Technology

Warner Bros. Discovery to split into two companies

By MICHELLE CHAPMAN, AP Business Writer

NEW YORK (AP) — Warner Bros. Discovery will calve off cable operations from its streaming service, creating two independent companies as the number of people “cutting the cord” brings with it a sustained upheaval in the entertainment industry.

HBO, and HBO Max, as well as Warner Bros. Television, Warner Bros. Motion Picture Group, DC Studios, will become part of the streaming and studios company, Warner Bros. said Monday.

The cable company will include CNN, TNT Sports in the U.S., and Discovery, top free-to-air channels across Europe, and digital products such as the Discovery+ streaming service and Bleacher Report.

Shares jumped 11% at the opening bell.

Warner Bros. Discovery CEO David Zaslav will become serve as CEO of the company that for right now is called Streaming & Studios. Gunnar Wiedenfels, chief financial officer of Warner Bros. Discovery, will be CEO of the cable-focused entity, for now known as Global Networks.

“By operating as two distinct and optimized companies in the future, we are empowering these iconic brands with the sharper focus and strategic flexibility they need to compete most effectively in today’s evolving media landscape,” Zaslav said in a statement.

Just days ago Warner Bros. Discovery shareholders in a vote that was symbolic as it’s nonbinding, rejected the 2024 pay packages of some executives, including Zaslav, who will make more than $51 million.

Warner Bros. Discovery said in December that it was implementing a restructuring plan in which Warner Bros. Discovery would become the parent company for two operating divisions, Global Linear Networks and Streaming & Studios. That was seen as a preview of the separation announced Monday.

Warner Bros. Discovery was created just three years ago when AT&T spun off WarnerMedia and it was merged with Discovery Communications in a $43 billion deal.

The cable industry has been under assault for years from streaming services like Disney, Netflix, Amazon and Warner Bros. own HBO Max. The industry is also being pressured by internet plans offered by mobile phone companies. Comcast, which is of nearly equal size to Charter, spun off many of its cable television networks in November, seeing so many customers swap out their cable TV subscriptions for streaming platforms.

Last month Charter Communications offered to acquire Cox Communications, a $34.5 billion merger that would combine two of the top three cable companies in the U.S.

So-called “cord cutting” has cost the industry millions of customers and left them searching for ways to successfully compete.

The Warner Bros. Discovery split is expected to be completed by the middle of next year. It still needs final approval from the Warner Bros. Discovery board.

Originally Published:

Technology

Samsung to showcase world’s first 1,040Hz gaming monitor at CES 2026

Samsung Electronics has unveiled its new most advanced Odyssey gaming monitor lineup. The lineup includes five new models that push the boundaries of resolution, refresh rates, and immersive visual performance.

Led by Samsung’s first 6K 3D Odyssey G9, the 2026 lineup debuts world-first display technologies for gamers and creators, including the next-generation Odyssey G6 and three new Odyssey G8 models.

First 6K glasses-free 3D monitor

“With this year’s Odyssey lineup, we’re introducing display experiences that simply weren’t possible even a year ago,” said Hun Lee, Executive Vice President of the Visual Display (VD) Business at Samsung Electronics.

“From the industry’s first 6K glasses-free 3D monitor to breakthrough 1,040Hz speed, we designed these monitors to meet the ambitions of today’s gamers and deliver a level of immersion that fundamentally changes how content looks and functions on screen.”

The 32-inch Odyssey 3D (G90XH model) debuts the world’s first 6K display with glasses-free 3D, introducing a new way to experience games on a monitor. Powered by real-time eye tracking, it adjusts depth and perspective in response to the viewer’s position, creating a layered sense of dimension for smooth, uninterrupted gameplay without the need for a headset, according to a press release.

PC gamers can enjoy high-quality expanded lineup

With 6K resolution, a 165Hz refresh rate boosted to 330Hz through Dual Mode, and 1ms response time, fast action stays sharp and smooth, according to Samsung.

The company claims that PC gamers can enjoy a high-quality expanded lineup of supported titles with optimized 3D effects developed in collaboration with game studios. Featured games such as The First Berserker: Khazan, Lies of P: Overture, and Stellar Blade will offer added dimensionality, enhancing terrain, distance, and object separation beyond standard 2D gameplay.

The South Korean company has also highlighted that the 27-inch Odyssey G6 (G60H model) gaming monitor advances competitive gaming with the world’s first 1,040Hz gaming monitor through Dual Mode and native QHD support up to 600Hz, delivering esports-level motion clarity to help players track targets and see fine details during high-speed movement.

When needed, the Odyssey G6 can boost performance in an instant, providing ultra-sharp resolution so viewers can experience breathtaking worlds and ultra-high speeds that fuel competitive adrenaline. With support from both AMD FreeSync Premium and NVIDIA G-Sync Compatible, the Odyssey G6 ensures that every frame is smooth, every color pops, and every moment feels responsive.

The Odyssey G8 series is expanding in 2026 with three distinct models, each offering a different balance of resolution and speed. Leading the lineup, the 32-inch Odyssey G8 (G80HS model), the industry’s first 6K gaming monitor, delivers native 165Hz performance with Dual Mode that supports up to 330Hz in 3K mode.

The 27-inch Odyssey G8 (G80HF model) offers a sharper 5K option with native support up to 180Hz, and Dual Mode boosts to 360Hz in QHD for smoother motion.

For users who want deeper contrast, the 32-inch Odyssey OLED G8 (G80SH model) pairs a 4K QD-OLED panel with a 240Hz refresh rate, Glare Free viewing, 300-nit brightness, and VESA DisplayHDR True Black 500 certification. Its DisplayPort 2.1 (UHBR20) supports up to 80 Gbps of bandwidth for seamless HDR and VRR playback, according to Samsung.

The complete Odyssey 2026 lineup will be on display at CES 2026 in Las Vegas from January 6-9.

Technology

Games of the Future Abu Dhabi 2025 Rewrites the Playbook for Sports with Phygital Innovation

Published on

December 25, 2025

By: Tuhin Sarkar

The Games of the Future Abu Dhabi 2025 have closed an unforgettable chapter in the evolution of phygital sports. Hosted under the patronage of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, the event marked an unparalleled fusion of physical and digital competition. Over six action-packed days, Abu Dhabi hosted more than 850 participants from 60+ countries, with fierce battles across 11 disciplines including Phygital Football, Phygital Basketball, esports, Phygital Fighting, drone racing, and VR gaming.

Games of the Future Abu Dhabi 2025 was not just a sporting event; it was a vision of the future. It set a global standard for what sports can look like in the digital age, where technology and human skill come together to create immersive and multi-dimensional experiences. The competition showed the world that the future of sports isn’t confined to a physical arena, but seamlessly integrates both the physical and digital.

The Champions of Tomorrow: Phygital Sports Takes Centre Stage

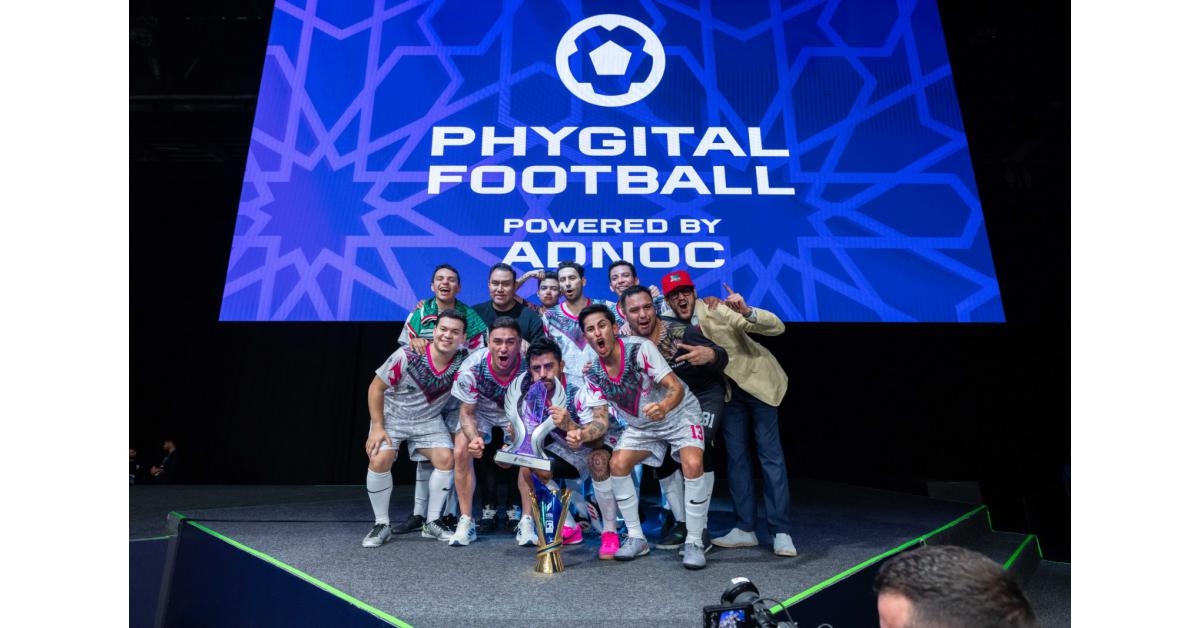

The Games of the Future Abu Dhabi 2025 featured 11 disciplines that blended traditional sports with futuristic technologies, including Phygital Football, Phygital Basketball, esports, Phygital Fighting, and Phygital Shooter. These unique formats tested competitors in both the physical and digital realms. For example, Phygital Football powered by ADNOC saw the México Quetzales – Armadillos FC clinch the Phygital Football title, defeating Troncos FC 2-4 in a thrilling final that captivated crowds throughout the week. Likewise, in Phygital Basketball, the LIGA PRO TEAM triumphed in a 29-23 victory over Moscowsky.

Other high-stakes competitions included Phygital Fighting.FATAL FURY: City of the Wolves, where Kuznya dominated, winning all four of their matches. Meanwhile, xGoat emerged victorious in the Phygital Shooter.CS 2 final, overcoming Dontsu Esports 2-0 in an intense digital shootout.

In the drone racing category, Drone Racing One wowed spectators by completing 50 laps of a challenging circuit, showcasing the high-tech thrill of phygital racing.

A Digital Revolution: The Rise of VR Gaming and Esports

Beyond traditional sports, Games of the Future Abu Dhabi 2025 brought esports and VR gaming into the spotlight. The esports events featured top teams and intense matches across a variety of games, including MOBA Mobile.MLBB and MOBA PC.Dota 2. In a thrilling final, ONIC defeated Aurora Gaming in the Mobile.MLBB championship, while teamWin overcame Vikings 2-0 in Dota 2.

The Battle Royale tournament, featuring Fortnite, saw Kami + Swizzy crush their opponents ZYRO + RAPID in the final. In VR gaming, the HADO competition proved to be one of the most exciting events, where Team Rock claimed the victory.

The digital revolution didn’t stop there—Phygital Dancing.Just Dance was an engaging crowd favorite, with Ivan “myakekcya” Vlasov taking home the crown. These events proved that esports and VR gaming are no longer just niche interests but are now integral parts of mainstream competition.

The Future is Phygital: Tech and Sport in Perfect Harmony

Games of the Future Abu Dhabi 2025 perfectly illustrated how technology and sports are converging to form an entirely new ecosystem. With events such as Phygital Football, Phygital Basketball, and drone racing, the Games were a showcase of the groundbreaking possibilities that arise when sports embrace digital innovations. Technology was not merely an accessory at this event—it was the cornerstone upon which the competitions were built.

With immersive experiences that brought together digital avatars, VR environments, and physical action, the event revealed a new way of experiencing and consuming sports. It also showcased how athletes and fans alike can now engage with sports in ways that were unimaginable just a decade ago.

Abu Dhabi Leads the Way: A Global Hub for Next-Generation Sports

As the host city, Abu Dhabi solidified its position as a global leader in the future of sports. This landmark event wasn’t just about showcasing phygital sports, but also about demonstrating the UAE’s commitment to innovation and technology. The event was a triumph of vision, execution, and global collaboration, bringing together athletes, clubs, and partners from around the world.

In his remarks, Saif Al Noaimi, CEO of Ethara, remarked on the complexity of delivering an event on such a grand scale: “Delivering an event of this scale and complexity required close coordination across multiple disciplines, venues, and partners. The Games of the Future Abu Dhabi 2025 showcased competitive excellence, but also operational innovation and audience engagement at the highest level.”

Similarly, Nis Hatt, CEO of Phygital International, praised the event’s impact: “What we saw over six days was not just competition, but the emergence of a global ecosystem where sport, esports, technology, and innovation coexist on one stage. Abu Dhabi set a new benchmark for scale, delivery, and ambition.”

A Glimpse into the Future: The Global Impact of Phygital Sports

The success of Games of the Future Abu Dhabi 2025 is not just about the event itself. It signals a transformative shift in how we view and experience sports in the 21st century. By embracing phygital sports, the UAE is not just shaping the future of competition, but also setting the stage for the next generation of athletes, fans, and sports industries.

The Phygital Sports Summit, which took place during the event, provided a platform for discussing the future of sports, technology, and innovation. The summit brought together industry leaders, athletes, and tech visionaries to discuss the convergence of physical and digital realms. The dialogue held here will help define the future trajectory of phygital sports and shape the policies that govern it.

Looking Ahead: The Future of Phygital Sports is Now

The Games of the Future Abu Dhabi 2025 wasn’t just a flash in the pan; it was a statement. The event demonstrated how sports and technology can work in harmony, paving the way for the next generation of competition. As Abu Dhabi continues to innovate and lead the way in phygital sports, the rest of the world is watching closely, eager to follow in the footsteps of this global hub for next-generation sports and entertainment.

As Stephane Timpano, CEO of ASPIRE, pointed out, “The success of this edition shows what is possible when vision, technology, and execution align.” The Games of the Future Abu Dhabi 2025 will undoubtedly serve as a springboard for even bigger, more ambitious events in the years to come, setting a new standard for what’s possible in the world of sports.

Technology

The Games of the Future Abu Dhabi 2025 Closes Landmark Edition, Setting New Benchmark for Phygital Sports

GOTF 1

Concludes GOTF.2

Concludes GOTF .3

ABU DHABI, UNITED ARAB EMIRATES, December 25, 2025 /EINPresswire.com/ — The Games of the Future Abu Dhabi 2025 powered by ADNOC concluded on Tuesday after six days of elite competition, innovation, and global participation, marking a milestone moment in the evolution of phygital sports.

Held under the patronage of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, the landmark event brought together more than 850 participants from over 60 countries and featured 11 disciplines, spanning Phygital Football, Phygital Basketball, esports, Phygital Fighting, Phygital Shooter, Phygital drone racing, and VR Game.HADO. Across arenas, stages, and digital battlegrounds, the event showcased how technology and sport are converging to shape the future of competition.

During the globally-watched event, champions were crowned in each discipline, delivering their own defining moments and reinforcing the unique multi-sport identity of the Games of the Future.

Phygital Football powered by ADNOC and Phygital Basketball.3on3 FreeStyle brought to you by M42 both drew vocal crowds throughout the week, with MÉXICO QUETZALES – ARMADILLOS FC taking the Phygital Football title in a thrilling 2-4 final win over Troncos FC, and LIGA PRO TEAM secured the Phygital Basketball title with a 29-23 victory over Moscowsky. Meanwhile, in Phygital Fighting.FATAL FURY: City of the Wolves, Kuznya finished top of the leaderboard after winning all four of their fights, dominating both on the digital stage and in the octagon, and xGoat won the Phygital Shooter.CS 2 final, beating Dontsu Esports 2-0 in the digital world to avoid the need for a deciding round of physical laser tag.

Tasting glory in the esports-focused disciplines, ONIC won the MOBA Mobile.MLBB final against Aurora Gaming, while the aptly-named teamWin beat Vikings 2-0 in the championship game of MOBA PC.Dota 2, and Kami + Swizzy conquered ZYRO + RAPID in the final of the Battle Royale.Featuring Fortnite. In the Phygital Drone Racing presented by InsuranceMarket.ae, which tasked clubs to complete 50 laps of a testing circuit filled with loops, hoops, and straights, Drone Racing One proved fastest on the final day ahead of Team BDS.

A pair of events taking place in the Atrium at ADNEC Centre drew plenty of attention as Ivan “myakekcya” Vlasov triumphed in the Phygital Dancing.Just Dance final, while Team Rock took the title in VR-game.HADO. Lastly, in Battle of Robots, proving itself one of the most spectacular disciplines of the week, Fierce Roc’s menacing Deep Sea Shark machine annihilated Team Cobalt’s Cobalt in a spectacularly destructive finale.

In parallel with the competitive program, the event week also featured an eye-catching and engaging Opening Ceremony and the inaugural Phygital Sports Summit, reinforcing Abu Dhabi’s position as a global hub for next-generation sport, innovation, and immersive entertainment.

Saif Al Noaimi, CEO of Ethara, reflected on intricacy of the Games: “Delivering an event of this scale and complexity required close coordination across multiple disciplines, venues, and partners. The Games of the Future Abu Dhabi 2025 showcased competitive excellence, but also operational innovation and audience engagement at the highest level. We are proud to have played a role in bringing this landmark event to life and in supporting its growth on the global stage.”

Nis Hatt, CEO of Phygital International, said: “The Games of the Future Abu Dhabi 2025 demonstrated how far this movement has come in a short space of time. What we saw over six days was not just competition, but the emergence of a global ecosystem where sport, esports, technology, and innovation coexist on one stage. Abu Dhabi set a new benchmark for scale, delivery, and ambition, and this edition has reinforced the Games of the Future as a defining platform for next-generation competition worldwide.”

Stephane Timpano, CEO of ASPIRE, added: “Hosting the Games of the Future in Abu Dhabi reflects the UAE’s commitment to shaping the future of sport and innovation. This event brought together athletes, clubs, partners, and audiences from around the world. The success of this edition shows what is possible when vision, technology, and execution align, and it positions Abu Dhabi firmly at the forefront of emerging sport formats.”

The Games of the Future Abu Dhabi 2025 is organized by ASPIRE, the Local Delivery Authority, in collaboration with Ethara, the Event Delivery Partner, and Phygital International, the Global Rights Holder. The event is supported by key partners, including Abu Dhabi Sports Council, ADNOC, EDGE, M42, Solutions+, The Galleria, Abu Dhabi Gaming, du Infra, InsuranceMarket.ae, Ministry of Sports, Advanced Technology Research Council, and ADNEC Group.

Deepra Ahluwalia

Action Global Communications

+971 56 477 0995

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Technology

3D Glasses-Free Gaming Monitors : Samsung Odyssey 3D G90XH

The Samsung Odyssey 3D G90XH gaming monitor features a 165Hz refresh rate that can be boosted to 330Hz in Dual Mode. The monitor is slated to arrive in 2026 and is expected to be a hit amongst avid gamers.

Technology

Stunning Stacked LED Displays : LG Display OLED technology

The Tandem WOLED technology will offer fast response time, high refresh rates, low motion blur, dual modes, enriched color depths and more. The Tandem OLED technology will allow screens to blend more seamlessly into everyday spaces thanks to its natural performance.

The latest LG Display OLED technology comes as part of the company’s rebranding of its screen technology to help usher in a new age for the brand.

Technology

Abu Dhabi to Showcase Its Esports and Motorsports Excellence: Gran Turismo World Series 2026 Kicks Off in the UAE

Published on

December 22, 2025

In a historic first for the Middle East, Abu Dhabi, the vibrant capital of the United Arab Emirates, will host the opening event of the Gran Turismo World Series 2026 on March 28, 2026. This prestigious event will take place at the Space42 Arena, showcasing Abu Dhabi’s growing influence in esports and motorsports. As the world’s most exciting digital racing series kicks off its new season in the heart of the UAE, the city’s status as a global hub for innovation, entertainment, and technology is further solidified.

This announcement was made during the Gran Turismo World Series 2025 Finals held in Fukuoka, Japan, by S.E. Saeed Al Fazari, the Executive Director of Strategic Affairs at the Department of Culture and Tourism – Abu Dhabi (DCT Abu Dhabi), and Kazunori Yamauchi, the producer of the Gran Turismo series. Their collaboration highlights Abu Dhabi’s readiness to host an event that will attract millions of esports fans and motorsport enthusiasts from around the world.

Abu Dhabi: The Perfect Location for the Gran Turismo World Series 2026

Abu Dhabi, already known for its world-class motorsport events such as the Formula 1 Abu Dhabi Grand Prix, is now expanding its footprint in the esports industry by welcoming the Gran Turismo World Series. This high-profile event, which brings together the best virtual drivers from around the globe, will elevate the UAE’s presence in the digital gaming and motorsport communities.

The Gran Turismo World Series: A Global Racing Championship

The Gran Turismo World Series is an annual competition that aims to crown the best Gran Turismo player in the world. The competition begins with online qualifiers, where players from across the globe compete to earn their spots in the live events. The series then moves to major international venues, where the top drivers from each region meet to race for the title. The 2026 series opener in Abu Dhabi will mark a monumental step in the history of the event, as it’s the first time the series has taken place in the Middle East.

Yas Marina Circuit in Gran Turismo 7: A Digital Tribute to Abu Dhabi’s Motorsports Legacy

Adding to the excitement, the Yas Marina Circuit, one of the most iconic motorsport venues in the world, will be featured in Gran Turismo 7. This addition allows players to virtually race on the very track that has hosted the Formula 1 Grand Prix since 2009. With this integration, Gran Turismo 7 connects real-world motorsports with virtual racing, offering players the chance to experience the thrill of Yas Marina from the comfort of their homes.

Key Highlights of the Gran Turismo World Series 2026 in Abu Dhabi

- Event Date: March 28, 2026

- Venue: Space42 Arena, Abu Dhabi, UAE

- Region’s First: This marks the first time the Gran Turismo World Series will take place in the Middle East.

- Key Features: The event will showcase the best virtual drivers, live competitions, and interactive experiences for fans.

- Inclusion of Yas Marina Circuit: The iconic Yas Marina Circuit will be featured in Gran Turismo 7, bringing a unique virtual motorsports experience to players globally.

Abu Dhabi’s Growing Role in Esports and Digital Innovation

Abu Dhabi has rapidly become a global leader in the esports sector, thanks to its investments in cutting-edge technology, entertainment infrastructure, and strategic partnerships. The opening of the Gran Turismo World Series 2026 marks a milestone in Abu Dhabi’s growing presence in the world of competitive gaming and motorsports. The event also supports the UAE’s Vision 2021, which aims to position the country as a leader in innovation, technology, and global partnerships.

The Role of Abu Dhabi Gaming

The event is organized by Abu Dhabi Gaming, an initiative led by the Department of Culture and Tourism – Abu Dhabi. Abu Dhabi Gaming is dedicated to transforming the emirate into a world-class esports and gaming hub, attracting global talent, investors, and partnerships that will help develop and expand the gaming ecosystem. With Gran Turismo World Series 2026, Abu Dhabi continues to build on its reputation as a city that hosts world-class events and provides a platform for esports growth.

Abu Dhabi’s Vision for Esports and Motorsports

S.E. Saeed Al Fazari expressed the importance of this event for both Abu Dhabi and the Middle East. He stated, “Hosting the opening of the Gran Turismo World Series is a moment of pride for Abu Dhabi and the entire MENA region, reflecting our ambition to be a destination with limitless possibilities. This marks a significant step for our esports and motorsport sectors, bringing the world’s elite competitors to the emirate and showcasing Abu Dhabi’s proven capacity to deliver world-class experiences in these fields.”

The Gran Turismo World Series 2026 will also contribute to Abu Dhabi’s broader vision of becoming a global center for innovation, entertainment, gaming, and motorsports. The emirate continues to offer a safe, future-ready environment for businesses, investors, and talent, providing opportunities for growth in emerging industries such as esports.

Kazunori Yamauchi on the Middle East’s Growing Impact on Esports

Kazunori Yamauchi, the producer of the Gran Turismo series, also expressed excitement about this landmark event. He said, “We are excited that Abu Dhabi will host the opening of the Gran Turismo World Series in March 2026, marking the first time the event will be held in the Middle East. This is a historic milestone for our championship and a testament to the region’s growing presence in esports and motorsports worldwide. We are also thrilled that the Yas Marina Circuit is now available in Gran Turismo 7, offering players an authentic experience of one of the world’s most remarkable motorsport venues.”

The Road Ahead: Esports and Abu Dhabi’s Future in the Digital Age

The Gran Turismo World Series will continue to evolve, and Abu Dhabi’s role in the esports and digital gaming industry will only continue to grow. Events like this serve as catalysts for the city’s vision to become a global leader in the sectors of esports, technology, and digital innovation. For Abu Dhabi, hosting the Gran Turismo World Series 2026 is just the beginning of its journey to build an esports ecosystem that connects global talents with world-class facilities.

How to Attend the Gran Turismo World Series 2026 in Abu Dhabi

Tickets for the Gran Turismo World Series 2026 opening event in Abu Dhabi will be available through Ticketmaster at website. Fans from around the world can look forward to witnessing this exciting event live, making it a must-attend for all esports and motorsports enthusiasts.

-

Motorsports3 weeks ago

Motorsports3 weeks agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Motorsports3 weeks ago

Motorsports3 weeks agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Motorsports3 weeks ago

Motorsports3 weeks agoRick Ware Racing switching to Chevrolet for 2026

-

NIL3 weeks ago

NIL3 weeks agoDeSantis Talks College Football, Calls for Reforms to NIL and Transfer Portal · The Floridian

-

Sports2 weeks ago

Sports2 weeks ago#11 Volleyball Practices, Then Meets Media Prior to #2 Kentucky Match

-

Motorsports2 weeks ago

Motorsports2 weeks agoSunoco to sponsor No. 8 Ganassi Honda IndyCar in multi-year deal

-

Motorsports3 weeks ago

Motorsports3 weeks agoNASCAR owes $364.7M to teams in antitrust case

-

Motorsports2 weeks ago

Motorsports2 weeks agoNascar legal saga ends as 23XI, Front Row secure settlement

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoWhy the Texas Sport for Healing Fund Should Return – The Daily Texan

-

Motorsports3 weeks ago

Motorsports3 weeks agoAccelerating Inclusion: Breaking Barriers in Motorsport