College Sports

The Business of Football: Why Tottenham have not been bought, and how much are Wrexham worth?

Among the many things this column is waiting for — a result in the Manchester City vs Premier League cage fight, Fenway Sports Group to buy a Spanish team, Gianni Infantino to give a press conference — none has been imminent for quite as long as a takeover at Tottenham Hotspur. Much like soccer has […]

Among the many things this column is waiting for — a result in the Manchester City vs Premier League cage fight, Fenway Sports Group to buy a Spanish team, Gianni Infantino to give a press conference — none has been imminent for quite as long as a takeover at Tottenham Hotspur.

Much like soccer has been the fastest-growing sport in the United States for half a century, Spurs have been the next big English club on the block for a decade.

In that time, Spurs have built the best multi-purpose stadium in Europe and sold lots of shirts, but won only one trophy. During the same period, the Premier League has become majority-owned by American billionaires and Tottenham’s billionaire former majority-owner, British businessman Joe Lewis, has put his shares into a family trust, pleaded guilty to insider trading, and celebrated his 88th birthday.

This is a fruit ripe for picking and every investor, private-equity firm and sovereign wealth fund looking for a prize asset in the world’s most popular domestic football league has kicked the tyres at Spurs, taken the tour and run the numbers.

So, why hasn’t anyone bought them yet?

Well, one big reason is that the club has been run by Lewis’ business partner, Daniel Levy, since 2001 and he owns just over a quarter of the club’s shares. Most experts believe Spurs are worth about £3billion ($4bn), or perhaps a bit more now that they are back in the Champions League and the likes of Beyonce are filling the stadium over the summer. But Levy wants £3.75b, another $1bn at today’s exchange rate.

Quite the gap, then, but not so wide that you cannot start haggling, which is why the Spurs takeover story re-emerges every few months and will continue to do so until someone hits Levy’s number, which may have to come down a tad when Joe Lewis’ family decide they want their inheritances.

Levy watches Tottenham play AZ in last season’s Europa League (Justin Setterfield/Getty Images)

None of this is particularly shocking and has been widely reported, but The Athletic has been told by several potential suitors that there are two under-reported factors which may influence where this meeting of minds will come.

The first is that not everybody sees the same potential in Tottenham — the north London district, not the club — that Levy and Lewis did. Spurs are by far the biggest attraction in an area that has not seen much gentrification. It is also usually an hour’s taxi ride from the West End hotels and restaurants that the Premier League’s overseas ownership class enjoy.

And the second is the £775million in private placement notes that Levy used to refinance the cost of building the stadium. The size of that debt is not the problem, as the additional revenue from the club’s new home is more than meeting the interest payments. The issue is that Levy, thanks to his good timing and great salesmanship, got a sweet deal when those notes were sold to asset managers, investment firms and pension funds in 2021.

Spurs issued nine tranches of notes, with a range of repayment dates from 2035 to 2051 and interest rates between 2.49 per cent and 3.02 per cent. According to the club’s most recent accounts, Spurs had total borrowings of £851.5m at the end of June 2024, at an average rate of 2.79 per cent and average maturity of almost 19 years.

This means Spurs are paying an interest rate that is lower than inflation. So, in financial terms, they are not really paying any interest at all. This is great for Spurs but terrible for everyone who holds that debt, which is why they are all hoping for a takeover, too, so they can exercise their change-of-control clauses, get their money back and do something else with it.

The club’s new owners would have no problem finding other people — and perhaps even the same people — with whom to refinance the debt. It will just cost them about £20m a year more at the current rates, which adds up over 19 years.

However, neither of those two issues — Spurs’ location or Levy’s luck with the interest rate cycle — are permanent or insurmountable. London is a city of villages that have ebbed and flowed in appeal over the centuries, and any extra interest payments could be covered by a naming rights deal. Interest rates are also meant to be coming down.

So, sit tight, takeover watchers. Spurs will be bought by someone, at some point.

Not the boldest of predictions, maybe, but it is the best we can do.

The big Wrexham valuation debate

On the subject of valuation gaps, Spurs’ is a hairline fracture compared to the gaping chasm at Wrexham or, more accurately, the debate about Wrexham’s valuation on this column’s favourite social-media channel, LinkedIn.

It all started earlier this month with a Bloomberg report headlined “Wrexham AFC Weighs Raising Funds at £350 Million Valuation”. Citing unnamed sources, the report said the newly promoted Championship club were talking to advisers about selling a minority stake to boost the playing budget and pay for a new stand.

Sensible stuff, right? And entirely in keeping with what the club’s owners have said they would do and — in fact — have already done, as they sold a stake to the New York-based Allyn family last October.

But that deal was at a valuation of £100m ($135m). OK, Wrexham were still a League One side back then, but it was a record for a third-tier side. So are we really suggesting they have more than tripled in value in less than nine months?

The answer is of course not… or perhaps, because Wrexham are unlike any other club in the English football pyramid.

First, they are Welsh. Second, they are the subject of a very popular Disney-made docuseries. And third, and we feel this column deserves a pat on the back for not mentioning this sooner, they are owned by Rob McElhenney and Ryan Reynolds.

For those among you who only have time in their lives for football, McElhenney is an American TV actor, producer and writer, and Reynolds is one of the world’s best-paid actors and most recognisable faces. They bought the then-fifth-tier club for £2m in 2021, but three straight promotions, all charted in heart-warming fashion by Disney’s cameras, have brought them to the gates of the Premier League.

But come on, £350m?!? That’s not far off half a billion U.S. dollars. Most English Football League clubs are lucky to be valued at double their annual turnover. In Wrexham’s case, that would be £70m based on last season’s earnings or £100m on next season’s projected earnings.

The top Premier League clubs are valued at about five times their turnover, which reflects the league’s mega media-rights deals, as well as their huge stadiums, global fanbases and access to European football. For Wrexham’s touted price tag to make sense, you would need to apply a revenue multiple that only the most popular American franchises, in the biggest leagues, can command.

But Wrexham is not Los Angeles, and the Championship is not the National Football League. Hence the arguments on LinkedIn.

Of those, the most interesting has been between Alexander Jarvis, the founder of Abu Dhabi-based Blackbridge Sports LLC, and former Charlton manager and Southampton vice-chairman Les Reed.

Jarvis, who recently advised an American group on their purchase of a small stake in Portugal’s Benfica, among other deals, has written two posts about the Wrexham valuation, calling it “a total clown show”, “football’s most outrageous over-valuation”, and “a gamble on celebrity and hype that completely ignores the hard realities of running a football club in the Championship”.

Plenty of people have replied to him saying they agree, including William Storey, who is best known for a collapsed sponsorship deal with F1 team Haas and several failed bids for football teams. He might not be the best referee, then.

Reed, who has been Wrexham’s “football strategy consultant” since 2021, hit back with a post that pointed out Jarvis & Co “have never actually experienced running a club, let alone a club in the Championship”, before noting that Southampton’s former owners, the Liebherr family, eventually sold their shares in the club for close to 10 times their initial investment, which is impressive but not quite the point Jarvis was making about multiples of turnover.

Reed continued by raising the examples of Bournemouth, Brentford and Brighton, three clubs who have invested heavily to become “sustainable” Premier League clubs, and asked “why would serious investors not want a stake” in Wrexham’s “journey” towards the same destination.

Reed, speaking at the Soccerex Global Convention in 2016, has worked as an adviser for Wrexham since 2021 (Daniel Smith/Getty Images for Soccerex)

So, who is right? The guy trying to earn his crust by advising on football takeovers, or the chap who works for Wrexham?

Well, according to this column’s panel of secret football finance experts, it depends on whether Wrexham should be valued as a regular football club or if they have transcended that status and are now a global entertainment brand. If it is the former, they are worth about £100m, which is the valuation the Allyns came in at. If it is the latter, well, why not?

However, even that more conservative valuation is highly vulnerable to what is known in business as “key person risk”. If Rob and Ryan are struck by lightning, get bored, fall out, get sick or lose a court case, will Wrexham look so transcendent?

It is a good debate and there is only one way to settle it: the price someone actually pays for a stake in the club.

Divide and… continue?

While very few clubs are as exposed to key person risk as Wrexham, all are vulnerable to any weakening in demand for the right to broadcast or stream their matches.

If you had to pick one reason valuations have kept rising in the big leagues on both sides of the Atlantic, it is that live sport has been a must-have for TV executives. This means their sports counterparts have only needed two rival broadcasters in any market to create an auction.

So, this month’s news that New York-based media giant Warner Bros Discovery (WBD) is splitting into two separate companies has prompted an outpouring of speculation about what it might mean for sport. So far, there is no real consensus.

For those who have missed this story, WBD was formed in 2022 by an expensive merger between two multinational media conglomerates, WarnerMedia and Discovery. But the company’s bosses have now decided to put all the cool, still-growing stuff in one company, Streaming & Studios, so it is not held back by the profitable-but-in-decline TV channels.

Channing Dungey, chairman and CEO of Warner Bros Television Group and WBD U.S. Networks (Dimitrios Kambouris/Getty Images for Warner Bros. Discovery)

The latter are being boxed up in a company called Global Networks and, just in case you did not work out which one of these two entities is the sexy one, it will be run by WBD’s head beancounter, while the chief executive is getting the company that makes Batman, Harry Potter and Game of Thrones. And just to underline that message, all of WBD’s merger-related debt is being passed to the dowdier daughter.

If there is any agreement on what this means for the sports industry, it is that any impact will be felt first in the United States, where WBD’s streaming platform Max has struggled to find its place in a congested market, despite having a decent range of sports to offer. Does this mean that sport is no longer a must-have for any self-respecting media offering, or has WBD just packaged it badly?

The main sports brand is TNT Sports, which is joining the gang in managed decline at Global Networks. It has been part of the Max bundle but has recently lost its NBA rights after a 40-year connection with the league. It still has some baseball, college basketball, ice hockey and motorsport, but it does not have any NFL, so it is more of a nice-to-have than a must-have for most American sports fans.

The picture in the UK is a little different, as TNT Sports does have what most British armchair sports fans consider to be essential viewing, namely a package of Premier League rights and near-exclusive rights to UEFA’s club competitions. TNT Sports acquired the football when it formed a 50-50 joint venture with BT Sports in 2022, which united BT’s menu of football, rugby and assorted North American pastimes with Eurosport’s smorgasbord of cycling, tennis and the snowy stuff we watch once every four years in the Winter Olympics.

And then, just to confuse you even further, WBD’s streaming offer in the UK and Europe has been Discovery+, although it has started to turn that off and replace it with Max. Oh, and BT has also been trying, unsuccessfully, to sell its 50 per cent of TNT Sports, which really means that WBD has declined to pay BT’s price for the rest of the business.

TNT presenter Laura Woods quizzes Rio Ferdinand and Steven Gerrard at last month’s Champions League final (Stu Forster/Getty Images)

To make some sense of all this, this column asked four media analysts for their takes on the WBD split.

Dan Harraghy of Ampere Analysis does not see any impact for WBD’s UK operations until HBO Max launches in early 2026. For him, the real lesson of this tale is the tension “between the high value placed on sports rights by linear TV players” and the negative outlook for traditional broadcasting, which would explain why so many leagues have stopped seeing growth in the value of their rights.

Even the mighty Premier League has had to throw in more content, spread out over the weekend, to get the same amount of money from its domestic partners.

Independent analyst Paolo Pescatore thinks the split will highlight something he has been saying for a while: TNT Sports is “an entity in slow, painful decline”. He thinks the joint venture was “poorly executed”, with subscriber numbers falling and losses rising, which is why nobody has bought that 50 per cent stake in the business. Pescatore also believes the rising cost of watching sport, coupled with confusion over where to watch it, has driven the rise in digital piracy.

Sports rights consultant Pierre Maes said he cannot see signs of any positive strategy for building an attractive streaming product in the UK and Europe, and dismisses the WBD split as a “desperate move to calm down the stock market”.

But the BBC’s former head of sports rights, David Murray, is a bit more optimistic.

“My initial view is that it’s probably a good thing for sport,” he said. “I never got their strategy of wanting to bundle the likes of HBO with TNT Sport. So, in theory, the Discovery+ proposition can be a lot more focused, which should keep the price lower and allow it to cut through more than it would have done as part of a broader bundle.”

Lower prices and more focus on providing a great sports product should be a benefit to consumers and sports rights-holders, as digital piracy is probably the number one threat to professional sport as we know it.

Missed deadline dashes Drogheda’s dream

Speaking of good times gone bad, we cannot have an edition of this column without a new cautionary tale about multi-club ownership (MCO).

This one concerns Irish club Drogheda United, who have just lost their appeal against a UEFA decision to prevent them taking part in next season’s Conference League, a prize they thought they had earned with their FAI Cup victory last November, because their American owners Trivela also have a stake in Danish side Silkeborg, who qualified for the same competition.

Under UEFA rules, two teams with common ownership cannot play in the same competition and any clash is avoided by removing the team that finished lowest in its league. In this case, UEFA looked at Drogheda United’s ninth-place finish in 2024 versus Silkeborg’s seventh-place finish this year.

Aaron McNally and Andrew Quinn celebrate winning the FAI Cup in November 2024 (Stephen McCarthy/Sportsfile via Getty Images)

Trivela took its case to the Court of Arbitration for Sport, claiming that neither the Football Association of Ireland nor UEFA told the Alabama-based group that European football’s governing body had moved forward the date for owners of MCO groups to create enough separation between their teams so they can potentially compete against each other.

Until this year, owners had until the start of June to dilute their shareholdings in one club or put all of their shares in a blind trust, but UEFA shifted that deadline to the start of March.

Drogheda United, of course, are not the only side to miss this memo, as FA Cup winners Crystal Palace are still waiting to find out if they will be allowed to take their place in the Europa League alongside their co-owner John Textor’s French side Lyon.

The two cases are not identical, as there is no dispute that Drogheda and Silkeborg are controlled by the same owner, whereas Textor has never had that much sway at Palace, but Trivela’s travails demonstrate that UEFA is getting increasingly strict with MCO groups.

“We are totally gutted by this outcome for the club, its players, its staff and its supporters,” Trivela co-founder Ben Boycott tells The Athletic.

“To all of them, I’m deeply sorry that we’re going through this. We genuinely felt we had a compelling case before CAS, a point somewhat reinforced in the observation that this appears to have been a split (2-1) decision among the arbitrators.”

Trivela has committed to filling the €500,000 (£425,000) hole in Drogheda United’s budget left by the removal of European football, but is still processing what Boycott believes was a “very harsh decision which ignored a number of mitigating factors and months of good-faith efforts on our part to come to a solution with UEFA”.

It has been a tough few weeks for Trivela as their English outfit, Walsall, were 12 points clear at the top of League Two with 11 games to go, only to lose form and end up in the play-offs, where they rallied to beat Chesterfield in the semi-finals, only to lose 1-0 at Wembley to AFC Wimbledon.

More clubs equal more opportunities for disappointment.

Regulator reaches final straight

And let us wrap up this edition of the Business of Football with another column staple: an update on the arrival of English football’s independent regulator.

We will keep this short and sweet — it really is coming now.

For the first time since this process started in 2021, something has happened ahead of schedule. On Tuesday, the Football Governance Bill passed through the committee stage of the legislative process, without requiring the three further days that had been scheduled for debate.

The next step is the report stage, then the third reading of the bill in the House of Commons, before moving to a final consideration of amendments and royal assent. But with the Conservative Party’s Premier League-backed rearguard action running out of puff, the bill’s supporters are confident it will become law before the politicians break up for their summer recess on July 22.

Which means we can all start moaning about the regulator’s shortcomings from next season.

(Top photo: Catherine Ivill – AMA/Getty Images)

College Sports

LSU Tigers Gymnastics Adds Boise State Graduate Transfer to 2026 Roster

BATON ROUGE – The LSU Gymnastics program announced the final piece to their 2026 roster on Tuesday as Boise State graduate transfer Courtney Blackson is set to join the Tigers this upcoming fall. Blackson achieved one of the most successful careers with the Broncos from 2021-2024, where she individually advanced to nationals two years in a […]

BATON ROUGE – The LSU Gymnastics program announced the final piece to their 2026 roster on Tuesday as Boise State graduate transfer Courtney Blackson is set to join the Tigers this upcoming fall.

Blackson achieved one of the most successful careers with the Broncos from 2021-2024, where she individually advanced to nationals two years in a row, including being the national vault runner up in 2023.

She was a nominee for the AAI Award in 2024, which is given to the top senior gymnast in the nation.

“I am incredibly grateful to be spending my fifth year of eligibility at LSU! From the moment I stepped on campus, there was a palpable feeling of belonging that confirmed this was exactly where I was meant to be,” said Blackson.

“I felt truly seen, valued, and inspired from the moment I first connected with the coaching staff, and their genuine belief in me as both an athlete and a person fostered a sense of purpose and belonging that I couldn’t overlook.

“LSU’s culture balances the pursuit of excellence with a strong sense of family, empowering every athlete not just to develop their skills but also to grow as individuals. I feel honored to join a community that challenges me, believes in me, and celebrates every step of my journey with sincerity and compassion.”

Blackson entered the transfer portal a year after completing her final year at Boise State in 2024. Now, the two-time All-American out of Elk Grove, California, plans to use her final year of eligibility with the two-time defending SEC Champions at LSU.

Blackson adds depth on three events for the Tigers this upcoming season.

She competed in all but three meets throughout her four years at Boise State and owns career bests of 10.000 on vault and 9.950 on bars and floor.

Blackson’s Career Accolades:

LSU Football, Texas Longhorns and Michigan Wolverines Trending in Recruiting

LSU Football and Notre Dame Fighting Irish Making Early Impression on Top Cornerback

No. 1 Athlete in America, Five-Star LSU Football Commit Helping Recruit Top Prospect

Follow Zack Nagy on Twitter: @znagy20 and LSU Tigers On SI: @LSUTigersSI for all coverage surrounding the LSU Tigers.

College Sports

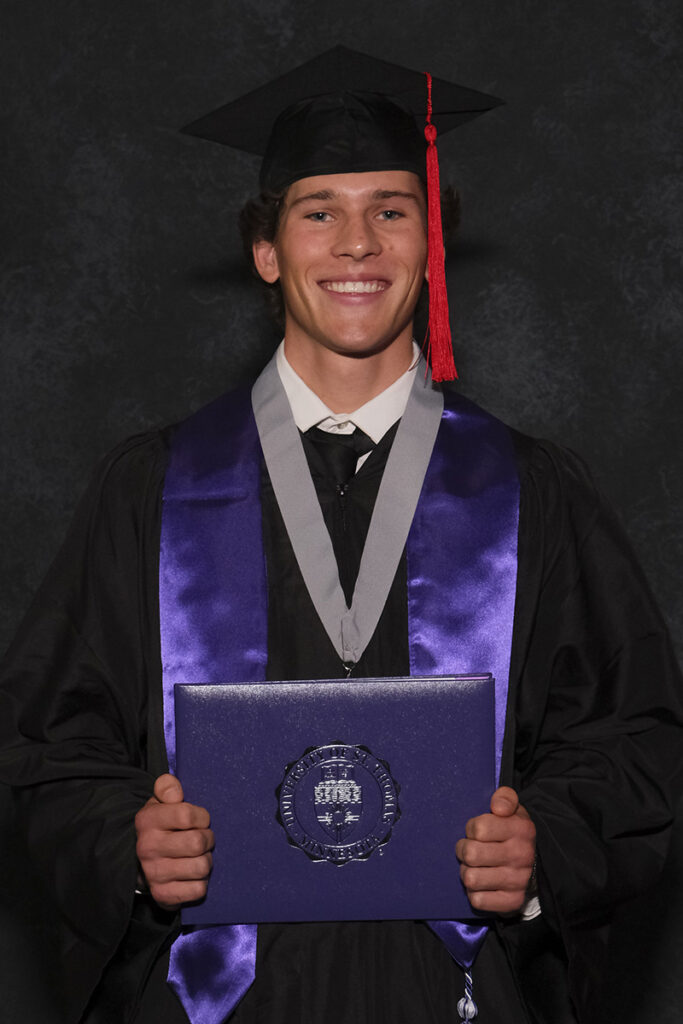

St. Thomas Students Go ‘Beyond the Buzzer’ in Collaboration With Athletics – Newsroom

When College of Arts and Sciences (CAS) Dean Bill Tolman and Vice President and Director of Athletics Phil Esten began discussing opportunities for a collaboration, they knew one thing: They wanted University of St. Thomas students to be at the center of the project. The result is a student-driven series of video shorts called “Beyond […]

When College of Arts and Sciences (CAS) Dean Bill Tolman and Vice President and Director of Athletics Phil Esten began discussing opportunities for a collaboration, they knew one thing: They wanted University of St. Thomas students to be at the center of the project. The result is a student-driven series of video shorts called “Beyond the Buzzer” and delivered in a big way.

The series was filmed, edited and produced by Digital Media Arts students Corina Sandy ’25 and Max Lidtke ’25, and then released in a social media campaign. Topics covered included sports medicine, broadcast production, gym setup and a preview of the Lee & Penny Anderson Arena, which will host its first competitive events this fall and winter for men’s and women’s basketball and ice hockey.

“This collaboration between Athletics and CAS provided an impactful learning experience for the students,” Tolman said. “Corina and Max were empowered to express their creative energy and skills to tell stories about people working behind the scenes to support athletic events and programs.”

Corina Sandy ’25

Major: Digital Media Arts

Minors: Catholic Studies, Theology

Hometown: Zimmerman, Minnesota

Future Plans: This summer I’ve begun doing wedding videography more full time, and I also manage social media at Cal & Lily Flower Farm. For the future, we will see where God takes me. I just know I will always be doing videography in some way!

The duo were a natural fit for the project. In addition to their time studying Digital Media Arts at St. Thomas, both had previously worked as members of Tommie Athletic Productions. (TAP). “Our idea was inspired by our personal experiences working with TAP and our desire to highlight the behind-the-scenes work,” Sandy said. “That led us to think about all the other roles within Athletics that many students and supporters may not be aware of.”

“Corina and Max are two very talented folks. To see them work, grow, and thrive in their time at St. Thomas, culminating in their excellent output on this keystone project, was special,” said Assistant Athletic Director and TAP lead Mike Gallagher, who connected the students with subject matter experts and oversaw the final editing process.

Max Lidtke ’25

Major: Digital Media Arts

Hometown: Hastings, Minnesota

Future Plans: My goal is to work in the NHL as a videographer/editor. I am currently a video production intern for the St. Louis Blues so my goals are becoming much more tangible!

Sandy and Lidtke both commented on the value of hands-on, experiential learning emphasized in the College of Arts and Sciences. Lidtke said that “this is the best type of learning. We get to use everything we already know to solve a problem or create something – and when we need help, it’s there.”

Dr. Peter Gregg, an associate professor and chair in the Emerging Media Department, provided key guidance throughout the project, often meeting weekly with Corina and Max to brainstorm topics and develop a robust proposal to pitch to Tolman and Gallagher. “Beyond the Buzzer reflects a student-led, professional media production experience,” Gregg said. “Being able to take the skills they’ve learned in their coursework and connect it to a Division I athletics organization is a significant opportunity and challenge, and the students succeeded in what they set out to do.”

As St. Thomas seeks to expand its impact and visibility as a national Catholic university, academic and athletic excellence will both play critical roles. “This is an area of great opportunity,” Tolman added. “I’m excited by this and other occasions for CAS and Athletics to work together to drive the university forward.”

This experience helped grow my confidence as a creator, pushing me to make decisions and trust them. I often remind myself, ‘Act confident and no one will question you,’ and I found myself leaning on that mindset often as I navigated a more professional environment as a student.

— Corina sandy ’25

College Sports

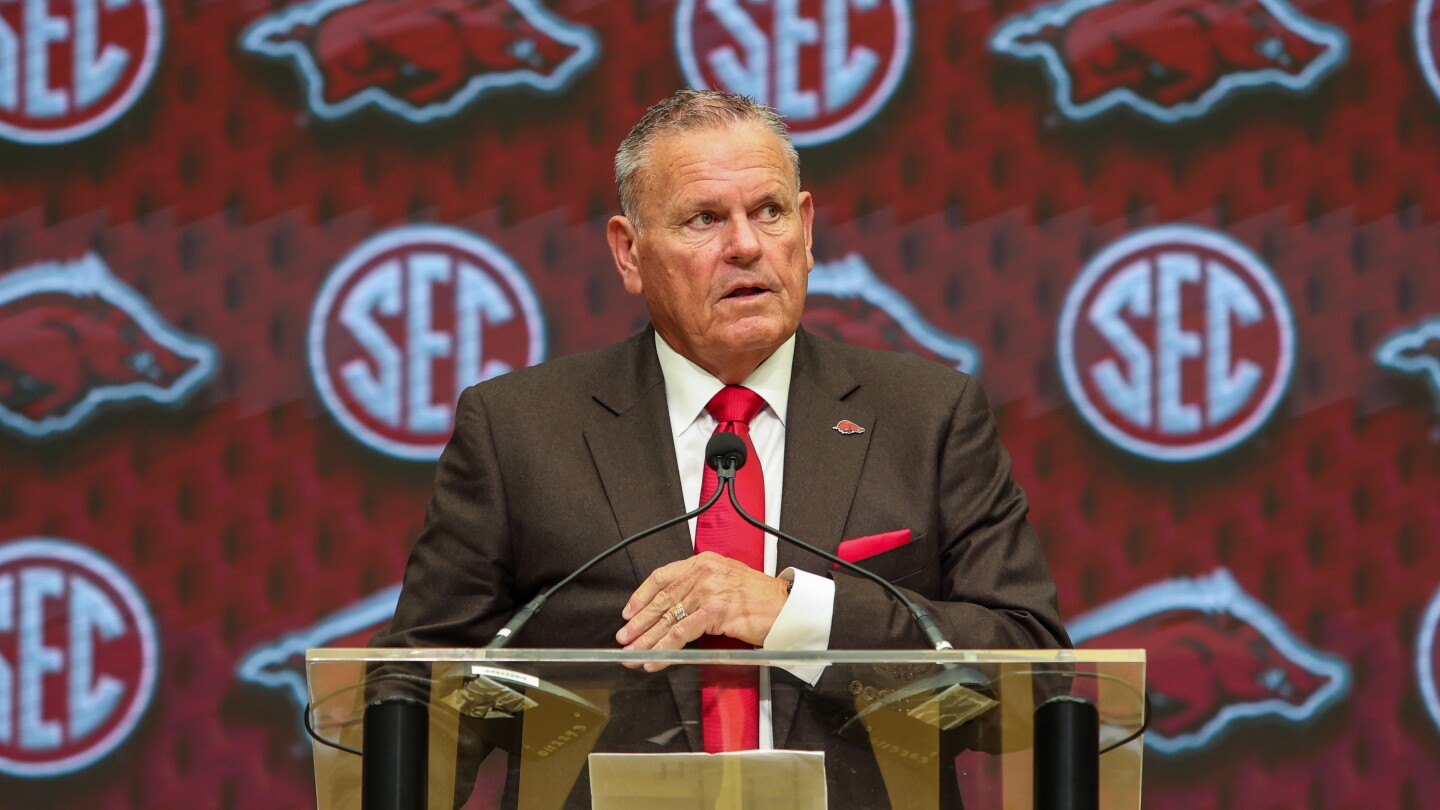

Coaches race to master art of retention amid NIL, revenue sharing and transfer portal challenges

Whether it was an ACC, SEC, Big Ten or Big 12 coach taking the podium at media days, one theme remained consistent: In an era where revenue sharing and NIL opportunities can swiftly steer athletes toward the transfer portal, programs across the country are racing to master the art of player retention. Its importance is […]

Whether it was an ACC, SEC, Big Ten or Big 12 coach taking the podium at media days, one theme remained consistent: In an era where revenue sharing and NIL opportunities can swiftly steer athletes toward the transfer portal, programs across the country are racing to master the art of player retention.

Its importance is clear to Arkansas coach Sam Pittman, who has seen all but five players from his 2023 recruiting class leave for different programs.

“Here’s what it’s not because of: the way they’re treated, because of the way they’re developed, because of the way they’re taught,” he said. “That’s not the reason. It could be playing time. It could be finances. Probably the majority of it is finances, but you’d have to ask those guys.”

More than 3,000 Bowl Subdivision players reportedly entered the transfer portal this past spring, which would average out to about 22 players per team. For the Razorbacks, 10 starters will be back and one of them is senior defensive lineman Cam Ball. He has remained with Arkansas his entire career, a somewhat rare occurrence for an NFL hopeful these days.

“I’m just a loyal guy. I’m loyal to the state of Arkansas; Arkansas has been loyal to me,” Ball said.

Arkansas, like many schools, is also trying to scare up more money from donors as it faces the financial ramifications of the $2.8 billion House settlement; last fall, the athletic director said the school needed some $12 million more annually to “be in the NIL game from a football perspective.” Besides the money, the Razorbacks have to find talented players; Ball grew up in Atlanta, just barely within the regional footprint in which Pittman prefers to recruit.

“We have to go outside our state,” Pittman said. “In-state recruiting has changed over the last three or four years because of NIL. So you have to think about the talent — who it is versus what pay is expected. So that’s been a little bit more difficult in our state.”

Pittman isn’t the only coach who wants prospects to be familiar with what their college experience will look like before making any life-changing decisions. Florida coach Billy Napier paints a clear picture of life in Gainesville and the challenges and perks that come with it.

“We present our product in a way where we’re selling the degree, the alumni network, the Gator-made program, and you have to be up for the challenge of trying to get Florida back to where it’s been before,” he said. “And I think that’s one of the reasons we’ve been able to keep it together.”

Florida’s 2023 recruiting class remains mostly intact, and from Napier’s perspective, hungrier than ever. Compared to other SEC teams, the Gators have had more success with retention. Napier doesn’t think it’s a coincidence.

“We told them when they came in, you know, look, it’s not going to be all sunshine and rainbows here. We’re in this thing for the long haul,” Napier said. “I think a lot of this is how you pitch it in recruiting. We’re going to continue to do that, and retention is more important than it’s ever been.”

Coaches scrambling to prevent transfers and maintain consistency isn’t exclusive to the SEC. The approval of the House settlement is a double-edged sword when it comes to retention, and Power Four schools and beyond are feeling the effects. Third-party NIL deals are no longer the only negotiation tactic schools need to worry about.

Complex contracts are becoming common and legal risks grow for athletes and programs alike as college football increasingly resembles the pros. Some deals are being negotiated solely by athletes as young as 18.

As a redshirt senior, Louisville linebacker TJ Quinn is used to the process.

“I wouldn’t say I was nervous (to negotiate) because this is my third year of having to do that,” Quinn said. “You’ve got to kind of stand your ground with what you feel like is your worth. If you’re comfortable with their offer, then sign. Then you have some guys that’ll leave and go to schools to get more money and stuff. That was never really like a big pusher for me, to go out and get more money because I feel like I’m in a good situation here at Louisville.”

Quinn’s loyalty could be the most convincing negotiation tactic of them all. While programs use revenue-share dollars to sway prospective transfers, coaches have begun to reward loyalty.

“To some degree, it’s capitalism that you get what you earn. So the guys that go out and play well are going to get more than the guys who haven’t proven it yet,” SMU coach Rhett Lashlee said. “Everybody on the team’s not going to make the same. Fair doesn’t always mean equal.”

But he also said the Mustangs are not going to add players “making a whole lot more than those guys who have already earned it here.”

“And I think that’s what helps us keep a good culture, is try to start with: Let’s retain first, and then whatever’s left, let’s go build the best team we can for those guys,” Lashlee said.

North Carolina State’s Dave Doeren doubled down.

“A guy that’s been on a team three years, that’s playing well and earned it on the field should make more than a guy coming in the door. I think that’s a proper way to do business,” Doeren said, though he warned that might not be the case across the board. “Right now, common sense is not prevailing in college football.”

College Sports

23 forwards to watch for Aug. 1

Carter Meyer is accelerating to be a junior. (Robert Chalmers/Cohen’s Hockey) This will be an interesting opening to college recruitment. For starters, there are high-end players that colleges are already recruiting hard. There is a slew of forwards who are pretty easily projectable as impact college hockey players. On defense, there is quite a bit […]

Carter Meyer is accelerating to be a junior. (Robert Chalmers/Cohen’s Hockey)

This will be an interesting opening to college recruitment.

For starters, there are high-end players that colleges are already recruiting hard. There is a slew of forwards who are pretty easily projectable as impact college hockey players. On defense, there is quite a bit of size, which has become all the rage for defensemen these days.

However, this recruiting cycle will be most interesting because of what happened last year: the CHL ruling.

With CHL players now eligible to play NCAA Division 1 hockey, there will likely be heavy implications on recruiting.

Will programs send out fewer offers? Will they wait for many of these players to develop further, pitting them against current CHL players?

And on the other side of it, will recruits be more hesitant to commit somewhere because of how many CHL players that school is taking in?

Time will tell.

Here are the top first-year eligible forwards to watch come Aug. 1, which is when rising juniors in high school can accept an offer. A separate story will be run on defensemen and goalies.

College Sports

Coaches race to master art of retention amid NIL, revenue sharing and transfer portal challenges

Whether it was an ACC, SEC, Big Ten or Big 12 coach taking the podium at media days, one theme remained consistent: In an era where revenue sharing and NIL opportunities can swiftly steer athletes toward the transfer portal, programs across the country are racing to master the art of player retention. Its importance is […]

Whether it was an ACC, SEC, Big Ten or Big 12 coach taking the podium at media days, one theme remained consistent: In an era where revenue sharing and NIL opportunities can swiftly steer athletes toward the transfer portal, programs across the country are racing to master the art of player retention.

Its importance is clear to Arkansas coach Sam Pittman, who has seen all but five players from his 2023 recruiting class leave for different programs.

“Here’s what it’s not because of: the way they’re treated, because of the way they’re developed, because of the way they’re taught,” he said. “That’s not the reason. It could be playing time. It could be finances. Probably the majority of it is finances, but you’d have to ask those guys.”

More than 3,000 Bowl Subdivision players reportedly entered the transfer portal this past spring, which would average out to about 22 players per team. For the Razorbacks, 10 starters will be back and one of them is senior defensive lineman Cam Ball. He has remained with Arkansas his entire career, a somewhat rare occurrence for an NFL hopeful these days.

“I’m just a loyal guy. I’m loyal to the state of Arkansas; Arkansas has been loyal to me,” Ball said.

Arkansas, like many schools, is also trying to scare up more money from donors as it faces the financial ramifications of the $2.8 billion House settlement; last fall, the athletic director said the school needed some $12 million more annually to “be in the NIL game from a football perspective.” Besides the money, the Razorbacks have to find talented players; Ball grew up in Atlanta, just barely within the regional footprint in which Pittman prefers to recruit.

“We have to go outside our state,” Pittman said. “In-state recruiting has changed over the last three or four years because of NIL. So you have to think about the talent — who it is versus what pay is expected. So that’s been a little bit more difficult in our state.”

Pittman isn’t the only coach who wants prospects to be familiar with what their college experience will look like before making any life-changing decisions. Florida coach Billy Napier paints a clear picture of life in Gainesville and the challenges and perks that come with it.

“We present our product in a way where we’re selling the degree, the alumni network, the Gator-made program, and you have to be up for the challenge of trying to get Florida back to where it’s been before,” he said. “And I think that’s one of the reasons we’ve been able to keep it together.”

Florida’s 2023 recruiting class remains mostly intact, and from Napier’s perspective, hungrier than ever. Compared to other SEC teams, the Gators have had more success with retention. Napier doesn’t think it’s a coincidence.

“We told them when they came in, you know, look, it’s not going to be all sunshine and rainbows here. We’re in this thing for the long haul,” Napier said. “I think a lot of this is how you pitch it in recruiting. We’re going to continue to do that, and retention is more important than it’s ever been.”

Coaches scrambling to prevent transfers and maintain consistency isn’t exclusive to the SEC. The approval of the House settlement is a double-edged sword when it comes to retention, and Power Four schools and beyond are feeling the effects. Third-party NIL deals are no longer the only negotiation tactic schools need to worry about.

Complex contracts are becoming common and legal risks grow for athletes and programs alike as college football increasingly resembles the pros. Some deals are being negotiated solely by athletes as young as 18.

As a redshirt senior, Louisville linebacker TJ Quinn is used to the process.

“I wouldn’t say I was nervous (to negotiate) because this is my third year of having to do that,” Quinn said. “You’ve got to kind of stand your ground with what you feel like is your worth. If you’re comfortable with their offer, then sign. Then you have some guys that’ll leave and go to schools to get more money and stuff. That was never really like a big pusher for me, to go out and get more money because I feel like I’m in a good situation here at Louisville.”

Quinn’s loyalty could be the most convincing negotiation tactic of them all. While programs use revenue-share dollars to sway prospective transfers, coaches have begun to reward loyalty.

“To some degree, it’s capitalism that you get what you earn. So the guys that go out and play well are going to get more than the guys who haven’t proven it yet,” SMU coach Rhett Lashlee said. “Everybody on the team’s not going to make the same. Fair doesn’t always mean equal.”

But he also said the Mustangs are not going to add players “making a whole lot more than those guys who have already earned it here.”

“And I think that’s what helps us keep a good culture, is try to start with: Let’s retain first, and then whatever’s left, let’s go build the best team we can for those guys,” Lashlee said.

North Carolina State’s Dave Doeren doubled down.

“A guy that’s been on a team three years, that’s playing well and earned it on the field should make more than a guy coming in the door. I think that’s a proper way to do business,” Doeren said, though he warned that might not be the case across the board. “Right now, common sense is not prevailing in college football.”

___

AP Sports Writer Aaron Beard contributed to this report.

___

AP college football: https://apnews.com/hub/college-football

College Sports

Eric Podbelski – Baseball Coach

Eric Podbelski is in his first season as the associate head coach of the Bears’ in 2026. With nearly three decades of collegiate head coaching experience under his belt, Podbelski came to College Hill in July 2025 to join Frank Holbrook’s staff, who was one of his former players at Wheaton. Podbelski served as […]

Podbelski served as the head coach at Wheaton for the first 28 years of the program’s existence, starting with its inaugural season in 1998. During his tenure, he posted an 817-342-5 overall record, the 15th-most wins among active Division III coaches as of 2025, while his .704 winning percentage was seventh-best among active coaches. The Lyons also never had a losing season during that time, qualifying for all 25 NEWMAC postseason Tournaments, three 40+ win seasons and 14 campaigns with at least 30 victories.

A model of consistency and excellence in his 28 seasons, Podbelski’s squads captured at least a share of 21 NEWMAC regular season titles, 17 tournament championships, made 18 NCAA Tournaments, and four trips to the Division III College World Series, including a pair of national runner-up finishes in 2006 and 2012. Wheaton earned at least a share of the NEWMAC regular season crown 17 years in a row, with Podbelski earning 12 NEWMAC Coach of the Year/Staff of the Year honors, six NEIBA Coach of the Year honors, and was selected as the regional coach of the year five times.

Podbelski coached 114 All-NEWMAC selections, as well as 132 all-region honorees and 21 All-Americans. Sixteen of his players were also named NEWMAC Players of the Year. Nine of his former players went on to sign professionally, including MLB veteran Chris Denorfia.

Podbelski graduated from Brandeis in 1991 where he finished among the school’s career leaders in wins with 23. He played one summer in the Cape Cod League with the Falmouth Commodores.

HEAD COACHING RECORDS

| Seasons | School | Overall | Pct. | Conference | Conf. Pct. |

|---|---|---|---|---|---|

| 1998-2025 | Wheaton | 817-342-5 | .704 | 297-75 | .798 |

COACHING TIMELINE

| Season | School | Title |

|---|---|---|

| 1993-1997 | Brandeis | Assistant Coach |

| 1998-2025 | Wheaton | Head Coach |

| 2026-present | Brown | Associate Head Coach |

-

Fashion2 weeks ago

Fashion2 weeks agoEA Sports College Football 26 review – They got us in the first half, not gonna lie

-

Health2 weeks ago

Health2 weeks agoCAREGD Trademark Hits the Streets for Mental Health Month

-

Youtube3 weeks ago

Youtube3 weeks agoWill Giannis DEPART Milwaukee⁉️ + How signing Turner & waiving Dame impacts the Bucks | NBA Today

-

Sports2 weeks ago

Sports2 weeks agoVolleyball Releases 2025 Schedule – Niagara University Athletics

-

Sports2 weeks ago

Sports2 weeks agoNew NCAA historical database provides wealth of information on championships

-

Sports2 weeks ago

Sports2 weeks agoAdapti, Inc. (OTC

-

College Sports3 weeks ago

College Sports3 weeks agoBuford DB Tyriq Green Commits to Georgia

-

High School Sports5 days ago

High School Sports5 days ago100 days to men's college basketball

-

Youtube3 weeks ago

Youtube3 weeks agoThe Twins squeeze out a walk-off win 👀

-

Rec Sports1 week ago

Rec Sports1 week agoFlorida woman, 20, accused of pepper-spraying rich men in Miami Beach hotels, stealing their luxury watches