Rec Sports

LEIFRAS Co., Ltd. Reports Financial Results for the Nine Months Ended September 30, 2025

TOKYO, Dec. 18, 2025 /PRNewswire/ — LEIFRAS Co., Ltd. (Nasdaq: LFS) (the “Company” or “Leifras”), a sports and social business company dedicated to youth sports and community engagement, today announced its unaudited financial results for the nine months ended September 30, 2025.

Financial Highlights for the Nine Months Ended September 30, 2025

- Revenue was JPY8.6 billion ($57.8 million) for the nine months ended September 30, 2025, an increase of 15.3% from JPY7.4 billion for the same period last year.

- Gross profit was JPY2.4 billion ($16.3 million) for the nine months ended September 30, 2025, an increase of 18.1% from JPY2.0 billion for the same period last year.

- Gross margin was 28.2% for the nine months ended September 30, 2025, which increased from 27.5% for the same period last year.

- Net income was JPY226.7 million ($1.5 million) for the nine months ended September 30, 2025, an increase of 0.7% from JPY225.1 million for the same period last year.

- Basic and diluted earnings per share was JPY9.1 ($0.06) for the nine months ended September 30, 2025, compared to basic earnings per share of JPY9.0 and diluted earnings per share of JPY8.3 for the same period last year.

Operational Highlights for the Nine Months Ended September 30, 2025

- Number of members in the sports school business was 71,529 for the nine months ended September 30, 2025, an increase of 2.3% from 69,924 for the same period last year.

- Average membership duration in the sports school business was 1.84 years for the nine months ended September 30, 2025, an increase of 1.1% from 1.82 years for the same period last year.

- Revenue per capita in the sport school business, which we define as the sales revenue of the sports school business divided by the number of employees involved in that business, was JPY9.6 million ($0.06 million) for the nine months ended September 30, 2025, an increase of 6.2% from JPY9.0 million for the same period last year.

- Number of schools served under the social business segment was 360 for the nine months ended September 30, 2025, an increase of 53.2% from 235 for the same period last year.

- Revenue per capita in the social business, which we define as the sales revenue of the social business divided by the number of employees involved in that business, was JPY7.6 million ($0.05 million) for the nine months ended September 30, 2025, an increase of 18.6% from JPY6.4 million for the same period last year.

Mr. Kiyotaka Ito, the Representative Director and Chief Executive Officer of Leifras, commented, “We delivered solid financial results in the first nine months of fiscal year 2025, with meaningful growth across our key financial and operational metrics. Revenue increased 15.3% and net income grew 0.7% from the same period last year. By segment, sports school business achieved revenue growth of 8.9% and social business revenue increased by 36.4% year over year. Our performance shows continued strength of our sports school business and expanding demand for our social business. Notably, revenue per capita in our social business rose by 18.6% year over year, highlighting the increasing value and impact of our community-based services. Looking ahead, we see meaningful opportunities in Japan’s shifting policy landscape. The government’s ongoing Club Activity Reform, which focuses on shifting school-based club activity management to regional and private organizations, is expected to create an important long-term growth pathway for Leifras. We recently secured a new contract with the City of Nagoya, Aichi Prefecture, to manage facilities at municipal junior high schools in Nagoya, marking an important step in our expansion strategy. We intend to actively pursue additional opportunities as municipalities seek specialized partners to deliver high-quality sports and community programs. In the future, we remain committed to cultivating the non-cognitive skills of children, strengthening community well-being, enhancing our service offerings, and delivering sustainable value to our shareholders and society.”

Financial Results for the Nine Months Ended September 30, 2025

Revenue

Total revenue was JPY8.6 billion ($57.8 million) for the nine months ended September 30, 2025, an increase of 15.3% from JPY7.4 billion for the same period last year.

Sports school business revenue was JPY6.2 billion ($41.9 million) for the nine months ended September 30, 2025, an increase of 8.9% from JPY5.7 billion for the same period last year. The increase in revenue was mostly driven by: (i) an increase in the number of members by 1,605, from 69,924 as of September 30, 2024 to 71,529 as of September 30, 2025, resulting in an increase in revenue of JPY315.7 million ($2.1 million) and (ii) an increase in the number of customers who joined events hosted by the Company from 136,695 for the nine months ended September 30, 2024 to 142,843 for the nine months ended September 30, 2025, leading to an increase in the sports school business revenue by JPY112.6 million ($0.8 million).

Social business revenue was JPY2.4 billion ($15.9 million) for the nine months ended September 30, 2025, an increase of 36.4% from JPY1.7 billion for the same period last year. The increase in revenue was mostly driven by: (i) an increase in the number of schools by 125, from 235 as of September 30, 2024 to 360 as of September 30, 2025, resulting in an increase in revenue of JPY505.1 million ($3.4 million), and (ii) an increase in after-school daycare service revenue by JPY86.1 million ($0.6 million).

Cost of Revenue

Cost of revenue was JPY6.1 billion ($41.5 million) for the nine months ended September 30, 2025, an increase of 14.2% from JPY5.4 billion for the same period last year.

Gross Profit

Gross profit was JPY2.4 billion ($16.3 million) for the nine months ended September 30, 2025, an increase of 18.1% from JPY2.0 billion for the same period last year.

Gross margin was 28.2% for the nine months ended September 30, 2025, which increased from 27.5% for the same period last year.

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses were JPY2.1 billion ($13.9 million) for the nine months ended September 30, 2025, an increase of 14.0% from JPY1.8 billion for the same period last year. The increase was attributed to (i) the increase in salaries and welfare expenses of JPY137.5 million ($0.9 million) due to business expansion as well as an increase in headquarters personnel in preparation for the Company’s initial public offering (“IPO”), (ii) the increase in promotion fees of JPY8.2 million ($0.06 million) due to business expansion, (iii) the increase in office rental fees of JPY14.1 million ($0.1 million) due to business expansion, (iv) the increase in system maintenance fee expenses of JPY17.3 million ($0.1 million) incurred due to the increase in the number of employees, and (v) the increase in recruitment fees of JPY53.8 million ($0.4 million) due to business expansion as well as an increase in headquarters personnel in preparation for the Company’s IPO.

Other Income (Expenses), Net

Other expenses, net were JPY1.9 million ($0.01 million) for the nine months ended September 30, 2025, compared to other income, net of JPY28.7 million for the same period last year. The decrease was attributed to: (i) net franchise income collected (returned) of JPY27.4 million ($0.02 million), which was the payments refunded to the franchisees in connection with the transfer of certain business rights, (ii) an eviction compensation of JPY5.5 million ($0.04 million) received in connection with the vacating of a leased building. Interest expenses, net were JPY9.7 million ($0.07 million) for the nine months ended September 30, 2025, a decrease of 21.8% from JPY12.4 million for the same period last year.

Net Income

Net income was JPY226.7 million ($1.5 million) for the nine months ended September 30, 2025, an increase of 0.7% from JPY225.1 million for the same period last year.

Basic and Diluted Earnings per Share

Basic earnings per share was JPY9.10 ($0.06) for the nine months ended September 30, 2025, compared to JPY9.04 for the same period last year.

Diluted earnings per share was JPY9.10 ($0.06) for the nine months ended September 30, 2025, compared to JPY8.32 for the same period last year.

Financial Condition

As of September 30, 2025, the Company had cash of JPY2.4 billion ($16.5 million), compared to JPY2.5 billion as of December 31, 2024.

Net cash provided by operating activities was JPY326.7 million ($2.2 million) for the nine months ended September 30, 2025, compared to net cash used in operating activities of JPY105.4 million for the same period last year.

Net cash used in investing activities was JPY48.5 million ($0.3 million) for the nine months ended September 30, 2025, compared to JPY45.7 million for the same period last year.

Net cash used in financing activities was JPY380.1 million ($2.6 million) for the nine months ended September 30, 2025, compared to JPY224.1 million for the same period last year.

Financial Guidance

The Company is projecting total revenue to be between JPY11.6 billion and JPY11.9 billion ($78.1 million and $80.5 million) for the fiscal year ending December 31, 2025, an increase of approximately 11.9% to 15.3% from JPY10.3 billion ($69.8 million) for the fiscal year ended December 31, 2024.

Income from operations is projected to be between JPY580.0 million and JPY696.5 million ($3.9 million and $4.7 million) for the fiscal year ending December 31, 2025, an increase of 11.6% to 34.0% from JPY519.8 million ($3.5 million) for the fiscal year ended December 31, 2024.

These projections are based on the assumption that no business acquisitions, restructuring activities, or legal settlements will take place during the period.

Exchange Rate Information

This announcement contains translations of certain Japanese Yen (“JPY”) amounts into U.S. dollars (“USD,” or “$”) for the convenience of the reader. Translations of amounts from JPY into USD have been made at the exchange rate of JPY147.97 = $1.00, the exchange rate on September 30, 2025 set forth in the H.10 statistical release of the United States Federal Reserve Board.

About LEIFRAS Co., Ltd.

Headquartered in Tokyo, Leifras is a sports and social business company dedicated to youth sports and community engagement. The Company primarily provides services related to the organization and operations of sports schools and sports events for children. As of December 31, 2024, Leifras was recognized as one of Japan’s largest operators of children’s sports schools in terms of both membership and facilities by Tokyo Shoko Research. The Company’s approach to sports education emphasizes the development of non-cognitive skills, following the teaching principle “acknowledge, praise, encourage, and motivate.” The holistic approach that integrates physical and mental development sets Leifras apart in the industry. Building upon deep experience and know-how in sports education, Leifras also operates a robust social business sector, dispatching sports coaches to meet various community needs with the aim to promote physical health, social inclusion, and community well-being across different demographics. For more information, please visit the Company’s website: https://ir.leifras.co.jp/.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may,” or other similar expressions in this press release. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. These statements are subject to uncertainties and risks, including, but not limited to, the uncertainties related to market conditions, and other factors discussed in the “Risk Factors” section of the registration statement filed with the U.S. Securities and Exchange Commission (the “SEC”). Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the registration statement and other filings with the SEC. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov.

For more information, please contact:

LEIFRAS Co., Ltd.

Investor Relations Department

Email: [email protected]

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: [email protected]

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||||||

|

December 31, |

September 30, |

September 30, |

||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

(Unaudited) |

(Unaudited) |

|||||||||||

|

ASSETS |

||||||||||||

|

CURRENT ASSETS |

||||||||||||

|

Cash |

2,538,554,638 |

2,436,675,605 |

16,467,362 |

|||||||||

|

Accounts receivable, net |

518,398,551 |

555,775,583 |

3,756,002 |

|||||||||

|

Short-term investments |

4,935,000 |

5,075,000 |

34,297 |

|||||||||

|

Inventories, net |

24,468,188 |

20,757,063 |

140,279 |

|||||||||

|

Prepaid expenses |

182,278,232 |

201,888,793 |

1,364,390 |

|||||||||

|

Other current assets |

34,381,843 |

57,886,907 |

391,207 |

|||||||||

|

TOTAL CURRENT ASSETS |

3,303,016,452 |

3,278,058,951 |

22,153,537 |

|||||||||

|

NON-CURRENT ASSETS |

||||||||||||

|

Property and equipment, net |

53,805,279 |

99,293,143 |

671,035 |

|||||||||

|

Finance lease right-of-use assets |

208,611,550 |

228,794,098 |

1,546,219 |

|||||||||

|

Operating lease right-of-use assets |

337,330,750 |

513,349,897 |

3,469,284 |

|||||||||

|

Intangible assets, net |

39,250,078 |

27,980,475 |

189,096 |

|||||||||

|

Goodwill |

27,999,994 |

27,999,994 |

189,228 |

|||||||||

|

Deferred tax assets, net |

214,671,578 |

189,283,332 |

1,279,201 |

|||||||||

|

Deferred initial public offering (“IPO”) costs |

157,482,065 |

254,764,117 |

1,721,728 |

|||||||||

|

Long-term deposits |

150,407,276 |

150,210,192 |

1,015,140 |

|||||||||

|

Other non-current assets |

3,090,205 |

9,784,796 |

66,127 |

|||||||||

|

TOTAL NON-CURRENT ASSETS |

1,192,648,775 |

1,501,460,044 |

10,147,058 |

|||||||||

|

TOTAL ASSETS |

4,495,665,227 |

4,779,518,995 |

32,300,595 |

|||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||

|

CURRENT LIABILITIES |

||||||||||||

|

Short-term loans |

700,000,000 |

700,000,000 |

4,730,689 |

|||||||||

|

Current portion of long-term loans |

230,785,000 |

169,252,000 |

1,143,826 |

|||||||||

|

Bond payable, current |

40,000,000 |

40,000,000 |

270,325 |

|||||||||

|

Accounts payable |

168,281,568 |

114,243,578 |

772,073 |

|||||||||

|

Accrued liabilities |

1,109,740,581 |

1,184,636,104 |

8,005,921 |

|||||||||

|

Income tax payable |

75,374,800 |

3,301,800 |

22,314 |

|||||||||

|

Contract liabilities, current |

147,628,310 |

267,364,483 |

1,806,883 |

|||||||||

|

Amount due to a director |

1,000,000 |

– |

– |

|||||||||

|

Finance lease liabilities, current |

71,681,545 |

83,549,523 |

564,638 |

|||||||||

|

Operating lease liabilities, current |

110,889,134 |

132,923,377 |

898,313 |

|||||||||

|

Other current liabilities |

195,952,191 |

156,907,705 |

1,060,403 |

|||||||||

|

TOTAL CURRENT LIABILITIES |

2,851,333,129 |

2,852,178,570 |

19,275,385 |

|||||||||

|

NON-CURRENT LIABILITIES |

||||||||||||

|

Long-term loans, net of current portion |

175,452,000 |

38,568,000 |

260,648 |

|||||||||

|

Bond payable, non-current |

56,807,020 |

37,833,335 |

255,682 |

|||||||||

|

Contract liabilities, non-current |

10,615,635 |

14,507,411 |

98,043 |

|||||||||

|

Finance lease liabilities, non-current |

140,333,247 |

143,881,183 |

972,367 |

|||||||||

|

Operating lease liabilities, non-current |

207,353,977 |

364,551,378 |

2,463,684 |

|||||||||

|

Assets retirement obligations |

12,914,758 |

30,671,626 |

207,283 |

|||||||||

|

TOTAL NON-CURRENT LIABILITIES |

603,476,637 |

630,012,933 |

4,257,707 |

|||||||||

|

TOTAL LIABILITIES |

3,454,809,766 |

3,482,191,503 |

23,533,092 |

|||||||||

|

COMMITMENTS AND CONTINGENCIES |

||||||||||||

|

SHAREHOLDERS’ EQUITY |

||||||||||||

|

Ordinary shares |

80,500,000 |

80,500,000 |

544,029 |

|||||||||

|

Additional paid-in capital |

748,840,080 |

778,624,844 |

5,262,045 |

|||||||||

|

Treasury shares |

(100,012,265) |

(100,012,265) |

(675,896) |

|||||||||

|

Retained earnings |

311,527,646 |

538,214,913 |

3,637,325 |

|||||||||

|

TOTAL SHAREHOLDERS’ EQUITY |

1,040,855,461 |

1,297,327,492 |

8,767,503 |

|||||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

4,495,665,227 |

4,779,518,995 |

32,300,595 |

|||||||||

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

||||||||||||

|

For the nine months ended |

||||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

NET REVENUE |

7,419,460,643 |

8,556,096,390 |

57,823,183 |

|||||||||

|

Cost of revenue |

(5,378,876,612) |

(6,145,159,916) |

(41,529,769) |

|||||||||

|

GROSS PROFIT |

2,040,584,031 |

2,410,936,474 |

16,293,414 |

|||||||||

|

Selling, general, and administrative expenses |

(1,802,047,253) |

(2,055,180,818) |

(13,889,172) |

|||||||||

|

INCOME FROM OPERATIONS |

238,536,778 |

355,755,656 |

2,404,242 |

|||||||||

|

OTHER INCOME (EXPENSE) |

||||||||||||

|

Interest income |

325,182 |

3,801,610 |

25,691 |

|||||||||

|

Interest expense |

(12,751,685) |

(13,514,164) |

(91,330) |

|||||||||

|

Grant income |

14,205,788 |

14,902,919 |

100,716 |

|||||||||

|

Unrealized (loss) gain on short-term investment |

(168,000) |

140,000 |

946 |

|||||||||

|

Loss on disposal of long-lived assets |

– |

(168,973) |

(1,142) |

|||||||||

|

Loss on disposal of a subsidiary |

(753,900) |

– |

– |

|||||||||

|

Other income (expense), net |

15,438,598 |

(16,773,644) |

(113,358) |

|||||||||

|

Total other income (expense), net |

16,295,983 |

(11,612,252) |

(78,477) |

|||||||||

|

INCOME BEFORE INCOME TAX PROVISION |

254,832,761 |

344,143,404 |

2,325,765 |

|||||||||

|

PROVISION FOR INCOME TAXES |

||||||||||||

|

Current |

(69,425,173) |

(92,067,891) |

(622,206) |

|||||||||

|

Deferred |

39,664,246 |

(25,388,246) |

(171,577) |

|||||||||

|

Total provision for income taxes |

(29,760,927) |

(117,456,137) |

(793,783) |

|||||||||

|

NET INCOME |

225,071,834 |

226,687,267 |

1,531,982 |

|||||||||

|

WEIGHTED AVERAGE NUMBER OF ORDINARY SHARES |

||||||||||||

|

Basic |

24,910,660 |

24,910,619 |

24,910,619 |

|||||||||

|

Diluted |

27,066,715 |

24,913,619 |

24,913,619 |

|||||||||

|

EARNINGS PER SHARE |

||||||||||||

|

Basic |

9.04 |

9.10 |

0.06 |

|||||||||

|

Diluted |

8.32 |

9.10 |

0.06 |

|||||||||

|

LEIFRAS CO., LTD. AND SUBSIDIARIES |

||||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||||||

|

For the nine months ended |

||||||||||||

|

2024 |

2025 |

2025 |

||||||||||

|

JPY |

JPY |

US$ |

||||||||||

|

Cash flows from operating activities |

||||||||||||

|

Net income |

225,071,834 |

226,687,267 |

1,531,982 |

|||||||||

|

Adjustments to reconcile net income to net cash provided by operating activities |

||||||||||||

|

Depreciation and amortization expense |

90,057,762 |

96,233,315 |

650,357 |

|||||||||

|

Loss on disposal of a subsidiary |

753,900 |

– |

– |

|||||||||

|

Provision for expected credit loss |

2,771,782 |

9,208,096 |

62,229 |

|||||||||

|

Loss on disposal of property and equipment |

– |

168,973 |

1,142 |

|||||||||

|

Accounts receivable written off as uncollectible |

– |

28,558 |

193 |

|||||||||

|

Provision for inventory impairment |

3,403,261 |

424,180 |

2,867 |

|||||||||

|

Unrealized loss (gain) on short-term investment |

168,000 |

(140,000) |

(946) |

|||||||||

|

Other non-cash expenses (income) |

1,100,148 |

29,173,060 |

197,155 |

|||||||||

|

Deferred tax expense (benefit) |

(39,664,246) |

25,388,246 |

171,577 |

|||||||||

|

Changes in operating assets and liabilities |

||||||||||||

|

Accounts receivable, net |

(1,051,687) |

(46,613,686) |

(315,021) |

|||||||||

|

Inventories |

(13,808,125) |

3,286,945 |

22,214 |

|||||||||

|

Prepaid expenses |

(105,900,505) |

(19,854,842) |

(134,182) |

|||||||||

|

Long-term deposits |

(6,998,055) |

197,084 |

1,332 |

|||||||||

|

Amount due from a director |

33,577,065 |

– |

– |

|||||||||

|

Other current assets |

(25,969,080) |

(23,505,064) |

(158,850) |

|||||||||

|

Other non-current assets |

(10,722,988) |

(6,694,591) |

(45,243) |

|||||||||

|

Accounts payable |

(61,359,477) |

(54,037,990) |

(365,196) |

|||||||||

|

Accrued liabilities |

(204,167,728) |

74,895,523 |

506,153 |

|||||||||

|

Contract liabilities |

121,711,898 |

123,627,949 |

835,493 |

|||||||||

|

Operating lease liabilities |

(400,151) |

3,212,497 |

21,710 |

|||||||||

|

Income tax payable |

(149,952,500) |

(72,073,000) |

(487,078) |

|||||||||

|

Amount due to a director |

– |

(1,000,000) |

(6,758) |

|||||||||

|

Other current liabilities |

36,020,082 |

(41,875,805) |

(283,002) |

|||||||||

|

Net cash (used in) provided by operating activities |

(105,358,810) |

326,736,715 |

2,208,128 |

|||||||||

|

Cash flows from investing activities |

||||||||||||

|

Cash outflow due to reduction in consolidated entities |

(17,257,489) |

– |

– |

|||||||||

|

Purchase of property and equipment |

(11,926,248) |

(42,598,215) |

(287,884) |

|||||||||

|

Purchase of intangible assets |

(16,521,500) |

(5,880,000) |

(39,738) |

|||||||||

|

Net cash used in investing activities |

(45,705,237) |

(48,478,215) |

(327,622) |

|||||||||

|

Cash flows from financing activities |

||||||||||||

|

Payment of finance lease liabilities |

(43,259,590) |

(64,438,481) |

(435,483) |

|||||||||

|

Proceeds from bank loans |

250,000,000 |

– |

– |

|||||||||

|

Repayment of bank loans |

(280,815,000) |

(198,417,000) |

(1,340,927) |

|||||||||

|

Repayment of bond payable |

(20,000,000) |

(20,000,000) |

(135,163) |

|||||||||

|

Payment of deferred IPO costs |

(129,983,403) |

(97,282,052) |

(657,445) |

|||||||||

|

Net cash used in financing activities |

(224,057,993) |

(380,137,533) |

(2,569,018) |

|||||||||

|

Net decrease in cash |

(375,122,040) |

(101,879,033) |

(688,512) |

|||||||||

|

Cash at the beginning of period |

2,729,282,346 |

2,538,554,638 |

17,155,874 |

|||||||||

|

Cash at the end of the period end |

2,354,160,306 |

2,436,675,605 |

16,467,362 |

|||||||||

|

Supplementary cash flow information |

||||||||||||

|

Cash paid for income taxes |

202,070,573 |

115,154,307 |

778,227 |

|||||||||

|

Cash paid for interest expenses |

11,651,537 |

12,325,868 |

83,300 |

|||||||||

SOURCE LEIFRAS Co., Ltd.

Rec Sports

Binghamton mayor talks housing, public safety

This week, JoDee Kenney sits down with Binghamton Mayor Jared Kraham.

Binghamton Mayor Jared Kraham takes the Spectrum News team on a walk-and-talk to various projects around the city. Mayor Kraham talks about the overseeing of significant developments in Dickinson, including the largest housing construction project, Town and Country apartments, with 256 units of affordable housing. He shares how the project is valued in tens of millions and features modern, energy-efficient units, and addresses past issues of crime and poor housing conditions. Mayor Kraham highlights how the city is also developing a new Recreation Center, repurposed from a local church, to serve as a hub for youth sports and community activities. He shares how the recreation center includes a full-size gym, classroom space, and a commercial kitchen. Mayor Kraham explains that these initiatives aim to enhance community life and provide permanent, affordable housing options.

Mayor Kraham also talks about community policing and emphasizes the need for increased staffing to allow officers to engage with the community effectively. He highlights the city’s low crime rate, attributing it to community policing, gun violence reduction initiatives funded by $1 million from the American Rescue Plan Act, and the use of advanced technology like license plate readers and street cameras. Mayor Kraham also details the revitalization of Clinton Street, a historic downtown area, through a $10 million state initiative to create a walkable, eclectic district that supports housing and regional tourism.

And finally, Mayor Kraham talks about being inspired by his father’s government service and his own interest in public communications. He discusses being a Syracuse University dual major in political science and broadcast journalism and emphasizes the importance of local politics and student engagement. He highlights his efforts to support small businesses, influenced by his experience working at his parents’ furniture store. Mayor Kraham also talks about his passion for local music, dining, and sports, and outlined his 2026 goals: revitalizing Clinton Street, enhancing public safety, and addressing affordable housing to foster neighborhood development.

You can watch the full interviews above. And be sure to tune in for a look inside the biggest issues impacting upstate New York, on In Focus with JoDee Kenney — every Sunday on Spectrum News 1.

Rec Sports

Power of basketball to connect people around the globe celebrated with World Basketball Day

Can basketball be a force that helps bring a divided nation, a divided world together?

That’s the dream of World Basketball Day. A day — designated by the United Nations to be commemorated every Dec. 21 — where we celebrate the power of basketball to unite communities and connect people around the world.

Advertisement

“There’s increasingly few spaces left where we humanize each other, where we actually spend time face-to-face, eye contact, wordlessly negotiating and sharing and creating space with and between each other — doing the kinds of intimate, continuous, fluid communication that the space of a basketball court fosters,” said David Hollander, an NYU professor who helped create World Basketball Day. “The game itself is an empathy lab. And so, yes, I believe it is one of the greatest exercises that people can engage in to begin to knit back together the social fabric.”

It’s a dream shared by the NBA and people who love basketball around the globe — and it’s a chance to give back to the community through the game.

“World Basketball Day is a chance to celebrate the game and impact it has on people everywhere,” the Celtics’ Jayson Tatum said. “Basketball has had such a positive influence on my life, and I hope I can pass along the joy and skills I’ve learned, both on- and-off the court, to the next generation.”

The NBA is doing this in part by announcing the extension of its longstanding relationship with the YMCA, collaborating on year-long youth basketball and community-focused programming that will reach 6 million youth in the next year. World Basketball Day also means events to connect with youth around the nation and around the globe.

Advertisement

“World Basketball Day takes on a special meaning this year as we commemorate the 175th anniversary of the YMCA, where the sport was first invented 134 years ago,” NBA Commissioner Adam Silver said. “We are thrilled to join our many friends in the basketball community to celebrate the game’s impact and influence around the world.”

What is World Basketball Day?

World Basketball Day is the brainchild of Hollander, an NYU professor with the Preston Robert Tisch Institute for Global Sport. Holland teaches a course at NYU called “How Basketball Can Save the World.”

“It’s a very popular elective that treats basketball like a philosophy,” Hollander said. “I created principles that I believe basketball stands for — the way you play basketball can be understood as a really good guide for how we can behave with each other. The way the game was intended to be structured can tell us a lot about how we ought to structure a society, and it’s a game intrinsically of hope.”

Advertisement

He eventually turned that course into a book, in which he drafted a UN resolution for World Basketball Day. That idea took off in a way he did not fully expect.

“Basketball was always intended to be stateless, borderless, global right from the very start,” Hollander said. “And as the world tries to solve the problems that only a whole world can solve, I suggested that we ought to start somewhere where the whole world is happy and the whole world comes together, and the whole world agrees. And, I said, that place is basketball, and it should have a day.

“That’s how it began.”

World Basketball Day was established in 2023 by the United Nations. Not coincidentally, World Basketball Day is observed each year on Dec. 21, the date in 1891 that Dr. James Naismith hung up the peach baskets and first introduced the game of basketball at the YMCA in Springfield, Mass.

Advertisement

Part of what World Basketball Day has become is a focus on the future and connecting people. For example, last week marked the third annual United Nations diplomats basketball game, in which more than 60 diplomats from 30 countries played pickup at the local YMCA.

“In other words, these peacemakers are actually doing the thing that I hope basketball on a grand scale achieves,” Hollander said.

It’s not just the NBA and the United States celebrating this, it is FIBA — the international governing body of basketball — and its coaching clinics and camps in Africa on this day. It’s local hoopers and content creators from Australia, Indonesia, Japan and the Philippines featuring World Basketball Day content across the NBA’s localized channels in those countries.

“Basketball has always been global,” Hollander said. “Dr James Naismith sent emissaries to teach basketball in 1895, as soon as he could right after he invented the game, to Europe to Australia, to China to South America. So it is no surprise to me that coming from all corners of the world are some of the most eloquent speakers of the language of basketball.”

Advertisement

That language of basketball and how it can be a unifying force deserves to be celebrated. And, much like Christmas, we could use more of that force and spirit all year-round.

Rec Sports

Saratoga Springs Youth Ballet performs ‘The Nutcracker’

ALBANY — The Saratoga Springs Youth Ballet brought its presentation of “The Nutcracker” to the UAlbany Performing Arts Center on Saturday.

A Christmas classic, the ballet is based on “The Nutcracker and the Mouse King,” an 1816 short story written by E. T. A. Hoffmann. The version performed by the youth ballet, choreographed and re-staged by Cristiane Santos and Joan Kilgore Anderson, featured more than 120 local dancers between the ages of 5 and 18, according to the nonprofit dance group’s website.

The show featured special guests such as Sarah MacGregor and Jethro Paine of Boulder Ballet and Andre Malo Robles as Herr Drosselmeyer.

Another performance is scheduled for Sunday at 2 p.m. That show is sold out, according to the event website.

Rec Sports

Obituary: Donny Wayne Stricklin, Jr.

Funeral services for Donny Wayne Stricklin, Jr., 54, of Bremen, AL will be 2 p.m. Sunday, December 21st at Hanceville Funeral Home Chapel. Burial will follow the service at Bethany Baptist Church. Bro. Brandon Stripling & Bro. Jay Washburn will officiate services. The family will welcome friends for visitation at Hanceville Funeral Home on Saturday, December 20th from 6 p.m. to 8 p.m.

Donny was a man whose life was defined by service, loyalty, and a deep love for people. Known for his big heart and even bigger sense of humor, Donny never met a stranger—only friends he hadn’t made yet.

A devoted and lifelong Alabama football fan, Donny proudly supported the Crimson Tide with passion that was impossible to miss even if it meant delaying an important event. To his grandchildren, he was lovingly known as “Pee Pee,” a title he cherished and lived up to every day through his constant presence, encouragement, and love. Donny worked for several years at Sansom Equipment, where his role went far beyond a job description. He treated his coworkers as family, always showing up for them—whether it was work-related or not. His loyalty and care for others were hallmarks of who he was.

A dedicated volunteer firefighter and EMT for many years, Donny selflessly served his community, willing to help in moments when others needed him most. His commitment extended to youth as well, as he devoted countless hours to Cold Springs Athletic youth sports, including Upwards Basketball, and proudly supported the RCBC Youth Council. He believed deeply in guiding and uplifting young people. Donny was truly a “friend’s friend”—someone who would stand by anyone, whether he knew them well or had just met them. His love for jokes and playful spirit were legendary, often expressed through perfectly timed—or hilariously inappropriately timed—music, guaranteeing laughter wherever he went.

Above all else, Donny loved his family. His loving wife, children and grandchildren were the center of his world, and he poured his heart into being present, supportive, and proud of each of them. Donny leaves behind a legacy of kindness, service, laughter, and love that will live on in the many lives he touched. He will be deeply missed and forever remembered.

Survivors include his loving wife, Lorrie Stricklin; children, Brennen (Allyson) Stricklin and Hannah Stricklin; grandchildren, Agustus Wayne Stricklin, Ivy Faye Stricklin and Omari Cooper Stricklin; father, Donald Wayne Stricklin Sr. (Rita); siblings, Danny Stricklin (Gloria), Devan Ponder (Brian), David Still (Kimberly) and James Still (Jennifer), step-brother, Tim Busbee (Rebecca); brother-in-law, Jamie Akin (Jan); grandfather, Leldon Stricklin; and a host of many nieces, nephews and cousins.

Mr. Stricklin was preceded in death by his mother, Modene Campbell Stricklin; grandparents, Mae Stricklin and Ogle & Oleta Campbell; step-sister, Tonya Busbee; niece, Rhianna Busbee; and mother and father-in-law, Gary and Linda Akin.

To celebrate his passion for Alabama football, the family asks that guests consider wearing causal Alabama football attire on Saturday or your favorite college football team.

Also, he was cared for beautifully by the liver transplant team, ABTX team, SICU team, and PCCU team at UAB.

Hanceville Funeral Home is honored to serve the Stricklin Family.

Rec Sports

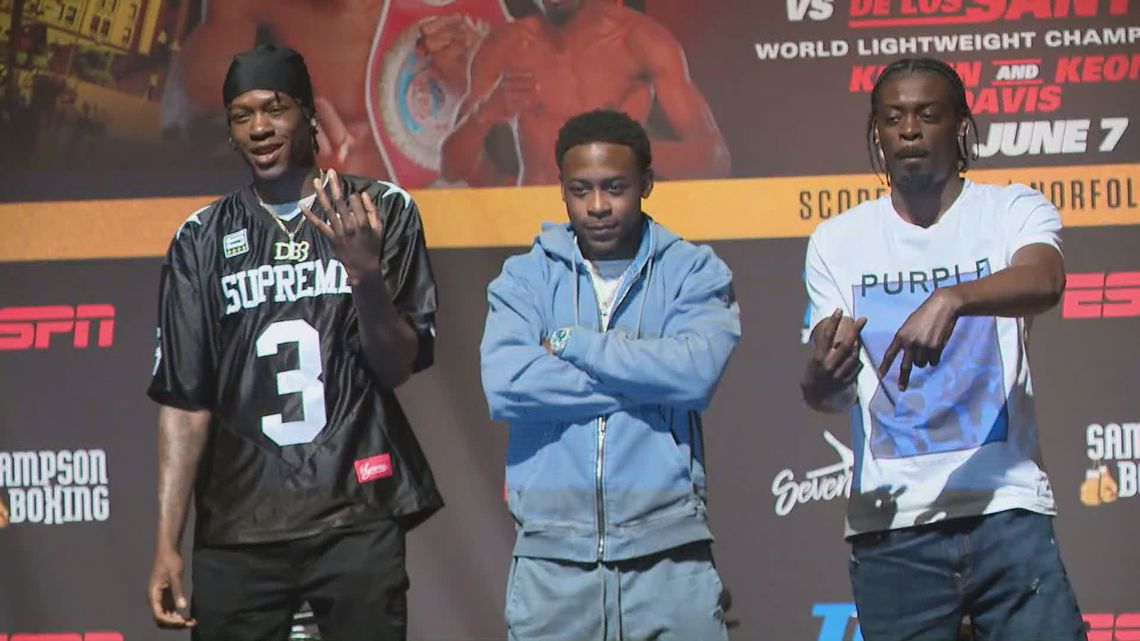

DB3 Boxing to host free community holiday event in Norfolk

DB3 Boxing hosts a free community holiday event on Monday, Dec. 22, in Norfolk with gifts, games, youth activities, and family-friendly fun.

NORFOLK, Va. — DB3 Boxing, a nonprofit organization focused on youth development through athletics and mentorship, will host a free community holiday celebration on Monday, Dec. 22, at Lambert’s Point Community Center in Norfolk.

The event, titled DB3 Boxing Community Day: Home for the Holidays, is scheduled from noon to 6 p.m. and is open to the public. Organizers say the gathering is designed to bring families together while offering recreational activities and seasonal support at no cost to attendees.

DB3 Boxing was founded by the Davis family and emphasizes discipline, education, and positive engagement for young people through sports. According to the organization, the Community Day will feature gift giveaways, free haircuts and hairstyling, nail services, youth dance performances, basketball games, and family-friendly attractions such as a bounce house.

The event will take place at Lambert’s Point Community Center, located at 1251 West 42nd Street.

The three brothers, professional boxers Keyshawn Davis, Kelvin Davis, and Keon Davis who are from Norfolk, have represented the city at the national and international level and remain involved in community-based initiatives through DB3 Boxing.

In addition to the on-site activities, organizers said attendees will have an opportunity to learn about DB3 Boxing programs and a chance to connect with the organization during Super Bowl week events in San Jose, California.

Admission is free, but registration is available through Eventbrite for those seeking additional information or to reserve tickets. Organizers note that the event is intended as a community-wide holiday gathering and does not require prior involvement with DB3 Boxing to attend.

Rec Sports

Science says we’ve been nurturing “gifted” kids all wrong

Exceptional performers play a major role in driving innovation and tackling some of the world’s most urgent challenges. Because of this, societies have a strong stake in understanding how top-level talent develops. A new review published in the journal Science argues that many long standing approaches to gifted education and talent development rest on flawed assumptions. For the first time, an international and interdisciplinary research team has brought together evidence on how world-class performers emerge in science, classical music, chess, and sports.

For decades, research on giftedness and expertise has followed a familiar model. Outstanding achievement was thought to depend on strong early performance, such as excelling in school subjects, sports, or concerts, combined with specific abilities like intelligence, physical coordination, or musical talent. These traits were believed to need years of intense, discipline-focused training to produce elite results. As a result, many talent programs concentrate on identifying the top young performers early and pushing them to specialize quickly.

According to new findings led by Arne Güllich, professor of sports science at RPTU University Kaiserslautern-Landau, this approach may not be the most effective way to nurture future high achievers.

Why Earlier Research Missed the Full Picture

Until recently, most studies of giftedness focused on young or sub-elite performers. These groups included school and college students, youth athletes, young chess players, and musicians training at conservatories. However, evidence drawn from adult world-class athletes has begun to challenge conclusions based on these earlier samples.

“Traditional research into giftedness and expertise did not sufficiently consider the question of how world-class performers at peak performance age developed in their early years,” Arne Güllich explains. The goal of the new Review was to address this gap by examining how elite performers actually progressed over time.

To do this, Güllich worked with an international research team that included Michael Barth, assistant professor of sports economics at the University of Innsbruck, D. Zach Hambrick, professor of psychology at Michigan State University, and Brooke N. Macnamara, professor of psychology at Purdue University. Their findings are now published in Science.

Pooling Evidence Across Fields

The researchers reexamined large datasets from many previous studies, analyzing the developmental histories of 34,839 top-level performers from around the world. The group included Nobel Prize winners in the sciences, Olympic medalists, elite chess players, and leading classical music composers. This effort made it possible, for the first time, to compare how world-class performers develop across very different disciplines.

Early Stars Are Rarely Future Legends

One of the most striking conclusions is that elite performers follow a developmental path that differs from long-held assumptions. “And a common pattern emerges across the different disciplines,” Güllich notes.

First, individuals who stand out as the best at a young age are usually not the same people who become the best later in life. Second, those who eventually reached the highest levels tended to improve gradually during their early years and were not top performers within their age group. Third, future world-class achievers typically did not focus on a single discipline early on. Instead, they explored a range of activities, such as different academic subjects, musical genres, sports, or professions (e.g., different subjects of study, genres of music, sports, or professions).

How Variety Builds Stronger Performers

The researchers propose three ideas that may help explain these patterns. “We propose three explanatory hypotheses for discussion,” says Güllich.

The search-and-match hypothesis suggests that exposure to multiple disciplines increases the likelihood of eventually finding the best personal fit. The enhanced-learning-capital hypothesis proposes that learning in diverse areas strengthens overall learning capacity, making it easier to continue improving later at the highest level within a chosen field. The limited-risks hypothesis argues that engaging in multiple disciplines reduces the chance of setbacks such as burnout, unhealthy work-rest imbalances, loss of motivation, or physical injury in psychomotor disciplines (sports, music).

Arne Güllich summarizes the combined effect of these factors: “Those who find an optimal discipline for themselves, develop enhanced potential for long-term learning, and have reduced risks of career-hampering factors, have improved chances of developing world-class performance.”

Encouraging Breadth Instead of Early Specialization

Based on these findings, Güllich offers clear guidance on how young talent should be supported. The evidence suggests avoiding early specialization in a single field. Instead, young people should be encouraged and given opportunities to explore several areas of interest and receive support in two or three disciplines.

These areas do not need to be closely related. Combinations like language and mathematics, or geography and philosophy, can be equally valuable. Albert Einstein provides a famous example — one of the most important physicists, who was also deeply engaged with music and played the violin from an early age.

Implications for Policy and Practice

The authors argue that these insights should inform changes in how talent development programs are designed. Policymakers and program leaders can move toward approaches grounded in evidence rather than tradition.

As Güllich concludes, “This may enhance opportunities for the development of world-class performers — in science, sports, music, and other fields.”

-

Motorsports2 weeks ago

Motorsports2 weeks agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Sports3 weeks ago

Sports3 weeks agoMen’s and Women’s Track and Field Release 2026 Indoor Schedule with Opener Slated for December 6 at Home

-

Motorsports2 weeks ago

Motorsports2 weeks agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoBlack Bear Revises Recording Policies After Rulebook Language Surfaces via Lever

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoDavid Blitzer, Harris Blitzer Sports & Entertainment

-

Motorsports2 weeks ago

Motorsports2 weeks agoJR Motorsports Confirms Death Of NASCAR Veteran Michael Annett At Age 39

-

Motorsports2 weeks ago

Motorsports2 weeks agoRick Ware Racing switching to Chevrolet for 2026

-

Sports2 weeks ago

West Fargo volleyball coach Kelsey Titus resigns after four seasons – InForum

-

Sports2 weeks ago

Elliot and Thuotte Highlight Men’s Indoor Track and Field Season Opener