C-suite leaders from Tonal, Hydrow and iFIT pushed back on doom narratives and spotlighted where connected fitness is headed next

The connected fitness category may have lost its pandemic-era sizzle, but according to industry leaders, it’s far from obsolete.

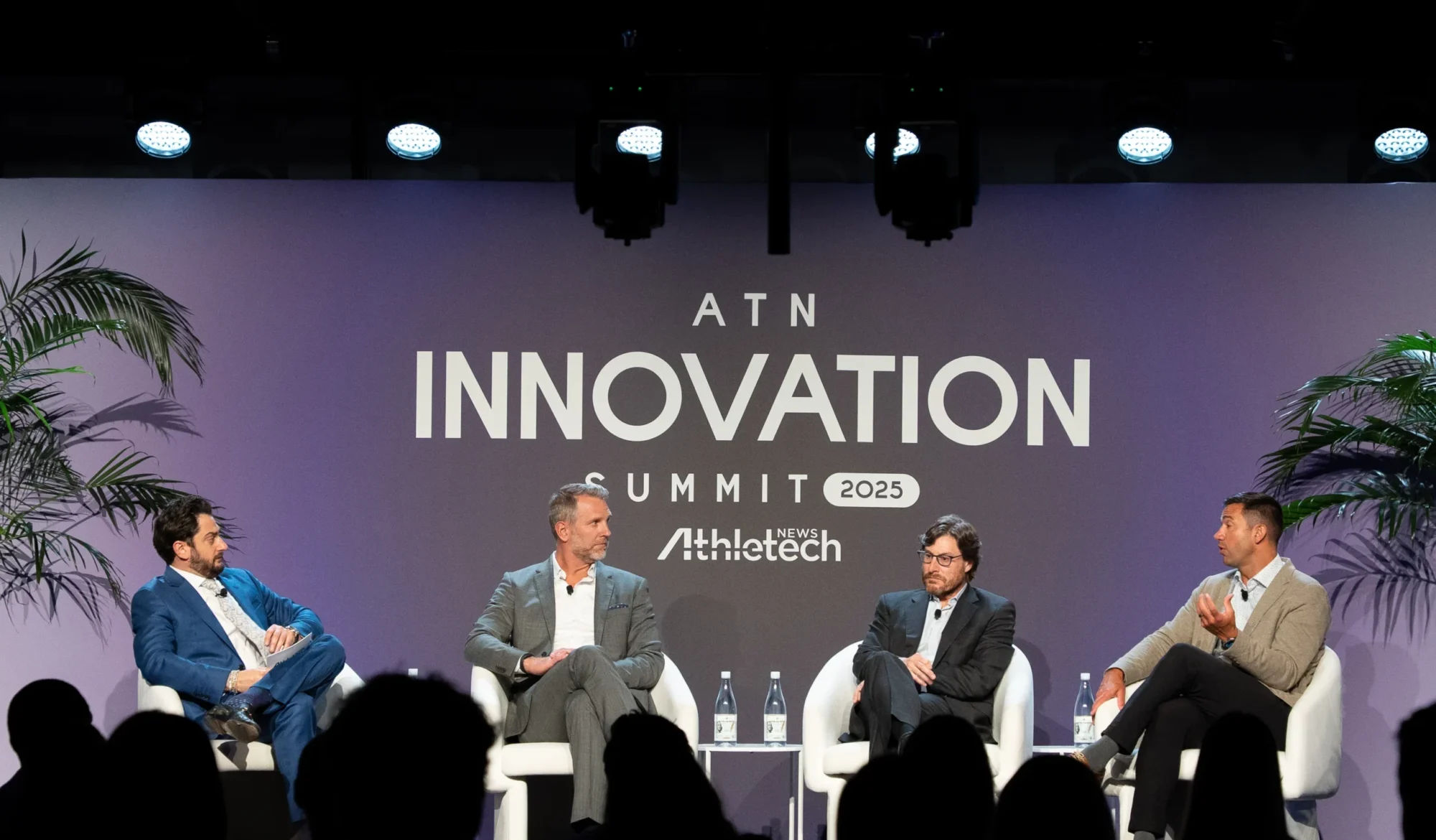

At the ATN Innovation Summit 2025, CEOs from Tonal, Hydrow and iFIT argued the sector is entering a more mature, sustainable phase, one focused on personalization, platform integration and smarter content delivery.

Moderated by Athletech News founder and CEO Edward Hertzman, the discussion featured Tonal CEO Darren MacDonald, Hydrow CEO John Stellato and iFIT Commercial CEO Mark Watterson, who each addressed the state of connected fitness and, more importantly, its future opportunities.

“It’s really easy to look at the boom of COVID, and obviously it’s been tough post-COVID,” Watterson said. “But connected fitness isn’t going anywhere. We live in a connected world. Everything around us is connected: our phones, our wearables, our watches…everything is connected. There’s no difference in fitness.”

While some headlines have fixated on post-COVID declines in hardware sales, panelists said that narrow framing ignores broader consumer trends. MacDonald pointed out that connected fitness has an anticipated go-forward view of 14% over the next five years, outpacing traditional gym growth. He also cited growing modalities such as mobility, strength and Pilates.

“But the biggest of those (modalities) is just going to be online,” he said. “People are looking for ways to work out that fit their lives, and I think that’s just a big trend that we’re going to be seeing.”

Feedback Is the New Feature

Stellato agreed, adding that younger consumers now expect a constant feedback loop from their fitness experiences.

“The generation that’s coming up now is more savvy about this than any before,” he said. “Everything is very much consumed in a feedback mechanism that connected fitness allows.”

Watterson cited evolving consumer expectations for personalization as a key driver of connected fitness innovation, noting it’s an area where the category can flex its muscles.

“The days of chasing a green dot around the tracker are long gone,” he said. “People are demanding hyper-personalization, AI, new forms of content. How we do that with connected fitness — it’s really exciting. The future is pretty bright.”

Panelists pointed to growing demand for strength training and holistic health metrics as signs of where the market is heading.

“There used to be all this data around cardio,” MacDonald said. “Now, as the science becomes more clear about strength, you’re seeing improved mitochondrial health and stabilization of glucose and all of these health benefits that really come about.”

He also called out core opportunity areas, including women, the active aging and individuals using GLP-1 medications.

“The fastest growing modality for women last year was strength,” he said. “People losing weight on GLP-1s are losing muscle at a faster rate than fat—that’s a problem, (but) it represents a major opportunity for us.”

AI Implementation

To serve evolving audiences, companies are rethinking how they deliver content. AI, unsurprisingly, is playing a central role. Watterson said advancements in AI have enabled iFIT to localize its Emmy-nominated content into multiple languages for global markets.

“The challenge now is how do you serve up the right content to the customer? So I think AI is playing a big part in that,” he added.

Stellato agreed. “The biggest thing we hear from our customers is, ‘Tell me what to do,’” he said. “‘Curate this for me. You know what I want, you know what my goals are, you know where the results are going. Tell me what to do and how do I get better using it?’ I think us being able to serve it up quicker and then more seamlessly—that’s what you can do to generate value.”

Beyond the Four Walls

While content remains a focus, hardware and software still matter, particularly as companies work to bridge fitness and healthcare. MacDonald pointed to Tonal’s motion tracking system as a tool with clinical potential.

“We’re literally correcting form at Gigabits per second,” he said. “We think the application to that in health care is significant.”

Connected fitness is also moving beyond the home. Watterson said 72% of gym goers are looking for hybrid experiences, and roughly half of them already subscribe to digital fitness services alongside their gym memberships.

“The old guard said let’s keep them inside the four walls,” he said. “The new guard sees the real competitor isn’t another gym—it’s inactivity. Our job is to meet members wherever they want to work out: at home, in a club or on the go.”

What’s Coming Next

Looking ahead, each executive teased developments for the second half of 2025.

Watterson said iFIT will continue leaning into AI and scale its new Pilates-focused acquisition, Reform RX. Stellato said Hydrow is excited about its technology in the strength area that will come to light as the year goes on, and other upcoming innovations. Tonal’s next phase may center on deeper integration of its motion analysis capabilities and push into health care, MacDonald indicated.

As connected fitness enters its next chapter, Stellato believes the winners will be those who move with purpose.

“The companies that are in this space—the winners in the space—are going to be acting a lot more rationally, chasing responsible growth,” he said.

This article is based on a live discussion held during the ATN Innovation Summit 2025, a two-day event dedicated to the future of fitness and wellness. See here for more Innovation Summit coverage.