Football Anthem for 2025

-

College Sports3 weeks ago

College Sports3 weeks agoCity rows to sporting destination goal on boats of new complexes & old strengths

-

Sports3 weeks ago

Sports3 weeks agoNtekpere honored as Second Team Academic All-American | APG State News

-

Rec Sports1 week ago

Rec Sports1 week agoSwimming & Diving Comments on the Rules – 2025-26

-

Health3 weeks ago

Health3 weeks agoTrump administration investigates Oregon's transgender athlete policies

-

Technology1 week ago

Technology1 week agoAmid Sports Chaos, ‘Known’ Data and Outcomes Help Agency Win

-

Sports3 weeks ago

Sports3 weeks agoMore State Schools of the Year

(via @arenasporttv/TT)

(via @arenasporttv/TT)