Technology

Web3 Gaming Market Size Worth USD 182.98 Billion by 2034 Driven by AI and Player-Centric Innovations

Also Read@ Metaverse in Gaming Market Poised to Reach $648.24 Billion by 2034 – Key Trends and Insights What are the Web3 Gaming Market Growth Factors? The growing player ownership and control over in-game items help the market grow. The growing play-to-earn opportunities are increasing the adoption of Web3 gaming. The longer-term retention and high […]

Technology

North America Exercise Bike Market Size and Analysis, 2033

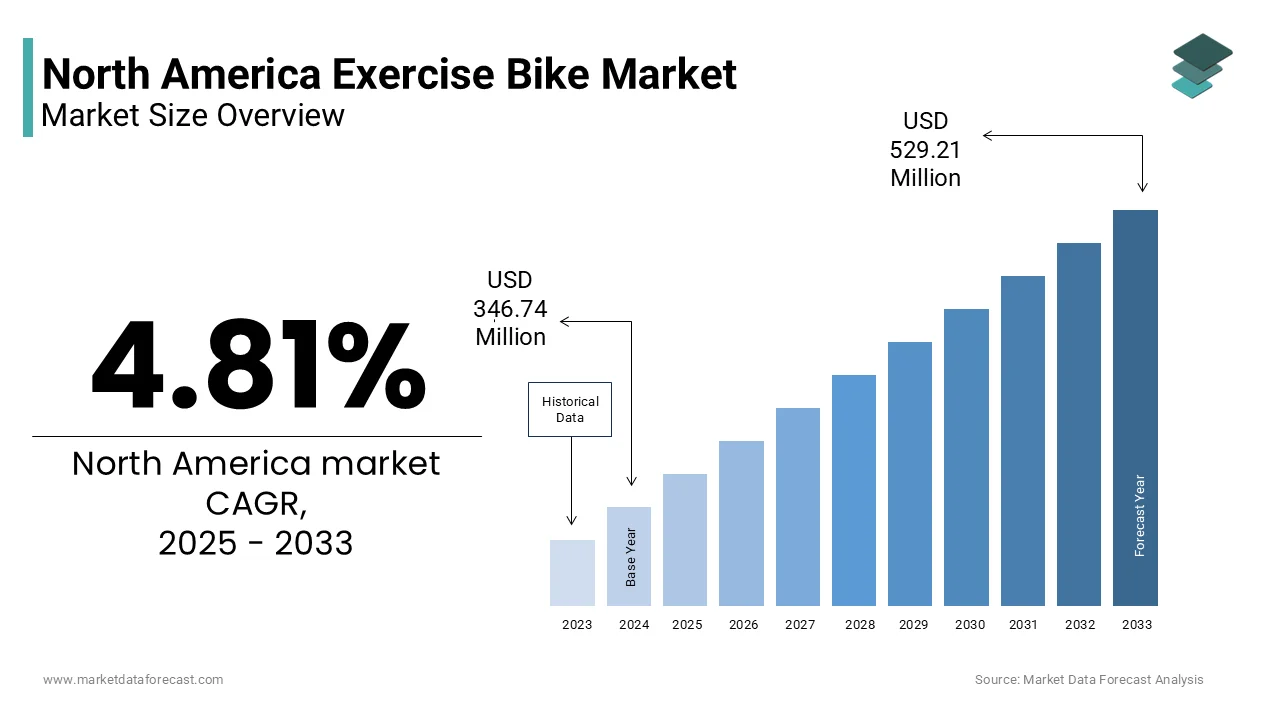

North America Exercise Bike Market Size The exercise bike market size in North America was valued at USD 346.74 million in 2024 and is predicted to be worth USD 529.21 million by 2033 from USD 363.42 million in 2025 and grow at a CAGR of 4.81% from 2025 to 2033. The exercise bikes include upright, […]

North America Exercise Bike Market Size

The exercise bike market size in North America was valued at USD 346.74 million in 2024 and is predicted to be worth USD 529.21 million by 2033 from USD 363.42 million in 2025 and grow at a CAGR of 4.81% from 2025 to 2033.

The exercise bikes include upright, recumbent, spin, and smart models equipped with features such as digital displays, heart rate monitoring, resistance control, and connectivity to fitness apps or virtual workout platforms. According to data from the U.S. Census Bureau, shipments in the fitness equipment manufacturing sector grew by 6.8% in 2023 compared to the previous year, indicating a strong recovery post-pandemic. The rise in sedentary lifestyles and chronic lifestyle-related diseases has prompted individuals to invest in personal fitness solutions, particularly in urban areas where access to gyms may be limited or costly. Moreover, advancements in connected fitness have transformed traditional exercise bikes into interactive training systems. Companies like Peloton, NordicTrack, and Echelon have led this shift by integrating live classes, AI-based coaching, and cloud-connected performance tracking.

MARKET DRIVERS

Rise in Home Fitness Adoption and Remote Work Culture

The increasing adoption of home fitness routines is largely influenced by the shift toward remote work and flexible schedules is attributed in propelling the growth of the North America exercise bike market. According to the U.S. Bureau of Labor Statistics, approximately 27% of employed Americans worked remotely at least part of the time in 2023, up from less than 5% before the pandemic. Exercise bikes offer a convenient and effective way to maintain cardiovascular health without requiring extensive space or specialized knowledge. A study published by the American College of Sports Medicine found that regular cycling, even indoors, can reduce the risk of heart disease, diabetes, and obesity when combined with a balanced diet. Additionally, the rising cost of gym memberships has made owning an exercise bike a more economical long-term solution. As per data from Statista, the average monthly gym membership fee in the U.S. exceeded $50 in 2023, prompting many individuals to opt for one-time investments in fitness equipment instead.

Integration of Smart Technology and Virtual Fitness Platforms

The integration of smart technology and immersive virtual fitness platforms is amplifying the growth of the North America exercise bike market. Modern exercise bikes are increasingly equipped with touchscreen displays, Wi-Fi connectivity, Bluetooth compatibility, and access to live or on-demand workout sessions hosted by professional instructors. Leading brands such as Peloton, NordicTrack, and Technogym have introduced premium models that sync with mobile applications and subscription-based fitness services, allowing users to participate in real-time classes, track performance metrics, and compete with others globally. Furthermore, advancements in artificial intelligence and machine learning are enabling adaptive workout programs tailored to individual fitness levels and goals.

MARKET RESTRAINTS

High Cost of Premium Smart Exercise Bikes

The high cost associated with premium smart models is to hinder the growth of the North America exercise bike market. While basic upright and recumbent bikes remain affordable for many consumers, top-tier models equipped with large touchscreens, AI-driven coaching, and live class subscriptions often exceed $1,500, placing them beyond the reach of budget-conscious buyers. This financial barrier is particularly pronounced among middle- and lower-income households, which represent a substantial portion of the population but may not prioritize expensive fitness equipment. The U.S. Department of Commerce reported that household discretionary spending growth slowed to 2.1% in 2023, reflecting tighter budgets and cautious consumer behavior. Many individuals opt for alternatives such as outdoor cycling, gym memberships, or second-hand equipment rather than investing in high-end indoor bikes. Moreover, recurring costs such as software subscriptions and maintenance fees add to the overall expense.

Space Constraints in Urban Households

The issue of space limitations in urban households in densely populated cities where apartment living is common is also to hinder the growth of the North America exercise bike market. Exercise bikes, especially high-end smart models, require dedicated floor space that many residents may not have available. This spatial limitation discourages potential buyers from purchasing bulky fitness equipment, especially if they lack storage solutions or multipurpose rooms. Additionally, landlords and property management companies frequently impose restrictions on large fitness equipment due to concerns about noise, weight load, and wear and tear on the flooring.

MARKET OPPORTUNITIES

Expansion of Corporate Wellness Programs and Office-Based Fitness Solutions

The growing integration of fitness equipment into corporate wellness programs and office environments is creating new opportunities for the growth of the North America exercise bike market. According to the Society for Human Resource Management, over 70% of mid-sized and large corporations in the U.S. offered wellness initiatives in 2023, including subsidized gym memberships, health screenings, and in-office fitness equipment. Additionally, government-backed health incentives encourage employers to adopt workplace wellness strategies.

Growing Demand for Rehabilitation and Senior-Friendly Fitness Equipment

The increasing demand for rehabilitation-focused and senior-friendly fitness equipment is ascribed to boost the growth of the North America exercise bike market. There is a growing need for low-impact cardiovascular machines that cater to older adults and individuals with mobility limitations as the aging population expands and post-injury recovery becomes more home-based. According to the U.S. Census Bureau, the number of Americans aged 65 and older surpassed 60 million in 2023, representing over 18% of the total population. This demographic shift has spurred interest in gentle yet effective forms of exercise, with stationary cycling being a preferred option due to its joint-friendly nature and adjustable resistance levels. Furthermore, physical therapy clinics and assisted living facilities are increasingly adopting recumbent and seated bikes designed for rehabilitation purposes. A study published by the Journal of Aging and Physical Activity found that patients recovering from knee surgery showed faster functional improvement when incorporating stationary cycling into their rehab regimen.

MARKET CHALLENGES

Rapid Product Obsolescence and Short Technology Lifecycle

The rapid pace of technological obsolescence, which results in shorter product lifecycles and increased consumer hesitation around high-cost purchases is restricting the growth of the North America exercise bike market. According to Frost & Sullivan, nearly 30% of smart fitness device owners expressed concerns about premature product depreciation, with some reporting that newer models were released within 12 to 18 months of their initial purchase. This accelerated innovation cycle creates uncertainty among consumers regarding the longevity and future compatibility of their investment. Additionally, manufacturers must continuously update cloud-based platforms, app integrations, and connectivity protocols to keep pace with evolving digital standards. A white paper by the Consumer Technology Association noted that nearly 45% of surveyed consumers delayed purchasing smart fitness equipment due to fears of future incompatibility with new workout platforms or operating system upgrades.

Declining Consumer Engagement Post-Purchase

The declining consumer engagement after the initial purchase period is also to spur the growth of the North America exercise bike market. This drop-off is primarily attributed to a lack of sustained motivation, inconsistent workout scheduling, and diminishing novelty.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.81% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Peloton Interactive, Inc., Cybex International, Inc., Johnson Health Tech. Co., Ltd. (Nautilus), Precor Incorporated, HOIST Fitness Systems, Inc., Rogue Fitness, Torque Fitness, iFIT Inc, and others |

SEGMENTAL ANALYSIS

By Type Insights

The upright bikes segment held 38.4% of the North America exercise bike market share in 2024 due to its accessibility and cost-effectiveness compared to more advanced models. The U.S. Consumer Product Safety Commission reported that upright bikes accounted for nearly half of all home fitness bicycle sales in 2023, with average prices ranging from $200 to $700 by making them an attractive option for budget-conscious consumers. Additionally, upright bikes are favored for their space-efficient footprint, making them ideal for apartment dwellers and small workout areas. A survey conducted by the National Association of Home Builders found that over 60% of respondents considered portability and compactness as decisive factors when choosing home fitness products.

The interactive bikes segment is projected to grow with a CAGR of 14.7% during the forecast period. These high-tech models integrate large touchscreen displays, real-time coaching, live classes, and performance tracking through cloud-based platforms. A report by McKinsey & Company indicated that over 60% of digitally engaged fitness consumers preferred interactive home workouts over conventional gym settings, citing convenience and personalized feedback as key benefits. Companies like Peloton, NordicTrack, and Echelon have capitalized on this trend by offering immersive virtual training environments that simulate outdoor rides and competitive challenges. Moreover, advancements in streaming services and wearable fitness device compatibility have further enhanced user engagement.

By Distribution Channel Insights

The online distribution channels segment was the largest by capturing 59.4% of the North America exercise bike market share in 2024 with the growing preference for e-commerce shopping, especially for bulky fitness equipment that is difficult to transport from physical stores. According to the U.S. Department of Commerce, online retail sales in the sporting goods and hobby category increased by 11.2% in 2023 compared to the previous year, reflecting stronger digital purchasing behavior. Another contributing factor is the integration of augmented reality tools and detailed product comparisons on e-commerce sites.

The online distribution segment is anticipated to grow with a CAGR of 12.4% in the next coming years. The expansion of subscription-based fitness ecosystems has made online purchases more appealing. Furthermore, the proliferation of buy-now-pay-later (BNPL) financing options has lowered entry barriers for high-end smart bikes. The Federal Reserve Bank of New York noted that BNPL usage in fitness equipment purchases grew by 22% in 2023, allowing consumers to spread costs without upfront financial strain.

REGIONAL ANALYSIS

United States

The United States was the top performer in the North America exercise bike market by occupying 85.3% of share in 2024. According to the Centers for Disease Control and Prevention, more than 42% of American adults were classified as obese in 2023, reinforcing the urgency for accessible home-based fitness solutions. The shift toward remote work and hybrid lifestyles has further encouraged individuals to invest in personal wellness equipment, with exercise bikes being one of the most popular choices due to their low-impact nature and cardiovascular benefits. In addition, the presence of major fitness tech companies such as Peloton, NordicTrack, and SoulCycle has propelled innovation and market penetration. A report by Morning Consult found that over 50% of Americans who purchased fitness equipment in 2023 did so through direct-to-consumer or e-commerce platforms.

Canada

Canada exercise bike market held 12.3% of the share in 2024 due to the rising health consciousness, increased home fitness adoption, and growing access to digital workout platforms tailored for Canadian consumers. Moreover, the popularity of virtual fitness programs has surged across the country. A white paper published by the Canadian Fitness Industry Association noted that over 60% of Canadians had tried at least one form of online fitness class in 2023, many of which were accessed via interactive exercise bikes. Additionally, the rise of hybrid work arrangements has allowed urban professionals to incorporate structured workouts into daily routines, further boosting demand for home-use models.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Peloton Interactive, Inc., Cybex International, Inc., Johnson Health Tech. Co., Ltd. (Nautilus), Precor Incorporated, HOIST Fitness Systems, Inc., Rogue Fitness, Torque Fitness, iFIT Inc are playing dominating role in the North America exercise bike market.

The competition in the North America exercise bike market is intense, marked by rapid innovation, shifting consumer preferences, and an influx of both traditional fitness equipment manufacturers and new entrants leveraging digital disruption. Established players like Peloton, NordicTrack, and Schwinn dominate due to their brand recognition, product quality, and integrated fitness ecosystems. However, emerging challengers—ranging from boutique fitness brands to tech startups—are gaining traction by offering cost-effective alternatives with enhanced connectivity and mobile-first workout experiences.

Differentiation strategies revolve around technological integration, user engagement, and pricing models. Companies are not only competing on hardware specifications but also on software capabilities, such as virtual coaching, cloud-based analytics, and compatibility with wearable devices. Additionally, customer acquisition and retention have become central to business models, with many firms’ adopting subscription-based services that add ongoing value beyond the initial purchase.

Price sensitivity and market saturation present additional challenges, particularly in the mid-tier segment where consumers seek performance without premium costs. The battle for market share will increasingly hinge on brand loyalty, ecosystem richness, and the ability to main

TOP PLAYERS IN THE MARKET

Peloton Interactive, Inc.

Peloton has been a defining force in the interactive fitness space, transforming the stationary bike market with its connected workout platform. The company pioneered the integration of live and on-demand cycling classes, fostering a strong community-driven fitness experience. Peloton’s success lies in its ability to merge hardware with digital content by offering users real-time coaching, performance tracking, and social engagement features that have redefined home exercise culture.

Technogym S.p.A. (North America Division)

Technogym is a global leader in premium fitness equipment, with a strong presence in both commercial and residential segments across North America. Known for its high-quality, durable bikes designed for gyms and elite training centers, Technogym has contributed significantly to the professionalization of indoor cycling. Its emphasis on ergonomics, biomechanics, and design excellence has made it a preferred brand among fitness enthusiasts and institutional clients alike.

NordicTrack (iFIT Health & Fitness Inc.)

NordicTrack, under the iFIT umbrella, has emerged as a major player by combining smart technology with affordability. The brand offers a diverse range of interactive bikes equipped with immersive training experiences powered by iFIT’s global workout library. NordicTrack’s aggressive digital marketing, bundled subscription services, and direct-to-consumer sales model have enabled widespread adoption in the North American home fitness market

TOP STRATEGIES USED BY KEY PLAYERS

Expansion of Digital Ecosystems and Subscription-Based Services

Leading companies are investing heavily in developing proprietary digital platforms that offer live and on-demand workout content.

Enhanced User Experience Through AI and Gamification

To improve retention and satisfaction, manufacturers are integrating artificial intelligence, personalized training programs, and gamified elements into their smart bikes. These features provide real-time feedback, adaptive resistance levels, and performance-based rewards, which is making workouts more engaging and goal-oriented.

Direct-to-Consumer Sales and Omnichannel Retail Integration

Major players are shifting toward D2C models and strengthening online distribution networks while also partnering with major retailers. This dual approach allows them to control branding, pricing, and customer service while expanding reach through established e-commerce and physical retail channels.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Peloton launched a refreshed line of its iconic Bike+ with updated display technology and expanded international instructor partnerships, which is aiming to enhance global content appeal and retain leadership in the premium interactive fitness segment.

- In May 2024, NordicTrack introduced a new tiered subscription model allowing users to access basic workout features at a lower price point while still offering full premium access by targeting budget-conscious buyers without compromising digital engagement.

- In July 2024, Schwinn partnered with leading wellness apps such as Apple Fitness+ and Google Fit to ensure seamless data synchronization and broader compatibility by reinforcing its position as a versatile and integrative option for tech-savvy consumers.

- In September 2024, Bowflex expanded its presence in Canada by launching region-specific marketing campaigns and localized customer support hubs, which is reflecting a strategic push to strengthen foothold beyond the U.S. market.

- In November 2024, Echelon introduced a modular smart bike concept that allows users to upgrade components over time rather than purchasing entirely new units by addressing concerns about product obsolescence and appealing to environmentally conscious consumers.

MARKET SEGMENTATION

This research report on the North America exercise bike market has been segmented and sub-segmented based on the following categories.

By Type

- Upright Bike

- Interactive Bike

- Recumbent Bike

- Dual-Action Bike

By Distribution Channels

- Online Distribution Channels

- Physical Stores

By Country

- The United States

- Canada

- Rest of North America

Technology

Sloane & Company Accelerates Ambitious Growth Plan with Senior Hires to Lead New Capital Markets and Media, Sports, Entertainment and Technology Practices

Sloane & Company Zack Mukewa and Jon Hammond join firm as principals following arrival of new CGO, Melissa Green NEW YORK, July 28, 2025 (GLOBE NEWSWIRE) — Sloane & Company, a leading strategic communications firm within the Stagwell (NASDAQ: STGW) network, today announced the appointment of two senior executives to lead newly created global practice areas and […]

Zack Mukewa and Jon Hammond join firm as principals following arrival of new CGO, Melissa Green

NEW YORK, July 28, 2025 (GLOBE NEWSWIRE) — Sloane & Company, a leading strategic communications firm within the Stagwell (NASDAQ: STGW) network, today announced the appointment of two senior executives to lead newly created global practice areas and accelerate the firm’s next phase of growth. Zack Mukewa joins as Principal and Head of Capital Markets and Strategic Advisory, while Jon Hammond steps in as Principal and Head of Media, Sports, Entertainment, and Technology.

Their hires underscore the firm’s ambitious growth plan and align with Stagwell’s broader target of reaching $5 billion in annual revenue by 2029.

“Sloane has ambitious plans to scale our growth in the coming years, and with Zack and Jon on our team, I am bullish about our future,” said Darren Brandt, CEO of Sloane & Company. “These strategic hires mark a pivotal step forward as we scale our operations, expand our market presence, and continue delivering exceptional value to our clients.”

“Zack and Jon bring distinct, high-value capabilities at a time when our clients are facing unprecedented complexity and transformation,” said Melissa Green, Chief Growth Officer at Sloane & Company, who stepped into the newly created role in March. “These hires are deliberate investments in two of the most strategically important growth vectors for our firm—and for the future of client service in our industry.”

Mukewa will lead the buildout of Sloane’s Capital Markets and Strategic Advisory practice, offering board-level counsel to public and private companies navigating investor relations, market transactions, and capital strategy. A veteran of global markets with nearly two decades of experience, Mukewa most recently scaled a capital markets advisory team from $2 million to $6 million in revenue within three years and led 16 capital events in 2024 alone.

“Sloane is trusted in the market for its ability to help clients navigate complex, high-stakes issues,” said Mukewa. “At a time when capital strategy and financial storytelling are central to long-term value creation, we’re building an advisory platform designed to deliver clarity and competitive advantage—across market cycles.”

Hammond will lead the firm’s new cultural strategy offering, advising brands, leagues and organizations, media properties, and talent on how to harness storytelling, influence, and innovation to drive growth and deepen engagement. He brings decades of experience from senior roles at the NBA, Condé Nast, and Time Inc., and for the past seven years, has been operating his own consultancy working with leading media companies, sports organizations, athletes, and brands with a track record of launching high-impact platforms and advising some of the most influential names in sports and entertainment. In addition, he brings extensive crisis communications expertise that will be leveraged across all practice areas.

Technology

Creating deepfakes is easier than ever. Fighting back may take AI

By DAVID KLEPPER WASHINGTON (AP) — The phone rings. It’s the secretary of state calling. Or is it? For Washington insiders, seeing and hearing is no longer believing, thanks to a spate of recent incidents involving deepfakes impersonating top officials in President Donald Trump’s administration. Digital fakes are coming for corporate America, too, as criminal […]

By DAVID KLEPPER

WASHINGTON (AP) — The phone rings. It’s the secretary of state calling. Or is it?

For Washington insiders, seeing and hearing is no longer believing, thanks to a spate of recent incidents involving deepfakes impersonating top officials in President Donald Trump’s administration.

Digital fakes are coming for corporate America, too, as criminal gangs and hackers associated with adversaries including North Korea use synthetic video and audio to impersonate CEOs and low-level job candidates to gain access to critical systems or business secrets.

Thanks to advances in artificial intelligence, creating realistic deepfakes is easier than ever, causing security problems for governments, businesses and private individuals and making trust the most valuable currency of the digital age.

Responding to the challenge will require laws, better digital literacy and technical solutions that fight AI with more AI.

“As humans, we are remarkably susceptible to deception,” said Vijay Balasubramaniyan, CEO and founder of the tech firm Pindrop Security. But he believes solutions to the challenge of deepfakes may be within reach: “We are going to fight back.”

AI deepfakes become a national security threat

This summer, someone used AI to create a deepfake of Secretary of State Marco Rubio in an attempt to reach out to foreign ministers, a U.S. senator and a governor over text, voice mail and the Signal messaging app.

In May someone impersonated Trump’s chief of staff, Susie Wiles.

Another phony Rubio had popped up in a deepfake earlier this year, saying he wanted to cut off Ukraine’s access to Elon Musk’s Starlink internet service. Ukraine’s government later rebutted the false claim.

The national security implications are huge: People who think they’re chatting with Rubio or Wiles, for instance, might discuss sensitive information about diplomatic negotiations or military strategy.

“You’re either trying to extract sensitive secrets or competitive information or you’re going after access, to an email server or other sensitive network,” Kinny Chan, CEO of the cybersecurity firm QiD, said of the possible motivations.

Synthetic media can also aim to alter behavior. Last year, Democratic voters in New Hampshire received a robocall urging them not to vote in the state’s upcoming primary. The voice on the call sounded suspiciously like then-President Joe Biden but was actually created using AI.

Their ability to deceive makes AI deepfakes a potent weapon for foreign actors. Both Russia and China have used disinformation and propaganda directed at Americans as a way of undermining trust in democratic alliances and institutions.

Steven Kramer, the political consultant who admitted sending the fake Biden robocalls, said he wanted to send a message of the dangers deepfakes pose to the American political system. Kramer was acquitted last month of charges of voter suppression and impersonating a candidate.

“I did what I did for $500,” Kramer said. “Can you imagine what would happen if the Chinese government decided to do this?”

Scammers target the financial industry with deepfakes

The greater availability and sophistication of the programs mean deepfakes are increasingly used for corporate espionage and garden variety fraud.

“The financial industry is right in the crosshairs,” said Jennifer Ewbank, a former deputy director of the CIA who worked on cybersecurity and digital threats. “Even individuals who know each other have been convinced to transfer vast sums of money.”

In the context of corporate espionage, they can be used to impersonate CEOs asking employees to hand over passwords or routing numbers.

Deepfakes can also allow scammers to apply for jobs — and even do them — under an assumed or fake identity. For some this is a way to access sensitive networks, to steal secrets or to install ransomware. Others just want the work and may be working a few similar jobs at different companies at the same time.

Technology

Creating deepfakes is easier than ever. Fighting back may take AI

By DAVID KLEPPER WASHINGTON (AP) — The phone rings. It’s the secretary of state calling. Or is it? For Washington insiders, seeing and hearing is no longer believing, thanks to a spate of recent incidents involving deepfakes impersonating top officials in President Donald Trump’s administration. Digital fakes are coming for corporate America, too, as criminal […]

By DAVID KLEPPER

WASHINGTON (AP) — The phone rings. It’s the secretary of state calling. Or is it?

For Washington insiders, seeing and hearing is no longer believing, thanks to a spate of recent incidents involving deepfakes impersonating top officials in President Donald Trump’s administration.

Digital fakes are coming for corporate America, too, as criminal gangs and hackers associated with adversaries including North Korea use synthetic video and audio to impersonate CEOs and low-level job candidates to gain access to critical systems or business secrets.

Thanks to advances in artificial intelligence, creating realistic deepfakes is easier than ever, causing security problems for governments, businesses and private individuals and making trust the most valuable currency of the digital age.

Responding to the challenge will require laws, better digital literacy and technical solutions that fight AI with more AI.

“As humans, we are remarkably susceptible to deception,” said Vijay Balasubramaniyan, CEO and founder of the tech firm Pindrop Security. But he believes solutions to the challenge of deepfakes may be within reach: “We are going to fight back.”

AI deepfakes become a national security threat

This summer, someone used AI to create a deepfake of Secretary of State Marco Rubio in an attempt to reach out to foreign ministers, a U.S. senator and a governor over text, voice mail and the Signal messaging app.

In May someone impersonated Trump’s chief of staff, Susie Wiles.

Another phony Rubio had popped up in a deepfake earlier this year, saying he wanted to cut off Ukraine’s access to Elon Musk’s Starlink internet service. Ukraine’s government later rebutted the false claim.

The national security implications are huge: People who think they’re chatting with Rubio or Wiles, for instance, might discuss sensitive information about diplomatic negotiations or military strategy.

“You’re either trying to extract sensitive secrets or competitive information or you’re going after access, to an email server or other sensitive network,” Kinny Chan, CEO of the cybersecurity firm QiD, said of the possible motivations.

Synthetic media can also aim to alter behavior. Last year, Democratic voters in New Hampshire received a robocall urging them not to vote in the state’s upcoming primary. The voice on the call sounded suspiciously like then-President Joe Biden but was actually created using AI.

Their ability to deceive makes AI deepfakes a potent weapon for foreign actors. Both Russia and China have used disinformation and propaganda directed at Americans as a way of undermining trust in democratic alliances and institutions.

Steven Kramer, the political consultant who admitted sending the fake Biden robocalls, said he wanted to send a message of the dangers deepfakes pose to the American political system. Kramer was acquitted last month of charges of voter suppression and impersonating a candidate.

“I did what I did for $500,” Kramer said. “Can you imagine what would happen if the Chinese government decided to do this?”

Scammers target the financial industry with deepfakes

The greater availability and sophistication of the programs mean deepfakes are increasingly used for corporate espionage and garden variety fraud.

“The financial industry is right in the crosshairs,” said Jennifer Ewbank, a former deputy director of the CIA who worked on cybersecurity and digital threats. “Even individuals who know each other have been convinced to transfer vast sums of money.”

In the context of corporate espionage, they can be used to impersonate CEOs asking employees to hand over passwords or routing numbers.

Deepfakes can also allow scammers to apply for jobs — and even do them — under an assumed or fake identity. For some this is a way to access sensitive networks, to steal secrets or to install ransomware. Others just want the work and may be working a few similar jobs at different companies at the same time.

Technology

SEGG, LTRYW) Showcases Drivers at Laguna Seca Java House Grand Prix of Monterey

PRESS RELEASE Published July 28, 2025 SEGG Media (NASDAQ: SEGG, LTRYW), a technology company at the intersection of sports, entertainment and gaming, announced that Lottery.com and Sports.com-sponsored drivers Callum Ilott, Louis Foster and Sebastian Murray will compete at the Java House Grand Prix of Monterey at WeatherTech Raceway Laguna Seca. Foster, driving the #45 Droplight […]

PRESS RELEASE

Published July 28, 2025

SEGG Media (NASDAQ: SEGG, LTRYW), a technology company at the intersection of sports, entertainment and gaming, announced that Lottery.com and Sports.com-sponsored drivers Callum Ilott, Louis Foster and Sebastian Murray will compete at the Java House Grand Prix of Monterey at WeatherTech Raceway Laguna Seca. Foster, driving the #45 Droplight Honda for Rahal Letterman Lanigan Racing, enters the event with an average starting position of 8.4 over the last five races and aims to convert his strong qualifying pace into points. Ilott returns to the circuit where he secured his career-best IndyCar finish of P5 in 2023, while Murray makes his comeback to INDY NXT after being medically cleared following a crash at Mid-Ohio. SEGG Media leadership will be on-site to advance its Young Drivers Academy Program as part of its long-term commitment to developing elite racing talent across INDYCAR and international series.

To view the full press release, visit https://ibn.fm/m2lRS

About SEGG Media Corporation

SEGG Media is a global sports, entertainment and gaming group operating digital assets such as Sports.com and Lottery.com. Focused on immersive fan engagement, ethical gaming and AI-driven live experiences, SEGG Media is redefining how global audiences interact with the content they love.

NOTE TO INVESTORS:?The latest news and updates relating to SEGG are available in the company’s newsroom at http://ibn.fm/SEGG

About TinyGems

TinyGems is a specialized communications platform with a focus on innovative small-cap and mid-cap companies with bright futures and huge potential. It is one of 70+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, TinyGems is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, TinyGems brings its clients unparalleled recognition and brand awareness. TinyGems is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from TinyGems, text “Gems” to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.TinyGems.com

Please see full terms of use and disclaimers on the TinyGems website applicable to all content provided by TinyGems, wherever published or re-published: https://www.TinyGems.com/Disclaimer

TinyGems

Austin, Texas

www.TinyGems.com

512.354.7000 Office

Editor@TinyGems.com

TinyGems is powered by IBN

COMTEX_467628603/2801/2025-07-28T13:24:02

Technology

Boise State Esports: From a classroom to a championship legacy

Boise State Esports is entering a new era – one built on the foundation of eight years of innovation, growth and competitive excellence. The program is officially graduating from the College of Innovation and Design to become part of Boise State Athletics. What began as a grassroots effort is now a nationally recognized powerhouse – […]

Boise State Esports is entering a new era – one built on the foundation of eight years of innovation, growth and competitive excellence. The program is officially graduating from the College of Innovation and Design to become part of Boise State Athletics. What began as a grassroots effort is now a nationally recognized powerhouse – poised to expand its reach, deepen its impact and create even more opportunities for student-athletes in the years ahead.

It all started in 2017, and in the most humble of spaces: a classroom. But it was never a small idea. The program was born from the vision of Chris “Doc” Haskell – also nicknamed the “Grandfather of Esports” – and backed by the innovation-focused spirit of the College of Innovation and Design.

Haskell joined forces with Brett Shelton, a professor of educational technology to explore the possibilities of competitive gaming in higher education. Together, they pitched the idea to the College of Innovation and Design. Gordon Jones, then-dean of the college saw the potential immediately – a program true to the college’s mission of investing in the future and building from bold ideas.

With the college’s support, the program launched under the Department of Educational Technology, but transitioned fully to the College of Innovation and Design in 2018, just one year after its founding. The program’s physical journey mirrored its growth. From a shared computer lab in the Education Building, it moved to a temporary home on the second floor of Albertsons Library. Then, in 2019, construction was completed on the now-iconic Boise State Esports Arena.

The downtown arena was originally a shared space with the Venture College. But during the COVID-19 pandemic, the Venture College shifted to virtual operations and the Esports program expanded to take over the entire arena – marking another key milestone in its growth.

Over the past eight years, Boise State Esports has grown into one of the winningest esports programs in the country. With more than 1,500 competitive matches under its belt, the program boasts multiple national titles, dozens of conference championships and a global reputation for excellence.

Eight Years of Milestones

- 2017: The program launches with a League of Legends match in the Student Union Building. Early broadcasts are run out of Doc Haskell’s office.

- 2018: Boise State enters regular-season play and competes in an exhibition match in Las Vegas against UNLV.

- 2019: The Boise State Esports Arena is completed, welcoming fans and competitors alike.

- 2020: The program thrives despite pandemic disruptions. Boise State becomes one of the first universities to broadcast Valorant.

- 2021: The Broncos enjoy their best season yet, winning the Mountain West and a Madden national championship.

- 2022: Boise State becomes a national powerhouse, claiming championships across the country, especially in Overwatch.

- 2023 (Spring): Boise State competes at worldwide championships and hosts high-profile tournaments on campus.

- 2023 (Fall): A new state-of-the-art broadcast studio is added to the downtown arena. Boise State hosts the NACE Starleague national championships.

- 2024: Multiple teams make it to May Madness finals, bringing home four Mountain West Championships and securing national recognition in Rocket League, Overwatch, Valorant, and CFB25.

An innovation incubator

The College of Innovation and Design has been more than a host – it has been an incubator and accelerator for the esports program. From the very beginning, the college offered the program a home, the flexibility to grow and access to the kind of support needed to thrive in uncharted territory.

In 2017, collegiate esports was still a new idea. Boise State was one of the first universities in the country to take the leap, and the college believed in that vision and invested early. Their support allowed the program to experiment, evolve and ultimately establish stability. The addition of funding from Idaho Central Credit Union allowed the program to begin offering scholarships, creating access for more students to participate.

Today, many universities are trying to replicate what Boise State built. But the College of Innovation and Design was there first – acting as the launchpad for what has become a nationally renowned program. The college’s history of fostering successful initiatives, such as Games, Interactive Media, and Mobile Technology, Human-Environment Systems, and Leadership Certificates, is part of what makes the College of Innovation and Design special. Esports is now the first non-credit-bearing program to successfully “graduate” – a major milestone for the college.

In the past year, the esports program has received institutional support from the president’s office and expanded its professional staff, further cementing its place as a core part of Boise State’s innovation ecosystem.

-

College Sports3 weeks ago

College Sports3 weeks agoWhy a rising mid-major power with an NCAA Tournament team opted out of revenue-sharing — and advertised it

-

Fashion2 weeks ago

Fashion2 weeks agoEA Sports College Football 26 review – They got us in the first half, not gonna lie

-

Health2 weeks ago

Health2 weeks agoCAREGD Trademark Hits the Streets for Mental Health Month

-

Sports2 weeks ago

Sports2 weeks agoVolleyball Releases 2025 Schedule – Niagara University Athletics

-

Youtube3 weeks ago

Youtube3 weeks agoWill Giannis DEPART Milwaukee⁉️ + How signing Turner & waiving Dame impacts the Bucks | NBA Today

-

Sports2 weeks ago

Sports2 weeks agoNew NCAA historical database provides wealth of information on championships

-

Sports2 weeks ago

Sports2 weeks agoAdapti, Inc. (OTC

-

College Sports2 weeks ago

College Sports2 weeks agoBuford DB Tyriq Green Commits to Georgia

-

Youtube3 weeks ago

Youtube3 weeks agoFREE AGENCY BREAKDOWN 🚨 What moves can the 76ers make? 🤔 | NBA Today

-

Youtube3 weeks ago

Youtube3 weeks agoStephen A. spoke with Deion about Shedeur falling to 5th round 😱 ‘He was devastated’ | First Take