Chevrolet revealed its revised NASCAR Cup Series bodywork in November, shortly after Kyle Larson secured his second Cup championship at Phoenix. The updated body draws inspiration from a performance accessories package developed for the street-going version of the car. On track, the Camaro race body will now carry a taller hood dome, a reshaped front grille, and reworked rocker panels.

Chevrolet explained that those elements mirror the Carbon Performance Package Accessories Kit, which features carbon-fiber components on the hood and rockers, along with a new grille and front splitter. The changes have already sparked renewed belief inside the walls of Hendrick Motorsports.

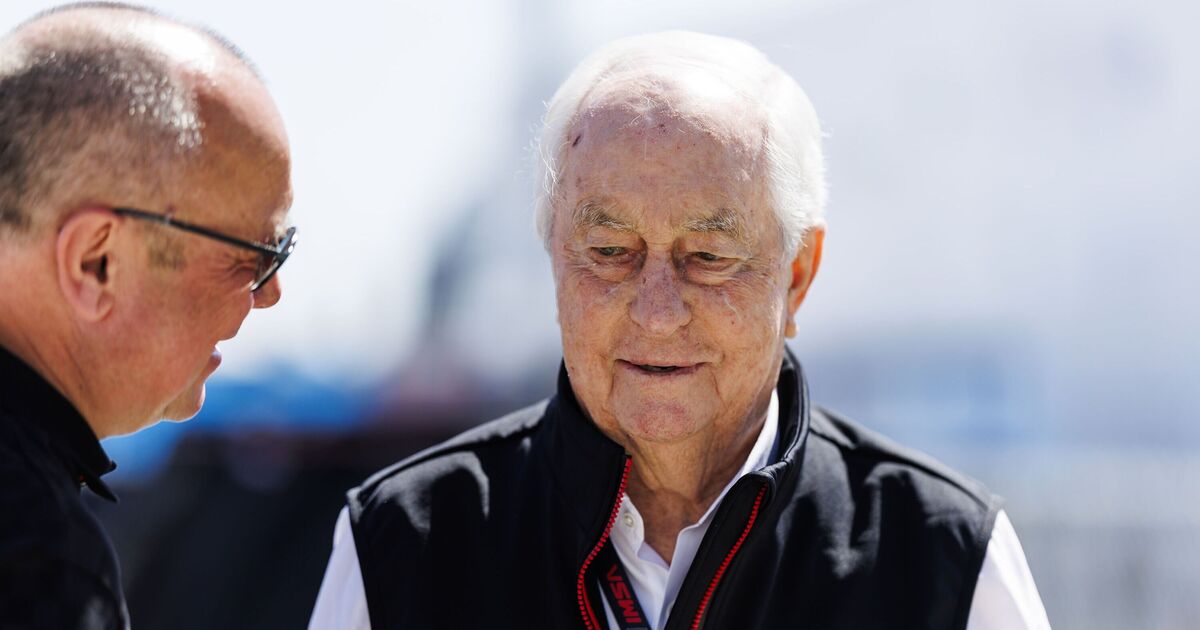

According to Jeff Gordon, the updated Chevrolet Camaro ZL1 could prove transformative when it makes its competitive debut at the season-opening Cook Out Clash exhibition at Bowman Gray Stadium. The new body underwent on-track testing in November, and the early indicators seemingly left the organization encouraged.

“When you’ve done what we’ve done with our car and our teams and one of those things is winning a lot of races and winning a championship, I get really excited when I think we’ve got something that’s an upgrade. I don’t want to get too caught up in that because sometimes, it takes time to fine-tune that change.”

Gordon acknowledged that HMS had been trailing some rivals in aerodynamic efficiency, particularly when comparing HMS Chevrolet entries to competitors. With the revised body now in hand, he believes the gap has closed. “I feel like we’ve gotten ourselves on a level playing field with them, so I’m very excited about that,” he said.

Though the visual changes appear restrained, their purpose runs deeper because the engineers designed the refinements to enhance stability and trim drag, a combination that could sharpen performance as Chevrolet aims to extend its run of five consecutive manufacturer championships. Improved airflow management should translate into greater downforce and a steadier balance at speed.

Chevrolet first introduced the Camaro ZL1 to NASCAR competition in 2018, replacing the outgoing Chevy SS. The body evolved into the Camaro ZL1 1LE in 2020, before transitioning to a Next Gen version when the platform arrived in the Cup Series two years later. On the consumer side, Chevrolet closed the chapter on the passenger-car Camaro after the 2024 model year.

Dale Jr. is skeptical about the new Chevy model

While many teams welcome the update, Dale Earnhardt Jr. finds himself split between anticipation and caution. The JR Motorsports co-owner, who plans another Daytona 500 entry in 2026, admitted the announcement unsettled him. His unease does not stem from budget or preparation but from the uncertainty that accompanies a brand-new body.

From a financial perspective, Junior views the timing as favorable, offering a chance to compete without bleeding resources. Still, the unknowns are haunting. He noted that when manufacturers roll out a new body, early returns at Daytona rarely come easily. Teams must first learn how that shape behaves in race trim, and without inside knowledge of the finer details, he said he will have to take the results as they come.

History also supports his concern. Fresh body designs often force teams into an early-season learning curve, deciphering aerodynamic traits under pressure. The task extends beyond power or mechanical grip, demanding balance where airflow and stability intersect. Manufacturers also tend to prioritize intermediate tracks when refining new bodies, a reality that explains Junior’s apprehension heading into superspeedway competition.