Asia Pacific Gaming Peripherals Market Size

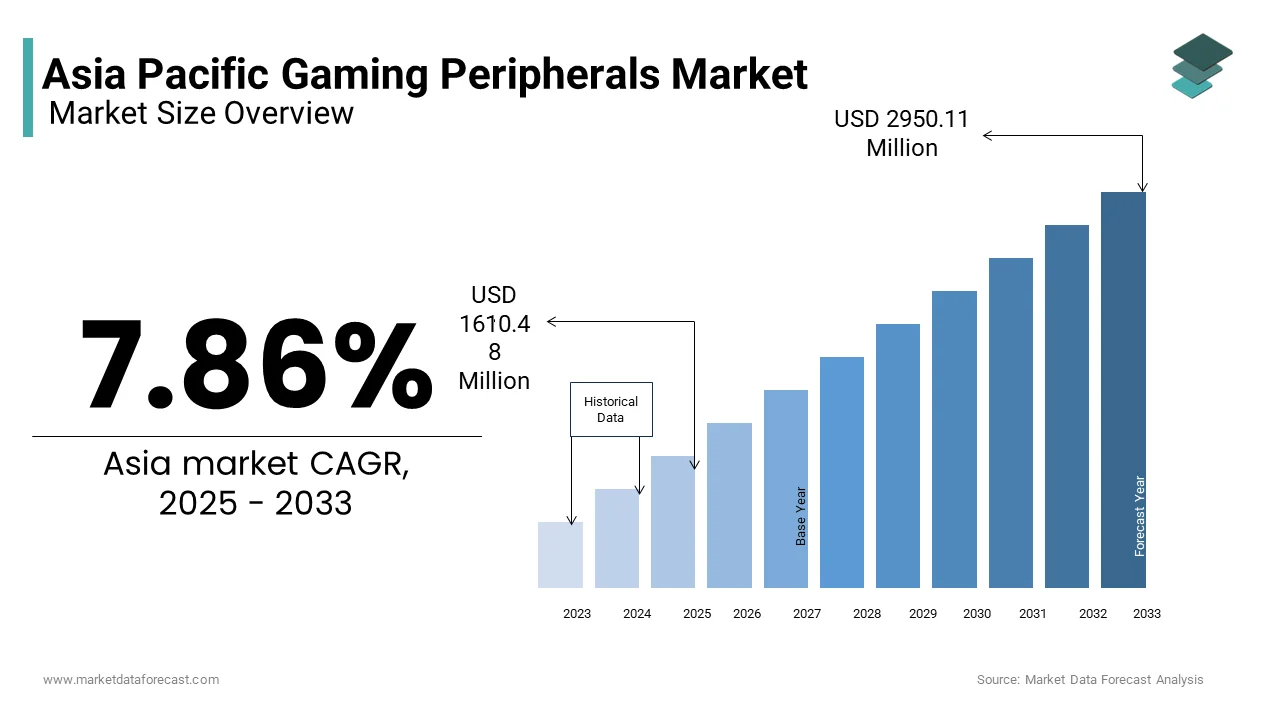

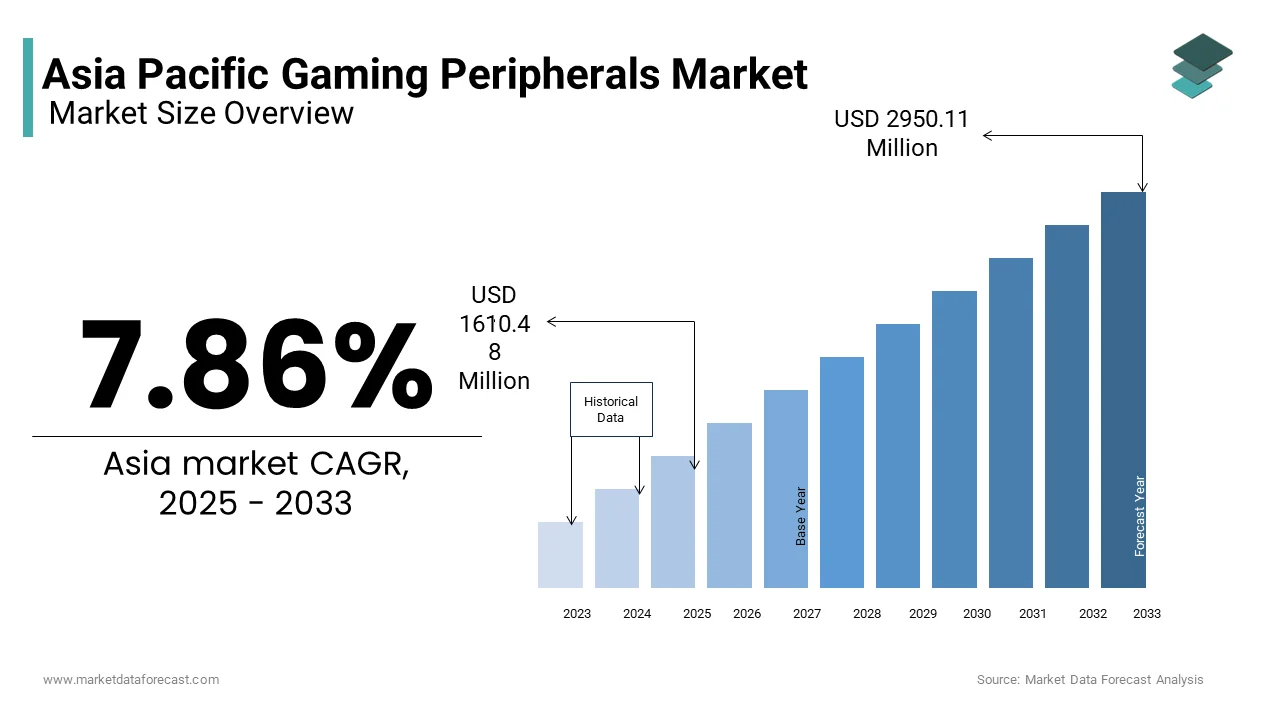

The Asia Pacific gaming peripherals market size was valued at USD 1493.12 million in 2024 and is anticipated to reach USD 1610.48 million in 2025 from USD 2950.11 million by 2033, growing at a CAGR of 7.86% during the forecast period from 2025 to 2033.

The Asia Pacific gaming peripherals market encompasses a wide range of hardware devices including gaming keyboards, mice, headsets, controllers, and VR accessories designed specifically for enhanced gaming experiences. Countries such as China, Japan, South Korea, India, and Australia are witnessing rapid expansion in both casual and professional gaming sectors, which is fueling product innovation and brand competition. A significant catalyst behind this growth is the increasing penetration of online and mobile gaming platforms, which have created new avenues for peripheral integration beyond traditional PC setups. According to Newzoo, the Asia Pacific region accounted for more than 45% of the global games market revenue in 2023, with China alone contributing over USD 40 billion in game-related spending. The rise in esports events and streaming content across platforms like Twitch and Douyu has further intensified consumer demand for premium-grade gaming gear that enhances performance and immersion.

MARKET DRIVERS

Surge in Competitive and Esports Gaming Activities

One of the primary drivers influencing the Asia Pacific gaming peripherals market is the exponential growth of competitive and esports gaming activities. The region has become a global epicenter for organized gaming tournaments, live-streamed competitions, and professional gamer sponsorships, all of which necessitate high-precision input devices and immersive audio equipment. China, in particular, remains home to some of the largest esports leagues globally, including the League of Legends Pro League and the King Pro League. These events attract millions of spectators and require players to utilize top-tier peripherals optimized for latency reduction, durability, and responsiveness. Similarly, South Korea’s well-established esports infrastructure fosters a continuous demand for high-end mechanical keyboards, ultra-fast mice, and noise-canceling headsets. In Japan, the government-backed Japan eSports Union has been actively promoting regulatory frameworks to legitimize professional gaming, encouraging brands to develop specialized product lines catering to this rising demographic. Additionally, universities and gaming academies across the Philippines, Malaysia, and Thailand are now offering formal esports training programs, further embedding gaming peripherals into mainstream education and youth culture.

Rising Popularity of Streaming and Content Creation Platforms

The second major driver propelling the Asia Pacific gaming peripherals market is the growing influence of livestreaming and digital content creation platforms. Platforms such as Twitch, YouTube Gaming, Douyu, and Kuaishou have transformed how individuals engage with video games, turning millions into creators who rely on high-fidelity microphones, webcams, RGB lighting systems, and programmable macro keys to enhance their production quality. According to StreamElements, in 2023, Asian broadcasters collectively logged over 700 million hours of streamed content, indicating a dramatic shift in media consumption and creator economies. Many of these creators invest heavily in premium peripherals such as studio-grade headsets, customizable mechanical keyboards, and multi-button gaming mice to improve interactivity and viewer engagement. Meanwhile, in South Korea, where streaming is deeply integrated into pop culture, influencers often collaborate with peripheral brands to launch signature editions, driving both visibility and sales.

MARKET RESTRAINTS

High Cost of Premium Gaming Peripherals

A significant restraint affecting the Asia Pacific gaming peripherals market is the relatively high cost of premium-grade accessories, which limits accessibility for budget-conscious consumers. Unlike standard computer peripherals, gaming-focused products often feature advanced components such as optical switches, high-polling rate sensors, and proprietary software ecosystems—all of which contribute to elevated price points. In countries like Indonesia, Vietnam, and the Philippines, where average per capita income remains lower compared to developed markets, affordability becomes a key barrier to adoption. While mid-range and entry-level alternatives exist, they often compromise on build quality, customization features, and long-term durability factors that are highly valued by serious gamers. Local retailers report that despite strong interest in high-performance gear, only a fraction of consumers can justify the cost given other financial priorities.

This pricing disparity restricts market penetration among younger demographics and casual gamers, who form a substantial portion of the regional player base. Additionally, counterfeit or grey-market products have gained popularity due to their lower costs, posing a challenge to legitimate brands trying to establish a foothold in certain parts of the region. Until pricing strategies evolve to better align with regional purchasing power, high-cost barriers will remain a persistent challenge for the widespread adoption of premium gaming peripherals in the Asia Pacific market.

Short Product Lifecycles and Rapid Technological Obsolescence

Another critical constraint hindering the growth of the Asia Pacific gaming peripherals market is the rapid pace of technological innovation, which leads to short product lifecycles and frequent obsolescence. Unlike traditional consumer electronics such as smartphones or televisions, gaming peripherals face constant pressure to integrate new features such as adaptive haptics, AI-driven macros, and wireless latency reduction. According to ABI Research, the average lifecycle of a high-end gaming mouse or keyboard is less than two years, forcing consumers to upgrade frequently to keep up with market trends.

This accelerated innovation cycle disproportionately affects price-sensitive markets in the Asia Pacific region, where users may not afford to replace gear at such intervals. For instance, in India and Thailand, many gamers still rely on older-generation peripherals due to limited disposable income and slower replacement cycles. OEMs and retailers note that while there is high awareness of cutting-edge models, actual purchase conversion remains low unless bundled with promotions or discounts.

MARKET OPPORTUNITIES

Expansion of Cloud Gaming and Cross-Platform Compatibility

An emerging opportunity shaping the Asia Pacific gaming peripherals market is the rapid rise of cloud gaming services and the push toward cross-platform compatibility. Companies like NVIDIA GeForce Now, Xbox Cloud Gaming, and Sony’s PS Plus Premium are expanding their presence in the region, enabling users to access high-end games without requiring expensive PCs or consoles. This transition has created a demand for peripherals that can seamlessly function across multiple platforms, including smartphones, tablets, laptops, and hybrid gaming devices. Manufacturers are responding by developing versatile input devices such as Bluetooth-enabled controllers, modular keyboards, and universal dongles that support Windows, Android, and iOS simultaneously. Brands like Razer and HyperX have already introduced peripherals tailored for cross-platform use, enhancing user flexibility and engagement.

Additionally, the proliferation of hybrid gaming devices such as the Steam Deck and Nintendo Switch OLED has spurred demand for compatible accessories that complement portable gameplay. Gamers in urban centers like Singapore, Tokyo, and Seoul are increasingly adopting lightweight, portable peripherals that sync effortlessly with their mobile and console environments.

Growth of Niche and Customizable Gaming Gear Markets

Another promising avenue for the Asia Pacific gaming peripherals market lies in the rising demand for niche and highly customizable gaming gear. Gamers today seek products that reflect personal style, ergonomic preferences, and performance-specific enhancements, creating opportunities for brands to differentiate through aesthetic design, modularity, and user-defined configurations. According to Grand View Research, the global customizable gaming peripherals segment is expected to grow at a CAGR of over 12% between 2023 and 2030, with Asia Pacific being a major contributor to this trend.

Japan stands at the forefront of this movement, with brands like Keychron and Drop collaborating with local designers to offer limited-edition mechanical keyboards inspired by anime, streetwear, and retro computing aesthetics. Similarly, in South Korea, custom-built PC gaming shops in cities like Seoul allow users to personalize every component—including keyboards and mice—based on color schemes, switch types, and even engraved details.

MARKET CHALLENGES

Intense Market Saturation and Brand Proliferation

A pressing challenge facing the Asia Pacific gaming peripherals market is the intense saturation caused by an influx of both international and local brands vying for consumer attention. The market has become highly fragmented, with numerous players offering similar product categories at varying price points, making differentiation difficult. According to Gartner, over 200 distinct gaming peripheral brands were active in the Asia Pacific region in 2023, ranging from established global names to emerging domestic startups.

This crowded landscape places immense pressure on marketing budgets and product innovation cycles. Global leaders like Logitech, Corsair, and Razer must compete against agile, cost-effective local brands such as Redragon (Australia), Qck (India), and Vortexgear (Philippines), which leverage regional manufacturing capabilities and localized branding to capture market share. Additionally, white-label manufacturers on e-commerce platforms are flooding the market with budget-friendly options, further complicating consumer decision-making processes and diluting brand loyalty.

Regulatory and Trade Barriers Affecting Supply Chains

Another critical challenge impacting the Asia Pacific gaming peripherals market is the evolving landscape of trade regulations, tariffs, and import restrictions that affect supply chain efficiency and product availability. The region’s geopolitical volatility, particularly between China, the United States, and neighboring ASEAN countries, has led to unpredictable trade policies that disrupt logistics networks and increase operational costs for manufacturers and distributors alike. For instance, India’s customs authorities imposed stricter import duties on electronic goods in 2023, including gaming peripherals, aiming to promote domestic manufacturing under its Make in India initiative. According to the Indian Ministry of Electronics and Information Technology, these measures led to a 25% increase in the landed cost of imported peripherals, directly affecting consumer access and brand profitability. Similarly, in Indonesia, regulatory mandates requiring localization certifications for imported electronics have delayed product launches and inflated compliance expenses for foreign vendors.

These trade complexities are compounded by logistical bottlenecks, especially in island nations like the Philippines and Malaysia, where last-mile delivery infrastructure struggles to meet e-commerce demands. Distributors report higher lead times and inconsistent inventory availability, affecting customer satisfaction and market expansion plans. Additionally, shifting data privacy laws in countries such as Australia and Japan impose additional compliance burdens on smart-enabled peripherals that collect user data, further complicating product development and distribution strategies.

REPORT COVERAGE

|

REPORT METRIC

|

DETAILS

|

|

Market Size Available

|

2024 to 2033

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025 to 2033

|

|

CAGR

|

7.86%

|

|

Segments Covered

|

By Product Type, Gaming Device, Technology, Distribution Channel and Region.

|

|

Various Analyses Covered

|

Global, Regional and country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

|

|

Regions Covered

|

North America, Europe, APAC, Latin America, Middle East & Africa

|

|

Market Leaders Profiled

|

Logitech International S.A., Razer, Inc., Cooler Master Technology, Inc., Eastern Times Technology Co., Ltd. (Redragon), Thermaltake Technology Co., Ltd., Guillemot Corporation S.A., Shenzhen Rapoo Technology Co., Ltd., Sennheiser Electronic GmbH & Co. KG, Anker Innovations Limited, Kingston Technology Company, Inc.,

|

SEGMENTAL ANALYSIS

By Product Type Insights

The gaming headsets segment dominated the Asia Pacific gaming peripherals market with 28.4% of share in 2024 due to the growing emphasis on immersive audio experiences across both casual and competitive gaming environments. Gamers increasingly rely on high-fidelity sound for positional awareness, voice communication, and content consumption in multiplayer and esports scenarios.

According to Futuresource Consulting, over 65% of PC and console gamers in South Korea and Japan use dedicated gaming headsets regularly, driven by the region’s strong esports culture and streaming habits. In China, where online multiplayer games such as Honor of Kings and PUBG Mobile are immensely popular, headset adoption has surged due to increased in-game voice chat requirements and social connectivity features. Additionally, brands like HyperX, Razer, and SteelSeries have expanded their product portfolios to include budget-friendly yet feature-rich headsets tailored for emerging markets like India and Southeast Asia. As per IDC, in 2023, gaming headset sales in India grew by 35% year-on-year, largely influenced by the rise in live-streaming platforms such as Twitch and YouTube Gaming. The increasing integration of noise cancellation, surround sound simulation, and RGB lighting further enhances consumer appeal, reinforcing the headsets category as the largest contributor to the regional market.

The gaming mice segment is projected to grow with a CAGR of around 11.4% in the next coming years. This rapid expansion is fueled by the increasing demand for precision control in PC gaming among players engaging in first-person shooters, real-time strategy games, and simulation-based titles.

China leads this growth trajectory, where a significant portion of the estimated 700 million gamers prefer mechanical keyboards and high-performance mice tailored for responsiveness and durability. According to Niko Partners, nearly 40% of Chinese PC gamers upgraded their input devices in 2023, with many opting for ultra-lightweight mice featuring adjustable DPI, programmable side buttons, and advanced sensor technologies.

In India, the shift toward professional esports training centers and home-based gaming setups has also contributed to rising mouse demand. The Esports Federation of India reported that organized PC gaming events grew by 50% in 2023, prompting enhanced peripheral investments from competitive players. Furthermore, e-commerce platforms such as Flipkart and Amazon.in witnessed a surge in cross-border listings for branded gaming mice, indicating strong consumer interest despite price sensitivity.

Japanese and Korean manufacturers are responding with innovations in optical tracking, weight customization, and wireless capabilities, ensuring compatibility with evolving desktop and laptop configurations. With continued advancements in ergonomics and performance optimization, the gaming mice segment remains one of the most dynamic areas within the Asia Pacific gaming peripherals landscape.

By Gaming Device Type Insights

The PC (desktop/laptop) segment led the Asia Pacific gaming peripherals market with dominant share in 2024. In China, the Ministry of Culture and Tourism recorded over 650 million PC gamers in 2023, contributing significantly to the demand for premium gaming gear. Tencent and NetEase, two major domestic game developers, continue to release new titles exclusively for PC, reinforcing the platform’s relevance in the ecosystem. Moreover, universities and corporate offices are integrating gaming laptops into digital media curricula and entertainment lounges, further expanding peripheral demand.

The gaming consoles segment is likely to grow with a CAGR of 9.7% from 2025 to 2033 owing to the proliferation of next-generation consoles such as PlayStation 5, Xbox Series X/S, and Nintendo Switch OLED, which have gained traction in both mature and developing markets. Japan remains a core hub for console gaming, with Sony and Nintendo actively releasing exclusive titles and enhancing cloud streaming capabilities to attract new audiences. Meanwhile, in South Korea, Microsoft’s introduction of Xbox Cloud Gaming has enabled users to stream console-quality games on mobile and tablet devices, increasing reliance on compact and adaptive controllers. Additionally, companies like Scuf Gaming and PowerA are launching localized controller variants with ergonomic improvements and customization options tailored for Asian consumers.

By Technology Insights

The wired technology segment was accounted in holding 56.4% of the Asia Pacific gaming peripherals market in 2024. Despite the rising popularity of wireless alternatives, a large portion of the gaming community still prefers wired peripherals for their perceived reliability, lower latency, and consistent power supply where factors deemed crucial in competitive and high-intensity gaming environments. South Korea exemplifies this trend, where professional esports teams and tournament organizers predominantly use wired mice and keyboards to ensure minimal input lag and maximum responsiveness. In China, the National Electronic Sports Association mandates strict hardware guidelines for sanctioned events, favoring wired connections due to concerns about signal interference and battery life reliability in wireless models. Moreover, in cost-sensitive markets like India and Indonesia, wired peripherals remain the preferred choice among budget-conscious gamers who prioritize affordability over mobility. Furthermore, many educational institutions and public gaming centers opt for durable, plug-and-play wired solutions to minimize maintenance costs and technical complications.

The wireless technology segment is expected to grow at the fastest CAGR of 13.2% from 2025 to 2033. This rapid expansion is being propelled by continuous advancements in wireless connectivity, including low-latency Bluetooth protocols, proprietary RF solutions, and improved battery life, all of which have addressed previous concerns regarding performance and reliability.

China is leading the charge, with a surge in demand for wireless gaming headsets, mice, and controllers that support the country’s growing mobile and hybrid gaming ecosystem. According to IDC, in 2023, over 45% of newly purchased gaming mice in China featured dual-mode wireless connectivity (Bluetooth + dongle), up from just 15% in 2020. Similarly, Japanese tech firms like Astro Gaming and Elecom are introducing lightweight, noise-canceling wireless headsets designed specifically for remote work and gaming convergence.

India is also experiencing a boom in wireless adoption, particularly among students and young professionals who value portability and aesthetics. Amazon India reported a 60% year-over-year increase in wireless keyboard and mouse combo sales in 2023, with influencer reviews and bundled promotions driving impulse purchases. Additionally, in Singapore and Australia, the rise of BYOD (bring your own device) policies in gaming lounges and co-working spaces has led to greater demand for peripherals that seamlessly switch between multiple devices.

By Distribution Channel

The online distribution channel dominated the Asia Pacific gaming peripherals market with prominent share in 2024. In China, Tmall and JD.com accounted for over 75% of all gaming peripheral sales in 2023, according to iResearch, thanks to aggressive marketing campaigns, fast delivery networks, and integrated payment gateways that facilitate seamless transactions. Similarly, in India, Amazon.in and Flipkart reported a 50% year-on-year increase in gaming accessory sales, driven by festive season discounts and easy EMI financing options targeted at youth consumers.

Southeast Asian countries like Vietnam and Thailand have also seen a surge in online shopping, with local platforms such as Shopee and Tokopedia offering localized payment methods and attractive bundling deals. The Esports Federation of the Philippines noted a 40% increase in online purchases of branded gaming mice and headsets among amateur players preparing for online tournaments hosted via Discord and Zoom. Moreover, direct-to-consumer brand stores operated by companies like Razer, Corsair, and Logitech have gained traction in the region, allowing customers to access limited-edition products and personalized configurations without intermediaries.

The offline distribution channel is projected to grow at a steady CAGR of 7.8% from 2025 to 2033. This growth is being driven by experiential retail, product demonstrations, and the strategic expansion of specialty electronics and gaming stores that cater to hands-on consumers seeking tactile engagement before purchase.

In Japan, electronics retailers such as Bic Camera and Sofmap have dedicated sections for high-end gaming peripherals, allowing shoppers to test ergonomics, button layouts, and actuation forces before committing to a purchase. Similarly, in South Korea, the resurgence of PC café chains like GotoPC and SpeedMate has revitalized interest in physical retail touchpoints, where users can trial peripherals before buying personal units. Some cafes even offer in-house branding partnerships with manufacturers like Razer and ASUS, creating localized product lines that resonate with regional preferences. In emerging markets like Indonesia and India, tier-2 and tier-3 cities are witnessing a rise in small-scale electronics retailers stocking branded and generic gaming accessories to meet grassroots demand. These shops provide after-sales support, warranty processing, and product swaps, which are often lacking in online-only setups.

COUNTRY-LEVEL ANALYSIS

China was the top performer in the Asia Pacific gaming peripherals market by capturing 34.4% of share in 2024. As the world’s most populous nation with one of the highest numbers of digital gamers globally, China’s influence on the peripheral ecosystem is substantial and multifaceted.

According to the China Internet Network Information Center (CNNIC), the country had over 650 million online gamers in 2023, with a significant portion engaged in PC and mobile-based gaming. This vast player base drives consistent demand for high-performance keyboards, mice, headsets, and controllers. Moreover, the government-backed esports initiatives, including the establishment of specialized training academies and national leagues, have reinforced the need for premium-grade peripherals among aspiring professionals. Companies like Tencent, NetEase, and Xiaomi have launched localized gaming hardware lines tailored to domestic preferences, while global brands such as Razer and Logitech have expanded their retail presence through partnerships with major e-commerce platforms like Tmall and JD.com. The proliferation of PC gaming cafés, estimated at over 100,000 nationwide, further amplifies the demand for commercial-grade peripherals that combine durability with performance.

Japan was held the second-largest position in the Asia Pacific gaming peripherals market with a share of 13.4% in 2024. As the birthplace of iconic gaming brands like Sony, Nintendo, and Bandai Namco, Japan has long been a hub for console-based and arcade-style gaming. According to the Computer Entertainment Supplier’s Association, over 60 million people in Japan engaged in regular gaming activities in 2023, many of whom relied on high-end peripherals such as custom-built keyboards, mechanical switches, and niche analog joysticks. The country is also home to some of the most influential gaming conventions, including Tokyo Game Show and Comiket, where peripheral manufacturers frequently debut prototype and limited-edition products. Companies like Astro Gaming, Elecom, and Hori have capitalized on this enthusiasm by producing locally inspired designs that blend functionality with aesthetic appeal, attracting both casual and serious gamers. Additionally, Japan’s well-established esports scene and growing adoption of virtual reality and mixed-reality gaming have spurred demand for immersive audio and haptic feedback devices. With a strong emphasis on quality, user experience, and innovation, Japan continues to be a vital contributor to the evolution of the Asia Pacific gaming peripherals market.

India is esteemed to grow lucratively with the country’s gaming ecosystem is undergoing rapid transformation, which is driven by improving internet infrastructure, rising smartphone penetration, and increasing disposable income among the youth demographic. According to the Indian Cellular and Electronics Association (ICEA), India added over 40 million new gamers in 2023, bringing the total gaming population to more than 450 million. Local e-commerce platforms like Amazon.in, Flipkart, and Reliance Digital have played a pivotal role in expanding accessibility to both global and indigenous brands. Companies like boAt, Redgear, and Zebronics have introduced affordable yet feature-rich gaming accessories tailored for budget-conscious consumers, while international players like HyperX and SteelSeries have ramped up their marketing efforts through collaborations with influencers and esports organizations.

South Korea gaming peripherals market is leveraging its reputation as a global leader in competitive gaming and digital entertainment. The country is widely recognized for its advanced broadband infrastructure, widespread adoption of esports, and deep integration of gaming into mainstream culture.

Seoul alone hosts hundreds of high-end PC cafés, known locally as “PC Bangs,” which serve as communal gaming hubs and breeding grounds for competitive talent. These establishments not only drive bulk purchases of peripherals but also serve as testing grounds for new product launches. Brands like Razer, ASUS Republic of Gamers, and Corsair have established strong footholds through sponsorships, exclusive store locations, and localized customer support programs.

Australia and New Zealand are gearing up to have prominent growth rate in the Asia Pacific gaming peripherals market in 2024. According to the Interactive Games & Entertainment Association (IGEA), over 70% of Australians engaged in regular gaming activities in 2023, with a growing percentage opting for high-fidelity peripherals to enhance their experience. The rise of streaming platforms like Twitch and YouTube Gaming has further amplified demand for microphones, webcams, and RGB-lit accessories among content creators. New Zealand, though smaller in scale, follows a similar pattern, with increasing participation in LAN events, college esports leagues, and virtual reality arcades. The New Zealand Game Developers Association reports that gaming activity among youth populations has grown steadily, with higher investment in peripherals such as mechanical keyboards and high-refresh-rate mice.

Top Players in the Market

Razer Inc. (United States-based, strong presence in APAC)

Razer is a globally recognized leader in gaming peripherals and has established a dominant footprint across the Asia Pacific region. Known for its high-performance products such as mechanical keyboards, precision mice, and immersive audio gear, Razer benefits from deep cultural alignment with gaming communities in Southeast Asia, Japan, and South Korea. The company strategically leverages its brand identity, premium aesthetics, and ecosystem integration to maintain a loyal customer base. Its localized marketing campaigns, collaborations with esports teams, and physical retail presence in key cities enhance its regional competitiveness.

Logitech G (Switzerland-based, significant operations in APAC)

Logitech G, the gaming division of Logitech, plays a pivotal role in the Asia Pacific market by offering a broad portfolio that caters to both casual and professional gamers. The company’s reputation for durable, high-quality peripherals, especially in the mouse and headset segments has earned it trust among consumers across India, China, and Australia. Logitech invests heavily in research and development, ensuring cutting-edge features such as ultra-low latency and adaptive lighting reach markets quickly.

Corsair Gaming (U.S.-based, growing influence in APAC)

Corsair has rapidly expanded its influence in the Asia Pacific gaming peripherals sector through a combination of performance-driven product design and aggressive distribution strategies. Particularly popular among PC enthusiasts in China and India, Corsair offers a wide range of customizable mechanical keyboards, RGB-lit mice, and premium headsets tailored to competitive play. The company has invested in localized e-commerce partnerships and retail expansion to better serve emerging markets. Its emphasis on system compatibility and modular upgradeability makes it a preferred choice among DIY PC builders and tech-savvy users in the region.

Top Strategies Used by Key Market Participants in the Market

Localization of Product Design and Marketing Campaigns

Key players are increasingly tailoring their product designs, branding, and promotional content to align with local gaming cultures and consumer preferences. This includes adjusting keyboard layouts for different language inputs, incorporating region-specific aesthetics, and collaborating with local influencers and esports organizations to build brand affinity. Companies like Razer and Corsair have launched limited-edition peripherals inspired by anime, K-pop, and regional gaming tournaments to deepen engagement with younger audiences in countries like Japan, South Korea, and India.

Expansion of Direct-to-Consumer and E-commerce Channels

To strengthen their regional foothold, leading brands are investing in robust online ecosystems, including branded digital stores and partnerships with major e-commerce platforms. By reducing reliance on third-party retailers, companies can offer exclusive bundles, faster delivery, and personalized after-sales support. This strategy has been particularly effective in densely populated markets like China and Indonesia, where online shopping dominates consumer behavior.

Strategic Collaborations with Game Developers and Streamers

Major gaming peripheral manufacturers are forging partnerships with game studios and top-tier streamers to co-develop products optimized for specific games or streaming environments. These collaborations not only drive visibility but also ensure that peripherals meet the technical demands of popular titles and livestreaming workflows. Brands are leveraging these relationships to reinforce their image as essential tools for elite performance and community engagement.

COMPETITION OVERVIEW

The competition in the Asia Pacific gaming peripherals market is intense and multifaceted, shaped by a mix of global giants, regional powerhouses, and agile startups vying for consumer attention. Established international brands such as Razer, Logitech G, and Corsair dominate with their advanced technologies, extensive product lines, and strong brand recognition. However, they face growing pressure from emerging domestic players who offer cost-effective alternatives with localized appeal. In markets like China, India, and Southeast Asia, affordability and customization are becoming key decision-making factors, prompting even global firms to introduce budget-friendly models under sub-brands or partner with local distributors.

Technology innovation plays a crucial role in maintaining competitive differentiation, especially in areas such as wireless connectivity, ergonomic design, and software integration. Companies are racing to incorporate low-latency solutions, modular components, and AI-enhanced features into their offerings. At the same time, marketing strategies are evolving beyond traditional advertising to include influencer endorsements, esports sponsorships, and user-generated content campaigns aimed at engaging younger demographics.

E-commerce dynamics are further intensifying rivalry, as brands compete for visibility on platforms like Amazon, Shopee, and Lazada. With price wars, bundled deals, and rapid product cycles becoming the norm, companies must continuously innovate and adapt to stay ahead. As the Asia Pacific gaming culture continues to mature, the battle for market dominance will hinge on a delicate balance between technological superiority, cultural relevance, and operational agility.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Razer announced the launch of its first flagship concept store in Singapore, featuring interactive product displays, custom-built demo stations, and live esports event screenings. This initiative was designed to deepen consumer engagement and elevate the brand’s experiential retail presence in Southeast Asia.

- In June 2024, Logitech G partnered with a leading Korean esports organization to co-develop a line of gaming mice and headsets tailored for League of Legends and Valorant players, enhancing performance metrics aligned with competitive gameplay requirements in the APAC region.

- In September 2024, Corsair opened a new regional logistics hub in Bangalore, India, aimed at improving supply chain efficiency and reducing lead times for online orders, especially during peak sales periods such as festive shopping seasons and gaming festival weekends.

- In November 2024, Redragon, an Australian-based gaming peripherals brand, entered into a strategic partnership with a Japanese electronics retailer to expand its offline retail presence, making its budget-focused gaming keyboards and mice more accessible to local consumers.

- In January 2025, SteelSeries collaborated with a major Chinese livestreaming platform to introduce a co-branded line of studio-grade microphones and RGB lighting kits specifically designed for content creators, targeting the booming live-streaming and influencer economy in the Asia Pacific region.

MARKET SEGMENTATION

This research report on the Asia Pacific gaming peripherals market is segmented and sub-segmented into the following categories.

By Product Type

- Headsets

- Keyboards

- Joysticks

- Mice

- Gamepads

- Others

By Gaming Device Type

- PC (Desktop/Laptop)

- Gaming Consoles

By Technology

By Distribution Channel

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC