Rec Sports

LEIFRAS Co., Ltd. Reports Financial Results for the Nine Months Ended September 30, 2025

TOKYO, Dec. 18, 2025 /PRNewswire/ — LEIFRAS Co., Ltd. (Nasdaq: LFS) (the “Company” or “Leifras”), a sports and social business company dedicated to youth sports and community engagement, today announced its unaudited financial results for the nine months ended September 30, 2025.

Financial Highlights for the Nine Months Ended September 30, 2025

- Revenue was JPY8.6 billion ($57.8 million) for the nine months ended September 30, 2025, an increase of 15.3% from JPY7.4 billion for the same period last year.

- Gross profit was JPY2.4 billion ($16.3 million) for the nine months ended September 30, 2025, an increase of 18.1% from JPY2.0 billion for the same period last year.

- Gross margin was 28.2% for the nine months ended September 30, 2025, which increased from 27.5% for the same period last year.

- Net income was JPY226.7 million ($1.5 million) for the nine months ended September 30, 2025, an increase of 0.7% from JPY225.1 million for the same period last year.

- Basic and diluted earnings per share was JPY9.1 ($0.06) for the nine months ended September 30, 2025, compared to basic earnings per share of JPY9.0 and diluted earnings per share of JPY8.3 for the same period last year.

Operational Highlights for the Nine Months Ended September 30, 2025

- Number of members in the sports school business was 71,529 for the nine months ended September 30, 2025, an increase of 2.3% from 69,924 for the same period last year.

- Average membership duration in the sports school business was 1.84 years for the nine months ended September 30, 2025, an increase of 1.1% from 1.82 years for the same period last year.

- Revenue per capita in the sport school business, which we define as the sales revenue of the sports school business divided by the number of employees involved in that business, was JPY9.6 million ($0.06 million) for the nine months ended September 30, 2025, an increase of 6.2% from JPY9.0 million for the same period last year.

- Number of schools served under the social business segment was 360 for the nine months ended September 30, 2025, an increase of 53.2% from 235 for the same period last year.

- Revenue per capita in the social business, which we define as the sales revenue of the social business divided by the number of employees involved in that business, was JPY7.6 million ($0.05 million) for the nine months ended September 30, 2025, an increase of 18.6% from JPY6.4 million for the same period last year.

Mr. Kiyotaka Ito, the Representative Director and Chief Executive Officer of Leifras, commented, “We delivered solid financial results in the first nine months of fiscal year 2025, with meaningful growth across our key financial and operational metrics. Revenue increased 15.3% and net income grew 0.7% from the same period last year. By segment, sports school business achieved revenue growth of 8.9% and social business revenue increased by 36.4% year over year. Our performance shows continued strength of our sports school business and expanding demand for our social business. Notably, revenue per capita in our social business rose by 18.6% year over year, highlighting the increasing value and impact of our community-based services. Looking ahead, we see meaningful opportunities in Japan’s shifting policy landscape. The government’s ongoing Club Activity Reform, which focuses on shifting school-based club activity management to regional and private organizations, is expected to create an important long-term growth pathway for Leifras. We recently secured a new contract with the City of Nagoya, Aichi Prefecture, to manage facilities at municipal junior high schools in Nagoya, marking an important step in our expansion strategy. We intend to actively pursue additional opportunities as municipalities seek specialized partners to deliver high-quality sports and community programs. In the future, we remain committed to cultivating the non-cognitive skills of children, strengthening community well-being, enhancing our service offerings, and delivering sustainable value to our shareholders and society.”

Financial Results for the Nine Months Ended September 30, 2025

Revenue

Total revenue was JPY8.6 billion ($57.8 million) for the nine months ended September 30, 2025, an increase of 15.3% from JPY7.4 billion for the same period last year.

Sports school business revenue was JPY6.2 billion ($41.9 million) for the nine months ended September 30, 2025, an increase of 8.9% from JPY5.7 billion for the same period last year. The increase in revenue was mostly driven by: (i) an increase in the number of members by 1,605, from 69,924 as of September 30, 2024 to 71,529 as of September 30, 2025, resulting in an increase in revenue of JPY315.7 million ($2.1 million) and (ii) an increase in the number of customers who joined events hosted by the Company from 136,695 for the nine months ended September 30, 2024 to 142,843 for the nine months ended September 30, 2025, leading to an increase in the sports school business revenue by JPY112.6 million ($0.8 million).

Social business revenue was JPY2.4 billion ($15.9 million) for the nine months ended September 30, 2025, an increase of 36.4% from JPY1.7 billion for the same period last year. The increase in revenue was mostly driven by: (i) an increase in the number of schools by 125, from 235 as of September 30, 2024 to 360 as of September 30, 2025, resulting in an increase in revenue of JPY505.1 million ($3.4 million), and (ii) an increase in after-school daycare service revenue by JPY86.1 million ($0.6 million).

Cost of Revenue

Cost of revenue was JPY6.1 billion ($41.5 million) for the nine months ended September 30, 2025, an increase of 14.2% from JPY5.4 billion for the same period last year.

Gross Profit

Gross profit was JPY2.4 billion ($16.3 million) for the nine months ended September 30, 2025, an increase of 18.1% from JPY2.0 billion for the same period last year.

Gross margin was 28.2% for the nine months ended September 30, 2025, which increased from 27.5% for the same period last year.

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses were JPY2.1 billion ($13.9 million) for the nine months ended September 30, 2025, an increase of 14.0% from JPY1.8 billion for the same period last year. The increase was attributed to (i) the increase in salaries and welfare expenses of JPY137.5 million ($0.9 million) due to business expansion as well as an increase in headquarters personnel in preparation for the Company’s initial public offering (“IPO”), (ii) the increase in promotion fees of JPY8.2 million ($0.06 million) due to business expansion, (iii) the increase in office rental fees of JPY14.1 million ($0.1 million) due to business expansion, (iv) the increase in system maintenance fee expenses of JPY17.3 million ($0.1 million) incurred due to the increase in the number of employees, and (v) the increase in recruitment fees of JPY53.8 million ($0.4 million) due to business expansion as well as an increase in headquarters personnel in preparation for the Company’s IPO.

Other Income (Expenses), Net

Other expenses, net were JPY1.9 million ($0.01 million) for the nine months ended September 30, 2025, compared to other income, net of JPY28.7 million for the same period last year. The decrease was attributed to: (i) net franchise income collected (returned) of JPY27.4 million ($0.02 million), which was the payments refunded to the franchisees in connection with the transfer of certain business rights, (ii) an eviction compensation of JPY5.5 million ($0.04 million) received in connection with the vacating of a leased building. Interest expenses, net were JPY9.7 million ($0.07 million) for the nine months ended September 30, 2025, a decrease of 21.8% from JPY12.4 million for the same period last year.

Net Income

Net income was JPY226.7 million ($1.5 million) for the nine months ended September 30, 2025, an increase of 0.7% from JPY225.1 million for the same period last year.

Basic and Diluted Earnings per Share

Basic earnings per share was JPY9.10 ($0.06) for the nine months ended September 30, 2025, compared to JPY9.04 for the same period last year.

Diluted earnings per share was JPY9.10 ($0.06) for the nine months ended September 30, 2025, compared to JPY8.32 for the same period last year.

Financial Condition

As of September 30, 2025, the Company had cash of JPY2.4 billion ($16.5 million), compared to JPY2.5 billion as of December 31, 2024.

Net cash provided by operating activities was JPY326.7 million ($2.2 million) for the nine months ended September 30, 2025, compared to net cash used in operating activities of JPY105.4 million for the same period last year.

Net cash used in investing activities was JPY48.5 million ($0.3 million) for the nine months ended September 30, 2025, compared to JPY45.7 million for the same period last year.

Net cash used in financing activities was JPY380.1 million ($2.6 million) for the nine months ended September 30, 2025, compared to JPY224.1 million for the same period last year.

Financial Guidance

The Company is projecting total revenue to be between JPY11.6 billion and JPY11.9 billion ($78.1 million and $80.5 million) for the fiscal year ending December 31, 2025, an increase of approximately 11.9% to 15.3% from JPY10.3 billion ($69.8 million) for the fiscal year ended December 31, 2024.

Income from operations is projected to be between JPY580.0 million and JPY696.5 million ($3.9 million and $4.7 million) for the fiscal year ending December 31, 2025, an increase of 11.6% to 34.0% from JPY519.8 million ($3.5 million) for the fiscal year ended December 31, 2024.

These projections are based on the assumption that no business acquisitions, restructuring activities, or legal settlements will take place during the period.

Exchange Rate Information

This announcement contains translations of certain Japanese Yen (“JPY”) amounts into U.S. dollars (“USD,” or “$”) for the convenience of the reader. Translations of amounts from JPY into USD have been made at the exchange rate of JPY147.97 = $1.00, the exchange rate on September 30, 2025 set forth in the H.10 statistical release of the United States Federal Reserve Board.

About LEIFRAS Co., Ltd.

Headquartered in Tokyo, Leifras is a sports and social business company dedicated to youth sports and community engagement. The Company primarily provides services related to the organization and operations of sports schools and sports events for children. As of December 31, 2024, Leifras was recognized as one of Japan’s largest operators of children’s sports schools in terms of both membership and facilities by Tokyo Shoko Research. The Company’s approach to sports education emphasizes the development of non-cognitive skills, following the teaching principle “acknowledge, praise, encourage, and motivate.” The holistic approach that integrates physical and mental development sets Leifras apart in the industry. Building upon deep experience and know-how in sports education, Leifras also operates a robust social business sector, dispatching sports coaches to meet various community needs with the aim to promote physical health, social inclusion, and community well-being across different demographics. For more information, please visit the Company’s website: https://ir.leifras.co.jp/.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may,” or other similar expressions in this press release. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. These statements are subject to uncertainties and risks, including, but not limited to, the uncertainties related to market conditions, and other factors discussed in the “Risk Factors” section of the registration statement filed with the U.S. Securities and Exchange Commission (the “SEC”). Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the registration statement and other filings with the SEC. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov.

For more information, please contact:

LEIFRAS Co., Ltd.

Investor Relations Department

Email: [email protected]

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: [email protected]

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||||||

|

December 31, |

September 30, |

September 30, |

||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

(Unaudited) |

(Unaudited) |

|||||||||||

|

ASSETS |

||||||||||||

|

CURRENT ASSETS |

||||||||||||

|

Cash |

2,538,554,638 |

2,436,675,605 |

16,467,362 |

|||||||||

|

Accounts receivable, net |

518,398,551 |

555,775,583 |

3,756,002 |

|||||||||

|

Short-term investments |

4,935,000 |

5,075,000 |

34,297 |

|||||||||

|

Inventories, net |

24,468,188 |

20,757,063 |

140,279 |

|||||||||

|

Prepaid expenses |

182,278,232 |

201,888,793 |

1,364,390 |

|||||||||

|

Other current assets |

34,381,843 |

57,886,907 |

391,207 |

|||||||||

|

TOTAL CURRENT ASSETS |

3,303,016,452 |

3,278,058,951 |

22,153,537 |

|||||||||

|

NON-CURRENT ASSETS |

||||||||||||

|

Property and equipment, net |

53,805,279 |

99,293,143 |

671,035 |

|||||||||

|

Finance lease right-of-use assets |

208,611,550 |

228,794,098 |

1,546,219 |

|||||||||

|

Operating lease right-of-use assets |

337,330,750 |

513,349,897 |

3,469,284 |

|||||||||

|

Intangible assets, net |

39,250,078 |

27,980,475 |

189,096 |

|||||||||

|

Goodwill |

27,999,994 |

27,999,994 |

189,228 |

|||||||||

|

Deferred tax assets, net |

214,671,578 |

189,283,332 |

1,279,201 |

|||||||||

|

Deferred initial public offering (“IPO”) costs |

157,482,065 |

254,764,117 |

1,721,728 |

|||||||||

|

Long-term deposits |

150,407,276 |

150,210,192 |

1,015,140 |

|||||||||

|

Other non-current assets |

3,090,205 |

9,784,796 |

66,127 |

|||||||||

|

TOTAL NON-CURRENT ASSETS |

1,192,648,775 |

1,501,460,044 |

10,147,058 |

|||||||||

|

TOTAL ASSETS |

4,495,665,227 |

4,779,518,995 |

32,300,595 |

|||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||

|

CURRENT LIABILITIES |

||||||||||||

|

Short-term loans |

700,000,000 |

700,000,000 |

4,730,689 |

|||||||||

|

Current portion of long-term loans |

230,785,000 |

169,252,000 |

1,143,826 |

|||||||||

|

Bond payable, current |

40,000,000 |

40,000,000 |

270,325 |

|||||||||

|

Accounts payable |

168,281,568 |

114,243,578 |

772,073 |

|||||||||

|

Accrued liabilities |

1,109,740,581 |

1,184,636,104 |

8,005,921 |

|||||||||

|

Income tax payable |

75,374,800 |

3,301,800 |

22,314 |

|||||||||

|

Contract liabilities, current |

147,628,310 |

267,364,483 |

1,806,883 |

|||||||||

|

Amount due to a director |

1,000,000 |

– |

– |

|||||||||

|

Finance lease liabilities, current |

71,681,545 |

83,549,523 |

564,638 |

|||||||||

|

Operating lease liabilities, current |

110,889,134 |

132,923,377 |

898,313 |

|||||||||

|

Other current liabilities |

195,952,191 |

156,907,705 |

1,060,403 |

|||||||||

|

TOTAL CURRENT LIABILITIES |

2,851,333,129 |

2,852,178,570 |

19,275,385 |

|||||||||

|

NON-CURRENT LIABILITIES |

||||||||||||

|

Long-term loans, net of current portion |

175,452,000 |

38,568,000 |

260,648 |

|||||||||

|

Bond payable, non-current |

56,807,020 |

37,833,335 |

255,682 |

|||||||||

|

Contract liabilities, non-current |

10,615,635 |

14,507,411 |

98,043 |

|||||||||

|

Finance lease liabilities, non-current |

140,333,247 |

143,881,183 |

972,367 |

|||||||||

|

Operating lease liabilities, non-current |

207,353,977 |

364,551,378 |

2,463,684 |

|||||||||

|

Assets retirement obligations |

12,914,758 |

30,671,626 |

207,283 |

|||||||||

|

TOTAL NON-CURRENT LIABILITIES |

603,476,637 |

630,012,933 |

4,257,707 |

|||||||||

|

TOTAL LIABILITIES |

3,454,809,766 |

3,482,191,503 |

23,533,092 |

|||||||||

|

COMMITMENTS AND CONTINGENCIES |

||||||||||||

|

SHAREHOLDERS’ EQUITY |

||||||||||||

|

Ordinary shares |

80,500,000 |

80,500,000 |

544,029 |

|||||||||

|

Additional paid-in capital |

748,840,080 |

778,624,844 |

5,262,045 |

|||||||||

|

Treasury shares |

(100,012,265) |

(100,012,265) |

(675,896) |

|||||||||

|

Retained earnings |

311,527,646 |

538,214,913 |

3,637,325 |

|||||||||

|

TOTAL SHAREHOLDERS’ EQUITY |

1,040,855,461 |

1,297,327,492 |

8,767,503 |

|||||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

4,495,665,227 |

4,779,518,995 |

32,300,595 |

|||||||||

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

||||||||||||

|

For the nine months ended |

||||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

NET REVENUE |

7,419,460,643 |

8,556,096,390 |

57,823,183 |

|||||||||

|

Cost of revenue |

(5,378,876,612) |

(6,145,159,916) |

(41,529,769) |

|||||||||

|

GROSS PROFIT |

2,040,584,031 |

2,410,936,474 |

16,293,414 |

|||||||||

|

Selling, general, and administrative expenses |

(1,802,047,253) |

(2,055,180,818) |

(13,889,172) |

|||||||||

|

INCOME FROM OPERATIONS |

238,536,778 |

355,755,656 |

2,404,242 |

|||||||||

|

OTHER INCOME (EXPENSE) |

||||||||||||

|

Interest income |

325,182 |

3,801,610 |

25,691 |

|||||||||

|

Interest expense |

(12,751,685) |

(13,514,164) |

(91,330) |

|||||||||

|

Grant income |

14,205,788 |

14,902,919 |

100,716 |

|||||||||

|

Unrealized (loss) gain on short-term investment |

(168,000) |

140,000 |

946 |

|||||||||

|

Loss on disposal of long-lived assets |

– |

(168,973) |

(1,142) |

|||||||||

|

Loss on disposal of a subsidiary |

(753,900) |

– |

– |

|||||||||

|

Other income (expense), net |

15,438,598 |

(16,773,644) |

(113,358) |

|||||||||

|

Total other income (expense), net |

16,295,983 |

(11,612,252) |

(78,477) |

|||||||||

|

INCOME BEFORE INCOME TAX PROVISION |

254,832,761 |

344,143,404 |

2,325,765 |

|||||||||

|

PROVISION FOR INCOME TAXES |

||||||||||||

|

Current |

(69,425,173) |

(92,067,891) |

(622,206) |

|||||||||

|

Deferred |

39,664,246 |

(25,388,246) |

(171,577) |

|||||||||

|

Total provision for income taxes |

(29,760,927) |

(117,456,137) |

(793,783) |

|||||||||

|

NET INCOME |

225,071,834 |

226,687,267 |

1,531,982 |

|||||||||

|

WEIGHTED AVERAGE NUMBER OF ORDINARY SHARES |

||||||||||||

|

Basic |

24,910,660 |

24,910,619 |

24,910,619 |

|||||||||

|

Diluted |

27,066,715 |

24,913,619 |

24,913,619 |

|||||||||

|

EARNINGS PER SHARE |

||||||||||||

|

Basic |

9.04 |

9.10 |

0.06 |

|||||||||

|

Diluted |

8.32 |

9.10 |

0.06 |

|||||||||

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||||||

|

For the nine months ended |

||||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

Cash flows from operating activities |

||||||||||||

|

Net income |

225,071,834 |

226,687,267 |

1,531,982 |

|||||||||

|

Adjustments to reconcile net income to net cash provided by operating activities |

||||||||||||

|

Depreciation and amortization expense |

90,057,762 |

96,233,315 |

650,357 |

|||||||||

|

Loss on disposal of a subsidiary |

753,900 |

– |

– |

|||||||||

|

Provision for expected credit loss |

2,771,782 |

9,208,096 |

62,229 |

|||||||||

|

Loss on disposal of property and equipment |

– |

168,973 |

1,142 |

|||||||||

|

Accounts receivable written off as uncollectible |

– |

28,558 |

193 |

|||||||||

|

Provision for inventory impairment |

3,403,261 |

424,180 |

2,867 |

|||||||||

|

Unrealized loss (gain) on short-term investment |

168,000 |

(140,000) |

(946) |

|||||||||

|

Other non-cash expenses (income) |

1,100,148 |

29,173,060 |

197,155 |

|||||||||

|

Deferred tax expense (benefit) |

(39,664,246) |

25,388,246 |

171,577 |

|||||||||

|

Changes in operating assets and liabilities |

||||||||||||

|

Accounts receivable, net |

(1,051,687) |

(46,613,686) |

(315,021) |

|||||||||

|

Inventories |

(13,808,125) |

3,286,945 |

22,214 |

|||||||||

|

Prepaid expenses |

(105,900,505) |

(19,854,842) |

(134,182) |

|||||||||

|

Long-term deposits |

(6,998,055) |

197,084 |

1,332 |

|||||||||

|

Amount due from a director |

33,577,065 |

– |

– |

|||||||||

|

Other current assets |

(25,969,080) |

(23,505,064) |

(158,850) |

|||||||||

|

Other non-current assets |

(10,722,988) |

(6,694,591) |

(45,243) |

|||||||||

|

Accounts payable |

(61,359,477) |

(54,037,990) |

(365,196) |

|||||||||

|

Accrued liabilities |

(204,167,728) |

74,895,523 |

506,153 |

|||||||||

|

Contract liabilities |

121,711,898 |

123,627,949 |

835,493 |

|||||||||

|

Operating lease liabilities |

(400,151) |

3,212,497 |

21,710 |

|||||||||

|

Income tax payable |

(149,952,500) |

(72,073,000) |

(487,078) |

|||||||||

|

Amount due to a director |

– |

(1,000,000) |

(6,758) |

|||||||||

|

Other current liabilities |

36,020,082 |

(41,875,805) |

(283,002) |

|||||||||

|

Net cash (used in) provided by operating activities |

(105,358,810) |

326,736,715 |

2,208,128 |

|||||||||

|

Cash flows from investing activities |

||||||||||||

|

Cash outflow due to reduction in consolidated entities |

(17,257,489) |

– |

– |

|||||||||

|

Purchase of property and equipment |

(11,926,248) |

(42,598,215) |

(287,884) |

|||||||||

|

Purchase of intangible assets |

(16,521,500) |

(5,880,000) |

(39,738) |

|||||||||

|

Net cash used in investing activities |

(45,705,237) |

(48,478,215) |

(327,622) |

|||||||||

|

Cash flows from financing activities |

||||||||||||

|

Payment of finance lease liabilities |

(43,259,590) |

(64,438,481) |

(435,483) |

|||||||||

|

Proceeds from bank loans |

250,000,000 |

– |

– |

|||||||||

|

Repayment of bank loans |

(280,815,000) |

(198,417,000) |

(1,340,927) |

|||||||||

|

Repayment of bond payable |

(20,000,000) |

(20,000,000) |

(135,163) |

|||||||||

|

Payment of deferred IPO costs |

(129,983,403) |

(97,282,052) |

(657,445) |

|||||||||

|

Net cash used in financing activities |

(224,057,993) |

(380,137,533) |

(2,569,018) |

|||||||||

|

Net decrease in cash |

(375,122,040) |

(101,879,033) |

(688,512) |

|||||||||

|

Cash at the beginning of period |

2,729,282,346 |

2,538,554,638 |

17,155,874 |

|||||||||

|

Cash at the end of the period end |

2,354,160,306 |

2,436,675,605 |

16,467,362 |

|||||||||

|

Supplementary cash flow information |

||||||||||||

|

Cash paid for income taxes |

202,070,573 |

115,154,307 |

778,227 |

|||||||||

|

Cash paid for interest expenses |

11,651,537 |

12,325,868 |

83,300 |

|||||||||

SOURCE LEIFRAS Co., Ltd.

Rec Sports

Refugee-Focused Youth Sport Initiatives : Moving for Change

The ‘Moving for Change’ corporate social responsibility initiative is designed to support UNHCR’s Sports for Protection programming and Primary Impact education initiative. The first focuses on utilizing structured sports activities for child protection and psychosocial support, while the second aims at sustaining primary education in refugee settings by funding teachers and essential learning materials.

ANTA Group reports that these combined efforts have reached an estimated 300,000 children and adolescents to-date.

Image Credit: UNHCR/Eric Bakuli

Rec Sports

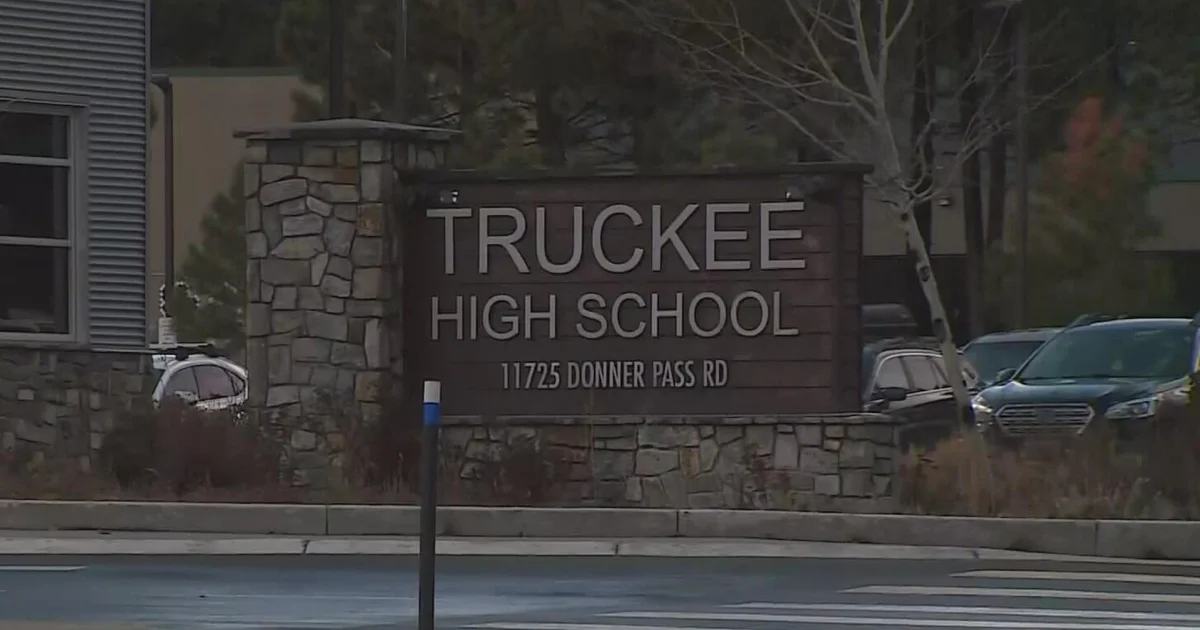

California orders Tahoe Truckee schools to leave Nevada sports over transgender athlete dispute

The California Department of Education is requiring the Tahoe Truckee Unified School District to follow state law in another clash over transgender athletes in youth sports in the state.

Currently, student-athletes in Tahoe Truckee Unified play sports in Nevada because of how close they are. But Nevada now bans transgender athletes in girls’ sports, which is against California state law.

So after decades of playing in Nevada, California’s Department of Education is requiring the Tahoe Truckee Unified School District to compete in California to comply with state laws that allow student athletes to compete based on their gender identity.

David Mack is the co-founder of Tahoe Pride and describes the new youth sports divide in the Tahoe region.

“So no one’s happy, it’s really sad, it’s quite tragic in that way,” Mack said. “People feel really upset that the school moved so fast on this. They feel blindsided, they feel not listened to, and then other people, like the trans kids, are getting steamrolled over like they’re not recognized in this argument.”

Nevada state lawmakers passed a law in April requiring a mandatory physical signed by a doctor to deem the athlete male or female based on their birth sex.

“This is a politically manufactured issue to try to divide people,” Mack said.

The Tahoe Truckee Unified School District is responding to the California Department of Education with a solution that the district legally join the California Interscholastic Federation in 2026, but continue to play in the Nevada Interscholastic Activities Association through 2028.

When asked if transgender athletes would be able to compete while operating in the NIAA, the district said it’s “still in the early stages of this transition, and many details are still being developed.”

In an October letter addressed to the California Department of Education, the school district’s attorney, Matthew Juhl-Darlington, said the Tahoe Truckee Unified is “not aware of any transgender youth who have expressed interest in participating in its 2025-2026 athletic programs.”

“While the NIAA recently updated its polices to define ‘male’ and ‘female’ based on sex assigned at birth and not as reflected in an individual’s gender identity, as required under California law, the District is interpreting and implementing this policy in a manner consistent with California’s legal requirements,” Juhl-Darlington said in the letter.

California Republican Rep. Kevin Kiley is opposed to the state order, arguing the weather conditions in Tahoe need to be considered.

“So in order to compete in a California league, you have to deal with this snowy weather and the travel dangers and so forth,” Kiley said.

The school board was expected to explain its solution to both join California’s CIF while playing in the NIAA through 2028 to parents and students Wednesday night at a board meeting.

So far, the California Department of Education has not said if it will accept this as a solution.

Rec Sports

Quincy University on probation after allowing over 100 ineligible students to participate in sports

QUINCY (WGEM) – Quincy University has to pay a $5,000 fine and spend two years on probation after the NCAA issued sanctions tied to more than 120 ineligible student-athletes who were allowed to play for the school.

The problem first surfaced in August 2024 when staff preparing the men’s and women’s soccer roster lists discovered three players had not received the required amateurism certification. That same day, another school alerted QU’s athletics office that a transfer student from Quincy also lacked the certification. The athletic office then launched a broader review.

What began as a handful of missing documents quickly grew. The department found potential eligibility problems for 95 student-athletes during the 2022-23 and 2023-24 school years. In November 2024, the department self-reported the findings to the NCAA and cooperated with an investigation.

The NCAA report names former Assistant Director of Athletics for Compliance Taylor Zerbe as central to the violations. Zerbe admitted to changing 74 student-athletes’ eligibility certifications and told investigators she felt overwhelmed by the workload. According to the report, she did not raise those concerns with her supervisor. Zerbe also admitted to knowing some athletes were ineligible when she altered their certification. She was not employed by QU when the problems were discovered.

QU’s internal review reached back to the 2021-22 school year, which coincided with Zerbe’s employment. That review uncovered additional violations. Overall, the NCAA says Zerbe falsified eligibility squad lists and that QU improperly certified 121 student-athletes across 17 sports.

The report details several consequences for those athletes: 93 practiced beyond the allowable 45-day period, 78 competed when they were not eligible, and 26 received financial aid while ineligible. The university also allowed 27 student-athletes to compete before their eligibility was formally reinstated, and two transfer student-athletes competed despite not meeting transfer eligibility rules.

QU and the NCAA agreed to a set of penalties intended to correct the system and increase transparency. In addition to the $5,000 fine and two-years probation, the school must tell prospective student-athletes in writing that the program is on probation and disclose the violations.

- Vacate any wins, records or participation that involved ineligible student-athletes from the time those athletes became ineligible until they were reinstated.

- Prevent head coaches from counting wins from games where ineligible athletes competed toward milestone totals (for example, a coach’s 100th win).

- Allow individuals who were eligible to keep any personal records or awards they earned.

- Undergo a comprehensive external review of certification and eligibility procedures during the probation period.

The NCAA report contains the full list of prescribed penalties.

Regarding Zerbe, the NCAA has barred her for two years from working at a member institution in any role that involves eligibility certification responsibilities.

QU declined on-camera interviews, but Athletic Director Josh Rabe told WGEM the university acted with integrity by self-reporting and taking steps to address the problem. Rabe said the department has tightened procedures and added what he called “a double-check to check the double-check.”

QU released the following statement:

Below is the full case summary:

Copyright 2025 WGEM. All rights reserved.

Rec Sports

Rep. Kim Hicks – Rochester DFL Legislators to Take Action on Rochester Sports Complex

PRESS RELEASE

Minnesota Legislature

Rochester Delegation

FOR IMMEDIATE RELEASE

December 18, 2025

HOUSE CONTACT: Marlee Schlegel

651-296-9873 or marlee.schlegel@house.mn.gov

SENATE CONTACT: Jack Vinck

651-440-5056 or jack.vinck@mnsenate.gov

Rochester DFL Legislators to Take Action on Rochester Sports Complex

Rochester, Minn – On Monday, Rochester Mayor Kim Norton vetoed the city council’s plan for a $65 million sports complex that is not reflective of the ballot initiative that funded the project in 2023. The city council is expected to overturn the Mayor’s veto at their December 22nd meeting.

In response, the DFL Rochester delegation intends to introduce legislation to revoke authorization of the Local Option Sales Tax they previously passed into law to fund the project. The delegation released the following statement:

“Rochester residents deserve to get what they paid and voted for. The updated plan for the sports complex no longer serves the best interests of Rochester residents. Rather, it serves a narrow set of special interests and ignores the community’s need for indoor recreation space — the very reason voters approved the project in the first place.

“Both as legislators who passed the legislation that allows the complex to be funded by the Local Option Sales Tax, and as voters who were excited to support the community-oriented initiative, we feel deceived. The changes made to the project to eliminate the indoor portion of the complex also eliminates the reason that many Rochester residents supported the project.”

Not long after the ballot approval of the complex, a new cost assessment was completed. Updated estimates came back at $120 million, nearly twice the cost of the initial $65 million proposal approved by voters.

“It’s unclear to us how such an expensive oversight was made on cost — and it’s equally unclear why the city council has chosen to prioritize the outdoor complex over the part of the project that won community support in the first place. Whatever the reason, the city council should either find a way to deliver on what voters approved or bring these significant changes back to the ballot.

“As legislators, we urge the Rochester council to change course and return to the original goal of meeting residents’ needs for indoor recreational space. After many conversations with stakeholders and community members, it is clear to us that as proposed, the project now falls outside of the parameters outlined in the original use of funds request. If the city council does not change course, we plan to introduce legislation to revoke authorization to use Local Option Sales Tax funds for the project. We remain committed to meeting the needs of our community and seeing that the residents of Rochester get what they’ve voted for, and we remain willing to work with the city council toward that goal.

“We want to see this project fully realized in a form that serves the entire community, as we were all assured it would.”

The DFL Rochester Delegation includes Senator Liz Boldon (DFL—Rochester), Representative Kim Hicks (DFL—Rochester), Representative Tina Liebling (DFL—Rochester) and Representative Andy Smith (DFL—Rochester).

###

Rec Sports

Tree collapses onto 2 young children waiting for school bus

TWIN FALLS, Idaho (KMVT/Gray News) – Two children in Idaho are critically injured after a tree fell on them while they were waiting for the school bus.

The Twin Falls County Sheriff’s Office said high winds caused rotten trees to fall on power lines before collapsing on the children.

The kids, both under the age of 10, and an older sibling were waiting outside for their bus when the tree collapsed. According to the sheriff’s office, the older sibling was not injured.

Aaron Hudson, the Twin Falls fire deputy chief, told KTVB first responders had to first get the kids out from the tree and downed power lines before they could prepare them for transport.

The sheriff’s office said one of the children was taken to the hospital by ambulance, while the other was airlifted.

According to Hudson, the weather conditions caused difficulties during transport. He said that it prevented the helicopter from going any further than the local hospital.

The family of the children has started a GoFundMe to help cover medical expenses.

Copyright 2025 KMVT via Gray Local Media, Inc. All rights reserved.

Rec Sports

Huskers year-end report shows concession sales up 75%, shares volleyball reseating data

LINCOLN, Neb. (KOLN) – Athletic Director Troy Dannen reflected on another year of Nebraska Athletics, sharing highlights and achievements of the men’s and women’s sports teams and hinting at what’s to come.

In competition, Huskers excelled in multiple sports:

- Nebraska volleyball team just completed a remarkable 33-1 season

- Wrestling finished as the national runner-up as a team and two Husker wrestlers won individual national championships

- Softball made an NCAA Super Regional appearance

- Football earned a second straight bowl berth

- Both basketball teams are undefeated and ranked in the AP Top 25.

This year, student-athletes set a school record with a 3.464 GPA, led the Big Ten Conference with 117 fall Academic All-Conference selections and once again posted a Graduation Success Rate over 90%, among the best in the nation. Dannen said they also made a positive impact in Lincoln and surrounding communities through their volunteer work.

Alcohol and food sales at Husker venues

The start of alcohol sales at all on-campus venues and the addition of new food options resulted in an increase of 75% in total concession revenue compared to last year, Dannen said.

“More than 313,000 alcoholic beverages were served and new food options were added to the menu, resulting in an increase of 75% in total concession revenue compared to last year,” Dannen said.

The introduction of alcohol sales came with concerns about the impact on fan behavior, but Dannen said it remained consistent with the previous five years.

John Cook Arena reseating

The John Cook Arena reseating process planned for 2026 has drawn criticism from longtime season ticket holders.

Dannen said the athletic staff has developed a plan that ensures that season-ticket holders in 2025 will be guaranteed season-tickets next year.

Dannen said 10% of current season-ticket holders did not use their tickets this year but rather sold those tickets through secondary markets. Those tickets, originally purchased for a total of $600,000 by those ticket holders, were then resold for a total of $3.2 million on the secondary market. Ticket use for this purpose is strictly prohibited.

The accounts that resold the entirety of their tickets will be excluded from the ability to purchase season-tickets in 2026, Dannen said.

1890 Nebraska winding down operations

With the implementation of the House settlement, 1890 Nebraska, Husker Athletics’ NIL collective, has begun winding down its operations.

“Hundreds of Husker fans donated millions of dollars over the past 24 months to support NIL for our student-athletes, as the rules at the time permitted,” Dannen said the in the letter.

The House settlement now prohibits much of what 1890 Nebraska provided, but in turn allows the university to share $20.5 million directly with student-athletes as they pay to license their NIL rights.

The five sports primarily supported by the collective include the Nebraska wrestling team, football team, two basketball teams and the volleyball team.

Facility upgrades

Several Nebraska athletic facilities saw enhancements including the completion of the track and field complex, along with new facilities for golf, rifle, swimming and diving and bowling.

In 2026, the athletics department is planning to renovate the softball and baseball clubhouses. Dannen said they are also looking forward to expanding the Devaney Center.

Entertainment

Three shows have been scheduled to take place inside Memorial Stadium next year. Zach Bryan will perform on April 25, the Savannah Bananas on June 13 and The Boys from Oklahoma on Aug. 22.

“Our plan is to continue to utilize our facilities for outside events to bring new events to our spaces and to help drive entertainment options in Lincoln,” Dannen said.

Due to anticipated construction, Nebraska Athletics will hold off on booking events for Memorial Stadium in 2027.

The athletics department is expecting to make two “big announcements on the Husker women’s sports front” early next year that will have a tremendous impact on its female student-athletes.

Click here to subscribe to our 10/11 NOW daily digest and breaking news alerts delivered straight to your email inbox.

Copyright 2025 KOLN. All rights reserved.

-

Motorsports1 week ago

Motorsports1 week agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Motorsports3 weeks ago

Motorsports3 weeks agoJo Shimoda Undergoes Back Surgery

-

NIL3 weeks ago

NIL3 weeks agoBowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoRobert “Bobby” Lewis Hardin, 56

-

Sports3 weeks ago

Wisconsin volleyball sweeps Minnesota with ease in ranked rivalry win

-

Motorsports1 week ago

Motorsports1 week agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Motorsports3 weeks ago

Motorsports3 weeks agoIncreased Purses, 19 Different Tracks Highlight 2026 Great Lakes Super Sprints Schedule – Speedway Digest

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw

-

Sports2 weeks ago

Sports2 weeks agoMen’s and Women’s Track and Field Release 2026 Indoor Schedule with Opener Slated for December 6 at Home

-

Motorsports3 weeks ago

Motorsports3 weeks agoMichael Jordan’s fight against NASCAR heads to court, could shake up motorsports