Technology

Game Publisher Market Size, Share

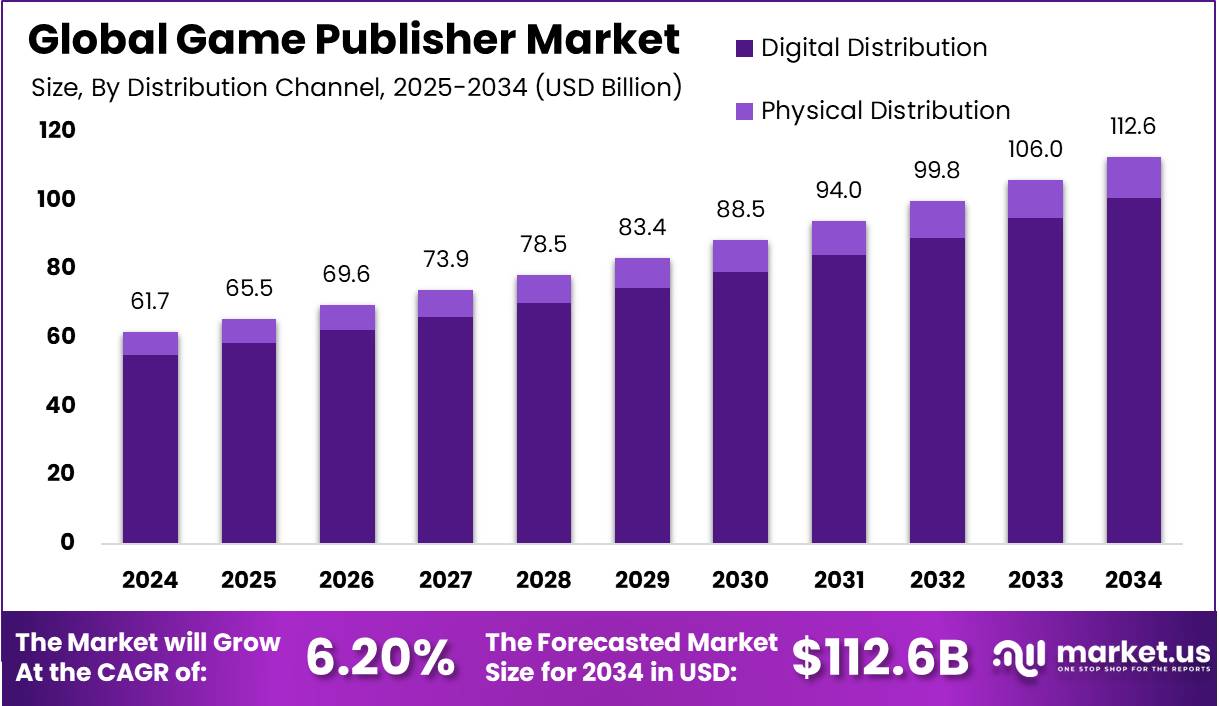

Game Publisher Market Size The Global Game Publisher Market size is expected to be worth around USD 112.6 Billion By 2034, from USD 61.7 Billion in 2024, growing at a CAGR of 6.20% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position in the game publisher market with […]

Game Publisher Market Size

The Global Game Publisher Market size is expected to be worth around USD 112.6 Billion By 2034, from USD 61.7 Billion in 2024, growing at a CAGR of 6.20% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position in the game publisher market with over a 36.78% share, generating USD 22.6 billion in revenue. Meanwhile, the market for game publishers in China was estimated at USD 6.35 billion, with a CAGR of 6.78%.

A game publisher is responsible for marketing, distribution, and often financing video games developed by others. The publisher market includes managing production timelines, promotion, sales, and distribution across platforms like consoles, PCs, and mobile devices. This market plays a key role in connecting developers with consumers, ensuring games reach their intended audience effectively.

The growth of the game publisher market is driven by key factors, including the global rise in smartphone penetration and internet connectivity, which expands the consumer base, especially in mobile gaming. Additionally, advancements in technology, such as AR and VR, have enhanced gaming experiences, attracting more users.

![]()

![]()

Market Overview

The demand within the game publisher market is primarily driven by the global increase in gaming audiences, especially in mobile and online gaming. As devices become more affordable and internet connectivity improves worldwide, more people engage in gaming activities. This trend is particularly strong in emerging markets where mobile devices are the primary means of internet access.

As of 2024, the gaming industry has seen a decisive shift toward digital platforms, with 95% of global game sales now occurring through digital downloads or streaming, leaving physical sales at a minimal 5%, according to Udonis. This transformation underlines the dominance of online distribution in consumer behavior and content delivery.

Mobile gaming continues to lead the sector, generating approximately USD 92 billion, which accounts for 49% of the global gaming revenue. Console gaming ranks second, contributing around USD 51 billion (28% share), followed by PC gaming at roughly USD 43 billion (23% share). This segmentation highlights the rising accessibility of mobile platforms and their growing engagement rates compared to traditional formats.

From a regional perspective, the United States and China remain the top contributors to industry revenue. In 2023, the U.S. generated approximately USD 46.7 billion, marginally surpassing China’s USD 44.6 billion. Other key markets include Japan (USD 18.4 billion), South Korea (USD 7.4 billion), Germany (USD 6.6 billion), and the United Kingdom (USD 5.5 billion).

The integration of cross-platform play has emerged as a major trend, enhancing player engagement by allowing gamers from different platforms to interact and play together. This trend is complemented by the Games-as-a-Service (GaaS) model, where games are continually updated with new content to maintain and grow user bases over time.

Key Takeaways

- The Global Game Publisher Market size is expected to be worth around USD 112.6 Billion by 2034, from USD 61.7 Billion in 2024, growing at a CAGR of 6.20% during the forecast period from 2025 to 2034.

- In 2024, the Action-Adventure Games segment held a dominant market position, capturing more than a 16.7% share in the game publisher market.

- In 2024, the Mobile Device segment held a dominant market position, capturing more than a 52.1% share in the game publisher market.

- In 2024, the Digital Distribution segment held a dominant market position, capturing more than an 89.4% share in the game publisher market.

- In 2024, the Casual Gamers segment held a dominant market position within the game publisher market, capturing more than a 67.3% share.

- In 2024, Asia-Pacific held a dominant market position in the game publisher market, capturing more than a 36.78% share and generating revenues amounting to USD 22.6 billion.

- In 2024, the market for game publishers in China was estimated at USD 6.35 billion. This sector is experiencing a steady growth trajectory, with a CAGR of 6.78%.

China Game Publisher Market

In 2024, the market for game publishers in China was estimated at USD 6.35 billion. This sector is experiencing a steady growth trajectory, with a compound annual growth rate (CAGR) of 6.78%. This expansion highlights the dynamic growth of the Chinese gaming industry, fueled by rising consumer demand and advancements in gaming technology.

The sustained growth of the Chinese game publisher market is driven by several factors, including the rising popularity of mobile gaming among China’s large population. Increased internet access and the spread of smartphones have made gaming more accessible, boosting market expansion. Additionally, innovations in game design and the integration of AR and VR are attracting new players while retaining the existing user base.

The Chinese game publisher market is set for continued growth, fueled by advancements in gaming technologies and supportive government policies for digital entertainment. Collaborations between publishers and mobile device manufacturers will create new opportunities for expansion. As the market matures, these factors will propel the industry forward, solidifying China’s role as a global gaming leader.

![]()

![]()

In 2024, Asia-Pacific held a dominant market position in the game publisher market, capturing more than a 36.78% share and generating revenues amounting to USD 22.6 billion. This significant market share can be largely attributed to the extensive digital transformation across the region, especially in major economies such as China, Japan, and South Korea.

Asia-Pacific benefits from a large, young population that is highly tech-savvy and enthusiastic about gaming. The region’s strong gaming culture, along with substantial local production and consumption, drives growth. In countries like South Korea, government support through subsidies and programs to promote game development has further boosted the industry.

Esports plays a key role in the dominance of the Asia-Pacific game publisher market, with top esports teams fueling enthusiasm for competitive gaming and driving demand for diverse genres. The market is poised to maintain its leadership, supported by innovations in gaming technology, expanding internet and mobile access, and the continued growth of an engaged gaming community.

![]()

![]()

Game Type Analysis

In 2024, the Action-Adventure Games segment held a dominant market position in the game publisher market, capturing more than a 16.7% share. This genre’s leading status comes from its wide appeal, combining engaging stories, immersive worlds, and interactive gameplay with problem-solving, exploration, and combat, attracting both casual and hardcore gamers.

Action-adventure games have thrived thanks to advancements in gaming hardware, enabling developers to craft more detailed and expansive worlds. These improvements make the games more engaging and visually appealing. The genre’s versatility, blending elements from various genres, also broadens its appeal, attracting a wider audience.

The rise of digital distribution platforms has further fueled the growth of the action-adventure games segment. Platforms like Steam, PlayStation Network, and Xbox Live provide developers with direct access to vast audiences globally, reducing barriers to entry and enabling more frequent updates and enhancements to existing games, which helps maintain player interest over longer periods.

The action-adventure games segment is set for sustained growth, driven by innovations like virtual reality (VR) and augmented reality (AR), which open new possibilities for player immersion. As technology and gameplay evolve, the market is expected to remain dominant, captivating gamers with engaging and innovative experiences.

Device Type Analysis

In 2024, the Mobile Device segment held a dominant market position in the game publisher market, capturing more than a 52.1% share. This dominance is driven by the global adoption of smartphones and the convenience of mobile gaming, allowing users to play on-the-go with games designed for quick, engaging sessions that suit busy lifestyles.

Furthermore, the mobile platform has seen an increase in the sophistication of games available, attracting a broader audience that includes both casual and hardcore gamers. Developers and publishers have leveraged this trend by focusing on mobile-first strategies, often releasing games exclusively for mobile devices before other platforms.

The economic model of mobile gaming also supports rapid growth. Many mobile games are free to play and monetize through in-app purchases and advertising, making them accessible to a larger demographic compared to traditionally priced PC and console games.

Technological advancements in mobile devices, like enhanced graphics and processing power, have led to more complex and visually appealing games. This progression is narrowing the gap in gaming quality between mobile devices and traditional consoles or PCs, further driving the growth of the mobile gaming market.

Distribution Channel Analysis

In 2024, the Digital Distribution segment held a dominant market position, capturing more than an 89.4% share. This substantial market share can be attributed to several pivotal factors that highlight the segment’s robust appeal and its alignment with contemporary consumer preferences and technological advancements.

Digital distribution platforms have revolutionized how consumers access and purchase games, offering 24/7 worldwide availability. Unlike physical stores, these platforms provide instant content delivery, eliminating the need for travel. This convenience appeals to consumers who prioritize ease and immediacy, which traditional retail outlets can’t match.

Digital distribution lowers costs by removing the need for manufacturing, shipping, and storage, allowing publishers to maintain higher margins. These savings can be reinvested into game development or marketing, boosting the overall quality and competitiveness of their products.

These platforms give publishers direct access to consumer behavior data, offering insights into market trends, preferences, and purchasing patterns. By using this data, publishers can refine marketing strategies and game development to better align with audience demands, leading to higher engagement and customer satisfaction.

The growth of digital distribution is further fueled by the rise of mobile gaming and cloud gaming technologies. These trends broaden the gaming market, attracting casual gamers who favor the accessibility of mobile devices. The integration of games into mobile and cloud platforms strengthens the dominance of digital distribution in the gaming industry.

End-user Analysis

In 2024, the Casual Gamers segment held a dominant market position within the game publisher market, capturing more than a 67.3% share. The significant market share can be attributed to the accessibility of gaming platforms and the wide variety of games that appeal to casual gamers’ diverse interests and skill levels, making gaming an attractive leisure activity for a broad audience. This inclusivity has driven the segment’s growth.

The rise of mobile gaming has played a key role in expanding the casual gamer base. With games designed to be intuitive and engaging, mobile gaming appeals to users seeking entertainment during commutes or short breaks. This accessibility and playability have attracted a large number of casual gamers.

Game publishers’ marketing strategies, including ads, social media campaigns, and brand collaborations, have effectively targeted casual gamers, boosting the visibility of casual-friendly games and driving growth. Additionally, the evolution of casual games, with more competition and social interaction elements, has kept players engaged and encouraged frequent play, helping the segment remain strong and influential in the broader gaming market.

![]()

![]()

Key Market Segments

By Game Type

- Action-Adventure Games

- First-person Shooters (FPS)

- Simulation Games

- Sports Games

- Fighting Games

- Survival Games

- eSports Games

- Others

By Device Type

- Mobile Device

- Computer

- Console

- Online

By Distribution Channel

- Digital Distribution

- Physical Distribution

By End-user

- Casual Gamers

- Professional Gamers

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Expansion of Mobile Gaming and Digital Distribution

The proliferation of smartphones and the widespread availability of affordable internet have significantly propelled the growth of mobile gaming. This segment has become a dominant force in the game publishing industry, driven by the accessibility of games on various devices and the convenience of digital distribution platforms.

The rise of app stores and online marketplaces has enabled publishers to reach a global audience without the constraints of physical distribution. Moreover, the adoption of cloud gaming services has further facilitated access to high-quality games across different platforms.

These developments have not only expanded the consumer base but have also opened new revenue streams through in-app purchases and subscription models. The continuous innovation in mobile technology and the increasing engagement of users with mobile games underscore the significance of this driver in the industry’s growth trajectory.

Restraint

Escalating Development Costs

The game publishing industry is currently grappling with the challenge of rising development costs, particularly for AAA titles. The demand for high-fidelity graphics, expansive open-world environments, and sophisticated gameplay mechanics necessitates substantial investment in technology and talent.

The rising cost of developing AAA games, often exceeding budgets, is putting financial pressure on publishers, who also face the need for costly marketing campaigns. As a result, many are becoming more risk-averse, prioritizing established franchises over innovative but unproven concepts. This trend may hinder creativity and reduce the diversity of games available to players.

Opportunity

Growth of Emerging Markets

Emerging markets, particularly in regions like Africa, present a significant opportunity for game publishers. The increasing penetration of smartphones and improvements in internet infrastructure have led to a growing gaming audience in these areas.

Local developers are creating culturally relevant content that resonates with regional audiences, while international publishers are exploring partnerships to tap into these markets. The potential for growth is substantial, as these markets are relatively untapped and offer a new consumer base eager for diverse gaming experiences. By investing in localized content and understanding regional preferences, publishers can establish a strong foothold and drive revenue growth in these burgeoning markets.

Challenge

Market Saturation and Visibility Issues

The game publishing industry faces the challenge of market saturation, with an overwhelming number of titles released annually. This abundance makes it increasingly difficult for individual games, especially from independent developers, to gain visibility and attract a substantial player base.

The competition for consumer attention is intense, and without significant marketing budgets, many quality games fail to achieve commercial success. This environment favors established publishers with the resources to promote their titles extensively, potentially marginalizing innovative projects from smaller studios. Addressing this challenge requires strategic marketing, community engagement, and leveraging alternative distribution channels to enhance discoverability.

Latest Market Trends

The game publishing landscape is shifting due to technological advancements and changing player expectations. A key trend is the rise of cross-platform development, which allows games to be accessible on PCs, consoles, and mobile devices. This expands the audience and boosts player engagement by offering flexible gaming experiences.

Cloud gaming is transforming the industry by enabling players to stream high-quality games without costly hardware, with services like Xbox Cloud Gaming and NVIDIA GeForce NOW leading the way. Additionally, ethical monetization practices are on the rise, with publishers moving away from loot boxes and pay-to-win models in favor of fairer strategies like cosmetic purchases and battle passes to maintain player trust.

AI is playing a larger role in game development, aiding in content creation, user acquisition, and data analytics for personalized gaming experiences. Additionally, there’s a growing focus on supporting indie developers, with companies like Pocketpair launching publishing divisions to fund and assist smaller studios, promoting innovation and diversity in game content.

Business Benefits

Game publishers provide essential funding to developers, particularly indie developers, allowing them to bring their creative visions to life without the burden of financial risk. This funding is often tied to development milestones, helping structure the development process and ensuring ongoing financial support.

Publishers play a critical role in marketing games, utilizing various channels such as social media, online advertising, and event promotions to increase visibility. Marketing support plays a vital role in a game’s success, helping it stand out in a crowded market. Strong strategies boost visibility, spark anticipation, and keep players engaged before and after launch.

Publishers provide valuable expertise in both game development and market strategies. This involves handling licensing, localizing for global markets, and ensuring quality. For smaller dev teams, this expertise helps tackle technical hurdles and improve game design for wider reach.

Key Player Analysis

The gaming industry is one of the most dynamic sectors globally, and its success relies heavily on a few key players who dominate the market.

Tencent Holdings is a Chinese multinational conglomerate that has become one of the largest and most powerful forces in the gaming industry. The company’s strength lies in its vast portfolio, which includes some of the world’s most popular games and gaming platforms. Additionally, Tencent is a key player in the mobile gaming market, which has seen rapid growth in recent years.

Sony Group Corporation is a well-known name in the entertainment world, and its gaming division, Sony Interactive Entertainment, plays a pivotal role in the video game market. Sony’s focus on providing high-quality gaming experiences, both in terms of hardware and software, has earned it a loyal customer base worldwide.

Microsoft Corporation is another major player that has made significant strides in the gaming sector, particularly with its Xbox consoles and its growing portfolio of game studios. Microsoft’s commitment to game subscription services like Xbox Game Pass has also revolutionized how players access and enjoy games, offering a wide variety of titles for a monthly fee.

Top Key Players in the Market

- Tencent Holdings Limited

- Sony Group Corporation

- Microsoft Corporation

- Sea Limited

- NetEase, Inc.

- Nintendo Co., Ltd.

- Electronic Arts Inc.

- Bandai Namco Holdings Inc.

- Entain plc

- Epic Games

- CyberAgent, Inc.

- Embracer Group AB

- Sega Sammy Holdings Inc.

- Nexon Co., Ltd.

- Playtika Holding Corp.

- Other Major Players

Top Opportunities for Players

The game publishing market is poised for dynamic growth with several key opportunities emerging from technological advancements and evolving market conditions.

- Cross-Platform Development: There’s a growing demand for games that offer a seamless experience across multiple platforms, including PC, consoles, and mobile devices. With over three billion active gamers worldwide, the ability to publish games that are accessible on various devices can significantly expand a game’s reach and revenue potential.

- Enhanced Monetization Strategies: Game publishers are increasingly exploring sophisticated monetization strategies beyond traditional sales, such as microtransactions, season passes, and in-game advertising. The key is to balance monetization with user experience to maintain player engagement and satisfaction.

- Indie Game Support: The barriers to game development are lowering, thanks to intuitive game engines and digital distribution platforms like Steam and the Epic Games Store. This trend presents a lucrative opportunity for publishers to partner with indie developers, who are now capable of creating hit titles without extensive budgets, and help them navigate the crowded marketplace.

- Global Expansion: Emerging markets present significant growth opportunities. Regions such as Asia-Pacific are rapidly growing in terms of gamer population and revenue, offering game publishers the chance to capitalize on new customer bases and diversified gaming preferences.

- Adoption of Latest Technologies: Incorporating advanced technologies such as AI, cloud computing, and virtual reality can lead to innovative game features and experiences. These technologies not only enhance gameplay but also provide new ways to engage users and stand out in a competitive market.

Industry News

- In January 2025, CyberAgent, Inc. took a step to expand its creative frontier by launching a brand-new anime production studio, CA Soa Inc., a move aimed at supercharging its presence and capabilities in the world of anime.

- In April 2024, Epic Games acquired Loci, an AI platform for automated tagging of 3D assets, to enhance its digital asset offerings.

Report Scope

Technology

Scale AI Announces Next Phase of Company’s Evolution – NORTHEAST

Jason Droege is a seasoned technology executive and entrepreneur. Before joining Scale, he was a Venture Partner at Benchmark, an investment firm focused on early-stage venture investing in consumer, marketplaces, open-source, AI, infrastructure, and enterprise software. He joined Benchmark in 2021 to collaborate closely with portfolio founders, leveraging his extensive experience in building consumer businesses. […]

Jason Droege is a seasoned technology executive and entrepreneur. Before joining Scale, he was a Venture Partner at Benchmark, an investment firm focused on early-stage venture investing in consumer, marketplaces, open-source, AI, infrastructure, and enterprise software. He joined Benchmark in 2021 to collaborate closely with portfolio founders, leveraging his extensive experience in building consumer businesses.

Technology

At HardTech, Holyoke wants to sell itself as a place ‘for companies from Boston to land’ in a new manufacturing economy

HOLYOKE — This city — with its affordable old mills-turned office lofts, affordable green hydropower and proximity to markets and to educated workers form the Five Colleges — kept coming up during a technology conference in tony Cambridge last week. And Mike Stone — resident, co-founder and principal of Cofab Design here and an organizer […]

HOLYOKE — This city — with its affordable old mills-turned office lofts, affordable green hydropower and proximity to markets and to educated workers form the Five Colleges — kept coming up during a technology conference in tony Cambridge last week.

And Mike Stone — resident, co-founder and principal of Cofab Design here and an organizer of the upcoming HardTech Holyoke — insists he wasn’t the one bringing his adopted hometown into the conversation.

“Holyoke is on their minds,” Stone said. “There is an energy.” The energy is for Boston- or New York-grown companies looking for a place where they can grow.

CoFab is a five-person engineering consultancy working on designs for manufacturers.

The trendy word is HardTech, hard technology meant to differentiate manufacturing physical things from developments in AI or software.

“We work in atoms, not bytes,” Stone said.

The second-ever HardTech Holyoke event will be held Wednesday from 5 to 8 p.m. at Mill 1 at Open Square. More information is available by emailing hello@hardtechholyoke.org or online at hardtechholyoke.org.

A mix of networking, information and making connections, the event provides space for representatives of established companies in Holyoke to meet with firms potentially looking to locate here and learn about all the positive assets Holyoke can provide, said Aaron Vega, director of planning economic development for the city.

The first event — in August 2023 — drew 100 people.

“It was this scene-building activity,” Vega said.

With an admittedly loose definition of “annual,” Stone said he goes for a relaxed vibe without a lot of presentations. There will be food and conversation with displays of technology developed in Holyoke.

“More like a gallery opening, but for manufacturing and engineering,” he said

A buzz, he said, generated by success stories like Clean Crop Technologies which is developing new ways to remove contamination from seeds and foods and is located just upstairs from Stone’s Cofab Design in the Wauregan Building at 340 Dwight St.

Sublime Systems has helped put Holyoke on the map despite the loss of a federal grant supporting its plans to bring an innovative cement manufacturing process to Holyoke.

Sublime says it is moving forward and hopes to recapture the federal money.

Xenocs, with offices in Open Square in Holyoke, uses X-ray technology to analyze nanoscale materials. It will participate as well.

Based in Sunderland, Florrent, a maker of supercapacitors for energy storage, is also part of the event.

Technology

How Technology Can Improve Your Sports Teams’ Performance

PHOTO: Chelsea Ouellet/Pixabay This blog contains links from which we may earn a commission. The world of sports has been known to change quickly, and one way this occurs is through technology. There is constantly a new wave of tech on the horizon that can better various aspects of sports, including athletes’ performance. Pairing the […]

PHOTO: Chelsea Ouellet/Pixabay

This blog contains links from which we may earn a commission.

The world of sports has been known to change quickly, and one way this occurs is through technology.

There is constantly a new wave of tech on the horizon that can better various aspects of sports, including athletes’ performance.

Pairing the prowess of an athlete with innovative technology can elevate both an individual’s and a team’s performance.

Wanting to better an athlete’s or a team’s performance is the norm for coaches, and all coaches could find this post useful.

Below, you will find out what types of technology are beneficial if you want to improve sports performance, as well as how this is achieved.

Athlete Monitoring with Wearable Technology

Athletes, coaches, and medical professionals can obtain precise data through wearable technology, which has completely transformed performance analysis in sports. Wearable tech can provide real-time data on various biomechanical and physiological parameters. Watches and other devices have been equipped with GPS and motion sensors, allowing individuals to analyze their performance patterns through their endurance, movements, and speed.

Coaches can use the data supplied to analyze performance, identify weaknesses, and optimize training routines. This will include distance, endurance, movement patterns, and speed from accelerometers and GPS.

These devices will also measure the athlete’s heart rate and variability (HRV), which can provide insight into fatigue, recovery, and stress. While HRV helps athletes assess their readiness for training, sensors like electromyography (EMG) will track muscle activation and engagement, helping to identify muscle imbalances. Obtaining this information in real time will allow for immediate adjustments during competition and/or training.

Performance Strategy with Monitoring Tools

PHOTO: Chelsea Ouellet/Pixabay

PHOTO: Chelsea Ouellet/PixabayThe use of monitoring tools in sports can provide valuable data that inform injury prevention, recovery, and training. Such data can be used by athletes and coaches to make data-driven decisions for them, optimize how they perform, and reduce the risk of injuries during training and competitions. This data will include key performance indicators, such as heart rate, movement patterns, and workload.

While wearable tech can also be used for this, the primary monitoring tools used by athletes and coaches include 3D motion capture systems, game analysis software, and video analysis systems. The latter is crucial to identify strengths and weaknesses, monitor performance, provide immediate and visual feedback, and track progress. If you wish to capture this type of data during training and so on, you should research the best sports video systems.

Video performance systems for sports should include advanced analytical tools, high-quality video capture, and integration capabilities. For example, Endzone Video Systems designs telescoping towers and sports camera systems, and this company has been recognized as one of the best, which means their products must be well-made.

Virtual Reality in Sports Training

With many advancements made in recent years, virtual reality (VR) has become well-known in some sports training sessions. VR can create an immersive and interactive environment that replicates the real-world game scenario, no matter if it is golf, motorsport, or soccer.. This allows athletes to practice their skills and strategies in a safe and repeatable manner.

There are several benefits to using VR in sports training. As well as providing real-time feedback on an athlete’s performance, this type of technology can enable athletes to better their decision-making under pressure, spatial awareness, and tactical understanding. This can also introduce them to high-pressure situations, assisting them with developing mental toughness and stress management techniques.

To conclude, there are a number of different types of technology that can improve the performance of a sports team.

Wearable tech, monitoring tools, and virtual reality, as discussed in this post, are only a few options that athletes and coaches should take advantage of to up their game in the future.

PHOTO: Chelsea Ouellet/Pixabay

Technology

D1 Training Unleashes Athletic Potential in Peachtree Corners with New Fitness Facility

D1 Training, a leading fitness enrichment concept utilizing the five core tenets of athletic-based training, recently opened a new location in Peachtree Corners at 5250 Triangle Pkwy NW Suite 400. The new group fitness facility employs a sports-science backed training regimen led by certified trainers to help people of all ages achieve their sport and fitness […]

D1 Training, a leading fitness enrichment concept utilizing the five core tenets of athletic-based training, recently opened a new location in Peachtree Corners at 5250 Triangle Pkwy NW Suite 400. The new group fitness facility employs a sports-science backed training regimen led by certified trainers to help people of all ages achieve their sport and fitness goals.

Roald and Marian Richards will join a roster of impressive existing franchisees, including professional athletes like Kylie Fitts and Jordan Gay. Additional franchise partners include notable figures such as Super Bowl MVP Von Miller, Tim Tebow, and Michael Oher

The Richards family has always embraced an active lifestyle. Marian played college basketball, while Roald was a multi-sport athlete in high school, competing in both basketball and track. Their children share that same passion: their oldest daughter competes in varsity basketball and track, and their son also plays varsity basketball. Both have played AAU basketball, along with baseball and soccer. Their youngest daughter is now following in their footsteps as a soccer player. Roald went on to coach basketball at the local YMCA after college and continued coaching his son through childhood. Marian is equally involved, having coached several of their children’s sports teams over the years.

In addition to coaching, Roald has enjoyed a successful 29-year career in finance. With a strong entrepreneurial spirit, he sought business opportunities after achieving financial security. D1 Training aligned perfectly with his interests and values, allowing him to provide youth athletes in his community with the chance to reach their fitness goals and become the best versions of themselves both on and off the field.

“Throughout my journey in sports, I’ve come to understand that athletics provide kids with the opportunity to build solid foundations and learn invaluable life lessons,” said Roald. “It’s about much more than just playing a game; through sports, children gain discipline and discover important truths about themselves, which can be crucial for their development. I’m excited to help the youth athletes of Peachtree Corners and the surrounding communities achieve their goals and cultivate the confidence they need to excel in whatever they pursue.”

D1 Training offers four age-based programs including Rookie (ages 7-11), Developmental (ages 12-14), Prep (ages 15-18) and D1 Adult. Each fitness program is based on the five athletic-based tenets: dynamic warm-up, performance, strength program, core and conditioning, and cool down. Outside of group workouts, D1 Training offers group, semi-private, and one-on-one training with world-class coaches. The goal is simple: to continue to train athletes who are dedicated to their sport or fitness goals, regardless of age, or athletic background.

“The Richards are the ideal candidates to bring the D1 Training experience to Peachtree Corners,” said the brand’s Chief Operating Officer, Dan Murphy. “We’re thrilled to welcome them to the D1 family and are confident in their ability to show the Peachtree Corners area what they’ve been missing out on. D1 is a one-of-a-kind fitness experience that’s built around the individual and meant to help people meet their athletic goals. Our strong network of franchisees embodies our core values to bring the D1 Training vision to life, and we know the Richards will do just that in Peachtree Corners and its surrounding communities.”

Strategically expanding across the nation through franchising, D1 Training has more than 100 performance centers open with over 100 additional locations in various stages of development. The brand is currently seeking financially qualified business builders, former athletes, and entrepreneurs, who share a passion for fitness and youth sports, who are ready to make a positive impact on their community.

For more information on D1 Training Peachtree Corners, please visit https://www.d1training.com/peachtree-corners/, or call (855) 783-7650.

About D1 Training

Founded in 2001 by former NFL player Will Bartholomew, and based in Nashville, D1 Training began franchising in 2017. The popular fitness brand has grown to more than 100 locations currently open, with over 250 additional locations in various stages of development. The brand was recently ranked in Entrepreneur Magazine’s Franchise 500, was named a Top 30 Gym in America by Men’s Health Magazine and made an appearance on The Inc. 5000 which ranks the fastest growing private companies in the nation. D1 Training has been endorsed by the NFL Players Association as an approved training facility and is a preferred partner of the National Academy of Sports Medicine. D1 Training is actively seeking qualified, community-minded franchisees with a passion for the fitness industry to continue its growth through single and multi-unit franchise deals. For more information on D1 Training and franchise opportunities, please visit https://www.d1franchise.com/.

Technology

Tech-Enriched Sports Equipment : GOAL concept

The ‘GOAL’ concept has been designed by Yewon Lee as a playful sports equipment solution that embraces technology to balance the offline world with the online one. The system consists of two main components including a base with a projector and a speaker alongside a smart ball that work together to immerse users in a […]

The ‘GOAL’ concept identifies how we could see toys evolve into the near-future as a means of bridging the disconnect between children who have grown up using technology, but need analog activities for further stimulation.

Technology

Top Founder-Run Company Stocks That Are Safe Long-Term Plays — TradingView News

An updated edition of the April 30, 2025, article. Founders cultivate and make a company from scratch. They have profound passion, a steadfast vision, and tireless dedication for their ventures. Their willingness to take risks often surpasses that of traditional managers, as they embrace unconventional ideas, champion innovation, and make bold decisions to drive success. As […]

An updated edition of the April 30, 2025, article.

Founders cultivate and make a company from scratch. They have profound passion, a steadfast vision, and tireless dedication for their ventures. Their willingness to take risks often surpasses that of traditional managers, as they embrace unconventional ideas, champion innovation, and make bold decisions to drive success. As a result, these businesses often become true reflections of their founders’ core values, ideals and long-term ambitions.

Founder-run companies represent less than 5% of the S&P 500 index. But that does not make their contribution any less. Everyone is aware of the success stories of visionary founder-owners like Elon Musk, Warren Buffett, Steve Jobs, Jeff Bezos, Mark Zuckerberg and Bill Gates, who have redefined industries, creating trillion-dollar companies that continue to thrive. Some of today’s prominent founder-run companies are NVIDIA Corporation NVDA, Amazon AMZN, Meta META, Berkshire Hathaway Inc. (BRK.A), (BRK.B) and Netflix NFLX. Founder-led companies represent nearly 15% of the total index’s market capitalization, with technology companies taking the lead.

As these companies are born out of a unique idea, they often involve technological innovation. These companies are built from scratch in a way that they can navigate challenges to stay sustainable over the long term.

Initially, others may not relate to a founder’s belief, making it difficult to source funds for the project. The founder often ends up putting personal wealth and savings into such bootstrap companies. If successful, they attract angel investors or raise funds. But it’s always the founder-owner whose stake and risk are the highest.

Moreover, founder-owners often struggle to delegate responsibilities, driven by skepticism about whether others can truly match their level of commitment or understanding. Thus, they tend to assume multiple senior roles and frequently struggle to identify a capable successor. However, excelling across all areas is rarely feasible. This hesitation to delegate can restrict the infusion of professional expertise, potentially impeding the company’s ability to scale effectively or respond swiftly to changing market dynamics.

Nevertheless, there is strong evidence that founder-led companies tend to perform better over time. Per Harvard Business Review Study, founder-led companies had a market-adjusted return of 12% over three years against a return of negative 26% for companies that hired a professional CEO. Our Founder-Run Companies Screen further makes it easy to identify high-potential stocks. Currently, stocks like Netflix, AppLovin Corporation APP and Dell Technologies Inc. DELL look appealing.

Ready to uncover more transformative thematic investment ideas? Explore 30 cutting-edge investment themes with Zacks Thematic Screens and discover your next big opportunity.

3 Founder-Run Companies to Add to Your Portfolio

Netflix, with a market capitalization of $387.7 billion, is considered a pioneer in the streaming space. The company evolved from a small DVD rental provider to a dominant streaming service provider, courtesy of its wide-ranging content portfolio and strong international footprint. Wilmot Reed Hastings Jr. co-founded Netflix with Marc Randolph in 1997 and is the executive chairman of the company.

Netflix has been spending aggressively on building its portfolio of original shows. This is helping the company sustain its leading position despite the launch of services like Disney+ and Apple TV+, as well as existing services like Amazon Prime Video. NFLX carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company’s focus on streaming regional content has been leading to international growth. Netflix is diversifying its content portfolio and working on projects across India, Mexico, Spain, Italy, Germany, Brazil, France, Turkey and the entire Middle East. The company has launched low-priced mobile plans in India, Indonesia, Malaysia, the Philippines and Thailand. Moreover, the upcoming lower-priced ad tier is expected to further drive growth in these price-sensitive regions.

Netflix’s 2025 priorities include improving its core business with more series and films to offer an enhanced product experience, growth of its ads business, and newer initiatives such as live programming and games. It believes these initiatives should help it sustain healthy growth and thus projects 2025 revenues between $43.5 billion and $44.5 billion and an operating margin of 29%.

AppLovin, with a market capitalization of $129.7 billion, has solidified its leadership in mobile advertising, powered by its next-gen AI engine, Axon 2. Adam Foroughi co-founded AppLovin with John Krystynak and Andrew Karamin in 2012 and is the executive chairman of the company.

AppLovin’s AXON machine learning engine has played a pivotal role in driving the growth of its software platform, enabling developers to optimize both user acquisition and monetization efforts. As the mobile advertising landscape shifts toward data-driven, performance-oriented solutions, AppLovin is strategically positioned to capture greater market share, particularly through its increasing emphasis on scalable, AI-enabled technologies. Its vertically integrated model, which combines cutting-edge ad tech with owned content, provides a competitive advantage in data utilization and user engagement optimization.

AppLovin’s transition to a software-centric model has led to improved margins and strengthened its financial performance, backed by solid free cash flow and effective capital management. The company’s decision to divest lower-performing gaming assets and focus on its high-growth ad tech platform positions it to further enhance profitability and deliver stronger returns on invested capital.

AppLovin is capitalizing on AI to drive direct, scalable monetization in mobile advertising, a strategy that is paying off. It sports a Zacks Rank #1.

Dell Technologies, with a market capitalization of $75.5 billion, is a leading provider of servers, storage and PCs. Boasting one of the world’s largest technology infrastructure companies, Dell was founded by Michael Saul Dell and is expected to benefit from recovering demand driven by the PC-refresh cycle.

Dell addresses the evolving needs of on-premises, cloud, and edge environments by enabling organizations to manage and secure workloads effectively through advanced storage solutions such as PowerProtect Data Domain and PowerScale. These systems are further strengthened by AI-powered ransomware detection, enhancing data protection and operational resilience.

This Zacks Rank #2 company is also benefiting from strong demand for AI servers, driven by ongoing digital transformation and heightened interest in generative AI applications. AI-focused server launches and collaboration with key players like NVIDIA and AMD further enhance its competitiveness in the AI infrastructure space. Dell’s strong cash flow, as well as disciplined capital allocation, reflects its solid performance.

Dell Technologies’ innovative portfolio, expanding partner base and growing AI footprint are major growth drivers. Thus, for the first quarter of fiscal 2026, revenues are expected to be between $22.5 billion and $23.5 billion, with the mid-point of $23 billion suggesting 3% year-over-year growth. Non-GAAP earnings are expected to be $1.65 per share (+/- 10 cents), indicating 25% growth at the midpoint.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

-

Health1 week ago

Health1 week agoOregon track star wages legal battle against trans athlete policy after medal ceremony protest

-

College Sports2 weeks ago

College Sports2 weeks agoIU basketball recruiting

-

Professional Sports1 week ago

Professional Sports1 week ago'I asked Anderson privately'… UFC legend retells secret sparring session between Jon Jones …

-

NIL3 weeks ago

NIL3 weeks ago2025 NCAA Softball Tournament Bracket: Women’s College World Series bracket, schedule set

-

Professional Sports1 week ago

Professional Sports1 week agoUFC 316 star storms out of Media Day when asked about bitter feud with Rampage Jackson

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoScott Barker named to lead CCS basketball • SSentinel.com

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoJ.W. Craft: Investing in Community Through Sports

-

Motorsports2 weeks ago

Motorsports2 weeks agoRockingham Speedway listed for sale after NASCAR return

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Penalty Report: Charlotte Motor Speedway (May 2025)

-

College Sports2 weeks ago

College Sports2 weeks agoOlympic gymnastics champion Mary Lou Retton facing DUI charge