Sports

Ramstad

“The traditional model of using high-revenue sports like football to subsidize other non-revenue sports may not be sustainable,” Pham said. “What I anticipate is more schools are going to explore private fundraising partnerships and creative revenue models. Some schools may ultimately cut programs, but others may be inclined to become more innovative.” The payout formula […]

“The traditional model of using high-revenue sports like football to subsidize other non-revenue sports may not be sustainable,” Pham said. “What I anticipate is more schools are going to explore private fundraising partnerships and creative revenue models. Some schools may ultimately cut programs, but others may be inclined to become more innovative.”

The payout formula puts football and men’s basketball players above other college athletes. I wouldn’t be surprised to see second- and third-string football players making tens of thousands of dollars, while top athletes in other sports get hundreds or a few thousand.

I reached out to the University of Minnesota a few weeks ago to get a feel for their planning. A spokesman said they would know more after the House settlement was finalized in court. Details were still being negotiated late last week.

Meanwhile, since far more money will be available to college athletes, the stakes will rise on athletes in junior highs and high schools to perform well and qualify for top-level university programs.

“You do fear that kids and parents are going to have a false hope of the money that will be there, and they will lose perspective that the benefit of sports is about playing the sport,” Campion said.

Patrick Campion, co-founder of Fame Sport in Minneapolis

Two forces lie underneath all this. The first is that sports represent the last way for advertisers to reach mass audiences. All forms of entertainment, including sports, have exploded in variety and means to reach people. In that growth, however, they have become more diffuse, reaching fewer people. However, the most popular sports attract the largest audiences on a relative basis.

Sports

Uncapped, not unnoticed: How Salonee Dangore went from track and field to the CPL

Jun 29, 2025, 01:13 AM ET It is rare for an uncapped player to get picked in an overseas T20 league, especially when they have not played in their own country’s equivalent tournament. But Salonee Dangore did the improbable when she signed with Trinbago Knight Riders (TKR) for the 2025 Women’s Caribbean Premier League (CPL). […]

It is rare for an uncapped player to get picked in an overseas T20 league, especially when they have not played in their own country’s equivalent tournament. But Salonee Dangore did the improbable when she signed with Trinbago Knight Riders (TKR) for the 2025 Women’s Caribbean Premier League (CPL).

A legspin-bowling allrounder, the 27-year-old Dangore is one of four overseas players at TKR alongside Lizelle Lee, Shikha Pandey and Jess Jonassen. For the last two WPL seasons, Dangore was a net bowler at Delhi Capitals, the franchise Pandey and Jonassen play for. It would not be a surprise if these two put in a word after watching her at close quarters.

Dangore’s cricketing journey is as improbable as her CPL selection. Growing up, she was a national-level athlete and had no interest in cricket. Until 2015, she did not even know of legspin’s existence.

“When I was in school, I used to run very fast,” she tells ESPNcricinfo. “So our sports teacher asked me to pursue athletics. I would do 100m, 200m, long jump and triple jump. During my Under-14 and Under-17 days, I represented Madhya Pradesh at the national level in all those events.”

She was around 17 when Jose Chacko, a Sports and Youth Welfare officer, advised her mother to make her switch to cricket for better opportunities. Dangore enrolled at an academy run by the former Ranji Trophy player Sunil Lahore in Indore. Since she had only watched boys in her residential colony bowl with long run-ups, she wanted to be a fast bowler. Lahore watched her bowl a couple of deliveries and told her to take up legspin.

After spending about two years at the academy, Dangore joined the Ramesh Bhatia Cricket Foundation (RBCF). As a track-and-field athlete, her fielding was top-notch, but she struggled to turn her legbreaks. That sounds incredible, because currently she can pitch it on middle and leg stump and consistently hit off.

“I was inspired by Shane Warne and the way he turned the ball,” she says. “But my arm would rotate in the other direction and most of my deliveries would end up as googlies. So I would watch his videos in slow motion to figure out how he did it.

“Apart from that, my coaches – Sanjay Choubey sir and Himanshu Vairagi sir – at the RBCF helped in correcting my arm alignment. It took a lot of effort but eventually I was able to turn the ball.”

Dangore made her debut for Madhya Pradesh in 2017-18. Two seasons later, she was their highest wicket-taker (14 in eight games, at an average of 11.50) and third-highest run-scorer (130 at 32.50) in the One-Day Trophy, before Covid-19 ended the tournament prematurely.

The turning point of her career came in 2022, when the Madhya Pradesh Cricket Association (MPCA) called up former India legspinner Narendra Hirwani for a camp. “He changed my mindset completely,” Dangore says. “He said, ‘You will do what you think you can. So you should think you are the best legspinner in the world.’ That advice is still fresh in my mind and gives me a lot of confidence when I am bowling.”

Shortly after that camp, the RBCF also invited Hirwani to their academy. Since then, Dangore has had multiple sessions with him.

“Sir also advised me to bowl slightly faster,” she says. “So right now I am working on increasing my pace while maintaining the turn. Apart from that, I am working on my slider and googly.”

When it comes to batting, Dangore’s focus is on power-hitting and strike rotation, so that she can “contribute in every situation”.

The stints with Capitals have also helped her immensely. “In my first year with them, there were only two net bowlers, [VJ] Joshitha and me,” she says. “I used to bowl in the same set as Jess Jonassen and would ask her about my bowling, tactics, and what to bowl when. Whatever feedback I got, I worked on that.”

Dangore also realised she needed to shoulder more responsibility for her domestic side to stand out. In search of better opportunities, she moved to Chhattisgarh before the 2024-25 season.

She picked up only two wickets in six games in the T20 Trophy, but emerged as Chhattisgarh’s leading wicket-taker in the one-dayers with 15 scalps from six matches at an average of 12.00. With the bat, she was their second-highest run-getter with most of her 144 runs coming at No. 6.

That, in December 2024, remains Dangore’s last competitive tournament. Since then, she has had another stint with Capitals and is eager to show off her learnings. But with the CPL allowing teams to field only three overseas players in their XI, will she get enough game time?

“I am not thinking about that because it’s not in my control,” she says. “Whenever I get a chance, I want to give my best. Moreover, the pitches there [in Guyana] should help spinners.”

Dangore cites Shreyanka Patil’s example. Patil too was uncapped when Guyana Amazon Warriors picked her in 2023, though unlike Dangore she had had a full WPL season behind her. She finished the CPL as the highest wicket-taker with nine wickets from five games.

“I want to create a similar impact,” Dangore says. “Whenever the team needs me – be it with the ball or the bat – I want to win matches. I hope this stint opens up more doors for me.”

Sports

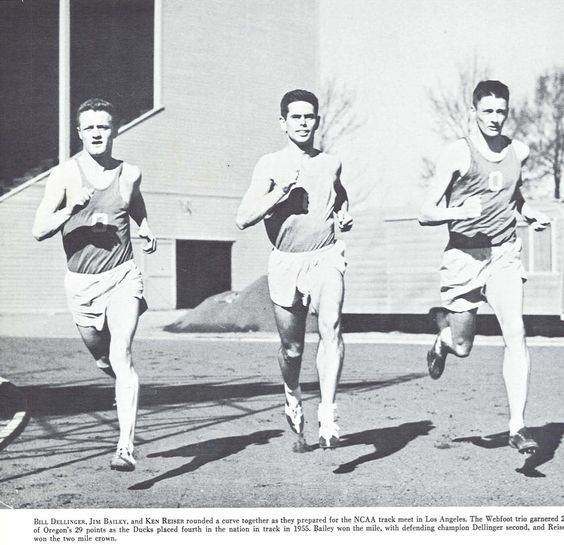

Bill Dellinger, 1934-2025, Eight Takeaways on The Amazing life of a Treasured Coach

Larry Eder Larry Eder has had a 52-year involvement in the sport of athletics. Larry has experienced the sport as an athlete, coach, magazine publisher, and now, journalist and blogger. His first article, on Don Bowden, America’s first sub-4 minute miler, was published in RW in 1983. Larry has published several magazines on athletics, from […]

Sports

'Usher Autograph Night' … and Other Less Popular Minor League Baseball Promotions

The season of the minor league ballgame is in full swing, and so are the minor league promotions. Here are some of the less popular ones. — Strained Groin Day — Usher Autograph Night — Free Pretzel in Every Beer: Save money! Save digestion time! — LIVE Bat Night: Wear a scarf! — Extra Marjoram […]

The season of the minor league ballgame is in full swing, and so are the minor league promotions. Here are some of the less popular ones.

— Strained Groin Day

— Usher Autograph Night

— Free Pretzel in Every Beer: Save money! Save digestion time!

— LIVE Bat Night: Wear a scarf!

— Extra Marjoram Madness: Marjoram sprinkled on any concession — gratis!

— Poppin’ Fresh Lookalike Contest: Winner gets a whole lot of dough! Literally.

— Adult Children of Jerks Day: Come in and cry. Our game will help!

— Signed Balls: Fellas! Get inked by the night’s MVP!

— Got the ultrasound to prove it? You’re in for free on: Pregnant with Twins Night!

— Safer than fireworks! Duracell and the National Fire Safety Council proudly present this evening’s: Post-Game Flashlight Follies!

— Cheek-Piercing Night: Ouch!

— Toilet Seat Toss: Actually, this one is real. Sorry.

— Show Us Your Rash: You could win a free ticket!

— There’s Your Mascot!: Win the chance to have our mascot sit in front of you the whole game.

— Health Is a Major League Issue: Turkey dogs served on seven-grain rolls with lip-smacking, thirst-quenching liquid kale.

— The North American Hooligan Society invites you to: Defenseless Little Old Ladies Night!

— Napkin Ring-Palooza!

— Go Blue!: It’s all-you-can-eat blue cheese night!

— Hermit Gift Basket: Razor, matches, and tin pot included.

— “J’adore Zee Baseball” Soiree: Berets and creme brulee for the first 100 attendees who can sing an entire Edith Piaf song.

— Minor League Bobbleheads: Who can forget “Slow and Steady” Stan Osofsky? Or Carl “I’m Getting There” Brown? Or away-game crowd favorite Mo “Oops!” Mallard? Your mantlepiece will groan with near-greatness!

— Free Cropped T-Shirts: Show off that dad bod!

–- Foam Toe Freebies: Give those foam fingers the toe! We’re (Toe) No. 1!

— Hairy, Scary Fun: Got a tarantula at home? Bring it in, set it loose and get a free ticket!

— Kombucha Kraziness: Free ice-cold kombucha when you buy a squishy tomato or cup of warm mush.

— Show Us Your Papers Night: kidding! (Not kidding.)

Creators.com

Sports

Study suggests water may not be the most hydrating drink for you

(CNN) – Researchers from Scotland’s Saint Andrews University have compared the hydration responses of several different drinks. While many Americans may reach for water when they get thirsty, the study suggests it may not be the best option. Researchers at the university found that milk is a better option for hydration. They said milk has […]

(CNN) – Researchers from Scotland’s Saint Andrews University have compared the hydration responses of several different drinks.

While many Americans may reach for water when they get thirsty, the study suggests it may not be the best option.

Researchers at the university found that milk is a better option for hydration.

They said milk has sugar, fat and protein – all of which help to slow the emptying of fluid from the stomach and keep hydration over a longer period.

Milk also has sodium, which acts like a sponge and holds ono water in the body.

Copyright 2025 CNN Newsource. All rights reserved.

Sports

Track and Field: Osakis sets new standards in 2025 – Alexandria Echo Press

OSAKIS — The 2025 season was a special one for the Osakis track and field program. The Osakis boys team won the Section 6A True Team title, Section 6A team title, the Prairie Conference team title (as did the girls), and had its best finish at the state championships as it finished second in Class […]

OSAKIS — The 2025 season was a special one for the Osakis track and field program.

The Osakis boys team won the Section 6A True Team title, Section 6A team title, the Prairie Conference team title (as did the girls), and had its best finish at the state championships as it finished second in Class A.

The Osakis boys team had only won one state title as Bob Gelle won the shot put state title in 1949.

Osakis won five state titles this season including two relays. Andrew Jones, Trenton VanNyhuis, Tyler Wolbeck, and Zackery Bruder won the 4×400-meter relay. Jones, VanNyhuis, Wolbeck, and Bryler Gustafson won the 4×200-meter relay.

Jones also won the boys 300m hurdles, while VanNyhuis won the boys triple jump, and Robert Kendall won the 400m wheelchair.

VanNyhuis placed second in the boys long jump and Kendall placed second in the wheelchair shot put.

Kendall earned third place finishes in the 100m and 200m wheelchair, and Bruder placed third in the 400m dash.

Harlie Schwope earned two top eight finishes as she placed sixth in the girls 100m hurdles, and eighth in the pole vault.

Sam Stuve / Alexandria Echo Press

Schwope, Ally Boyer, Kaelyn Walker, and Addison Roering placed 16th in the girls 4x200m relay.

Schwope, Jones, VanNyhuis, Wolbeck, Gustafson, and Bruder earned all-state honors.

Osakis set a plethora of school records this season.

Jones now holds the school record in the boys 200m (22.63), 110m hurdles (15.35), and 300m hurdles (37.39). Bruder set the school record in the 400m (48.72) and the 800m (1:57.02), and Kendall set records in the 100m wheelchair (21.56), 200m wheelchair (41.35), 400m wheelchair (1:31.51), and wheelchair shot put (13’3.75).

Jones, Wolbeck, VanNyhuis, and Bruder set the school record in the 4x200m (1:28.42), and Jones, Gustafson, Wolbeck, and Bruder set the school record in the boys 4x400m (3:21.22).

VanNyhuis now holds the record in the boys triple jump (45’3.5) and long jump (22’5.75).

Schwope set the school record in the girls pole vault (11’0).

For team awards, Bruder won the boys Most Valuable Track Athlete award, while Roering won the girls Most Valuable Track Athlete award.

Bruder also won the boys Will to Win award, while Adelyne Olschlager won the girls award.

VanNyhuis has been named the boys Most Valuable Field Athlete, while Stephy Marthaler won the girls award.

Sophia Doiron was named the girls most improved athlete, while Gustafson was named the boys most improved athlete.

Sam Stuve / Alexandria Echo Press

Taven Ebnet won the boys Silverstreak Award, while Morgan Baker won the girls award.

Each season, Osakis hands out the Stroup “Big Picture” Award in memory of former coach Chris Stroup. Mikkel Steinert won the boys Stroup “Big Picture” Award, and Stephy Marthaler won girls award.

2025 Osakis Track and Field

All-State Academic (3.6 GPA and meet performance standard) (9th Grade and Above)

Stephy Marthaler

Kaelyn Walker

Addison Roering

Katie Collins

Ally Boyer

Stephanie Mages

Harlie Schwope

Anna Marie Ruegemer

Erika Baker

Kaleb Helberg

Trenton VanNyhuis

Isaac Chisholm

All-Conference Academic (3.7 GPA and Letter Winner) (9th Grade and Above)

Stephy Marthaler

Morgan Baker

Addison Roering

Ally Boyer

Emmarose Olschlager

Lexy Marthaler

Emma Lubbers

Katie Collins

Alexis Bruder

Stephanie Mages

Harlie Schwope

Anna Marie Ruegemer

Erika Baker

Aislinn Brown

Trenton VanNyhuis

Chase Johanson

Ezequeil Rodriguez

Isaac Chisholm

Roger Dunn

Boys – Academic All-State – Silver (Team GPA above 3.5), team GPA was 3.73

Girls – Academic All-State – Gold (Team GPA above 3.75), team GPA is 3.978

Letter-Winners

BOYS – Austin Dickinson, Micah Moore, Caiden Knox, Andrew Ziesmer, Taven Ebnet, Bryler Gustafson, Grant Winkle, Zackery Bruder, Kaleb Helberg, Mikkel Steinert, Christian Nathe, Levi Ries, Trenton VanNyhuis, Andrew Jones, Keaton Lien, Chase Johanson, Jaxon Christner, Tyler Wolbeck, Kegan Thole, Ezequiel Rodriguez, Tal Loverink, Isaac Chisholm, Luke Kraemer, Roger Dunn, Robert Kendall, Henry Miller

GIRLS – Stephy Marthaler, Morgan Baker, Abby Fiskness, Addison Roering, Ally Boyer, Katie Collins, Addison Kranz, Emmarose Olschlager, Lexy Marthaler, Emma Lubbers, Stephanie Mages, Harlie Schwope, Anna Marie Ruegemer, Erika Baker, Aislinn Brown, Adelyne Olschlager, Sophia Doiron, Dakotah Pastian, Lillian Tenhoff, Mary Beach, Jaylyn Lusty, Jadelyn Bruder, Lucy Boyer, Alexis Bruder

Participants

BOYS – Damian Ruegemer, Connor Tenhoff, Ethan Owens, Tytus Doman, Logan Holmquist, Hunter Goodwin, Levi Hanson, Guy Steinbeisser, Dylan Karnes, Emmet Thompson, Colbie Klimek, Rylan Gould, Riley Marthaler, Thomas Glenetske, Max Bayer-Rooney

GIRLS – Kaelyn Walker, Mataya Moore, Abby Fiskness, Aliana Gould, Mahala Anderson, Lydia Brown, Kaleigh Fredriks, Madison Stier, Eliana Lund, Maralyne Meyer, Serena Moore, Brooklyn Lee, Abigail Marcyes, Laney Kalpin, Ellie Otremba, Taylor Lubbers, Tressa Gunther, Bryn Ferris, Gemma Jacobson

Team Awards

Most Valuable Track Athlete – Addison Roering (girls), Zackery Bruder (boys)

Most Valuable Field Athlete – Stephy Marthaler (girls), Trenton VanNyhuis (boys)

Most Improved Athlete – Sophia Doiron (girls), Bryler Gustafson (boys)

Silverstreak Award – Morgan Baker (girls), Taven Ebnet (boys)

Will to Win Award – Adelyne Olschlager (girls), Zackery Bruder (boys)

Stroup “Big Picture” Award (In memory of former coach Chris Stroup) – Stephy Marthaler (girls), Mikkel Steinert (boys)

Sports

Belleville HS athletes announce their college decisions – Essex News Daily

This slideshow requires JavaScript. BELLEVILLE, NJ — Belleville High School Athletics honored several senior student-athletes who announced their collegiate decisions to continue their athletic careers, during a recent ceremony. The following are those athletes: Nicholas Bustios, Fairleigh Dickinson University–Madison, soccer. Eric Castillo, Caldwell University, soccer. Jeremiah Cook – Kean University, football. Tristan Hargrove — Iona […]

BELLEVILLE, NJ — Belleville High School Athletics honored several senior student-athletes who announced their collegiate decisions to continue their athletic careers, during a recent ceremony.

The following are those athletes:

- Nicholas Bustios, Fairleigh Dickinson University–Madison, soccer.

- Eric Castillo, Caldwell University, soccer.

- Jeremiah Cook – Kean University, football.

- Tristan Hargrove — Iona University, rowing.

- Izabella Luna, New Jersey City University, wrestling.

- Raul Pineda – FDU–Madison, soccer.

- Jolieana Pagan – FDU cheerleading.

- Shaniece Perez– Caldwell University, cheerleading.

- Wilberto Solozano, FDU–Madison, soccer.

- Yamile Serna, FDU cheerleading.

- Anthony Torres – Caldwell University, track and sprint football.

Photos Courtesy of Belleville HS Athletics

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Weekend Preview: Autódromo Hermanos Rodríguez

-

Motorsports3 weeks ago

Motorsports3 weeks agoNASCAR Through the Gears: Denny Hamlin has gas, a border needs crossing, and yes, that’s a Hemi

-

High School Sports3 weeks ago

High School Sports3 weeks agoHighlights of the Tony Awards

-

Professional Sports3 weeks ago

Professional Sports3 weeks agoUFC 316

-

Health2 weeks ago

Health2 weeks agoGymnast MyKayla Skinner Claims Simone Biles 'Belittled and Ostracized' Her amid Riley …

-

NIL3 weeks ago

NIL3 weeks agoTennessee law supersedes NCAA eligibility rule

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Race Today: Mexico City start times, schedule and how to watch live on TV

-

Sports3 weeks ago

Sports3 weeks agoCoco Gauff, The World's Highest

-

College Sports3 weeks ago

College Sports3 weeks agoFisk to discontinue history-making gymnastics program after 2026 | Area colleges

-

Social Media2 weeks ago

Social Media2 weeks agoPune Athletes Make Global Mark at IRONMAN Hamburg and Brazil 2025