Technology

Small businesses are an innovation powerhouse. For…

The federal government wants to boost Australia’s productivity levels – as a matter of national priority. It’s impossible to have that conversation without also talking about innovation.

We can be proud of (and perhaps a little surprised by) some of the Australian innovations that have changed the world – such as the refrigerator, the electric drill, and more recently, the CPAP machine and the technology underpinning Google Maps.

Australia is continuing to drive advancements in machine learning, cybersecurity and green technologies. Innovation isn’t confined to the headquarters of big tech companies and university laboratories.

Small and medium enterprises – those with fewer than 200 employees – are a powerhouse of economic growth in Australia. Collectively, they contribute 56% of Australia’s gross domestic product (GDP) and employ 67% of the workforce.

Our own Reserve Bank has recognised they also have a huge role to play in driving innovation. However, they still face many barriers to accessing funding and investment, which can hamper their ability to do so.

Finding the funds to grow

We all know the saying “it takes money to make money”. Those starting or scaling a business have to invest in the present to generate cash in the future. This could involve buying equipment, renting space, or even investing in needed skills and knowledge.

A small, brand new startup might initially rely on debt (such as personal loans or credit cards) and investments from family and friends (sometimes called “love money”).

Having exhausted these sources, it may still need more funds to grow. Bank loans for businesses are common, quick and easy. But these require regular interest payments, which could slow growth.

Selling stakes

Alternatively, a business may want to look for investors to take out ownership stakes.

This investment can take the form of “private equity”, where ownership stakes are sold through private arrangement to investors. These can range from individual “angel investors” through to huge venture capital and private equity firms managing billions in investments.

It can also take the form of “public equity”, where shares are offered and are then able to be bought and sold by anyone on a public stock exchange such as the Australian Securities Exchange (ASX).

Unfortunately, small and medium-sized companies face hurdles to accessing both kinds.

Kvalifik/Unsplash

Private investors’ high bar to clear

Research examining the gap in small-scale private equity has found 46% of small and medium-sized firms in Australia would welcome an equity investment – despite saying they were able to acquire debt elsewhere.

They preferred private equity because they also wanted to learn from experienced investors who could help them grow their companies. However, very few small and medium-sized enterprises were able to meet private equity’s investment criteria.

When interviewed, many chief executives and chairs of small private equity firms said their lack of interest in small and medium-sized enterprises came down to cost and difficulty of verifying information about the health and prospects of a business.

To make it easier for investors to compare investments, all public companies are required to disclose their financial information using International Financial Reporting Standards.

In contrast, small private companies can use a simplified set of rules and do not have to share their statements of profit and loss with the general public.

Share markets are costly and complex

Is it possible to list on a stock exchange instead? An initial public offering (IPO) would enable the company to raise funds by selling shares to the public.

Unfortunately, the process of issuing shares on a stock exchange is time-consuming and costly. It requires a team of advisors (accountants, lawyers, and bankers) and filing fees are high.

There are also ongoing costs and obligations associated with being a publicly traded company, including detailed financial reporting.

Last week, the regulator, the Australian Securities and Investments Commission (ASIC), announced new measures to encourage more listings by streamlining the IPO process.

Despite this, many small companies do not meet the listing requirements for the ASX.

These include meeting a profits and assets test and having at least 300 investors (not including family) each with A$2,000.

There is one less well-known alternative – the smaller National Stock Exchange of Australia (NSX), which focuses on early-stage companies. Ideally, this should have been a great alternative for small companies, but it has had limited success. The NSX is now set to be acquired by a Canadian market operator.

Making companies more attractive

Our previous research has highlighted that small and medium-sized businesses should try to make themselves more attractive to private equity companies. This could include improving their financial reporting and using a reputable major auditor.

At their end, private equity companies should cast a wider net and invest a little more time in screening and selecting high-quality smaller companies. That could pay off – if it means they avoid missing out on “the next Google Maps”.

Susan Quin & The Bigger Picture, CC BY

What about the $4 trillion of superannuation?

There are other opportunities we could explore. Australia’s pool of superannuation funds, for example, have begun growing so large they are running out of places to invest.

That’s led to some radical proposals. Ben Thompson, chief executive of Employment Hero, last year proposed big superannuation funds be forced to invest 1% of their cash into start-ups.

Less extreme, regulators could reassess disclosure guidelines for financial providers which may lead funds to prefer more established investments with proven track records.

There is an ongoing debate about whether the Australian Prudential Regulation Authority (APRA), which regulates banks and superannuation, is too cautious. Some believe APRA’s focus on risk management hurts innovation and may result in super funds avoiding startups (which generally have a higher likelihood of failure).

In response, APRA has pointed out the global financial crisis reminded us to be cautious, to ensure financial stability and protect consumers.

This article is part of The Conversation’s series, The Productivity Puzzle.

The author would like to acknowledge her former doctoral student, the late Dr Bruce Dwyer, who made significant contributions to research discussed in this article. Bruce passed away in a tragic accident earlier this year.

![]()

Colette Southam does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.

Technology

How Smart Technology Is Transforming Online Gaming

Smart technology has quietly reshaped nearly every part of modern life, from how we manage our homes to how we consume entertainment. One area seeing particularly rapid innovation is online gaming. Advances in artificial intelligence, cloud computing, and mobile connectivity are not just improving visuals or speed — they’re fundamentally changing how users interact with digital gaming platforms. For tech-savvy audiences, this evolution represents a fascinating case study in how intelligent systems enhance user experience at scale.

Online gaming platforms today are built on sophisticated technology stacks designed to personalize content, streamline performance, and improve security. This shift is especially visible in online casino gaming, where algorithms analyze player behavior to deliver tailored game recommendations and seamless performance across devices. For example, players looking to explore modern gaming platforms can Experience the thrill of top-rated casino games at Winna while seeing firsthand how smart systems elevate engagement and usability.

As entertainment increasingly converges with technology, the online gaming sector offers valuable insight into how innovation drives adoption, retention, and trust.

AI and Machine Learning Powering Smarter Gameplay

AI and Machine Learning Powering Smarter GameplayiStock

AI and Machine Learning Powering Smarter GameplayiStock

Artificial intelligence plays a central role in today’s online gaming experiences. Machine learning models continuously analyze gameplay data to understand user preferences, playing patterns, and engagement habits. This allows platforms to create more intuitive interfaces and personalized recommendations without requiring users to manually search for content.

In casino-style gaming, AI helps recommend games based on past behavior, optimize load times, and ensure smooth performance during high-traffic periods. Beyond user experience, AI is also critical for maintaining fair play. Behavioral analysis tools can detect unusual activity, flag potential fraud, and help operators maintain secure, trustworthy environments — an essential factor for platforms handling real-money transactions.

From a broader technology perspective, these systems demonstrate how real-time data processing and adaptive learning models are becoming essential components of modern digital services.

Cloud Computing and the Shift to Device-Agnostic Gaming

Cloud Computing on the rise iStock

Cloud Computing on the rise iStock

Cloud technology has removed many traditional barriers to entry for online gaming. Instead of relying on powerful local hardware, games can now be rendered and processed remotely, with gameplay streamed directly to users’ devices. This shift allows complex, graphics-rich experiences to run smoothly on smartphones, tablets, and laptops.

For consumers, this means flexibility — gaming is no longer tied to a single device or location. For developers and operators, cloud infrastructure enables faster updates, scalable performance, and reduced downtime. These benefits are especially important for online platforms that must remain accessible around the clock while supporting thousands of simultaneous users.

As cloud adoption accelerates across industries, online gaming stands out as one of the clearest examples of how distributed computing enhances both performance and accessibility.

Mobile Connectivity and Market Growth

Mobile technology has been one of the biggest drivers of growth in the online gaming sector. Improvements in smartphone processing power, combined with faster networks like 5G, have made mobile gaming experiences nearly indistinguishable from desktop or console play.

Industry data highlights just how significant this shift has been. According to Statista’s research on mobile gaming market trends, mobile games account for a substantial share of global gaming revenue, driven by ease of access and growing consumer demand.

For online gaming platforms, optimizing for mobile is no longer optional. Responsive interfaces, fast-loading content, and secure mobile payment systems are now baseline expectations. Platforms that successfully integrate these elements benefit from higher engagement and broader audience reach.

Security Innovations Building User Trust

Security remains a top concern for users engaging with online gaming platforms, particularly those involving financial transactions. Smart technology has enabled several major advancements in this area, helping build confidence and credibility across the industry.

Modern platforms rely on encryption protocols to protect personal and financial data, while AI-powered monitoring systems analyze activity in real time to identify irregular behavior. Some platforms are also experimenting with biometric authentication and blockchain-based transaction verification to further strengthen transparency and security.

These technologies not only protect users but also demonstrate how advanced security solutions can be deployed at scale without sacrificing user convenience — a balance many digital industries continue to pursue.

Social Features and Interactive Experiences

Social Features and Interactive Experiences iStock

Social Features and Interactive Experiences iStock

Gaming has evolved from a solitary activity into a highly social experience. Smart technology has enabled real-time chat, live multiplayer interaction, and integrated streaming features that allow users to share gameplay instantly.

Live gaming and streaming platforms have blurred the line between player and audience, creating communities built around shared interests and experiences. As virtual and augmented reality technologies continue to mature, these social elements are expected to become even more immersive, allowing users to interact in fully realized digital environments.

This shift reflects a broader trend in tech-driven entertainment: experiences are no longer just consumed — they’re shared.

What the Future Holds for Smart Gaming

The next wave of innovation in online gaming will likely focus on deeper AI integration, enhanced immersion, and cross-platform compatibility. AI-generated content, adaptive storytelling, and predictive personalization will allow platforms to deliver experiences that evolve with each user.

Virtual reality, augmented reality, and spatial computing are also poised to redefine how players interact with digital worlds. Combined with cloud infrastructure and intelligent analytics, these technologies will continue pushing online gaming toward more immersive, responsive, and inclusive experiences.

Conclusion

Online gaming has become a powerful showcase for how smart technology can transform digital experiences. Through AI-driven personalization, cloud-based performance, mobile optimization, and advanced security, modern platforms are delivering entertainment that is more accessible, engaging, and secure than ever before.

For tech-focused audiences, this evolution highlights the practical impact of intelligent systems operating behind the scenes. As innovation continues, online gaming will remain at the forefront of demonstrating how technology enhances not just how we play — but how we connect, interact, and experience digital entertainment.

From Your Site Articles

Related Articles Around the Web

Technology

A First Look at the TLTC Innovation Hub

Launching for the Spring 2026 semester, the TLTC Innovation Hub will expand hands-on discovery, immersive learning and high-quality content creation

for the Seton Hall community. The Hub supports academic inquiry and creative exploration

across disciplines by bringing together fabrication tools, XR and AI technologies

and production studios, plus open collaboration spaces and consultation rooms.

“We built the Innovation Hub so that learning does not stop at the classroom door,”

said Michael Soupios, executive director of the Teaching, Learning and Technology Center. “It is a creative space where students and faculty can experiment with new tools,

turn ideas into prototypes and explore projects beyond traditional assignments. The

Innovation Hub helps transform how we teach and learn by giving our community room

to explore, make and imagine what is possible.”

The Innovation Hub includes an open lounge and collaboration space with comfortable

seating, flexible work areas, ambient lighting and easy power access. The Hub also

features several dedicated studios, each designed for a different kind of making,

creating and problem-solving. Here is what students, faculty and staff can expect

in each area.

Maker Studio

A hands-on space for designing, prototyping and building. Users can work with 3D printing,

A hands-on space for designing, prototyping and building. Users can work with 3D printing,

laser engraving and desktop CNC machining, plus sublimation printing, vinyl cutting

and robotics or microcontroller kits. Completed 3D prints can be retrieved through

secure project pickup lockers.

Learn more about the Maker Studio and available equipment.

XR/AI Studio

A dedicated space for extended reality, mixed reality and AI exploration. Users can

A dedicated space for extended reality, mixed reality and AI exploration. Users can

work with Meta Quest Pro headsets, immersive applications and simulations, along with

workshops and training to support XR integration in courses and projects.

Explore the XR and AI Studio.

Content Creation Studios

Four spaces for creating high-quality audio and video, including a four-microphone podcast studio, a one-button video studio, a lightboard studio and a production

Four spaces for creating high-quality audio and video, including a four-microphone podcast studio, a one-button video studio, a lightboard studio and a production

studio supported by the TLTC’s Digital Media Team.

Learn more about the Content Creation Studios.

Solutions Studio

The Solutions Studio is the Innovation Hub’s walk-up support desk and first stop for

The Solutions Studio is the Innovation Hub’s walk-up support desk and first stop for

technology assistance. Beginning in Spring 2026, select Information Technology services

currently located in Corrigan Hall will operate from the Innovation Hub, providing

support for technology questions and laptop or mobile device issues. Located in the

open-style seating area next to the elevator, the Solutions Studio is designed to

be approachable and make it easy to get the help you need.

“By relocating the Solutions Studio to a central location in the Innovation Hub, we

are ensuring that every member of the University community has easy access to the

technology support they need,” said John Fernandes, senior director of IT Service

Management. “From assistance with SHU network login issues such as Wi-Fi and account

access to hardware and software support, our goal is to deliver a premier experience.

Whether you are troubleshooting an issue or learning something new, we invite everyone

to stop by. We are here to help.”

Visit the Solutions Studio.

The Hub will officially open in the Spring 2026 semester, with a grand opening celebration

and a blessing of the new Walsh Library entrance planned later in the semester. The

TLTC Innovation Hub is designed to make innovation more accessible for students, faculty

and staff. Whether you are studying, meeting with classmates, brainstorming a project

or exploring emerging technologies, the Innovation Hub is a place where learning becomes

interactive, content is created and ideas come to life.

Updates on services and access will be shared in the coming weeks. Visit the TLTC Innovation Hub webpage for additional information.

Categories:

Science and Technology

Technology

Phygital Baseball Board Games : Base on Board 2.0

Purely digital games lack tactile, social play, while classic board games can’t adapt probabilities, stream competition, or evolve with live data. Base on Board 2.0 delivers the best of both with dynamic E-ink smart dice that shift probabilities in real time using MLB stats, plus AI commentary and visual effects. Altogether, Base on Board 2.0 delivers authentic baseball drama and supports competitions in a physical-digital gaming hybrid experience.

Technology

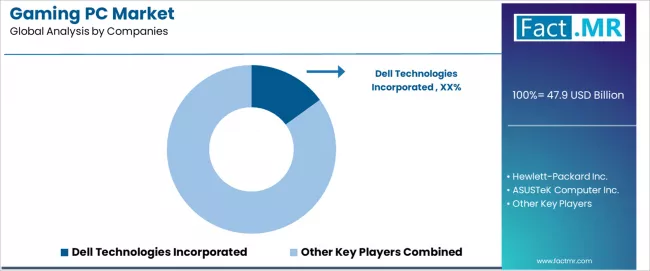

Gaming PC Market | Global Market Analysis Report

Gaming PC Market Forecast and Outlook 2026 to 2036

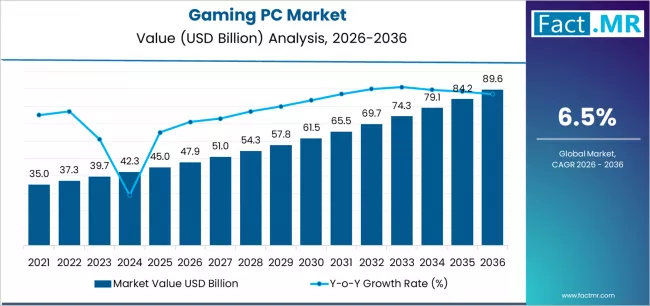

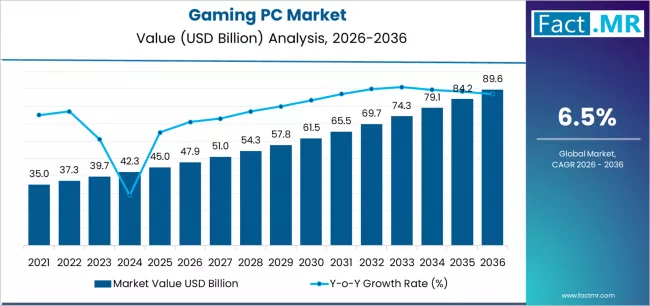

The global gaming PC market is valued at USD 47.9 billion in 2026 and is projected to reach USD 89.6 billion by 2036, reflecting an absolute increase of USD 41.7 billion. This represents total growth of 87.1%, with the market expanding at a CAGR of 6.5% over the forecast period.

Growth is driven by rising demand for high-performance gaming systems, increasing esports participation, and growing requirements for advanced gaming experiences across competitive gaming, content creation, and virtual reality applications.

Quick Stats for Gaming PC Market

- Gaming PC Market Value (2026): USD 47.9 billion

- Gaming PC Market Forecast Value (2036): USD 89.6 billion

- Gaming PC Market Forecast CAGR: 6.5%

- Leading System Type in Gaming PC Market: Desktop Gaming PCs (72.3%)

- Key Growth Regions in Gaming PC Market: Asia Pacific, North America, Europe

- Key Players in Gaming PC Market: Dell Technologies Incorporated, Hewlett-Packard Inc., ASUSTeK Computer Inc., Micro-Star International Co. Ltd., Corsair Gaming Incorporated

Desktop gaming PCs are expected to account for 72.3% of market share in 2026, supported by their superior performance capabilities, upgrade flexibility, and thermal management advantages. Competitive gaming applications are projected to hold 48.7% share, driven by demand for high refresh rates, low-latency processing, and stable performance in professional esports and streaming environments.

Between 2026 and 2030, the market is forecast to grow to USD 65.8 billion, contributing 42.9% of total decade growth, supported by advancing hardware standards and immersive gaming demand. From 2030 to 2036, expansion to USD 89.6 billion will be driven by AI-integrated systems, cloud-gaming hybrids, and expanding virtual reality and content creation ecosystems.

Gaming PC Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2026E) | USD 47.9 billion |

| Forecast Value in (2036F) | USD 89.6 billion |

| Forecast CAGR (2026 to 2036) | 6.5% |

Category

| Category | Segments |

|---|---|

| System Type | Desktop Gaming PCs; Gaming Laptops; Mini Gaming PCs; Workstation Gaming Systems; Other System Configurations |

| Application | Competitive Gaming; Content Creation; Virtual Reality Gaming; Casual Gaming; Others |

| End-User | Individual Gamers; Esports Organizations; Content Creators; Gaming Cafes; Others |

| Price Range | Entry-Level Systems; Mid-Range Systems; High-End Systems; Premium Configurations |

| Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Segmental Analysis

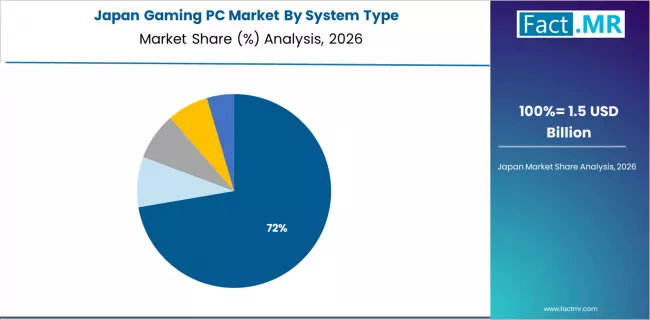

By System Type, Which Segment Holds the Dominant Market Share?

Desktop gaming PCs are projected to account for 72.3% of the gaming PC market in 2026, maintaining clear dominance. This reflects their higher processing capability, graphics performance, and upgrade flexibility compared with portable systems. Compatibility with advanced GPUs, cooling solutions, and peripheral ecosystems continues to support adoption among enthusiasts and competitive players.

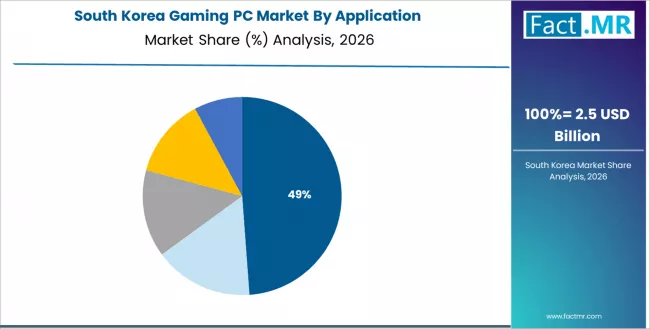

By Application, Which Segment Registers the Highest Share?

Competitive gaming applications are projected to represent 48.7% of market demand in 2026, driven by the growth of esports and performance-intensive gaming formats. Professional and semi-professional players require stable frame rates, low latency, and hardware customization, reinforcing demand for high-performance gaming PCs. Ongoing improvements in gaming engines and competitive platforms are expected to sustain this segment’s leading position.

What are the Drivers, Restraints, and Key Trends of the Gaming PC Market?

The gaming PC market is expanding due to rising adoption of competitive gaming, growth of esports ecosystems, and increasing demand for high-performance systems across entertainment and professional use cases. Gamers and content creators require powerful hardware to support high frame rates, advanced graphics, and simultaneous gameplay and streaming. However, market growth is restrained by competition from gaming consoles, price sensitivity among mainstream consumers, and the technical complexity associated with system configuration, upgrades, and maintenance.

A key trend shaping the market is the deeper integration of gaming PCs into esports and content creation workflows. Systems are increasingly optimized for competitive play, live streaming, and video production, supporting stable performance and real-time content delivery. Another major trend is the adoption of ray tracing and AI-enhanced technologies. These innovations improve visual realism, optimize system performance, and enable advanced gaming features, strengthening the appeal of gaming PCs among enthusiasts seeking immersive and high-fidelity gaming experiences.

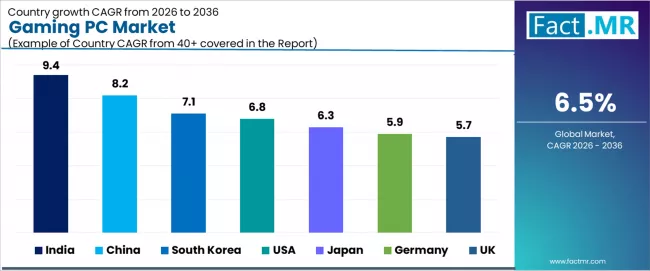

Analysis of the Gaming PC Market by Key Countries

| Country | CAGR (2026-2036) |

|---|---|

| China | 8.2% |

| USA | 6.8% |

| South Korea | 7.1% |

| Germany | 5.9% |

| Japan | 6.3% |

| UK | 5.7% |

| India | 9.4% |

How are E-sports Expansion and Demographic Momentum Driving India’s Market Leadership?

India’s gaming PC market is projected to grow at a CAGR of 9.4% through 2036, supported by a rapidly expanding gaming population, strong youth demographics, and increasing focus on e-sports development. Rising participation in competitive gaming and greater affordability of high-performance hardware are strengthening demand across urban gaming hubs. Manufacturers and distributors are expanding retail, customization, and after-sales capabilities to address growing performance expectations.

- Growth in e-sports participation and gaming communities is accelerating gaming PC adoption across metropolitan regions.

- Demographic advantages and rising technology adoption are supporting demand for premium performance-oriented systems.

Why is E-sports Infrastructure Investment Strengthening China’s Market Potential?

China’s gaming PC market is expanding at a CAGR of 8.2%, driven by sustained investment in e-sports infrastructure, competitive gaming awareness, and high consumer focus on performance hardware. Growth in professional gaming leagues and streaming platforms is reinforcing demand for advanced gaming systems. Suppliers are scaling distribution and service networks to support high-volume demand.

- Expansion of e-sports ecosystems is sustaining demand for high-performance gaming PCs.

- Advancements in gaming hardware technology support adoption among competitive users.

How do Mature E-sports Standards Support Expansion in South Korea?

South Korea’s gaming PC market is projected to grow at a CAGR of 7.1% through 2036, supported by its established e-sports culture, structured competitive frameworks, and leadership in gaming technology. Competitive precision and system reliability remain key purchase criteria across professional and enthusiast segments.

- Mature competitive gaming environments drive consistent demand for premium gaming PCs.

- Strong regulatory and performance standards support adoption of advanced gaming systems.

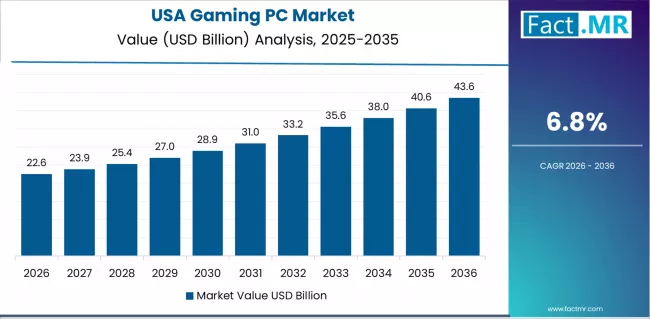

Why is Content Creation Driving Gaming PC Demand in the USA?

The USA gaming PC market is expected to grow at a CAGR of 6.8%, supported by expansion of content creation, live streaming, and performance-focused gaming applications. Users increasingly seek systems capable of handling gaming, production, and streaming workloads simultaneously.

- Growth in streaming and content creation is increasing demand for high-performance gaming PCs.

- Emphasis on performance efficiency supports adoption of specialized gaming configurations.

How do Performance Optimization Trends Support Germany’s Market Growth?

Germany’s gaming PC market is projected to grow at a CAGR of 5.9%, supported by strong consumer focus on system reliability, performance optimization, and technical quality. Demand remains steady across enthusiast gaming and professional performance segments.

- Preference for technically optimized systems supports consistent gaming PC demand.

- Strong quality standards reinforce adoption of premium gaming hardware.

Why does Market Maturity Sustain Steady Growth in Japan?

Japan’s gaming PC market is forecast to grow at a CAGR of 6.3%, supported by an established gaming culture, mature technology markets, and steady demand for high-quality systems. Users prioritizing performance consistency and long-term reliability drive adoption.

- Mature gaming markets sustain stable demand for quality gaming PCs.

- Focus on durability and performance supports continued adoption.

How is Competitive Gaming Development Supporting Growth in the UK?

The UK gaming PC market is projected to grow at a CAGR of 5.7%, driven by expanding competitive gaming participation, technology integration, and performance-focused gaming setups. Demand is rising across esports, streaming, and enthusiast gaming segments.

- Expansion of competitive gaming environments is driving demand for advanced gaming PCs.

- Emphasis on technical precision supports adoption of performance-oriented systems.

Competitive Landscape of the Gaming PC Market

The gaming PC market is characterized by competition among established technology companies, specialized gaming manufacturers, and integrated performance solution providers. Companies are investing in advanced gaming technologies, specialized integration platforms, product innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable gaming PC systems. Innovation in component optimization, thermal management advancement, and performance-focused product development is central to strengthening market position and customer satisfaction.

Dell Technologies Incorporated offers a a strong focus on gaming innovation and comprehensive high-performance solutions, offering premium and enthusiast systems with emphasis on performance excellence and gaming heritage through its Alienware brand. Hewlett-Packard Inc. provides integrated gaming solutions with a focus on mainstream market applications and competitive price networks.

ASUSTeK Computer Inc. delivers comprehensive gaming technology solutions with a focus on enthusiast positioning and performance efficiency. Micro-Star International Co. Ltd. specializes in comprehensive gaming systems with an emphasis on competitive applications. Corsair Gaming Incorporated focuses on comprehensive gaming components with advanced design and premium positioning capabilities.

Key Players in the Gaming PC Market

- Dell Technologies Incorporated

- Hewlett-Packard Inc.

- ASUSTeK Computer Inc.

- Micro-Star International Co. Ltd.

- Corsair Gaming Incorporated

- Razer Incorporated

- Origin PC Corporation

- NZXT Incorporated

- CyberPowerPC Systems USA Incorporated

- iBUYPOWER Computer Corporation

- Falcon Northwest Computer Systems

- Digital Storm LLC

- Maingear Voodoo LLC

- System76 Incorporated

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2026) | USD 47.9 Billion |

| System Type | Desktop Gaming PCs, Gaming Laptops, Mini Gaming PCs, Workstation Gaming Systems, Other System Configurations |

| Application | Competitive Gaming, Content Creation, Virtual Reality Gaming, Casual Gaming, Others |

| End-User | Individual Gamers, Esports Organizations, Content Creators, Gaming Cafes, Others |

| Price Range | Entry-Level Systems, Mid-Range Systems, High-End Systems, Premium Configurations |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, MEA, Other Regions |

| Countries Covered | China, USA, South Korea, Germany, Japan, UK, India, and 40+ countries |

| Key Companies Profiled | Dell Technologies Incorporated, Hewlett-Packard Inc., ASUSTeK Computer Inc., Micro-Star International Co. Ltd., Corsair Gaming Incorporated, and other leading gaming PC companies |

| Additional Attributes | Dollar sales by system type, application, end-user, price range, and region; regional demand trends, competitive landscape, technological advancements in gaming engineering, competitive performance optimization initiatives, system enhancement programs, and premium product development strategies |

Gaming PC Market by Segments

-

System Type :

- Desktop Gaming PCs

- Gaming Laptops

- Mini Gaming PCs

- Workstation Gaming Systems

- Other System Configurations

-

Application :

- Competitive Gaming

- Content Creation

- Virtual Reality Gaming

- Casual Gaming

- Others

-

End-User :

- Individual Gamers

- Esports Organizations

- Content Creators

- Gaming Cafes

- Others

-

Price Range :

- Entry-Level Systems

- Mid-Range Systems

- High-End Systems

- Premium Configurations

-

Region :

-

North America

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Nordic Countries

- BENELUX

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Argentina

- Rest of Latin America

-

MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

-

Technology

Games of the Future 2025 Offers $5M Prize Pool

“Phygital” sports combine traditional athletic competition with its digital counterpart in a unified format that requires competitors to excel in both dimensions. Teams begin the challenge in the digital round before facing off again in the physical arena, with victory determined by the combined results of both performances.

This model reflects the growing convergence of technology and real-world performance, offering a new and immersive form of sporting competition.

More than 850 athletes from 60 countries will participate, representing clubs, emerging talents, and new faces across 11 phygital sports disciplines.

Faisal Al Bannai, Adviser to the UAE President for Strategic Research and Advanced Technology Affairs and Secretary-General of the Advanced Technology Research Council, said:

“Digital sport is not merely a new format; it embodies the mindset of a new generation.

Bridging physical excellence and digital mastery

Abu Dhabi is proud to host this edition of the Games of the Future 2025, providing an environment that brings together physical excellence and digital mastery. Our goal is to empower youth, accelerate innovation, and build communities around the technologies that will shape the future.”

The 2025 edition comes with strong global momentum, bringing together elite athletes from across the phygital sports ecosystem—competitors who demonstrate exceptional physical performance alongside advanced digital skills.

The event will feature professional athletes, esports stars, and rising phygital talents, promising outstanding competitions that showcase the best of both the physical and digital worlds. The championship reflects the rapid transformation of sport in an increasingly interconnected world, positioning the 2025 edition as a pivotal milestone in the global evolution of this growing sector.

Abu Dhabi prepares to deliver an exceptional edition

The draw has determined the opening group-stage matchups across the various disciplines, setting the stage for the first competitive narratives that audiences will follow. As the event progresses, full competitive pathways will unfold, with clubs vying for qualification and top positions in the finals, which will feature a total prize pool of USD 5 million.

In parallel with the tournament, Abu Dhabi will host the Phygital Sports Summit on 17 December 2025. The summit will serve as an intellectual platform bringing together global experts, athletes, innovators, and decision-makers to discuss the evolution of hybrid sports. Its comprehensive program includes keynote addresses, panel sessions, and in-depth discussions on the intersection of sport and technology, human–AI integration, the future of youth engagement, athlete health in hybrid environments, and the sustainable legacy of phygital sports.

Summit sessions will be moderated by Amy Jane Gillingham, Mohamed Al Hosani, and Sabine Sassen, with participation from senior representatives of Phygital International, partners of the Games of the Future, and leading global figures shaping both the digital and physical sports movements.

Distinguished guests expected to attend include H.E. Dr. Ahmad Belhoul Al Falasi, UAE Minister of Sports, and a high-level international delegation featuring H.E. Ilham Aliyev, President of the Republic of Azerbaijan; H.E. Rawan bint Najeeb Tawfiqi, Minister of Youth Affairs of the Kingdom of Bahrain; Sheikha Deena bint Rashid Al Khalifa, Adviser for Planning and Development at Bahrain’s Ministry of Youth Affairs; and Dr. Osman Aşkın Bak, Minister of Youth and Sports of the Republic of Türkiye.

Sport of the next generation

Technology

The evolution of entertainment technology and its business impact – EUbusiness.com

Entertainment has always played a vital role in society, and the ways we access and enjoy it have changed drastically over time. Today, as online platforms, streaming services, and digital applications gain traction, businesses are rethinking their strategies in this evolving landscape.

Innovations in entertainment technology touch everything from live sports to gaming and betting, as seen at bet777, demonstrating how rapidly shifting trends impact the industry as a whole.

From analog to digital: the transformation of entertainment

The transition from analog to digital technology marks one of the most significant changes in entertainment history. In the past, physical media such as vinyl records, VHS tapes, and CDs were the norm. With the rise of digital formats, accessibility and distribution underwent a revolution. Digital streaming made it possible for consumers to access content instantly, eliminating the limitations of geography and physical storage. This convenience not only changed how audiences consume media but also how creators and companies distribute and monetize their content.

As digital solutions expanded, new forms of entertainment began to emerge. Video games, interactive apps, and online casinos grew in popularity, shifting the focus from passive viewing to active participation. The proliferation of high-speed internet and smartphones further fueled this transformation, enabling entertainment anywhere, anytime. Companies operating in this environment had to adapt quickly to user expectations of on-demand, personalized experiences. This ongoing evolution continues to blur the line between creators, distributors, and consumers, changing the entire value chain.

Streaming services and the shift in business models

The introduction of video and music streaming platforms led to fundamental changes in business models across the sector. Subscription services replaced one-time purchases, shifting the focus to long-term customer retention and recurring revenue streams. This not only increased competition among platforms but also gave rise to exclusive content and original productions as key differentiators. The bargaining power shifted to content creators and platforms able to attract large subscriber bases, while traditional broadcasters and physical retailers had to reinvent or risk becoming obsolete.

This transition has also extended to other segments such as live sports, eSports, and iGaming. Businesses are investing in digital infrastructure and user experience, offering everything from artificial intelligence-driven recommendations to interactive live events. The ability to collect and analyze user data allows companies to tailor offerings directly to their audiences, driving engagement and loyalty. Simultaneously, regulatory challenges and data security concerns have emerged, demanding new approaches to compliance and consumer protection in digital entertainment.

Immersive technology and the business of innovation

The latest chapter in entertainment technology is defined by immersive experiences such as virtual reality (VR), augmented reality (AR), and advanced streaming features. As these technologies find mainstream adoption, businesses are leveraging them to create new ways to engage users. For example, VR concerts, AR-enhanced sports statistics, and immersive gaming environments offer fresh revenue opportunities and deepen the user’s connection with content.

To stay competitive, entertainment companies must constantly invest in innovation and understand emerging trends. Cloud gaming and interactive betting platforms exemplify how technology influences entertainment choices and opens up lucrative business channels. The integration of social features, mobile-first strategies, and cross-platform compatibility are now prerequisites for success. As the landscape continues to evolve, keeping pace with technology and user preferences will be crucial for organizations aiming to thrive in the future of entertainment.

-

Motorsports3 weeks ago

Motorsports3 weeks agoJo Shimoda Undergoes Back Surgery

-

Motorsports1 week ago

Motorsports1 week agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

NIL3 weeks ago

NIL3 weeks agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoHow this startup (and a KC sports icon) turned young players into card-carrying legends overnight

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoRobert “Bobby” Lewis Hardin, 56

-

Motorsports3 weeks ago

Motorsports3 weeks agoPohlman admits ‘there might be some spats’ as he pushes to get Kyle Busch winning again

-

Sports3 weeks ago

Wisconsin volleyball sweeps Minnesota with ease in ranked rivalry win

-

Motorsports1 week ago

Motorsports1 week agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Motorsports3 weeks ago

Motorsports3 weeks agoIncreased Purses, 19 Different Tracks Highlight 2026 Great Lakes Super Sprints Schedule – Speedway Digest

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw