Costa Rica, known for its stable democracy and innovative perspectives on technology, has now become an important destination for the global iGaming market. Costa Rica’s location in Central America, its welcoming business environment, and technical features for continued development, including digital accessibility, and a range of suppliers for developers, have allowed many online gambling operators, software developers, and companies that service gambling operators to access and maintain their successful gaming businesses.

In addition, the flexible nature of the law in Costa Rica is an attraction for many companies, including start-ups and established brands that desire to add their operations to an international industry, with a limited amount of regulations, and uncertainty as to what the future brings in terms of regulations.

Furthermore, in recent years, Costa Rica’s advances in some lesser-known aspects of iGaming and the transfer of knowledge from each cohort of online-based technology entrepreneurs to the next cohort of entrepreneurs have been a huge asset, alongside the government’s ongoing endorsement of tech-based entrepreneurship in Costa Rica.

Table 1: Key Statistics

| Metric |

Value (2025) |

| Market Revenue |

US$794 million |

| CAGR (LatAm iGaming, 2022–28) |

18.4% |

| Number of Gamers |

1.4 million+ |

| Female Gamers |

39.8% |

| Age Group (Majority) |

17–38 years |

| Popular Game Types |

Casino, Sports Betting, Poker, eSports |

| Leading Operators |

888 Holdings, bet365, Betsson France |

| Crypto Adoption |

High |

Market Overview

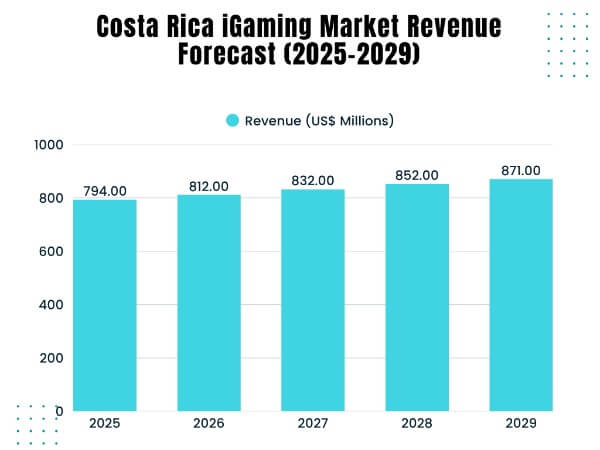

Market Growth and Size

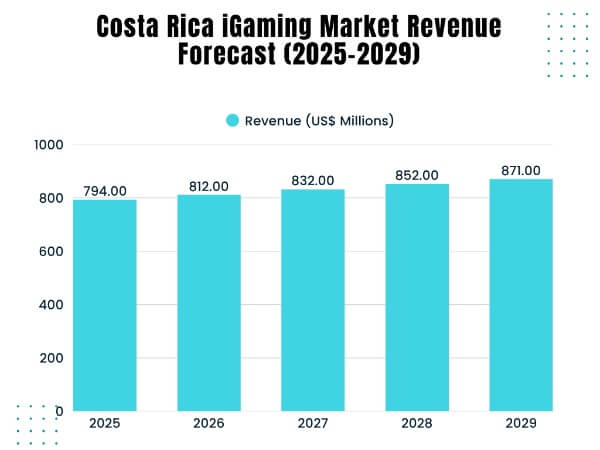

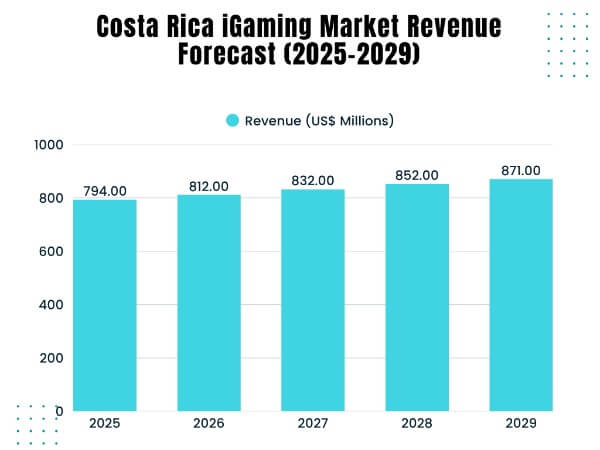

Costa Rica’s gambling and iGaming market is experiencing significant growth, with domestic and international operators alike taking advantage of the flexibility of the regulatory environment. The estimated revenue for the gambling market in 2025 is approximately US$794 million, with a projected compound annual growth rate (CAGR) of 2.34% between 2025 and 2029, which is expected to result in a projected market volume of US$871 million or more by 2029. This number incorporates both traditional land-based gambling and casino-style wagering through online gambling, where online gambling continues to gain traction due to technology adoption and changing consumer preferences.

The player base in Costa Rica is also already considerable, with over 1.4 million active gamers. This figure is indicative of a high level of penetration in terms of population, as well as a significant value for the territory’s iGaming stature within the region. Enhancements in the availability of high-speed internet and mobile devices have further fueled this growth, opening online gambling access to a wider demographic of consumers.

Table 2: Costa Rica iGaming Market Size & Growth (2025-2029)

| Year |

Market Revenue (US$ million) |

Growth Rate (CAGR %) |

| 2025 |

794 |

2.34% |

| 2026* |

812 |

|

| 2027* |

832 |

|

| 2028* |

852 |

|

| 2029* |

871 |

|

*Projected values

Major types of games available

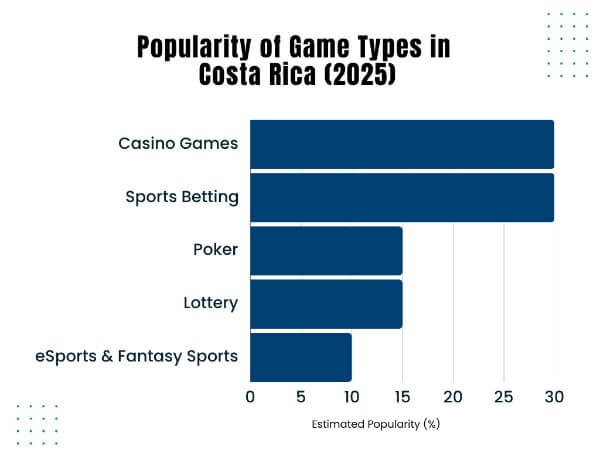

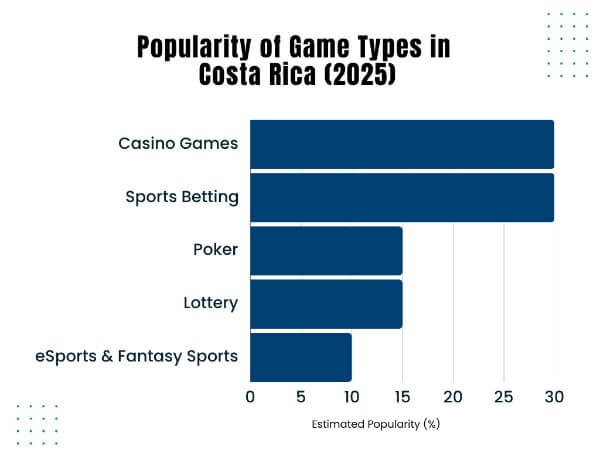

As can be seen, the gambling range of activities in Costa Rica is very diverse, accommodating all types of players:

- Casino Games: Slots, table games (such as blackjack, roulette, and baccarat), and live dealers are available through both land-based (usually associated with hotels) and online casino platforms.

- Sports Betting: Sports betting is likely the largest vertical in the gambling industry as many Costa Ricans participate in wagers based on football, basketball, and international sporting events. Online sports wagering options are appealing as more convenient and easier to place wagers from mobile devices.

- Poker: Poker, whether offline or online, possesses a consistent player base in both tournaments and cash games.

- Lottery: The national lottery, provided by the Junta de Protección Social, holds a monopoly on any legal lottery game and is a dominant part of the local gambling market.

- eSports and Fantasy Sports: eSports has led to the creation of professional teams, tournaments, and dedicated arenas, which points to an increase in interest in competitive gaming.

Table 3: Popular Game Types in Costa Rica iGaming Market

| Game Type |

Description / Popularity |

| Casino Games |

Slots, Blackjack, Roulette, Baccarat; popular online & offline |

| Sports Betting |

Football, basketball, international sports; strong online presence |

| Poker |

Online and offline tournaments and cash games |

| Lottery |

State monopoly operated by Junta de Protección Social |

| eSports & Fantasy Sports |

Growing interest with professional teams and tournaments |

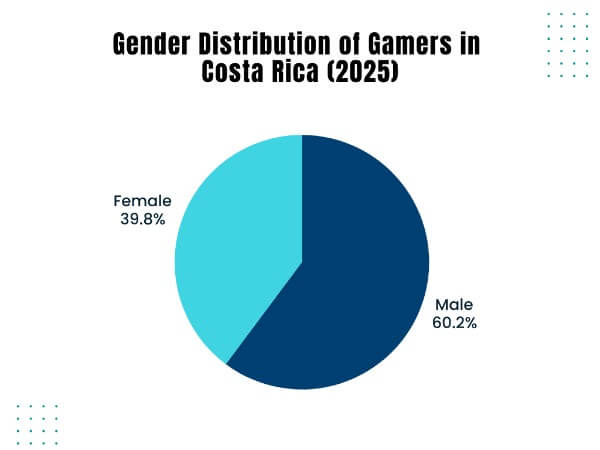

Demographics of Players

Costa Rica’s iGaming and gambling audience is youthful, diverse, and digitally engaged:

- Age: Most players are between 17 – 38 years of age, and college students/university or young professionals, who are highly tech-savvy and open to game experiences.

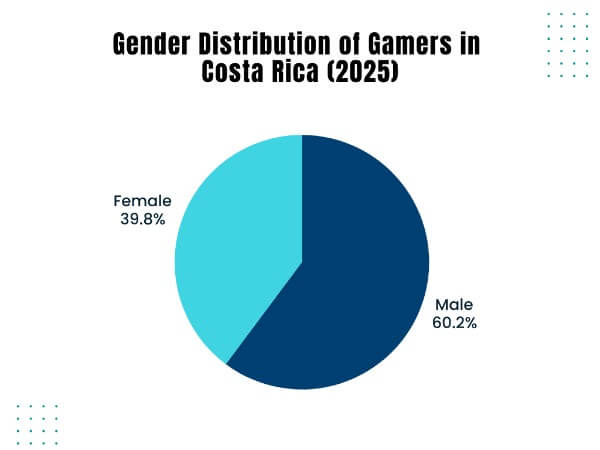

- Gender: Approximately 40% of gamers are women, which shows a relatively equal gender divide and a wide market.

- Preferences: Gamers in Costa Rica tend to prefer mobile video games, which translates into over 70% gaming an average of three-plus hours each day. Electronically, gamers preferred video games that included social connection, immersive experiences, and game elements to video games they could do alone.

- eSports, online multiplayer games, and mobile casino games are very popular with younger users.

- Spending Habits: Gamers in Costa Rica spend on average between $500 and $1,000 on gaming products and services in any six months.

Table 4: Player Demographics

| Demographic |

Details |

| Age Range |

17–38 years |

| Gender Distribution |

~40% female, 60% male |

| Preferences |

Mobile gaming, social features, gamification, eSports |

| Spending Habits |

Majority spend between $500 and $1,000 every six months |

Regulatory Landscape

Overview of Existing Gambling Regulations

Costa Rica’s gambling landscape represents a unique combination of strictness and permissiveness. Land-based casinos are sanctioned; however, they must be operated as an extension of a hotel. This is structured under Law No. 9050 and overseen by the Ministry of Public Security. There are specific tax and operational obligations for these casinos. The national lottery represents the only state monopoly for gambling and is controlled by the Junta de Protección Social, the government agency that also controls other legal games of chance.

Online gambling, on the other hand, occupies a grey area within this legislative context. There is no legal framework or regulatory authority to govern online gambling. Instead, businesses can leverage the freedoms provided to them by their location in Costa Rica, as demonstrated through the Data Processing License, for example, to run an online operation from Costa Rica (as long as they do not target Costa Rican residents or utilize local financial institutions to transact funds).

Licensing Requirements and Regulatory Bodies

Costa Rica does not have a formal license for online operators to use for gambling. Rather, companies must:

- Register as a legal entity (typically an Ltd. or SA) in Costa Rica and have a local address.

- Apply for a Data Processing License through the local municipality, which gives the company a license to process data, but it is not a gambling license.

- Follow provider terms that, in effect, prohibit the provision of services to the residents of Costa Rica and gambling transactions through local banks.

Details on Taxation and Compliance

Costa Rica has a very favorable tax regime for iGaming operators:

- No direct taxes are placed on profits derived from international gambling operations.

- The only taxes incurred by operators are normal business registry and maintenance taxes.

- A company that operates predominantly in the domestic market will have some tax obligations locally, whereas most online operators are exempted as they are primarily international customers.

- For Costa Rican residents, there are no taxes on gambling winnings, which is even more attractive for operators to use as a base in Costa Rica.

Compliance focuses on:

- AML & KYC polices and internal controls and transaction monitoring;

- Business regulations, including registration, documentation compliance, and limited-term audits

Upcoming Changes in Legislation

As of mid-2025, dialogue continues on the potential for online gambling regulations to enable formalization to improve investor/supplier confidence, claims of player protection, and market confidence. However, there has been no significant movement on legislation. Industry players believe that the potential reforms may provide:

- An established regulatory body for online gambling.

- More stringent compliance and reporting requirements.

- Tax changes or licensing fees for online operators.

Table 5: Regulatory Overview

| Aspect |

Details |

| Land-based Casinos |

Legal, must be attached to hotels; regulated by Ministry of Public Security |

| Online Gambling |

No formal license; Data Processing License for international operations only |

| Lottery |

Monopoly by Junta de Protección Social |

| Licensing Authority |

No dedicated online gambling regulator; municipal Data Processing License |

| Taxation |

No direct gambling taxes for international operators; standard business fees apply |

| Compliance |

AML, KYC, business registration, periodic audits |

Competitive Landscape

Key Market Players

Costa Rica’s iGaming space is made up of a range of locally-owned start-up businesses and international businesses that have made an operational or administrative base in the country due to its flexible regulatory environment. Costa Rica does not offer formal online gambling licenses, but rather companies build their operations in the country using a Data Processing License, which allows them to operate legally in their target international markets.

Some of the international operators with an operational presence in Costa Rica are 888 Holdings, bet365, Betsson France, and 22bet. A handful of long-term players, such as Wild Vegas Casino, Club Player Casino, CoolCat Casino, Prism Casino, and Royal Ace Casino, have specialized in casino and poker games with good rewards for players loyal to their online casinos.

Table 6: Key Market Players

| Operator |

Type |

Focus |

| 888 Holdings |

International |

Global iGaming platforms |

| bet365 |

International |

Sports betting, casino |

| Betsson France |

International |

Casino, poker, sports betting |

| Wild Vegas Casino |

Local |

Online casino, slots |

| Club Player Casino |

Local |

Online casino, poker |

Market Share Distribution

As there is not, as of now, a formal licensing regime or an official regulator to provide exact market share data, the data is limited. The Costa Rica market is largely dominated by international operators, who use Costa Rica primarily as an operational and managerial location for their platforms targeting Latin America, Europe, and other, still-emerging regions.

Meanwhile, the local operators will typically focus on niche markets or game verticals, ie, crypto casinos or poker rooms. The market does remain fragmented, with no single operator delivering the largest market share, which creates a competitive environment in which innovation, offering variety, and unique approaches can thrive.

Partnerships and Strategic Alliances

Strategic partnerships are an important component within the iGaming ecosystem of Costa Rica. Operators regularly engage with software developers, payment processors, and technology companies focused on blockchain and AI in order to expand their platform functionalities. Partnerships with international gaming companies allow a Costa Rican-based operator to utilize the latest technology, expand their game library, and enter new markets efficiently.

Additionally, many operators will partner with marketing agencies and affiliate marketing networks for customer acquisition and retention optimization, taking advantage of Costa Rica’s business-friendly environment in order to scale. These partnerships are all very important for operators that need to remain competitive while working in a low-regulatory environment with high operational demands.

Costa Rica’s competitive landscape ultimately shows how this is a dynamic sector that thrives on innovation, where flexibility and strategic alliances are the keys to winning.

Table 7: Strategic Partnerships & Alliances

| Partnership Type |

Purpose |

| Software Providers |

Enhance game portfolios and platform capabilities |

| Payment Processors |

Support cryptocurrency and traditional payments |

| Marketing Agencies |

Customer acquisition and retention |

| Affiliate Networks |

Expand market reach |

| Technology Firms (AI, Blockchain) |

Innovation in security, personalization, transparency |

Consumer Trends

Player Behavior and Preferences

- Mobile gaming is the dominant mode of play, driven by widespread smartphone adoption and affordable data plans.

- Players seek personalized experiences, gamification, and social features such as leaderboards and achievements.

Payment Methods and Technology

- Cryptocurrency payments are widely accepted, with blockchain technology ensuring transparent and secure transactions.

- Traditional payment methods (credit cards, e-wallets) are also supported for international players.

Social and Cultural Influences

- Costa Rica’s young, educated, and tech-savvy population is highly receptive to new gaming experiences and technological innovation.

- The rise of eSports and gaming culture is reflected in the establishment of professional teams, tournaments, and dedicated arenas.

Opportunities & Challenges

Growth Potential For New Entrants

- Costa Rica provides a business-friendly climate with low barriers to regulation and openness to innovation. Considerations for new businesses and investors are valuable.

- Costa Rica’s reputation as a technology hub for innovative and daring new businesses and as a port to Latin America is advantageous as it provides ample opportunity for a quick and quick launching pad for regional expansion.

Regulatory and Operational Challenges

- A lack of a formal online gambling or sports betting license raises questions for operators who are looking for long-term certainty in continuing to operate in a system that is stable and regulated.

- Any future regulation may lead to more to movers having to adhere to rules and compliance that could affect their debut swiftly.

Innovations and Investment Areas

- AI, machine learning, and gaming have the ability to personalize for players, detect fraud detection and reinforce responsible gaming.

- Blockchain and crypto gaming have the ability for secure payment processing as well as outcomes for transparent gaming.

- Mobile-first platforms and cloud-based gaming will allow for a better audience reach and a lower barrier to entry.

- Sustainability of the operations in CI, to a certain extent comparison to studio operations in the US or Canada, including eco-friendly server hosting from a renewables standpoint, aligns with attention at the national level.

Conclusion & Recommendations

Costa Rica’s iGaming industry is unique because of its adaptability, innovation, and reach. Without major regulations and a technologically literate labor force in a supportive business environment, the country has been able to establish itself as a prime destination for iGaming operators and investors. While the lack of formal licensing brings inherent risks, it also presents unmatched opportunities for new and established brands to trial and grow new ideas.

Strategic Recommendations for Market Entry

- Market Entry: New entrants should take advantage of Costa Rica’s low-cost, low-barrier operating environment to trial new products that can leverage mobile and blockchain technology.

- Compliance: Operators need to be aware of the potential for future liability in compliance with international AML regulations and keep an eye on any potential changes in regulation going forward.

- Sustainability: Investing in environmentally friendly infrastructure and responsible gaming initiatives will increase brand credibility and long-term viability.

- Regional Expansion: Use Costa Rica as a launching pad to access Latin America’s broader markets by establishing local partnerships and forming international partnerships (with brands in Europe and North America) that might have local ties.

Future Outlook for the iGaming Sector in Costa Rica

As the worldwide gaming industry continues to experience change, Costa Rica is poised to retain its position as an innovation engine and center of global operations. Ongoing dialogue surrounding regulation denotes a shift towards more formalization, resulting in enhanced investor certainty and sector reliability and sustainability.

Data and Sources:

- NuxGame: Costa Rica Gambling License 2025 Guide

- Statista: Gambling Market Forecast Costa Rica 2025

- Research and Markets: Gambling Market Report 2025

- Gambling Insider: Costa Rica: Effective Regulation and Market Outlook 2025

- Rue.ee: Costa Rica Gambling License 2025 Overview

- TGM Research: Sports Betting and Gambling Industry Data Costa Rica

- ENV Media: iGaming in Latin America Outlook 2024-2025

- The Business Research Company: Global Gambling Market Report 2025-2034