NIL

UConn Players React to Qadence Samuels Landing With NC State After Transfer

On April 11 (just five days after the UConn Huskies won the 2025 national title), Qadence Samuels, who spent the first two seasons of her college career in Connecticut, announced that she would be entering the NCAA transfer portal.

In an Instagram post announcing this decision, Samuels wrote, “To my teammates, thank you for always being there for me and for pushing me to become a better player. The incredible moments we’ve both shared on and off the court have truly been unforgettable. You are all the best sisterhood I ever could have asked for. To my coaches thank you for pushing me to be my very best, not just as a player but as a person.

“With that said, I have decided to enter the transfer portal and look forward to the next chapter of my journey,” she added.

However, given some of Samuels’ social media activity and it taking her a longer time than many other players to decide on a new school, there was some speculation that she could be returning to UConn after all.

But it’s now clear that this is not the case, as Samuels announced on May 30 that she has committed to NC State.

A joint Instagram post from Samuels and the NC State women’s basketball team showcased a graphic of her commitment, along with several photos of her wearing a Wolfpack jersey. The post was captioned, “Welcome to the Pack, Qadence 🐺 We have a playmaker coming to Raleigh!”

Several current (and former) Huskies players have reacted to this news. UConn guard Ashlynn Shade commented by writing, “Congrats Q! Happy for you!!”

Guard Morgan Cheli posted the announcement on her Instagram story and added, “🫶🫶”. And former Huskies icon Nika Muhl, who played with Samuels in 2023-24 and is now with the Seattle Storm, commented, saying, “Congrats Q!!!!<3”.

Clearly Samuels’ former teammates are feeling happy for her in the wake of this transfer decision.

NIL

Georgia football’s Dontrell Glover, Bo Walker arrested for shoplifting

Updated Dec. 12, 2025, 9:24 p.m. ET

Two Georgia football players were arrested Friday and charged with misdemeanor theft by shoplifting.

Starting offensive guard Dontrell Glover and running back Bo Walker were booked into the Clarke County Jail after 5:30 p.m. and released before 8 p.m, according to the jail’s online booking report. The arresting agency is the Athens-Clarke County Police.

NIL

Matt Rhule endorses Nick Saban as commissioner for college football

Amid all the complaints about the current state of college football, be it the College Football Playoff or NIL and the NCAA Transfer Portal, the only solution that has any consensus is the overwhelming desire for a “commissioner” to create and enforce rules and regulations across the sport.

And, whenever the topic of a college football commissioner comes up, one name always seems to be connected: Nick Saban. Of course, the 74-year-old former Alabama head coach-turned-ESPN College GameDay analyst has repeatedly shot down any such suggestion when it inevitably comes up.

“I don’t want to be in that briar patch of being a commissioner,” Saban told the Associated Press in late August. “But I do want to do everything I can to make it right.”

But now the call is coming from inside the house. This week, Nebraska head football coach Matt Rhule openly championed for Saban to accept the yet-to-be-created position during a discussion about the untenable current college football calendar on his House Rhules podcast.

“I can tell you this, I know most coaches, I know me, if that was one the table, I’d certainly vote yes,” Rhule said during Thursday’s episode of his podcast, House Rhules. “Because he’s been in the trenches, he has experience, he has the vision. And you also have to have someone who has the guts and the toughness to make hard decisions, because you’re not going to make everyone happy. That’s why the NFL has Roger Goodell, he’s going to do things, even if people don’t like them, he’s going to do what’s right for the game. And they protect the league.

“For us, our conferences are our leagues, so everyone is protecting their own conference, which is why things end up being maybe a little disjointed as a result,” Rhule concluded. “So, shoot, come on Coach Saban, do it, man. We need you.”

Saban has long been a proponent of more regulation and structure in the sport, especially after this summer’s passage of the House v. NCAA settlement that ended the NCAA’s outdated “amateur” model. The settlement ushered in revenue-sharing across college athletics, allowing programs to pay as much as $20.5 million to their student-athletes, with football teams expected to receive roughly 75% of that total annually. Of course, that has only created more issues, so much so that Congress is now getting involved.

“For years and years and years as coaches, and when we were players, we learned this, we’re trying to create value for our future,” Saban told the AP. “That’s why we’re going to college. It’s not just to see how much money we can make while we’re in college. It’s, how does that impact your future as far as our ability to create value for ourselves?”

That said, if Saban really wants to be part of the solution to what ails college football, Rhule knows the perfect way for him to make the biggest impact.

NIL

The Clemson Insider

CLEMSON — While Clemson continues to prepare to play Penn State in the Pinstripe Bowl on Dec. 27, there are things happening inside the program that will help shape what takes place next year.

The next month is going to be the most important month Dabo Swinney’s program will have in a very long time.

Why?

There is a lot going on, whether it be through the transfer portal, NIL or coaching. There are a lot of moving parts right now and it is all important to next year’s team.

Though Swinney will not talk about next year’s team until this season is over, we can.

As we have reported, there are and there will be more changes to the coaching staff. There will also be more changes to the personnel.

The transfer portal officially opens on Jan. 2, and, as you know, several Tigers have already given their intentions to enter the portal. Four underclassmen have declared for the NFL Draft, as well.

Clemson welcomes 19 freshmen to the team, most of them will enroll in January. However, the Tigers will have two weeks to bring in some more talent from the portal.

How Swinney and the coaching staff attack the portal will be paramount to the 2026 team’s success?

It has been well documented Clemson has not handled the NIL and portal as well as other schools. You only need to look at the four previous seasons to see what I am talking about.

Since 2021, the Tigers are 37-16 (.698) with one College Football Playoff appearance. Granted, the Tigers did win ACC Championships in 2022 and ’24, but it is obvious the program has slipped a notch in this new era of college football.

Can the Tigers reach the top of the mountain, again?

I am not sure.

Let’s be honest, the NIL has hurt Clemson. Part of that is Clemson’s fault, part of that is just the way things are. It’s hard for Clemson to compete in the third-party NIL world with schools that can. That is one reason why the Tigers cannot sign 5-star prospects anymore.

While Clemson continues to struggle with the NIL, other schools within the ACC, continue to have success. ACC Champion Duke is a perfect example of this.

Before the NIL, Duke was irrelevant in football and there was no way they could compete with the Clemson’s and Florida State’s. These days, the Blue Devils own a two-game win streak against the Tigers.

Why?

Because they are more successful with the NIL.

Virginia is another example. Tony Elliott went to the portal and pulled 30 new players on a team that made it to the ACC Championship Game. He used revenue sharing and NIL funds to get the best players he could.

As we mentioned before, the changes in college football are very reminiscent of how new rules in college baseball affected the Clemson baseball program some 15 years ago. Clemson baseball has never fully recovered.

Will Clemson Football?

To do that, Clemson must change its philosophy when it comes to paying players from the portal.

This is like free agency in the NFL. You must go and pay for the best.

You must do what is best for the program, not worry if you hurt the feelings of a current player on the roster.

Look at it this way, Clemson is losing, potentially, three first-round picks—Peter Woods, Avieon Terrell and T.J. Parker—and one second-round pick in Antonio Williams. Those guys are all underclassmen. Who are the Tigers replacing them with?

Let me ask you this. How many first-round picks will next year’s roster have?

This is an important off-season. Swinney must make the right choices in the portal.

The Tigers cannot afford to go 4-4 in the ACC again, which is possible if you look at next year’s schedule.

Clemson will play Georgia Tech, Miami, North Carolina and Virginia at home in 2026. As well as visit California, Duke, Florida State and Syracuse. Look at that schedule, do you think the Tigers, with the current roster, can win the ACC next season?

This is why the next month is going to be so big for the Clemson Football program.

NIL

Oregon WR Dakorien Moore signs NIL deal with Red Bull

Dec. 12, 2025, 10:38 a.m. PT

College football has always been an expansive and complex entity and it has shifted even further in that direction in recent years with the introduction of NIL deals and the expansion of the transfer portal. Oddly enough, it is those same alterations that play a part in the Oregon Ducks becoming such an attractive destination.

They landed five-star wide receiver Dakorien Moore last recruiting cycle and he has been everything that the school and scouts hoped he would be. He is dealing with a knee injury currently, but he had recorded 443 yards and three touchdowns in just eight games before his stellar season was disrupted.

Moore has been so impressive that reports surfaced yesterday that he is signing an NIL deal with Red Bull, an energy drink manufacturer. No details have emerged about how much it is worth, but the true freshman wideout added yet another partnership to an already strong package of NIL contracts.

Moore has become one of the rare freshmen that gets the chance to step on the field for the Ducks and he has made that leap of faith worth their while. If he continues on this trajectory, then there is no reason to believe that he won’t continue to rack up collaborations with other major corporations during his time in college.

This deal with Red Bull should be one of the first in a long line of significant sponsorships.

Contact/Follow @Ducks_Wire on X (formerly Twitter) and like our page on Facebook to follow ongoing coverage of Oregon Ducks news, notes and opinions.

NIL

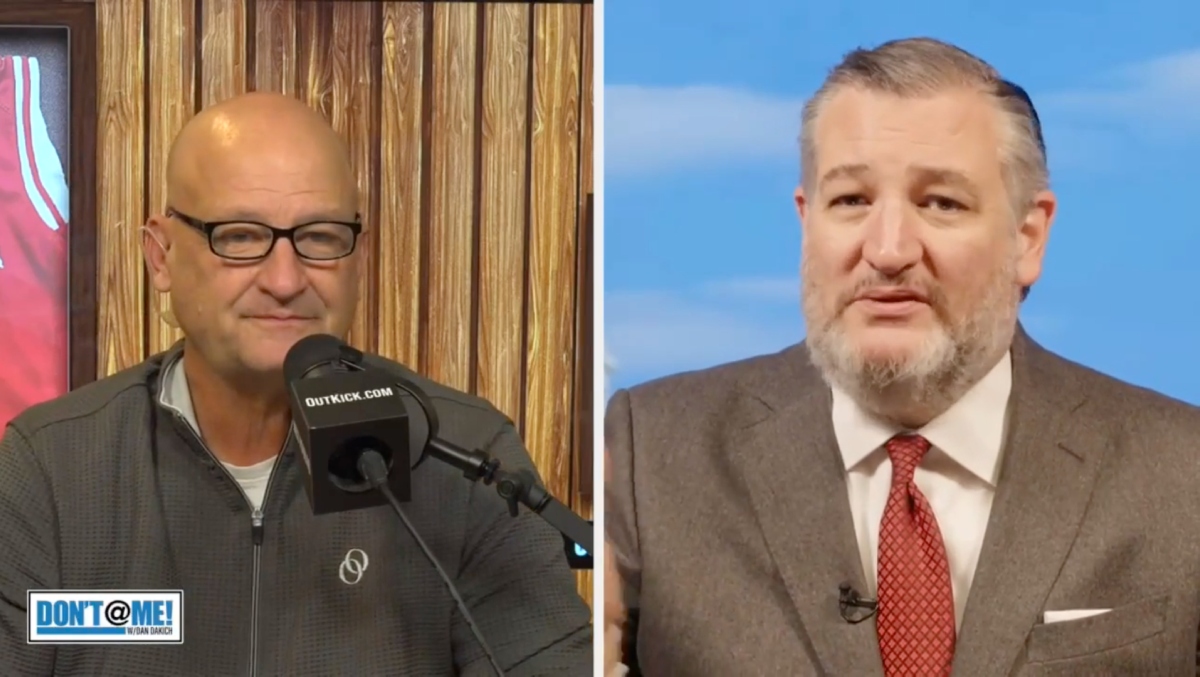

Sen. Ted Cruz Talks College Sports, Prop Bets, And Sen. Kennedy One-Liners

Senator Ted Cruz joined OutKick’s Dan Dakich for a wide-ranging interview that touched on everything from saving college sports to making sure betting on prop bets doesn’t lead to corruption of integrity to the one-liners of Louisiana Sen. John Kennedy.

As I said, wide-ranging, and you can check out the interview in its entirety on the Don’t @ Me with Dan Dakich YouTube channel.

One of the biggest stories in sports these days has to do with the state of college sports and how it has been impacted by NIL. Sen. Cruz talked about how, while it’s good that athletes can make some money off of their name, image, and likeness, the bidding wars we see are going to threaten the existence of college sports.

There’s An Absolute Crisis In College Sports | Don’t @ Me w/ Dan Dakich

“So look, I think there’s an absolute crisis in college sports. I think the current situation [is] the Wild West,” the Republican senator from Texas said. “Every school is in a bidding war. It keeps going up and up and up. With the transfer portal, you’ve got people jumping from school to school to school, and I don’t think any of this is good for college schools.

“I think we’re on a path where, if Congress doesn’t act, we’re going to see a handful of schools, maybe 30 [or] 40, schools that are ‘super schools’ that survive… But a whole bunch of other schools on the current path — I think division two schools, division three schools, and even a bunch of division one schools — this bidding war is pricing them out of being competitive. That’s not good for sports.”

Cruz also talked about how sports that don’t typically earn income for their schools are going to be in a lot of danger because of the current system, and how that could take away incredible opportunities for those student-athletes.

“I’m really worried about all the kids that this is their only hope to get an education,” Sen. Cruz said. “To learn the discipline and teamwork and all the skills you get playing sports that then help you in life, help you get a job, help you build a business, help you provide for your family. And so I think there is an urgent need for Congress to step in.”

Another major issue impacting sports that Dakich and Sen. Cruz discussed has to do with sports gambling. Specifically, prop bets and how easy it can be for players to manipulate them, thereby threatening the integrity of the game.

Sen. Cruz: Prop Bets = Corruption Waiting to Happen | Don’t @ Me w/ Dan Dakich

“I can tell you, I’ve recently sent oversight letters to the NBA and Major League Baseball inquiring, getting the facts about how many, how many complaints I’m particularly concerned about prop bets,” Sen. Cruz said. “If you can bet on whether the first pitch in a game is going to be a ball or a strike, well, you know what? The pitcher can’t necessarily guarantee it’s a strike, but 100% of the time, he can guarantee it’s a ball, and that just invites corruption.”

Sen. Cruz mentioned that he has talked to leagues and gambling platforms about this issue and is exploring ways Congress might be able to help maintain the integrity of games.

“I don’t think anyone wants to see sports where you don’t trust the outcome, where you think it’s rigged, where you have an athlete throwing a game because he wants to make a buck,” the senator said. “That’s a bad outcome, and I do think we need to work to prevent it.”

And finally, Dakich and Cruz hit on a lighter topic, and those are the legendary one-liners of Louisiana Republican Sen. John Kennedy.

“That judiciary committee hearing where John Kennedy leaned forward into the microphone and he says, ‘Christmas tree ornaments and Jeffrey Epstein: two things you know, didn’t hang themselves.'” Sen. Cruz recalled. “I always fell out of my chair. I’m like, Wait, how was that out loud?”

How great is that? It would’ve made a perfect Carnac joke back in the day.

Dakich then mentioned that one of his favorite Sen. Kennedy lines, “She’s not the dumbest person in the country, but she better hope the dumbest person doesn’t die.”

“John is essentially a stand–up comedian,” Sen. Cruz said, before bringing up an all-time Kennedy gem. “He said things like ‘AOC is why they put instructions on shampoo.’”

…

Be sure to check out the entire interview on the Don’t @ Me with Dan Dakich YouTube channel.

NIL

Rodriguez collects Bednarik Award for fifth national honor

LUBBOCK, Texas – Texas Tech senior linebacker Jacob Rodriguez collected his fifth national award this season Friday evening as he was tabbed the winner of the Bednarik Award during the College Football Awards Show live on ESPN.

Rodriguez is the first Red Raider in program history to win the Bednarik Award, which is presented annually by the Maxwell Football Club to the nation’s top defensive player. The Bednarik Award selected Rodriguez over Ohio State safety Caleb Downs and Texas A&M defensive end Cashius Howell.

With the addition of the Bednarik Award, Rodriguez is now the winner of the Butkus Award (nation’s top linebacker), the Bronko Nagurski Trophy (nation’s top defensive player), the Lombardi Award (nation’s top lineman or linebacker) and the Pony Express Award (nation’s top duo with David Bailey) this season alone. He is the third player in history to win the Butkus Award as well as the Nagurski Trophy and Bednarik Award in the same season, joining Miami’s Dan Morgan (2000) and Notre Dame’s Manti Te’o (2012). Rodriguez joins Te’o as the only players to also win the Lombardi Award.

Rodriguez, who was also tabbed a first team All-American by the Walter Camp Foundation during the ESPN broadcast, has bolstered one of the nation’s top defenses, leading the Red Raiders to their first Big 12 title in program history this season and their first appearance in the College Football Playoff. The Red Raiders enter a potential matchup with either No. 5 Oregon or No. 12 seed James Madision at 12-1 overall, marking the most wins in program history.

Rodriguez has now led Texas Tech to four-consecutive bowl appearances during his career after going from a scholarship quarterback at Virginia, to walk-on linebacker with the Red Raiders and now a national award winner. He was joined during the ESPN College Football Awards Show by his parents, Joe and Ann Rodriguez, and his wife, Emma.

Rodriguez enters bowl season as the FBS leader with seven forced fumbles and ranks among the top-15 players nationally with 117 tackles. He is the first FBS player since 2005 to record at least five forced fumbles, two fumble recoveries and four interceptions all in the same season. His impact has bolstered a Texas Tech defense that leads the nation with 31 takeaways and ranks third nationally in scoring defense at 10.9 points per game. Rodriguez was responsible for nine takeaways himself — all in Big 12 play – thanks to his ability to punch the ball out and also read the quarterback in coverage.

Rodriguez is currently the highest-rated player in all of college football, according to Pro Football Focus, grading out at 93.3 overall so far this season. He is the top-rated player in the country in terms of rush defense, receiving a 95.5 grade in that area for a Red Raider defense that is easily the nation’s best in stopping opponents on the ground. Texas Tech is giving up only 68.5 rushing yards a game thanks to Rodriguez, who also ranks fifth nationally in coverage with a 92.3 grade.

Established in 1995, the Chuck Bednarik Award is one of the most-prestigious honors in college football, awarded annually to the most outstanding defensive player. This accolade recognizes exceptional talent, tenacity and impact on the defensive side of the ball. The award is named in tribute to Chuck Bednarik, a revered figure in football history known for his remarkable career as a linebacker.

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoFirst Tee Winter Registration is open

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoFargo girl, 13, dies after collapsing during school basketball game – Grand Forks Herald

-

Motorsports3 weeks ago

Motorsports3 weeks agoCPG Brands Like Allegra Are Betting on F1 for the First Time

-

Motorsports3 weeks ago

Motorsports3 weeks agoF1 Las Vegas: Verstappen win, Norris and Piastri DQ tighten 2025 title fight

-

Sports3 weeks ago

Sports3 weeks agoTwo Pro Volleyball Leagues Serve Up Plans for Minnesota Teams

-

Sports2 weeks ago

Sports2 weeks agoUtah State Announces 2025-26 Indoor Track & Field Schedule

-

Sports3 weeks ago

Sports3 weeks agoSycamores unveil 2026 track and field schedule

-

Motorsports2 weeks ago

Motorsports2 weeks agoJo Shimoda Undergoes Back Surgery

-

Motorsports2 weeks ago

Motorsports2 weeks agoRedemption Means First Pro Stock World Championship for Dallas Glenn

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoRobert “Bobby” Lewis Hardin, 56