Technology

Yes, you can train your brain to like exercise | FIU News

Even as a lifelong fitness enthusiast, who has personally experienced the myriad benefits of weightlifting and jiu jitsu, Bigliassi is fascinated by the findings.

The first of the team’s tolerance experiments explored the connection between people’s self-reported exercise tolerance and their ability to endure the cold pressor test without moving their hand or making a fist.

Across the board, high-tolerant people endured the discomfort for almost a minute longer than their lower-tolerant counterparts.

This was to be expected, says Dayanne Antonio, a Ph.D. student and teaching assistant in Bigliassi’s lab who helped lead the research. What was more intriguing: The low-tolerant group reported feeling more confident after the test was over.

“It made us wonder: If they put their hand in cold water before exercise, could it influence their experience at high intensities?” says Antonio.

For the follow-up study, recently published in Stress and Health, a group of 34 participants who were minimally active or didn’t exercise at all came to Bigliassi’s lab. They filled out a questionnaire and were told about the two tests, so they knew what to expect.

First came the cold pressor test. Immediately after, they hopped on an indoor bike for an explosive burst of cycling.

Was it absolute torture for them? Surprisingly, not quite. Participants reported the peak intensity as being, well, not so bad and yes, even enjoyable and less painful.

The takeaway isn’t necessarily to start experimenting with cold showers or ice baths (unless that’s something you’re interested in!)

“People will ask me that and I have to tell them, no, that’s not really the idea,” Antonio laughs. “It’s that pushing our limits changes how we perceive stress, discomfort, and pain and is the only way to build up the cognitive abilities that make you mentally resilient enough to deal with whatever comes your way.”

Bigliassi agrees, noting it is necessary to confront challenges, with one caveat.

“You have to match the level of complexity to your current capabilities. The goal isn’t to fail, fail, fail because then you’ll only feel terrible,” he says. “We want you to do hard things that are hard for you. Not anyone else. Only you.”

For example, if you’ve been sedentary for years and walking is difficult for you, don’t start off trying to get 10,000 steps a day. Instead, Bigliassi suggests aiming for shorter distances and gradually working up to longer ones.

To an extent, there may be some truth to that old school motivational exercise motto, ‘no pain, no gain.’ Beyond what’s comfortable, there’s a lot of untapped potential for growth.

“I guess I like to make people stressed,” Bigliassi says. “But it’s because I want them to capitalize on stress, not be afraid of it. If my work helps make someone mentally stronger and more resilient, so they can have a good, long, healthy life, well, that would be amazing.”

Technology

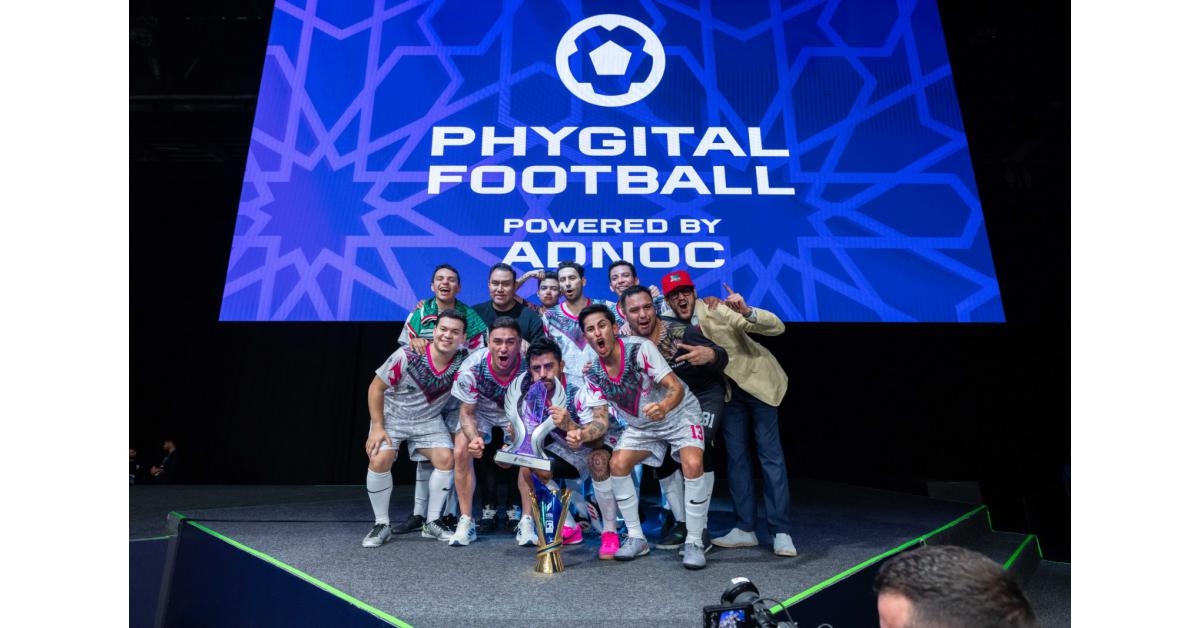

The Games of the Future Abu Dhabi 2025 Closes Landmark Edition, Setting New Benchmark for Phygital Sports

GOTF 1

Concludes GOTF.2

Concludes GOTF .3

ABU DHABI, UNITED ARAB EMIRATES, December 25, 2025 /EINPresswire.com/ — The Games of the Future Abu Dhabi 2025 powered by ADNOC concluded on Tuesday after six days of elite competition, innovation, and global participation, marking a milestone moment in the evolution of phygital sports.

Held under the patronage of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, the landmark event brought together more than 850 participants from over 60 countries and featured 11 disciplines, spanning Phygital Football, Phygital Basketball, esports, Phygital Fighting, Phygital Shooter, Phygital drone racing, and VR Game.HADO. Across arenas, stages, and digital battlegrounds, the event showcased how technology and sport are converging to shape the future of competition.

During the globally-watched event, champions were crowned in each discipline, delivering their own defining moments and reinforcing the unique multi-sport identity of the Games of the Future.

Phygital Football powered by ADNOC and Phygital Basketball.3on3 FreeStyle brought to you by M42 both drew vocal crowds throughout the week, with MÉXICO QUETZALES – ARMADILLOS FC taking the Phygital Football title in a thrilling 2-4 final win over Troncos FC, and LIGA PRO TEAM secured the Phygital Basketball title with a 29-23 victory over Moscowsky. Meanwhile, in Phygital Fighting.FATAL FURY: City of the Wolves, Kuznya finished top of the leaderboard after winning all four of their fights, dominating both on the digital stage and in the octagon, and xGoat won the Phygital Shooter.CS 2 final, beating Dontsu Esports 2-0 in the digital world to avoid the need for a deciding round of physical laser tag.

Tasting glory in the esports-focused disciplines, ONIC won the MOBA Mobile.MLBB final against Aurora Gaming, while the aptly-named teamWin beat Vikings 2-0 in the championship game of MOBA PC.Dota 2, and Kami + Swizzy conquered ZYRO + RAPID in the final of the Battle Royale.Featuring Fortnite. In the Phygital Drone Racing presented by InsuranceMarket.ae, which tasked clubs to complete 50 laps of a testing circuit filled with loops, hoops, and straights, Drone Racing One proved fastest on the final day ahead of Team BDS.

A pair of events taking place in the Atrium at ADNEC Centre drew plenty of attention as Ivan “myakekcya” Vlasov triumphed in the Phygital Dancing.Just Dance final, while Team Rock took the title in VR-game.HADO. Lastly, in Battle of Robots, proving itself one of the most spectacular disciplines of the week, Fierce Roc’s menacing Deep Sea Shark machine annihilated Team Cobalt’s Cobalt in a spectacularly destructive finale.

In parallel with the competitive program, the event week also featured an eye-catching and engaging Opening Ceremony and the inaugural Phygital Sports Summit, reinforcing Abu Dhabi’s position as a global hub for next-generation sport, innovation, and immersive entertainment.

Saif Al Noaimi, CEO of Ethara, reflected on intricacy of the Games: “Delivering an event of this scale and complexity required close coordination across multiple disciplines, venues, and partners. The Games of the Future Abu Dhabi 2025 showcased competitive excellence, but also operational innovation and audience engagement at the highest level. We are proud to have played a role in bringing this landmark event to life and in supporting its growth on the global stage.”

Nis Hatt, CEO of Phygital International, said: “The Games of the Future Abu Dhabi 2025 demonstrated how far this movement has come in a short space of time. What we saw over six days was not just competition, but the emergence of a global ecosystem where sport, esports, technology, and innovation coexist on one stage. Abu Dhabi set a new benchmark for scale, delivery, and ambition, and this edition has reinforced the Games of the Future as a defining platform for next-generation competition worldwide.”

Stephane Timpano, CEO of ASPIRE, added: “Hosting the Games of the Future in Abu Dhabi reflects the UAE’s commitment to shaping the future of sport and innovation. This event brought together athletes, clubs, partners, and audiences from around the world. The success of this edition shows what is possible when vision, technology, and execution align, and it positions Abu Dhabi firmly at the forefront of emerging sport formats.”

The Games of the Future Abu Dhabi 2025 is organized by ASPIRE, the Local Delivery Authority, in collaboration with Ethara, the Event Delivery Partner, and Phygital International, the Global Rights Holder. The event is supported by key partners, including Abu Dhabi Sports Council, ADNOC, EDGE, M42, Solutions+, The Galleria, Abu Dhabi Gaming, du Infra, InsuranceMarket.ae, Ministry of Sports, Advanced Technology Research Council, and ADNEC Group.

Deepra Ahluwalia

Action Global Communications

+971 56 477 0995

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Technology

3D Glasses-Free Gaming Monitors : Samsung Odyssey 3D G90XH

The Samsung Odyssey 3D G90XH gaming monitor features a 165Hz refresh rate that can be boosted to 330Hz in Dual Mode. The monitor is slated to arrive in 2026 and is expected to be a hit amongst avid gamers.

Technology

Stunning Stacked LED Displays : LG Display OLED technology

The Tandem WOLED technology will offer fast response time, high refresh rates, low motion blur, dual modes, enriched color depths and more. The Tandem OLED technology will allow screens to blend more seamlessly into everyday spaces thanks to its natural performance.

The latest LG Display OLED technology comes as part of the company’s rebranding of its screen technology to help usher in a new age for the brand.

Technology

Abu Dhabi to Showcase Its Esports and Motorsports Excellence: Gran Turismo World Series 2026 Kicks Off in the UAE

Published on

December 22, 2025

In a historic first for the Middle East, Abu Dhabi, the vibrant capital of the United Arab Emirates, will host the opening event of the Gran Turismo World Series 2026 on March 28, 2026. This prestigious event will take place at the Space42 Arena, showcasing Abu Dhabi’s growing influence in esports and motorsports. As the world’s most exciting digital racing series kicks off its new season in the heart of the UAE, the city’s status as a global hub for innovation, entertainment, and technology is further solidified.

This announcement was made during the Gran Turismo World Series 2025 Finals held in Fukuoka, Japan, by S.E. Saeed Al Fazari, the Executive Director of Strategic Affairs at the Department of Culture and Tourism – Abu Dhabi (DCT Abu Dhabi), and Kazunori Yamauchi, the producer of the Gran Turismo series. Their collaboration highlights Abu Dhabi’s readiness to host an event that will attract millions of esports fans and motorsport enthusiasts from around the world.

Abu Dhabi: The Perfect Location for the Gran Turismo World Series 2026

Abu Dhabi, already known for its world-class motorsport events such as the Formula 1 Abu Dhabi Grand Prix, is now expanding its footprint in the esports industry by welcoming the Gran Turismo World Series. This high-profile event, which brings together the best virtual drivers from around the globe, will elevate the UAE’s presence in the digital gaming and motorsport communities.

The Gran Turismo World Series: A Global Racing Championship

The Gran Turismo World Series is an annual competition that aims to crown the best Gran Turismo player in the world. The competition begins with online qualifiers, where players from across the globe compete to earn their spots in the live events. The series then moves to major international venues, where the top drivers from each region meet to race for the title. The 2026 series opener in Abu Dhabi will mark a monumental step in the history of the event, as it’s the first time the series has taken place in the Middle East.

Yas Marina Circuit in Gran Turismo 7: A Digital Tribute to Abu Dhabi’s Motorsports Legacy

Adding to the excitement, the Yas Marina Circuit, one of the most iconic motorsport venues in the world, will be featured in Gran Turismo 7. This addition allows players to virtually race on the very track that has hosted the Formula 1 Grand Prix since 2009. With this integration, Gran Turismo 7 connects real-world motorsports with virtual racing, offering players the chance to experience the thrill of Yas Marina from the comfort of their homes.

Key Highlights of the Gran Turismo World Series 2026 in Abu Dhabi

- Event Date: March 28, 2026

- Venue: Space42 Arena, Abu Dhabi, UAE

- Region’s First: This marks the first time the Gran Turismo World Series will take place in the Middle East.

- Key Features: The event will showcase the best virtual drivers, live competitions, and interactive experiences for fans.

- Inclusion of Yas Marina Circuit: The iconic Yas Marina Circuit will be featured in Gran Turismo 7, bringing a unique virtual motorsports experience to players globally.

Abu Dhabi’s Growing Role in Esports and Digital Innovation

Abu Dhabi has rapidly become a global leader in the esports sector, thanks to its investments in cutting-edge technology, entertainment infrastructure, and strategic partnerships. The opening of the Gran Turismo World Series 2026 marks a milestone in Abu Dhabi’s growing presence in the world of competitive gaming and motorsports. The event also supports the UAE’s Vision 2021, which aims to position the country as a leader in innovation, technology, and global partnerships.

The Role of Abu Dhabi Gaming

The event is organized by Abu Dhabi Gaming, an initiative led by the Department of Culture and Tourism – Abu Dhabi. Abu Dhabi Gaming is dedicated to transforming the emirate into a world-class esports and gaming hub, attracting global talent, investors, and partnerships that will help develop and expand the gaming ecosystem. With Gran Turismo World Series 2026, Abu Dhabi continues to build on its reputation as a city that hosts world-class events and provides a platform for esports growth.

Abu Dhabi’s Vision for Esports and Motorsports

S.E. Saeed Al Fazari expressed the importance of this event for both Abu Dhabi and the Middle East. He stated, “Hosting the opening of the Gran Turismo World Series is a moment of pride for Abu Dhabi and the entire MENA region, reflecting our ambition to be a destination with limitless possibilities. This marks a significant step for our esports and motorsport sectors, bringing the world’s elite competitors to the emirate and showcasing Abu Dhabi’s proven capacity to deliver world-class experiences in these fields.”

The Gran Turismo World Series 2026 will also contribute to Abu Dhabi’s broader vision of becoming a global center for innovation, entertainment, gaming, and motorsports. The emirate continues to offer a safe, future-ready environment for businesses, investors, and talent, providing opportunities for growth in emerging industries such as esports.

Kazunori Yamauchi on the Middle East’s Growing Impact on Esports

Kazunori Yamauchi, the producer of the Gran Turismo series, also expressed excitement about this landmark event. He said, “We are excited that Abu Dhabi will host the opening of the Gran Turismo World Series in March 2026, marking the first time the event will be held in the Middle East. This is a historic milestone for our championship and a testament to the region’s growing presence in esports and motorsports worldwide. We are also thrilled that the Yas Marina Circuit is now available in Gran Turismo 7, offering players an authentic experience of one of the world’s most remarkable motorsport venues.”

The Road Ahead: Esports and Abu Dhabi’s Future in the Digital Age

The Gran Turismo World Series will continue to evolve, and Abu Dhabi’s role in the esports and digital gaming industry will only continue to grow. Events like this serve as catalysts for the city’s vision to become a global leader in the sectors of esports, technology, and digital innovation. For Abu Dhabi, hosting the Gran Turismo World Series 2026 is just the beginning of its journey to build an esports ecosystem that connects global talents with world-class facilities.

How to Attend the Gran Turismo World Series 2026 in Abu Dhabi

Tickets for the Gran Turismo World Series 2026 opening event in Abu Dhabi will be available through Ticketmaster at website. Fans from around the world can look forward to witnessing this exciting event live, making it a must-attend for all esports and motorsports enthusiasts.

Technology

PlayStation Market Accelerates Global Gaming Evolution:

Playstation Market

The global PlayStation Market continues to be a cornerstone of the interactive entertainment industry, driven by technological innovation, immersive gameplay, and a rapidly expanding gaming ecosystem. Valued at USD 34.12 billion in 2025, the market is projected to reach USD 54.12 billion by 2035, growing at a steady CAGR of 4.72% between 2024 and 2035. This sustained expansion reflects the increasing popularity of console gaming, digital distribution, and evolving consumer engagement models across the world.

With 2024 as the base year and historical data spanning 2019 to 2024, the market outlook for 2025-2035 highlights long-term stability supported by loyal user bases and continuous innovation. The PlayStation brand has evolved beyond hardware into a comprehensive entertainment platform, integrating online services, exclusive titles, cloud gaming, and virtual reality experiences that redefine modern gaming.

The competitive landscape of the PlayStation Market is highly dynamic and innovation-driven. Sony Interactive Entertainment (JP) remains the dominant force with its PlayStation console ecosystem, while competitors and partners such as Microsoft Corporation (US), Nintendo Co., Ltd. (JP), Electronic Arts Inc. (US), Activision Blizzard, Inc. (US), Take-Two Interactive Software, Inc. (US), Ubisoft Entertainment S.A. (FR), and Bandai Namco Entertainment Inc. (JP) play critical roles in shaping content, technology, and user engagement. These companies compete through exclusive titles, cross-platform compatibility, subscription services, and cutting-edge gaming engines.

“Access Full Report Now” – Gain Comprehensive Insights into the Market with Our Detailed Research Report

https://www.marketresearchfuture.com/reports/playstation-market-22446

One of the most influential growth drivers in the PlayStation Market is the continuous advancement of gaming technology. High-performance consoles, ultra-realistic graphics, faster load times, and enhanced processing capabilities have significantly elevated user experiences. Additionally, the growing popularity of online multiplayer gaming and esports has further strengthened platform engagement, particularly among younger demographics.

Market segmentation reveals a diverse and evolving ecosystem. The market is segmented by platform, game genre, revenue source, age group, gaming style, and region, enabling companies to tailor offerings to specific consumer segments. Action-adventure, role-playing, and sports games continue to dominate demand, while digital downloads, in-game purchases, and subscription-based services generate a growing share of overall revenue.

“Free Sample Copy” – Access A Complimentary Copy of Our Report to Explore Its Content and Insights

https://www.marketresearchfuture.com/sample_request/22446

A key market opportunity lies in the integration of virtual reality (VR) to enhance player immersion. PlayStation VR technologies are reshaping how users interact with games, offering deeper engagement and new gameplay formats. As VR hardware becomes more affordable and content libraries expand, adoption rates are expected to rise, opening new revenue streams and redefining console gaming experiences.

Geographically, the PlayStation Market spans North America, Europe, Asia-Pacific (APAC), South America, and the Middle East & Africa (MEA). North America remains a leading market due to strong console adoption, high disposable income, and a well-established gaming culture. Europe follows closely, supported by a robust player base and strong presence of global publishers. APAC, particularly Japan, South Korea, and emerging Southeast Asian markets, continues to demonstrate rapid growth driven by technological advancements and a digitally native population.

The market is also influenced by shifting consumer preferences toward digital ecosystems. Physical game sales are increasingly replaced by digital downloads, cloud gaming services, and subscription models. This transition not only enhances convenience but also allows companies to maintain continuous engagement with users through regular updates, downloadable content (DLC), and live-service games.

“Proceed To Buy” – Move Forward with Your Purchase and Gain Instant Access to the Complete Report

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22446

Intensifying competition remains a defining market dynamic. Companies are investing heavily in exclusive franchises, strategic acquisitions, and cross-platform compatibility to maintain competitive advantage. Strategic partnerships with game developers and technology providers are also playing a crucial role in expanding content libraries and enhancing user retention.

Another critical trend shaping the market is the growing emphasis on social and community-driven gaming. Features such as live streaming, social sharing, and interactive online communities have transformed gaming into a social experience. This evolution has strengthened brand loyalty and expanded PlayStation’s reach beyond traditional gaming audiences.

The report provides comprehensive coverage, including revenue forecasts, growth drivers, competitive analysis, and emerging trends, offering valuable insights for stakeholders across the gaming ecosystem. As segmentation analysis deepens, opportunities continue to emerge across age groups, gaming styles, and monetization models.

Looking ahead, the PlayStation Market is well-positioned for sustained growth through 2035, supported by innovation, immersive technologies, and evolving consumer expectations. As gaming continues to converge with entertainment, social interaction, and digital lifestyles, PlayStation remains a key force shaping the future of global interactive entertainment.

Discover More Research Reports on Consumer and Retail By Market Research Future:

Residential Food Waste Disposer Market Size, Share, Growth | Report, 2035 – https://www.marketresearchfuture.com/reports/residential-food-waste-disposer-market-37125

Residential Hob Market Size, Trends, Analysis By 2035 – https://www.marketresearchfuture.com/reports/residential-hob-market-37057

Residential Induction Cooktop Market Size, Trends, Growth, 2035 – https://www.marketresearchfuture.com/reports/residential-induction-cooktop-market-41404

Residential Outdoor Gas Fire Pit Market Size, Growth, 2035 – https://www.marketresearchfuture.com/reports/residential-outdoor-gas-fire-pit-market-37242

Residential Outdoor Storage Product Market Size, Share, Outlook, Demand – https://www.marketresearchfuture.com/reports/residential-outdoor-storage-product-market-34934

Contact us:

Market Research Future (part of Wantstats Research and Media Private Limited),

99 Hudson Street,5Th Floor, New York, New York 10013, United States of America

Contact Number:

+1 (855) 661-4441 (US)

+44 1720 412 167 (UK)

+91 2269738890 (APAC)

Email: info@marketresearchfuture.com

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

This release was published on openPR.

Technology

How eSports Is Shaping Competitive Mindsets in Miami and Beyond – Five Reasons Sports Network

The Rise of eSports Culture

In recent years, eSports has surged from niche communities to mainstream entertainment, capturing the attention of fans across Miami and South Florida. Competitive gaming now mirrors traditional sports in intensity, strategy, and fan engagement. Players and spectators alike are drawn to the thrill of high-stakes competition, the precision required in gameplay, and the communal energy that surrounds tournaments and streaming events.

As eSports grows, so does the sophistication of its audience. Fans analyze strategies, follow performance metrics, and engage with personalities just as they do with local sports teams. This analytical mindset is becoming a defining feature of modern competitive culture.

Strategy, Skill, and Community

Successful eSports athletes rely on more than reflexes—they depend on strategy, preparation, and teamwork. Understanding the meta, predicting opponents’ moves, and adapting to real-time scenarios are all crucial skills. Fans develop similar abilities, honing their analytical thinking by following tournaments, studying player performances, and discussing tactics in online communities.

For those looking to explore competitive gaming beyond spectating, platforms like spacehills.nl offer immersive experiences where fans can engage directly with games. These platforms combine accessibility, real-time updates, and strategic challenges, allowing users to test their skills while enjoying the thrill of eSports.

Why Miami Is a Hotspot for eSports Engagement

Miami’s sports culture has always been vibrant, energetic, and fiercely loyal. These traits translate naturally to eSports, where fans are eager to cheer, analyze, and participate. Several factors make the region a prime hub for competitive gaming:

- Diverse audience: A mix of cultural influences contributes to a rich eSports fan base.

- Tech-savvy population: Familiarity with digital platforms and streaming technology facilitates engagement.

- Community-driven events: Local tournaments and fan meetups foster interaction and competition.

- Proximity to international markets: Miami’s global connectivity attracts players and content creators worldwide.

These elements combine to create a thriving ecosystem where both professional and amateur gamers can flourish.

Table: eSports vs Traditional Sports Skills

| Skill | Application in eSports | Application in Traditional Sports |

| Strategic Thinking | Planning moves, predicting opponents | Game strategy, tactical plays |

| Teamwork | Coordinating with teammates online | On-field collaboration and communication |

| Adaptability | Reacting to dynamic in-game scenarios | Adjusting to opponent strategies |

| Focus & Concentration | Multi-tasking, split-second decisions | Maintaining performance under pressure |

| Analytics | Tracking stats, meta trends | Performance metrics, player analytics |

This comparison shows how eSports demands similar cognitive and social skills as traditional sports, further bridging the gap between the two worlds.

Technology Driving eSports Innovation

Platforms and tools have revolutionized the way fans interact with eSports. Live streaming, predictive analytics, and interactive dashboards make gaming more engaging and accessible. Players can study opponent tendencies, track personal performance, and participate in global tournaments—all from their homes.

Key technological features that enhance the experience include:

- Real-time performance tracking and statistics

- Interactive leaderboards and rankings

- Multi-platform streaming for convenience

- Gamification elements such as achievements and badges

- Community forums and chat integration

These innovations keep fans invested, ensuring that competitive gaming continues to grow at a rapid pace.

The Psychology of Competitive Play

Just as sports fans experience adrenaline and anticipation during live events, eSports participants experience similar psychological engagement. Competitive gaming taps into natural drives for achievement, mastery, and social recognition.

- Adrenaline and excitement: High-stakes matches create intense emotional investment.

- Skill development: Continuous improvement fosters personal growth.

- Community recognition: Rankings, leaderboards, and tournaments provide status and validation.

- Strategic satisfaction: Applying analytical thinking to achieve victory delivers mental rewards.

Platforms like spacehills.nl leverage these psychological aspects to create compelling experiences that resonate with both casual and dedicated players.

Bridging Sports Fandom and eSports Participation

Miami’s sports enthusiasts are naturally inclined to embrace eSports. Their experience following teams, analyzing plays, and engaging with communities translates seamlessly into competitive gaming. The crossover between sports fandom and gaming participation represents a new frontier for entertainment, blending strategy, skill, and social engagement.

Fans now have the opportunity to expand their competitive horizons, applying knowledge of traditional sports to virtual arenas where skill, adaptability, and teamwork are just as critical.

Building a Thriving Digital Ecosystem

The success of platforms like spacehills.nl demonstrates the potential for digital gaming to capture fan engagement on multiple levels. By providing accessible, interactive, and strategic experiences, these platforms create spaces where community, competition, and technology intersect.

Miami’s unique sports culture—energetic, analytical, and community-focused—positions it as a natural hub for this type of digital innovation. Fans are not merely spectators; they are active participants, shaping the eSports landscape through engagement, analysis, and competition.

The growth of competitive gaming highlights a cultural shift where traditional sports enthusiasm merges with digital innovation, creating new arenas for interaction, learning, and excitement.

-

Motorsports2 weeks ago

Motorsports2 weeks agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Motorsports2 weeks ago

Motorsports2 weeks agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoDavid Blitzer, Harris Blitzer Sports & Entertainment

-

Motorsports3 weeks ago

Motorsports3 weeks agoJR Motorsports Confirms Death Of NASCAR Veteran Michael Annett At Age 39

-

Sports3 weeks ago

Elliot and Thuotte Highlight Men’s Indoor Track and Field Season Opener

-

Sports3 weeks ago

West Fargo volleyball coach Kelsey Titus resigns after four seasons – InForum

-

Motorsports2 weeks ago

Motorsports2 weeks agoRick Ware Racing switching to Chevrolet for 2026

-

NIL2 weeks ago

NIL2 weeks agoDeSantis Talks College Football, Calls for Reforms to NIL and Transfer Portal · The Floridian

-

Sports3 weeks ago

Sports3 weeks agoTemple Begins Indoor Track & Field Season at UPenn This Weekend