Technology

Game Publisher Market Size, Share

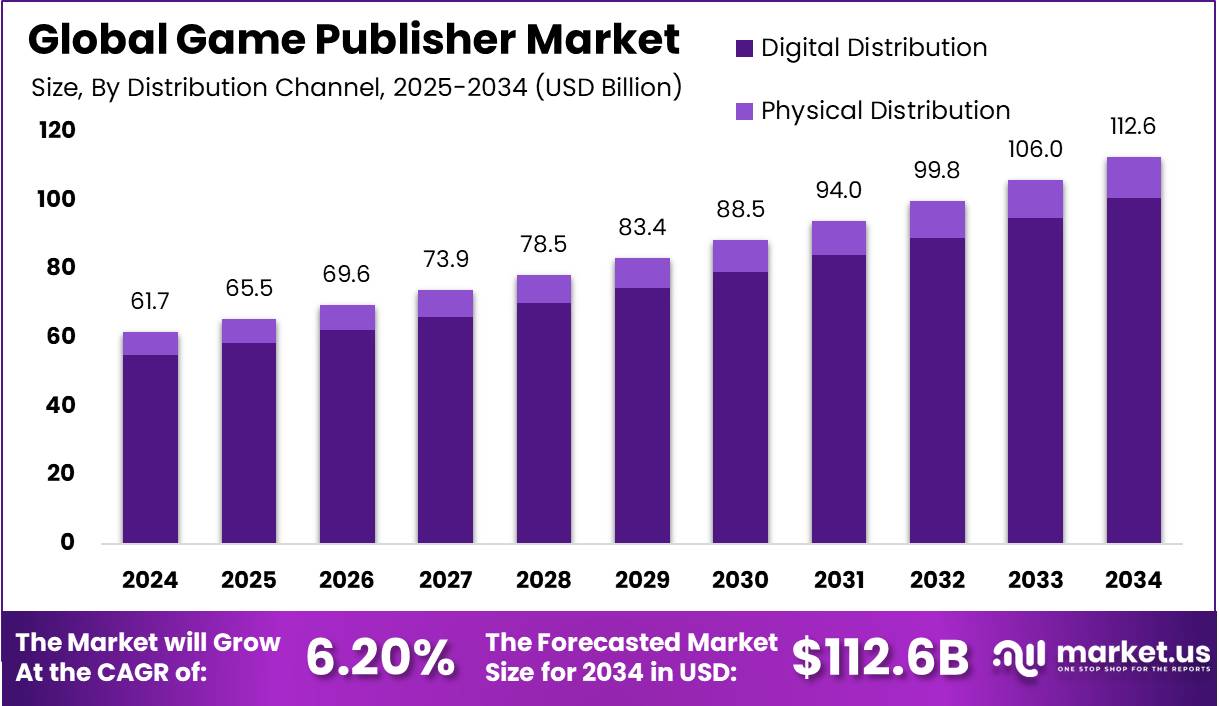

Game Publisher Market Size The Global Game Publisher Market size is expected to be worth around USD 112.6 Billion By 2034, from USD 61.7 Billion in 2024, growing at a CAGR of 6.20% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position in the game publisher market with […]

Game Publisher Market Size

The Global Game Publisher Market size is expected to be worth around USD 112.6 Billion By 2034, from USD 61.7 Billion in 2024, growing at a CAGR of 6.20% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position in the game publisher market with over a 36.78% share, generating USD 22.6 billion in revenue. Meanwhile, the market for game publishers in China was estimated at USD 6.35 billion, with a CAGR of 6.78%.

A game publisher is responsible for marketing, distribution, and often financing video games developed by others. The publisher market includes managing production timelines, promotion, sales, and distribution across platforms like consoles, PCs, and mobile devices. This market plays a key role in connecting developers with consumers, ensuring games reach their intended audience effectively.

The growth of the game publisher market is driven by key factors, including the global rise in smartphone penetration and internet connectivity, which expands the consumer base, especially in mobile gaming. Additionally, advancements in technology, such as AR and VR, have enhanced gaming experiences, attracting more users.

![]()

![]()

Market Overview

The demand within the game publisher market is primarily driven by the global increase in gaming audiences, especially in mobile and online gaming. As devices become more affordable and internet connectivity improves worldwide, more people engage in gaming activities. This trend is particularly strong in emerging markets where mobile devices are the primary means of internet access.

As of 2024, the gaming industry has seen a decisive shift toward digital platforms, with 95% of global game sales now occurring through digital downloads or streaming, leaving physical sales at a minimal 5%, according to Udonis. This transformation underlines the dominance of online distribution in consumer behavior and content delivery.

Mobile gaming continues to lead the sector, generating approximately USD 92 billion, which accounts for 49% of the global gaming revenue. Console gaming ranks second, contributing around USD 51 billion (28% share), followed by PC gaming at roughly USD 43 billion (23% share). This segmentation highlights the rising accessibility of mobile platforms and their growing engagement rates compared to traditional formats.

From a regional perspective, the United States and China remain the top contributors to industry revenue. In 2023, the U.S. generated approximately USD 46.7 billion, marginally surpassing China’s USD 44.6 billion. Other key markets include Japan (USD 18.4 billion), South Korea (USD 7.4 billion), Germany (USD 6.6 billion), and the United Kingdom (USD 5.5 billion).

The integration of cross-platform play has emerged as a major trend, enhancing player engagement by allowing gamers from different platforms to interact and play together. This trend is complemented by the Games-as-a-Service (GaaS) model, where games are continually updated with new content to maintain and grow user bases over time.

Key Takeaways

- The Global Game Publisher Market size is expected to be worth around USD 112.6 Billion by 2034, from USD 61.7 Billion in 2024, growing at a CAGR of 6.20% during the forecast period from 2025 to 2034.

- In 2024, the Action-Adventure Games segment held a dominant market position, capturing more than a 16.7% share in the game publisher market.

- In 2024, the Mobile Device segment held a dominant market position, capturing more than a 52.1% share in the game publisher market.

- In 2024, the Digital Distribution segment held a dominant market position, capturing more than an 89.4% share in the game publisher market.

- In 2024, the Casual Gamers segment held a dominant market position within the game publisher market, capturing more than a 67.3% share.

- In 2024, Asia-Pacific held a dominant market position in the game publisher market, capturing more than a 36.78% share and generating revenues amounting to USD 22.6 billion.

- In 2024, the market for game publishers in China was estimated at USD 6.35 billion. This sector is experiencing a steady growth trajectory, with a CAGR of 6.78%.

China Game Publisher Market

In 2024, the market for game publishers in China was estimated at USD 6.35 billion. This sector is experiencing a steady growth trajectory, with a compound annual growth rate (CAGR) of 6.78%. This expansion highlights the dynamic growth of the Chinese gaming industry, fueled by rising consumer demand and advancements in gaming technology.

The sustained growth of the Chinese game publisher market is driven by several factors, including the rising popularity of mobile gaming among China’s large population. Increased internet access and the spread of smartphones have made gaming more accessible, boosting market expansion. Additionally, innovations in game design and the integration of AR and VR are attracting new players while retaining the existing user base.

The Chinese game publisher market is set for continued growth, fueled by advancements in gaming technologies and supportive government policies for digital entertainment. Collaborations between publishers and mobile device manufacturers will create new opportunities for expansion. As the market matures, these factors will propel the industry forward, solidifying China’s role as a global gaming leader.

![]()

![]()

In 2024, Asia-Pacific held a dominant market position in the game publisher market, capturing more than a 36.78% share and generating revenues amounting to USD 22.6 billion. This significant market share can be largely attributed to the extensive digital transformation across the region, especially in major economies such as China, Japan, and South Korea.

Asia-Pacific benefits from a large, young population that is highly tech-savvy and enthusiastic about gaming. The region’s strong gaming culture, along with substantial local production and consumption, drives growth. In countries like South Korea, government support through subsidies and programs to promote game development has further boosted the industry.

Esports plays a key role in the dominance of the Asia-Pacific game publisher market, with top esports teams fueling enthusiasm for competitive gaming and driving demand for diverse genres. The market is poised to maintain its leadership, supported by innovations in gaming technology, expanding internet and mobile access, and the continued growth of an engaged gaming community.

![]()

![]()

Game Type Analysis

In 2024, the Action-Adventure Games segment held a dominant market position in the game publisher market, capturing more than a 16.7% share. This genre’s leading status comes from its wide appeal, combining engaging stories, immersive worlds, and interactive gameplay with problem-solving, exploration, and combat, attracting both casual and hardcore gamers.

Action-adventure games have thrived thanks to advancements in gaming hardware, enabling developers to craft more detailed and expansive worlds. These improvements make the games more engaging and visually appealing. The genre’s versatility, blending elements from various genres, also broadens its appeal, attracting a wider audience.

The rise of digital distribution platforms has further fueled the growth of the action-adventure games segment. Platforms like Steam, PlayStation Network, and Xbox Live provide developers with direct access to vast audiences globally, reducing barriers to entry and enabling more frequent updates and enhancements to existing games, which helps maintain player interest over longer periods.

The action-adventure games segment is set for sustained growth, driven by innovations like virtual reality (VR) and augmented reality (AR), which open new possibilities for player immersion. As technology and gameplay evolve, the market is expected to remain dominant, captivating gamers with engaging and innovative experiences.

Device Type Analysis

In 2024, the Mobile Device segment held a dominant market position in the game publisher market, capturing more than a 52.1% share. This dominance is driven by the global adoption of smartphones and the convenience of mobile gaming, allowing users to play on-the-go with games designed for quick, engaging sessions that suit busy lifestyles.

Furthermore, the mobile platform has seen an increase in the sophistication of games available, attracting a broader audience that includes both casual and hardcore gamers. Developers and publishers have leveraged this trend by focusing on mobile-first strategies, often releasing games exclusively for mobile devices before other platforms.

The economic model of mobile gaming also supports rapid growth. Many mobile games are free to play and monetize through in-app purchases and advertising, making them accessible to a larger demographic compared to traditionally priced PC and console games.

Technological advancements in mobile devices, like enhanced graphics and processing power, have led to more complex and visually appealing games. This progression is narrowing the gap in gaming quality between mobile devices and traditional consoles or PCs, further driving the growth of the mobile gaming market.

Distribution Channel Analysis

In 2024, the Digital Distribution segment held a dominant market position, capturing more than an 89.4% share. This substantial market share can be attributed to several pivotal factors that highlight the segment’s robust appeal and its alignment with contemporary consumer preferences and technological advancements.

Digital distribution platforms have revolutionized how consumers access and purchase games, offering 24/7 worldwide availability. Unlike physical stores, these platforms provide instant content delivery, eliminating the need for travel. This convenience appeals to consumers who prioritize ease and immediacy, which traditional retail outlets can’t match.

Digital distribution lowers costs by removing the need for manufacturing, shipping, and storage, allowing publishers to maintain higher margins. These savings can be reinvested into game development or marketing, boosting the overall quality and competitiveness of their products.

These platforms give publishers direct access to consumer behavior data, offering insights into market trends, preferences, and purchasing patterns. By using this data, publishers can refine marketing strategies and game development to better align with audience demands, leading to higher engagement and customer satisfaction.

The growth of digital distribution is further fueled by the rise of mobile gaming and cloud gaming technologies. These trends broaden the gaming market, attracting casual gamers who favor the accessibility of mobile devices. The integration of games into mobile and cloud platforms strengthens the dominance of digital distribution in the gaming industry.

End-user Analysis

In 2024, the Casual Gamers segment held a dominant market position within the game publisher market, capturing more than a 67.3% share. The significant market share can be attributed to the accessibility of gaming platforms and the wide variety of games that appeal to casual gamers’ diverse interests and skill levels, making gaming an attractive leisure activity for a broad audience. This inclusivity has driven the segment’s growth.

The rise of mobile gaming has played a key role in expanding the casual gamer base. With games designed to be intuitive and engaging, mobile gaming appeals to users seeking entertainment during commutes or short breaks. This accessibility and playability have attracted a large number of casual gamers.

Game publishers’ marketing strategies, including ads, social media campaigns, and brand collaborations, have effectively targeted casual gamers, boosting the visibility of casual-friendly games and driving growth. Additionally, the evolution of casual games, with more competition and social interaction elements, has kept players engaged and encouraged frequent play, helping the segment remain strong and influential in the broader gaming market.

![]()

![]()

Key Market Segments

By Game Type

- Action-Adventure Games

- First-person Shooters (FPS)

- Simulation Games

- Sports Games

- Fighting Games

- Survival Games

- eSports Games

- Others

By Device Type

- Mobile Device

- Computer

- Console

- Online

By Distribution Channel

- Digital Distribution

- Physical Distribution

By End-user

- Casual Gamers

- Professional Gamers

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Expansion of Mobile Gaming and Digital Distribution

The proliferation of smartphones and the widespread availability of affordable internet have significantly propelled the growth of mobile gaming. This segment has become a dominant force in the game publishing industry, driven by the accessibility of games on various devices and the convenience of digital distribution platforms.

The rise of app stores and online marketplaces has enabled publishers to reach a global audience without the constraints of physical distribution. Moreover, the adoption of cloud gaming services has further facilitated access to high-quality games across different platforms.

These developments have not only expanded the consumer base but have also opened new revenue streams through in-app purchases and subscription models. The continuous innovation in mobile technology and the increasing engagement of users with mobile games underscore the significance of this driver in the industry’s growth trajectory.

Restraint

Escalating Development Costs

The game publishing industry is currently grappling with the challenge of rising development costs, particularly for AAA titles. The demand for high-fidelity graphics, expansive open-world environments, and sophisticated gameplay mechanics necessitates substantial investment in technology and talent.

The rising cost of developing AAA games, often exceeding budgets, is putting financial pressure on publishers, who also face the need for costly marketing campaigns. As a result, many are becoming more risk-averse, prioritizing established franchises over innovative but unproven concepts. This trend may hinder creativity and reduce the diversity of games available to players.

Opportunity

Growth of Emerging Markets

Emerging markets, particularly in regions like Africa, present a significant opportunity for game publishers. The increasing penetration of smartphones and improvements in internet infrastructure have led to a growing gaming audience in these areas.

Local developers are creating culturally relevant content that resonates with regional audiences, while international publishers are exploring partnerships to tap into these markets. The potential for growth is substantial, as these markets are relatively untapped and offer a new consumer base eager for diverse gaming experiences. By investing in localized content and understanding regional preferences, publishers can establish a strong foothold and drive revenue growth in these burgeoning markets.

Challenge

Market Saturation and Visibility Issues

The game publishing industry faces the challenge of market saturation, with an overwhelming number of titles released annually. This abundance makes it increasingly difficult for individual games, especially from independent developers, to gain visibility and attract a substantial player base.

The competition for consumer attention is intense, and without significant marketing budgets, many quality games fail to achieve commercial success. This environment favors established publishers with the resources to promote their titles extensively, potentially marginalizing innovative projects from smaller studios. Addressing this challenge requires strategic marketing, community engagement, and leveraging alternative distribution channels to enhance discoverability.

Latest Market Trends

The game publishing landscape is shifting due to technological advancements and changing player expectations. A key trend is the rise of cross-platform development, which allows games to be accessible on PCs, consoles, and mobile devices. This expands the audience and boosts player engagement by offering flexible gaming experiences.

Cloud gaming is transforming the industry by enabling players to stream high-quality games without costly hardware, with services like Xbox Cloud Gaming and NVIDIA GeForce NOW leading the way. Additionally, ethical monetization practices are on the rise, with publishers moving away from loot boxes and pay-to-win models in favor of fairer strategies like cosmetic purchases and battle passes to maintain player trust.

AI is playing a larger role in game development, aiding in content creation, user acquisition, and data analytics for personalized gaming experiences. Additionally, there’s a growing focus on supporting indie developers, with companies like Pocketpair launching publishing divisions to fund and assist smaller studios, promoting innovation and diversity in game content.

Business Benefits

Game publishers provide essential funding to developers, particularly indie developers, allowing them to bring their creative visions to life without the burden of financial risk. This funding is often tied to development milestones, helping structure the development process and ensuring ongoing financial support.

Publishers play a critical role in marketing games, utilizing various channels such as social media, online advertising, and event promotions to increase visibility. Marketing support plays a vital role in a game’s success, helping it stand out in a crowded market. Strong strategies boost visibility, spark anticipation, and keep players engaged before and after launch.

Publishers provide valuable expertise in both game development and market strategies. This involves handling licensing, localizing for global markets, and ensuring quality. For smaller dev teams, this expertise helps tackle technical hurdles and improve game design for wider reach.

Key Player Analysis

The gaming industry is one of the most dynamic sectors globally, and its success relies heavily on a few key players who dominate the market.

Tencent Holdings is a Chinese multinational conglomerate that has become one of the largest and most powerful forces in the gaming industry. The company’s strength lies in its vast portfolio, which includes some of the world’s most popular games and gaming platforms. Additionally, Tencent is a key player in the mobile gaming market, which has seen rapid growth in recent years.

Sony Group Corporation is a well-known name in the entertainment world, and its gaming division, Sony Interactive Entertainment, plays a pivotal role in the video game market. Sony’s focus on providing high-quality gaming experiences, both in terms of hardware and software, has earned it a loyal customer base worldwide.

Microsoft Corporation is another major player that has made significant strides in the gaming sector, particularly with its Xbox consoles and its growing portfolio of game studios. Microsoft’s commitment to game subscription services like Xbox Game Pass has also revolutionized how players access and enjoy games, offering a wide variety of titles for a monthly fee.

Top Key Players in the Market

- Tencent Holdings Limited

- Sony Group Corporation

- Microsoft Corporation

- Sea Limited

- NetEase, Inc.

- Nintendo Co., Ltd.

- Electronic Arts Inc.

- Bandai Namco Holdings Inc.

- Entain plc

- Epic Games

- CyberAgent, Inc.

- Embracer Group AB

- Sega Sammy Holdings Inc.

- Nexon Co., Ltd.

- Playtika Holding Corp.

- Other Major Players

Top Opportunities for Players

The game publishing market is poised for dynamic growth with several key opportunities emerging from technological advancements and evolving market conditions.

- Cross-Platform Development: There’s a growing demand for games that offer a seamless experience across multiple platforms, including PC, consoles, and mobile devices. With over three billion active gamers worldwide, the ability to publish games that are accessible on various devices can significantly expand a game’s reach and revenue potential.

- Enhanced Monetization Strategies: Game publishers are increasingly exploring sophisticated monetization strategies beyond traditional sales, such as microtransactions, season passes, and in-game advertising. The key is to balance monetization with user experience to maintain player engagement and satisfaction.

- Indie Game Support: The barriers to game development are lowering, thanks to intuitive game engines and digital distribution platforms like Steam and the Epic Games Store. This trend presents a lucrative opportunity for publishers to partner with indie developers, who are now capable of creating hit titles without extensive budgets, and help them navigate the crowded marketplace.

- Global Expansion: Emerging markets present significant growth opportunities. Regions such as Asia-Pacific are rapidly growing in terms of gamer population and revenue, offering game publishers the chance to capitalize on new customer bases and diversified gaming preferences.

- Adoption of Latest Technologies: Incorporating advanced technologies such as AI, cloud computing, and virtual reality can lead to innovative game features and experiences. These technologies not only enhance gameplay but also provide new ways to engage users and stand out in a competitive market.

Industry News

- In January 2025, CyberAgent, Inc. took a step to expand its creative frontier by launching a brand-new anime production studio, CA Soa Inc., a move aimed at supercharging its presence and capabilities in the world of anime.

- In April 2024, Epic Games acquired Loci, an AI platform for automated tagging of 3D assets, to enhance its digital asset offerings.

Report Scope

Continue Reading

Technology

How adult sports leagues took over your city

Adult social sports leagues are a big deal, and one entrepreneur wants to make them even bigger. 0

Adult social sports leagues are a big deal, and one entrepreneur wants to make them even bigger.

Technology

Hannah Taylor talks plans to boost women’s sports from PR side

Many people have left the sports journalism world in recent decades, but some of them haven’t gone far. Amongst that group is Hannah Taylor (née Withiam), who recently shifted from journalism to a sports public relations role at The Lippin Group. Before this move (a March promotion and shift to a full-time role following previous time […]

Many people have left the sports journalism world in recent decades, but some of them haven’t gone far. Amongst that group is Hannah Taylor (née Withiam), who recently shifted from journalism to a sports public relations role at The Lippin Group.

Before this move (a March promotion and shift to a full-time role following previous time as a consultant), Taylor spent eight years in sports journalism. That included time as a sports reporter and producer at The New York Post, as a managing editor at The Athletic, and (most recently) as senior managing editor at Just Women’s Sports. But she told Awful Announcing by email the time was ripe for her to do something different.

“After working in the sports journalism industry for eight years, I was ready for a new challenge,” Taylor said. “While I will always have a passion for storytelling and the creative process behind bringing a writer’s vision to life, I felt an urge to do something more strategic on the business side of sports.”

Taylor is joining The Lippin Group as an accounts supervisor. She’ll be responsible for new business development and acquisition in the sports industry, in addition to day-to-day client relations work. And she said her journalism background will be crucial to success there.

“By transitioning into PR and communications, I was confident I could bring my learnings from the sports media world to help clients develop successful content, media and brand strategies. Understanding what makes a good story is at the center of our work in PR–whether it’s devising a brand narrative, promoting a campaign or pitching a media story or segment–and that skill has come in handy during this transitional period.”

She said it’s also beneficial that she comes in with experience doing a wide range of things across a broad swathe of publications.

“Each publication I worked for was different in its storytelling focus and approach, which helped me acquire a variety of skills and expand my repertoire as a sports journalist,” Taylor said. “I always say the New York Post was one of the best places I could have begun my sports reporting career because working in that competitive and fast-paced newsroom taught me how to identify a news hook, ask the hard questions and write concisely – all while on tight deadlines.

“The Athletic taught me good feature writing and investigative journalism, while Just Women’s Sports broadened my horizons in content strategy and editorial management since I helped build the startup’s website and newsletter from the ground up.”

Taylor’s last couple of roles specifically focused on women’s sports, and came at bold times for those companies. She said helping The Athletic launch women’s basketball verticals (including with dedicated team beat writers) in 2019 particularly stood out to her.

“Launching The Athletic’s WNBA and women’s college basketball verticals in 2019 was an eye-opening experience. While women’s sports verticals are more commonplace these days, what we did then was largely unprecedented.

“We formed a team of dedicated WNBA writers, including one assigned to each team, bringing the sports beat writing model long associated with men’s sports to a women’s sports league. Instead of dipping our toes in WNBA coverage when convenient or stretching one writer to cover an entire league, as many outlets have done with women’s sports in the past, we dove in headfirst.”

Taylor said a key lesson there was that there was notable interest in the WNBA at that time, even pre-Caitlin Clark, but that there were still many who weren’t really aware of the league.

“This approach allowed us to cover the league the way we felt it deserved and more accurately determine the audience’s appetite for it. Managing these verticals showed me just how much work needed to be done to bring more awareness to women’s sports and ultimately led me to Just Women’s Sports to continue to make a difference in the industry.”

And Taylor’s now hoping to make that difference for women’s sports on the PR front as part of her new role.

“My goal is to take my experience working in women’s sports media and use it to help companies and creators make their mark in the industry. As the business opportunities in women’s sports continue to grow, and companies look to invest and carve out their own lane in the field, driving brand awareness and forging the right connections through strategic media campaigns will be key to their success. That’s where I can come in.

“With the help of The Lippin Group’s wealth of PR experience and relationships, I can support these companies in their publicity efforts and continue to lift up the women’s sports industry as a whole. Even though I’m on the other side of women’s sports media coverage now, I believe I can still play a meaningful role in furthering a mission that will always be important to me.”

On a more specific front, Taylor said she feels her experience from the journalistic side can help her in pitching and coordinating stories from the PR side.

“In PR, I find that my experiences both telling my own stories as a reporter and knowing what goes into assigning and choosing stories for publication as an editor have translated into effective media campaign strategies for clients. When we are promoting new content or a new narrative through earned media, I look at it through the lens of which story angle or piece of content I would be interested in pursuing as a journalist and devise the strategy accordingly.

“I also know what’s going on behind the scenes in a newsroom, such as the pressures of producing for quantity and reaching traffic goals, the editorial process behind bringing a story to publication and the conflicts of the editorial or sports calendar. That mutual understanding allows me to communicate effectively with journalists, helping them achieve their goals while also serving the client’s best interest.”

And she said The Lippin Group (where she previously worked as a consultant before taking this full-time role) stood out as a logical landing spot given their background and history.

“The Lippin Group has decades of experience creating strategic communications campaigns for companies, creators and content in media and entertainment, including sports. As I was looking to make the jump from sports media into PR and communications, melding The Lippin Group’s expertise in this area with my own experience in sports seemed like the perfect fit.

“I learned so much from my colleagues about how to run a successful PR campaign during my time as a consultant, and that has allowed me to hit the ground running now as a full-time employee. We have an opportunity to set ourselves apart in the sports PR industry by combining our skill sets, and I am excited to see what we can accomplish as we work to build out the sports division of the company.

Some of Taylor’s current clients include those focused on sports documentaries and marketing. She said working on documentaries appeals to her thanks to their storytelling nature.

“Sports documentaries have a lot of the same qualities that I love about editorial features. They both tell the human sides of a sports story, offering us a window into the stakes and emotions behind the athletes, games and moments that remind us why sports inspire and appeal to us in the first place. Being a part of sharing these types of stories with larger audiences is what excites me most about working with sports documentary clients.”

Taylor said there are many current documentary opportunities in women’s sports, too, and those documentaries may be a key way to sell those sports to wider audiences.

“It’s encouraging to see many more women’s sports documentaries in production these days because I had always considered the lack of them a microcosm of the issues plaguing women’s sports media. For women’s sports to become more mainstream, their stories need to be more accessible and the stakes need to be clearer to prospective fans, and one of the best mediums for achieving this is the documentary.

“It’s no surprise to me that producers, networks and streaming companies are racing to greenlight women’s sports documentaries because, after years of neglect and hesitation, there are a wealth of stories waiting to be told.”

And there’s interest in those stories. Taylor said the dramatic rises in ratings across women’s sports live games and studio programming discussing those sports show off the opportunities here, which transcend just specific pro leagues.

“We are seeing the exponential growth in women’s basketball and soccer play out before our eyes. For both the WNBA and NWSL in recent years, you saw a catalyst to their surge in fan and business interest – with the popularity of women’s college basketball driving more eyeballs to the WNBA, and the Women’s World Cup and U.S. women’s national team positively influencing the NWSL.

“I see similar dynamics playing out right now with the rise of women’s volleyball, softball and hockey. For volleyball and softball, the college game has created more opportunities at the professional level, including three current pro volleyball leagues in the U.S. and Athletes Unlimited moving to a traditional team-based format for its softball league starting this year. For hockey, fan interest in international competition, especially the storied USA vs. Canada women’s rivalry, has contributed to the steady rise of the PWHL.”

Taylor said there’s a lot that will be needed to keep those sports growing, though. She said that includes everything from media coverage to sponsorships to TV rights deals.

“TV broadcast deals and brand sponsorships are important drivers of growth in women’s sports because they provide leagues and teams with the financial resources to support their players, which in turn creates a better product and drives more attendance and viewership. And at the crux of it all, media coverage keeps the ball moving forward by making women’s sports more accessible so it’s both easier and more appealing to get invested.”

Taylor said mainstream media coverage of women’s sports is crucial to that. And she thinks that’s improved in recent years.

“The arguments I made in this op-ed I wrote for Parity last year about the state of women’s sports media coverage still ring true for me today. In it, I explain why women’s sports must get the mainstream media treatment to show it’s worth investing in and suggest four methods for achieving that status.

“When I joined Just Women’s Sports in 2021, the idea was that if legacy media outlets weren’t going to cover women’s sports properly, we needed to do it ourselves. In the year since I wrote the piece for Parity and stepped away from women’s sports journalism, it has been fantastic to see media outlets creating more jobs, verticals and shows dedicated to women’s sports.”

But Taylor said there’s still a long way to go in normalizing coverage of women’s sports.

“The next step I would like to see the industry take, instead of isolating women’s sports coverage to one writer or one vertical, is to integrate women’s sports into regular coverage with enough resources for output and promotion that will paint an accurate picture of the return on investment. I would also like to see more original women’s sports reporting and storytelling, which requires more time and funding but is so important to creating a healthy media ecosystem and maintaining positive momentum.”

Technology

Aramark wins Las Vegas ballpark F&B deal

Image: HNTB and Athletics Aramark Sports + Entertainment has been selected as the food and beverage service provider for the proposed new A’s ballpark in Las Vegas. Sports Business Journal said that as part of a 20-year deal, Aramark has had to shell out at least $175 million to land the job, including an equity […]

Image: HNTB and Athletics

Aramark Sports + Entertainment has been selected as the food and beverage service provider for the proposed new A’s ballpark in Las Vegas.

Sports Business Journal said that as part of a 20-year deal, Aramark has had to shell out at least $175 million to land the job, including an equity investment into the team of at least $100 million and a capex investment commitment of at least $75 million, according to sources.

The 33,000-capacity New Las Vegas Stadium is a future fixed-roof ballpark to be built on the site of the former Tropicana Las Vegas (casino hotel) on the Las Vegas Strip in Paradise, Nevada (US).

It is planned as the new home stadium of the Athletics of Major League Baseball (MLB) after they complete their planned relocation from Oakland, California, to the Las Vegas Metropolitan area.

The A’s give Aramark a second big MLB account win in as many years after it picked up the San Francico Giants last year just before the 2024 MLB season started.

Image: HNTB and Athletics

Image: HNTB and Athletics

In addition to the A’s and Giants, Aramark S+E’s MLB portfolio includes PNC Park (Pirates), Daikin Park (Astros), Kauffman Stadium (Royals), Fenway Park (Red Sox), Coors Field (Rockies), Citizens Bank Park (Phillies), and Citi Field (Mets).

Aramark also worked with the A’s as their concessionaire at Oakland Coliseum.

SBJ further stated that five of the sports venue F&B industry’s six biggest companies – Aramark Sports + Entertainment, Delaware North, Legends, Levy, and Sodexo Live – competed for the A’s’ business, beginning late last year.

At least four of those were willing to consider the A’s equity stake request. Oak View Group, which doesn’t have any baseball clients and is already engaged in Las Vegas with its recent takeover of Allegiant Stadium, was the only major player that didn’t compete.

Image: HNTB and Athletics

Image: HNTB and Athletics

Delaware North, Levy, and Aramark emerged with the highest/best offers in the last month of the RFP process, which concluded in April.

The A’s Las Vegas stadium project still hasn’t been completely finalized, though it is progressing toward an official groundbreaking in June.

A’s owner John Fisher is reportedly looking to close a stadium funding gap of at least $500 million.

Legends is operating the A’s’ food and beverage service for the next few years at Sutter Health Park in West Sacramento while the team waits for its new Las Vegas stadium to be built.

Image: HNTB and Athletics

Image: HNTB and Athletics

The A’s announced they’re opening an experience sales center this fall and they’re looking to officially break ground this summer.

Clark County (Nevada) recently put an agreement in place for what happens to the site if the stadium project isn’t finished, though that’s normal procedure for a project of this magnitude, especially for valuable land near the Las Vegas Strip.

Continue to follow Coliseum for latest updates on venues business news. Coliseum is dedicated towards building the best global community of sports and entertainment venue executives and professionals creating better and more profitable venues.

Become a member of the only Global Sports Venue Alliance and connect with stadiums, arenas and experts from around the world. Apply for membership at coliseum-online.com/alliance and make use of the 365Coliseum Business.

Watch 420 member-exclusive videos with valuable tips for your venue

« Previous News: Heaselgrave expertise to enrich-elevate PSG

» Next News: FC Thun planned home takeover fiscal edge

Technology

Push30 Accelerates Growth with Key Investments and International Expansion

Push30 was selected to join the Al-Farabi Scale-Up Program, a prestigious acceleration initiative held in Riyadh, Saudi Arabia, from January to February 2025. Baku, Azerbaijan, May 30, 2025 — Push30, a next-generation digital wellness platform, is revolutionizing how people and organizations approach healthy living. With a single subscription, users can access an extensive network of […]

Push30 was selected to join the Al-Farabi Scale-Up Program, a prestigious acceleration initiative held in Riyadh, Saudi Arabia, from January to February 2025.

— Push30, a next-generation digital wellness platform, is revolutionizing how people and organizations approach healthy living. With a single subscription, users can access an extensive network of fitness and spa centers across different cities and countries — promoting convenience, flexibility, and a healthy lifestyle that fits into even the busiest of schedules.

Founded in 2019 in Azerbaijan, Push30 quickly rose to become the leading fitness tech brand in the country. At its core, Push30 is more than just a gym access app — it is a holistic wellness ecosystem tailored to the needs of the modern urban individual. Whether it’s an early-morning gym session or a lunch break yoga class, Push30 empowers users to integrate fitness into their daily routines with ease.

Push30, a next-generation digital wellness platform, is transforming how companies support the health, motivation, and productivity of their employees. Designed specifically for the B2B sector, Push30 empowers organizations to offer flexible, convenient access to a wide network of fitness and wellness centers across multiple cities and countries —promoting convenience, flexibility, and a healthy lifestyle that fits into even the busiest of schedules.

Founded in 2020 in Azerbaijan, Push30 quickly rose to become the leading fitness tech brand in the country. At its core, Push30 is a holistic wellness ecosystem built around the needs of modern businesses and their teams. Whether it’s early-morning workouts, lunchtime yoga sessions, or evening spa visits, employees can seamlessly integrate wellness into their daily routines — boosting morale and performance along the way.

From day one, Push30’s mission has been to redefine corporate wellness. By offering customizable packages tailored to different company sizes and cultures, the platform has helped organizations improve employee retention, foster engagement, and build stronger workplace communities.

With its dedicated B2B approach and focus on scalable solutions, Push30 is not only improving individual well-being but also driving long-term business success across the region.

Push30 at Al-Farabi Scale-Up Program in Riyadh

As part of its growth strategy, Push30 was selected to join the Al-Farabi Scale-Up Program, a prestigious acceleration initiative held in Riyadh, Saudi Arabia, from January to February 2025. This exclusive program brought together top-performing startups from around the region, providing them with an opportunity to network with key players in the Saudi innovation ecosystem.

Throughout the 3-month long program, the offline part lasted one month. Push30 engaged with high-level investors, industry veterans, and regional stakeholders, gaining strategic insights into market entry, user behavior, and localization. The program culminated in a highly anticipated Demo Day on February 26, hosted at CODE Riyadh — a central hub for startups and innovation in the region.

Push30’s pitch drew significant attention and further validated its readiness to enter new international markets.

$300,000 Investment Update & Series A Round Progress

One of the highlights of Demo Day was a major investment update: White Hill Capital, Push30’s bridge-round VC investor, signed a letter of intent for a follow-on investment of $300,000 after the acceleration program. This investment signals continued confidence in Push30’s leadership, product strategy, and expansion plans.

Push30’s Series A fundraising round is also progressing rapidly. With a target of $3 million, nearly 50% of the round is already secured, driven by strong interest from both global and regional investors. Existing investors are actively working to increase their commitments, further validating Push30’s long-term vision and market relevance.

International Expansion: Uzbekistan, Kazakhstan, and Saudi Arabia

Push30 is strategically expanding into new markets with remarkable success. In 2023, the company launched in Tashkent, Uzbekistan, and has since partnered with 200+ fitness centers across the city. Further expansion across Uzbekistan is already in progress.

In December 2024, Push30 entered the Kazakhstani market, starting operations in Astana and Almaty, where it onboarded over 200 fitness partners. These milestones demonstrate the platform’s adaptability and universal appeal across diverse markets.

Saudi Arabia is next. The time spent in Riyadh during the Al-Farabi program confirmed strong demand and enthusiasm for the Push30 product. The team is now fully focused on adapting the app to fit local cultural and business norms while preparing for an official launch. Riyadh is set to become a strategic base for further growth in the Gulf region.

Push30 Invites Partners and Investors for Collaboration

Push30 invites partners and investors to collaborate in supporting innovative projects and nurturing future leaders. By working with Push30, partners and investors gain access to new business opportunities and strong networks. Push30 is ready to build mutually beneficial partnerships with every collaborator.

Finally, an interview with Push30 CEO Adil Gasimov is presented. You can read the full interview by clicking the link below: read more.

Contact : To learn more about investment or partnership opportunities, reach out at contact@push30.app

Support Email : support@push30.az

About the company: Push30 is a forward-thinking technology firm rooted in Baku, Azerbaijan, with a growing presence in Uzbekistan, Kazakhstan and Saudi Arabia. Known for its innovative solutions and ability to penetrate new markets successfully, Push30 is dedicated to enhancing user experiences and expanding its technological footprint globally.

Contact Info:

Name: Guljan Nazarli

Email: Send Email

Organization: Push30 LLC

Website: https://push30.az/

Release ID: 89161243

Should you detect any errors, issues, or discrepancies with the content contained within this press release, or if you need assistance with a press release takedown, we kindly request that you inform us immediately by contacting error@releasecontact.com (it is important to note that this email is the authorized channel for such matters, sending multiple emails to multiple addresses does not necessarily help expedite your request). Our expert team will be available to promptly respond and take necessary steps within the next 8 hours to resolve any identified issues or guide you through the removal process. We value the trust placed in us by our readers and remain dedicated to providing accurate and reliable information.

Technology

SB 395 slams the brakes on Nevada’s future – Las Vegas Sun News

Friday, May 30, 2025 | 2 a.m. Las Vegas is the heart of the global innovation, tourism, sports and entertainment economy. Each year, the city hosts hundreds of major trade shows and thousands of technology-focused corporate events where new products are introduced to the world, visions shared and serendipitous meetings and conversations make magic. Mobility […]

Friday, May 30, 2025 | 2 a.m.

Las Vegas is the heart of the global innovation, tourism, sports and entertainment economy. Each year, the city hosts hundreds of major trade shows and thousands of technology-focused corporate events where new products are introduced to the world, visions shared and serendipitous meetings and conversations make magic.

Mobility powers this connectivity, but there’s a threat to our autonomous driving future.

Las Vegas spends billions to establish its global reputation as a place where the future meets the present — and it creates jobs. From Black Fire Innovation at UNLV and advanced tech integrated at Harry Reid International Airport, to robot-assisted hotel rooms, to the autonomous taxis serving the Strip, Las Vegas leans into innovation. That’s not to mention the immersive entertainment and sporting venues creating an unmatched experience for global visitors and Nevadans alike. All that investment, innovation and job creation could be threatened by Senate Bill 395, which would stall autonomous trucking in the state before it revs up.

SB 395 would require a licensed human driver in every autonomous commercial truck. This legislation should concern anyone who believes in the power and promise of innovation. Studies suggest this technology can already be safer than human drivers. Requiring a redundant driver adds huge costs for companies working to innovate the way we move.

This legislation, which passed the state Senate, is likely a reaction to stories from truck drivers worried about their future. While those stories are emotional, data show an alarming gap between the number of drivers available and those we’ll need. This legislation would throw Nevada into reverse, pushing it away from dozens of forward-looking states that explicitly allow degrees of autonomous trucking. Twenty-four states now allow fully driverless vehicles that comply with public safety, none with SB 395’s constraints. If passed, AV companies would bypass Nevada for friendlier markets, taking jobs, infrastructure investment and supply chain solutions with them.

As head of the Consumer Technology Association, owner and producer of CES, I’ve seen the show’s reliance on a finely tuned global supply chain — one that relies on autonomy and smart trucking to help us gather in one place. The 2025 show gathered more than 142,000 people in Las Vegas, and generated so much coverage on social media that it could in theory have introduced every human with an internet connection to the marvels of Las Vegas’ show halls.

CES isn’t the only big tech show in Las Vegas. APAA, AWS re:Invent, HPE Discover, NAB, MWC, NBAA, SEMA and dozens of other shows center on innovation and technology. Hundreds more tech-oriented companies host major national and global meetings in Las Vegas. With nearly every company now branding itself a “tech company” and Las Vegas well-established as the world’s premier convention city, the City of Lights is poised to shine brighter — if it retains its status as an innovation hub.

Beyond the Las Vegas lights, autonomous trucking will deliver benefits for all Americans. This technology will improve supply chains and contribute to efficient global trade. That lowers costs and helps get the products you order to your door more quickly, reliably and sustainably.

Fortunately, forward-thinking legislators in the Assembly have recognized the dangers of this bill and are leading the charge to keep Nevada on the cutting edge. By rejecting unnecessary restrictions on autonomous technology, they’re ensuring our state remains a beacon of innovation — not a relic of the past. Let’s support their efforts to build a smarter, more efficient future for Nevada and the nation.

Gary Shapiro is CEO and vice chair of Consumer Technology Association, and the author of books including “Pivot or Die.” CTA owns and produces CES.

Technology

A new study links intensive chores to better heart health

Ever had to decide between cleaning your house or working out? Well, experts say there’s a way to do both. Let me explain. Get a workout in… by doing chores Great news: Your spring cleaning may be just as good as some other forms of exercise. A recent study found that every minute people spent […]

Ever had to decide between cleaning your house or working out? Well, experts say there’s a way to do both. Let me explain.

Get a workout in… by doing chores

Great news: Your spring cleaning may be just as good as some other forms of exercise. A recent study found that every minute people spent doing daily activities at a higher intensity was equal to about 3 minutes of moderate-intensity and 35 to 50 minutes of light-intensity activity.

That led to heart benefits too: Participants whose movements were intensified saw a reduced risk of cardiovascular disease of up to 67%. So the next time you’re scrubbing your bathtub, scrub extra hard to break a sweat. And pick up the pace the next time you Swiffer, organize your cabinets or haul garbage bags.

One small thing to buy

Which chores make you break a sweat? Let us know. Happy weekend!

About One Small Thing: One Small Thing is a daily health newsletter from Yahoo News.

-

College Sports1 week ago

College Sports1 week agoPortal Update – Basketball and Gymnastics Take Hits

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoThe Program, a New Basketball Training Facility, Opening in Greenpoint This September

-

Sports3 weeks ago

Sports3 weeks agoBarnes, Lippert and Smeal Set School Records at APU Franson Meet

-

NIL3 weeks ago

NIL3 weeks ago2025 NCAA Softball Tournament bracket, schedule revealed

-

Motorsports3 weeks ago

Motorsports3 weeks agoLayne Riggs (Bed Cover) Disqualified From Second-Place

-

College Sports2 weeks ago

College Sports2 weeks agoPortal Update – Basketball and Gymnastics Take Hits

-

Motorsports3 weeks ago

Motorsports3 weeks agoNASCAR Delivers Blow To Two Cup Teams After Pre-Race Inspections In Kansas

-

Sports3 weeks ago

Sports3 weeks agoNo. 12 Men’s Outdoor Track & Field Wins A-R-C Championship

-

Sports3 weeks ago

Sports3 weeks ago4A Boys Volleyball: Regis Groff Captures First State Championship

-

Sports3 weeks ago

Sports3 weeks agoSteffen wins MVP, three events at league championships

(via @TheMasters/X)

(via @TheMasters/X)