Rec Sports

Island youth baseballer set to represent Team Netherlands in international play

STATEN ISLAND, N.Y. — Soccer may be considered the unofficial national sport of the Netherlands, but Staten Islander Dex Zimmerman — who holds dual American-Dutch citizenship — is set to don the iconic Oranje for the Dutch U12 national baseball team at the upcoming Youth Baseball European Championship hosted in the Czech Republic.

Zimmerman, who will soon graduate from PS 60 in Graniteville and move onto IS 72 in New Springville, is currently in Europe for a scrimmage against the Belgian national team on Wednesday ahead of the European Championship, which begins on July 2.

Dex’s path to international baseball began about four years ago, when his father, Todd, reached out to a coach from the Dutch program to explore opportunities for Dex to get involved. At the time, he was told Dex was too young — but now, he’s ready to take the international stage.

“Out of nowhere this year, the same coach reached back out and told us they were having a tryout; we went a little less than a month ago, and he made the team,” Zimmerman proudly said of his son’s accomplishment.

Though he primarily serves as a pitcher for the Dutch squad, Zimmerman is also effective at shortstop and center field — a testament to the versatile skillset his father helped cultivate during his years as Dex’s coach, prior to his transition to club coaching with the New York Prospects last year.

“He’s a very humble boy,” Zimmerman said of his son’s attitude despite his talent at such a young age.

“We started playing baseball together when he was around 1-year-old, and I try to keep him humble, but that’s something he’s always had in him,” Zimmerman continued.

Staten Islander Dex Zimmerman poses outside the home stadium of the Hoofddorp Pioniers, a local Dutch baseball team, ahead of representing the country in a youth baseball tournament.Todd Zimmerman

Zimmerman has firmly established himself as a young talent locally, but his father acknowledged that competing on the international stage will bring a new set of challenges.

“While he’s playing for the Dutch team, the field is 46 feet from the mound to home and 60 feet between the bases; those are dimensions similar to Little League, but when he’s playing travel ball for the Prospects, the field is definitely bigger,” Zimmerman said of one of the ways Dex may need to readjust his game while playing in Europe.

Dex will also get the chance to meet his Dutch national teammates for the first time, as this marks his debut traveling abroad for competition. While some cultural differences may arise, his father is confident that Dex —fluent in both Dutch and English — will form friendships that last a lifetime.

“They’re not into the small talk like we are,” Todd said with a laugh.

“He’s a little bit of an outsider for now; they’re a little bit different than us, but he’s a social kid,” he continued.

In addition to reconnecting with his Dutch roots, Zimmerman is also contributing to the global growth of baseball in real time — a role his father finds especially meaningful with the World Baseball Classic on the horizon next year.

“We’re really into that competition,” Todd said of their own fondness of how the WBC has promoted the sport globally.

“The Netherlands is ranked seventh in the world currently, since they also include Aruba and Curaçao. Andruw Jones is the head coach of the Netherlands and has recruited guys like Xander Bogaerts and Jurickson Profar to play for him, so it’s a very good breeding ground for baseball,” Zimmerman said of the nation’s senior team.

While Dex still has a long road ahead to reach that level, his involvement in the global baseball community is already laying the foundation for a lifelong love of the game — and a chance to see the world through it.

“He’s really looking forward to it,” Todd said of Dex’s excitement ahead of the tournament.

“It should be a really interesting experience getting to interact with different countries and hear different languages; he’s just really always loved the game of baseball, the fact that they took a chance on somebody from New York was really cool. They want him to stay with it for the long haul,” he continued.

The Dutch U12 team will kick off its 2025 European Championship campaign when it takes on Ukraine in Hluboká, Czech Republic on July 2.

Rec Sports

LEIFRAS Co., Ltd. Reports Financial Results for the Nine Months Ended September 30, 2025

TOKYO, Dec. 18, 2025 /PRNewswire/ — LEIFRAS Co., Ltd. (Nasdaq: LFS) (the “Company” or “Leifras”), a sports and social business company dedicated to youth sports and community engagement, today announced its unaudited financial results for the nine months ended September 30, 2025.

Financial Highlights for the Nine Months Ended September 30, 2025

- Revenue was JPY8.6 billion ($57.8 million) for the nine months ended September 30, 2025, an increase of 15.3% from JPY7.4 billion for the same period last year.

- Gross profit was JPY2.4 billion ($16.3 million) for the nine months ended September 30, 2025, an increase of 18.1% from JPY2.0 billion for the same period last year.

- Gross margin was 28.2% for the nine months ended September 30, 2025, which increased from 27.5% for the same period last year.

- Net income was JPY226.7 million ($1.5 million) for the nine months ended September 30, 2025, an increase of 0.7% from JPY225.1 million for the same period last year.

- Basic and diluted earnings per share was JPY9.1 ($0.06) for the nine months ended September 30, 2025, compared to basic earnings per share of JPY9.0 and diluted earnings per share of JPY8.3 for the same period last year.

Operational Highlights for the Nine Months Ended September 30, 2025

- Number of members in the sports school business was 71,529 for the nine months ended September 30, 2025, an increase of 2.3% from 69,924 for the same period last year.

- Average membership duration in the sports school business was 1.84 years for the nine months ended September 30, 2025, an increase of 1.1% from 1.82 years for the same period last year.

- Revenue per capita in the sport school business, which we define as the sales revenue of the sports school business divided by the number of employees involved in that business, was JPY9.6 million ($0.06 million) for the nine months ended September 30, 2025, an increase of 6.2% from JPY9.0 million for the same period last year.

- Number of schools served under the social business segment was 360 for the nine months ended September 30, 2025, an increase of 53.2% from 235 for the same period last year.

- Revenue per capita in the social business, which we define as the sales revenue of the social business divided by the number of employees involved in that business, was JPY7.6 million ($0.05 million) for the nine months ended September 30, 2025, an increase of 18.6% from JPY6.4 million for the same period last year.

Mr. Kiyotaka Ito, the Representative Director and Chief Executive Officer of Leifras, commented, “We delivered solid financial results in the first nine months of fiscal year 2025, with meaningful growth across our key financial and operational metrics. Revenue increased 15.3% and net income grew 0.7% from the same period last year. By segment, sports school business achieved revenue growth of 8.9% and social business revenue increased by 36.4% year over year. Our performance shows continued strength of our sports school business and expanding demand for our social business. Notably, revenue per capita in our social business rose by 18.6% year over year, highlighting the increasing value and impact of our community-based services. Looking ahead, we see meaningful opportunities in Japan’s shifting policy landscape. The government’s ongoing Club Activity Reform, which focuses on shifting school-based club activity management to regional and private organizations, is expected to create an important long-term growth pathway for Leifras. We recently secured a new contract with the City of Nagoya, Aichi Prefecture, to manage facilities at municipal junior high schools in Nagoya, marking an important step in our expansion strategy. We intend to actively pursue additional opportunities as municipalities seek specialized partners to deliver high-quality sports and community programs. In the future, we remain committed to cultivating the non-cognitive skills of children, strengthening community well-being, enhancing our service offerings, and delivering sustainable value to our shareholders and society.”

Financial Results for the Nine Months Ended September 30, 2025

Revenue

Total revenue was JPY8.6 billion ($57.8 million) for the nine months ended September 30, 2025, an increase of 15.3% from JPY7.4 billion for the same period last year.

Sports school business revenue was JPY6.2 billion ($41.9 million) for the nine months ended September 30, 2025, an increase of 8.9% from JPY5.7 billion for the same period last year. The increase in revenue was mostly driven by: (i) an increase in the number of members by 1,605, from 69,924 as of September 30, 2024 to 71,529 as of September 30, 2025, resulting in an increase in revenue of JPY315.7 million ($2.1 million) and (ii) an increase in the number of customers who joined events hosted by the Company from 136,695 for the nine months ended September 30, 2024 to 142,843 for the nine months ended September 30, 2025, leading to an increase in the sports school business revenue by JPY112.6 million ($0.8 million).

Social business revenue was JPY2.4 billion ($15.9 million) for the nine months ended September 30, 2025, an increase of 36.4% from JPY1.7 billion for the same period last year. The increase in revenue was mostly driven by: (i) an increase in the number of schools by 125, from 235 as of September 30, 2024 to 360 as of September 30, 2025, resulting in an increase in revenue of JPY505.1 million ($3.4 million), and (ii) an increase in after-school daycare service revenue by JPY86.1 million ($0.6 million).

Cost of Revenue

Cost of revenue was JPY6.1 billion ($41.5 million) for the nine months ended September 30, 2025, an increase of 14.2% from JPY5.4 billion for the same period last year.

Gross Profit

Gross profit was JPY2.4 billion ($16.3 million) for the nine months ended September 30, 2025, an increase of 18.1% from JPY2.0 billion for the same period last year.

Gross margin was 28.2% for the nine months ended September 30, 2025, which increased from 27.5% for the same period last year.

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses were JPY2.1 billion ($13.9 million) for the nine months ended September 30, 2025, an increase of 14.0% from JPY1.8 billion for the same period last year. The increase was attributed to (i) the increase in salaries and welfare expenses of JPY137.5 million ($0.9 million) due to business expansion as well as an increase in headquarters personnel in preparation for the Company’s initial public offering (“IPO”), (ii) the increase in promotion fees of JPY8.2 million ($0.06 million) due to business expansion, (iii) the increase in office rental fees of JPY14.1 million ($0.1 million) due to business expansion, (iv) the increase in system maintenance fee expenses of JPY17.3 million ($0.1 million) incurred due to the increase in the number of employees, and (v) the increase in recruitment fees of JPY53.8 million ($0.4 million) due to business expansion as well as an increase in headquarters personnel in preparation for the Company’s IPO.

Other Income (Expenses), Net

Other expenses, net were JPY1.9 million ($0.01 million) for the nine months ended September 30, 2025, compared to other income, net of JPY28.7 million for the same period last year. The decrease was attributed to: (i) net franchise income collected (returned) of JPY27.4 million ($0.02 million), which was the payments refunded to the franchisees in connection with the transfer of certain business rights, (ii) an eviction compensation of JPY5.5 million ($0.04 million) received in connection with the vacating of a leased building. Interest expenses, net were JPY9.7 million ($0.07 million) for the nine months ended September 30, 2025, a decrease of 21.8% from JPY12.4 million for the same period last year.

Net Income

Net income was JPY226.7 million ($1.5 million) for the nine months ended September 30, 2025, an increase of 0.7% from JPY225.1 million for the same period last year.

Basic and Diluted Earnings per Share

Basic earnings per share was JPY9.10 ($0.06) for the nine months ended September 30, 2025, compared to JPY9.04 for the same period last year.

Diluted earnings per share was JPY9.10 ($0.06) for the nine months ended September 30, 2025, compared to JPY8.32 for the same period last year.

Financial Condition

As of September 30, 2025, the Company had cash of JPY2.4 billion ($16.5 million), compared to JPY2.5 billion as of December 31, 2024.

Net cash provided by operating activities was JPY326.7 million ($2.2 million) for the nine months ended September 30, 2025, compared to net cash used in operating activities of JPY105.4 million for the same period last year.

Net cash used in investing activities was JPY48.5 million ($0.3 million) for the nine months ended September 30, 2025, compared to JPY45.7 million for the same period last year.

Net cash used in financing activities was JPY380.1 million ($2.6 million) for the nine months ended September 30, 2025, compared to JPY224.1 million for the same period last year.

Financial Guidance

The Company is projecting total revenue to be between JPY11.6 billion and JPY11.9 billion ($78.1 million and $80.5 million) for the fiscal year ending December 31, 2025, an increase of approximately 11.9% to 15.3% from JPY10.3 billion ($69.8 million) for the fiscal year ended December 31, 2024.

Income from operations is projected to be between JPY580.0 million and JPY696.5 million ($3.9 million and $4.7 million) for the fiscal year ending December 31, 2025, an increase of 11.6% to 34.0% from JPY519.8 million ($3.5 million) for the fiscal year ended December 31, 2024.

These projections are based on the assumption that no business acquisitions, restructuring activities, or legal settlements will take place during the period.

Exchange Rate Information

This announcement contains translations of certain Japanese Yen (“JPY”) amounts into U.S. dollars (“USD,” or “$”) for the convenience of the reader. Translations of amounts from JPY into USD have been made at the exchange rate of JPY147.97 = $1.00, the exchange rate on September 30, 2025 set forth in the H.10 statistical release of the United States Federal Reserve Board.

About LEIFRAS Co., Ltd.

Headquartered in Tokyo, Leifras is a sports and social business company dedicated to youth sports and community engagement. The Company primarily provides services related to the organization and operations of sports schools and sports events for children. As of December 31, 2024, Leifras was recognized as one of Japan’s largest operators of children’s sports schools in terms of both membership and facilities by Tokyo Shoko Research. The Company’s approach to sports education emphasizes the development of non-cognitive skills, following the teaching principle “acknowledge, praise, encourage, and motivate.” The holistic approach that integrates physical and mental development sets Leifras apart in the industry. Building upon deep experience and know-how in sports education, Leifras also operates a robust social business sector, dispatching sports coaches to meet various community needs with the aim to promote physical health, social inclusion, and community well-being across different demographics. For more information, please visit the Company’s website: https://ir.leifras.co.jp/.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may,” or other similar expressions in this press release. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. These statements are subject to uncertainties and risks, including, but not limited to, the uncertainties related to market conditions, and other factors discussed in the “Risk Factors” section of the registration statement filed with the U.S. Securities and Exchange Commission (the “SEC”). Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the registration statement and other filings with the SEC. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov.

For more information, please contact:

LEIFRAS Co., Ltd.

Investor Relations Department

Email: [email protected]

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: [email protected]

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||||||

|

December 31, |

September 30, |

September 30, |

||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

(Unaudited) |

(Unaudited) |

|||||||||||

|

ASSETS |

||||||||||||

|

CURRENT ASSETS |

||||||||||||

|

Cash |

2,538,554,638 |

2,436,675,605 |

16,467,362 |

|||||||||

|

Accounts receivable, net |

518,398,551 |

555,775,583 |

3,756,002 |

|||||||||

|

Short-term investments |

4,935,000 |

5,075,000 |

34,297 |

|||||||||

|

Inventories, net |

24,468,188 |

20,757,063 |

140,279 |

|||||||||

|

Prepaid expenses |

182,278,232 |

201,888,793 |

1,364,390 |

|||||||||

|

Other current assets |

34,381,843 |

57,886,907 |

391,207 |

|||||||||

|

TOTAL CURRENT ASSETS |

3,303,016,452 |

3,278,058,951 |

22,153,537 |

|||||||||

|

NON-CURRENT ASSETS |

||||||||||||

|

Property and equipment, net |

53,805,279 |

99,293,143 |

671,035 |

|||||||||

|

Finance lease right-of-use assets |

208,611,550 |

228,794,098 |

1,546,219 |

|||||||||

|

Operating lease right-of-use assets |

337,330,750 |

513,349,897 |

3,469,284 |

|||||||||

|

Intangible assets, net |

39,250,078 |

27,980,475 |

189,096 |

|||||||||

|

Goodwill |

27,999,994 |

27,999,994 |

189,228 |

|||||||||

|

Deferred tax assets, net |

214,671,578 |

189,283,332 |

1,279,201 |

|||||||||

|

Deferred initial public offering (“IPO”) costs |

157,482,065 |

254,764,117 |

1,721,728 |

|||||||||

|

Long-term deposits |

150,407,276 |

150,210,192 |

1,015,140 |

|||||||||

|

Other non-current assets |

3,090,205 |

9,784,796 |

66,127 |

|||||||||

|

TOTAL NON-CURRENT ASSETS |

1,192,648,775 |

1,501,460,044 |

10,147,058 |

|||||||||

|

TOTAL ASSETS |

4,495,665,227 |

4,779,518,995 |

32,300,595 |

|||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||

|

CURRENT LIABILITIES |

||||||||||||

|

Short-term loans |

700,000,000 |

700,000,000 |

4,730,689 |

|||||||||

|

Current portion of long-term loans |

230,785,000 |

169,252,000 |

1,143,826 |

|||||||||

|

Bond payable, current |

40,000,000 |

40,000,000 |

270,325 |

|||||||||

|

Accounts payable |

168,281,568 |

114,243,578 |

772,073 |

|||||||||

|

Accrued liabilities |

1,109,740,581 |

1,184,636,104 |

8,005,921 |

|||||||||

|

Income tax payable |

75,374,800 |

3,301,800 |

22,314 |

|||||||||

|

Contract liabilities, current |

147,628,310 |

267,364,483 |

1,806,883 |

|||||||||

|

Amount due to a director |

1,000,000 |

– |

– |

|||||||||

|

Finance lease liabilities, current |

71,681,545 |

83,549,523 |

564,638 |

|||||||||

|

Operating lease liabilities, current |

110,889,134 |

132,923,377 |

898,313 |

|||||||||

|

Other current liabilities |

195,952,191 |

156,907,705 |

1,060,403 |

|||||||||

|

TOTAL CURRENT LIABILITIES |

2,851,333,129 |

2,852,178,570 |

19,275,385 |

|||||||||

|

NON-CURRENT LIABILITIES |

||||||||||||

|

Long-term loans, net of current portion |

175,452,000 |

38,568,000 |

260,648 |

|||||||||

|

Bond payable, non-current |

56,807,020 |

37,833,335 |

255,682 |

|||||||||

|

Contract liabilities, non-current |

10,615,635 |

14,507,411 |

98,043 |

|||||||||

|

Finance lease liabilities, non-current |

140,333,247 |

143,881,183 |

972,367 |

|||||||||

|

Operating lease liabilities, non-current |

207,353,977 |

364,551,378 |

2,463,684 |

|||||||||

|

Assets retirement obligations |

12,914,758 |

30,671,626 |

207,283 |

|||||||||

|

TOTAL NON-CURRENT LIABILITIES |

603,476,637 |

630,012,933 |

4,257,707 |

|||||||||

|

TOTAL LIABILITIES |

3,454,809,766 |

3,482,191,503 |

23,533,092 |

|||||||||

|

COMMITMENTS AND CONTINGENCIES |

||||||||||||

|

SHAREHOLDERS’ EQUITY |

||||||||||||

|

Ordinary shares |

80,500,000 |

80,500,000 |

544,029 |

|||||||||

|

Additional paid-in capital |

748,840,080 |

778,624,844 |

5,262,045 |

|||||||||

|

Treasury shares |

(100,012,265) |

(100,012,265) |

(675,896) |

|||||||||

|

Retained earnings |

311,527,646 |

538,214,913 |

3,637,325 |

|||||||||

|

TOTAL SHAREHOLDERS’ EQUITY |

1,040,855,461 |

1,297,327,492 |

8,767,503 |

|||||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

4,495,665,227 |

4,779,518,995 |

32,300,595 |

|||||||||

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

||||||||||||

|

For the nine months ended |

||||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

NET REVENUE |

7,419,460,643 |

8,556,096,390 |

57,823,183 |

|||||||||

|

Cost of revenue |

(5,378,876,612) |

(6,145,159,916) |

(41,529,769) |

|||||||||

|

GROSS PROFIT |

2,040,584,031 |

2,410,936,474 |

16,293,414 |

|||||||||

|

Selling, general, and administrative expenses |

(1,802,047,253) |

(2,055,180,818) |

(13,889,172) |

|||||||||

|

INCOME FROM OPERATIONS |

238,536,778 |

355,755,656 |

2,404,242 |

|||||||||

|

OTHER INCOME (EXPENSE) |

||||||||||||

|

Interest income |

325,182 |

3,801,610 |

25,691 |

|||||||||

|

Interest expense |

(12,751,685) |

(13,514,164) |

(91,330) |

|||||||||

|

Grant income |

14,205,788 |

14,902,919 |

100,716 |

|||||||||

|

Unrealized (loss) gain on short-term investment |

(168,000) |

140,000 |

946 |

|||||||||

|

Loss on disposal of long-lived assets |

– |

(168,973) |

(1,142) |

|||||||||

|

Loss on disposal of a subsidiary |

(753,900) |

– |

– |

|||||||||

|

Other income (expense), net |

15,438,598 |

(16,773,644) |

(113,358) |

|||||||||

|

Total other income (expense), net |

16,295,983 |

(11,612,252) |

(78,477) |

|||||||||

|

INCOME BEFORE INCOME TAX PROVISION |

254,832,761 |

344,143,404 |

2,325,765 |

|||||||||

|

PROVISION FOR INCOME TAXES |

||||||||||||

|

Current |

(69,425,173) |

(92,067,891) |

(622,206) |

|||||||||

|

Deferred |

39,664,246 |

(25,388,246) |

(171,577) |

|||||||||

|

Total provision for income taxes |

(29,760,927) |

(117,456,137) |

(793,783) |

|||||||||

|

NET INCOME |

225,071,834 |

226,687,267 |

1,531,982 |

|||||||||

|

WEIGHTED AVERAGE NUMBER OF ORDINARY SHARES |

||||||||||||

|

Basic |

24,910,660 |

24,910,619 |

24,910,619 |

|||||||||

|

Diluted |

27,066,715 |

24,913,619 |

24,913,619 |

|||||||||

|

EARNINGS PER SHARE |

||||||||||||

|

Basic |

9.04 |

9.10 |

0.06 |

|||||||||

|

Diluted |

8.32 |

9.10 |

0.06 |

|||||||||

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||||||

|

For the nine months ended |

||||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

Cash flows from operating activities |

||||||||||||

|

Net income |

225,071,834 |

226,687,267 |

1,531,982 |

|||||||||

|

Adjustments to reconcile net income to net cash provided by operating activities |

||||||||||||

|

Depreciation and amortization expense |

90,057,762 |

96,233,315 |

650,357 |

|||||||||

|

Loss on disposal of a subsidiary |

753,900 |

– |

– |

|||||||||

|

Provision for expected credit loss |

2,771,782 |

9,208,096 |

62,229 |

|||||||||

|

Loss on disposal of property and equipment |

– |

168,973 |

1,142 |

|||||||||

|

Accounts receivable written off as uncollectible |

– |

28,558 |

193 |

|||||||||

|

Provision for inventory impairment |

3,403,261 |

424,180 |

2,867 |

|||||||||

|

Unrealized loss (gain) on short-term investment |

168,000 |

(140,000) |

(946) |

|||||||||

|

Other non-cash expenses (income) |

1,100,148 |

29,173,060 |

197,155 |

|||||||||

|

Deferred tax expense (benefit) |

(39,664,246) |

25,388,246 |

171,577 |

|||||||||

|

Changes in operating assets and liabilities |

||||||||||||

|

Accounts receivable, net |

(1,051,687) |

(46,613,686) |

(315,021) |

|||||||||

|

Inventories |

(13,808,125) |

3,286,945 |

22,214 |

|||||||||

|

Prepaid expenses |

(105,900,505) |

(19,854,842) |

(134,182) |

|||||||||

|

Long-term deposits |

(6,998,055) |

197,084 |

1,332 |

|||||||||

|

Amount due from a director |

33,577,065 |

– |

– |

|||||||||

|

Other current assets |

(25,969,080) |

(23,505,064) |

(158,850) |

|||||||||

|

Other non-current assets |

(10,722,988) |

(6,694,591) |

(45,243) |

|||||||||

|

Accounts payable |

(61,359,477) |

(54,037,990) |

(365,196) |

|||||||||

|

Accrued liabilities |

(204,167,728) |

74,895,523 |

506,153 |

|||||||||

|

Contract liabilities |

121,711,898 |

123,627,949 |

835,493 |

|||||||||

|

Operating lease liabilities |

(400,151) |

3,212,497 |

21,710 |

|||||||||

|

Income tax payable |

(149,952,500) |

(72,073,000) |

(487,078) |

|||||||||

|

Amount due to a director |

– |

(1,000,000) |

(6,758) |

|||||||||

|

Other current liabilities |

36,020,082 |

(41,875,805) |

(283,002) |

|||||||||

|

Net cash (used in) provided by operating activities |

(105,358,810) |

326,736,715 |

2,208,128 |

|||||||||

|

Cash flows from investing activities |

||||||||||||

|

Cash outflow due to reduction in consolidated entities |

(17,257,489) |

– |

– |

|||||||||

|

Purchase of property and equipment |

(11,926,248) |

(42,598,215) |

(287,884) |

|||||||||

|

Purchase of intangible assets |

(16,521,500) |

(5,880,000) |

(39,738) |

|||||||||

|

Net cash used in investing activities |

(45,705,237) |

(48,478,215) |

(327,622) |

|||||||||

|

Cash flows from financing activities |

||||||||||||

|

Payment of finance lease liabilities |

(43,259,590) |

(64,438,481) |

(435,483) |

|||||||||

|

Proceeds from bank loans |

250,000,000 |

– |

– |

|||||||||

|

Repayment of bank loans |

(280,815,000) |

(198,417,000) |

(1,340,927) |

|||||||||

|

Repayment of bond payable |

(20,000,000) |

(20,000,000) |

(135,163) |

|||||||||

|

Payment of deferred IPO costs |

(129,983,403) |

(97,282,052) |

(657,445) |

|||||||||

|

Net cash used in financing activities |

(224,057,993) |

(380,137,533) |

(2,569,018) |

|||||||||

|

Net decrease in cash |

(375,122,040) |

(101,879,033) |

(688,512) |

|||||||||

|

Cash at the beginning of period |

2,729,282,346 |

2,538,554,638 |

17,155,874 |

|||||||||

|

Cash at the end of the period end |

2,354,160,306 |

2,436,675,605 |

16,467,362 |

|||||||||

|

Supplementary cash flow information |

||||||||||||

|

Cash paid for income taxes |

202,070,573 |

115,154,307 |

778,227 |

|||||||||

|

Cash paid for interest expenses |

11,651,537 |

12,325,868 |

83,300 |

|||||||||

SOURCE LEIFRAS Co., Ltd.

Rec Sports

Upcoming events: Lights, shows and Christmas dinner | News, Sports, Jobs

photo by: Contributed

Volunteers serve hot meals Wednesday, Dec. 25, 2024, for Lawrence’s annual Community Christmas Dinner.

Friday, Dec. 19

Christmas Through the Ages: Historic Lecompton’s Annual Christmas Tree Display, 10 a.m.-4 p.m., Territorial Capital Museum, 640 E. Woodson Ave., Lecompton.

“Holiday Reflections” walk-through village, 10 a.m.-8 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

“Adornment” Holiday Art Show & Sale, 1-6 p.m., Van Go, 715 New Jersey St.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Knights of Lights, 5:30-10 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Moving screening: “Trading Places” (1983), 7 p.m., Liberty Hall Little Theater, 644 Massachusetts St. See liberty-hall.com for ticket information.

Kansas City Symphony Presents: Christmas Festival, 7 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Wine and Carols, 7-9 p.m., Trivedi Wine, 1826 E. 1150 Road. $5 cover charge.

Kansas City Ballet Presents: “The Nutcracker,” 7:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 8 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Saturday, Dec. 20

Festivus Fun Run, 9 a.m., Ad Astra Running, 837 Massachusetts St. See connect.garmin.com/modern/course/239297421 for course.

“Holiday Reflections” walk-through village, 9 a.m.-7 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Christmas Through the Ages: Historic Lecompton’s Annual Christmas Tree Display, 10 a.m.-4 p.m., Territorial Capital Museum, 640 E. Woodson Ave., Lecompton.

“Adornment” Holiday Art Show & Sale, 10 a.m.-5 p.m., Van Go, 715 New Jersey St.

Silent Book Club meeting, 10:30 a.m., Tous les Jours, 525 Wakarusa Drive. Bring whatever book you’re reading. No assigned reading; readers quietly gather to enjoy their various books in silent companionship.

Festival of Nativities, noon-4 p.m., Centenary United Methodist Church, 245 N. Fourth (corner of Fourth and Elm), North Lawrence.

Holiday Bake Sale to benefit Sunrise Project, noon-4 p.m., 245 N. Fourth St.

Kansas City Symphony Presents: Christmas Festival, 1 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 2 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Kansas City Ballet Presents: “The Nutcracker,” 2 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Winter Wonderland, 5-8 p.m., Prairie Park Nature Center, 2730 Harper St. Pre-register at lprd.org.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Knights of Lights, 5:30-10 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Miller Marley Performing Companies: “Clara’s Dream and a Holiday Musical Revue,” 6 p.m., Lied Center, 1600 Stewart Drive. See lied.ku.edu for tickets.

Kansas Ballet Presents “The Nutcracker” featuring the Topeka Symphony, 7 p.m., Topeka Performing Arts Center, 214 SE 8th St., Topeka.

Kansas City Symphony Presents: Christmas Festival, 7 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Kansas City Ballet Presents: “The Nutcracker,” 7:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Movie screening: “Spaceballs” (1987), 8 p.m., Liberty Hall, 644 Massachusetts St. See liberty-hall.com for tickets.

KC Rep: “A Christmas Carol,” 8 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Sunday, Dec. 21

“Holiday Reflections” walk-through village, 9 a.m.-7 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Festival of Nativities, noon-4 p.m., Centenary United Methodist Church, 245 N. 4th (corner of 4th and Elm), North Lawrence.

Holiday Bake Sale to benefit Sunrise Project, noon-4 p.m., 245 N. Fourth St.

“Adornment” Holiday Art Show & Sale, 1-5 p.m., Van Go, 715 New Jersey St.

Miller Marley Performing Companies: “Clara’s Dream and a Holiday Musical Revue,” 2 p.m., Lied Center, 1600 Stewart Drive. Tickets at lied.ku.edu.

Knights of Lights, 5:30-9 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Kansas Ballet Presents “The Nutcracker” featuring the Topeka Symphony, 7 p.m., Topeka Performing Arts Center, 214 SE 8th St., Topeka.

KC Rep: “A Christmas Carol,” 1 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Kansas City Ballet Presents: “The Nutcracker,” 1 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Christmas Through the Ages: Historic Lecompton’s Annual Christmas Tree Display, 1-5 p.m., Territorial Capital Museum, 640 E. Woodson Ave., Lecompton.

Kansas City Symphony Presents: Christmas Festival, 2 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Drunken Fiddles Holiday Music, 3 p.m., Lucia’s, 1016 Massachusetts St.

Kansas City Ballet Presents: “The Nutcracker,” 5:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

KC Rep: “A Christmas Carol,” 6 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Movie screening: “Home Alone” (1990), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. See liberty-hall.com for tickets.

Kansas City Symphony Presents: Christmas Festival, 7 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Monday, Dec. 22

“Holiday Reflections” walk-through village, 10 a.m.-8 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Kansas City Ballet Presents: “The Nutcracker,” 2 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Knights of Lights, 5:30-9 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Movie screening: “Holiday” (1938), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. Tickets at liberty-hall.com.

Kansas City Ballet Presents: “The Nutcracker,” 7:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Tuesday, Dec. 23

“Holiday Reflections” walk-through village, 10 a.m.-8 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Kansas City Ballet Presents: “The Nutcracker,” 2 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Knights of Lights, 5:30-9 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Kansas City Symphony Presents: It’s a Wonderful Life in Concert, 7 p.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 7 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Movie screening: “Gremlins” (1984), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. See liberty-hall.com for tickets.

Kansas City Ballet Presents: “The Nutcracker,” 7:30 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

Wednesday, Dec. 24

“Holiday Reflections” walk-through village, 10 a.m.-2 p.m., Grand Plaza, Union Station, 30 West Pershing Road, Kansas City, Mo.; see unionstation.org for tickets.

Christmas Through the Ages: Historic Lecompton’s Annual Christmas Tree Display, 10 a.m.-4 p.m., Territorial Capital Museum, 640 E. Woodson Ave., Lecompton.

Kansas City Symphony Presents: It’s a Wonderful Life in Concert, 11 a.m., Helzberg Hall, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 1 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Kansas City Ballet Presents: “The Nutcracker,” 1 p.m., Muriel Kauffman Theatre, Kauffman Center, 1601 Broadway Blvd., Kansas City, Mo.

KC Rep: “A Christmas Carol,” 5 p.m., Spencer Theatre, UMKC Campus, 4949 Cherry St., Kansas City, Mo.

Knights of Lights, 5:30-9 p.m., KC Ren Fest, Queen’s Gate Entrance, 628 N. 126th St., Bonner Springs.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Movie screening: “The Shop Around the Corner” (1940), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. See liberty-hall.com for tickets.

Thursday, Dec. 25

Community Christmas Dinner, 11 a.m.-2 p.m., First United Methodist Church, 946 Vermont St. Home deliveries also available.

Lawrence Lights: Making Spirits Bright, 5:30-9:30 p.m., Youth Sports Complex, 4911 W. 27th St. See lawrence-lights.com.

Movie screening: “While You Were Sleeping” (1995), 7 p.m., Liberty Hall Main Theater, 644 Massachusetts St. Tickets at liberty-hall.com.

Rec Sports

DeKalb County receives grant to expand women’s flag football programs

STONE MOUNTAIN, Ga. (Atlanta News First) — The Arthur M. Blank Family Foundation announced Thursday that it is donating $6.3 million in grants to school districts across metro Atlanta to help grow youth sports programs.

DeKalb County Schools received a grant from the foundation to help fill gaps in its middle school flag football teams, said Myss Jelks, executive director of athletics for the district.

“Our goal is to have all 19 middle schools playing flag football next year,” Jelks said.

This year, all 19 high schools in DeKalb County participated in flag football, along with 13 middle schools and almost 70 elementary schools, Jelks said.

The sport’s pilot program was started seven years ago by the Arthur M. Blank Family Foundation with 19 schools in Gwinnett County. More than 300 high schools in Georgia now participate in flag football, with 45 schools starting programs in 2025. About 7,000 girls participated statewide this year.

The Georgia High School Association sanctioned girls’ flag football in 2020.

Jelks said she believes her athletic background could have translated to flag football success if the opportunity had existed when she was younger.

“In my head, I think I would have been a great running back,” Jelks said.

Instead, she specialized in sports medicine.

“Well, number one, football is my favorite sport,” Jelks said when asked about her aversion to the historical perception of football as a men’s sport.

Schools are currently classified by location rather than by size, unlike tackle football, which Jelks expects to change soon. She anticipates continued growth in the sport’s popularity.

“It is an everybody sport,” Jelks said.

Copyright 2025 WANF. All rights reserved.

Rec Sports

Democrats Compare Trump’s New Youth Sports Event to ‘The Hunger Games’

President Donald Trump announced on Thursday that in addition to the headline-grabbing UFC fight on the National Mall next year to celebrate the United States’ 250th anniversary, a host of other events will also be scheduled, including a parade and an athletic competition for high school students.

“We will host the first-ever ‘Patriot Games,’ an unprecedented, four-day athletic event featuring the greatest high school athletes — one young man and one young woman from each state and territory,” Trump said in a pre-recorded video shot from the Oval Office. “But I promise there will be no men playing in women’s sports.”

Trump said that a new nonpartisan organization called Freedom 250 would be responsible for hosting the events and coordinating with the federal agencies to deliver on events nationwide through 2026.

One of the main events will be “the first-ever Patriot Games,” which were first announced in July as part of a slate of anniversary celebrations championed by the Trump administration.

America turns 250 🇺🇸🇺🇸

President Donald J. Trump on Freedom 250 and the 2026 celebration that honors our nation like never before. WATCH: pic.twitter.com/aSaPqQ0U7m

— The White House (@WhiteHouse) December 18, 2025

Critics of the Trump administration were quick to point out the plan mirrored the plot of the fictional “Hunger Games” series, which depicts teenage representatives from each district of a country who are forced to fight to the death in a televised event, as part of an annual celebration of their nation’s revolution.

In a post to X on Thursday, the national Democratic Party shared a clip from the movie along with a quote: “And so it was decreed that, each year, the various districts of Panem would offer up, in tribute, one young man and woman to fight to the death in a pageant of honor, courage and sacrifice.”

The Democratic governors of California and Illinois, Gavin Newsom and JB Pritzker, also reposted the White House’s announcement with clips from the film showing the country’s fictional dictator.

“May the odds be ever in your favor,” Newsom wrote, reprising the phrase told to young Hunger Games participants in the fictional series.

The White House did not respond to a request for comment on Democrats’ “Hunger Games” comparison.

In addition to the Patriot Games, one of Freedom 250’s planned initiatives is a full illumination of the Washington Monument between New Year’s Eve and Jan. 5, “marking the start of this once-in-a-generation anniversary year,” a press release reads.

Memorial Day will be celebrated with a “Spirit of America parade” and a “National Prayer Event on the National Mall will rededicate the nation as One Nation Under God.”

In June, Flag Day will be marked with a first-of-its-kind UFC event, and toward the end of month the National Mall will be converted into the “Great American State Fair” featuring pavilions from each state.

“The event will feature a spectacular flyover by our Nation’s Military, roaring over the Capitol and the Lincoln Memorial,” reads a Thursday press release. “A major address by the President of the United States will precede Salute to America: The Nation’s 250th Birthday Fireworks Celebration — the largest fireworks display in the world, illuminating the Mall in a breathtaking finale.”

Rec Sports

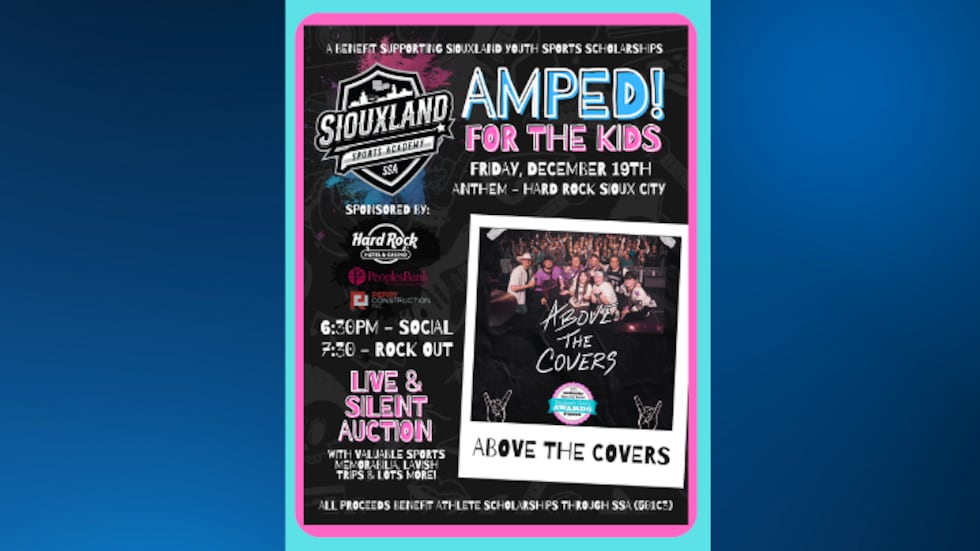

Benefit concert at the Hard Rock aims to raise money for young kids

SIOUX CITY (KTIV) – The Siouxland Sports Academy is planning to rock out at the Hard Rock Hotel and Casino during a benefit concert event.

The benefit concert featuring Above the Covers is expected to take place on Friday, Dec. 19.

“We are very excited to be able to host this event in this great facility with this great local band to raise money for kids in need. It is very important to us that we are able to provide opportunities to kids regardless of socioeconomic status,” said SSA Executive Director Dustin Cooper.

Doors open at 6:30 p.m. for a silent auction and social. The band performs at 7:30 p.m.

The Siouxland Sports Academy says its organization is a 501c3 nonprofit that works to create opportunities for young people in Siouxland.

The nonprofit also says 100% of the proceeds in ticket sales and at the auction will go towards financing local youth sports scholarships.

“During the concert, there will be silent auction items up for grabs that include priceless autographed sports memorabilia, unbelievable sports experiences, and at intermission of the concert, a trip to Turks and Caicos will be live auctioned!” said Siouxland Sports Academy.

Tickets are available on the Hard Rock Hotel and Casino’s website.

Want to get the latest news and weather from Siouxland’s News Source? Follow these links to download our KTIV News app and our First Alert Weather app.

Copyright 2025 KTIV. All rights reserved.

Rec Sports

National flag football tournament heads to Eau Claire

EAU CLAIRE, Wis. — Eau Claire has flagged down a major sporting event for 2026: the Pylon 7on7 Flag Football Tournament is heading to the Sonnentag Field House from March 14 to 15.

The tournament — a traveling flag football tournament for high school athletes — is expected to welcome about 1,000 athletes, coaches, families and fans. Pylon 7on7 said it will welcome more than 30 teams to the Wisconsin-based event.

The Eau Claire tournament will be indoors.

Pylon 7on7 is a “critical exposure platform” for high schoolers looking to play football in college. Over the past 20 years, more than 3,000 student-athletes who have played in Pylon 7on7 committed to Division I programs. More than 300 players made it to the NFL.

“We’re extremely excited to welcome Pylon 7on7 to Eau Claire,” said Lucas Connolly, sports relationship manager for Visit Eau Claire. “This event brings elite competition to our community and provides young athletes with a platform to compete, be seen, and develop, while highlighting the Sonnentag Center as a top-tier venue for national sporting events.”

Visit Eau Claire said it expects a positive, direct economic impact from the tournament.

“This tournament is another example of how Eau Claire continues to grow as a destination for youth sports, and we are excited to partner with Visit Eau Claire to welcome Pylon 7on7 Football and the many athletes, families, and visitors who will experience our community,” said Steve Kirk, Interim General Manager of the Sonnentag Center.

Eau Claire is just one site of more than two dozen Pylon 7on7 tournaments taking place from Jan. through May 2026. Nationals will take place in Indianapolis on May 30 and 31.

-

Motorsports1 week ago

Motorsports1 week agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Motorsports3 weeks ago

Motorsports3 weeks agoJo Shimoda Undergoes Back Surgery

-

NIL3 weeks ago

NIL3 weeks agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoHow this startup (and a KC sports icon) turned young players into card-carrying legends overnight

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoRobert “Bobby” Lewis Hardin, 56

-

Sports3 weeks ago

Wisconsin volleyball sweeps Minnesota with ease in ranked rivalry win

-

Motorsports1 week ago

Motorsports1 week agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Motorsports3 weeks ago

Motorsports3 weeks agoIncreased Purses, 19 Different Tracks Highlight 2026 Great Lakes Super Sprints Schedule – Speedway Digest

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw

-

Sports2 weeks ago

Sports2 weeks agoMen’s and Women’s Track and Field Release 2026 Indoor Schedule with Opener Slated for December 6 at Home