Sports

Viking Track & Field to compete at the NSAA Conference Championships

Story Links VALLEY CITY, N.D. – The Valley City State University track & field teams are headed to Dickinson to compete in the North Star Athletic Association Outdoor Championships on Thursday and Friday, May 8-9. The action starts on Thursday beginning with field events at 12:30 p.m. First […]

VALLEY CITY, N.D. – The Valley City State University track & field teams are headed to Dickinson to compete in the North Star Athletic Association Outdoor Championships on Thursday and Friday, May 8-9.

The action starts on Thursday beginning with field events at 12:30 p.m. First up is the men’s javelin. Running events will follow starting with the women’s 100-meter hurdles at 3:00 p.m.

On Friday field events will resume at 10:00 a.m. starting with the men’s long jump. Running events are set to start at 12:00 p.m. with the women’s 3000-meter steeplechase.

View Meet Information | View Live Results

The Vikings are slated to take on athletes from Bellevue, Dakota State, Dickinson State, and Jamestown.

Viking track and field has two returning conference champions from the 2024 outdoor season. Senior Kendra Odegard was a national qualifier and conference champion in the javelin 2024. Sophomore Aaron Cutshall was the 2024 conference champion in the long jump.

In addition to Odegard and Cutshall, VCSU’s returning all-conference athletes include Sadie Hansen, Emma Muggli, Olivia Backus, and Cameron Champagnie.

Viking freshman to look out for are Tayshaun Robinson competing in the 110-meter hurdles, Gage Gunther competing in the 800-meter, Jordan Mount in the 200 and 400-meter, Zeke Barnick in the high jump and long jump, and Caitlin Armbrust in the triple jump.

Sports

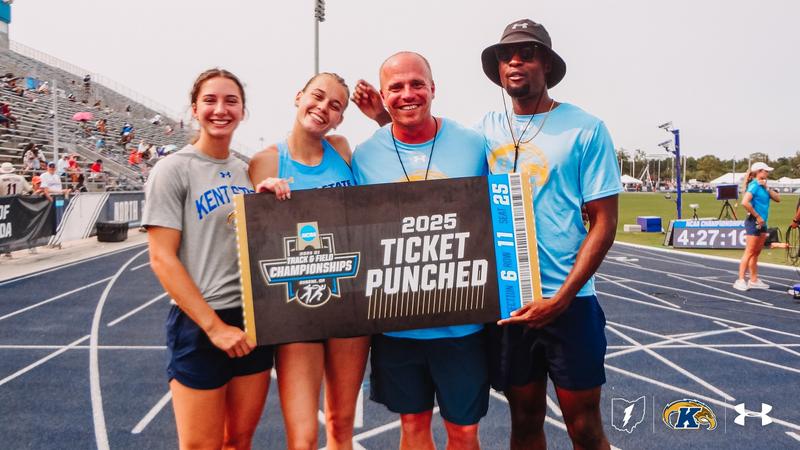

Trio to Represent Kent State at NCAA Outdoor Track and Field Championships

Story Links Three Kent State student-athletes will compete at the 2025 NCAA Outdoor Track and Field Championships later this week. While the four-day meet at historic Hayward Field in Eugene, Oregon begins on Wednesday, the Golden Flashes will only be in action on Friday and Saturday. Shelby Grover begins the […]

Three Kent State student-athletes will compete at the 2025 NCAA Outdoor Track and Field Championships later this week. While the four-day meet at historic Hayward Field in Eugene, Oregon begins on Wednesday, the Golden Flashes will only be in action on Friday and Saturday.

Shelby Grover begins the women’s heptathlon at 2:45 p.m. ET on Friday with the 110-meter hurdles, the first of four events on the day, and continue with the long jump at 6:30 p.m. ET on Saturday. Grover broke the school record with 5,555 points at the Mid-American Conference Championships and is Kent State’s first qualifier in the event since 2011.

Alexandre Malanda seeks to close his Flashes with a strong performance in the men’s triple jump on Friday at 8:10 p.m. ET. Malanda advanced to the national meet with an outdoor personal-best mark of 52′-9.50″ on his final attempt during competition at the NCAA East Preliminary Rounds. The Paris native earned First-Team All-America honors earlier this year with a seventh-place finish at the NCAA Indoor Championships.

Svenia De Coninck will be Kent State’s final competitor and is slated for women’s high jump action at 8:30 p.m. ET on Saturday. De Coninck punched her NCAA ticket by clearing 5′-10.50″ for a new personal-best at the NCAA East Preliminary Rounds.

The NCAA Outdoor Track and Field Championships will be broadcast in its entirety by the ESPN family of networks and the ESPN app. For detailed broadcast information, visit NCAA.com.

FOLLOW KENT STATE TRACK AND FIELD

For complete coverage of Kent State Track and Field, download the official Kent State Golden Flashes app (iOS, Android) and follow the Golden Flashes on social media on X, Instagram and Facebook for news and updates.

NCAA Outdoor Track and Field Championships Schedule

Friday, June 13

Women’s Heptathlon – Shelby Grover

• 2:45 p.m. ET – 110-Meter Hurdles

• 3:45 p.m. ET – High Jump

• 5:45 p.m. ET – Shot Put

• 9:43 p.m. ET – 200-Meter Dash

8:10 p.m. ET – Men’s Triple Jump – Alexandre Malanda

Saturday, June 14

Women’s Heptathlon – Shelby Grover

• 6:30 p.m. ET – Long Jump

• 7:45 p.m. ET – Javelin Throw

• 10:43 p.m. ET – 800-Meter Run

8:30 p.m. ET – Women’s High Jump – Svenia De Coninck

Sports

Oregon athletes are grateful to compete at home for this week’s NCAA Division I Track and Field Championships

This week, Eugene hosts the biggest college track and field meet of the year. The NCAA Division I Championship meet spans four days, with men competing Wednesday and Friday, and women on Thursday and Saturday. Although the Oregon women won this year’s NCAA Indoor Track and Field Championships, they come into this meet ranked 5th. […]

This week, Eugene hosts the biggest college track and field meet of the year.

The NCAA Division I Championship meet spans four days, with men competing Wednesday and Friday, and women on Thursday and Saturday.

Although the Oregon women won this year’s NCAA Indoor Track and Field Championships, they come into this meet ranked 5th. The Duck’s strongest event is the 1500 meter race, where Klaudia Kazimierska is seeded 6th, Silan Ayyildiz is seeded 7th, and Mia Barnett is seeded 21st of the 24 qualifiers.

At a Monday press conference in Eugene,100 meter hurdler Aaliyah McCormick said the home track will help Oregon.

“It’s such an advantage,” she said. “I mean, the fans for me just do it all. Feeling them makes me want to run for them and makes me want to win.”

McCormick is seeded first in her race, and is one of 12 Duck women in nine events.

NCAA teams with multiple strong entries are in contention for the women’s and men’s team titles, which the Oregon women last won in 2017. The UO men last won the national outdoor track and field title in 2015.

This year, the men of Oregon aren’t ranked in the top 25 teams, but 800 meter qualifier Matthew Erickson said not to dismiss them.

“The Ducks just know how to step up when it counts,” he said, noting that the men were not slated to win the Big Ten Outdoor Track and Field Championship, but they did. “A sign of a great athlete is someone that knows how to bring their best performance on the biggest stage.”

The Oregon men have eight entries in the championships, including Simeon Birnbaum in the 1500 meter race and Benjamin Balasz in the 3K Steeplechase.

Oregon State doesn’t have a men’s program. Sara Sanders will represent the Beaver women, competing in the javelin on Thursday.

The men’s decathlon starts the competition Wednesday at noon. You can find more information, including the full schedule here.

Hayward Field will host more high-profile track and field events in the coming weeks. The USATF Under 20 Championships are next week, the Prefontaine Classic is July 5, and the USATF Outdoor National and Para National meet, which select teams for the Tokyo World Championships, starts July 31.

Sports

USF Coaches and Student-Athletes Headline Bulls Around the Bay Event at Busch Gardens

Story Links Football head coach Alex Golesh and others to meet fans TAMPA, JUNE 10, 2025 – South Florida head football coach Alex Golesh, head women’s tennis coach Cristina Moros, and student-athletes from football, men’s basketball and women’s basketball will meet fans on Saturday, June 14 at Busch Gardens in the first […]

Football head coach Alex Golesh and others to meet fans

TAMPA, JUNE 10, 2025 – South Florida head football coach Alex Golesh, head women’s tennis coach Cristina Moros, and student-athletes from football, men’s basketball and women’s basketball will meet fans on Saturday, June 14 at Busch Gardens in the first Bulls Around the Bay event.

The Bulls will meet fans in the “Cheetah Hunt” area of the park on Saturday afternoon from 1:30 to 3:30 p.m. Coach Golesh will be available from 2:15 to 3:15 p.m. The June 14 event is part of Busch Gardens’ Sports Fan Fest featuring representatives from the Tampa Bay Rays, Tampa Bay Lightning and South Florida Bulls. Busch Gardens will also be hosting a Father’s Day event on Saturday.

Information on Busch Gardens Father’s Day weekend events can be found here.

Busch Gardens tickets can be purchased here.

About USF Athletics

USF Athletics sponsors 21 varsity teams, with 20 competing at the NCAA Division I level in the American Athletic Conference, including the recent additions of women’s lacrosse and women’s beach volleyball. The Bulls’ athletic program, founded in 1965, is in its 59th season.

Nearly 500 student-athletes train and compete in the Tampa General Hospital Athletics District on the east end of USF’s Tampa campus. The Bulls have won 154 conference titles across 16 sports, with 82 men’s championships and 72 women’s championships. Men’s tennis and men’s soccer lead with 20 titles each, while women’s programs have been headlined by women’s tennis (14) and volleyball (13). Since joining the American Athletic Conference in 2013, USF has secured 36 conference team titles.

Academically, USF student-athletes have achieved a program-record 21 consecutive semesters with a combined GPA of 3.0 or above as of fall 2024. Since 2015, more than 750 Bulls have earned their degrees.

Follow USF Athletics on X (@USFAthletics) and Facebook for all the latest information concerning the USF Athletic program.

– #GoBulls –

Sports

Q & A: Three Game Changers for Sports Business in 2025 | GW Today

GW Business Professor Lisa Delpy Neirotti has researched and taught the business side of sports for more than 30 years. In a Q & A with GW Today, Neirotti offers her insights into the ever-evolving collegiate athletics environment, the growing popularity of women’s sports at all levels and the impact of technology such as AI […]

GW Business Professor Lisa Delpy Neirotti has researched and taught the business side of sports for more than 30 years. In a Q & A with GW Today, Neirotti offers her insights into the ever-evolving collegiate athletics environment, the growing popularity of women’s sports at all levels and the impact of technology such as AI on Olympic sports.

Q. The University of Kentucky Board of Trustees recently moved its athletic department to a subsidiary company, distancing athletics from the university. What collegiate athletics developments are you watching?

A. There are many issues and challenges under discussion right now. One is how universities will handle the financial side of the new rules for paying players. You may end up paying a student athlete $4 million and then not have funds to hire faculty. That’s when things are going to get a little confrontational.

I think that at some point universities are going to license out their names to venture capital or private equity firms, wealthy individuals or others interested in owning and running sports teams, specifically football and basketball. That private owner will pay the university for the right to use the school’s name, and that licensee will be responsible for revenue and expenses including recruiting, training and paying the athletes. The licenses could run from five to 20 years, and the universities could use the license fees to pay for non-revenue sports, like tennis and swimming.

Q. The Olympics are one of the global sports business segments you study. Will collegiate pay-for-play disrupt U.S. Olympic opportunities?

A. Over 70 percent of the U.S. Olympic teams have competed in collegiate sports at some point. Right now, many receive scholarships to train and compete at the collegiate level, including track and field, swimming, diving, fencing, rowing, water polo, volleyball and wrestling. If universities stop offering Olympic sport programs to focus resources on revenue sports, it will limit the options for talented athletes who cannot afford to pay for training on their own. Privatized sport clubs may absorb some but not all athletes will continue competing.

Also, approximately 13 percent of NCAA I student-athletes are international. A reduction in Olympic sport programs may also eliminate opportunities for international students seeking scholarships.

Q. In what significant ways are AI and technology changing sports?

A. Technology is integrated both on and off the field. Wearables generate vast amounts of data on players’ biometrics, movement and positioning during practice and competition. The data is used to reduce injuries and extend player careers by identifying physical changes and adjusting workouts and playing time. Tracking movements during play helps to optimize formations, spacing and rosters.

On the business side, data analytics are used to maximize revenues in ticketing, concessions, merchandise, sponsors and media. What food items are selling and how much could prices increase before seeing a decline in purchases? Is touchless technology increasing concessions sales? What time do fans enter venues? Do promotions change behavior?

Q. Women’s sports are on the rise. What are the business repercussions?

For years, women’s sports were an afterthought—an “add on” to men’s media right deals and corporate partnerships. NCAA and FIFA are now selling women’s rights as independent properties. The value of these rights is not yet proportional to the viewership but they are on the right trajectory. It will take time to change the mentality about the true value in women’s sports. More brands like Ally Bank need to step up and invest.

Taking NCAA media rights as an example, women’s championships are valued at $65 million, while men’s are about $870 million per year. In 2025, women’s games average 8.5 million viewers and men’s average 10.2 million. That means women’s viewership is 83 percent of the men’s viewership yet the women’s TV rights are valued at just 7 percent of the men’s contract. That will shift when companies realize women shop more than men. We’re in the process of educating advertisers on the benefits of advertising with women’s sports.

One of the misconceptions in women’s sports is that only women watch. For the 2023 Women’s World Cup, 54 percent of the fans were male. And men represent over 55 percent of the WNBA fan base. Furthermore, research shows that women are the economy’s power players—outpacing men in income and spending growth.

The other big thing is that there is finally some research on women athletes. There is interesting initial research, for example, that suggests women playing during their menstrual cycle may have a greater risk of injury. Although no causal relationship has been established, the idea that someone is conducting research on female athletes is an important development.

Sports

Opinion: The Reliance-Disney Star Merger

GV Krishnamurthy (GVK) Reliance’s acquisition of Disney Star’s India business is more than a corporate transaction it’s a seismic event that is reshape India’s media and entertainment landscape. By uniting Disney+ Hotstar, Viacom’s and Disney Star’s entire television portfolio (including GECs, movies, music, and sports channels), premium sports rights, and an extensive distribution network under […]

Reliance’s acquisition of Disney Star’s India business is more than a corporate transaction it’s a seismic event that is reshape India’s media and entertainment landscape. By uniting Disney+ Hotstar, Viacom’s and Disney Star’s entire television portfolio (including GECs, movies, music, and sports channels), premium sports rights, and an extensive distribution network under one umbrella, Reliance has forged an end-to-end powerhouse that spans content creation, distribution, and monetisation.

What’s Included in the Deal

- Disney+ Hotstar: India’s leading OTT platform, with over 55 million paid subscribers.

- Television Channels: Viacom’s and Disney Star’s portfolio including GECs (family-viewing channels), movies, music, and sports channels.

- Sports Rights: Exclusive digital (IPL, ICC tournaments) and television rights for cricket arguably the crown jewel of Indian sports broadcasting.

- Distribution Infrastructure: While not part of this acquisition, Reliance already owns JioFiber (broadband), JioCinema (OTT), DEN Networks, and Hathway (cable distribution). These existing assets give Reliance near-complete control over the “pipeline” from studio to sofa. Moreover, Reliance is in advanced talks with multiple other MSO’s across the country for potential acquisitions, further extending its grip on distribution and last-mile connectivity.

Industry Snapshot (2024–25)

- Total M&E Market: ₹ 2.5 trillion (US $ 29.4 billion) in 2024, up 3.3 percent year-on-year.

- Digital Media: Now the largest segment, contributing 32 percent of overall revenues (₹ 802 billion in 2024, +17 percent YoY).

- Television: Under pressure revenues fell 4.5 percent in 2024 after a 2 percent drop in 2023.

- OTT Platforms: The market reached ₹ 37,940 crore in FY 24–25, with Disney+ Hotstar and JioCinema leading in subscriber count and engagement.

- Digital Advertising: Grew 21.1 percent in 2024 to ₹ 49,251 crore, driven by performance marketing and digital OOH.

- Sports Industry: Valued at roughly US $ 52 billion, outpacing telecom in growth underscoring how premium cricket rights command top dollar.

Vertical Integration & Synergies

- End-to-End Control

- Reliance now “owns the entire stack”: licensing Disney Star originals for Hotstar, producing Hotstar exclusives, airing Viacom’s/Disney Star’s prime-time shows, and controlling cable distribution (DEN, Hathway), broadband (JioFiber), and streaming (JioCinema).

- This vertical integration grants unprecedented leverage over advertising inventory, subscription pricing, and promotional bundling.

- Digital Dominance

- Merging Disney+ Hotstar’s 55 million + paid users with JioCinema’s free and paid tiers accelerates scale: Reliance can claim India’s largest OTT subscriber base, eclipsing Netflix, Prime Video, Zee5, SonyLIV, and MX Player.

- In sports streaming especially IPL—Reliance will funnel all premium cricket rights through JioCinema/Hotstar (Now Jio Hotstar), making it nearly impossible for rivals to compete.

- Consumer Convenience (& Concerns)

- A single “one-stop shop” could yield unified apps, bundled subscriptions, and integrated user accounts (watch history, recommendations, payments) across sports, movies, series, and live TV.

- Conversely, fewer standalone subscription options, potential price hikes, and more aggressive ad loads could erode consumer choice over time.

The Upside: Scale, Simplification, Innovation

- Unmatched Scale: Reliance is now India’s biggest content owner across TV, digital, and sports. Advertisers face a single entity controlling an estimated 70 percent of premium inventory across multiple screens.

- Operational Synergies: Shared technology platforms (CDN’s, recommendation engines, ad servers), unified data analytics (viewership patterns across cable and OTT), and cross-promotion between Jio’s telecom user base and Disney Star’s loyal subscribers create cost efficiencies.

- Content-Tech Fusion: Reliance can leverage Jio’s first-party data (demographics, broadband usage) to personalise recommendations on Hotstar/JioCinema potentially leapfrogging global OTT competitors on engagement.

The Downside: Monopoly Risks, Creative Constraints, Market Distortion

- Agency Dynamics Shift

- Historically, media agencies negotiated rates between multiple broadcasters and platforms. Now, with Reliance controlling both inventory (Viacom’s/Disney Star channels, Hotstar, JioCinema) and distribution (DEN, Hathway), bargaining power tilts heavily toward the seller.

- “Rate cards” may become non-negotiable. Agencies will have little choice but to buy standardised packages; volume or loyalty discounts could vanish.

- Barrier to New Entrants

- Startups or mid-sized OTT platforms will struggle to secure marquee content or premium sports rights. Content budgets must now compete not just on creative merit, but on distribution scale that few niche players can match.

- Regional players need deep pockets or must carve hyper-niche segments (e.g., ultra-local language web series, micro-genres) to remain relevant.

- Regulatory Blind Spots

- The Competition Commission of India (CCI) may face scrutiny over ultra consolidation: one entity controlling content creation, rights, advertising inventory, cable networks, broadband, and mobile distribution.

- Cricket rights alone account for over half of Hotstar’s subscription revenue; funneling them exclusively through Jio platforms could be construed as anti-competitive, especially if bundled with telecom/broadband plans.

TV vs Digital: Is Traditional Media on Borrowed Time?

- Linear TV’s Lingering Reach

- Over 220 million TV households still rely on cable and satellite, especially in Tier II/III towns and rural areas. Broadcasters like Sun TV, Zee (Z), and Sony remain vital for regional GEC, movie, music, and sports content.

- Yet, ad revenue on TV is in decline: a 4.5 percent drop in 2024 signals waning advertiser interest as digital viewership grows.

- Digital Acceleration

- Reliance’s play: shift viewers (and ad dollars) behind the paywall. Live sports, family-drama serials, and Bollywood blockbusters once free on TV now become premium digital offerings.

- TV networks that can’t pivot risk losing viewer mindshare. Regional channels with strong local content can still thrive but only if they adapt distribution (e.g., launch affordable OTT tiers, partner with rural broadband initiatives).

Implications for Stakeholders

- Regional Broadcasters

- Must invest aggressively in digital analytics, localised OTT platforms, and community engagement. Deep cultural resonance (dialects, folklore, hyper-local stories) will be their competitive moat.

- Lower-cost subscription models tailored to sub-₹ 200 per month can win over price-sensitive viewers in Bharat.

- National Networks (Sony, Zee (Z), Viacom18, Sun TV, Enterr10 etc..)

- Reassess partnerships: explore tie-ups with telecom or tech firms (e.g., partnering with Airtel, GenNext Technologies) for distribution.

- Double down on original IP franchise series, reality shows with big-ticket sponsors, and co-productions with international studios to differentiate from Reliance’s mass-market offerings.

- Agencies

- With price negotiation power eroding, agencies must pivot from “media buying” to “media advisory.” Clients will value data-driven insights: ROI-focused planning, attribution modelling, cross-channel synergy.

- Emphasize programmatic efficiency and performance marketing where small-to-mid-tier publishers or digital-first platforms may still offer yield at competitive CPMs.

- Brands & Marketers

- Initially, many may pay a premium to maintain reach especially during high-visibility events like IPL. But if ROI doesn’t justify costs, they will explore alternatives: influencer marketing, regional OTT tie-ups, or direct-to-consumer (D2C) digital campaigns.

- Data transparency becomes paramount: brands will demand third-party viewability audits (e.g., Nielsen Digital Ad Ratings) to measure actual engagement rather than relying solely on Reliance’s dashboards.

- Content Creators

- Big studios may receive first priority for budgets benefiting those who can deliver franchise-worthy content. Niche filmmakers, indie creators, and regional storytellers must forge alliances with alternative platforms (e.g., Hoichoi for Bengali, Aha for Telugu) or pivot to short-form verticals (YouTube, Instagram Reels) to stay visible.

- Consumers

- Short-Term Gains: Consolidated bundling could drive down monthly subscription costs (e.g., “Jio + Hotstar bundle at ₹ 299/month” instead of separate ₹ 199 + ₹ 399 plans).

- Long-Term Risks: Less diversity of choice. As content libraries consolidate, viewers may face higher renewal rates, bundled ad loads, and fewer alternatives. Subscription fatigue and churn could rise unless Reliance maintains clear value.

Consequences for Brands

If Disney Star-Reliance hikes CPM’s for digital without improving transparent measurement or drives up CPRP’s for linear TV while viewership data remains opaque brands risk plowing budgets into “black boxes.” Over time, they may demand:

- Independent viewability audits (to validate impressions and completion rates).

- A/B testing of ad creatives (to optimise audience engagement).

- Stronger ROI guarantees, such as pay-per-view or pay-per-action models, and performance-based buys.

The Bigger Picture: Beyond Media—A Market Realignment

While Reliance-Disney Star consolidation focuses on supply-side dominance, an equally powerful force looms on the demand side: agency consolidation. If Omnicom and IPG merge to become the largest holding company and WPP remains the other global giant then two behemoths (WPP and the combined Omnicom-IPG) would command most major brand budgets. The result? A duopoly on both supply (Disney Star-Reliance) and demand (WPP and Omnicom-IPG), controlling over 70 percent of market flow.

- Ad Pricing: Will be “dictated, not negotiated.” Scarce premium inventory means standardised packages at premium price points; custom campaigns or bulk discounts become expensive.

- Innovation at Risk: With giant duopolies focused on protecting margins, experimental or niche content may struggle to secure funding. Unless smaller players innovate in distribution (e.g., programmatic guaranteed, private marketplaces), creative diversity could shrink.

- ROI Under Pressure :As transparent measurement erodes—both in TV (BARC controversies) and digital (no independent auditing)—brands may struggle to optimise spends. When ROI dips, they will shift budgets into alternative channels: performance marketing, influencer collaborations, regional platforms, or direct social engagement.

Final Thoughts: A New Era of Convergence and Competition

Reliance’s acquisition of Disney Star India isn’t just asset consolidation; it’s a strategic blueprint for the future of Indian entertainment. By owning content, distribution, data, and monetisation, Reliance is poised to define what a billion Indians watch, how they watch it, and at what cost. But with that power comes responsibility: to maintain competitive pricing, transparent measurement, and a diverse content slate across languages and genres.

The winners in this new paradigm will be those who:

- Embrace Transparency

- Adopt independent measurement tools (third-party view ability, brand lift studies, A/B testing frameworks).

- Provide granular insights into audience behaviour, cross-platform engagement, and incremental lift.

- Innovate at the Edge

- Launch hyper-local or niche offerings whether a Tamil thriller anthology on Aha, a Marathi short-form series on MX Player, or a gaming-centric OTT hub targeting Gen Z.

- Leverage emerging technologies (AR/VR matchday experiences, interactive storytelling) to differentiate.

- Prioritise Data-Driven ROI Models

- Move beyond “reach and frequency” to “engagement and conversion.”

- Offer performance-based advertising options (e.g., pay-per-click, pay-per-view) alongside traditional CPM/CPRP buys.

- Champion Consumer Choice

- Bundle sensibly: avoid forcing consumers into “all-or-nothing” packages.

- Maintain a freemium (ad-supported) tier for price-sensitive segments, while offering customisation for premium viewers.

- At its core, media and entertainment exist to serve viewers and to amplify brands’ stories. If measurement and choice erode under duopolistic pressures, the entire ecosystem risks stagnation. Yet history shows that every Goliath makes room for a new David: a nimble competitor armed with deep local insights, a transparent value proposition, and a relentless focus on user experience.

The future belongs not to the largest checkbook, but to those who deliver transparent value at scale, in real time, and with unwavering focus on both viewer delight and brand performance. Let the new media game begin. But let’s remember: in every era of consolidation, there’s always room for innovative challengers who rewrite the rules.

Sports

Ranking The Jumpers At 2025 NCAA Track And Field National Championships

The 2025 NCAA Track and Field National Championships are right around the corner and the jumper fields are set. From Hayward Field in Eugene, Oregon, athletes will compete to take home NCAA Titles in the jumping events. The men’s long jump and pole vault finals will start on Wednesday, June 11 and the women’s on […]

The 2025 NCAA Track and Field National Championships are right around the corner and the jumper fields are set. From Hayward Field in Eugene, Oregon, athletes will compete to take home NCAA Titles in the jumping events.

The men’s long jump and pole vault finals will start on Wednesday, June 11 and the women’s on Thursday, June 12. The rest of the events will take place on Friday and Saturday, the final days of competition.

See the top 10 athletes in each jumping event here:

Men’s High Jump

- Riyon Rankin – Georgia – 2.29m

- Arvesta Troupe – Ole Miss – 2.26m

- Tyus Wilson – Nebraska – 2.25m

- Kampton Kam – Penn – 2.25m

- Aiden Hayes – Texas State – 2.25m

- Tito Alofe – Harvard – 2.25m

- Kason O’Riley – Texas State – 2.25m

- Elias Gerald – USC – 2.23m

- Bradford (BJ) Jennings – Texas Tech – 2.22m

- Arthur Chitty – Samford – 2.22m

Women’s High Jump

- Temitope Adeshina – Texas Tech – 1.97m

- Rose Yeboah – Illinois – 1.91m

- Kristi Perez-Snyman – Missouri – 1.90m

- Rachel Glenn – Arkansas – 1.89m

- Elena Kulichenko – Georgia – 1.89m

- Jenna Rogers – Nebraska – 1.88m

- Maria Arboleda – Iowa – 1.88m

- Sharie Enoe – Kansas State – 1.88m

- Cheyla Scott – South Carolina – 1.87m

- Celia Rifaterra – Virginia – 1.86m

- Arienne Birch – North Dakota State – 1.86m

Men’s Pole Vaut

- 1. Aleksandr Solovev – Texas A&M – 5.72m

- 2. Logan Hammer – Utah State – 5.70m

- 3. Arnie Grunert – Western Illinois – 5.65m

- 4. Benjamin Conacher – Virginia Tech – 5.61m

- 4. Ashton Barkdull – Kansas – 5.61m

- 6. Simen Guttormsen – Duke – 5.60m

- 7. Cade Gray – Tennessee – 5.55m

- 7. Bradley Jelmert – Arkansas State – 5.55m

- 7. Scott Toney – Washington – 5.55m

- 7. Dyson Wicker – Nebraska – 5.55m

Women’s Pole Vault

- 1. Amanda Moll – Washington – 4.78m

- 2. Hana Moll – Washington – 4.65m

- 3. Molly Haywood – Baylor – 4.58m

- 4. Marleen Mulla – South Dakota – 4.57m

- 4. Olivia Lueking – Oklahoma – 4.57m

- 6. Anna Willis – South Dakota – 4.52m

- 7. Mason Meinershagen – Kansas – 4.51m

- 7. Tenly Kuhn – Baylor – 4.51m

- 9. Erica Ellis – Kansas – 4.50m

- 9. Chloe Timberg – Rutgers – 4.50m

- 9. Tatum Moku – Washington State – 4.50m

Men’s Long Jump

- Lokesh Sathyanathan – Tarleton State – 8.14m

- Charles Godfred – Minnesota – 8.13m

- Greg Foster – Princeton – 8.10m

- Reinaldo Rodrigues – Arizona – 8.05m

- Chrstyn John Stevenson – USC – 8.02m

- Chris Preddie – Texas State – 8.01m

- Curtis Williams – Florida State – 7.96m

- Jayden Keys – Georgia – 7.95m

- Sir Jonathan Sims – Tarleton State – 7.94m

- Blair Anderson – Oklahoma State – 7.93m

Women’s Long Jump

- Alexis Brown – Baylor – 7.03m

- Anthaya Charlton – Florida – 6.82m

- Alyssa Jones – Stanford – 6.81m

- Sydney Johnson – UCLA – 6.79m

- Tacoria Humphrey – Illinois – 6.73m

- Janae De Gannes – Baylor – 6.72m

- Prestina Ochonogor – Tarleton State – 6.67m

- Shamaya Joiner – Grambling – 6.67m

- Synclair Savage – Louisville – 6.64m

- Aaliyah Foster – Texas – 6.57m

Men’s Triple Jump

- Brandon Green Jr. – Oklahoma – 16.94m

- Hakeem Ford – Minnesota – 16.54m

- Selva Prabhu – Kansas State – 16.49m

- Xavier Drumgoole – Stanford – 16.42m

- Gabriele Tosti – Tarleton State – 16.39m

- Theophilus Mudzengerere – South Carolina – 16.38m

- Kyvon Tatham – Florida State – 16.37m

- Kelsey Daniel – Texas – 16.34m

- Luke Brown – Kentucky – 16.33m

- Floyd Whitaker – Oklahoma – 16.27m

Women’s Triple Jump

- 1. Winny Bii – Texas A&M – 14.01m

- 1. Agur Dwol – Oklahoma – 14.01m

- 1. Shantae Foreman – Clemson – 14.01m

- 4. Victoria Gorlova – Texas Tech – 13.99m

- 5. Emilia Sjostrand – San Jose State – 13.78m

- 6. Daniela Wamokpego – Iowa – 13.67m

- 7. Tamiah Washington – Texas Tech – 13.63m

- 7. Simone Johnson – San Jose State – 13.63m

- 9. Busola Akinduro – Texas Tech – 13.59m

- 10. Ryann Porter – Oregon – 13.55m

About Hayward Field

Hayward Field, which was built in 1919, is no stranger to top-tier track and field events, including the Diamond League and the U.S. Olympic Team Trials.

The venue is named after Bill Hayward, who ran the University of Oregon track and field program from 1904 to 1947. Though it originally was intended for Ducks football, many additions and renovations over the century have helped it become a premier destination.

In September 2023, the venue became the first facility outside of Zurich or Brussels to host the two-day season-ending Wanda Diamond League Final, where the year’s 32 overall champions were crowned.

What Schools Won The Team Titles At The 2025 NCAA Division I Men’s And Women’s Outdoor Track And Field Championships?

The Arkansas women took home the outdoor team title in 2024, sweeping the indoor and outdoor championships for the 2023-2024 season.

Florida, led by legendary head coach Mike Holloway, secured the men’s title in 2024, giving the Gators three consecutive outdoor men’s titles. Florida became the first team to three-peat since Texas A&M (2009-2011).

What Schools Have Won The Most Titles At The NCAA Division I Outdoor Track And Field Championships?

The NCAA Division I Men’s Outdoor Track and Field Championships first was held in 1921.

USC owns the most men’s titles with 25, while Arkansas is the only other program with 10 or more (10).

The NCAA Division I Women’s Outdoor Track and Field Championships first was held in 1982.

LSU has won the most women’s titles with 14. The next-closest is Texas with five.

From FloTrack YouTube

Check out these potential future collegiate stars: Incredible Finish In 8-Year-Old 4×1 National Championship

FloTrack Is The Streaming Home For Many Track And Field Meets Each Year

Don’t miss all the track and field season action streaming on FloTrack. Check out the FloTrack schedule for more events.

FloTrack Archived Footage

Video footage from each event will be archived and stored in a video library for FloTrack subscribers to watch for the duration of their subscriptions.

Join The Track & Field Conversation On Social

-

Professional Sports3 weeks ago

Professional Sports3 weeks agoJon Jones answers UFC retirement speculation as fans accuse champion of 'holding the belt …

-

NIL2 weeks ago

NIL2 weeks ago2025 NCAA Softball Tournament Bracket: Women’s College World Series bracket, schedule set

-

Motorsports3 weeks ago

Motorsports3 weeks agoWhy IHOP Rode With Dale Earnhardt Jr. In Amazon NASCAR Debut

-

Health5 days ago

Health5 days agoOregon track star wages legal battle against trans athlete policy after medal ceremony protest

-

College Sports1 week ago

College Sports1 week agoIU basketball recruiting

-

Professional Sports5 days ago

Professional Sports5 days ago'I asked Anderson privately'… UFC legend retells secret sparring session between Jon Jones …

-

Youtube3 weeks ago

Youtube3 weeks agoAnt greets A-Rod & Barry Bonds before Game 3

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoJ.W. Craft: Investing in Community Through Sports

-

Professional Sports6 days ago

Professional Sports6 days agoUFC 316 star storms out of Media Day when asked about bitter feud with Rampage Jackson

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoScott Barker named to lead CCS basketball • SSentinel.com

Stephen A. responds to LeBron’s NBA coverage criticism | First Take

Stephen A. responds to LeBron’s NBA coverage criticism | First Take