JAS Motorsport Tensei

JAS Motorsport

At present, automakers have 75 electric vehicle models for sale in the U.S. Through the first nine months of last year, electric vehicle sales slowed in the U.S., but they are still growing.

The Austin, Texas, company sold 495,570 vehicles from October through December, boosting deliveries to 1.79 million for the full year. That was 1.1% below 2023 sales of 1.81 million as overall demand for electric vehicles in the U.S. and elsewhere slowed.

The fourth-quarter deliveries fell thousands short of Wall Street expectations. Analysts polled by data provider FactSet expected sales of 498,000 vehicles.

Fourth-quarter production of 459,445 vehicles was below total deliveries for the quarter, and full-year production of 1.77 million was less than the year’s sales.

Daniel Ives, a financial analyst at Wedbush, said he thinks the stock should be valued more because of its promise of creating fully self-driving, autonomous vehicles and AI technology, and it is still worth buying despite the sales drop.

Aside from the Cybertruck, which has had limited appeal, Tesla’s newest consumer model is the Y small SUV which first went on sale in 2020.

The fourth-quarter boost came with a cost. Analysts polled by FactSet expected Tesla’s average sales price to fall to just over ,000 in the quarter, the lowest in at least four years.

The year-over-year global sales drop is Tesla’s first since 2011, according to figures from analytics firm Global Data. The company sold 1,306 vehicles in 2010, but that dropped slightly to 1,129 the following year.

DETROIT (AP) — Tesla posted its first annual sales drop in more than a dozen years Thursday, sinking a stock that has soared since Donald Trump’s victory on optimism Elon Musk’s close relationship to the president-elect will help the company.

Also, Musk’s support of Trump for U.S. president also could be turning off some buyers who may be more environmentally conscious and lean toward Democrats, Schuster said. A broader, less costly lineup would appeal to a larger group of buyers, he said. “I suppose the choices that he’s made on the political front don’t line up with a good portion of his buyers’ profile,” Schuster said.

“We have never viewed Tesla simply as a car company…instead we have always viewed Musk and Tesla as a leading disruptive technology global player,” wrote Ives. “And the first part of this grand strategic vision has taken shape.”

“At that point you’re comparable to some Hondas and Fords and GMs,” Goldstein said. “It takes you out of the luxury market to the more affordable vehicle market.”

Musk donated more than 0 million to Trump’s campaign and is a regular guest at Trump’s Mar-a-Lago resort in Florida. Tesla investors have pushed the stock up more than 50% since the election on hopes the new administration will streamline electric vehicle regulations and address other Musk policy priorities.

Competition from legacy and startup automakers is also growing as they try to nibble away at the company’s market share.

Falling sales early in the year led to once-unheard of discounts for the automaker, cutting into its industry leading profit margins.

The fourth-quarter sales, while a record for Tesla, show that the company’s aging model lineup is reaching saturation in the entry level luxury vehicle market, said Morningstar Analyst Seth Goldstein.

Industry experts say that Tesla used to be the only automaker with credible electric vehicles, but now others such as China’s BYD now have more to offer.

Jeff Schuster, vice president of automotive research Global Data, said Tesla faces intense competition worldwide from EV makers in China, the U.S., and elsewhere, many of which are selling EVs to more mainstream buyers. “If they want to continue to see the growth they had, they need to expand to other sizes and price points,” he said.

Tesla’s global vehicle sales rose 2.3% in the final quarter thanks to 0% financing, free charging, and low-priced leases. But that was not enough for billionaire Musk’s most valuable holding to overcome a sluggish start to 2024.

To meet Tesla management’s guidance of 20% to 30% annual sales growth this year, the company will need to come out with a vehicle priced in the mid ,000s to appeal to more mainstream buyers who might be considering gas, electric or hybrid vehicles, Goldstein said.

In 2022, Tesla predicted that its sales would grow 50% most years, but the prediction ran into an aging model lineup and increased competition in China, Europe, and the U.S. In the U.S., analysts say most early adopters of technology already own electric vehicles, and more mainstream buyers have concerns about range, price, and the ability to find charging stations on longer trips.

Tesla’s global electric vehicle sales edged out Chinese rival BYD, which announced Thursday that total soared 41% last year including 1.77 million EVs. The company is vying with Tesla for the world’s top selling EV maker.

Nearly all of Tesla’s sales last quarter came from the smaller and less-expensive Models 3 and Y, with the company selling only 23,640 of its more expensive models that include X and S, as well as the new Cybertruck.

Through September, new EV sales rose 7.2% to about 936,000 in the U.S., according to Motorintelligence.com. That’s slower growth than the 47% increase in 2023. But EV sales this year still are likely to surpass last year’s record of 1.19 million. Most other automakers will report full-year sales on Friday.

Tesla has floated the possibility of a new version of the Model Y that would cost in the mid ,000s that may be smaller inside than the current Y with fewer features, Goldstein said.

That doesn’t bode well for Tesla’s fourth-quarter earnings on Jan. 29 and Tesla’s stock fell more than 7% Thursday.

CHARLOTTE — NASCAR teams went to the sanctioning body in early 2022 asking for an improved revenue model and argued the system at the time was unsustainable, the president of the series testified Thursday in the antitrust case lodged against the top motorsports series in the United States.

Steve O’Donnell, named president of NASCAR earlier this year, was at that March meeting when representatives of four teams asked that the negotiating window on a new charter agreement open early because they were fighting for their financial survival. The negotiating window was not supposed to open until July 2023.

O’Donnell testified that in that first meeting, four-time series champion Jeff Gordon, now vice chair of Hendrick Motorsports, asked specifically if the Florida-based France family was “open to a new model?”

Ben Kennedy, the great-grandson of NASCAR founder Bill France Sr., told Gordon yes.

But O’Donnell testified that NASCAR chairman Jim France was opposed to a new revenue model.

Thus began more than two years of bitter negotiations on a new charter agreement that was finalized in September 2024. The teams had asked in that first meeting for a deal to be reached by July 2022.

When the final deal was presented to the teams on the eve of the 2024 playoff opener, they were given a six-hour deadline to sign the charter agreements. All but two of 15 organizations signed; Front Row Motorsports and Michael Jordan-owned 23XI Racing refused to sign and instead sued, bringing the case to federal court for what is expected to be a two-week trial.

O’Donnell testified that the team representatives had very specific requests: maximized television revenue, the creation of a more competitive landscape, a new cost model and a potential cost cap.

NASCAR spent the next few months in internal discussions on how to approach the charter renewal process, said O’Donnell, who was called as an adverse witness for the plaintiffs. NASCAR acknowledged the teams were financially struggling, and worried they might create a breakaway series similar to the LIV golf league.

In a presentation made to the board, O’Donnell listed various options that both the teams and NASCAR could take. O’Donnell noted the teams could boycott races, build their cars internally, and race at non-NASCAR owned tracks, or potentially sell their charters to Liberty Media, the commercial rights holder for Formula 1.

“We knew the industry was challenged,” O’Donnell testified.

As far as NASCAR’s options, O’Donnell told the board it could lock down an exclusivity agreement with tracks not owned by NASCAR, dissolve the charter system, or partner directly with the drivers.

A charter is the equivalent of the franchise model used by other sports leagues, but in NASCAR it guarantees a team a spot in the field for all 38 races plus a designated percentage of revenue. The extensions that began this year upped the guaranteed money for every chartered car to $12.5 million in annual revenue, from $9 million.

Denny Hamlin, co-owner of 23XI, and Front Row owner Bob Jenkins have both testified it costs $20 million to bring a single car to the track for all 38 races. That figure does not include any overhead, operating costs or a driver’s salary.

Jenkins opened the fourth day of the trial with continued testimony. On Wednesday the fast-food franchiser said he was a passionate NASCAR fan who fulfilled a longtime dream when he was finally able to own a car in the top racing series in the United States.

But he said he has lost $100 million since becoming a team owner in the early 2000s — and that’s even with a 2021 victory in the Daytona 500. He said Thursday he “held his nose” when he signed the 2016 charter agreements because he didn’t think the deal was very good for the teams.

When the extensions came in 2024 the weekend the playoffs opened at Atlanta Motor Speedway, he said the 112-page document went “virtually backward in so many ways.” He refused to sign and joined 23XI in filing a lawsuit.

Jenkins said no owners he has spoken to are happy about the new charter agreement because it falls short of so many of their asks. He refused to sign because “I’d reached my tipping point.”

Jenkins said he was upset that Jim France refused a meeting the week before the final 2025 offers were presented with four owners who represented nine charters, only to learn France was talking to other team owners.

“Our voice was not being heard,” said Jenkins, who believes NASCAR rammed the 2025 agreement through. “They did put a gun to our head and got a domino effect — teams that said they’d never sign saw their neighbor sign.”

Jenkins also said teams are upset about the current Next Gen car, which was introduced in 2022 as a cost-saving measure. The car was supposed to cost $205,000 but parts must be purchased from specified NASCAR vendors and teams cannot make any repairs themselves so the actual cost is now closer to double the price.

“To add $150,000 to $200,000 to the cost of the car — I don’t think any of the teams anticipated that,” Jenkins testified. “What’s anti-competitive is I don’t own that car. I can’t use that car anywhere else.”

©2025 Cox Media Group

Nitro Motorsports is proud to announce that Gian Buffomante will return to the team’s Trans Am Series Presented by Pirelli CUBE 3 Architecture TA2 Series program for the 2026 season. Building on his strong rookie-year momentum and setting his sights firmly on the championship fight, Buffomante will aim for race wins and podium results in his quest to lead Nitro Motorsports to the championship title in the upcoming 2026 season.

Buffomante delivered an impressive 2025 rookie campaign, quickly establishing himself as a consistent frontrunner within one of North America’s most competitive road racing programs. Throughout the year, he earned multiple top-five finishes, several podium-contending runs, and showcased development in both qualifying pace and race craft. His ability to adapt to the demanding and heavy TA2 platform earned him recognition throughout the paddock as one of the drivers to watch in the future.

Returning for 2026, Buffomante is focused on elevating his performance even further as he now enters the season with a full year of experience and a stronger understanding of the TA2 car, the competition, and the tracks.

“I’m really excited to be back with Nitro Motorsports for the 2026 TA2 season and make a run at the title,” explained Gian Buffomante. “Last year was all about learning—new car, new tracks, new team, and new challenges—and I feel like I grew a ton throughout the season. Now, with that experience behind me, the goal is clear, and I want to fight for wins and be in the hunt for the championship. Nitro Motorsports has given me everything I need to take that next step, and I’m ready to go after it.”

Nitro Motorsports Co-Owner Nick Tucker believes Buffomante’s progression in 2025 is just the beginning of what he’s capable of achieving.

“Gian impressed us from the moment he stepped into a TA2 car,” added Tucker. “Obviously, there is always the rookie learning curve that involves some bumps and bruises, but his speed, composure, and ability to learn quickly made his rookie season a strong one. With the experience he gained in 2025 and the work he’s already putting into 2026, we fully expect him to be at the front of the field and fighting to put the Nitro Motorsports brand on the top step of the podium. Gian is hungry, focused, and ready—and we’re excited to support him in making a championship run.”

Buffomante will join a deep and competitive Nitro Motorsports lineup for 2026, with preseason testing already underway and preparations accelerating toward the season opener.

For more information on Nitro Motorsports, please contact Nick Tucker via email HERE or visit them online at www.RaceNitro.com.

JAS Motorsport is taking it upon itself to bring back one of the greatest sports cars in Japanese automotive history.

After months of teases, the Italian racing team has finally unveiled its Acura NSX restomod. Dubbed the Tensei—which means “rebirth” in Japanese—the vehicle will feature a body designed by Pininfarina and what is promised to be a competition-derived powertrain.

If you’re wondering why a racing team is building a restomod, it’s because JAS and Honda, Acura’s parent company, have a long history together. Although JAS, which was founded in 1995, initially worked with Alfa Romeo, it has been an official Honda partner since 1998. It also has direct experience with the NSX—which was sold as a Honda model outside of the U.S.—having developed the GT3 racer for the car’s second generation.

JAS Motorsport Tensei

JAS Motorsport

That know-how has helped inspire one of the more intriguing restomods we’ve seen this year. And a lot of that is due to how it looks, since the car wears a carbon-fiber body designed by Pinifarina. The legendary studio didn’t try to reimagine the NSX, which debuted all the way back in 1990, for today; it simply refined it. The low-slung coupe still features pop-up headlights and an integrated rear wing, but its lines are smoother and its aerodynamic elements are larger. If the long-rumored third-generation NSX looks anything like this restomod, we imagine there will be a lot of happy enthusiasts out there.

We may know what the Tensei will look like, but we’re still waiting on some vital information. Mainly, what will power the restomod? JAS’s reveal was light on details, other than to say that the vehicle will feature “cutting-edge technology and advanced mechanics” informed by the team’s experience in motorsports. In October, shortly after the first teaser images of the car began circulating, Road & Track and Motor1.com reported that it would come with a naturally aspirated V-6 mated to a six-speed manual. The car will also be available with either a left- or right-hand-drive configuration.

JAS Motorsport

We’ll also have to see how much JAS’s NSX restomod will cost, as no price has been announced for the Tensei as of press time. A price tag in the high six figures doesn’t seem out of the question, especially since first-generation NSXs can command up to $1 million at auction these days.

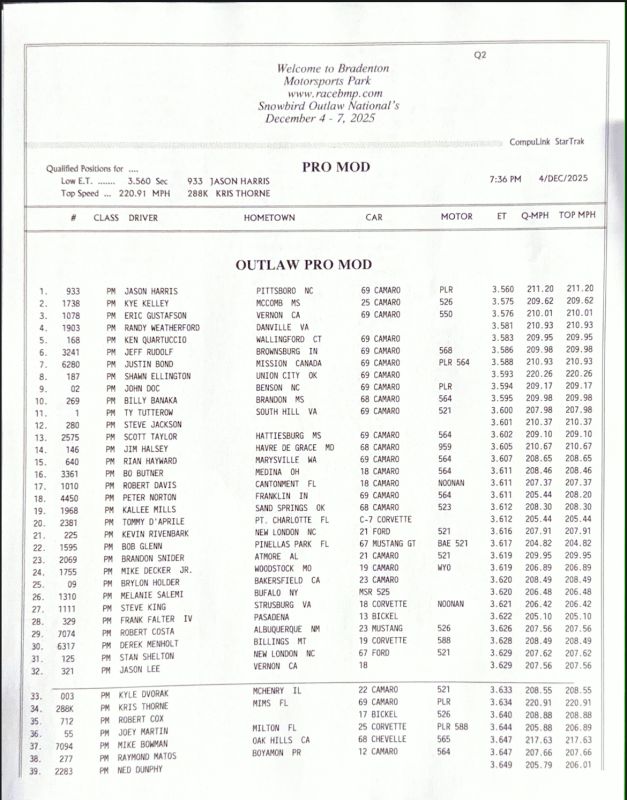

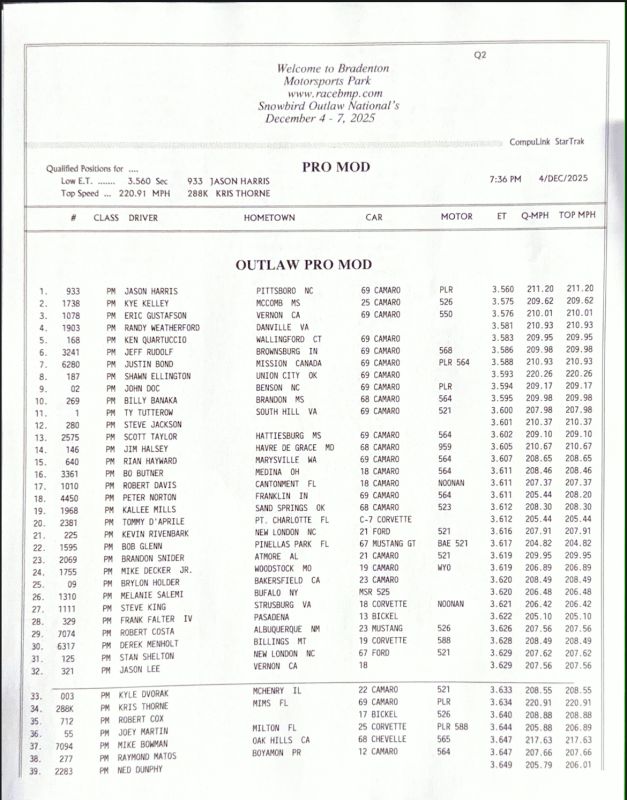

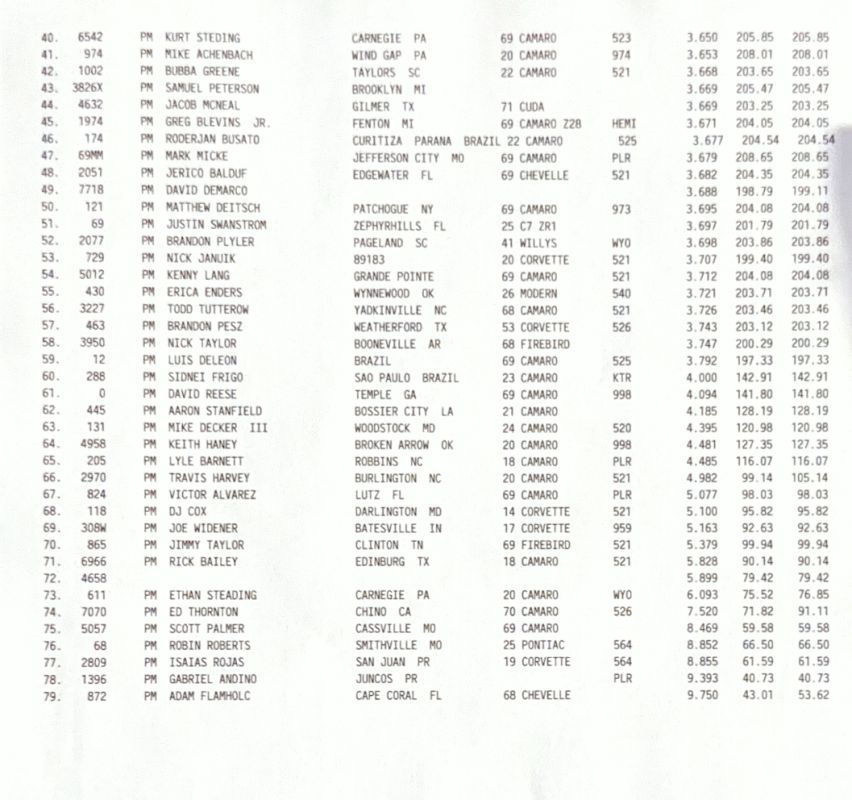

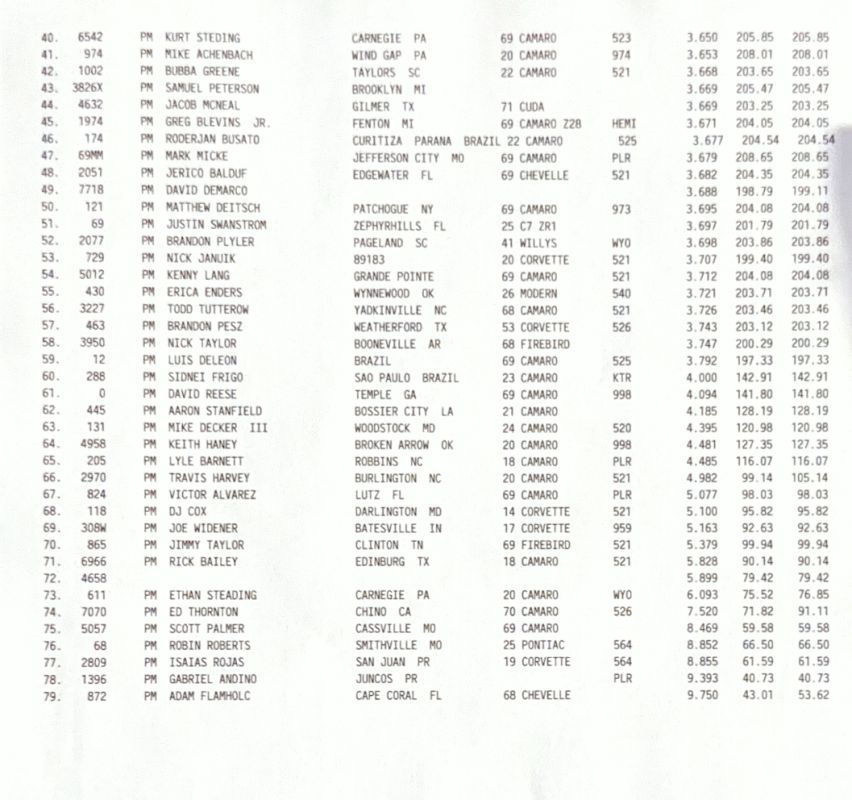

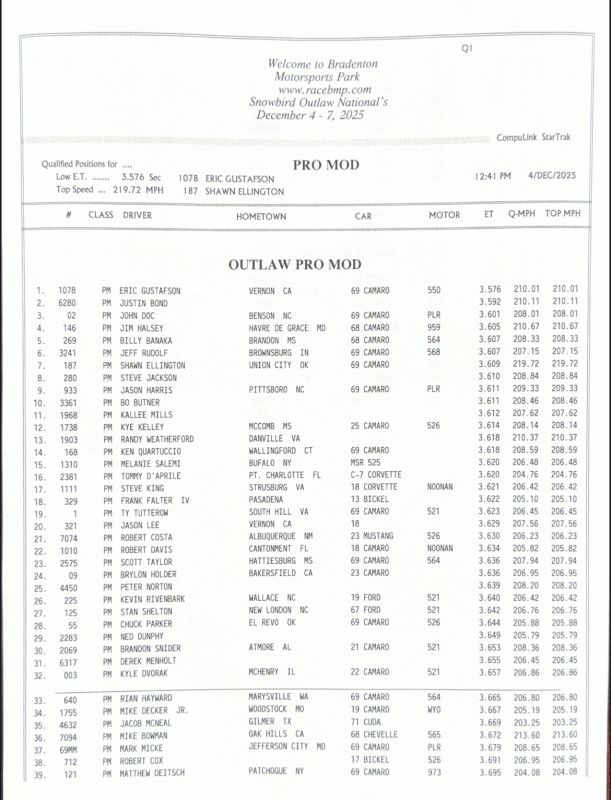

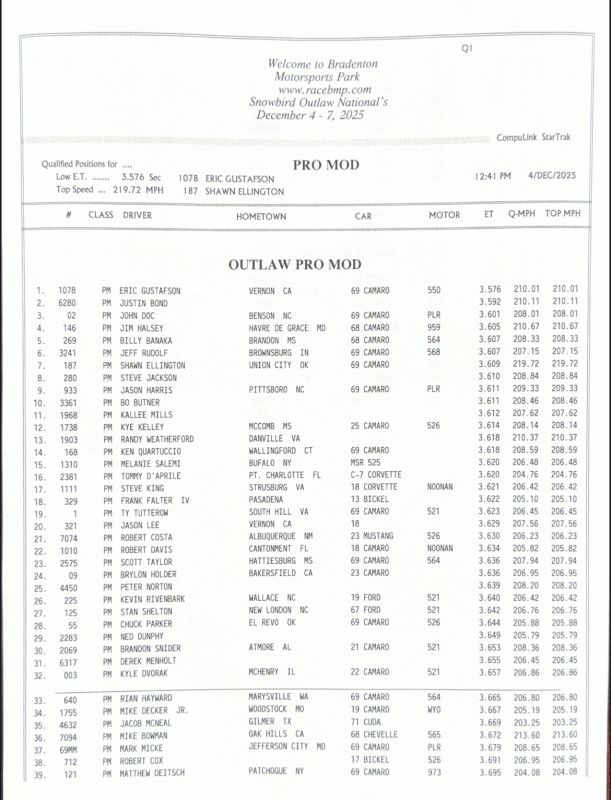

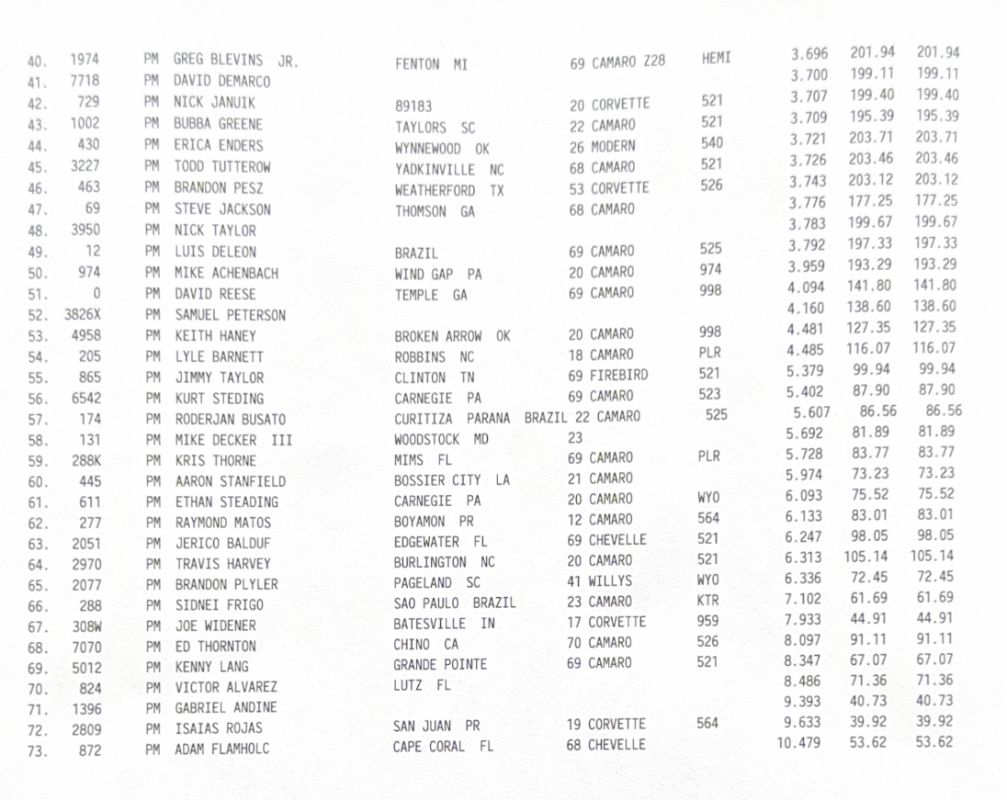

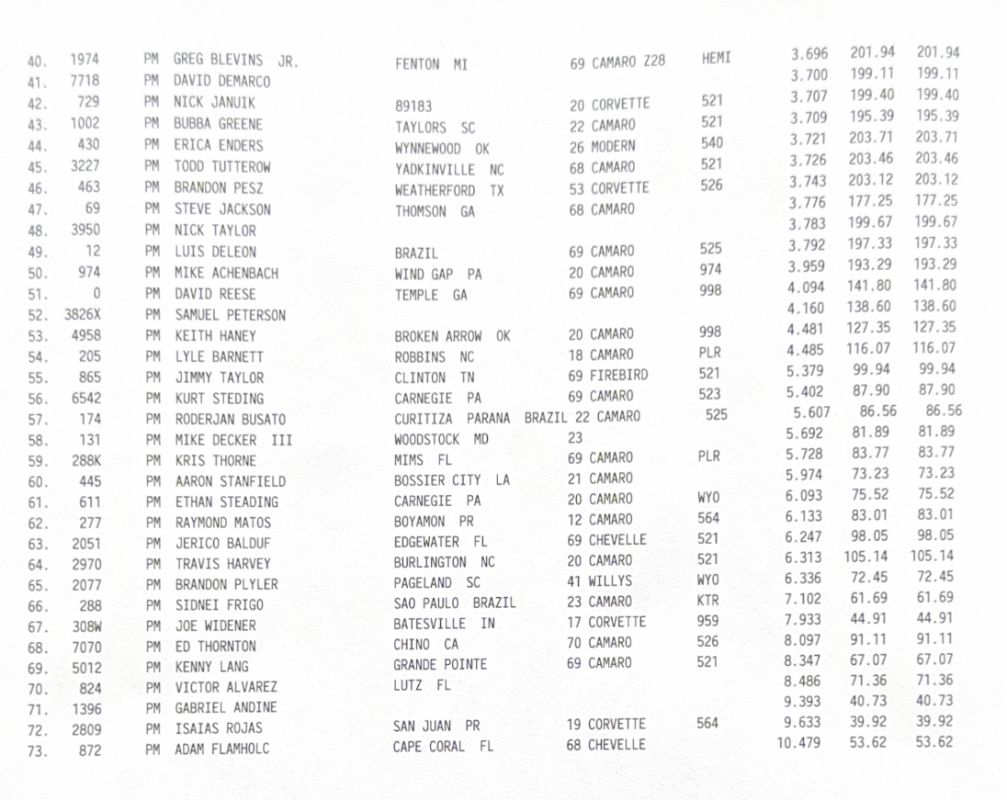

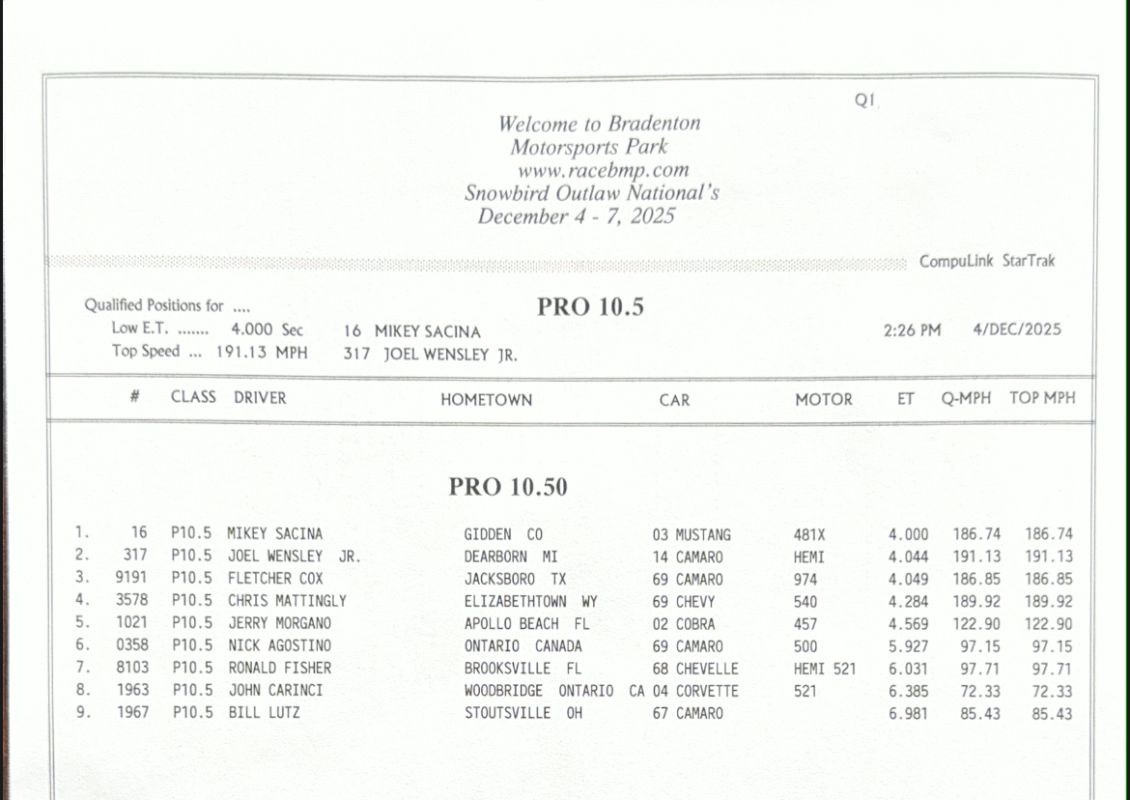

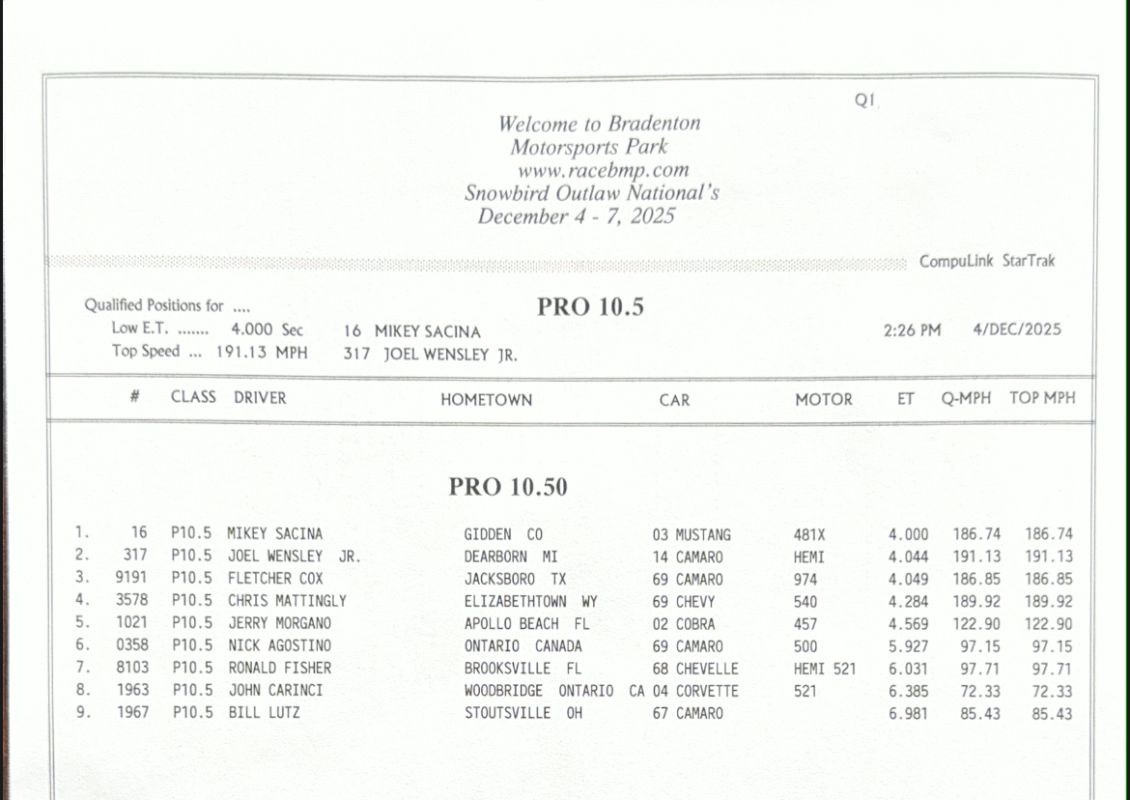

The 2025 Snowbird Outlaw Nationals presented by Motion Raceworks at Bradenton Motorsports Park is officially underway with Thursday qualifying. Due to rain in the Sunday forecast, race officials moved up the event schedule. The plan is now to complete qualifying on Thursday and Friday before going into eliminations Saturday and crowning winners on Saturday night.

The historic event serves as the opening race of the second annual Drag Illustrated Winter Series presented by J&A Service, a three-race Pro Mod series paying out more than $275,000 to race winners and the series champion. The event also includes Pro 10.5, True 10.5 N/T, Lil Gangstas, Limited Drag Radial, Ultra Street and more.

Tune in to the official event livestream on FloRacing here: https://flosports.link/46edcdu

Find additional class qualifying results on the Bradenton Motorsports Park Facebook page here.

pro mod q1

pro mod q1

This story was originally published on December 4, 2025.

The antitrust lawsuit trial between NASCAR and 23XI Racing/Front Row Motorsports is bringing out emotional testimonies and mind-bending numbers every day. The courtroom drama has been intense, and fans are eager to see what the outcome will be. After all, it will have a bearing on the future of the sport.

Ken Schrader, however, doesn’t see anything good on the horizon. The former superstar gave his take on the matter in a video on Kenny Wallace’s YouTube channel. Wallace mentioned how all the other team owners must be looking at 23XI Racing as a champion.

In response, Schrader hit everyone with a strong dose of the reality that would be inevitable if 23XI Racing won in the end. He pointed out how several team owners were trying to convince 23XI Racing to settle with NASCAR before the trial.

Once the trial began, they’re now hoping for the team to emerge victorious. “If they do win, what’s it going to do? Began Schrader.

“At what cost? What’s it going to do to our sport? What’s it going to do to the attendance? How many fans are we going to piss off? How many sponsors are we going to piss off?” He continued.

“‘Hey, we’re not involved in this thing as a sponsor. We’re not involved in this deal to be in the middle of something like this. We’ll sponsor something else.’ You know, nothing really good can come from it,” added Schrader, whose point shed light outcome that many have been conveniently ignoring thus far.

The next course of action, should 23XI Racing prevail, is something NASCAR’s elite has to plan for.

Judge Kenneth D. Bell has warned teams multiple times during these proceedings that going to trial could have severe consequences. NASCAR might even be ordered to sell all its race tracks if it fails to end up winning the case.

What this means is that a new order of things will have to be implemented. The charter system could be dismantled, the promotion and the teams could suffer major financial damages, and the France family might have to sell parts of its property.

As Schrader pointed out, this isn’t what the TV partners or the sponsors signed up for. They might be forced to cut their losses and take their business elsewhere.

CHARLOTTE, N.C. (AP) — Front Row Motorsports owner Bob Jenkins has testified in an antitrust case against NASCAR, accusing it of monopolistic practices. Jenkins, a passionate NASCAR fan, claims he’s lost $100 million since becoming a team owner. He joined 23XI Racing, owned by Michael Jordan and Denny Hamlin, in a lawsuit against NASCAR. They argue the charter agreements are unfair. Jenkins says NASCAR’s final offer was insulting and forced owners to sign without negotiation. NASCAR contends it has done nothing wrong and claims the charter system has created significant value. The trial could reshape NASCAR’s framework.

Michael Jordan arrives in the Western District of North Carolina on Monday Dec 1, 2025 for the start of the antitrust trial between 23XI Racing and Front Row Motorsports against NASCAR, in Charlotte, N.C. (AP Photo/Jenna Fryer)

CHARLOTTE, N.C. (AP) — Front Row Motorsports owner Bob Jenkins was back on the stand Thursday to testify on the fourth day of the explosive antitrust case that accuses NASCAR of being a monopolistic bully in violation of federal antitrust laws.

Jenkins began his testimony Wednesday, and the fast-food franchiser said he was a passionate NASCAR fan who fulfilled a longtime dream when he was finally able to own a car in the top racing series in the United States.

But he said he has lost $100 million since becoming a team owner in the early 2000s — and that’s even with a 2021 victory in the Daytona 500. His love of the sport and belief that it can be profitable have kept him going but says a no-win revenue model led Front Row to join 23XI Racing in a federal lawsuit against NASCAR.

23XI is owned by Basketball Hall of Famer Michael Jordan and three-time Daytona 500 winner Denny Hamlin. Jordan has the funding to fight NASCAR, and Jenkins joined the battle when he became offended by NASCAR’s “take-it-or-leave-it” offer on charter agreements.

A charter is the equivalent of the franchise model used by other sports leagues, but in NASCAR it guarantees a team a spot in the field for all 38 races plus a designated percentage of revenue. Front Row was one of the teams that received two charters for free when NASCAR created the system in 2016 and Jenkins thought the agreements were lousy then — but a step in the right direction.

All 15 Sprint Cup organizations fought for more than two years for better terms on the charter extensions that began this year. But when NASCAR’s final offer was presented at 6 p.m. on a Friday last year with six hours to sign the 112-page document, Jenkins balked because it went “virtually backward in so many ways.”

“It was insulting, it went so far backward,” he testified Wednesday. “NASCAR wanted to run the governance with an iron fist; it was like taxation without representation. NASCAR has the right to do whatever it wants.”

He said he was “honestly very hurt” by the sequence of events and believed NASCAR “knew we had to blindly sign it. Some of these owners have $500-$600 million facilities, long-term sponsors. They couldn’t walk away from that.”

Jenkins testified that Joe Gibbs personally apologized to Jenkins for signing the deal, and most owners reluctantly signed the agreement.

“Not a single owner said, ‘I was happy to sign it.’ Not a single one,” he testified. “100% of the owners think the charter system is good. The charter agreement is not.”

Front Row and 23XI were the only two organizations out of 15 that refused to sign and instead went to court in a trial that could completely rework NASCAR’s framework.

The extensions ended more than two years of bitter negotiations in which neither NASCAR or the teams budged.

NASCAR executive vice president in charge of strategy Scott Prime testified Wednesday that a study he worked on as a consultant found the longevity of the sport was in danger if NASCAR didn’t act to improve the health of their race teams.

Prime said NASCAR became concerned about the threat of a breakaway stock car series during 2024 charter negotiations.

Jeffrey Kessler, attorney for the teams, told the jury Monday that over a three-year period almost $400 million was paid to the France Family Trust and a 2023 evaluation by Goldman Sachs found NASCAR to be worth $5 billion. The pretrial discovery process revealed NASCAR made more than $100 million in 2024.

NASCAR contends it is doing nothing wrong and has not restrained trade or commerce by its teams. The series says the original charters were given for free to teams when the system was created in 2016 and the demand for them created a market of $1.5 billion in equity for chartered organizations.

The new charter agreement upped the guaranteed money for every chartered car to $12.5 million in annual revenue, from $9 million. But Hamlin and Jenkins have both testified it costs $20 million to bring a single car to the track for all 38 races and that figure does not include any overhead, operating costs or a driver’s salary.

Both testified they don’t have the ability to slash costs and teams are too reliant on outside sponsorship to survive.

“It’s offensive to say I’ve overspent. We have a model that works for us,” Jenkins testified. “I have never turned a profit. And it’s not from malpractice. The level we compete at is just so expensive.”

Prime testified as much and noted in his consulting role he discovered in 2014 that teams lost a combined $85 million, or an average of $1.3 million a car. He also learned that under the system before charters, when cars had to qualify for a race based on speed, a team would lose $700,000 if it failed to make the field.

The trial is expected to last two weeks with Jordan, Rick Hendrick and Roger Penske still set to testify. Jordan has been in court each day and is occasionally demonstrative, either laughing at funny remarks or shaking his head at testimony he disagrees with.

NASCAR is owned and operated by the France family, which founded the series in 1948.

___

AP auto racing: https://apnews.com/hub/auto-racing

For local news, click here.

First Tee Winter Registration is open

Fargo girl, 13, dies after collapsing during school basketball game – Grand Forks Herald

Volleyball Recaps – November 18

CPG Brands Like Allegra Are Betting on F1 for the First Time

F1 Las Vegas: Verstappen win, Norris and Piastri DQ tighten 2025 title fight

Two Pro Volleyball Leagues Serve Up Plans for Minnesota Teams

Utah State Announces 2025-26 Indoor Track & Field Schedule

Texas volleyball vs Kentucky game score: Live SEC tournament updates

Sycamores unveil 2026 track and field schedule

Bowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14