Technology

How Tech Startups Are Disrupting the Sports Betting Industry with AI

The sports betting industry, long associated with traditional oddsmaking and human intuition, is undergoing a profound transformation. Thanks to the emergence of tech startups leveraging artificial intelligence (AI), the once-conservative sector is rapidly evolving into a data-driven, highly automated industry. AI is not just enhancing the sports betting experience; it’s fundamentally disrupting how bets are […]

The sports betting industry, long associated with traditional oddsmaking and human intuition, is undergoing a profound transformation. Thanks to the emergence of tech startups leveraging artificial intelligence (AI), the once-conservative sector is rapidly evolving into a data-driven, highly automated industry.

AI is not just enhancing the sports betting experience; it’s fundamentally disrupting how bets are made, odds are set, and customers engage with platforms.

The New Age of Predictive Analytics

Historically, bookmakers have relied on a mix of expert opinion, statistical analysis, and market sentiment to set odds. While effective, this approach leaves room for human error and bias. AI changes the game by enabling startups to analyze massive datasets — player statistics, weather conditions, team dynamics, historical outcomes, and even social media sentiment — in real time.

Startups like Unikrn and Swish Analytics are leading the charge, offering AI-powered models that predict outcomes with far greater accuracy than traditional methods. By utilizing machine learning algorithms that continuously improve with each game played, these platforms create dynamic, up-to-the-minute odds that adapt as new information becomes available, making it easier than ever to bet on your favorite sports with confidence.

Personalized Betting Experiences

Beyond odds-making, tech startups are using AI to deliver personalized experiences for bettors. Advanced recommendation engines suggest bets based on a user’s past behavior, favorite teams, risk tolerance, and betting patterns. This mirrors the personalization algorithms seen on platforms like Netflix or Amazon but applied to the betting world.

Companies like BetBuddy and Pinnacle have begun incorporating behavioral analytics to predict what types of bets a user might prefer. This not only enhances user engagement but also boosts loyalty and time spent on the platform — critical metrics in a competitive market.

AI-Powered Risk Management

One of the biggest challenges for any sportsbook is managing risk. Traditional models depend heavily on manual oversight and reactive adjustments. However, AI-powered risk management systems allow operators to proactively adjust betting lines, identify sharp bettors, and mitigate exposure to large losses.

Startups are introducing fraud detection and responsible gambling measures that leverage AI to spot suspicious betting patterns or signs of gambling addiction. These tools enable betting companies to intervene earlier, ensuring both regulatory compliance and customer safety.

Automation of Customer Support

AI-driven chatbots and virtual assistants have become commonplace in many industries, and sports betting is no exception. Tech startups are rolling out sophisticated AI customer service solutions that can handle everything from bet placement inquiries to payout questions and responsible gaming resources.

By automating customer support, betting platforms can operate 24/7 while reducing operational costs and improving customer satisfaction. The quick response times and personalized assistance powered by natural language processing (NLP) make a measurable difference in user retention.

In-Play Betting Gets Smarter

In-play or live betting, where users place bets during the event, is one of the fastest-growing segments of the sports betting industry. The real-time nature of these bets requires lightning-fast updates and analysis, which AI is uniquely equipped to provide.

Startups are developing real-time predictive models that adjust odds within seconds of new developments on the field — a goal, a penalty, a player substitution. The agility and accuracy offered by AI give bettors a far more engaging and responsive experience while giving operators better control over odds volatility.

Challenges and Ethical Considerations

Despite the benefits, the adoption of AI in sports betting raises important ethical questions. The hyper-optimization of user experiences might encourage problematic gambling behavior. Tech startups must balance innovation with social responsibility, ensuring their AI tools do not exploit vulnerable individuals.

Additionally, regulatory bodies are still playing catch-up with the pace of technological change. Issues such as algorithm transparency, data privacy, and fair play are critical concerns that need to be addressed as AI becomes more embedded in the sports betting ecosystem.

The Road Ahead

As AI technology continues to mature, the future of sports betting looks increasingly automated, personalized, and data-driven. We can expect further innovations like voice-activated betting, AR/VR integrations for immersive experiences, and predictive models that take into account even broader datasets, such as player biometrics and real-time fan sentiment.

Tech startups have clearly demonstrated that the sports betting industry is ripe for disruption. By focusing on AI, these innovators are not just making sports betting smarter and faster — they’re reimagining what it can be.

The real winners in this new AI-powered world of sports betting are likely to be those startups that prioritize both technological excellence and ethical integrity. As the market continues to grow, bettors can look forward to more intuitive platforms, smarter bets, and a safer, more engaging betting environment overall.

Technology

The Role of Government Policies in Fostering Innovation

Innovation is widely recognized as a key driver of economic growth and social progress. Governments play a pivotal role in shaping the environment where new ideas can flourish. Through a combination of funding, regulation, education, and collaboration, government policies significantly impact a country’s capacity to innovate and compete on the global stage. Financial Support and […]

Innovation is widely recognized as a key driver of economic growth and social progress. Governments play a pivotal role in shaping the environment where new ideas can flourish. Through a combination of funding, regulation, education, and collaboration, government policies significantly impact a country’s capacity to innovate and compete on the global stage.

Financial Support and Incentives

One of the most direct ways governments encourage innovation is through financial mechanisms such as grants, subsidies, and tax incentives. Research and development (R&D) tax credits reduce the financial risks for companies investing in new technologies, making it more feasible to pursue groundbreaking projects. In many countries, government-backed venture capital funds provide essential seed funding to startups, helping bridge the gap between ideas and market-ready products. These financial incentives serve as a strong signal to private investors and entrepreneurs that innovation is a national priority.

Regulatory Frameworks that Enable Innovation

How regulators design and implement rules can either enable or stifle innovation. Governments that have demonstrated flexible and future-oriented approaches to regulation are likewise to have fostered better environments for experimentation and faster growth for the world of innovation. Regulatory “sandboxes”, for example, allow fintech companies to test innovative products under supervision, without requiring full regulatory compliance right away. Balanced data protection laws protect important consumer rights while allowing businesses space to develop new technologies. Good regulatory policy supports and establishes trust and certainty, therefore, creating surety for innovators to be more experimental with appropriate boundaries.

Investing in Education and Research Infrastructure

Long-term innovation depends heavily on the availability of skilled talent and robust research ecosystems. Governments, moreover, investing in STEM education help develop a workforce equipped with the knowledge and skills required for modern industries. Moreover, funding public research institutions and universities underpins scientific discoveries that often lead to new technologies and commercial opportunities. Collaborative efforts between academia and industry, supported by government initiatives, accelerate the translation of research into practical applications and startups.

Promoting Collaboration and Ecosystem Development

People share knowledge and resources in environments where innovation flourishes. Governments recognize this and continue to promote collaboration through innovation hubs, technology parks, and incubators that foster a shared environment within (and between) startups, corporations, and research organisations. Governments engage in and invest in inter-institutional partnerships to develop a collaborative framework and a means for sharing resources and innovations. Policies that strengthen the protection of intellectual property and public-private partnerships have overall built trust in and resources for all parties involved in the ecosystem. The more cooperation and less duplication of effort between participants encourage innovations, creativity, and allow for a faster pipeline from ideation to market. Put simply, collaborations and partnerships promote the survival of innovation faster, while creating a richer environment for innovation.

Addressing Inclusivity and Societal Challenges

Government policy is a valuable part of the process of preparing for and fostering innovation. Through economic incentives, regulations helpful to innovation, investments in education and research, enabling collaboration, and including all voices of the innovation conversation including historically excluded groups, governments can energize economic growth and help advance society as a whole through technology and innovation. With the rapid pace of global technological advancement continuing to increase, adaptive policy approaches and government involvement will be increasingly important for maintaining a dynamic innovative economy.

Related

Technology

Backblaze’s Gleb Budman Talks Products, Partnerships, and the Growth in Cloud Storage

The company’s Scalable Application Keys received an NAB 2025 Product of the Year Award As the M&E space evolves at a breakneck pace, Backblaze is making waves, thanks to new features, expanded partnerships, and a major push into AI and high-performance cloud (HPC) storage. SVG caught up with Backblaze CEO/co-founder Gleb Budman to talk about […]

The company’s Scalable Application Keys received an NAB 2025 Product of the Year Award

As the M&E space evolves at a breakneck pace, Backblaze is making waves, thanks to new features, expanded partnerships, and a major push into AI and high-performance cloud (HPC) storage. SVG caught up with Backblaze CEO/co-founder Gleb Budman to talk about the company’s NAB 2025 Product of the Year Award; its latest innovations, such as Overdrive and Scalable Application Keys; and how the company helps creative teams embrace flexible, cloud-first workflows without sacrificing performance or control.

Backblaze’s Gleb Budman: “We’ve got more than 500,000 customers and 4 exabytes under management. The best part is watching creative teams focus on being creative instead of worrying about infrastructure.”

In general, what are you seeing in the M&E market today, and how is your company evolving to meet customer demands?

We’re seeing strong momentum around modern cloud-first workflows in media and entertainment. Our partnerships let creative teams break free from traditional walled-garden systems and embrace remote workflows that actually work. We’ve got more than 500,000 customers and 4 exabytes under management now, which is pretty wild to think about. The best part is watching creative teams focus on being creative instead of worrying about infrastructure. That’s what we’re here for.

NAB 2025 in April was a big show for you. What were some of the highlights?

NAB was fantastic this year. We hosted a bunch of partner showcases where we got to show off some amazing projects we’ve been working on with companies like Twelve Labs, on AI-driven semantic search, and Mimir, on helping teams work with reliable storage.

A big highlight was winning the NAB Show 2025 Product of the Year Award for our Scalable Application Keys in the Cloud Computing and Storage category. It’s a feature that’s helping organizations manage massive amounts of data while keeping it secure and accessible. It’s exciting to see our efforts making a real impact in the media-production space.

Can you provide a bit more detail on the Scalable Application Keys feature in Backblaze B2 cloud storage? As organizations manage more and more feeds from large networks of cameras and devices, how does this feature improve your offering for customers? And how does it reflect the evolution of the market and customer demands?

Companies are deploying cameras everywhere now, and they’re keeping footage longer than ever before. But managing access to all that data can be a real headache, especially with growing security concerns and changing rules around data use.

That’s where Scalable Application Keys comes in. You can now generate up to 10,000 unique access keys per minute. That means each camera, drone, or other device can get its own temporary, secure key, making it easier to manage access without sacrificing security. It’s one of those features that sounds technical, but it actually makes life way easier for the teams managing all this gear.

We’ve seen Backblaze launch new partnerships and alliances in an effort to better serve customers. Why did you opt for a joint go-to-market partnership with media company CHESA? What will this offering entail?

CHESA has been a great partner for years, so this was about doubling down on what’s already working. They know media workflows inside and out, and we know cloud storage. Put those together, and you get solutions that make sense for how media teams work.

Media workflows are pretty complex: you often need seamless collaboration, robust storage, and advanced systems integration working together. As content demands grow and technology evolves, media organizations need solutions that can scale, innovate, and empower teams to deliver faster and better content. We want to work with experts like CHESA to show our commitment to empowering media organizations with innovative, efficient, and secure solutions.

How does AI factor into your future roadmap? Tell us a bit about the recent PureNodal partnership and how it will help you accelerate AI at scale.

AI is the fastest-growing piece of our business. Our AI customer base grew 66% last quarter, and our data grew by 25 times. Backblaze is a great fit for AI use cases because we provide a high-performance, low-cost storage platform that supports the open cloud. You can use whatever GPU provider you want.

The PureNodal partnership is exciting because it combines our scalable foundation for AI and HPC workloads with their high-performance computing expertise. Together, we can unlock the full potential of AI by providing the flexibility to build with best-in-class tools and infrastructure.

Another big announcement was the release of Overdrive, your new high-performance cloud storage solution delivering terabit-speed throughput starting at just $15 per terabyte. How are you able to offer this kind of pricing, and why did it make sense to launch this new offering?

We’ve got a history of cost-leading innovation, but B2 Overdrive is a leap forward in achieving high performance at a fraction of the cost of hyperscalers. We’re not starting from zero — we can leverage our existing assets — and that’s how we can hit $15 per terabyte. Also, no egress fees and complex pricing tiers. There’s no room for surprise pricing in this world of AI, machine learning, and high-performance computing.

After a sprint to the public cloud in the early part of this decade, we’ve seen a bit of a retrenchment back to on-premises for many broadcasters, and it seems that hybrid models are now the norm. How has Backblaze reacted to this evolution, and how do you expect the cloud/on-premises/hybrid story to play out in the coming one or two years?

We’re seeing that, too. Most media companies are still predominantly hybrid. They want to mix and match based on what makes sense for each project. From live editing and postproduction to content delivery and much more, media teams can freely store their data without being locked into one vendor. Once again, this is where our free egress shines. You can move stuff between your on-prem setup and the cloud without worrying about getting slammed with fees.

Backblaze has grown and changed a lot since you co-founded the company in 2007. What are some of the biggest moves you’ve made during that time, and how have your offerings evolved? And, looking ahead, what are your primary goals for the next 12 months?

It has been an amazing experience. The biggest shift recently has been seeing AI companies become a huge part of our business: we have three AI companies among our top 10 customers, which would have been unthinkable a few years ago. Launching Overdrive was another big moment because it challenges this idea that you have to choose between performance and price. We’re proving you can have both.

Looking ahead, we’re excited about [a pair of] tools. Live Read lets media teams working on live events access, edit, and transform content as it’s being uploaded. Powered By, on the other hand, allows other platforms to integrate Backblaze B2 directly into their own services.

Technology

The Apple Watch Series 10 Is At Its Lowest Price Ever On Amazon

If you’re part of the Apple iPhone gang and obsessed with tracking your health stats, you’re in for a real treat. The tech giant’s latest fitness tracker, the Apple Watch Series 10, is shockingly slashed by $100 on Amazon—its lowest price ever. Given its relatively new status on the market and steep price drop, I […]

If you’re part of the Apple iPhone gang and obsessed with tracking your health stats, you’re in for a real treat. The tech giant’s latest fitness tracker, the Apple Watch Series 10, is shockingly slashed by $100 on Amazon—its lowest price ever. Given its relatively new status on the market and steep price drop, I deem this rare deal too good to pass up.

If you’re unfamiliar with the gadget’s latest fixings, allow me to school you. First off, it’s Apple’s thinnest watch to date, with 40 percent more brightness than the Series 9. Long story short, it’s easy on the eyes while still being a tech-savvy workhorse that can track anything from tai chi to Pilates to cycling. Better yet, the latest iOS update introduces an AI-powered “Workout Buddy” that acts as a motivator and coach—I’m sure we could all use some words of encouragement. Aside from aesthetics, other notable upgrades include an 80 percent faster charging rate for full battery life within 30 minutes, and temperature detection in cold ocean waters (ouch). It also weighs 20 percent less than the last edition, at 30 grams.

While I’m not personally an iPhone user, I’d be lying if I said I didn’t think about crossing over to the other side—I may have to say goodbye to my Google Pixel. Men’s Health senior editor Brett Williams, NASM has been using it for marathon training and says the battery life holds up for intense mileage. “By the time I was finished with the workout (2 hours and 40 minutes total elapsed time), I spent about an hour relaxing at the beach that was my endpoint, and another hour or so on the train and bus commute back to my apartment, my battery was at 52 percent,” says Williams.

Technology

Apollo’s $6.3B IGT-Everi Gaming Acquisition Clears Nevada Hurdle

Join Our Telegram channel to stay up to date on breaking news coverage Apollo Global Management’s ambitious strategy to reshape the gaming supplier landscape achieved a crucial milestone this week as Nevada regulators granted initial approval to the private equity giant’s $6.3 billion acquisition of IGT Gaming and Everi Holdings. The unanimous endorsement by the […]

Join Our Telegram channel to stay up to date on breaking news coverage

Apollo Global Management’s ambitious strategy to reshape the gaming supplier landscape achieved a crucial milestone this week as Nevada regulators granted initial approval to the private equity giant’s $6.3 billion acquisition of IGT Gaming and Everi Holdings. The unanimous endorsement by the Nevada Gaming Control Board represents one of the largest corporate mergers in gaming supplier history and positions Apollo to create North America’s dominant slot machine provider through strategic consolidation.

This transformative deal reflects Apollo’s systematic expansion across the gaming sector, where the firm has deployed over $20 billion since 2002 in pursuit of comprehensive market coverage. The complex transaction will merge two established gaming suppliers into a single privately-held entity that will retain the IGT brand while commanding unprecedented scale in the North American gaming market.

Key Takeaways

- Regulatory Milestone: Nevada Gaming Control Board unanimously approved Apollo’s $6.3 billion acquisition of IGT Gaming and Everi Holdings, marking a crucial step toward completion.

- Market Dominance: The combined entity will operate over 70,000 slot machines across North America, surpassing current market leader Light & Wonder’s 54,397 units.

- Financial Scale: Pro forma 2024 revenue of $2.6 billion and adjusted EBITDA of $1.1 billion positions the merged company as a gaming supplier powerhouse.

- Leadership Transition: Nick Khin will serve as interim CEO before Hector Fernandez assumes permanent leadership in Q4 2025, bringing proven gaming industry expertise.

- Strategic Integration: Apollo aims to create a comprehensive gaming supplier capable of meeting all operator needs from a single source.

- Timeline Pressure: The deal requires approvals from eight additional jurisdictions before the July 1, 2025 closing target.

- Industry Consolidation: The transaction exemplifies broader private equity-driven consolidation trends across the gaming supplier sector.

The Deal Structure: Creating a Gaming Goliath

Apollo’s acquisition strategy involves simultaneously purchasing IGT’s Gaming and Digital business for $4.05 billion and Everi Holdings for $2.25 billion, combining them into a single entity that will maintain the IGT brand identity. This structure allows Apollo to capture synergies between IGT’s global distribution network and Everi’s specialized financial technology solutions while preserving established market relationships.

Under the agreement terms, Everi stockholders will receive $14.25 per share in cash—representing a substantial 56% premium over the company’s July 2024 closing price. This premium reflects Apollo’s confidence in the strategic value of combining the two businesses and the competitive necessity of securing shareholder approval in a competitive M&A environment.

For IGT, the transaction enables the company to focus on its lottery and sports betting operations while providing capital for debt reduction and shareholder returns. The proceeds will be used strategically to optimize IGT’s remaining business lines and strengthen its balance sheet for future growth initiatives.

Unprecedented Market Scale

The merged entity will command impressive scale metrics that establish it as the clear leader in North American gaming supply:

- Combined installed base: Over 70,000 slot machines across North America, significantly exceeding Light & Wonder’s current 54,397 units

- Market position: Greater combined slots sales market share than either Light & Wonder or Aristocrat individually

- Geographic coverage: Comprehensive distribution network spanning all major North American gaming jurisdictions

- Product portfolio: Diversified offerings across gaming machines, systems, software, and financial technology

This scale provides several strategic advantages, including enhanced negotiating power with casino operators, improved operational efficiencies through consolidated manufacturing and distribution, and the ability to invest more heavily in research and development across all product categories.

Leadership Architecture and Strategic Vision

Apollo has carefully structured the leadership transition to ensure operational continuity while bringing proven gaming industry expertise to guide the combined entity. Nick Khin, currently IGT’s President of Global Gaming, will serve as interim CEO during the integration phase before transitioning to head the Global Gaming division when Hector Fernandez assumes permanent leadership in Q4 2025.

Nick Khin’s Industry Experience

Khin brings over 23 years of gaming industry experience to his interim CEO role, including significant leadership positions at Aristocrat where he successfully managed the company’s largest revenue-generating Americas division. His deep understanding of both supplier and operator perspectives provides valuable insight for navigating the complex integration of two established businesses with different cultures and operational approaches.

Nevada regulators praised Khin’s appointment during the approval hearing, highlighting his track record of successful strategic initiatives and comprehensive industry knowledge. His unanimous approval by the Gaming Control Board reflects regulatory confidence in his ability to lead the combined entity through its critical integration phase.

Hector Fernandez’s Strategic Leadership

The appointment of former Aristocrat Gaming CEO Hector Fernandez as permanent CEO signals Apollo’s commitment to industry-leading strategic vision. Fernandez brings extensive experience in gaming technology innovation, international market development, and operational excellence that will be crucial for maximizing the potential of the combined IGT-Everi platform.

Fernandez’s background at Aristocrat, where he successfully led the company’s global expansion and technology advancement initiatives, provides him with unique insights into the competitive dynamics and growth opportunities within the gaming supplier sector. His leadership will be particularly valuable as the combined entity seeks to leverage its enhanced scale to compete more effectively against established competitors.

Apollo’s Comprehensive Gaming Portfolio Strategy

The IGT-Everi acquisition represents the latest strategic move in Apollo’s systematic expansion across the gaming sector, where the firm has become one of the most significant private equity investors globally. Apollo’s current gaming portfolio demonstrates the firm’s commitment to building comprehensive platforms that can capture value across multiple aspects of the gaming ecosystem.

Existing Gaming Investments

Apollo’s gaming portfolio includes several landmark acquisitions that demonstrate the firm’s long-term commitment to the sector:

- The Venetian Resort Las Vegas: Acquired for $2.25 billion in 2022, representing one of the most significant casino acquisitions in recent history

- Great Canadian Gaming: Significant investment in Canada’s leading gaming operator

- Lottomatica Group: Strategic stake in Italy’s dominant lottery and gaming operator

- Multiple smaller gaming technology and service providers: Building a comprehensive supplier ecosystem

This diversified portfolio approach allows Apollo to understand the gaming industry from multiple perspectives—operators, suppliers, technology providers, and service companies—creating strategic insights that inform investment decisions and operational improvements.

Integrated Supplier Strategy

Daniel Cohen, Apollo’s gaming sector lead, articulated the firm’s ambitious vision during regulatory hearings: “Our goal long term is to become the operator’s supplier. So if you’re the Venetian or Caesars or anyone else, you can come to IGT for basically every one of your product needs.”

This integrated approach reflects Apollo’s recognition that gaming operators increasingly prefer working with suppliers who can provide comprehensive solutions rather than managing relationships with multiple specialized vendors. By combining IGT’s gaming machines and systems with Everi’s financial technology and operational services, Apollo creates a platform capable of addressing most operator needs through a single relationship.

The strategy also provides opportunities for cross-selling and upselling across the combined product portfolio, potentially increasing revenue per customer while reducing customer acquisition costs. This integrated approach has proven successful in other industries where private equity firms have consolidated fragmented supplier markets.

Market Dynamics and Competitive Positioning

The IGT-Everi combination directly addresses IGT’s competitive challenges in a market increasingly dominated by Aristocrat and Light & Wonder. These competitors have successfully captured market share through technological innovation, operational efficiency, and strategic geographic expansion, creating pressure on IGT’s historical market position.

Addressing Competitive Challenges

Apollo partner Daniel Cohen acknowledged during regulatory hearings that the combined business “has a margin profile that is significantly lower than our largest peers,” but expressed confidence that private ownership would enable the necessary investments to close the performance gap. This candid assessment reflects Apollo’s realistic understanding of the competitive challenges while demonstrating commitment to making the investments necessary for long-term success.

Private ownership provides several advantages for addressing competitive challenges:

- Long-term investment horizon: Freedom from quarterly earnings pressure allows focus on strategic initiatives that may take time to yield results

- Capital availability: Apollo’s substantial financial resources enable significant investments in research and development, manufacturing capabilities, and market expansion

- Operational expertise: Apollo’s portfolio of gaming investments provides insights and best practices that can be applied to improve operational performance

Revenue Diversification Benefits

Fitch Ratings highlighted the strategic benefits of combining IGT and Everi, particularly noting the enhanced revenue diversification that reduces dependence on any single product category or market segment. The diversified revenue structure positions the combined entity to weather market volatility more effectively:

- Gaming operations: 29% of revenue from recurring gaming machine placements

- Gaming sales: 23% from outright machine sales to operators

- Systems and software: 23% from technology solutions and ongoing support

- FinTech: 15% from Everi’s financial technology services

- Digital: 10% from online gaming and digital entertainment solutions

This diversification provides multiple growth opportunities while reducing the risk associated with concentration in any single revenue stream. The combination also enables cross-selling opportunities between IGT’s global distribution network and Everi’s specialized financial technology solutions.

Regulatory Approval Process and Timeline

While Nevada’s approval represents a crucial milestone, Apollo still faces the challenge of securing approvals from eight additional jurisdictions before the July 1, 2025 closing target. Each regulatory approval process involves detailed scrutiny of the transaction structure, leadership qualifications, and competitive implications.

Key Remaining Approvals

The most significant remaining regulatory hurdles include:

- Pennsylvania Gaming Control Board: Hearing scheduled for June 26, representing a key approval given Pennsylvania’s importance in the gaming market

- Nevada Gaming Commission: Final determination scheduled for June 26, following the Control Board’s recommendation

- Additional state and tribal gaming authorities: Various jurisdictions where IGT and Everi hold licenses or conduct business

Apollo officials have expressed confidence about receiving all necessary approvals within the target timeframe, citing extensive preparation and proactive engagement with regulatory authorities across multiple jurisdictions. The firm’s experience with gaming regulatory processes through its existing portfolio companies provides valuable expertise for navigating these complex approval requirements.

Integration Planning and Execution

Beyond regulatory approvals, Apollo faces the substantial challenge of integrating two established companies with different cultures, systems, and operational approaches. The firm has already begun detailed integration planning to ensure smooth combination of the businesses while maintaining operational continuity for customers.

Key integration priorities include:

- Technology systems consolidation: Merging different software platforms and operational systems

- Sales force integration: Combining field sales teams while maintaining customer relationships

- Manufacturing optimization: Consolidating production facilities and supply chains for improved efficiency

- Corporate culture alignment: Creating a unified culture that captures the best elements of both organizations

Industry Transformation and Future Outlook

The Apollo-IGT-Everi transaction occurs during a period of significant change within both the gaming industry and Nevada’s regulatory environment. These broader industry trends provide important context for understanding the strategic rationale and potential success of the combination.

Nevada Regulatory Leadership Transition

The approval comes during a period of leadership transition within Nevada’s gaming regulatory apparatus. Gaming Control Board Chairman Kirk Hendrick is stepping down after the June meeting, with former Gaming Arts CEO Mike Dreitzer assuming the chairmanship. This transition occurs as the industry grapples with unprecedented anti-money laundering enforcement actions that have resulted in over $24 million in fines this year alone.

The regulatory environment’s evolution toward more stringent enforcement and oversight requirements actually supports the strategic rationale for the IGT-Everi combination. Larger, well-capitalized suppliers are better positioned to invest in the compliance infrastructure and operational sophistication required to meet evolving regulatory expectations.

Private Equity Gaming Investment Trends

The IGT-Everi combination reflects broader consolidation trends across the gaming supplier sector, where companies seek scale and diversification to compete effectively in an increasingly sophisticated market. Private equity firms have deployed over $21 billion in gaming investments since 2018, with platform building through strategic acquisitions becoming the dominant investment strategy.

This private equity involvement brings several benefits to the gaming industry:

- Capital for innovation: Significant investment in research and development to drive technological advancement

- Operational expertise: Application of best practices from other industries and portfolio companies

- Long-term strategic focus: Freedom from public market short-term pressures enables focus on sustainable competitive advantages

- Consolidation efficiency: Ability to combine fragmented competitors into more efficient, larger-scale operations

Technology and Market Evolution

The gaming supplier industry faces significant technological disruption driven by digital transformation, mobile gaming growth, and evolving player preferences. The combined IGT-Everi entity will be better positioned to invest in and adapt to these technological changes through its enhanced scale and Apollo’s capital backing.

Key technological trends influencing the industry include:

- Digital integration: Seamless connection between land-based gaming machines and digital platforms

- Data analytics advancement: Sophisticated player behavior analysis and personalization capabilities

- Payment technology evolution: Enhanced financial technology integration for improved player experience

- Regulatory technology: Advanced compliance and monitoring systems to meet evolving regulatory requirements

Financial Implications and Value Creation Strategy

Apollo’s $6.3 billion investment in the IGT-Everi combination represents one of the firm’s largest gaming sector commitments and reflects confidence in the long-term growth potential of the combined entity. The transaction structure and strategic rationale suggest several paths for value creation over Apollo’s typical investment horizon.

Value Creation Opportunities

The combination creates multiple opportunities for value enhancement:

- Cost synergies: Elimination of redundant corporate functions, consolidated manufacturing, and optimized distribution networks

- Revenue growth: Cross-selling opportunities and expanded geographic reach

- Margin improvement: Operational efficiency gains and premium pricing for integrated solutions

- Market share gains: Enhanced competitive position against fragmented competitors

- Technology advancement: Increased investment in research and development enabled by improved scale

Private Equity Advantages

Private ownership provides several advantages for executing this value creation strategy:

- Investment flexibility: Ability to make substantial capital investments without quarterly earnings pressure

- Strategic patience: Long-term investment horizon allows for initiatives that may take several years to yield results

- Operational expertise: Apollo’s portfolio of gaming investments provides insights and best practices

- Exit optionality: Multiple potential exit strategies including strategic sale, IPO, or dividend recapitalization

Conclusion: A Defining Moment for Gaming Supplier Consolidation

Apollo Global Management’s $6.3 billion acquisition of IGT Gaming and Everi Holdings represents more than a significant financial transaction—it embodies a strategic vision for reshaping the gaming supplier industry through scale, integration, and operational excellence. The unanimous approval by Nevada regulators validates both the strategic rationale and Apollo’s capability to execute complex gaming industry transactions.

The combination creates North America’s largest gaming supplier by installed base, with over 70,000 slot machines and comprehensive product offerings spanning gaming machines, systems, software, and financial technology. This scale provides competitive advantages in an industry increasingly dominated by technological sophistication and operational efficiency requirements.

For the broader gaming industry, the transaction signals a new phase of supplier consolidation driven by private equity investment and strategic integration. As operators seek comprehensive solutions from fewer, more capable suppliers, the combined IGT-Everi entity positions itself to capture significant market share through its enhanced scale and integrated offerings.

The success of Apollo’s ambitious combination will depend on effective integration execution, regulatory approval completion, and the ability to leverage enhanced scale for competitive advantage. If successful, this transaction could serve as a template for further consolidation across the gaming supplier sector, potentially accelerating the industry’s evolution toward larger, more integrated platform providers.

As Apollo prepares to integrate two established suppliers into a single gaming powerhouse, the coming months will determine whether this bold strategic vision can deliver the operational excellence and financial returns that justify the substantial investment. For an industry experiencing rapid technological change and evolving regulatory requirements, the combined entity’s ability to adapt and lead may define the future competitive landscape for gaming suppliers across North America and beyond.

Join Our Telegram channel to stay up to date on breaking news coverage

Technology

Louis Vuitton Teams Up With Real Madrid as It Expands in High-End Sports Marketing

Louis Vuitton is deepening its relationship with the world of sports through a landmark partnership with Real Madrid. The French luxury house has signed a multi-year deal to become the official off-field partner of the Spanish club marking its first major foray into team football. Under the agreement, Louis Vuitton will provide formalwear for Real […]

Louis Vuitton is deepening its relationship with the world of sports through a landmark partnership with Real Madrid. The French luxury house has signed a multi-year deal to become the official off-field partner of the Spanish club marking its first major foray into team football. Under the agreement, Louis Vuitton will provide formalwear for Real Madrid’s men’s and women’s soccer teams, as well as its men’s basketball team, for institutional appearances and official travel.

The collection, designed by Pharrell Williams, creative director of Louis Vuitton’s men’s line, includes suits, accessories and travel items in the brand’s iconic monogram. It also incorporates details inspired by the white club, such as the initials RM or charms in the team’s colors.

“At Real Madrid we tirelessly pursue excellence as a way to stay at the top,” said Emilio Butragueño, the club’s director of institutional relations, in an official statement, in which he also pointed out that “this same philosophy defines a brand as iconic in the luxury industry as Louis Vuitton”.

The collection includes ready-to-wear outfits, footwear, accessories and luggage, which will not be available for direct sale. However, customers will be able to purchase similar models such as the Keepall bag or the Horizon suitcase in store, and customize them with the club’s colors. Also, the official Louis Vuitton label in natural leather has been sewn on the lapels of the jackets and on the back pockets of the pants; while accessories include belts with LV buckle in palladium, embroidered caps and sneakers.

Louis Vuitton approaches soccer as a cultural ‘soft power’ mechanism.

With this move, Louis Vuitton expands its strategy of linking with sport as a vehicle for socio-cultural positioning. The maison had already collaborated with major sports institutions such as Fifa, the NBA or the America’s Cup, and has designed cases for the World Cup trophies, the Monaco Grand Prix or even the Paris 2024 Olympic Games. However, this agreement marks a turning point: it is the first time that the brand has officially and permanently dressed a sports club.

Beyond the field of play, Real Madrid is one of the major symbolic assets of global sport. For Louis Vuitton, the partnership with the white entity allows it to consolidate its narrative as a cultural brand, beyond the product, with a presence in territories such as music, gaming or art.

The agreement does not imply the presence of Louis Vuitton on the game’s jerseys, which are in charge of the German company Adidas, nor on the Santiago Bernabéu stadium, which has been recently renovated. The activation will be limited to institutional events, international trips and moments of official representation, in which the players will act as brand ambassadors in extra-sporting contexts.

Real Madrid, for its part, recovers a strategy of collaboration with luxury houses initiated in 2016 with Hugo Boss and continued in recent years with the Italian Zegna, while consolidating its position as the club with the greatest commercial and institutional projection in European soccer.

Technology

Center for Health Improvement launches cutting-edge AI fitness technology

The Center for Health Improvement (CHI) at HaysMed. Courtesy photo HaysMed The Center for Health Improvement at HaysMed is leading the charge in fitness innovation by becoming the first pilot site in the United States to introduce Fit-X, an AI-powered personal training system. As one of the few locations nationwide to debut this groundbreaking technology, Center for Health […]

HaysMed

The Center for Health Improvement at HaysMed is leading the charge in fitness innovation by becoming the first pilot site in the United States to introduce Fit-X, an AI-powered personal training system. As one of the few locations nationwide to debut this groundbreaking technology, Center for Health Improvement is offering its members a smarter, safer, and more personalized workout experience.

Fit-X, a company with roots in the fitness industry dating back to 1997, has evolved with the times by integrating advanced AI and sensor technology into traditional strength training equipment. Each machine is equipped with dual sensors that track form, speed, weights lifted and range of motion in real time. This data is used to ensure your workout is both effective and safe.

Personalized fitness at your fingertips

The Fit-X app is the centerpiece of this new system. It allows users to input their unique workout goals and constraints such as recent injuries and then creates workout plans accordingly. Whether you’re managing weight, recovering from a knee replacement, or just starting out, the app tailors workouts to each individual’s goals, physical condition, and experience level.

After each session, users receive an AI-generated summary detailing the muscle groups targeted and progress toward their goals. The app also adapts future workouts based on past performance and user feedback, eliminating guesswork and maximizing results.

Comprehensive tracking and flexibility

Even activities outside the gym can be logged manually into the app. For example, if you walk to CHI for your workout, you can enter that cardio session to get a complete picture of your fitness efforts, all in one place.

According to Stephanie Howie, Director of Center for Health Improvement, “We’re thrilled to be the first pilot location in the country for Fit-X. This is a fantastic opportunity for our members and the Hays community. We also offer personal training sessions to help members get started.”

Why strength training matters

Despite its many benefits, such as improving bone density, supporting weight management, enhancing cardiovascular health, and maintaining independence with age, strength training remains underutilized. According to Fit-X, less than one-third of gym-goers and only 14% of older adults incorporate it into their routines.

Fit-X aims to change that by making strength training more accessible, intuitive, and results-driven. With real-time coaching, automatic weight adjustments, and an average of 50–75% strength gains in just three months, users can expect faster progress with fewer injuries.

Getting started

Ready to experience the future of fitness? Becoming a member at the Center for Health Improvement is your first step toward accessing the innovative Fit-X technology. Center for Health Improvement staff are here to walk you through the setup process and help you get the most out of your personalized fitness journey.

To become a member, call 785-623-5900 or visit the Center for Health Improvement website.

To learn more about Fit-X, visit www.fit-x.tech.

-

Health1 week ago

Health1 week agoOregon track star wages legal battle against trans athlete policy after medal ceremony protest

-

Professional Sports1 week ago

Professional Sports1 week ago'I asked Anderson privately'… UFC legend retells secret sparring session between Jon Jones …

-

College Sports2 weeks ago

College Sports2 weeks agoIU basketball recruiting

-

NIL3 weeks ago

NIL3 weeks ago2025 NCAA Softball Tournament Bracket: Women’s College World Series bracket, schedule set

-

Professional Sports1 week ago

Professional Sports1 week agoUFC 316 star storms out of Media Day when asked about bitter feud with Rampage Jackson

-

Rec Sports2 weeks ago

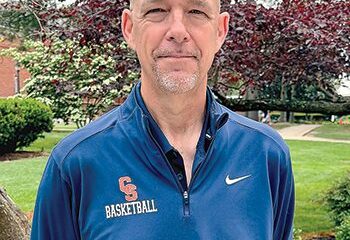

Rec Sports2 weeks agoScott Barker named to lead CCS basketball • SSentinel.com

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoJ.W. Craft: Investing in Community Through Sports

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Penalty Report: Charlotte Motor Speedway (May 2025)

-

Motorsports2 weeks ago

Motorsports2 weeks agoRockingham Speedway listed for sale after NASCAR return

-

NIL3 weeks ago

NIL3 weeks agoGreg Sankey: ‘I have people in my room asking, why are we still in the NCAA?’