sports analytics market

“

The Sports Analytics market is experiencing a period of rapid expansion, driven by a confluence of factors including the increasing sophistication of data collection technologies, the growing demand for data-driven decision-making within sports organizations, and the desire to enhance both on-field performance and fan engagement. The proliferation of wearable sensors, high-definition video capture, and advanced statistical modeling techniques are generating unprecedented volumes of data that can be analyzed to gain a competitive edge. Furthermore, sports organizations are recognizing the value of analytics in optimizing training regimens, preventing injuries, tailoring game strategies, and improving player recruitment. This market is pivotal in addressing the global challenge of maximizing human potential in sports while simultaneously enhancing the overall fan experience. Technological advancements such as machine learning and artificial intelligence are playing a crucial role in processing and interpreting the vast amounts of sports data, leading to more accurate predictions and actionable insights. The market is also instrumental in promoting transparency and fairness in sports, as data-driven analysis can help to identify and address biases in officiating and player evaluation. Ultimately, the sports analytics market is transforming the sports industry by empowering stakeholders with the knowledge and tools they need to make informed decisions and achieve their goals. The convergence of technology, data science, and sports expertise is creating a dynamic and rapidly evolving market with significant growth potential.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/2712

Market Size:

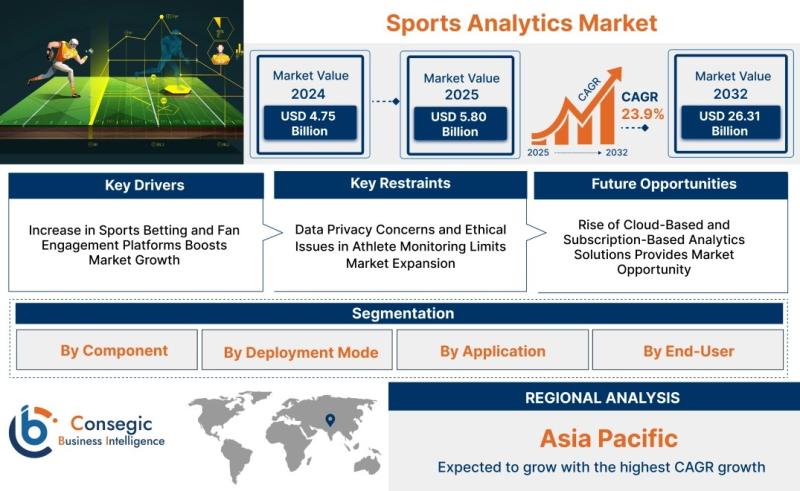

The sports analytics market size is estimated to reach over USD 26.31 Billion by 2032 from a value of USD 4.75 Billion in 2024. It is projected to grow by USD 5.80 Billion in 2025, growing at a CAGR of 23.9% from 2025 to 2032.

Definition of Market:

The Sports Analytics market encompasses the application of data analysis techniques and technologies to gain insights and improve decision-making within the sports industry. It involves collecting, processing, analyzing, and interpreting data related to various aspects of sports, including player performance, team strategy, fan engagement, and business operations.

Key components of this market include:

Solutions: Software platforms and tools designed for data collection, analysis, visualization, and reporting. These solutions often incorporate advanced statistical models, machine learning algorithms, and artificial intelligence to extract meaningful insights from sports data.

Services: Consulting, implementation, training, and support services related to sports analytics solutions. These services help sports organizations to effectively utilize analytics tools and to integrate data-driven insights into their decision-making processes.

Key terms related to the market include:

Player Tracking: The use of sensors and cameras to monitor the movement and performance of athletes during games and practices.

Performance Metrics: Statistical measures used to evaluate the performance of individual players and teams.

Predictive Analytics: The use of historical data to forecast future outcomes, such as game results or player injuries.

Fan Engagement: Strategies and technologies used to interact with and involve fans, such as personalized content and interactive games.

The overall goal of sports analytics is to provide actionable insights that can help sports organizations to improve their performance, increase revenue, and enhance the fan experience.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/2712

Market Scope and Overview:

The scope of the Sports Analytics market is broad, encompassing a range of technologies, applications, and industries. Technologies within this market include data visualization software, predictive modeling tools, machine learning platforms, and wearable sensors. These technologies are applied across various aspects of sports, including player and team performance analysis, fan engagement and marketing, health and injury prevention, game strategy and planning, broadcasting and media, and ticketing and merchandise sales. The market serves a diverse range of end-users, including sports teams and clubs, leagues and sports associations, coaches and analysts, athletes, broadcasting and media companies, and sponsors and advertisers.

The Sports Analytics market plays a crucial role in the larger context of global trends. The increasing availability of data, coupled with advancements in data analytics technologies, is transforming the way sports are played, managed, and consumed. Data-driven insights are enabling sports organizations to make more informed decisions, optimize their operations, and enhance the fan experience. The market is also contributing to the growing emphasis on performance optimization and injury prevention in sports. As athletes push the boundaries of human performance, the need for data-driven strategies to improve training regimens and reduce the risk of injury becomes increasingly important. Furthermore, the Sports Analytics market is playing a key role in the evolution of the sports media landscape, as broadcasters and media companies leverage data to create more engaging and informative content for their audiences. The market’s influence stretches beyond the field, impacting areas such as marketing, sponsorship, and revenue generation, demonstrating its integral role in the modern sports ecosystem. In summary, the Sports Analytics market is a dynamic and rapidly evolving space that is shaping the future of sports across various dimensions.

Top Key Players in this Market

IBM (USA) SAP SE (Germany) Catapult Sports (Australia) STATS Perform (USA) Hudl (USA) Sportlogiq (Canada) Oracle Corporation (USA) Kinexon (Germany) Sportradar (Switzerland) Second Spectrum (USA)

Market Segmentation:

The Sports Analytics market is segmented based on several factors:

By Component: Solutions, which include software and platforms for data analysis and visualization, and Services, which encompass consulting, implementation, and support.

By Deployment Mode: On-Premise, where the analytics infrastructure is managed internally, and Cloud-Based, where the solutions are hosted and accessed remotely.

By Application: Player & Team Performance Analysis, focusing on improving on-field performance; Fan Engagement & Marketing, aimed at enhancing the fan experience; Health & Injury Prevention, which uses data to reduce injuries; Game Strategy & Planning, helping teams make better tactical decisions; Broadcasting & Media, enhancing content delivery; and Ticketing & Merchandise Sales, optimizing revenue generation.

By End-User: Sports Teams & Clubs, Leagues & Sports Associations, Coaches & Analysts, Athletes, Broadcasting & Media Companies, and Sponsors & Advertisers, each leveraging analytics for their specific needs.

Each segment contributes to the overall market growth. For example, the demand for solutions is driven by the increasing need for advanced analytics tools, while the services segment benefits from the complexity of implementing and managing these solutions. Cloud-based deployment is gaining traction due to its scalability and cost-effectiveness. The application segments are growing as organizations seek data-driven insights to improve performance and increase revenue.

Market Drivers:

Technological Advancements: The continuous evolution of data collection and analysis technologies, such as wearable sensors, video analysis tools, and machine learning algorithms, is enabling more sophisticated and accurate sports analytics.

Increasing Demand for Data-Driven Decision-Making: Sports organizations are increasingly recognizing the value of data in making informed decisions about player selection, training regimens, game strategies, and business operations.

Growing Focus on Performance Optimization: The pursuit of marginal gains in performance is driving the adoption of sports analytics tools that can identify areas for improvement and optimize training programs.

Enhanced Fan Engagement Opportunities: Sports analytics is enabling organizations to create more personalized and engaging experiences for fans, leading to increased attendance, viewership, and merchandise sales.

Rising Prevalence of Injuries: The need to reduce the incidence and severity of injuries is driving the adoption of sports analytics solutions that can identify risk factors and prevent injuries.

Market Key Trends:

Rise of Machine Learning and Artificial Intelligence: Machine learning and AI are being increasingly used to analyze large datasets and identify patterns that would be difficult or impossible for humans to detect.

Integration of Wearable Technology: Wearable sensors are becoming more prevalent in sports, providing valuable data on player movement, physiological parameters, and performance metrics.

Growth of Esports Analytics: The increasing popularity of esports is driving the demand for analytics solutions that can help teams and players improve their performance and engage with fans.

Focus on Predictive Analytics: Predictive analytics is being used to forecast future outcomes, such as game results or player injuries, allowing organizations to make proactive decisions.

Increased Adoption of Cloud-Based Solutions: Cloud-based analytics solutions are becoming more popular due to their scalability, cost-effectiveness, and ease of use.

Market Opportunities:

The Sports Analytics market presents numerous growth prospects:

Expansion into Emerging Sports: Opportunities exist to extend sports analytics solutions to less traditional sports and recreational activities.

Development of Personalized Training Programs: Creating individualized training regimens based on player-specific data and analytics.

Integration with Fan Engagement Platforms: Developing analytics-driven fan engagement tools that enhance the fan experience and drive revenue.

Advancements in Injury Prediction and Prevention: Innovating new methods for predicting and preventing injuries using advanced data analysis techniques.

Enhancements in Esports Analytics: Developing specialized analytics solutions for the rapidly growing esports market.

Market Restraints:

High Initial Costs: The cost of implementing sports analytics solutions, including software, hardware, and services, can be a barrier for some organizations.

Data Privacy Concerns: The collection and use of personal data raise privacy concerns, which can limit the adoption of certain sports analytics solutions.

Lack of Skilled Professionals: There is a shortage of skilled data scientists and analysts with expertise in sports, which can hinder the effective use of sports analytics tools.

Resistance to Change: Some sports organizations may be resistant to adopting new technologies and data-driven approaches.

Data Integration Challenges: Integrating data from different sources, such as wearable sensors, video analysis systems, and electronic health records, can be challenging.

Market Challenges:

The Sports Analytics market, while brimming with potential, faces a unique set of challenges that could impede its growth trajectory. One of the most significant hurdles is the *Data Siloing and Integration Issues*. Sports organizations often collect data from various sources, including wearable sensors, video analysis systems, Electronic Medical Records (EMRs), and ticketing platforms. However, these data sources are frequently disparate and incompatible, making it difficult to integrate and analyze the data holistically. This lack of integration limits the ability to generate comprehensive insights and prevents organizations from fully leveraging the power of their data.

Another critical challenge lies in the *Interpretability and Actionability of Insights*. While advanced analytics techniques like machine learning can uncover complex patterns in data, translating these patterns into actionable insights that coaches, players, and management can understand and implement is not always straightforward. There’s a need for skilled data translators who can bridge the gap between data science and sports expertise, ensuring that analytical findings are relevant, understandable, and ultimately lead to improved performance.

*Data Quality and Accuracy* are also paramount concerns. The quality of data used in sports analytics can vary significantly depending on the source and collection method. Inaccurate or incomplete data can lead to misleading insights and flawed decision-making. Ensuring data integrity through rigorous quality control measures and validation processes is crucial for building trust in analytics-driven decisions.

The *Ethical Considerations and Data Privacy* pose another layer of complexity. As sports analytics becomes more sophisticated, it raises ethical questions about the use of personal data, particularly in areas like player health and injury prevention. Organizations must ensure that they are collecting and using data responsibly and ethically, adhering to privacy regulations and respecting the rights of athletes. This includes obtaining informed consent, anonymizing data when appropriate, and safeguarding data from unauthorized access.

Finally, the *Cost of Implementation and Maintenance* can be a significant barrier to entry, especially for smaller sports organizations with limited budgets. Implementing and maintaining a robust sports analytics infrastructure requires investments in software, hardware, and skilled personnel. Finding cost-effective solutions and demonstrating the value of analytics through clear ROI metrics are essential for driving wider adoption across the sports industry.

Market Regional Analysis:

The Sports Analytics market exhibits regional variations in terms of adoption rates, market maturity, and growth potential. North America is currently the largest market, driven by the widespread adoption of sports analytics in professional leagues such as the NFL, NBA, and MLB. Europe is also a significant market, with growing interest in sports analytics across various sports, including soccer, rugby, and cricket. The Asia-Pacific region is emerging as a high-growth market, fueled by the increasing popularity of sports and the growing investment in sports infrastructure.

Each region has unique factors influencing market dynamics. In North America, the market is driven by a strong focus on data-driven decision-making and a well-developed sports ecosystem. Europe benefits from a rich sporting heritage and a growing emphasis on performance optimization. The Asia-Pacific region is characterized by a large and growing population of sports fans and a increasing disposable incomes. Factors such as cultural preferences, regulatory frameworks, and technological infrastructure also play a role in shaping the Sports Analytics market in different regions.

For instance, the strict data privacy regulations in Europe may influence the types of data that can be collected and analyzed, while the rapid technological advancements in Asia-Pacific may accelerate the adoption of new sports analytics solutions. Understanding these regional nuances is crucial for companies seeking to expand their presence in the global Sports Analytics market.

Frequently Asked Questions:

What is the projected growth of the Sports Analytics market?

The Sports Analytics market is projected to grow at a CAGR of 23.9% from 2025 to 2032, reaching over USD 26.31 Billion by 2032.

What are the key trends in the Sports Analytics market?

Key trends include the rise of machine learning and artificial intelligence, the integration of wearable technology, the growth of esports analytics, and the increasing adoption of cloud-based solutions.

What are the most popular Market types in sports analytics?

The most popular Market types include player and team performance analysis, fan engagement and marketing, and health and injury prevention solutions.

“

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra – 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web – https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn – https://www.linkedin.com/company/consegic-business-intelligence/

YouTube – https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook – https://www.facebook.com/profile.php?id=61575657487319

X – https://x.com/Consegic_BI

Instagram – https://www.instagram.com/cbi._insights/

This release was published on openPR.