Rec Sports

Youth Sports Was 2025’s Breakout M&A Theme. Here’s What’s Next

Today’s guest columnist is Chris Russo, CEO of Fifth Generation Sports.

In the world of sports mergers and acquisitions, 2025 was the year of youth sports. What had long been a fragmented, passion-driven corner of the sports economy became one of the most active segments for investors and strategic acquirers.

Numerous acquisitions closed across software, events, media and facility operations. Many private equity firms, some of which had never made sports-related investments, “discovered” youth sports as a scalable, high growth opportunity.

The result was a surge of deal volume, valuations and heightened competition for quality assets. But the youth sports boom was not a one-year anomaly. It’s become one of the hottest M&A categories, driven by structural factors that continue to reshape the industry:

1. Scale of the market

Youth sports is now a $40+ billion economic engine, including registration fees, equipment and uniforms, travel and lodging, and lessons and instruction, among other expenditures charted by the Aspen Institute. These products and services are targeted to approximately 27 million kids aged 6-17 who play organized sports in the U.S. The sheer size of this total addressable market (TAM) makes it an attractive sector for acquirers.

2. Extreme fragmentation across verticals

Youth sports remains extraordinarily fragmented with thousands of independent clubs, hundreds of regional tournament operators, dozens of niche software or video-analysis providers, and event companies with highly localized or sports specific reach. But beyond simple fragmentation, many of these operators are historically “mom and pop” run without standardized operations or scalable infrastructure. For private equity, this represents a double opportunity, for roll-up synergies (shared services, procurement, marketing, cross-selling, branding) and professionalization upside (opportunity to enhance margins and performance once modern systems and management discipline are introduced). Buyers recognize that even modest consolidation may create meaningful value when replicated across dozens or hundreds of locations or events.

3. Parent spending and the emergence of NIL

Youth sports spending has long been resilient as families prioritize team fees, tournament travel, private coaching and club participation over many other expenses. But in recent years, the rise of NIL has raised the stakes and accelerated this trend, helping to drive a 46% increase in average family spending on each child’s primary sport since 2019, according to the Aspen Institute. The ability for college athletes to earn name, image and likeness (NIL) income has fundamentally changed the psychology of many parents. While only a small percentage of athletes will ever play in college, a much larger percentage of families believe they might, or at minimum, believe their child has a shot at scholarship or NIL-related opportunities. This belief system—whether realistic or aspirational—has driven even greater investment in club teams and travel tournaments, showcases, personal training, recruiting platforms and video analysis.

4. Development of new products and services

The past five years have seen an explosion in new monetizable products and services that have expanded the youth-sports wallet. COVID accelerated video streaming, enabling live event subscription, remote instruction and enhanced digital recruiting. Technology and AI are now transforming performance and training, including AI-driven highlights, player tracking, advanced analytics and data aggregation, and biometric tools. These tech and software innovations have also created new recurring-revenue business models that may scale more efficiently than clubs or facilities. Some investors see this as a structural tailwind that will last for years.

5. Entrance of respected investors and buyers

Perhaps the most important accelerant in 2025 was the entry of highly credible investors—PE firms, family offices, pro-team owners and sports-focused funds—who validated the category. This process had actually begun a few years earlier in 2022 when KKR invested in PlayOn. Then in 2024 and 2025, Josh Harris and David Blitzer—owners of the Philadelphia 76ers, New Jersey Devils and other pro sports properties—publicly and aggressively entered youth sports through the creation of Unrivaled Sports.

The Harris Blitzer initiative was featured in a widely circulated New York Times article published in July, a watershed moment for the industry. The piece validated youth sports as a legitimate, investable asset class, signaled that major sports owners were now committed to the sector, and inspired a wave of new entrants (family offices, PE and institutional capital).

As the youth sports investment wave matures, investors and operators will be focused on three defining questions:

1. Are there enough scaled assets?

The biggest constraint in youth sports has always been a lack of scaled properties to sustain deal momentum. Many clubs, events and platforms are sub-$5M EBITDA businesses, and a question remains as to whether there are enough $5M+ EBITDA assets to keep institutional buyers active.

2. Will robust valuations continue?

2025 saw elevated multiples for top-tier assets, driven in part by competition from first-time PE entrants. The sustainability of valuations in 2026 may hinge on supply/demand imbalances for quality companies, platform performance and integration success of recently completed deals, and overall economic factors (e.g. interest rate trends and the cost of debt).

3. Which sectors will attract the most investment and buyer interest?

Several youth sports verticals appear best positioned for 2026 activity, including facilities, events, video streaming and software products, especially for performance and training. However, there is also the possibility that other categories (e.g., e-commerce or traditional categories such as equipment and apparel) could emerge as high growth opportunities over the next 12 months.

This much is clear. The youth sports boom of 2025 was not a temporary spike—it was the formal institutionalization of an asset class long overlooked. Structural drivers remain intact, respected investors are now committed, and an emerging ecosystem of scaled operators is taking shape. The next year will test whether the sector can keep pace, but many indicators suggest youth sports could remain one of the most dynamic and investable categories within the sports economy for years to come.

Chris Russo is CEO of Fifth Generation Sports, a boutique advisory firm focused on middle market sports transactions. He advised SportsRecruits and Big Teams on the deals listed above. Previously, Russo served as a managing director at Houlihan Lokey, and before his tenure in investment banking, he managed the NFL’s digital media group. Russo holds a B.A. from Northwestern University and an MBA from the Harvard Business School.

Rec Sports

Marana Youth Thunder 12U Team Claims AYF Division 3 National Championship

NAPLES, Florida — The Marana Youth Thunder 12-and-under football team has achieved the pinnacle of youth football success, capturing the Division 3 National Championship in the American Youth Football (AYF) tournament.

The thrilling championship game, held in Naples, Florida, saw the Thunder dominate the Woodbridge Raiders from Delaware with a convincing 40-19 victory. This win marked sweet redemption for the team, as they had previously lost to the same Raiders squad in double overtime the year before, finishing in third place nationally.

Leading the charge was standout player Princeton Britt, who earned the prestigious Most Valuable Player (MVP) award for his exceptional performance throughout the tournament.Guiding the team from the sidelines was head coach Philip Britt, Princeton’s father, adding a special family touch to this historic accomplishment.

This group of young athletes has been a force in recent years, securing an impressive five consecutive city championships along with two regional titles. The national championship represents the breakthrough moment, capping off years of hard work and dedication.

The victory highlights the strength of youth sports programs in Marana and serves as an inspiration for young athletes across the region. Congratulations to the Marana Youth Thunder on their well-deserved national title!

Rec Sports

New youth grants awarded by the Youth Advisory Council | News, Sports, Jobs

Courtesy photo

Members of the Youth Advisory Council for the Community Foundation for Northeast Michigan pose for a photo. The council allocates money for youth related projects in the region.

ALPENA — Education, arts programs, sports programs, mental health and human services programs are just some of the areas touched by the most recent round of youth grants totaling $22,141.75. Youth Advisory Council grants covering a four-county area of Alcona, Alpena, Montmorency, and Presque Isle Counties include:

– $1,450 to Alcona Community Schools to offer cultural enrichment through field trips, cultural exchanges, and community events for the Alcona High School French Club; to help start the Alcona High School Theatre Club; and to purchase supplies that would help in educating students about distracted driving.

– $500 to Future Farmers of America and its State Association and Local Chapter to provide winter gear for students of Alcona Community Schools.

– $500 to K’Lorne Acres to build a sheltered pavilion for equine therapy students.

– $1,500 to Matrix Community Ministries to host a basketball tournament for community-based recreation for the youth in Alcona and surrounding counties.

– $1,991.75 to Alpena Gymnastics to bring Pied Piper students to the gymnastics center for open gym exercise and fun.

– $2,000 to Ana’s Treasures to provide essentials for foster children and families.

– $2,000 to the Boys and Girls Club of Alpena to help teens build positive peer connections, learn healthy decision-making skills, and enjoy activities that foster life and career development.

– $2,000 to Rayola to purchase care package supplies for foster kids (pictured above).

– $2,500 to Thunder Bay Transportation Authority to transport youth to summer programs at the Boys & Girls Club.

– $700 to Alpena Montmorency Alcona Educational Service District to provide supplies for therapeutic groups for Hillman students in the summer months.

– $1,500 to Atlanta Community Schools to purchase supplies to help grow the new wrestling program.

– $1,500 to NEMCSA to purchase supplies for hygiene kits and tools that would teach students how to maintain good health.

– $2,500 to Michigan Works! Northeast Consortium to purchase supplies for practical care items that promote mental health, stress relief, and personal well-being.

– $1,500 to Posen Consolidated Schools to fund the Students Against Destructive Decisions assembly and after-hours event.

The next opportunity for grants is through the CFNEM Community Impact Grants and the next cycle of the NEMYAC Grants. Applications for both grant opportunities are due on January 15, 2026.

Rec Sports

Trump announces ‘Patriot Games,’ a youth athletic competition celebrating United States’ 250th birthday

President Donald Trump announced Thursday the White House will host the “Patriot Games,” a competition with young athletes from across the county, as part of the celebration of the United States’ 250th anniversary next year.

“In the fall, we will host the first ever Patriot Games, an unprecedented four-day athletic event featuring the greatest high school athletes — one young man and one young woman from each state and territory,” Trump said.

Democrats have mocked the athletic competition online, comparing it to “The Hunger Games,” a dystopian young adult novel and popular movie franchise in which children are forced to fight to the death in televised arenas.

The president revealed the plans for the Patriot Games in a video announcement from Freedom 250, which was launched Thursday. It is a “a national, non-partisan organization leading the Administration’s celebration of America’s 250th birthday,” according to a news release.

Trump previously previewed the competition in July, saying at the time it would be televised and led by Health and Human Services Secretary Robert F. Kennedy.

During the video, Trump also highlighted his plans to begin construction soon on a new arch monument in the nation’s capital.

“We are the only major place without a triumphal arc. A beautiful triumphal arc, one like in Paris, where they have the great, a beautiful arc. They call it the Arc de Triomphe, and we’re going to have one in Washington, DC, very soon,” Trump said.

A UFC fight on the South Lawn is another of Trump’s ideas for the 250th celebration and will take place on his birthday, June 14.

“On Flag Day, we will have a one-of-a-kind UFC event here at the White House. It’ll be the greatest champion fighters in the world, all fighting that same night. The great Dana White is hosting, and it’s going to be something special,” Trump said.

Trump has long touted his desire to shape the nation’s 250th celebrations. In the past year, the Trump administration has moved quickly to align federal funding with the president’s anniversary priorities, and agencies have followed suit.

The Department of Agriculture, for instance, has embraced the president’s Great American State Fair initiative. The idea was first floated by Trump on the campaign trail in 2023, and it asks states to compete to have their fair chosen by Trump as the “most patriotic.”

Meanwhile, the White House is conducting a sweeping review of the Smithsonian Institution and has demanded the 250th content at the nation’s largest museum complex renews national pride.

This story has been updated with additional details.

CNN’s Piper Hudspeth Blackburn contributed to this report.

For more CNN news and newsletters create an account at CNN.com

Rec Sports

Youth Sports Business in 2025: The Year the Industry Grew Up

Key Themes That Defined 2025:

• The M&A Avalanche: Private equity poured billions into youth sports with landmark deals including KKR’s $4.8B Varsity Brands acquisition, marking the formal institutionalization of the sector as an asset class

• AI Goes Mainstream: Automated production technology processed 1.5 million games while AI-powered coaching, registration, and content creation became standard operating infrastructure

• Brands Discover Youth Sports: Corporate America expanded beyond traditional sports apparel with telecoms, insurance, automotive, and CPG brands investing millions in partnerships targeting engaged families

• The Affordability Crisis Reaches Congress: Federal lawmakers held hearings on youth sports access as family costs hit $1,016 per child annually, up 46% since 2019

• Women’s Sports Investment Surge: Michele Kang’s $55M commitment, Title IX’s impact reaching 3M+ additional opportunities, and girls flag football’s Olympic pathway reshaped participation

• Safety Becomes Federal Priority: Proposed concussion legislation, MLB’s Amateur Recovery Period, and NFL youth protocols signal regulatory intervention in player health

• Infrastructure Boom Continues: Communities invested hundreds of millions in facilities from Davis County’s $70M complex to Fort Worth’s $82M build-out plan

This year-end analysis draws from YSBR’s coverage of more than 750 stories published throughout 2025, spanning M&A transactions, technology launches, policy developments, facility openings, partnership announcements, and industry trends. We reviewed every major story we covered to identify recurring themes, tracked the biggest deals and announcements, and synthesized patterns that defined the year.

We also incorporated external research including the Aspen Institute’s State of Play 2025 report, congressional testimony on youth sports access, and industry analysis from Sportico and Stout. The result is a comprehensive view of how youth sports evolved from a fragmented, passion-driven sector into a recognized industry with institutional backing, federal scrutiny, and professional infrastructure

2025 was the year youth sports transitioned from fragmented local operations to a recognized, investable industry with institutional backing, federal scrutiny, and professional infrastructure. What Sportico correctly identified as “2025’s Breakout M&A Theme” represented something larger: the entire ecosystem maturing simultaneously across technology, finance, policy, safety, and access.

The numbers tell the story. Participation recovered to 55.4%, the highest rate since pre-COVID. But that growth came with a 46% cost increase since 2019, creating a two-tier system where affluent families spend $3,000+ annually while working-class participation drops. Private equity deployed billions. Technology automated production at scale. Congress held hearings. The contradictions were impossible to ignore.

Private Equity’s Billion-Dollar Bet: M&A Reaches Critical Mass

The deal volume in 2025 validated what insiders had suspected for years: youth sports had become too big, too profitable, and too scalable for institutional capital to ignore.

The Landmark Transactions:

KKR acquired Varsity Brands for $4.8 billion, marking the company’s fourth private equity transition since 2010. CEO Adam Blumenfeld, who survived all four ownership changes, told us the company would likely go public “within the next few years” as it outgrows private market buyers. With $3B in annual revenue and $400M EBITDA serving 55 million youth athletes, Varsity’s scale demonstrated how consolidation creates platforms too large for even the largest PE buyers.

But the M&A activity extended far beyond Varsity. Scorability acquired Ryzer, combining recruiting technology with the largest camp management platform serving 4,000+ college programs. Hudl acquired SportContract to strengthen its hockey ecosystem. Volo Sports merged with ZogSports to create the largest recreational sports network. PlayHQ was acquired by Alpine Software Group, bringing Australian sports technology into a U.S.-based PE portfolio.

The pattern was unmistakable: fragmented, locally-operated businesses were being rolled up into national platforms with professional management, technology infrastructure, and growth capital.

Growth Equity Validates Independent Players:

Not every deal involved acquisition. Sprocket Sports raised a Series A from Frontier Growth while maintaining founder control, positioning itself as “the only independent, founder-led modern club management software provider” as competitors sold to larger platforms. TeamLinkt raised $8.3M CAD to scale its free platform model across North America, challenging subscription-based competitors.

These investments signaled that multiple business models could attract institutional capital, not just roll-up consolidation strategies.

via Sportico

Why Now?

A $40B+ market, extreme fragmentation, resilient parent spending amplified by NIL psychology, new monetizable products (streaming, AI analytics, recruiting platforms), and, critically, the entrance of respected investors who validated the category.

Josh Harris and David Blitzer’s creation of Unrivaled Sports, featured in The New York Times in July, served as the watershed moment. When billionaire pro-team owners publicly commit to youth sports, it signals to other institutional investors that the opportunity is real, the market is maturing, and the timing is right.

As one PE partner told Sportico: “If we didn’t see the potential to at least double to triple the size of this business, then the investment would not have been for us.” That’s the language of institutional capital entering a growth stage. And 2025 was the year it happened at scale.

Technology Becomes Infrastructure: AI, Automation, and the Production Revolution

Technology in youth sports moved beyond pilot programs and early adopter experiments in 2025. It became essential operating infrastructure.

Automated Production Reaches Industrial Scale:

Pixellot processed 1.5 million games in 2025 across 14 sports, streaming live events with AI-powered cameras that required minimal human intervention. The company raised $35M as new CEO Doron Gerstel described a shift to “AI as a Service” models where Pixellot aligns revenue directly with partners’ success rather than selling traditional software licenses.

In our conversation with Pixellot’s Rob DeSlavo, he explained the competitive advantage of scale: processing 150,000+ monthly events creates a learning loop where the AI gets smarter with every game. That’s not just technology. That’s a sustainable moat.

GameChanger partnered with Pixellot to bring fixed AI cameras to recreational baseball and softball fields, doubling viewership across 32 leagues in pilot testing. Parents and coaches scan QR codes to activate cameras, which automatically start streams and alert team followers. The integration eliminates phone-based streaming while maintaining GameChanger’s ecosystem.

Professional-quality production that once cost thousands per game now runs automatically at fields serving house leagues and travel teams.

AI Becomes Operational Standard:

TeamLinkt launched Emi, an AI assistant that creates registration forms, schedules, rosters, automated communications, and web content. Sprocket Sports, Scorability, and other platforms integrated AI-powered features that reduce administrative burden on volunteer-run organizations.

The shift wasn’t about adding AI as a feature. It was about using AI to make essential operations (registration, scheduling, communication) faster, cheaper, and more accessible to organizations without professional staff.

The Technology Stack Consolidates:

Hudl’s acquisition of SportContract demonstrated how leading platforms are building complete ecosystems. Rather than point solutions for video or statistics, the industry is moving toward integrated platforms that handle capture, analysis, sharing, recruiting, and communication in unified systems.

For brands, this consolidation creates new advertising opportunities. Our analysis of Hudl’s partnership with T-Mobile showed how brands can reach millions of engaged families through homepage placements (+195% CTR) and livestream integrations (12x benchmark performance).

Technology enables content at scale, content attracts audience, audience attracts brands, brand revenue funds more technology.

Brands Discover Youth Sports: From Telecoms to Hydration

Corporate America dramatically expanded its presence in youth sports in 2025, moving beyond traditional sports apparel companies to include telecoms, insurance providers, automotive manufacturers, and consumer packaged goods brands.

Technology and Telecommunications Lead Investment:

T-Mobile partnered with Hudl to expand their Friday Night 5G Lights initiative to twice as many markets, transforming traditional sponsorship into a cultural movement celebrating high school football in small-town America. The partnership leveraged real-time content creation, community activation, and livestream innovation to showcase T-Mobile’s 5G network while targeting a 32% increase in school participation across underserved rural markets.

The approach delivered measurable results through Hudl’s platform. Homepage placements achieved +195% click-through rates, while livestream video placements performed 12x above benchmark averages. The partnership demonstrated how brands could reach millions of engaged families through youth sports technology infrastructure rather than traditional media buys.

Financial Services and Insurance Enter the Space:

New York Life served as presenting sponsor of the Little League Community Heroes program for the second consecutive year while expanding soccer partnerships through the USWNT’s SheBelieves Cup and presenting sponsorship of the US Youth Soccer Championships. The insurance company’s multi-sport approach focused on community recognition and youth development.

Bank of America committed to youth sports through multiple initiatives including “Golf with Us” (partnering with Youth on Course) and “Soccer with Us” programs. As FIFA’s first global banking sponsor, Bank of America positioned youth sports access as core to their community impact strategy.

Automotive Manufacturers Fund Scholarships:

Toyota invested in more than 300,000 NFL FLAG youth football scholarships through a network of 700+ dealers who donate $3 million annually to cover player registration fees, provide jerseys and equipment, throw kickoff celebrations, and provide sideline tents. The company hosted the Toyota Glow Up Classic flag football event featuring players in glowing jerseys under blacklights, with proceeds funding permanent field lighting for youth facilities.

Military Recruitment Through Grassroots Basketball:

Army National Guard partnered with MADE Hoops, one of the world’s largest grassroots basketball organizations serving over 85,000 athletes. The collaboration provided custom touchpoints across onsite events, bespoke social content, and new intellectual property while launching the inaugural LDRSHIP Award recognizing high school players who exemplify commitment to philanthropy and community impact.

Consumer Brands Target Family Decision Makers:

Downy Rinse partnered with NFL FLAG as the official laundry partner of the youth flag football league serving athletes ages 5-17, positioning its odor-fighting fabric rinse as the solution for youth sports uniforms and gear.

Dairy MAX renewed its Hudl partnership through 2026, expanding the Built w/Chocolate Milk campaign targeting Gen Z athletes in the western U.S. through display ads, rich media, livestream video, and athlete highlight placements across Hudl’s platform reaching 5 million athletes and 100 million fans.

Traditional Sports Brands Expand Youth Focus:

Nike continued its Community Impact Fund investments ($149 million in FY22) focusing on women, girls, and the Black Community Commitment with partnerships across 100+ community organizations. The company’s Phenom America camp series and support for youth leagues demonstrated sustained commitment beyond professional athlete endorsements.

Gatorade maintained its youth sports presence through the Player of the Year program, Youth Partnerships providing product donations, and campaigns like #SistersinSweat focused on keeping girls in sports longer. The brand positioned itself as a partner in the athletic journey rather than just a sponsor of events.

DICK’S Sporting Goods continued its Sports Matter program providing grants to youth sports programs facing financial challenges while partnering with Youth on Course to expand access nationwide through $5 simulator rentals at 110+ Golf Galaxy locations and DICK’S House of Sport venues.

Under Armour’s “More Than Just a Game” initiative aimed to create opportunities for millions of young athletes by 2030, sponsoring the All-America Game showcasing top high school football players while providing uniforms, footwear, and training gear.

Adidas maintained its Little League World Series partnership (since 2019), providing uniforms, footwear, and equipment to participating teams while promoting values of teamwork, sportsmanship, and perseverance.

Emerging Brand Categories:

Target committed $14 million to youth soccer through an $8 million local soccer grant program and $6 million partnership with the U.S. Soccer Foundation.

Dove partnered with Nike for the #KeepHerConfident initiative addressing body confidence issues that contribute to girls dropping out of sports.

GEICO, Amazon, Pizza Hut all activate at the City of Palms Classic Basketball Tournament.

The Strategic Shift:

The brand investment wave reflected recognition that youth sports provide access to highly engaged families making household purchasing decisions. According to research, youth sports sponsorships drove 3x higher engagement among 18-34 year-olds compared to older demographics, with 75% of Gen Z consumers saying they’re more likely to support brands aligned with their values.

For brands, youth sports offered something professional sports couldn’t: direct community connection, authentic grassroots engagement, and association with positive youth development rather than entertainment. The shift from logo placement to integrated partnerships demonstrated maturation in how corporate America approaches the space.

The Affordability Crisis Goes to Washington: Access, Equity, and Federal Intervention

While participation hit record highs, the cost crisis reached a breaking point that attracted Congressional attention.

The Numbers Behind the Crisis:

The Aspen Institute’s State of Play 2025 report documented what families already knew: youth sports costs increased 46% since 2019 to average $1,016 per child annually for their primary sport. But averages mask the reality. Families spending $3,000+ annually on elite programs exist alongside families completely priced out of participation.

The gap is widening. Youth from families earning $100K+ participate at 65%, while those from families earning under $25K participate at just 37%. That 28-point gap represents millions of kids for whom sports remain inaccessible despite the documented benefits for academic achievement, leadership development, and long-term economic outcomes.

Congress Examines the Crisis:

In December, the House Early Childhood, Elementary, and Secondary Education Subcommittee held a hearing titled “Benched: The Crisis in American Youth Sports and Its Cost to Our Future.” Chairman Kevin Kiley and witnesses from USA Climbing, PHIT America, and the Aspen Institute’s Project Play testified about declining participation among low-income families.

Senator Chris Murphy highlighted private equity’s role in rising costs, specifically citing PE-owned hockey rinks that charge families streaming fees. “I was told if I livestreamed my child’s hockey game, my kid’s team will be penalized,” Murphy said, pointing to policies that prioritize facility revenue over family access.

Representative Josh Gottheimer introduced the PLAY Act, proposing $2,000 tax credits for youth sports expenses. The bill represents federal acknowledgment that youth sports costs have become a barrier to participation that requires policy intervention.

Private Funding Steps In:

While federal solutions moved slowly, private capital addressed gaps directly. LA84 Foundation distributed $1.78M to 19 Southern California programs serving 4,400+ youth, specifically eliminating barriers like registration fees, transportation costs, and equipment expenses.

Canada Basketball’s UNIFIED Assist Program distributed $500K+ to 40+ organizations since 2023, prioritizing programs serving girls and women in underserved regions.

Michele Kang committed $55M to women’s sports research and youth programs, including the first nationwide study on female athlete needs and the creation of the Kang Women’s Institute with U.S. Soccer.

GoFundMe reported $250M raised for sports since 2010, including $37M for youth programs. The platform’s partnership with YSBR to launch The Inaugural Youth Sports Awards awards and Feel Good Friday series demonstrated how crowdfunding fills gaps that traditional funding sources miss.

Corporate Partnerships Create Access:

Golf Galaxy and DICK’S House of Sport partnered with Youth on Course to expand access nationwide. Following a 25-store pilot that generated 2,000+ simulator rental hours, the partnership rolled out to all 110+ Golf Galaxy locations and the expanding DICK’S House of Sport network (projected at 35 locations).

Youth on Course members now receive $5 simulator rentals (down from standard rates), one complimentary lesson from PGA Teaching Professionals, and access to special in-store events. Members create DICK’S Scorecard accounts and book through Game Time Booking to redeem benefits.

“By providing access to instruction and indoor facilities, we’re removing another barrier and ensuring that every young person, regardless of background, can continue building their skills,” said Michael Lowe, Head of Impact at Youth on Course.

The partnership addresses year-round access challenges, particularly in regions where weather limits outdoor play. It represents a corporate infrastructure solution to affordability by using existing retail footprints to subsidize youth access rather than building new facilities.

The pattern was consistent: where public systems and market forces fail to provide access, philanthropic capital, grassroots fundraising, and corporate partnerships step in. But the scale of need far exceeds the available resources.

Women’s Sports Investment Accelerates: Equity Meets Opportunity

2025 marked a turning point for women’s sports investment, driven by both equity imperatives and market opportunity.

The Investment Thesis:

The Women’s Sports Foundation released data showing that 71% of women who played youth sports later achieved leadership positions as managers, directors, or executives. The ROI case was clear: youth sports participation translates directly to workforce leadership.

But coaching opportunities for women declined even as participation surged. Female coaches held 90% of women’s collegiate coaching positions in 1971. By 2025, that figure dropped to 42%. The pipeline for women in sports leadership was broken despite growing athlete participation.

Major Capital Commitments:

Michele Kang’s $55M investment represented the largest private commitment specifically targeting female athlete research and development. The initiative included $30M for youth programs, launching the Kang Women’s Institute with U.S. Soccer to conduct the first nationwide study on female athlete needs, particularly around the critical age-12 dropout point when girls leave sports at alarming rates during puberty.

USWNT coach Emma Hayes framed the challenge: “It’s not as simple as just going to the field with an extra tampon… How might we support them when body image plays such an important part in their own self-confidence?”

Only 6% of global sports science research focuses on women. Kang’s investment aims to change that by developing evidence-based frameworks for coaching, health protocols, and retention strategies.

Participation Trends:

Girls flag football emerged as the fastest-growing high school sport, growing 14% while baseball declined 19%. The sport’s addition to the 2028 LA Olympics created both visibility and legitimacy.

Oakley expanded its Icon Alliance tournament to 16 teams with games at NFL facilities and broadcast coverage. The brand’s VP Corey Hill told us youth engagement with Oakley increased double digits over three years, with measurable sales growth in flag-specific products.

Volleyball participation dwarfed other sports. Marcus Spears, ESPN NFL analyst, noted you can find 6,000 girls at volleyball tournaments versus 800 at comparable basketball events. That 7.5x participation gap explains why pro athletes’ daughters increasingly choose volleyball. Carter Booth (Calvin Booth), Riley Curry (Steph Curry), Zhuri James (LeBron James) all play volleyball rather than their fathers’ sports.

League One Volleyball (LOVB) announced its ninth franchise in San Francisco with a women-led ownership group of 20+ Olympic medalists, entrepreneurs, and Bay Area executives. The league’s youth-first model spans 92+ clubs with 30,000+ athletes, creating a pipeline from grassroots to professional competition.

Safety Becomes Federal Priority: From Concussions to Coaching Standards

Player safety moved from organizational best practices to proposed federal mandates in 2025.

Concussion Legislation:

Senators Dick Durbin and Representative Mark DeSaulnier introduced the Protecting Student Athletes from Concussions Act, requiring states to adopt “when in doubt, sit it out” policies. The bill would prohibit same-day return to play for any athlete suspected of concussion, requiring medical clearance before resuming participation.

The timing reflected growing concern over youth concussion rates. The National Federation of State High School Associations reported 254,126 students sustained concussions across nine high school sports in 2023-24 alone.

The legislation received unprecedented support from all major professional leagues (NFL, NBA, MLB, NHL, NWSL, PWHL, WNBA, U.S. Soccer), the NCAA, medical associations, and youth organizations. This coalition demonstrated industry-wide consensus around concussion protocols.

Research Validates Policy:

New research presented at the American Academy of Orthopaedic Surgeons meeting showed a 25.6% relative risk reduction in soccer-related concussions following the U.S. Soccer Federation’s header restriction policy. The study validated the effectiveness of age-appropriate restrictions while highlighting persistent gender disparities. Female players experienced 9.6% concussion rates compared to 6.2% for males.

MLB Creates Amateur Recovery Period:

Major League Baseball prohibited professional scouting of amateur players during designated rest periods, creating a mandatory Amateur Recovery Period of three months for high school players (October-January) and two months for college players.

Dr. Gary Green, MLB Medical Director, explained the rationale: “Young pitchers are foregoing periods of rest and recovery in order to ‘max-out’ at showcase events.” The policy removes evaluation pressure during peak rest months, directly addressing dramatic increases in pitcher injuries from year-round showcase culture.

Coaching Standards Consolidate:

Pop Warner and USA Football extended their partnership, requiring all Pop Warner tackle and flag coaches to complete USA Football’s Youth Coach Course. With 1.3M+ course completions since 2012, the standardized curriculum now satisfies Coach Safely Act requirements in Alabama and Arkansas.

The partnership demonstrates how two influential organizations are aligning standards rather than competing frameworks, creating consistency for coaches working across different leagues and levels.

Infrastructure Investment Accelerates: Facilities as Economic Development

Communities invested hundreds of millions in youth sports facilities in 2025, viewing them as economic development tools rather than recreational amenities.

Major Projects:

Davis County, Utah opened the $70M Western Sports Park, transforming a former Olympics venue into a 55-acre complex with six soccer fields and 120,000 square feet of indoor space. Tourism tax dollars funded the project, targeting traveling tournament teams with strategic Wasatch Front location and airport proximity.

Fort Worth proposed an $82M investment over 12 years, including a new baseball/softball complex with 8+ fields eyed for 2030 bond funding. City officials acknowledged the capacity problem: the Cowtown Classic tournament draws 300+ teams but turns away more due to field shortages. Youth play soccer at one-third the rate of neighboring Frisco (5% vs 15%).

Multiple communities followed similar patterns: Gig Harbor ($90-120M facility), Hillsborough County (indoor facility design funded by BP settlement), Kuna (facility planning), and dozens of others. The common thread was positioning facilities as regional hubs that capture sports tourism dollars rather than just serving local recreation needs.

The Economic Argument:

The 2022 youth-centered sports tourism market was valued at $91B nationally. When families travel for tournaments, they spend on hotels, restaurants, fuel, retail, and entertainment. Communities increasingly view facility investment as a strategy to capture these dollars locally rather than watching them flow to neighboring jurisdictions with better infrastructure.

Ken Hagan, Hillsborough County Commissioner, noted the personal impact: “After nine years of my daughter playing travel softball, I felt it in the pocketbook.” Keeping those dollars local through facility development represents significant economic opportunity.

Funding Creativity:

Communities demonstrated creativity in financing: hospital benefit zones (Gig Harbor), oil spill settlements (Hillsborough), tourism development taxes (multiple projects), and corporate sponsorships (expected to fund most of True Gritt Sports’ $90-120M project).

LakePoint Sports announced a five-year soccer growth initiative timed around the 2026 FIFA World Cup, leveraging its 1,300-acre campus with 11 outdoor soccer fields and 12 indoor futsal courts. The timing reflects strategic alignment with major events to drive programming and facility utilization.

The Academy Model Gets an NGB Partner:

Masters Academy International (MAI) announced plans for an $83.8 million redevelopment of an 82-acre campus in Stow, Massachusetts. The site, formerly Bose Corporation’s headquarters, will become a private sports academy serving 600+ student-athletes. Designed to rival IMG Academy, the project secured $2.85 million in state tax credits and will create 190 jobs.

But the real story broke when USA Fencing signed a multi-year deal making MAI the home of its Olympic and Paralympic national teams. This first-of-its-kind partnership between a youth sports academy and National Governing Body includes a $350,000 annual minimum guarantee, office space, athlete housing, year-round training facilities, and a national fencing academy with scholarship opportunities.

The revenue-sharing structure and NGB integration marks a new model: academies aren’t just competing with IMG anymore, they’re partnering with governing bodies to create official development pipelines. Rich Odell, former head of school at IMG Academy, leads MAI’s effort to position New England as a national hub for athlete development.

Industry Standards

Quality Standards Emerge:

The Aspen Institute released its Play Equity Framework, moving beyond “patchwork programs” to address root systemic barriers through coordinated action. The framework identifies five systemic barriers and six operational strategies targeting interconnected systems (education, economics, culture).

Rather than expanding programs, the framework emphasizes systems transformation: changing how education, economics, and culture intersect to create or remove barriers to participation.

Partnerships Reshape the Landscape: Collaboration Over Competition

Strategic partnerships proliferated in 2025 as organizations recognized they could achieve more through collaboration than competition.

Governing Body Partnerships:

MLS GO partnered with NRPA (National Recreation and Park Association) and RCX Sports to leverage 60,000 existing park and recreation agencies across all 50 states. Rather than building new infrastructure, the partnership activated existing community assets with programming expertise and $100,000 in grant funding through the MLS GO PLAY FUND.

RCX Sports holds official partnerships with NFL, NBA, WNBA, NHL, MLS, MLB, and USTA, creating unified youth sports experiences rather than fragmented, competing programs.

NBA and YMCA announced a year-long partnership for NBA World Basketball Day, expanding programming globally through existing YMCA infrastructure. The partnership demonstrates how professional leagues increasingly work through established community organizations rather than building parallel systems.

Media and Content Partnerships:

ESPN partnered with Academy Award winners Brian Grazer and Ron Howard’s Imagine Documentaries for Little League coverage, applying Hollywood production values to youth baseball. DICK’S Sporting Goods launched a dedicated production studio for youth sports storytelling.

The pattern was clear: premium content creation requires collaboration between media companies, brands, and content specialists. No single organization has all the capabilities needed to create compelling youth sports content at scale.

Looking Ahead: 2026 and Beyond

Three questions from the Sportico article frame the outlook:

1. Are there enough scaled assets?

The biggest constraint remains the lack of scaled properties. Many clubs, events, and platforms remain sub-$5M EBITDA businesses. The industry needs more $10M+ EBITDA assets to sustain institutional deal momentum.

However, technology platforms like Pixellot, GameChanger, Sprocket, and TeamLinkt are building scaled businesses through software and services rather than physical operations. These platforms may provide the scaled assets that traditional clubs and facilities cannot.

2. Will robust valuations continue?

2025 saw elevated multiples driven partly by first-time PE entrants competing for assets. Sustainability depends on supply/demand imbalances for quality companies, successful integration of completed deals, and overall economic factors including interest rates and debt costs.

The Varsity Brands trajectory (from $184M to $4.8B in 14 years) suggests valuations can sustain when companies demonstrate consistent growth and professionalization. But not every deal will show similar returns.

3. Which sectors will attract the most investment?

Facilities, events, video streaming, and software (particularly for performance and training) appear best positioned. But e-commerce, equipment, and apparel could emerge as opportunities if operators can demonstrate scalable business models.

The wild card is technology. AI-powered platforms that reduce operational costs while improving outcomes may attract the most capital because they scale more efficiently than physical facilities or events.

The Bottom Line

2025 was the year youth sports grew up. The industry attracted billions in investment, faced Congressional scrutiny, embraced technology at scale, addressed safety through proposed legislation, invested hundreds of millions in facilities, launched recognition programs, and built collaborative partnerships.

But growth revealed contradictions. Participation hit records while costs priced out working families. Technology democratized access to production while private equity-owned facilities charged streaming fees. Investment poured in while Congress questioned the industry’s sustainability.

These tensions won’t resolve quickly. But 2025 established youth sports as a recognized industry with institutional backing, professional infrastructure, and public scrutiny. The fragmented, passion-driven corner of the sports economy matured into something bigger: an ecosystem that generates $40B+ annually, serves 27M+ participants, and attracts both capital and controversy.

The question for 2026 isn’t whether growth continues. Structural drivers remain intact. The question is whether the industry can deliver on its mission to make youth sports better, more accessible, and more sustainable while navigating the pressures that come with institutionalization.

YSBR provides this content on an “as is” basis without any warranties, express or implied. We do not assume responsibility for the accuracy, completeness, legality, reliability, or use of the information, including any images, videos, or licenses associated with this article. For any concerns, including copyright issues or complaints, please contact YSBR directly.

About Youth Sports Business Report

Youth Sports Business Report is the largest and most trusted source for youth sports industry news, insights, and analysis covering the $54 billion youth sports market. Trusted by over 50,000 followers including industry executives, investors, youth sports parents and sports business professionals, we are the premier destination for comprehensive youth sports business intelligence.

Our core mission: Make Youth Sports Better. As the leading authority in youth sports business reporting, we deliver unparalleled coverage of sports business trends, youth athletics, and emerging opportunities across the youth sports ecosystem.

Our expert editorial team provides authoritative, in-depth reporting on key youth sports industry verticals including:

- Sports sponsorship and institutional capital (Private Equity, Venture Capital)

- Youth Sports events and tournament management

- NIL (Name, Image, Likeness) developments and compliance

- Youth sports coaching and sports recruitment strategies

- Sports technology and data analytics innovation

- Youth sports facilities development and management

- Sports content creation and digital media monetization

Whether you’re a sports industry executive, institutional investor, youth sports parent, coach, or sports business enthusiast, Youth Sports Business Report is your most reliable source for the actionable sports business insights you need to stay ahead of youth athletics trends and make informed decisions in the rapidly evolving youth sports landscape.

Join our growing community of 50,000+ industry leaders who depend on our trusted youth sports business analysis to drive success in the youth sports industry.

Stay connected with the pulse of the youth sports business – where industry expertise meets actionable intelligence.

Sign up for the biggest newsletter in Youth Sports – Youth Sports HQ – The best youth sports newsletter in the industry

Follow us on LinkedIn

Follow Youth Sports Business Report Founder Cameron Korab on LinkedIn

Are you a brand looking to tap into the world’s most passionate fanbase… youth sports?

Introducing Play Up Partners, a leading youth sports marketing agency connecting brands with the power of youth sports. We specialize in youth sports sponsorships, partnerships, and activations that drive measurable results.

About Play Up Partners

Play Up Partners is a leading youth sports marketing agency connecting brands with the power of youth sports. We specialize in youth sports sponsorships, partnerships, and activations that drive measurable results.

Why Sponsor Youth Sports?

Youth sports represents one of the most engaged and passionate audiences in sports marketing. With over 70 million young athletes and their families participating annually, the youth sports industry offers brands unparalleled access to motivated communities with strong purchasing power and loyalty.

What Does Play Up Partners Do?

We’ve done the heavy lifting to untangle the complex youth sports landscape so our brand partners can engage with clarity, confidence, and impact. Our vetted network of accredited youth sports organizations (from local leagues to national tournaments and operators) allows us to create flexible, scalable programs that evolve with the market.

Our Approach

Every partnership we build is rooted in authenticity and value creation. We don’t just broker deals. We craft youth sports marketing strategies that:

- Deliver measurable ROI for brand partners

- Create meaningful experiences for athletes and families

- Elevate the youth sports ecosystem

Our Vision

We’re positioning youth sports as the most desirable and effective platform in sports marketing. Our mission is simple: MAKE YOUTH SPORTS BETTER for athletes, families, organizations, and brand partners.

Common Questions About Youth Sports Marketing

Where can I sponsor youth sports? How do I activate in youth sports? What is the ROI of youth sports marketing? How much does youth sports sponsorship cost?

We have answers. Reach out to info@playuppartners.com to learn how Play Up Partners can help your brand navigate the youth sports landscape.

Youth sports organizations: Interested in partnership opportunities? Reach out to learn about our accreditation process.

Rec Sports

Blackhawks’ youth line going through learning process together

MONTREAL — With their stalls positioned next to each other in the back corner of the Montreal Canadiens’ visiting dressing room, the Blackhawks’ Oliver Moore, Nick Lardis and Ryan Greene summoned over CHSN TV analyst Darren Pang on Thursday.

What they wanted to know was whether Pang thought they were the youngest current line in the NHL. If anyone would know, Pang, also a national analyst, probably would.

Pang wasn’t positive, but he definitely thought they had to be close with Lardis and Moore both being 20 years old, and Greene, 22. Officially, they are tied for the youngest line. The San Jose Sharks’ line of Collin Graf, 23, Macklin Celebrini, 19, and Igor Chernyshov, 20, averages out the same.

“They’re as young probably as any line I’ve had in the NHL,” Blackhawks coach Jeff Blashill said before Thursday’s 4-1 loss to the Canadiens. “I’ve had a line in college or junior maybe. So, yeah, they are a young line.”

Blashill chose to put the trio together when Lardis arrived to the NHL last week because he thought they could complement each other well. Greene and Moore had chemistry together with the Rockford IceHogs in the AHL earlier in the season. Greene, a center, has earned more and more of Blashill’s trust throughout the season due to his two-way play, vision and composure. Plus, all three of general manager Kyle Davidson’s draft picks possess speed.

“I feel like we’re obviously young, but we play with a lot of energy, like we’re fast players,” Greene said. “So I think it’s been great, you know. It’s an opportunity that, obviously, (we’re) all like thankful we’re getting and trying to make the best of it, make it work together.”

Together, there is a unique comfort level, too. As welcoming as veterans can be, the dynamic is usually different when younger players are playing with older ones. For Moore, Lardis and Greene, they communicate more freely with each other.

“We know each other so well,” Moore said. “It’s definitely a lot of comfortability.”

In the line’s three games together, they’ve had their ups and downs. In their first game together, they came out flying against the Detroit Red Wings and set the pace. They haven’t consistently found that level since, but they’ve had their share of shifts where they’ve been dangerous. Greene and Lardis had a two-on-one opportunity on Thursday, and Greene drew a penalty during it. Overall, though, Thursday was a tough game. With the line on the ice in five-on-five play, the Canadiens had a 12-6 advantage in shot attempts, 6-0 in shots on goal and 5-3 in scoring chances. The line had a 36.93 expected goals percentage, according to Natural Stat Trick.

“They struggled tonight, to be dead honest with you,” Blashill said. “It is a lot to ask of three guys of that age with that inexperience to step into the NHL and try to get it done. You don’t have anybody that can help carry you around a little bit. They’ve had moments of good, and tonight was not good enough. It’s a process for them. That’s part of what we’re doing here: putting these guys in spots where they’ve got to grow. We’ll see what we do — might mix the lines up a little bit come Saturday, but we’ll see how that goes.”

Like Tuesday against the Toronto Maple Leafs, the Blackhawks held Thursday’s game close enough to win. They just have such a small margin for error right now with their offense being minimal without Connor Bedard.

Thursday’s game began to turn against the Blackhawks after two penalties in the final minutes of the second period. Dominic Toninato took the first one. The Canadiens scored on their power play, but it was overturned when challenged for offside. A minute after the Blackhawks killed that penalty, Frank Nazar took another one. The Canadiens began that power play strongly, but couldn’t get a goal before the period ended. But 20 seconds into the third period, they scored and went ahead. They carried the play most of the period from there and added two more goals to secure the win.

“I thought we came out, we played pretty strong, relatively even through the first two periods,” Blackhawks defenseman Matt Grzelcyk said. “We took probably too many penalties at the end of the second. They just completely outplayed us in the third. I think they had a level of desperation that we couldn’t match. That’s unacceptable on our end.”

The Blackhawks had their share of scoring chances at five-on-five. It wasn’t completely lopsided in that respect. Notably, Tyler Bertuzzi had a few chances that just missed. The Blackhawks know they need more offense if they’re going to win, though. They’ve scored a total of three goals in the three games without Bedard. The Canadiens had a 35-15 advantage in shots on goal.

“We passed up shots in scoring areas, so that would be step one,” Blashill said. “You can’t pass up a shot in a scoring area. We literally passed it out of a scoring area into a non-scoring area. That’s nonsensical. We’re going to have to simplify that piece of it and make sure we have much more of a shooting mentality and create the chaos off the shots.”

The one goal the Blackhawks did score Thursday was a much-needed one for Nazar. Grzelcyk found him at the back post, and Nazar knocked it into the net in the first period. It was his first goal in 22 games.

Nazar didn’t have much interest in discussing the goal coming in a loss, but Blashill did. Blashill thought it was coming.

“I think he’s been playing good enough to deserve that,” Blashill said. “We just talked about it today, him and I, that, ‘If you just keep it up, you’re going to get rewarded.’ It was good for him to get rewarded. It’s unfortunate it wasn’t in a win, but we’re going to need him these next few games here to get hot and really feel it offensively, and that’s a confidence thing. So certainly scoring helps that.”

Nazar finished the game with nine shot attempts.

Quick hits

• Louis Crevier, who is from Quebec, was the go-to Blackhawks player for the Montreal media before Thursday’s game. He was swarmed by a group in the Blackhawks’ dressing room after their morning skate.

• Thursday’s game included three overturned goals due to challenges. The Blackhawks correctly challenged two for offside, and the Canadiens challenged another for goaltender interference.

• Blackhawks defenseman Artyom Levshunov returned Thursday after being a healthy scratch in the last game and played a team-high 21:58.

Rec Sports

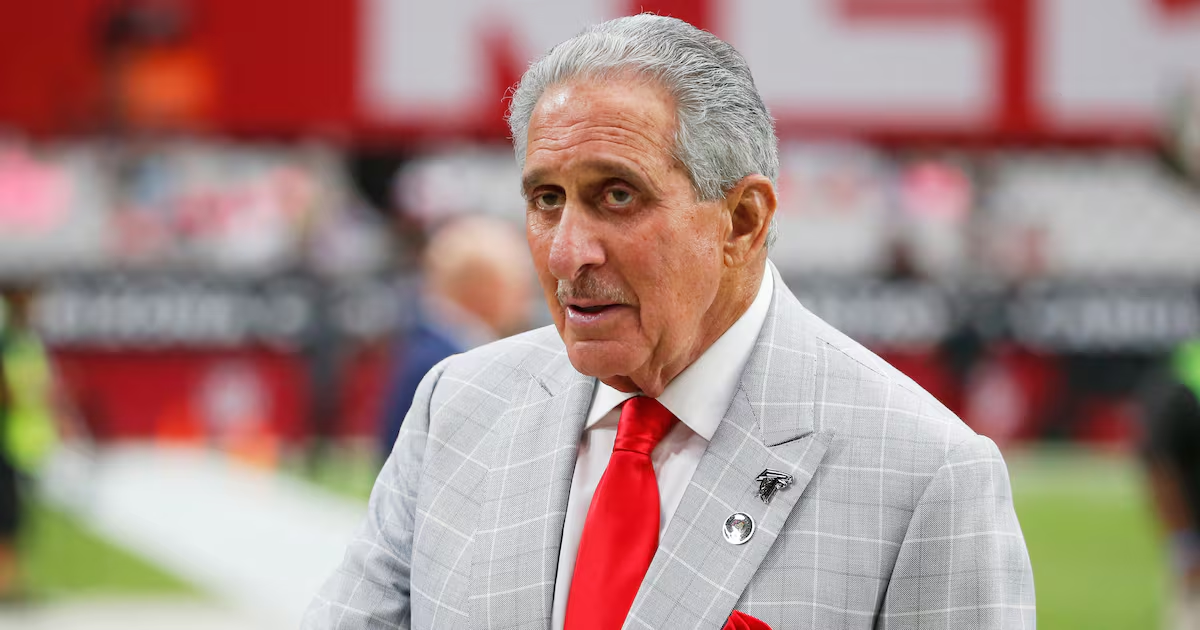

6 metro area school districts get Blank Foundation grants to fund youth sports – WSB-TV Channel 2

ATLANTA — The Arthur M. Blank Family Foundation is committing millions of dollars to help six metro Atlanta school districts expand access to middle and high school sports.

According to a release from the foundation, more than $6.3 million will be split between through grant funding from the foundation and a partnership with Atlanta United, the Atlanta Falcons and PGA TOUR Superstore.

Citing data from the Aspen Institute, the Blank Family Foundation said average families in the United states spent more than $1,000 on their children’s primary sports participation in 2024, a reported 46% increase from 2019.

The funding from the grants is aimed at lowering participation costs and increasing the variety of sports offered through the metro Atlanta area, as well as improving sports experiences for students.

[DOWNLOAD: Free WSB-TV News app for alerts as news breaks]

TRENDING STORIES:

“The Arthur M. Blank Family Foundation and AMB Sports and Entertainment recognize and prioritize the importance of providing kids the opportunity to participate in sports,” AMB Sports and Entertainment CEO and AMBFF Associate Board Member Rich McKay said in a statement. “We are proud to partner with these six school districts to remove barriers of entry to sports and enhance the sports experience for their students. We anticipate this funding will impact more than 7,500 athletes at the middle and high school level across Metro Atlanta.”

The following school districts will receive grant funding, meant to “address specific needs” in each county:

- Clayton County Public Schools to create the district’s first coaching development program in partnership with A Better Way Athletics for its 27 middle and high schools.

- DeKalb County Public Schools to establish girls flag football programs at 18 middle schools and alleviate the cost to participate in middle school girls flag football.

- Fulton County Public Schools to alleviate the cost to participate – including transportation costs – in high school boys and girls soccer, golf, tennis and wrestling; provide high-quality performance equipment for athletes in these sports.

- Griffin-Spalding Public Schools to establish boys and girls soccer programs at all four middle schools; launch girls flag football programs at the middle school level; alleviate the cost to participate in middle school boys and girls soccer and girls flag football, and improve the quality of athletic fields utilized by its four middle schools.

- Gwinnett County Public Schools to establish girls flag football programs at 14 middle schools beginning in 2026; alleviate the cost to participate in boys and girls soccer at the middle school level, and install field lighting to improve safety and enhance scheduling capabilities at six athletic fields across the school district.

- Rockdale County Public Schools to alleviate the cost to participate – including transportation costs – in boys and girls soccer, girls flag football, tackle football and volleyball at the middle school level, and in boys and girls golf, swimming, tennis and wrestling at the high school level; improve field conditions and play-space access at four middle schools, and provide high-quality performance equipment at the middle and high school level for athletes in these sports.

[SIGN UP: WSB-TV Daily Headlines Newsletter]

©2025 Cox Media Group

-

Motorsports1 week ago

Motorsports1 week agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

NIL3 weeks ago

NIL3 weeks agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoRobert “Bobby” Lewis Hardin, 56

-

Sports3 weeks ago

Wisconsin volleyball sweeps Minnesota with ease in ranked rivalry win

-

Motorsports2 weeks ago

Motorsports2 weeks agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw

-

Motorsports3 weeks ago

Motorsports3 weeks agoMichael Jordan’s fight against NASCAR heads to court, could shake up motorsports

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoBlack Bear Revises Recording Policies After Rulebook Language Surfaces via Lever

-

Sports3 weeks ago

Sports3 weeks agoMen’s and Women’s Track and Field Release 2026 Indoor Schedule with Opener Slated for December 6 at Home

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoDavid Blitzer, Harris Blitzer Sports & Entertainment