Technology

Sports betting industry braces for Trump’s ‘Big, Beautiful Bill’

0:06 spk_0

Welcome to Yahoo Finance Sports Report, a unique look at the business of sports brought to you by Yahoo Finance and Yahoo Sports. I’m your host, Joe Popriano, and I’m here to coach you through the financial game. Today, we’ve got Yahoo Sports senior writer Jake Mintz coming on the show to discuss all things baseball, and British boxing promoter Eddie Hearn joining us to discuss Mattroom’s growing business around the world. Let’s huddle up and get right into it.We are kicking off this week with POM’s Playbook, where I take a look at some of the biggest headlines in sports that you and your portfolio need to know. First up, the recently passed One Big Beautiful Bill Act includes a tax provision that could quietly destroy professional gambling in the United States. Right now, gamblers can offset 100% of their losses against winnings. However, starting in 2026, that deduction will be capped at 90%.That means if you win $100,000 in a year and also lose $100,000 in the same year, you’ll be taxed as if you made $10,000 in profit, despite the fact that you really didn’t make any money.This seemingly small change could collapse the foundation of legal sports betting. Professional gamblers who help set efficient lines and fund prize pools will flee to offshore markets. Without their volume, sports books will reduce contests, wide odds, and raise fees on casual players. Daily fantasy sports prize pools will shrink, betting markets will get less.And legal gambling will start to spiral. Ironically, some sports books may welcome this. Professional gamblers eat into their profits, and this bill could push them out of the system entirely. But state governments stand to lose the most. They build big budgets around gambling revenue. If activity goes offshore, tax revenue dries up, not just federally but locally too.This isn’t the first time excessive gambling taxes backfired. It happened in the US in 1951 in the UK before the 2000s. So, unless Congress steps in to fix it, we could see history repeat itself.Next up, Texas Tech just pulled off one of the biggest recruiting wins in college football history, and it comes with a massive payday. On the 4th of July, 5-star offensive tackle Felix Ojo, the #6 overall player in the 2026 class and the top recruit in Texas, committed to Texas Tech over Blue Bloods like Texas, Oklahoma, and Ohio State.But this wasn’t just a football decision, it was a business one too. According to reports, Ojo signed a fully guaranteed revenue sharing deal with Texas Tech worth $5.1 million over three years. About half of that is guaranteed, with the rest tied to incentives and renegotiation clauses. He’s set to earn $1.2 million in year 1 $1.6 million in year two, and $2.1 million in year three. Numbers previously unheard of for an offensive lineman at the.level. This all became possible thanks to the House for NCAA settlement, which took effect on July 1st and officially allows schools to share revenue directly with athletes. Texas Tech has already been making waves in the transfer portal, but this solidifies their emergence as a serious national player. Ojo becomes the highest rated commitment in school history and headlines would shaping up to be a top 25 class. It’s a new era in college football, and Texas Tech is wasting no time jumping in headfirst.And last on PO’s playbook today is news that ESPN just landed a major win with NFL analyst Dan Orlowski set to stay with the network for several more years. After weeks of speculation, Front Office Sports is reporting that Orlowski and ESPN have agreed to a long-term contract extension. The former NFL quarterback is set to continue on his roles on NFL Live, SportsCenter, First Take, GetUp, and as lead analyst for the ESPN’s #2 Monday Night Football broadcast team along Chris Fowler and Lewis Reddick.This deal brings stability with the NFL preseason just around the corner and shuts down any potential move to CBS, where Dan Lawsky was reportedly on tap as a top candidate for the college football coverage. His popularity has even sparked coaching rumors with reports that he’s spoken to NFL teams and expressed interest in a future on the sidelines. But for now, ESPN gets to keep one of its rising stars just in time for what’s shaping up to be a big 2025 season.All right, everyone, let’s talk baseball. July is a big month for Major League Baseball. We’re halfway through the season. The All-Star game is a week away, and the trade deadline is set for July 31st. So today we’re bringing on Yahoo sports writer Jake Mintz to cover all the bases. Pun absolutely intended. Jake, welcome to the show. Thank you so much for joining us today. Let’s start with just what your top storylines for MLB so far this year are.

4:20 spk_1

Hm, good question. Uh, I think it is the Los Angeles Dodgers versus the world, just the staggering amount of money that that organization has decided to spend on players, uh, is really overwhelming.They have kind of, you know, been sleepwalking through what has been a dominant first half. They are up by a comfortable margin in the National League West, uh, and the storyline moving forward is can anybody challenge them come playoff time, and then in Newand the Big Apple, you have the Yankees and the Mets, two other big market teams, kind of scuffling a little bit through June, starting to maybe find their footing as they move towards the trade deadline, which will be a good opportunity for them to reinforce their rosters.

5:07 spk_0

Yeah, as a Yankees fan, the last couple of weeks have been tough, especially with pitching injuries and everything else, but hopefully they clean that up. I mean, the Dodgers have had some injuries too, so, uh, the fact that they’re, they’re doing so well is is uh quite impressive. But let’s talk about, uh, the CBA. One of the things that I think is fascinating is that the, um, the CBA is going to be renegotiated, I think in uh at the start of 2026, it’s up and need to sign a new deal.One of the things that keeps popping up is that uh the idea of a salary cap. Now, this has been talked about for a long time, owners obviously would like it, uh, players do not want it. What do you see happening here? Will there be a lockout? Do you think it’ll actually get approved, or do they just kind of go business as usual and keep things status quo?

5:47 spk_1

So, everything that I’ve heard rumblings about the next round of CBA negotiations is that it’s going to be pretty adversarial, and there is an expectation that some games may be missed, um, hopefully a full lockout is avoided. I do think you’re right that the salary cap is going to be a major issue.Next time that the CBA gets negotiated, the union will not agree to a salary cap without a salary floor would be my assumption. I think that the spending that the Dodgers have undergone over the last few years has made a salary cap a more interesting proposition for fans.And so you’re seeing more of a push for that from the public side. How that actually impacts negotiations remains to be seen.

6:37 spk_0

Are there anything else, uh, within the CBA that you’re hearing would be of interest to either the owners of the players that might be sort of like a um uh a point of emphasis that could cause a lockout or something like that?

6:49 spk_1

Um, I think the, the last CBA negotiation, the big conversation was about competitive balance and incentivizing small market teams to spend, right? What the union wants is for the owners of these teams to see their uh ownership.stewardship, as an investment in a local institution, and not necessarily as some something that makes money for the sake of making money, that there are other, you know, areas and avenues for these business people to go ahead and do that. And I think Steve Cohen, the owner of the Mets, hasMaybe, uh, not created some discord within the group of owners, but showed that there’s kind of a different way. Like he is spending money on the Mets because he grew up a Mets fan and he wants them to win the World Series, and I think that is what fans want to see owners acting like instead of a larger kind of, you know, investment group coming in and using the organization as more of a, you know, an an investment opportunity.

7:45 spk_0

And lastly, I’d love to just get your opinion quickly on uh just the state of Major League Baseball. I mean, the year started with ESPN backing out of its deal with MLB. I think maybe they might even regret that to a degree. The numbers are obviously really good this year and the sports appears to be doing rather healthy. There’s a lot of young stars, etc. Like, what is your general impression of where baseball is today versus where it was maybe 5 years ago?

8:07 spk_1

The rule changes that Commissioner Rob Manfred implemented a couple years ago have been very successful, most notably the pitch clock. The games move faster, they end earlier, and for a younger generation that is more distracted than ever, that is a big deal. Numbers are up in terms of viewership, numbers are up in terms of attendance, but when itcomes to the national stage, it is still a very localized sport, more than any other sport in our country, and that is part of the hold up with the negotiations with ESPN, right? ESPN would like more of a local focus in that package, because that’s where the viewership numbers are. I believe 25%.Around uh of the total revenue comes from these local TV packages across the entire league. Um, and so ESPN is a little bit less interested in the national stuff during the regular season, because it doesn’t really move the needle. Local is king when it comes to baseball. But as far as the sport is concerned as a whole, I do think it’s in a really healthy spot compared to where it was 5 years ago.

9:09 spk_0

Yep, I’ve really been enjoying this season so far. Jake, thank you so much for joining us.

9:13 spk_1

It’s a pleasure. Thank you for having me. All

9:15 spk_0

right, we’ve got to take a quick break, but coming up we’ve got an inside look at the man turning boxing matches into blockbuster events, not just in the US or UK but all over the world.Welcome back to Yahoo Finance Sports Report. I’m your host, Joe Pompeiano, and for today’s one on one, I’m joined by one of the most powerful men in boxing. He’s promoted more than 1000 fights, filled stadiums around the world, and never turns down a microphone. This week we’re talking to Mattroom Sport chairman Eddie Hearn. Eddie, thank you so much for joining the show today. For people that are listening to this show that maybe aren’t as familiar with boxing as a sport or you in general, uh, can you just explain a little bit about what Mattroom does specifically?

10:05 spk_2

Yeah well, Metrom is a, a big sports global promotional company. So we are delivering sports events globally around the world across a multitude of sports. Boxing probably the most famous of those, and certainly with the highest profile as well. Um, trying to explain boxing is very difficult. Uh, trying to explain a sport with no barriers to entry, um, you know, all these different governing bodies, all these different promoters, all these different networks, all these different.Uh, platforms is very difficult, but essentially boxing is, you know, the, the prize fighting sport that spans back decades with, you know, steeps of history and a huge amount of hype and noise every time there’s a major event and.Through the peaks and troughs of the sport of boxing, one thing remains, the, the desire of platforms and broadcasters and, and money men and fans to become involved in the major events, and right now, boxing’s seeing a major boom in the market.

11:06 spk_0

Yeah, one of the things that we’ve noticed over the years specifically is, uh, the type of boxing has changed, right? I think in America specifically, we’ve become accustomed to some of these more celebrity driven fights where uh the boxers themselves have become celebrities, but we’ve seen crossovers from UFC uh with Conor McGregor. We’ve seen some of the YouTube personalities start to box as well. What makes like a good fight in your opinion, to where you’re gonna be able to draw a good viewership number?

11:30 spk_2

I think really it’s about narrative, you know, it’s about the promotion, and one of the reasons that these crossover fights work is because of the.Uh, profile and the self-promotional ability of those individuals. I mean, Conor McGregor’s a great example. Jake Paul is obviously another example as well. So it’s really about the, you know, the, the drawing power of the individual, the followers that they have, and the narrative that they can sell. For us, we’re a pure boxing promotional company. I, I probably started the YouTube mess by doing KSI against Logan Paul 2 in in Staples Center. We made a lot of money, but I really didn’t enjoy it because it was just not.You know, I’m a, I’m a hardcore boxing fan, you know, so we’re trying to bring the great fights back. And I think what Is the big event, of course, is a great product, which is a great fight, but also great storytelling, great narrative, and, and, you know, that’s when you know you’ve got a great fight and you can build a huge audience. So, yeah, right now the boxing world, you know, like I said, sometimes it’s a little bit like the wild west in terms of the, the product itself.Um, but certainly the key for me in driving a big event is pre-event hype, build up, and a great narrative, great storytelling, and really that’s my job as a promoter, to tell the fan base the story of this fight.

12:44 spk_0

And I’m sure you’ve been asked about this a million times, but you mentioned earlier how kind of, uh, segregated boxing is, right? There’s no barrier to entry. There’s all these different organizational bodies, and it’s really difficult to comprehend for new fans. One of the things that I think American sports fans have probably heard of over the last few months is, uh, the new entity that is now popping up to sort of be like a traditional sports league for boxing between TKO Group, Saudi, Turkey, etc. What is your overall just opinion on what that looks like and its chances of success?

13:12 spk_2

I think it’s great for boxing, you know, I mean, firstly, you have to ask yourself why is Dana White trying to enter the space? The answer is right now, I think boxing he is much hotter than MMA, you know, for, for a long period of time, it hasn’t had the big events, it hasn’t had the profile, it hasn’t had the hype, and now you’re seeing that with promoters stepping up with Turkey la Sheikh and Saudi Arabia investing a huge amount of money in the sport. For Dana and those guys, I think they’re gonna find it very difficult in boxing because they’re a business that’s built out of control.And for me, boxing is actually out of control, which in a sense makes it quite fun. But, you know, I think their plan is to go in and try and build young talent and and those middle line prospects and kind of create that ownership where you fight whoever you’re told to fight. And in boxing, probably to the detriment of the sport, sometimes you’re individually negotiating every single fight of a multi-fight contract.And that’s something you’re not doing in UFC. You sign a, you know, you sign a contract, you’re told when you’re fighting, your purse is already set. The UFC had complete control over the fighter, the talent, and that’s what they’ll be trying to do in boxing, and I don’t think that’s necessarily going to wash. It’s definitely not gonna wash with the big guys, because I think, you know, every fighter has a manager, a lawyer, an advisor.And they want to navigate the career correctly, ultimately their job is to take the easiest fights for the most amount of money.And the promoter’s job is to pay the fighter the right money for the biggest fights possible.

14:43 spk_0

I think that’s a very fair way to look at it. Those people are obviously very uh smart and have done a great job with the UFC, but you can’t just simply take that model and move it over to boxing, right? Even if you look at the UFC, the most popular fighters that would be able to demand the most money, they’ve had a lot of issues with those fighters, right? Because you get to a point where those fighters don’t want to be told who to fight, when to fight for this amount of money. They want to be able to negotiate their own.Deals and they know their values. So, uh, I’m totally aligned on that. But one of the things that I think Matchroom specifically has uh done that’s interesting is, uh, from a streaming perspective. I know that you guys have this broader partnership with the global streamer Dione, and you were one of the first global promoters to really dive into that from a linear TV to a streaming perspective. Why did you decide to do that initially and how do you think it has gone so far? And what do you think the future looks like for that versus uh linear television goingforward?

15:30 spk_2

I just think we noticed that the, you know, the habits of the viewer were changing, you know, from that of traditional linear TV to streaming. I mean, you know, obviously the, the growth of Netflix and and other apps like that is, is easy to, to identify. But from a sports perspective, I, I just think that people now, they want variation and they want the ability, because I think their attention span is drifting and they’re multitasking during during viewership.And I think really we wanted the ability to stream direct to mobile phones, to tablets, and we saw that growth many years ago, and our deal with the zone started 6 years ago, and it’s incredible the rise. I mean, people don’t necessarily understand in America, perhaps the size of the zone.Globally, in terms of the multitude of sports rights that it acquires. In America, really, you know, I know they’ve got the FIFA Club World Cup, of course, and, and other products as well. But it’s, it’s notoriously known as a boxing service, and it is now the global home of boxing. But, you know, Joe, when I launched with the Zone 6 years ago, I was going to these fighters pitching them and trying to have a conversation to explain that it’s time to leave HBO or Showtime because they’ll be leaving the space and you need to go with a streaming partner.You know, I laugh now at the conversation, so, so you’re telling me it’s an app. I’m like, yeah, it’s an app. But I, you know, this is the future of broadcast and it’s the future of boxing, and they’ve got there now, they’re in a tremendous place. I mean, I think it’s over 80 odd shows a year on the zone. Every major fight is on the platform. And we got ridiculed for a long time from our rival promoters.You know, calling the, the app or what’s the fight, who wants to fight on an app, you know, it’s dead zone, it’s not the zone, trying to make sure the fighters didn’t.Migrate there. Now those same promoters are phoning up the platform trying to get a rights deal with the platform and trying to place their product there. So it’s been a huge success and luckily we got that one right, you know, with with with streaming. And it was a long while back, it was a big move, cos we went from our traditional broadcasters like Sky Sports and HBO who I had a deal with at the time in America, and made the move globally to Dizone. And what was important with that was as well.Every market we had an individual rights deal with, and it’s a very mixed message. So when I’m out across social media trying to explain to the global fight fan where you can find the product, you know, it’s on Sky Sports in the UK it’s on HBO in America, it’s on Fox in Australia, it’s, it’s on via sat in Scandinavia. Now there’s one place where you can find Mattro’s product, globally, anywhere in the world, and that’s on the zone, and it’s been a, been a big success for our business.

18:09 spk_0

Yeah, very interesting and certainly the right decision. Last question for you, Eddie, is around uh just global expansion. I know Matchroom is expanding globally, US, UK, etc. but Saudi Arabia and the Middle East specifically has become a major player in boxing over the last number of years. Is this something that you think is sustainable or is it more of a short term kind of a gold rush?

18:29 spk_2

Yeah, for us individually, I mean, we’re the only global promotional company in the world, and what I mean by that is we’re the only promotional company that is the lead promoter in all these different territories. So we have major rights deals of course in the UK, in the US, in Mexico, 6 shows a year, 6 shows a year in Australia, Italy, Spain, um, and of course Saudi Arabia, Uzbekistan throughout Eastern Europe. I mean we’re everywhere.And that’s been great for us. The growth in Saudi Arabia has been very interesting. I mean, they’re probably, they’re coming up to 2 years deep now in boxing. A lot of people felt that they would have left by now, but Turkey al Sheikh has a very good vision and is also very intelligent as well. And they are spending a huge amount of money, and I mean, I think it’s really benefiting the sport cos we’re seeing the big fights being made, but they certainly.Showing no signs of slowing down. Also, their partnership with us, their partnership with the zone. You know what I mean, this weekend you’ve got a Ring magazine card coming up uh in New York, fantastic card next weekend. We’re in Texas with Jesse Vargas, so, uh, Jesse Rodriguez. Last week we’re in Manchester. It’s like a global tour with the zone and the Saudis are really, really investing in the sport, not just in terms of paying up for, for, for the fights, but investing in the promotion.You know, Turkeyala Sheikh’s acquisition of the Ring Magazine as well, making that a very powerful platform for the sport. So that’s helped the profile of boxing, and as I said, it’s made, in my opinion, boxing now much bigger than MMA and it’s even made the guys in MMMA Michaelri it over to boxing. So I think at the moment, the property is red hot, the zone is red hot and uh long may it continue.

20:09 spk_0

Very interesting. Yeah, boxing doesn’t seem to be slowing down at all, especially in Saudi Arabia or anywhere else. Eddie, thank you so much for joining the show today.Thanks, Joe.The clock is running down here, but we have just enough time for some final buzz. So let’s talk about the business behind the Tour de France. It all started in 1903 when French newspaper Elato created the tour as a marketing sun to boost circulation, and it worked with sales doubling immediately. Today, it’s owned by Amari sport organization, or ASO, a private company that also runs the Dakar Rally and other events, but the Tour de France is their crown jewel, accounting for more than half of ASO’s annual revenue.So how does it bring in that kind of money? Well, first is sponsorships. Roughly 50% of tour revenue comes from corporate sponsors. There are over 40 official partners, including LCL Bank and Continental. Even the iconic jerseys, the yellow, green, polka dot, and white, each have their own dedicated sponsor.Next up is meteorites. The tour is broadcast in over 190 countries and attracts up to 3.5 billion cumulative viewers. ASO reportedly earns more than $80 million annually from global broadcasting deals. Then there are hosting fees. Towns pay between $70,000 and $120,000 to host the stage start or finish. Why? Well, because the tour draws tens of thousands of tours, global media attention and priceless.Marketing value. ASO then uses that money to fund the race’s prize pool. The total purse is around $2.5 million with the winner taking home about $540,000. But unlike other sports, riders usually split that money with their entire team, including mechanics, chefs, support staff, and other riders on their team. That’s why most riders rely on salaries and sponsorships more than prize money. Top cyclists can earn between$2 million.05 million dollars annually through team deals and endorsements. In simple terms, the Tour de France is much more than a bike race. It’s a three-week traveling roadshow with 4500 staff members, team buses, helicopters, and production crews coordinating a new city each day. It’s also a global marketing platform. Sponsors don’t just put their logos on jerseys, they set up villages, run caravans, and interact with millions of fans lining the roads.So, next time you see a pack of riders charging up a mountain, remember behind every pedal stroke is a century old business model that’s still spinning out profits.We’re all out of time, so it’s officially game over for this week. Thank you so much to Jake, Eddie, and for all of you for joining us. Please make sure to scan the QR code below to follow Yahoo Finance podcast for more videos and expert insight and catch us every Friday wherever you get your podcast. I’m your host, Joe Pompeiano. See you next

22:38 spk_3

time.This content was not intended to be financial advice and should not be used as a substitute for professional financial services.

Technology

High-Performance Monitor Lineups : HKC Corporation

HKC Corporation’s showcase is anchored by the introduction of several flagship products. The HKC M10 Ultra is promoted as the first monitor to utilize an RGB MiniLED backlight system for enhanced color and brightness control. It would appeal to professional graphic designers, video editors, and game developers. The KOORUI S4941XO is a large-format OLED screen with a high refresh rate aimed at immersive simulation gaming. Finally, the ANTGAMER ANT275PQ Ultra stands as an LCD monitor with an exceptionally high refresh rate for competitive esports.

Collectively, HKC Corporation’s display products demonstrate the company’s technical focus on advancements in panel construction, backlight engineering, and integrated image processing software.

Image Credit: HKC Corporation

Technology

Innovative Gaming Peripheral Ecosystems : gaming peripheral

At CES 2026, Akko calls attention to three distinct series — the Nest, the Dash, and the Framer. The brand highlights the Dash as its “most advanced mouse to date.” This computer peripheral weighs just 39 grams and boasts the PixArt 3950 sensor for ro-grade precision and stability. Nest, on the other hand, is a right-hand ergonomic style, while the Framer is for entry-level gaming.

In addition to the high-performance computer mice, Akko is also highlighting new keyboards — including the aluminum rapid assembly magnetic-switch keyboard MOD007v5 HE and the Year of the Snake Keyboard — as well as the M1 V5 TMR technology by Akko’s sister brand MonsGeek.

Image Credit: Akko

Technology

Gambling Industry Trends And Predictions For 2026

Gambling Industry Trends and Predictions for 2026

The global gambling industry enters 2026 on a rapid growth trajectory and at the cusp of transformative change. After reaching an estimated $99 billion in 2024, the global betting and gaming market is projected to nearly double by 2033 (approaching $182 billion) as digital platforms, mobile betting, and AI-driven innovations reshape how people gamble. This boom is fueled not only by technological leaps, but also by evolving consumer behaviors and shifting regulatory landscapes. By 2026, the industry will be more connected, data-driven, and consumer-focused than ever, blurring the line between gambling and broader digital entertainment.

Global Focus, Local Moves: North America and Europe currently dominate gambling revenue (about three-quarters of the market), but Asia-Pacific and Latin America are emerging as the next frontiers. In particular, Asia-Pacific’s liberalizing regulations, rising incomes, and mobile adoption are accelerating participation across the region. At the same time, the United States – which ignited a sports betting boom after 2018 – continues to expand state-by-state. Meanwhile, Europe’s mature markets are prioritizing sustainability and responsibility, and Latin America and Africa are opening up new opportunities. Across the world, stakeholders are “going all-in” on innovation and expansion, while bracing for greater oversight to ensure gambling grows safely.

In this outlook for 2026, we highlight the key trends shaping the iGaming (online gambling) sector and its convergence with traditional brick-and-mortar casinos. From new markets and regulations to tech breakthroughs and changing player expectations, the year ahead promises high stakes and big opportunities.

New Markets and Regulatory Shifts on the Horizon

Legalization Wave Continues

The map of regulated gambling is set to expand further in 2026. Several countries and jurisdictions are transitioning from gray markets to fully legal, competitive industries. Notably, Brazil – long considered a “sleeping giant” of gaming – is rolling out regulations for online sports betting and casino gaming, creating one of the world’s largest new markets. In Europe, Finland has decided to end its state monopoly and move toward a competitive licensing model by 2026, opening its lucrative market to private iGaming operators. These moves follow the trend of governments seeking tax revenue and consumer protection through licensing rather than prohibition.

United States Focus

In the U.S., the sports betting frenzy that spread to 35+ states is settling into a mature phase, but there are still holdouts and new opportunities. Major states like Texas and California remain unresolved – Texas lawmakers are weighing another push for sportsbooks (though realistically not before 2027) and California’s tribal vs. commercial interests make legalization challenging. Still, the pressure is mounting as Americans in nearly every region have gained access to legal betting.

Meanwhile, online casino gaming (iGaming) – currently legal in only seven states – is gaining traction. In 2025, multiple U.S. states saw legislative efforts to legalize online casinos, eyeing the success of pioneers like New Jersey, Michigan, and Pennsylvania. The record-breaking revenues reported by existing iGaming states underscore the opportunity: several markets have posted all-time monthly records, and year-over-year growth in iGaming has significantly outpaced growth in brick-and-mortar casinos. This momentum is likely to push more U.S. states to consider regulating online casinos in 2026 and beyond, especially as they watch neighbors reap tax windfalls.

Stricter Rules and Compliance

As new markets open, regulators everywhere are also tightening the rules in existing markets. Governments in major jurisdictions are introducing tougher measures for consumer protection, anti-money-laundering (AML), and advertising. The United Kingdom’s regulatory overhaul is a prime example – from stricter ad guidelines to potential online slot stake limits and affordability checks, UK operators face a more controlled environment. Other countries have gone so far as to heavily restrict or ban gambling advertising. Across Europe, compliance is king: the era of “grey area” operations is fading as authorities push operators to either go fully legal or get out.

In the U.S., regulators are aggressively enforcing rules to ensure a safe market. Several states have intensified enforcement against unlicensed platforms, increased cease-and-desist activity, and introduced new rule updates emphasizing tighter licensing standards, identity verification, AML protocols, and mandatory responsible gambling tools. This reflects a broader North American trend: as the online market matures, regulators are shifting from simply enabling new industries to rigorously policing them for compliance and strengthening player protections.

Tax and Policy Changes

Policymakers are also adjusting the financial rules around gambling. In the U.S., a notable change takes effect in 2026: recreational gamblers will lose a portion of their tax deductions on losses, with federal law capping deductible losses at 90% of winnings (down from 100%). This tax tweak may discourage some high-volume bettors or at least complicate their accounting. At the same time, U.S. reporting thresholds for certain jackpots have been modernized in recent years, reflecting a slow but steady effort to update outdated compliance burdens.

Overall, 2026’s regulatory landscape will be defined by expansion paired with vigilance: more markets opening up and more scrutiny to ensure gambling growth comes with strong consumer safeguards. Next, we look at one of the most intriguing regulatory battles brewing – the clash between traditional gambling operators and a new breed of betting platform known as prediction markets.

A major storyline heading into 2026 is the rise of prediction markets and their collision with traditional sports betting. Once a niche idea, prediction markets allow users to wager on practically any real-world outcome – from elections and economic indicators to pop culture outcomes – treating events like stocks to be traded. In the past two years, this segment expanded rapidly in the United States, blurring the line between gambling and financial trading. A growing roster of platforms has launched or gone mainstream, and major sports and gaming brands are experimenting with prediction-style products.

This flurry of innovation points to demand for new forms of interactive wagering. Younger bettors especially enjoy the stock-market-like experience of trading event outcomes, and volumes have surged across several platforms. These numbers have not gone unnoticed by the traditional gaming industry – or by its regulators.

Regulatory Crossfire

Prediction markets currently operate in a legal gray area in the U.S., often falling under federal commodities oversight rather than state gambling law. This has triggered backlash from established gambling stakeholders who argue these products resemble sports betting without the same level of licensing, consumer protection, and responsible gaming guardrails.

On the other side, prediction market companies and allied fintech firms are organizing and pushing for clearer frameworks that legitimize these markets nationwide. They argue that the legal system hasn’t kept pace with modern products, and that a patchwork of rules will create confusion and drive demand to offshore alternatives. The stage is set for a significant confrontation in 2026: federal regulators vs. state gaming authorities, and innovative platforms vs. incumbent casino and sportsbook ecosystems.

Why This Matters in 2026

Whether prediction markets are integrated into the regulated gaming system, restricted, or forced into separate lanes will shape everything from taxation and consumer protections to how sportsbooks innovate. The industry may be moving toward a reality where traditional operators either (1) partner into this category, (2) fight it aggressively, or (3) watch parts of wagering demand shift outside classic sportsbook rails. The outcome won’t just impact the U.S.; it will influence global regulators as they face similar fintech-gambling convergence pressures.

The Great Convergence: Merging iGaming with Brick-and-Mortar Casinos

The year 2026 will also highlight the convergence between online and land-based gambling, often dubbed the “omnichannel” approach. While online iGaming is booming, traditional physical casinos are not standing idle – many are leveraging technology and cross-platform strategies to stay relevant and connected to digital audiences. The central question for casino operators has become: How can we integrate the on-site casino experience with online play?

Omnichannel Strategies

Some forward-thinking casino companies are embracing hybrid innovations that turn brick-and-mortar resorts into content engines for digital channels. New live dealer concepts, broadcast-style casino content, and in-property studios are becoming a real strategy: they extend a casino brand beyond physical walls while turning on-site foot traffic into marketing reach.

Another critical driver of convergence is the integration of loyalty programs and currencies across channels. Big operators are linking loyalty points so that players earn and spend rewards whether they’re at a slot machine in Vegas or betting on an app at home. Increasingly, these rewards behave more like digital ecosystems than simple points programs. Over time, this may evolve toward a portable digital identity where engagement across sportsbook, casino, social gaming, and entertainment can be recognized and rewarded holistically.

Physical Casinos Go Digital

Brick-and-mortar casinos are also adopting more digital infrastructure: cashless wagering options, mobile wallets, app-driven player experiences, and increasing experimentation with biometrics for identity and loyalty recognition. These upgrades align with younger customers’ expectations and help casinos enhance operational efficiency while reducing certain fraud and compliance risks.

It’s worth noting that not all casino operators are on board. Some U.S. regional casino companies and tribal stakeholders remain cautious, citing cannibalization concerns and social impacts. Still, the broader revenue picture continues to pressure the industry toward convergence, especially as online channels deliver faster growth and higher scalability.

The “Phygital” Casino Experience

In 2026, expect to see more crossover initiatives that make gambling an anytime, anywhere activity. The convergence is also evident in content: casino games increasingly borrow features from video games (missions, rewards loops, community events), while physical casinos adopt attractions influenced by digital culture. For operators, the strategic advantage goes to whoever can unify experiences across platforms while respecting the regulatory and responsible gaming frameworks required in each market.

Tech Innovations: AI, Apps, and Immersive Betting

Technology has always been a driving force in iGaming, but heading into 2026, it’s clear the industry is entering another innovation cycle. Several tech trends are set to redefine how gambling products are built and how players engage:

Mobile 2.0 – Faster and More Immersive

Mobile betting is the primary channel for many consumers, and in 2026 mobile platforms are leveling up. Expect smoother UX, deeper personalization, more embedded live content, and early-stage applications of AR to create more immersive experiences. The smartphone is not just a portal to betting anymore; it’s becoming the interface layer for entertainment, payments, community, and identity.

Artificial Intelligence Everywhere

AI has moved from experimentation to operational core. It is now embedded in risk management, fraud detection, dynamic promotions, personalization, customer support, and even content generation. The next stage in 2026 is “industrialized AI”: measurable ROI, tighter governance, and clearer outcomes. In regulated markets, AI will increasingly be paired with compliance expectations – including systems designed to detect problem gambling behaviors earlier and deliver better interventions.

Fintech and Payments Innovation

Payments are becoming a strategic battleground. Open banking capabilities, faster payouts, improved fraud detection, and easier onboarding are changing player expectations. In parallel, crypto rails remain relevant, especially for international markets and certain user segments. For regulated operators, the key is not crypto hype, but crypto’s utility: faster settlement, transparent transaction trails, and optionality for global payments where traditional banking remains restrictive.

New Game Formats – eSports, Virtuals, and Microbets

New formats continue to expand the addressable audience. eSports betting is growing, virtual sports offer always-on wagering, and micro-betting is becoming a major engagement driver as operators refine the latency, data feeds, and in-play UX that this product demands. Major global sporting events in 2026 will likely accelerate micro-betting adoption as consumers learn to treat a match not as one bet, but as dozens of moment-to-moment decision points.

Gamification and Social Play

Gamification is now a baseline expectation in modern apps: missions, rewards, leaderboards, community challenges, and social layers that borrow heavily from video games. Meanwhile, streaming culture continues to collide with iGaming, as content creators, live casino formats, and interactive “watch and play” mechanics become more common acquisition channels. As these experiences scale, expect regulators to sharpen the rules around marketing, affiliate behavior, and ensuring responsible gaming protections extend into creator-led environments.

Cybersecurity and Reliability

As platforms scale, cybersecurity becomes existential. Attacks, phishing, and platform reliability issues can quickly damage trust. In 2026, regulators and major partners will increasingly treat security readiness and resilience as non-negotiable. Operators will invest further in multi-cloud uptime strategies, monitoring, and stronger identity protections to ensure stable, compliant operations at scale.

Responsible Gambling and the Social License

Amid all the growth and innovation, the industry in 2026 is putting a sharper focus on responsible gambling (RG). As gambling becomes more accessible digitally, the expectations rise: operators must prevent harm, regulators must protect consumers, and stakeholders must prove that industry growth can be sustainable.

Real-Time Intervention

One of the most important evolutions is the use of AI and behavioral analytics to detect harmful patterns earlier. Instead of relying solely on players to self-report or set limits, modern systems can identify risk signals and trigger interventions such as dynamic messaging, cooling-off prompts, or structured friction in the user journey.

Mandatory Measures and Culture Change

More jurisdictions are tightening requirements: deposit and time limits, self-exclusion enforcement, clear loss/win displays, enhanced KYC checks, and more robust proof-of-source-of-funds rules in higher-risk cases. The direction is clear: responsible gambling is no longer optional, and the companies that build it into product design will find it easier to keep market access, maintain brand trust, and partner with mainstream institutions.

The challenge is that responsible gambling messaging must be effective, not performative. Generic slogans are losing impact. The next phase is more personalized, contextual, and integrated into product design without creating a punitive experience for recreational users.

Conclusion: 2026 and Beyond – A High-Tech, High-Responsibility Future

The year 2026 is poised to be a pivotal chapter for iGaming and the casino industry, marked by convergence and innovation on one hand, and heightened responsibility and regulation on the other. We will see new markets expand, the U.S. inch closer to broader iGaming adoption, and regulators increasingly demand stronger safeguards as online access becomes ubiquitous.

Technology

Where Is India’s Gaming Industry Headed Next?

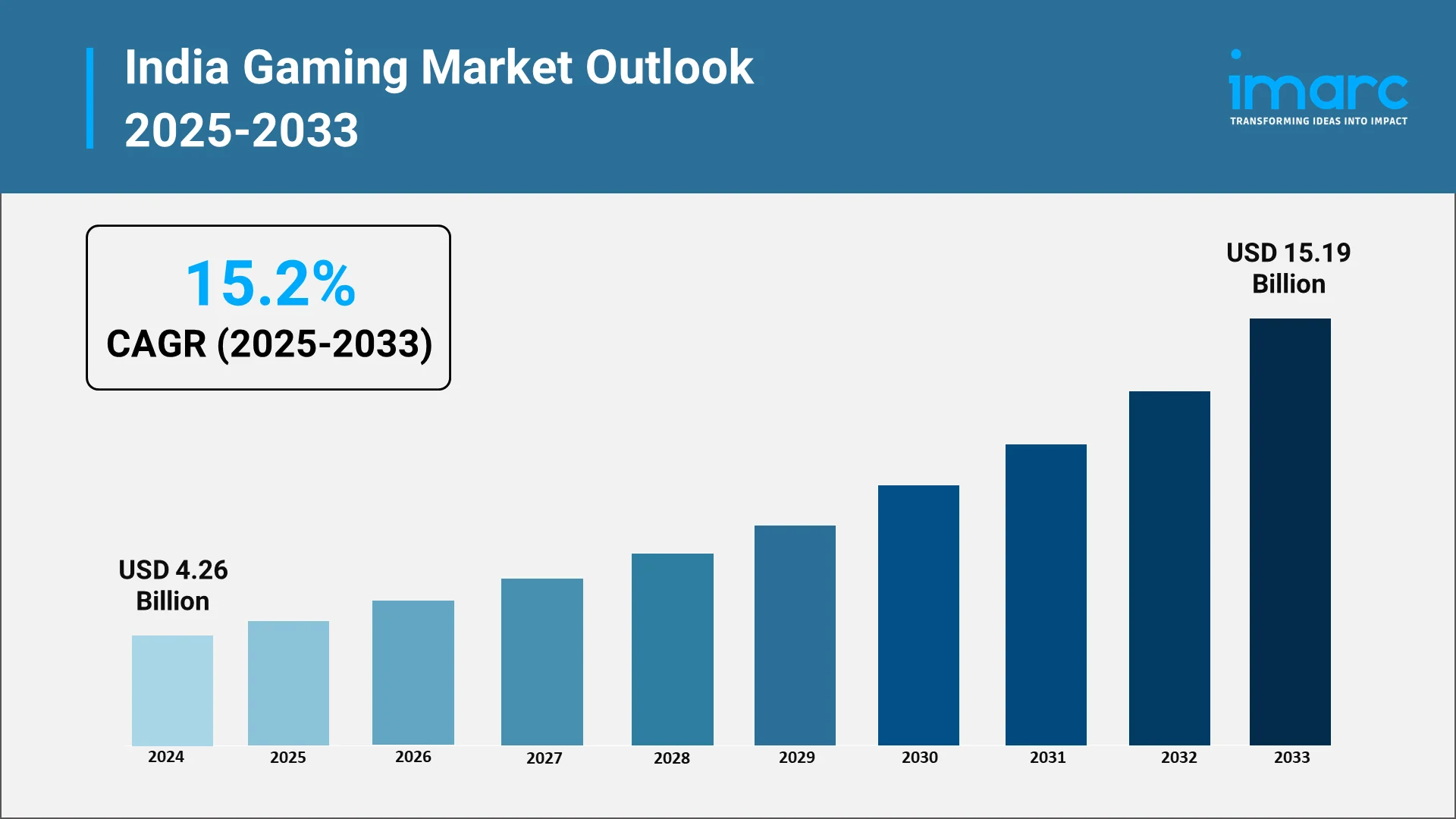

India’s gaming industry is rapidly evolving into one of the largest and most dynamic markets in the world. Driven by the increasing adoption of smartphones, affordable internet, and a tech-savvy youth population, gaming is becoming a mainstream form of entertainment. With mobile gaming leading the charge, the India gaming market is also witnessing significant growth in esports, cloud gaming, and immersive technologies like augmented reality (AR) and virtual reality (VR).

Unlocking New Realms: The Evolution and Key Opportunities in India’s Gaming Sector

The gaming sector is transitioning from a specialized sector to a dynamic and swiftly growing market, fueled by the rising use of smartphones, accessible internet, and a young, tech-oriented demographic. The rise of mobile gaming is at the heart of this transformation, with millions of people in India engaging in gaming on their smartphones daily. With the nation’s gaming industry growing, a variety of gamers, covering mobile, console, and PC platforms, are shaping the industry. Quantifying this rapid expansion, the IMARC Group reported that the gaming market size in India reached USD 4.26 Billion in 2024.

The primary opportunities ahead are in the rising need for localized content, as developers are concentrating on designing games that connect with Indian cultural and regional tastes. This presents substantial potential to reach a broader audience, especially in tier-2 and tier-3 cities. Moreover, the growth of esports, cloud gaming, AR, and VR technologies offers new opportunities for expansion. With the growing investment and support from both the government and private sectors, there is significant potential to establish India as a worldwide center for gaming development and creativity.

With the market’s maturation, the advancement of monetization strategies, enhanced infrastructure, and stronger regulations will continue to contribute to the increase in India gaming market share, unlocking untapped potential and fostering global competitiveness.

Explore in-depth findings for this market, Request Sample

Game On: Current Trends and Market Drivers Shaping India’s Gaming Future

According to IMARC Group’s projections, the India gaming market is projected to grow at a CAGR of around 15.2% from 2025 to 2033, reaching USD 15.19 Billion by 2033. The growth will be supported by the following factors:

- Smartphone and Internet Penetration

India’s increasing number of affordable smartphones, coupled with the expansion of high-speed internet access, is significantly broadening the market reach. As rural and non-metro areas gain improved connectivity, companies can target new user segments beyond urban centers. This growing accessibility enables casual, on-the-go gaming, contributing to a surge in user numbers and expanding the market. As of March 2024, India had 954.40 million total internet subscribers, with 398.35 million rural subscribers. Furthermore, by April 2024, 95.15% of India’s 644,131 villages were equipped with 3G/4G mobile connectivity, underscoring the increasing digital penetration across the country and creating vast opportunities for gaming expansion in rural areas.

- Monetization Evolution: In–App, Subscription & Cloud

The monetization models in the gaming market in India are evolving beyond basic in-app purchases. Traditional in-app purchases are being complemented by subscription models, cloud streaming, and cross-platform play, providing new revenue streams and catering to players seeking more flexibility and value. This shift allows gaming companies to offer premium experiences while enhancing player lifetime value. A prime example of this trend is Nvidia’s announcement in 2025 that its GeForce NOW cloud gaming service will launch in India, offering high-end gaming experiences on various devices. Premium members can access over 4,500 games, including popular titles like Borderlands 4 and Call of Duty: Black Ops 7, solidifying cloud gaming’s potential in India.

- Esports Partnerships and Innovation

A key factor driving the growth of the market is the increasing investment in esports partnerships and innovation. Realme’s collaboration with Krafton India as the official smartphone partner for the BattleGrounds Mobile Series (BGIS) 2025 and BGMI Pro Series (BMPS) 2025 highlights this trend. By using its GT 7 Pro for the tournaments, Realme is directly supporting both professional and grassroots players. This partnership not only boosts esports visibility but also strengthens the gaming ecosystem in India. As esports continues to gain traction, such collaborations enhance the gaming experience and contribute to market expansion.

- Localized Product Offerings and Market Tailoring

The growing availability of localized products tailored to the needs of Indian gamers is positively influencing the market. Acer’s announcement in 2025 to launch “Make in India” gaming laptops is a prime example. By customizing its Aspire/ALG, Nitro, and Predator series for the Indian market, Acer is addressing the performance, pricing, and usage patterns unique to Indian gamers. This move not only supports the rising demand for gaming PCs across casual, competitive, and creator segments but also taps into the rising interest in AI-ready devices, contributing to the rapid expansion of India’s gaming ecosystem.

The rise of accelerator programs and funding initiatives is helping local developers access advanced technology, mentorship, and global networks. The adoption of AI tools is particularly transformative, enhancing game development, player experiences, and monetization strategies. These AI-driven innovations improve gameplay mechanics, automate processes, and offer personalized content, making Indian games more competitive globally. A prime example is Meta’s India-focused Gaming Accelerator, launched in 2025, which supports 20–30 emerging studios with AI tools like Llama, along with mentorship and investor access to scale their games for global markets.

The Game Plan: Conquering Challenges and Unlocking New Opportunities

The Indian gaming industry encounters challenges like regulatory ambiguity, with many states lacking clear rules for online gaming, creating confusion for developers and players. The country’s vast and diverse population also requires significant investment in localization and culturally relevant content. Additionally, piracy and data security concerns remain persistent threats.

Despite these obstacles, the rapid increase in internet access and smartphone adoption, particularly in tier-2 and tier-3 cities, presents a large untapped market. Mobile gaming is becoming popular because of affordable smartphones and data plans, while localization offers a chance to engage diverse user bases. The growing momentum of the India Mobile Gaming Market further highlights how digital engagement is expanding across demographic groups. Esports and online competitions are also gaining traction, creating new opportunities for competitive gaming and sponsorships.

Masters of the Game: Who’s Leading India’s Gaming Industry

Major figures in the market are progressively concentrating on broadening their reach and enhancing user interaction by utilizing mobile-first approaches and integrating localized content. These firms are focusing on creating games that align with local tastes, providing content in various languages and crafting gameplay that reflects India’s rich cultural diversity. Numerous developers are investigating fresh monetization strategies, such as in-app purchases, subscription models, and live events, while incorporating social and multiplayer elements to promote community engagement. To remain competitive, they are significantly investing in technology like AI and cloud gaming to improve user experiences and provide smooth cross-platform play. Directly illustrating the investment in technology like cloud gaming to improve user experiences and provide smooth cross-platform play, Xbox launched cloud gaming in India for Game Pass subscribers in 2025, allowing high-end games to stream on mobiles, tablets, and PCs.

.webp)

The Game Changers: How Investment and Government Support Are Elevating the Gaming Sector

The gaming market in India is influenced by government-backed initiatives and a clear regulatory framework that foster innovation and growth. These programs support game design, development, and talent, attracting both local and global investments. The regulatory system ensures fair practices and transparency, building market trust and safeguarding user interests.

- Government-backed programs are essential in driving innovation and creating a vibrant gaming ecosystem in India. By supporting game design, development, and talent nurturing, these initiatives provide infrastructure, networking, and industry collaboration that attract both local and global investments. They also focus on cultivating local talent, ensuring the sector’s sustainability and competitiveness. The government’s commitment is evident in major initiatives like the Create in India Challenge and the AVGC-XR Mission, launched in 2025, which aim to foster original creation and collaboration across gaming, animation, VFX, and immersive technologies. These efforts strengthen India’s creative economy and position the country as a global hub for AVGC-XR innovation.

- A coherent regulatory system is vital for driving the gaming market in India. By establishing clear rules and categories for different game types, such as esports and online gaming, the framework ensures transparency and fair practices, fostering trust among investors and participants. This organized approach enhances market security for both developers and users, promoting sustainable growth. In 2025, the Ministry of Electronics and Information Technology (MeitY) addressed the need for such a framework with the release of the Draft Promotion and Regulation of Online Gaming Rules under the PROG Act. This created India’s first unified framework, with the Online Gaming Authority overseeing compliance, classification, and registration.

Leveling Up: IMARC’s Playbook for Navigating India’s Thriving Gaming Market

IMARC Group empowers stakeholders in India’s gaming industry with data-driven insights to succeed in one of the world’s fastest-growing entertainment markets. Our research and consulting services help clients identify untapped opportunities, navigate market uncertainties, and drive innovation in game design, marketing, and retail strategy.

- Market Insights: Track trends shaping India’s gaming market, including the rise in mobile gaming, increasing demand for esports, and the growing popularity of educational and strategy-based games. We also explore the emergence of local developers and the expanding gaming ecosystem.

- Strategic Forecasting: Predict future developments in the integration of digital and physical gaming experiences, the growth of online gaming platforms, evolving user preferences, and the impact of regional content and culturally relevant game narratives.

- Competitive Intelligence: Analyze strategies and offerings from leading game publishers and emerging startups, including how they are redefining gaming experiences with local themes, storytelling, and sustainable production practices.

- Policy and Regulatory Analysis: Understand trade regulations, intellectual property protection, licensing, and safety compliance standards crucial to the production and distribution of games in India.

- Tailored Consulting Solutions: Benefit from customized advice on market entry strategies, distribution models, branding, and game localization. IMARC’s expertise supports businesses in developing scalable, client-centric growth strategies in an expanding gaming ecosystem.

Technology

New Nevada Gaming Board Chairman Knows The Importance Of Getting Technology OK’d Quickly

The New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, signaling a clear focus on modernizing how gaming innovations move from development to casino floors. This approach reflects an understanding that technology now plays a central role in the gaming industry and that regulatory systems must evolve to keep Nevada competitive while maintaining its high standards.

New Chairman Knows the Importance of Approving Technology

Gaming technology is advancing at a rapid pace, from new slot machine platforms to cashless systems and enhanced security tools. When approvals take too long, Nevada risks seeing new products debut elsewhere first. The New Nevada Gaming Board Chairman knows the importance of getting technology approved quickly because delays can affect manufacturers, casino operators, and ultimately the state’s position as a leader in regulated gaming.

Industry Experience Shaping Regulatory Priorities

Leadership matters in regulatory agencies, especially in industries as complex as gaming. The new chairman brings experience that bridges regulation and technology, offering insight into how long approval timelines can impact innovation. This background helps explain why the New Nevada Gaming Board Chairman knows the importance of getting technology OK’d quickly, not as a shortcut, but as a way to make processes more efficient and predictable.

How Faster Approvals Benefit Nevada’s Gaming Industry

Timely technology approvals help casinos remain competitive and allow players to experience the latest advancements sooner. When Nevada can approve new gaming systems without unnecessary delays, it strengthens relationships with manufacturers and reinforces the state’s reputation as the global standard for gaming regulation.

Maintaining Integrity While Moving Faster

Speed does not mean sacrificing oversight. Nevada’s gaming regulators are still responsible for ensuring fairness, security, and compliance. The emphasis is on refining internal processes, improving communication, and reducing bottlenecks. This balanced approach explains why the Nevada Gaming Board Chairman knows the importance of getting technology approved quickly while continuing to uphold strict regulatory safeguards.

What This Means for the Future of Gaming Regulation

Looking ahead, a more responsive approval process could encourage greater innovation within Nevada’s gaming sector. Developers may be more inclined to launch new technologies in the state, and operators can adapt more quickly to player expectations.

By aligning regulatory efficiency with technological progress, Nevada positions itself to remain both a trusted regulator and an innovation-friendly environment in an increasingly competitive global gaming market.

Looking for Legal Guidance in Gaming?

If you follow SCCG content and have inquiries about your gaming business, connect with Lazarus Crystal Law Firm—formed by SCCG Management and Lazarus Legal to unite top-tier gaming law with commercialization and market-entry strategy.

Our Areas of Expertise Include:

• Nevada and multi-state gaming licensing

• Regulatory compliance and audit services

• International market entry and cross-border advisory

• Gaming M&A legal due diligence

• Tribal gaming legal and strategic support

• iGaming and sports betting regulatory guidance

Follow us on LinkedIn: Lazarus Crystal Law Firm

Technology

Page not found

-

Motorsports3 weeks ago

Motorsports3 weeks agoRoss Brawn to receive Autosport Gold Medal Award at 2026 Autosport Awards, Honouring a Lifetime Shaping Modern F1

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoStempien to seek opening for Branch County Circuit Court Judge | WTVB | 1590 AM · 95.5 FM

-

NIL3 weeks ago

NIL3 weeks agoDowntown Athletic Club of Hawaiʻi gives $300K to Boost the ’Bows NIL fund

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoPrinceton Area Community Foundation awards more than $1.3 million to 40 local nonprofits ⋆ Princeton, NJ local news %

-

NIL3 weeks ago

NIL3 weeks agoKentucky AD explains NIL, JMI partnership and cap rules

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoTeesside youth discovers more than a sport

-

Sports3 weeks ago

Sports3 weeks agoYoung People Are Driving a Surge in Triathlon Sign-Ups

-

Sports3 weeks ago

Sports3 weeks agoThree Clarkson Volleyball Players Named to CSC Academic All-District List

-

Motorsports3 weeks ago

Motorsports3 weeks agoPRI Show revs through Indy, sets tone for 2026 racing season

-

Sports3 weeks ago

Sports3 weeks agoCentral’s Meyer earns weekly USTFCCCA national honor