Technology

I’m a health tech editor. These are the Memorial Day sales fitness enthusiasts should shop

Current price: $200 Original price: $250 The nice thing about buying one of Oura’s earlier model smart rings is you’ll get the same app and software experience — just a different form factor and one less day of battery life. If prospective Oura Ring buyers don’t mind this, they should opt for the Oura Ring […]

- Current price: $200

- Original price: $250

The nice thing about buying one of Oura’s earlier model smart rings is you’ll get the same app and software experience — just a different form factor and one less day of battery life. If prospective Oura Ring buyers don’t mind this, they should opt for the Oura Ring 3, which has reduced its price by around 20% since the Oura Ring 4’s debut.

The Oura Ring tracks your daily sleep, stress, activity, and readiness to deliver scores, insights, and recommendations. It’s a great health tracker for people looking to optimize their sleep and activity routine, but who want gentle recommendations and encouragements that won’t make them feel bad about a poor night of sleep or a day of low activity. It’s constantly innovating with new features, like a Cardiovascular Age feature that tells you if your physiological age is ahead, behind, or at your chronological age. Plus, it partners with other health brands, like Dexcom, so you can keep track of your glucose levels on the Oura app if you use its Stelo continuous glucose monitor.

The smart ring is compatible with Android and iOS phones, so everybody can use it to capture data. The only downside of an Oura Ring is its $70 annual subscription (which is not on sale) to unlock all that data it collects and displays. The Ring Gen 3 is also an sale in select finishes and sizes at Oura.

Technology

Massive Multiplayer Online Games Market Size

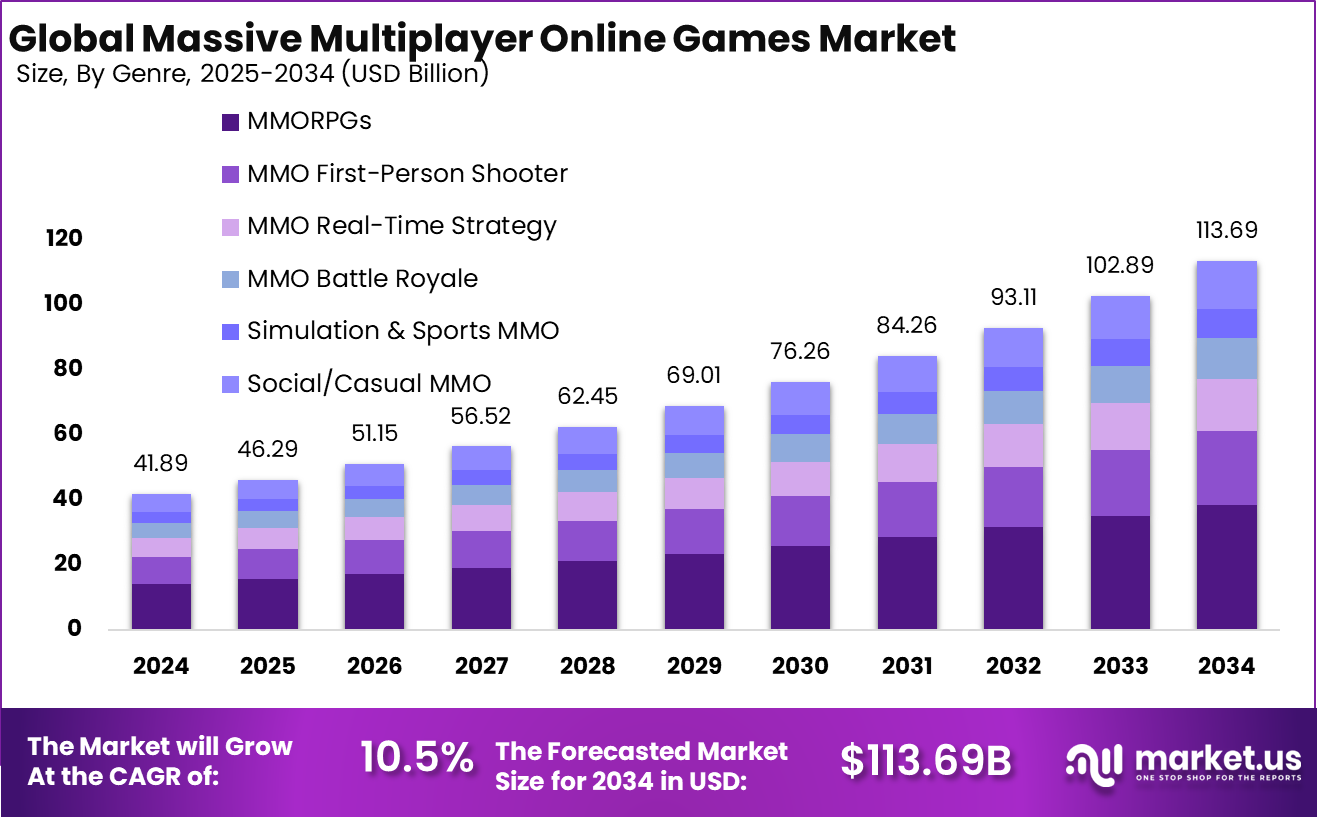

Report Overview The Global Massive Multiplayer Online (MMO) Games Market size is expected to be worth around USD 113.69 billion by 2034, from USD 41.89 billion in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 44% share, holding USD […]

Report Overview

The Global Massive Multiplayer Online (MMO) Games Market size is expected to be worth around USD 113.69 billion by 2034, from USD 41.89 billion in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 44% share, holding USD 18.4 billion in revenue.

The market for Massive Multiplayer Online (MMO) games is primarily driven by the increasing demand for immersive, social, and interactive gaming experiences. As internet access and mobile device penetration continue to rise globally, more players are drawn to the dynamic, community-driven environments that MMOs provide.

![]()

![]()

Consumer demand is being driven by a desire for immersive, persistent experiences and deep social interaction through guilds, events, and collaborative gameplay. The convenience and ubiquity of mobile devices, combined with the cloud and subscription-based access, attract diverse demographics beyond the traditional hardcore gamer segment.

For instance, In January 2025, South Korea’s gaming sector gained momentum as Nexon unveiled a new MMO project integrating advanced AI and cloud gaming features. This move reflects Nexon’s strategic push to enhance immersive gameplay and strengthen its position in both domestic and global MMO markets.

Investment in these technologies is being driven by their ability to lower hardware costs, expand audience reach, and enhance player retention. Cloud adoption enables flexible scaling and global accessibility, while AI integration fosters deeper engagement through intelligent matchmaking and adaptive game environments. Energy efficiency aligns with broader sustainability goals, which can be monetized through consumer goodwill and cost savings.

Business benefits include extended user lifecycles through recurring revenue models, strengthened brand loyalty via community building, and diversified monetization channels (e.g. free‑to‑play with in‑game purchases). Additionally, advancements in sustainability and safety can enhance reputation and comply with social and regulatory expectations.

Key Insights Summary

- The global MMO games market is projected to grow from USD 41.89 billion (2024) to USD 113.69 billion by 2034, registering a CAGR of 10.5%.

- In 2024, the Asia Pacific region led the market with over 44% share, generating USD 18.4 billion in revenue.

- China alone contributed USD 13.5 billion, growing at a CAGR of 8.3%.

- By genre, Massively Multiplayer Online RPGs (MMORPGs) dominated with a 34% share.

- Mobile platforms led usage, accounting for 41% of total market revenue.

- The Free-to-Play (F2P) model remained most popular, capturing a 48% share of the revenue model segment.

China MMO Games Market Size

The market for Massive Multiplayer Online (MMO) Games within China is growing tremendously and is currently valued at USD 13.5 billion, the market has a projected CAGR of 8.3%. China’s growing market for Massive Multiplayer Online (MMO) games is largely due to its expanding internet connectivity, tech-savvy youth, and increasing interest in online sports.

The demand for mobile gaming in China is driven by its thriving culture, which is heavily connected to online gaming and competitive gaming. In addition, government support for digital entertainment and the development of high-speed internet and 5G networks are key factors driving the growth of MMOs.

For instance, In June 2025, Tencent was reportedly considering the acquisition of Nexon, a well-known MMO game developer. This strategic move could enhance Tencent’s MMO portfolio and reinforce its global market presence. By tapping into Nexon’s successful franchises, Tencent aims to solidify its leadership in the highly competitive MMO gaming industry.

![]()

![]()

In 2024, Asia Pacific held a dominant market position in the Global Massive Multiplayer Online (MMO) Games Market, capturing more than a 44% share, holding USD 18.4 billion in revenue. This region is in a dominant position due to a rapidly growing gamer population, widespread mobile device adoption, and advanced digital infrastructure.

It benefits from low-cost smartphones, high bandwidth, and the growing popularity of mobile gaming, which makes MMOs accessible to many. In addition, a strong esports culture, continuous innovation in gaming technology, and robust community engagement have reinforced Asia Pacific’s leadership, with China playing a pivotal role in this growth.

For instance, in October 2024, a leak revealed that Nintendo is planning to launch a Minecraft-style MMO for the Switch, which will allow players to build, explore, and interact in an open-world environment. The game, which is expected to be available through Nintendo Switch Online, will feature a blend of sandbox gameplay and multiplayer features, offering a dynamic, collaborative gaming experience.

![]()

![]()

Genre Analysis

In 2024, the Massively Multiplayer Online RPGs (MMORPGs) segment held a dominant market position, capturing a 34% share of the Global Massive Multiplayer Online (MMO) Games Market. The MMORPG market’s dominance is due to the genre’s unique ability to provide engaging, long-lasting gaming experiences with complex plotlines, detailed character development, and expansive online virtual worlds.

The ability of MMORPGs to create strong player groups is crucial for maintaining a sense of community and participation among players. Through the sustained success of flagship titles, as well as frequent additions to the content and inclusion of advanced social features, this popularity has further enhanced the genre’s appeal and solidified its position as a dominant force in the global MMO gaming market.

For instance, In April 2025, the creators of Axie Infinity announced the shutdown of Project T, their MMO RPG initiative. The closure was attributed to difficulties in aligning the game’s blockchain-based economic model with sustained player engagement. This outcome underscores the ongoing challenges in merging blockchain mechanics with MMORPG design, particularly in maintaining long-term user retention and balanced virtual economies.

Platform Analysis

In 2025, the Mobile segment held a dominant market position, capturing a 41% share of the Global Massive Multiplayer Online (MMO) Games Market. The increase in demand for MMO experiences has been largely driven by the widespread use of smartphones, improved internet connectivity, and mobility for gaming.

This growth has also been supplemented by the introduction of free-to-play models, cross-platform functionality, and ongoing improvements to mobile graphics and performance. Also, due to the popularity of multiplayer and social aspects, as well as regular content updates and active community engagement, mobile has become the preferred platform for many MMO enthusiasts.

For instance, in February 2025, Nexon reported a record annual revenue of ¥446.2 billion (~$3 billion), driven largely by the continued success of Dungeon Fighter Online (DFO), which saw significant growth in both its mobile and PC versions. The strong performance of DFO helped Nexon maintain its position as a leader in the MMO market.

Revenue Model Analysis

In 2024, the Free-to-Play (F2P) segment held a dominant market position, capturing a 48% share of the Global Massive Multiplayer Online (MMO) Games Market. This dominance is due to the widespread appeal of F2P models, which lower the barrier to entry for players, allowing anyone to access the game without upfront costs.

Additionally, the revenue generated through in-game purchases, such as virtual goods, cosmetics, and microtransactions, has proven highly profitable. Regular content updates, seasonal events, and the integration of social features also contribute to strong player retention and continuous monetization opportunities, reinforcing the F2P model’s market leadership.

For Instance, in June 2025, NetEase Games introduced custom servers for Once Human, a popular free-to-play survival crafting game. These custom servers allow players to adjust various game parameters, such as PvE/PvP scenarios and difficulty levels, offering a more tailored experience. This move enhances the game’s accessibility and player engagement by providing a highly customizable gameplay environment.

Key Market Segments

By Genre

- Massively Multiplayer Online Role-Playing Games (MMORPGs)

- MMO First-Person Shooter (MMOFPS)

- MMO Real-Time Strategy (MMORTS)

- MMO Battle Royale

- Simulation & Sports MMO

- Social/Casual MMO

By Platform

- PC

- Console

- Mobile

- Cloud Gaming Platforms

By Revenue Model

- Subscription-based

- Free-to-Play (F2P)

- Buy-to-Play

- Hybrid Models

- NFT/Play-to-Earn (P2E)

Drivers

Growing Popularity of Esports

Esports has become a major player in the MMO industry, sparking heightened interest and involvement. Games such as League of Legends and Dota 2 have shifted from being recreational activities to large-scale arenas with audiences across the globe.

Besides building up loyal fan bases, this trend generates revenue through sponsorships, advertising, and merchandise sales. The esports framework has elevated MMOs’ status as a top entertainment spectacle, attracting sponsorships from major companies and drawing in mainstream media attention.

For instance, in September 2023, the Odin Cup garnered significant attention, showcasing the immense potential of the MMO market in Southeast Asia, particularly within esports. The event highlighted the region’s growing appetite for competitive gaming, with Odin: Valhalla Rising leading the charge in attracting both players and audiences.

Restraint

Security and Privacy Concerns

Security and privacy concerns remain a major challenge for MMO developers. The online gaming industry is a prime target of hackers, fraudsters, and data breaches that expose compromising personal information. The reputation of a game can be severely damaged by these events, which can lead to lowered player confidence and ultimately result in the loss of users.

The implementation of robust cybersecurity measures and data safeguarding practices is essential for developers to ensure that their players are protected by regulations and minimize data risks. For instance, in December 2023, Street Mobster, a popular MMO game, was found to have a significant data breach, exposing the personal information of over 2 million players.

The leaked data included sensitive details such as usernames, passwords, and email addresses, which raised serious concerns about the game’s security protocols. This incident highlights the ongoing risks of data security in online gaming environments and underscores the importance of robust protection measures to safeguard player privacy in the increasingly connected MMO market.

Opportunities

Community and Social Features

As gaming becomes more social, MMOs are leveraging the benefits of community-based features. A stronger connection to social media platforms, collaborations with influencers, and the development of in-game communities create immersive environments that foster player involvement and commitment.

Through word-of-mouth, these characteristics drive organic growth and foster long-term retention as players become socially enticed by the game. MMOs that promote seamless social interactions both within and beyond the game can enhance user relationships, leading to increased engagement and revenue.

For instance, in April 2025, Ronin Games announced a collaboration with Forgotten Runiverse and Pixels to bring influencer-driven content into their MMO ecosystem. This partnership aims to integrate exclusive in-game content, such as limited-edition skins and events, which are promoted through influencer channels.

By leveraging the reach of popular content creators, the collaboration not only enhances player engagement but also taps into new audiences, further highlighting the growing trend of influencer partnerships in the MMO space to drive engagement and monetization.

Challenges

Intense Competition from New Entrants

The MMO arena is a highly competitive field, with both established franchises and emerging developers competing fiercely. The presence of new and exciting competitions can undermine the authority of established games, making it more challenging for any championship to maintain a dominant position.

Classic MMOs face a challenge from new competitors who bring in fresh gameplay mechanics, narratives, and monetization strategies to retain their audience. In this highly competitive atmosphere, it is imperative to constantly adjust and evolve to meet the changing preferences and demands of players.

For instance, in October 2024, Nintendo announced it is developing a new MMO-style game aimed at competing with popular titles like Minecraft and Roblox. The game, which is expected to feature expansive open-world mechanics, user-generated content, and multiplayer interactions, will target a broad audience, including younger players.

This strategic move positions Nintendo to tap into the growing market of social and sandbox gaming, combining its rich history in family-friendly entertainment with the growing demand for immersive, online multiplayer experiences.

Latest Trends

Innovations in Augmented Reality (AR), Virtual Reality (VR), and 5G connectivity are significantly enhancing the MMO gaming experience. AR and VR have created virtual experiences that are so immersive and visually stunning that gamers can experience them in real life without having to go through the physical stuff.

Additionally, 5G and faster internet speeds are reducing lag and improving the responsiveness of multiplayer games, enabling real-time connections between players. Both developers and players are now able to utilize the innovations to unlock more profound, captivating gameplay possibilities in the MMO realm.

For instance, in May 2020, Bublar announced the soft launch of Otherworld Heroes, a location-based augmented reality (AR) MMORPG. This innovative game integrates AR technology to create immersive, real-world environments where players can interact with virtual elements overlaid onto their surroundings. The use of AR in Otherworld Heroes enhances the traditional MMO experience by blending the digital and physical worlds, offering a more engaging and dynamic gameplay experience.

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Activision Blizzard Inc., Electronic Arts Inc., and Ubisoft Entertainment SA lead the MMO games market with strong global IPs and recurring content updates. Their focus on live-service models and cross-platform play drives long-term player engagement. NCSOFT Corporation and Giant Interactive Group Inc. maintain a solid presence in Asia, supported by culturally tailored MMORPGs and loyal user bases.

In June 2024, NCSOFT, in collaboration with Amazon Games, launched Throne and Liberty, a free-to-play MMORPG across PC, PlayStation 5, and Xbox Series X|S. Featuring a dynamic open world with changing weather and seasons, the game offers immersive PvP and PvE gameplay. This launch marks a key milestone for NCSOFT, reinforcing its competitive standing in the global MMO gaming market.

Tencent Holdings Limited, Amazon Game Studios, and Nexon Co. Ltd are investing in cloud gaming and cross-device features. Jagex Limited and Bright Star Studios focus on player-centric design, offering deep storytelling and persistent online worlds that appeal to core MMO players.

Daybreak Game Company, CCP Games UK Ltd, and Neteasegames Inc. rely on genre diversity and real-time events to retain users. Aeria Games and Gravity Corporation expand in mobile-friendly and emerging markets. Other players are exploring blockchain, NFTs, and player-owned assets, pushing the MMO market toward decentralized, creator-driven experiences.

Top Key Players in the Market

- Activision Blizzard Inc.

- Electronic Arts Inc.

- Ubisoft Entertainment SA

- NCSOFT Corporation

- Giant Interactive Group Inc.

- Tencent Holdings Limited

- Amazon Game Studios

- Nexon Co. Ltd

- Jagex Limited

- Bright Star Studios

- Daybreak Game Company

- CCP games UK Ltd

- Netease Games Inc.

- Aeria Games

- Gravity Corporation

- Others

Recent Developments

- In July 2024, Amazon Game Studios announced significant updates for New World, their MMORPG, introducing new content and gameplay features to enhance the player experience. The update focused on expanding the game’s world with additional zones, quests, and PvP modes.

- In October 2023, Activision Blizzard plans to introduce several of its popular games to Xbox Game Pass, expanding accessibility for players on Microsoft’s platform in 2024. This move follows the company’s acquisition by Microsoft and aims to enhance the reach of Activision’s game library, which includes highly successful franchises like Call of Duty and World of Warcraft.

Report Scope

Technology

Anthropic wins ruling on AI training in copyright lawsuit but must face trial on pirated books

By MATT O’BRIEN In a test case for the artificial intelligence industry, a federal judge has ruled that AI company Anthropic didn’t break the law by training its chatbot Claude on millions of copyrighted books. But the company is still on the hook and must now go to trial over how it acquired those books […]

By MATT O’BRIEN

In a test case for the artificial intelligence industry, a federal judge has ruled that AI company Anthropic didn’t break the law by training its chatbot Claude on millions of copyrighted books.

Technology

Kroger plans to close 60 US stores in 18 months to improve profits – East Bay Times

By DEE-ANN DURBIN, Associated Press Kroger plans to close around 60 U.S. grocery stores over the next 18 months to improve efficiency. The Cincinnati, Ohio-based company announced the plan during a corporate earnings call last Friday. The company hasn’t said which stores it plans to shutter, but said the closures will happen around the country. […]

By DEE-ANN DURBIN, Associated Press

Kroger plans to close around 60 U.S. grocery stores over the next 18 months to improve efficiency.

The Cincinnati, Ohio-based company announced the plan during a corporate earnings call last Friday. The company hasn’t said which stores it plans to shutter, but said the closures will happen around the country. It also said employees at impacted stores will be offered jobs at other locations.

Technology

Lehigh Valley tech company Shift4 makes deal for Smartpay

Shift4 announced Sunday that it is acquiring a New Zealand credit card processing company. It is the Upper Saucon Township payments and commerce technology company’s first major transaction since Taylor Lauber became CEO this month. The deal, which was conducted in New Zealand dollars, is worth about $180 million. Smartpay sells tailored payment solutions in […]

Shift4 announced Sunday that it is acquiring a New Zealand credit card processing company. It is the Upper Saucon Township payments and commerce technology company’s first major transaction since Taylor Lauber became CEO this month.

The deal, which was conducted in New Zealand dollars, is worth about $180 million. Smartpay sells tailored payment solutions in Australia and New Zealand with more than 40,000 merchants in the region. The acquisition is expected to close in the fourth quarter of 2025, subject to regulatory approvals.

“This acquisition follows the Shift4 playbook to a tee,” Lauber said. “It deepens our strategic presence in Australia and New Zealand, providing a significant opportunity to offer our full suite of software and payments solutions in the region.”

Lauber was named the next CEO after company founder Jared Isaacman was nominated to lead NASA. After the nomination was withdrawn, Isaacman became executive chair.

In trading Tuesday, Shift4 shares were up 4.6% to $97.89.

Originally Published:

Technology

Fitness Trackers Aren’t Accurate For People With Obesity | Health

State AlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareFloridaGeorgiaHawaiiIdahoIllinoisIndianaIowaKansasKentuckyLouisianaMaineMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontanaNebraskaNevadaNew HampshireNew JerseyNew MexicoNew YorkNorth CarolinaNorth DakotaOhioOklahomaOregonPennsylvaniaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWashington D.C.West VirginiaWisconsinWyomingPuerto RicoUS Virgin IslandsArmed Forces AmericasArmed Forces PacificArmed Forces EuropeNorthern Mariana IslandsMarshall IslandsAmerican SamoaFederated States of MicronesiaGuamPalauAlberta, CanadaBritish Columbia, CanadaManitoba, CanadaNew Brunswick, CanadaNewfoundland, CanadaNova Scotia, CanadaNorthwest Territories, CanadaNunavut, CanadaOntario, CanadaPrince Edward Island, CanadaQuebec, CanadaSaskatchewan, CanadaYukon Territory, Canada Zip Code Country United States of […]

Technology

Federal Judge In SF Rules That AI Company Anthropic Did Not Violate Copyright Law In Training Its Chatbot

In what is being seen as an important early judicial ruling for the AI industry, a federal judge in San Francisco has ruled that Anthropic did not break the law when it used copyrighted material to train its AI chatbot Claude. The company will have to go to trial, however, over its use of pirated […]

In what is being seen as an important early judicial ruling for the AI industry, a federal judge in San Francisco has ruled that Anthropic did not break the law when it used copyrighted material to train its AI chatbot Claude. The company will have to go to trial, however, over its use of pirated copies of books.

US District Judge William Alsup issued a pretrial ruling late Monday that absolves San Francisco-based Anthropic, for now, over the issue of the use of books and copyrighted material to train its AI model. As the Associated Press reports, Alsup was convinced by Anthropic’s attorneys that reading the material into their large language models qualifies as “fair use” under copyright law, because the product produced, the chatbot, was “quintessentially transformative.”

“Like any reader aspiring to be a writer, Anthropic’s [AI large language models] trained upon works not to race ahead and replicate or supplant them — but to turn a hard corner and create something different,” Alsup wrote in his ruling.

But, Alsup said that a trial could proceed on the question of how Anthropic collected the books it first fed into Claude, namely from pirated copies found on the internet. Internal communications at the company allegedly reveal that employees knew this could spell trouble, and only later did they pay for digital copies of the books.

Alsup wrote that “Anthropic had no entitlement to use pirated copies for its central library.” And, the fact “That Anthropic later bought a copy of a book it earlier stole off the internet will not absolve it of liability for the theft but it may affect the extent of statutory damages.”

This decision may set some precedent in the ongoing battles over chatbots and the fast-and-loose way in which companies including Anthropic and OpenAI have scraped the internet, copyrights be damned, to train the robots how to write and respond to human prompts.

A case with a somewhat different angle is headed to trial in New York, in which the New York Times and other publishers are suing OpenAI for the way in which it fed mass amounts of articles into its ChatGPT and other models. In that case, which a judge in March ruled could head to trial, attorneys for the Times argue both that OpenAI scoured its archive without payment, and that its model reproduces Times reporting in ways that are not “transformative,” as the “fair use” doctrine requires.

The Harvard Law Review noted in April that the Times is arguing the exact opposite case than it did 24 ago in a case involving freelance writers, New York Times Co. v. Tasini. The Times is now arguing for the “creative, deeply human work of journalists,” when in the earlier case, it fought to protect its own financial interests against the copyright interests of freelancers. The Supreme Court, in an opinion written by Ruth Bader Ginsberg, ruled in favor of the freelancers, who said their copyrights had been violated when the Times and other publications fed their work into databases devoid of the context in which it was originally written, and without compensation.

Previously: Meta’s AI Efforts Include Huge Privacy Flub; Sam Altman Says Meta’s Been Trying to Poach OpenAI Staff

Top image: In this photo illustration, a person holds a smartphone displaying the logo of “Claude,” an AI language model by Anthropic, with the company’s logo visible in the background, illustrating the rapid development and adoption of generative AI technologies, on December 29, 2024 in Chongqing, China. Artificial Intelligence (AI) has become a cornerstone of China’s strategic ambitions, with the government aiming to establish the country as a global leader in AI by 2030. (Photo illustration by Cheng Xin/Getty Images)

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Weekend Preview: Autódromo Hermanos Rodríguez

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Through the Gears: Denny Hamlin has gas, a border needs crossing, and yes, that’s a Hemi

-

Motorsports3 weeks ago

Motorsports3 weeks agoChase Elliott’s $12.6 billion backer made major Kyle Larson decision – Motorsport – Sports

-

Health3 weeks ago

Health3 weeks agoBold and unapologetic

-

NIL3 weeks ago

NIL3 weeks agoShai Gilgeous

-

Motorsports3 weeks ago

Motorsports3 weeks agoJudge rules against Michael Jordan’s team in NASCAR lawsuit – NBC Boston

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Race Today: Mexico City start times, schedule and how to watch live on TV

-

NIL3 weeks ago

NIL3 weeks agoNCAA super regional game today

-

Youtube3 weeks ago

Youtube3 weeks agoPerk says Steph Curry is 1 Championship & Finals MVP AWAY from the GOAT CONVERSATION

| First Take

-

Sports3 weeks ago

Sports3 weeks agoUSA Men’s Junior National Team Roster Announced For Upcoming World Aquatics U20 Water Polo Championships

+ Knicks’ coaching search a SMOKE-SCREEN

+ Knicks’ coaching search a SMOKE-SCREEN | PTI

| PTI