Technology

Top Founder-Run Company Stocks That Are Safe Long-Term Plays — TradingView News

An updated edition of the April 30, 2025, article. Founders cultivate and make a company from scratch. They have profound passion, a steadfast vision, and tireless dedication for their ventures. Their willingness to take risks often surpasses that of traditional managers, as they embrace unconventional ideas, champion innovation, and make bold decisions to drive success. As […]

An updated edition of the April 30, 2025, article.

Founders cultivate and make a company from scratch. They have profound passion, a steadfast vision, and tireless dedication for their ventures. Their willingness to take risks often surpasses that of traditional managers, as they embrace unconventional ideas, champion innovation, and make bold decisions to drive success. As a result, these businesses often become true reflections of their founders’ core values, ideals and long-term ambitions.

Founder-run companies represent less than 5% of the S&P 500 index. But that does not make their contribution any less. Everyone is aware of the success stories of visionary founder-owners like Elon Musk, Warren Buffett, Steve Jobs, Jeff Bezos, Mark Zuckerberg and Bill Gates, who have redefined industries, creating trillion-dollar companies that continue to thrive. Some of today’s prominent founder-run companies are NVIDIA Corporation NVDA, Amazon AMZN, Meta META, Berkshire Hathaway Inc. (BRK.A), (BRK.B) and Netflix NFLX. Founder-led companies represent nearly 15% of the total index’s market capitalization, with technology companies taking the lead.

As these companies are born out of a unique idea, they often involve technological innovation. These companies are built from scratch in a way that they can navigate challenges to stay sustainable over the long term.

Initially, others may not relate to a founder’s belief, making it difficult to source funds for the project. The founder often ends up putting personal wealth and savings into such bootstrap companies. If successful, they attract angel investors or raise funds. But it’s always the founder-owner whose stake and risk are the highest.

Moreover, founder-owners often struggle to delegate responsibilities, driven by skepticism about whether others can truly match their level of commitment or understanding. Thus, they tend to assume multiple senior roles and frequently struggle to identify a capable successor. However, excelling across all areas is rarely feasible. This hesitation to delegate can restrict the infusion of professional expertise, potentially impeding the company’s ability to scale effectively or respond swiftly to changing market dynamics.

Nevertheless, there is strong evidence that founder-led companies tend to perform better over time. Per Harvard Business Review Study, founder-led companies had a market-adjusted return of 12% over three years against a return of negative 26% for companies that hired a professional CEO. Our Founder-Run Companies Screen further makes it easy to identify high-potential stocks. Currently, stocks like Netflix, AppLovin Corporation APP and Dell Technologies Inc. DELL look appealing.

Ready to uncover more transformative thematic investment ideas? Explore 30 cutting-edge investment themes with Zacks Thematic Screens and discover your next big opportunity.

3 Founder-Run Companies to Add to Your Portfolio

Netflix, with a market capitalization of $387.7 billion, is considered a pioneer in the streaming space. The company evolved from a small DVD rental provider to a dominant streaming service provider, courtesy of its wide-ranging content portfolio and strong international footprint. Wilmot Reed Hastings Jr. co-founded Netflix with Marc Randolph in 1997 and is the executive chairman of the company.

Netflix has been spending aggressively on building its portfolio of original shows. This is helping the company sustain its leading position despite the launch of services like Disney+ and Apple TV+, as well as existing services like Amazon Prime Video. NFLX carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company’s focus on streaming regional content has been leading to international growth. Netflix is diversifying its content portfolio and working on projects across India, Mexico, Spain, Italy, Germany, Brazil, France, Turkey and the entire Middle East. The company has launched low-priced mobile plans in India, Indonesia, Malaysia, the Philippines and Thailand. Moreover, the upcoming lower-priced ad tier is expected to further drive growth in these price-sensitive regions.

Netflix’s 2025 priorities include improving its core business with more series and films to offer an enhanced product experience, growth of its ads business, and newer initiatives such as live programming and games. It believes these initiatives should help it sustain healthy growth and thus projects 2025 revenues between $43.5 billion and $44.5 billion and an operating margin of 29%.

AppLovin, with a market capitalization of $129.7 billion, has solidified its leadership in mobile advertising, powered by its next-gen AI engine, Axon 2. Adam Foroughi co-founded AppLovin with John Krystynak and Andrew Karamin in 2012 and is the executive chairman of the company.

AppLovin’s AXON machine learning engine has played a pivotal role in driving the growth of its software platform, enabling developers to optimize both user acquisition and monetization efforts. As the mobile advertising landscape shifts toward data-driven, performance-oriented solutions, AppLovin is strategically positioned to capture greater market share, particularly through its increasing emphasis on scalable, AI-enabled technologies. Its vertically integrated model, which combines cutting-edge ad tech with owned content, provides a competitive advantage in data utilization and user engagement optimization.

AppLovin’s transition to a software-centric model has led to improved margins and strengthened its financial performance, backed by solid free cash flow and effective capital management. The company’s decision to divest lower-performing gaming assets and focus on its high-growth ad tech platform positions it to further enhance profitability and deliver stronger returns on invested capital.

AppLovin is capitalizing on AI to drive direct, scalable monetization in mobile advertising, a strategy that is paying off. It sports a Zacks Rank #1.

Dell Technologies, with a market capitalization of $75.5 billion, is a leading provider of servers, storage and PCs. Boasting one of the world’s largest technology infrastructure companies, Dell was founded by Michael Saul Dell and is expected to benefit from recovering demand driven by the PC-refresh cycle.

Dell addresses the evolving needs of on-premises, cloud, and edge environments by enabling organizations to manage and secure workloads effectively through advanced storage solutions such as PowerProtect Data Domain and PowerScale. These systems are further strengthened by AI-powered ransomware detection, enhancing data protection and operational resilience.

This Zacks Rank #2 company is also benefiting from strong demand for AI servers, driven by ongoing digital transformation and heightened interest in generative AI applications. AI-focused server launches and collaboration with key players like NVIDIA and AMD further enhance its competitiveness in the AI infrastructure space. Dell’s strong cash flow, as well as disciplined capital allocation, reflects its solid performance.

Dell Technologies’ innovative portfolio, expanding partner base and growing AI footprint are major growth drivers. Thus, for the first quarter of fiscal 2026, revenues are expected to be between $22.5 billion and $23.5 billion, with the mid-point of $23 billion suggesting 3% year-over-year growth. Non-GAAP earnings are expected to be $1.65 per share (+/- 10 cents), indicating 25% growth at the midpoint.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Technology

Amen Rahh Led A South LA High School To A 100% Graduation Rate, Now He’s Using Fintech To Fight Absenteeism And Build Black Wealth

Amen Rahh, widely known as “Principal Rahh,” is a nationally recognized educator and best-selling author from Compton, CA, who first gained attention after leading a South Los Angeles high school to a 100% graduation rate. However, his mission took an unexpected turn. One of his students, Keon — an unhoused teen in foster care — […]

Amen Rahh, widely known as “Principal Rahh,” is a nationally recognized educator and best-selling author from Compton, CA, who first gained attention after leading a South Los Angeles high school to a 100% graduation rate.

However, his mission took an unexpected turn.

One of his students, Keon — an unhoused teen in foster care — had been accepted to Tuskegee University but couldn’t afford the final $480 he needed to attend.

“He thought, ‘If I can get this $400, I can get out,’” Rahh told AFROTECH™. “Tragically, he lost his life before he could.”

Rahh learned the news while working on his doctorate at UCLA and says the loss changed everything.

“At [age] 34, I left my job and started a tech company to transform education,” Rahh said.

The company — Knowlej — is using fintech innovation to reimagine what’s possible for underserved students nationwide.

The Classroom To Real Life

Since its 2023 launch, the fintech app Knowlej has reached more than 30,000 students, according to Rahh. He says the platform works with school districts across Los Angeles, New York, Colorado, Washington, D.C., and beyond, collaborating with educators to rethink traditional measures of student success.

“Our mission is ‘learn to earn.’ Kids from communities like mine need hope,” he said to AFROTECH™. “Now we’re using AI to integrate financial systems and automate scholarships, making tuition rewards accessible and personalized.”

Knowlej addresses chronic absenteeism, defined as missing over 10% of the school year, as the U.S. Department of Education’s website notes.

“For Black students, that’s 40% of the population,” Rahh told us. “That’s over a month of missed school, impacting career readiness and workforce development.”

What sets Knowlej apart is how it turns learning into real-world rewards, according to the platform’s website.

“Most youth-focused fintech platforms, like Greenlight or Step, focus on financial literacy. That’s important, but it’s not enough,” he said. “Think back to when you were 13, in eighth grade, dreaming of becoming a writer. What if a platform rewarded you with stock or scholarships for writing articles? The more you wrote, the more you could build a portfolio to fund your future.”

Rahh added, “Financial literacy alone isn’t enough if you’re broke. We want to provide that seed money and show students there’s a path forward.”

From Feeling Seen To Showing Up

“From students, the biggest thing we hear is, ‘I feel seen.’ That’s powerful,” Rahh said. “Schools often give incentives kids don’t care about — how many pizza parties can you throw before they’re over it?”

According to Rahh, Knowlej connects students with over 3,000 brands, including Nike, Target, and Apple, in its rewards marketplace, letting them earn stock options and choose their own incentives.

“Now school feels relevant to them,” he said, adding that with these brands on board, students see the real-world value of showing up, and excelling and educators see benefits too.

“Traditional systems like Eagle Bucks require constant manual tracking. Ours is automated,” Rahh explained to us.

Knowlej’s adaptive AI customizes rewards based on individual progress, making it easier for schools to deliver timely, targeted support.

In high-disengagement schools, Knowlej is already making an impact.

At Garnet-Patterson S.T.A.Y. Opportunity Academy in Washington, D.C., where nearly 96% of students are chronically absent, according to Rahh, Principal DeWayne Little says the partnership has already led to noticeable improvements in attendance and engagement. Little credits Knowlej’s creative approach for giving students a new reason to show up.

Building Generational Wealth Beyond The Classroom

Knowlej isn’t just closing the achievement gap; it’s also aiming to bridge the wealth gap.

“Right now, the U.S. has a $1.7 trillion student loan debt crisis,” Rahh told AFROTECH™. “But when you break down the numbers, Title I kids – foster youth, low-income, Black, and English language learners – hold the most debt. So even when they do close the achievement gap, they still get hit with the wealth gap.”

Looking Ahead: A New Tool For The Future

To expand its reach, Knowlej also runs Knowlej TV, a YouTube channel sharing stories from students and educators that highlight the platform’s impact.

In addition, Rahh said Knowlej aims to launch a debit card later in 2025, offering financial and tuition rewards.

“We’ve partnered with over 500 universities and want to connect with more HBCUs,” he told us. “Families can earn up to $4,000 a year for tuition just by using the card while students succeed in school.”

As for the future, with schools stretched thin, Rahh believes educators must lead innovation.

He concluded, “We need solutions built by those who understand the system — tools that restore hope.”

Technology

Georgia Tech’s first new residence hall in decades starts topping out

The first traditional residence hall to be built on Georgia Tech’s campus in almost 50 years has reached its max height—at least partly. One section the two-building Curran Street Residence Hall, the south tower, has topped out on the western fringes of campus, according to a Georgia Tech Infrastructure and Sustainability photo update this week. The […]

The first traditional residence hall to be built on Georgia Tech’s campus in almost 50 years has reached its max height—at least partly.

One section the two-building Curran Street Residence Hall, the south tower, has topped out on the western fringes of campus, according to a Georgia Tech Infrastructure and Sustainability photo update this week.

The project’s north tower has largely topped out, too, apart from a middle section. A formal groundbreaking was held in March, though construction had launched last year.

The dorm project continues a building spree for Georgia Tech that includes the expanded Science Square district, a football stadium expansion, and the topped-out Technology Square Phase 3 in Midtown, in addition to smaller projects.

The Curran Street Residence Hall calls for 862 beds spread across eight residential floors for first-year students. Building features—previously described as state-of-the-art—will include a 24-hour automated market, study rooms, e-gaming spaces, and a fitness center, Georgia Tech officials have said.

Looking southeast to downtown, recent construction progress on the two-building Curran Street Residence Hall project. Georgia Tech Infrastructure and Sustainability

Georgia Tech Infrastructure and Sustainability

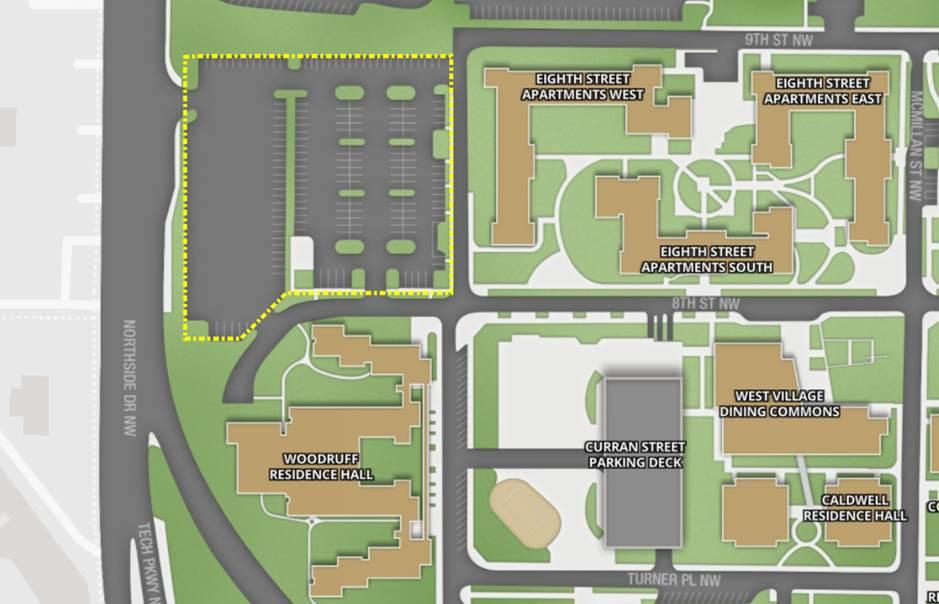

The project has risen from a site along Northside Drive, between Eighth and Ninth streets. It marks the first housing of any sort added on campus since 2005, when the 153-bed Tenth and Home complex opened along 10th Street to accommodate growing family-student and graduate enrollment.

Formerly the property in question—situated just south of The Interlock project’s second phase and new Stella at Star Metals luxury high-rise—was home to surface parking and little else.

Officials consider the new residential facility an important cog in goals put forward in Georgia Tech’s emerging Comprehensive Campus Plan, which could continue to transform multiple areas of the campus grounds. The project was estimated to cost $117 million in 2023, when it was approved by the University System of Georgia Board of Regents.

How the Curran Street Residence Hall project will meet Northside Drive. Georgia Institute of Technology

The project’s footprint between Eighth and Ninth streets on the western edge of campus. Georgia Institute of Technology

The residence hall will be geared toward accommodating Georgia Tech’s first-year enrollment growth over the next decade, while also housing students relocated during planned renovations to existing on-campus residential buildings.

All rooms in the 191,000-square-foot building will be made for double-occupancy, with group kitchens, community lounges, and collaborative learning spaces featured elsewhere, according to the school.

The construction schedule calls for opening the new dorms in August 2026 for fall semester.

The student living options will join a multitude of new off-campus housing in highly amenitized buildings that have sprouted across Midtown and downtown over the past decade.

Swing up to the gallery for more context and visuals.

…

Follow us on social media:

Twitter / Facebook/and now: Instagram

• Georgia Tech news, discussion (Urbanize Atlanta)

Technology

Wearable AI Market 2025–2035 | Trends, Opportunities & Regional Insights

Overview of the Market The global Wearable AI Market is valued at USD 23.56 Billion in 2024 and is projected to reach a value of USD 303.59 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 17.6% between 2025 and 2035. The Wearable AI Market refers to the industry surrounding intelligent wearable devices powered by Artificial Intelligence (AI), including smartwatches, smart […]

Overview of the Market

The global Wearable AI Market is valued at USD 23.56 Billion in 2024 and is projected to reach a value of USD 303.59 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 17.6% between 2025 and 2035.

The Wearable AI Market refers to the industry surrounding intelligent wearable devices powered by Artificial Intelligence (AI), including smartwatches, smart glasses, fitness bands, and hearables. These devices leverage AI algorithms to provide users with personalized insights, automate health monitoring, enhance communication, and improve user experience through features like voice recognition and smart assistant capabilities.

Driven by the convergence of advanced sensor technology, increasing consumer awareness, and the integration of AI in consumer electronics, the market is rapidly expanding. Growing demand for real-time health monitoring, the popularity of Internet of Things (IoT) devices, and the rising trend of digital wellness further stimulate market growth.

Moreover, the increasing adoption of AI-powered wearable tech in sectors such as healthcare, sports, and defense has amplified its commercial potential across a variety of industries.

Our comprehensive Wearable AI Market report is ready with the latest trends, growth opportunities, and strategic analysis- View Sample Report PDF.

Market Segmentation & Key Players

Segment Covered

By Application

- Consumer electronics

- Healthcare

- Automotive

- Military and Defense

- Media and Entertainment

- Others

By Type

- Smart Watch

- Smart Glasses

- Smart Earwear

- Smart Glove

- Others

By Region

- North America

- Europe

- Asia-Pacific

- LAMEA

By Operation

- On-device AI

- Cloud-based AI

Regions & Countries Covered

- North America – (U.S., Canada, Mexico)

- Europe – (U.K., France, Germany, Italy, Spain, Rest Of Europe)

- Asia Pacific – (China, Japan, India, South Korea, South East Asia, Rest Of Asia Pacific)

- Latin America – (Brazil, Argentina, Rest Of Latin America)

- Middle East & Africa – (GCC Countries, South Africa, Rest Of Middle East & Africa)

Companies Covered

- Sony Corporation

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- SAMSUNG ELECTRONICS CO. LTD

- Fitbit Inc.

- TOMTOM INTERNATIONAL B.V

- Garmin Ltd

- Amazon.com Inc. Google Inc.

- Motorola Mobility LLC

Market Dynamics

The Wearable AI Market is influenced by several dynamic variables, including technological advancements, consumer behavior shifts, increasing healthcare demands, and evolving digital lifestyles. A key driver is the rising demand for real-time data and actionable analytics, especially in the healthcare sector for continuous patient monitoring. Consumers now favor seamless interconnectivity and smart features that resonate with their habits, like AI-powered voice commands, gesture control, and proactive health suggestions. Additionally, the proliferation of 5G technology is enhancing device connectivity and data processing capabilities, further accelerating the adoption of wearable AI.

On the regulatory and commercial side, companies are investing heavily in R&D to develop microprocessors and AI chips optimized for wearable ecosystems. Tech giants like Apple, Google, and Huawei are playing pivotal roles in shaping the future of AI wearables, from voice-based assistants to diagnostic health tools.

However, data privacy, security risks, and device interoperability continue to influence buyer decisions. The market is also witnessing mergers and collaborations, particularly in the tech-healthcare crossover segment, suggesting a shift toward a more integrated and intelligent wearable tech environment. Overall, while opportunities abound, the market dynamics indicate a race toward smart, user-centric innovation underpinned by AI.

Top Trends

One of the most significant trends in the Wearable AI Market is its growing role in healthcare and preventive medicine. Wearables equipped with AI now go beyond basic fitness tracking — they analyze heart rate variability, oxygen saturation, sleep patterns, and even mental health parameters. This shift marks the evolution of wearables into sophisticated health companions capable of aiding medical professionals in remote diagnostics and patient engagement.

Another trend is the integration of Natural Language Processing (NLP) and machine learning algorithms that allow devices to interact and learn from user preferences, resulting in personalized experiences. Voice assistants built into smartwatches and hearables are becoming increasingly intuitive and multilingual, broadening their accessibility and functionality across global markets.

AI-powered wearables are also gaining traction in industrial applications. In manufacturing and logistics, smart wearables help monitor worker health, enhance safety, and improve productivity. In the sports industry, AI wearables are being used to optimize athletic performance through data-driven coaching and injury prevention tools.

Furthermore, adoption of edge AI, where data processing occurs within the device rather than in the cloud, is on the rise. This reduces latency, enhances security, and enables faster decision-making. As hardware gets smaller and more efficient, wearable AI devices continue to evolve to become less intrusive and more powerful. Sustainability is also influencing design and production, with manufacturers leaning toward eco-friendly materials and energy-efficient components.

Latest Announcements

Motorola Solutions to Acquire Theatro, Maker of AI and Voice-powered Communication and Digital Workflow Software for Frontline Workers

- In January 2025, Motorola Solutions entered into a definitive agreement to acquire Theatro Labs, Inc. (“Theatro”), maker of AI and voice-powered communication and digital workflow software for frontline workers, based in Richardson, Texas.

Introducing the new AI-powered Microsoft Surface PCs

- In March 2024, Microsoft announced at a digital event the release of two new AI-powered PCs, along with advances in its management portal and the commercial availability of its Microsoft Adaptive Accessories

Top Report Findings

- The global Wearable AI Market is valued at USD 23.56 Billion in 2024 and is projected to reach a value of USD 303.59 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 17.6% between 2025 and 2035.

- Based on the Product Type, the Smartwatches category accounted for a significant market share in the Wearable AI market industry for 32.30% in 2024

- In 2024, by Operation, On-Device AI dominated the Wearable AI market with 57.08% of market share.

- Based on the Application, the Consumer Electronics category accounted for a significant market share in the Wearable AI market industry for 31.30% in 2024

- Based on the Component, the Sensors category accounted for a significant market share in the Wearable AI market industry for 56.70% in 2024

- North America dominated the Wearable AI market industry with 44.60% Wearable AI market share in 2024

- Asia Pacific region is anticipated to grow at the highest CAGR during the forecast period in the Wearable AI market industry.

Challenges

Despite its vast potential, the Wearable AI Market faces several challenges that could constrain its growth if not adequately addressed. One of the most pressing issues is data privacy and cybersecurity. Wearable devices collect extensive personal information, from biometric data to daily routines, which can be misused if not properly protected. With increasing regulations around data protection, manufacturers must ensure strict compliance and secure data transmission protocols.

Battery life and device design optimization present technological hurdles. Integrating AI, sensors, and wireless capabilities into compact devices without compromising performance remains a difficult engineering challenge. Additionally, the high development and manufacturing costs can result in premium pricing, which limits accessibility in price-sensitive markets. Interoperability between different ecosystems, for instance, wearables not syncing well with platforms like Android, iOS, or proprietary healthcare tools, further complicates seamless user experiences.

Moreover, there is limited public understanding of advanced AI features, which can create a gap in market penetration. To thrive, companies must focus not only on innovation but also on building customer trust and fostering technological inclusiveness.

Opportunities

The future of the Wearable AI Market is underpinned by a variety of promising opportunities. Chief among them is the healthcare sector, where AI-powered wearables are increasingly being used for chronic disease management, rehabilitation support, and remote patient monitoring. With an aging population and the rise of personalized medicine, demand for real-time, AI-driven diagnostics and health tracking is only expected to grow. Hospitals and insurance companies are beginning to integrate wearable data into their digital transformation strategies, opening doors for partnerships and new business models.

There is also immense potential in emerging markets, where mobile-first populations are leapfrogging into advanced technologies. Wearables that offer language translation, mobile payment integration, and diagnostics in remote areas can significantly add value. Another promising area is sports and military applications, where performance optimization through AI creates a competitive edge.

Additionally, with the development of wearable AI in fashion (smart fabrics) and mental health monitoring, the scope for diversification is broadening. As developers craft more affordable, interoperable, and user-centric designs, wearable AI is poised for mass adoption across global demographics.

Key Questions Answered in the Report

1. What is the current size and projected growth of the global Wearable AI Market?

2. Which key segments dominate the wearable AI industry?

3. What are the major drivers fueling market demand for wearable AI devices?

4. How are AI-powered wearables shaping the future of healthcare and diagnostics?

5. What are the key challenges restricting wider adoption of wearable AI technologies?

6. Who are the leading vendors in the market and what strategies are they using to stay competitive?

7. What technological trends are shaping the development of wearable AI devices?

8. How does the North American region contribute to the advancement and growth of the wearable AI market?

Regional Analysis: North America

North America holds a dominant position in the Wearable AI Market, primarily driven by a robust technological ecosystem, significant R&D investments, and high consumer awareness of digital health and smart devices. The United States is the central hub for innovation in both AI and wearable technology, with Silicon Valley housing major players such as Apple, Google, and Fitbit. The region’s focus on health-conscious lifestyles has fueled the adoption of smartwatches and fitness trackers integrated with AI for personalized health monitoring.

Healthcare providers across the U.S. and Canada are increasingly integrating AI-powered wearables into remote patient monitoring systems, chronic disease management, and telehealth services. Initiatives supporting value-based care models have further boosted the use of AI wearables to track real-time patient data, enabling clinical decision-making outside traditional healthcare settings. Furthermore, the region is witnessing substantial governmental and private funding for AI and IoT innovations, creating fertile ground for market expansion.

Regulatory support, combined with nationwide rollout of 5G networks, is accelerating seamless connectivity and pushing the boundaries for wearable applications. North American consumers’ high purchasing power, tech-savviness, and lifestyle-oriented demand for wellness and productivity tools also contribute to the region’s market lead. With startups and established brands focusing on creating smoother user experiences, North America is set to remain a frontrunner in shaping the global wearable AI landscape.

Expanding Market Need: Access Our Full Report for In-Depth Analysis and Trends!

https://www.vantagemarketresearch.com/industry-report/wearable-ai-market-1364

The Wearable AI Market is entering an exciting phase of growth, innovation, and disruption. From shaping the future of digital health to redefining personal convenience through smart automation, wearable AI devices are merging seamlessly into our daily lives. Although challenges such as privacy concerns and device limitations remain, the overwhelming momentum behind real-time analytics, 5G, and personalized consumer experiences promises a future where wearable AI becomes not just a gadget, but an intelligent partner. As industries push toward smarter, faster, and more connected ecosystems, wearable AI stands ready to transform how we live, work, and thrive in the digital era.

Technology

UAE Investor 885 Capital Emerges as Sports Force With PFL Stake

The Professional Fighters League has a long list of well-known investors, including financial heavy-hitters Ares, Elysian Park and the Saudi-backed SURJ, as well as team owners David Blitzer, Ted Leonsis and Mark Lerner. But relatively few know of one of PFL’s most significant shareholders: 885 Capital. The United Arab Emirates-based investment fund bought into PFL […]

The Professional Fighters League has a long list of well-known investors, including financial heavy-hitters Ares, Elysian Park and the Saudi-backed SURJ, as well as team owners David Blitzer, Ted Leonsis and Mark Lerner. But relatively few know of one of PFL’s most significant shareholders: 885 Capital.

The United Arab Emirates-based investment fund bought into PFL with a previously unreported direct investment in late 2024. It became one of the largest shareholders in the mixed martial arts league, putting the Donn Davis-founded organization at the top of its expanding sports portfolio.

“We’re looking for projects, in general, for which there is potential perpetually robust or even infinite demand, and that’s the case when it comes to sports, because humans are emotional and sports brings people together,” 885 Capital cofounder Sudeep Ramnani said on a video call.

Ramnani comes to sports from what originated as a series of startups in financial services. In 2011, shortly after attending the London School of Economics, the London-born Ramnani founded a series of fintech ventures on the continent; Paystack, one of the ventures which Ramnani backed with 885 cofounder Jai Mahtani, was bought by Stripe for $200 million in 2020. More Africa-focused fintech startups followed. The pair formed Sporty Group, which operates Africa’s largest sports book, SportyBet; and SportyTV, the largest free-to-air soccer channel on the continent. SportyTV includes games of Real Madrid, a club for which SportyBet is a regional sponsor.

It’s through Sporty Group that the business partners started finding investment opportunities in athletics, founding 885 to formally invest in sports deals as well as technology and real estate. “We’re in the ecosystem, one door opens the other … once people realize there’s been some success,” Ramnani said. “Operating across the ecosystem across gaming, across broadcasting, means that we come across interesting projects.”

Ramnani and PFL’s Davis got to know each other through meeting with PFL to discuss African broadcast rights, leading to 885’s direct investment in the league. 885 has no outside investors—it’s all Ramnani’s and Mahtani’s money—and while they decline to say how much capital they have in 885 and the size of their investment in PFL, both are probably significant; PFL is now valued at $1 billion, according to the league, and 885 has two of the 10 board seats, filled by Ramnani and Mahtani. Only Saudi Arabia’s sovereign wealth fund, with two representatives from PIF and SURJ’s Danny Townsend, has more seats.

“Sudeep and Jai are dynamic entrepreneurs and connected global executives who have brought tremendous insights and relationships to PFL business and expansion in short period of time,” Davis said in an email. “We work most closely with them on digital, media and gaming initiatives in emerging markets.”

Ramnani’s macro thesis that humans are forever drawn to sports doesn’t mean 885 invests wildly. His parameters for buying into a team or a league are built around the structural shift in broadcasting and intellectual property control. “There are a lot of new sports properties where they are founder-led, where there is end-to-end control of the project, IP ownership and the ability to build something without too many egos in the room, kind of the DNA of a technology company,” he explained.

Such companies are usually “challenger brands,” according to Ramnani, which is reflected in his sports portfolio that includes the six-per-side European soccer Baller League, rugby’s R360 startup effort and the European League of Football, which fills the void left by the NFL’s exit from the continent. 885 also co-owns Blue Crow Sports Group, a more traditional holding of equity in four teams across Mexico, Europe and Dubai.

Like the soccer and rugby leagues, PFL fits 885’s preferred profile well—“to build upon the success UFC has had, [but] taking a localized approach and giving regional fighters the opportunity to become local heroes and also be part of a global platform,” Ramnani said.

PFL’s smaller footprint relative to UFC actually can help the league. “There are some structural changes taking place in sports, and you can make your weaknesses your strengths,” he said. “Like if you don’t have a huge existing legacy revenue stream, then you have a blank canvas to work with, and have a more direct relationship with the consumer.”

Free-to-air broadcasting can be a PFL strength, making it the first MMA brand most consumers will interact with as UFC focuses on large single events and pay-per-view.

As to why Ramnani is opening up after quietly buying into PFL months ago, the executive says there’s value to people knowing who he and Mahtani are. “We’re not selling anything, we’re not looking to raise external capital, we’re not looking for investors. We’re people who are very open to collaboration, very open to conversations and creating value—building stuff together.”

(This story has been corrected in the third paragraph to reflect that Ramnani was born in London, and that he invested in Paystack. This story has also been corrected in the ninth paragraph to clarify that 885 isn’t the only owner of Blue Crow.)

Technology

How Wordle, Connections, and Strands Stack Up in Gameplay (and Which One You’ll Likely Enjoy)

Once you start playing one of the New York Times’ quick little word games, it’s easy to end up playing the others as well. (Heck, I originally subscribed to their app for the crosswords.) But maybe you’re currently playing one of the games, and eyeing up the others suspiciously. So let’s break it down: What […]

Once you start playing one of the New York Times’ quick little word games, it’s easy to end up playing the others as well. (Heck, I originally subscribed to their app for the crosswords.) But maybe you’re currently playing one of the games, and eyeing up the others suspiciously. So let’s break it down: What do each of these three popular games have to offer, and what does it take to be good at each one?

Wordle

In Wordle, you guess one word, and you’re given nothing to go on at the start. You have to bring your own starter word: I like ARISE but everybody has their favorites. Green and yellow squares guide you after each guess. Green means you guessed a letter in the right place; yellow letters are in the word somewhere but you have the position wrong.

Time commitment: Minimal. Most days it takes me less than a minute, but a tricky word (or a few bad guesses) can mean I’m staring at the thing for several minutes. Sometimes I put my phone away and come back to it later.

Skills required: This game rewards people who have spent a lot of time thinking about how words are constructed. If you play a lot of other word games (and are a good speller), you’ll get a lot of enjoyment out of Wordle and will probably be good at it. If you just guess words without much thought or strategy, it’s not as rewarding.

Skills that will help you to solve Wordle include:

-

Knowledge of which letters are most common in short words, and how words tend to be structured.

-

A sense of what words the editors like to include. Simple plurals, no. Topical words on holidays, no. Rare or strange words, not usually. Words with double letters or ending in a “Y”: Heck yeah, they love those.

-

Strategically making guesses (probing common letters, not repeating information you already know).

Frustration factor: Medium. The game is pretty straightforward, but there are some scenarios that can get tough, and they often depend on your luck in guessing. If you guess most of the word, but there are many options for what to fill in those last few blank spaces (infamously, “-OUND”), you may run out of guesses before you’ve tried all the words. Strategy can help but sometimes you just don’t have enough guesses to figure it out. That said, if you’re good at this game, you’ll almost always be able to win. Personally I’ve only lost four times in over 1,000 games.

Has an archive of past puzzles: Yes, for subscribers.

Has a bot that can analyze your guesses and tell you how well you did: Yes, for subscribers.

Where to find our daily hints: Right here.

Connections

In Connections, you’re given sixteen words (or phrases, or names) and you have to divide them into four groups according to … well, whatever the puzzle creator thought the groups should be. Often they are synonyms of each other, or members of a category (say, baseball teams). But some can be incredibly tricky (“homophones of units of measure”—that one was CARROT, HURTS, JEWEL, OM).

Time commitment: A few minutes. I timed myself and did an easier puzzle in about a minute, a tougher one in about five. The real head-scratchers may, of course, take a bit longer.

Skills required: You don’t need to be a word nerd to do well at Connections, but it helps to:

-

Know a lot of vocabulary—sometimes there’s an unusual word.

-

Be up on pop culture, so you can recognize names of bands or movie directors or sports teams.

-

Be willing to think outside the box, for the occasional strange wordplay.

-

Recognize subtle spelling differences, and similar details. GENIUS is not GENUS, and why would GENUS be on the list? (See above about strange wordplay—that one was in a list of “Spelling Bee ranks minus one letter.” GEN[I]US, GOO[D], [A]MAZING, S[O]LID)

Frustration factor: High, since there will often be apparent groups thrown in as red herrings. You’d think GUITAR, NECK, and STRINGS go together, but they each belonged to different categories in that day’s puzzle. There are also those strange wordplay categories I mentioned, names that look like dictionary words and vice versa, and other unexpected groupings.

Has an archive of past puzzles: Yes, for subscribers.

Has a bot that can analyze your guesses and tell you how well you did: Yes, for subscribers.

What do you think so far?

Where to find our daily hints: Right here.

Strands

Strands is a word search game with some cute mechanics. The words are all on a theme, and there’s an “aha” moment that will (ideally) make you chuckle and/or kick yourself, and there are free hints when you’re stuck.

Time commitment: About two minutes for an easy one, five or more if it’s tricky.

Skills required: The hints make this a much easier game than it would be otherwise. If you find three words that are real dictionary words, but aren’t the words you’re supposed to find, you get a free hint. You can use the hint anytime you want, and it will outline the letters in one of the theme words—but it’s still up to you to put the letters in order.

That said, you’ll be good at Strands if you can do these things well:

-

Recognize words when their letters are out of order.

-

Spell well (if you misspell a word as you’re finding it, it will be “wrong” even if the letters are right there in front of you and you know what word it should be).

-

Figure out what the theme, spangram, and words have to do with each other. There’s often a tricky connection, and recognizing it makes the game a lot easier.

-

Have a good vocabulary, including some pop culture knowledge. Sometimes a word or phrase is somewhat obscure.

Frustration factor: Low, usually. Sometimes you’ll end up with a clump of letters, know that they must make a word, but have no idea how to combine the letters. This is especially problematic if you simply don’t know the word or phrase. There’s nothing to do at that point but swipe your finger in random directions until something takes.

Has an archive of past puzzles: No. (At least, not yet!)

Has a bot that can analyze your guesses and tell you how well you did: No.

Where to find our daily hints: Right here.

Technology

UK regulator seeks special status for Apple and Google that could mandate changes for Big Tech

FILE – The Apple logo is illuminated at a store in the city center of Munich, Germany, Dec. 16, 2020. (AP Photo/Matthias Schrader, File) By KELVIN CHAN LONDON (AP) — Britain’s antitrust watchdog has proposed labeling Google’s and Apple’s mobile ecosystems with “strategic market status,” which would mandate changes at the Big Tech companies to […]

FILE – The Apple logo is illuminated at a store in the city center of Munich, Germany, Dec. 16, 2020. (AP Photo/Matthias Schrader, File)

By KELVIN CHAN

LONDON (AP) — Britain’s antitrust watchdog has proposed labeling Google’s and Apple’s mobile ecosystems with “strategic market status,” which would mandate changes at the Big Tech companies to improve competition.

-

College Sports2 weeks ago

College Sports2 weeks agoWhy a rising mid-major power with an NCAA Tournament team opted out of revenue-sharing — and advertised it

-

Motorsports3 weeks ago

Motorsports3 weeks agoTeam Penske names new leadership

-

Sports2 weeks ago

Sports2 weeks agoNew 'Bosch' spin

-

Fashion1 week ago

Fashion1 week agoEA Sports College Football 26 review – They got us in the first half, not gonna lie

-

Sports1 week ago

Sports1 week agoVolleyball Releases 2025 Schedule – Niagara University Athletics

-

College Sports3 weeks ago

College Sports3 weeks agoMSU Hockey News – The Only Colors

-

Sports2 weeks ago

Sports2 weeks agoE.l.f Cosmetics Builds Sports Marketing Game Plan Toward Bigger Goals

-

Health1 week ago

Health1 week agoCAREGD Trademark Hits the Streets for Mental Health Month

-

College Sports2 weeks ago

College Sports2 weeks agoBuford DB Tyriq Green Commits to Georgia

-

Youtube2 weeks ago

Youtube2 weeks agoWill LeBron James request a trade? 🤔 Windy says MULTIPLE TEAMS would make offers 👀 | NBA Today