Technology

‘Flight simulator’ for lab equipment raises further £1 million

Envoke, a UK company specialising in software that enables medical staff to train to use laboratory equipment and troubleshoot problems, dubbed ‘Flight simulator for lab equipment’ has raised a further 1 million GBP. NPIF – Mercia Equity Finance, which is managed by Mercia and is part of the Northern Powerhouse Investment Fund, has invested 500,000 […]

Envoke, a UK company specialising in software that enables medical staff to train to use laboratory equipment and troubleshoot problems, dubbed ‘Flight simulator for lab equipment’ has raised a further 1 million GBP.

NPIF – Mercia Equity Finance, which is managed by Mercia and is part of the Northern Powerhouse Investment Fund, has invested 500,000 GBP matched by 500,000 GBP from Finance Yorkshire’s Seedcorn Fund.

Envoke’s platform, which creates a virtual model of each machine, is the only one of its type that can provide e-learning on medical devices. It also enables manufacturers to offer remote support, reducing the need for site visits, while its AI-powered diagnosis tool allows users to resolve many problems themselves.

Envoke’s clients include leading device manufacturers such as Bio-Rad, Waters Corporation, PacBio, Grifols and the Terumo Group, and the system is now used in laboratories worldwide including in the NHS and other health services as well as leading universities.

Envoke was founded in 2019 by Stuart Warrington and arose from his film and animation production firm. The platform was originally designed for product demonstrations, however it was soon evident that there was an even greater need for a system that could deliver remote training and aftersales.

The Leeds-based company secured £1m from Mercia and NPIF in 2023 to further develop the platform to meet the demand. Following the launch of the new module late last year, the company has won a host of new clients and as a result, has almost doubled its annual recurring revenue in the past 12 months.

The latest funding will allow the business to further enhance the system, boost sales and marketing and roll it out to more customers in the run-up to a Series A investment. Envoke, which currently employs 11 staff, plans to create two new jobs in the coming months.

Stuart Warrington, CEO, says: “Healthcare services worldwide rely on rapid and accurate laboratory testing. However training staff is costly, and machine downtime is commonplace, often due to operator error or simple faults that could easily be fixed with the right support. We believe our platform will dramatically improve productivity by enhancing staff skills and keeping equipment up and running, while also reducing warranty costs for manufacturers.”

Dawn Tyler of Mercia Ventures added: “Envoke’s pioneering platform could transform training for laboratory staff in the same way the flight simulator did for pilots. Our initial investment enabled the team to develop this latest version, which has attracted strong interest from the healthcare industry. We are pleased to support the company once again, and welcome on board Finance Yorkshire as a new investment partner.”

Finance Yorkshire CEO Alex McWhirter said: “Envoke’s success is to be applauded as part of the growing technology and AI sector in Yorkshire and Humber. Finance Yorkshire is pleased to support Envoke as it embarks on the next chapter in its growth strategy.”

Lizzy Upton, senior manager at the British Business Bank, said: “This second round of investment shows that businesses are able succeed over time with the help of the first Northern Powerhouse Investment Fund, and is a testament to external finance being an important tool for growth. This exciting technology company is paving the way in the healthcare sector, creating jobs, and making a measurable difference to the local economy by working with more partners and other businesses in the region.”

Finance Yorkshire is preparing to make further investments in 2025 after a positive review of its investment performance over the last three years during which 55 SMEs were supported, creating and safeguarding over 700 jobs.

Investments from Finance Yorkshire’s growth, seedcorn and loan funds are expected to total 50 million GBP by 2027, enabling more SMEs across Yorkshire and Humber to grow and prosper.

The Northern Powerhouse Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

Related

Technology

Why are youth sports so expensive?

The U.S. has been the largest importer of sporting goods since 2010, accounting for 31% of the world’s imports in 2022. Youth sports are a big part of Karli Casamento’s life. Her son, Jax, 15, golfs and plays on three baseball teams. Her youngest son, Colt, 7, plays baseball and basketball. The costs, especially for […]

The U.S. has been the largest importer of sporting goods since 2010, accounting for 31% of the world’s imports in 2022.

Youth sports are a big part of Karli Casamento’s life. Her son, Jax, 15, golfs and plays on three baseball teams. Her youngest son, Colt, 7, plays baseball and basketball.

The costs, especially for Jax, add up in a hurry. That’s why Casamento, 48, and her husband, Michael, 46, are watching closely for the ramifications of tariffs on their rising youth sports budget.

“All of their equipment I’m sure comes from China,” said Karli Casamento, a second-grade teacher in suburban Philadelphia. “As they get bigger, they need new equipment. So that is definitely a concern.”

For families like the Casamentos and businesses in the marketplace, there is continued uncertainty surrounding the possible effects of President Donald Trump’s tariffs — the 10% baseline tariffs, along with a 30% rate on Chinese goods — on youth sports.

Nike, Adidas, Under Armour and Puma were among 76 companies that signed an April 29 letter to Trump asking for a footwear exemption from reciprocal tariffs. The Footwear Distributors & Retailers of America letter warned tariffs would “become a major impact at the cash register for every family.”

Amer Sports, the parent company of Wilson Sporting Goods and Louisville Slugger, downplayed the effect of tariffs when it announced its first-quarter earnings on May 20. But looking beyond this year, chief financial officer Andrew Page mentioned pricing as one way the company could offset higher import tariffs.

Dick’s Sporting Goods reaffirmed its earnings guidance for 2025 when it provided its first-quarter update on May 28. CEO Lauren Hobart said Dick’s had no plans to trim its product assortment in response to tariff costs, and that its guidance confirmation was based on its belief it can manage the situation.

“We are constantly assessing our pricing down to the item level, SKU level, and we do that based on consumer demand and the profitability of the business,” Hobart said in response to a question on possible price increases. “We have a very advanced pricing capability, much more advanced than we used to have, and much more enabled to make real time and quick decisions.”

Many of the US’s most popular sports rely on imported equipment

The U.S. has been the largest importer of sporting goods since 2010, accounting for 31% of the world’s imports in 2022, according to a 2024 World Trade Organization report. Boosted by racket sports, China is the most significant exporter of sporting goods at 43% in 2022.

Fueled by golf, badminton and tennis equipment, Vietnam and Taiwan experienced rapid expansion in exporting outdoor sports equipment to the U.S. from 2018 to 2024, according to data from the consulting firm, AlixPartners. Vietnam increased 340% to $705 million, and Taiwan was up 16% to $946 million.

Tariffs of 46% for Vietnam and 32% for Taiwan could go into effect next month after a 90-day pause.

Hockey skates, sticks and protective gear are often imported. Same for baseball gloves and composite and aluminum bats, which are often imported or use materials that are imported, according to the National Sporting Goods Association. Soccer goals, lacrosse nets and cones are often sourced from low-cost labor markets.

“You can’t get around the fact that a lot the stuff that we use in youth sports is coming from abroad,” said Travis Dorsch, the founding director of the Families in Sport Lab at Utah State University. “So surely if the tariffs go into effect and in any long-term or meaningful way, it’s going to affect youth sports.”

The Casamento family cheers for the Philadelphia Phillies, and that’s how Jax and Colt got into baseball. Karli Casamento called sports “a safe way to socialize, and it gets them active.”

But equipment has become a major expense for the family. Jax has a $400 bat and a $300 glove, Karli Casamento said, and his catching equipment is $700. There is an additional cost for registration for his travel team, in addition to what it costs to travel to tournaments.

“We’ve tried to say to Jax, ‘Well, you’re in ninth grade now, do you really need to play tournament ball? You’re not going to grow up and be, you know, the next Mike Schmidt,’ things like that,” Karli Casamento said, “because it’s just, it’s $5,000 a year and now we have two kids in sports.”

Tariffs may not impact all sports families equally

That effect most likely will be felt by middle- and low-income families, threatening recent gains in participation rates for youth sports.

The Sports & Fitness Industry Association, which tracks youth participation by sport, found in 2023 there was a 6% increase in young people who regularly participated in a team sport, which it said was the highest rate (39.8%) since 2015. An Aspen Institute study released in October showed participation for girls was at its highest levels since at least 2012.

“I’m really concerned that we’re going to spike this great momentum because families, who are already saying that sports is getting increasingly more expensive, equipment’s getting more expensive and they’re continuing to stretch to make that work, like this might be the one that just kind of puts them over the sidelines,” said Todd Smith, the president and CEO of the Sports & Fitness Industry Association.

Smith was in China in April for a World Federation of Sporting Good Industries board meeting. He visited some manufacturing facilities while he was in the country.

“The ones that I went to are really, really impressive,” Smith said. “First class, high tech, like highly skilled. And the thought that tariffs are all of a sudden just going to allow a 10-plus million dollar facility to just pop up the next day in the U.S. is just, it’s not feasible.”

Low-income families were already feeling a financial strain with youth sports before Trump was elected to a second term. According to the Aspen Institute study, 25.1% of children ages 6-17 from households earning under $25,000 played a sport on a regular basis in 2023, down slightly from 25.8% in 2022. That’s compared to 43.5% of children from households earning at least $100,000, up slightly from 42.7% in 2022.

Youth sports participation has a wide range of ramifications for public health, said Tom Farrey, the founder and executive director of the Aspen Institute’s Sports & Society Program.

“This incredibly virtuous cycle can be engaged if you can simply get kids off their phones and off their couches and into the game and they have a sustained experience into adolescence,” Farrey said. “And if you don’t, then you’re at risk for a range of health consequences, including obesity.”

Going along with playing on three baseball teams, Jax Casamento has workouts for his travel squad and also takes hitting lessons. The Casamentos turned a baseball trip to South Carolina into a family vacation last year.

Michael Casamento is a physical education teacher in an elementary school, so the family’s concerns about the effect of tariffs on the cost of youth sports go beyond their two boys.

“I work with a lot of kids that are a lower socio-economic status,” Karli Casamento said. “It really makes it harder for those types of families to be able to afford to play sports.”

Copyright 2025 Associated Press. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Technology

Xiaomi Smart Band 10 Review: The Best Budget Fitness Tracker, Again

At a glance Expert’s Rating Pros Stylish design Large, clear display Smooth software 5ATM waterproof Cons Mi Fit app feels a bit clunky in places Heart rate tracking not impeccable Ceramic edition pushes price up Our Verdict The Xiaomi Smart Band 10 cements its place as the best cheap fitness tracker with some nice upgrades, […]

Expert’s Rating

Pros

- Stylish design

- Large, clear display

- Smooth software

- 5ATM waterproof

Cons

- Mi Fit app feels a bit clunky in places

- Heart rate tracking not impeccable

- Ceramic edition pushes price up

Our Verdict

The Xiaomi Smart Band 10 cements its place as the best cheap fitness tracker with some nice upgrades, a new (pricier) look and a mix of features and performance that make it worthy of a place on your wrist.

Price When Reviewed

This value will show the geolocated pricing text for product undefined

Best Pricing Today

Price When Reviewed

Unavailable in the US

The Xiaomi Smart Band 10 arrives as the latest instalment in Xiaomi’s long-running fitness tracker band series, which once again wants to redefine your expectations of what a cheap fitness tracker can be and do.

For the Xiaomi Smart Band 9‘s successor, you can expect a larger AMOLED display, a new look and tracking sensors along with promised improvements to its onboard sports and sleep smarts.

Xiaomi has rarely put a foot wrong with its budget tracker, elevating the design and performance with every new edition. The Band 10 once again looks set to build on that good work to make the latest Band a tracker that continues to punch above its price tag of just £39.

Design & Build

- New ceramic case option

- Supports different wearing options

- Waterproof up to 50 metres

Xiaomi sticks largely to the same look as the Smart Band 9, matching up an aluminium case with a TPU strap and it’s now introduced a new ceramic finish case that’s partnered up with a fluororubber strap.

Mike Sawh

The non-ceramic version comes in black, silver or rose, while the ceramic version comes in pearl white. I can’t vouch for the look of the new model, but I can say that there’s nothing cheap-feeling about the standard model I’ve tested here.

The full colourways options are as follows:

- Midnight Black

- Glacier Silver

- Mystic Rose

- Ceramic Edition Pearl White

Both versions measure 10.95mm thick, so again, the same as the Band 9. They weigh less than 30g without the strap and even with the strap, this is a light tracker to wear and is very unobtrusive to take to bed as well.

Mike Sawh

Xiaomi lets you match up those cases with 11 optional band accessories and that includes a pendant option to let you wear it around your neck. Removing the straps is a breeze and is done by pressing two buttons on the back of each strap.

I was able to switch between living with the TPU band and one of the metallic link bracelet-style straps. I didn’t love the janky design of the metallic one, but it did at least offer a really nice solution to removing links to make it fit better. The TPU, while comfortable to wear, features one of my least favourite button clasp mechanisms that has on the odd occasion, got caught when taking off a t-shirt or jumper.

Mike Sawh

A 5ATM waterproof rating does make it safe to go swimming and to keep on in the shower. I’ve taken it for a dip in the pool and it’ll lock that screen before you get into swim tracking mode to prevent accidentally activating the display.

Screen & Audio

- Bigger AMOLED screen, thinner bezels

- Supports always-on mode

- No microphone or speaker included

The most notable design change lies with the screen where Xiaomi has moved from a 1.62-inch AMOLED display to a 1.72-inch, 212 x 520 one. That’s protected by 2.5D reinforced glass. Xiaomi says it’s also notched up the brightness, going from 1,200 nits to 1,500 nits.

growing the display helps to make features like displaying notifications feel a little less cramped

Mike Sawh

The display is supposedly surrounded by thinner bezels than the previous Band, though I’m not sure I could really tell a massive difference. What I could tell is that growing the display helps to make features like displaying notifications feel a little less cramped.

It is a nicely bright screen and you can adjust that brightness manually or leave the Band to do it automatically based on your conditions. You can keep the display on at all times too, with useful scheduled and smart modes available that display mode where it’s most relevant to do so and help keep battery life strong.

Unlike the Chinese version of the Band 10, a microphone and speaker remain missing in action for Xiaomi’s global model, which means missing out on being able to speak to Xiaomi’s Xiao assistant.

Software & Features

- Works with Android and iOS

- Offers music controls and over 200 watch faces

- Xiaomi smart home controls only for Xiaomi smartphones

The look and feel of Xiaomi’s HyperOS 2.0 really feels mostly identical to what we got on the Band 9. It’s a continuation of the good work Xiaomi has done to work on the Band’s slim screen.

The software runs smoothly and is a very easy operating system to get to grips with

Mike Sawh

Swipe from the main watch face in all directions and that is your way to get around. There are no physical buttons, so it’s all about taps, swipes and presses to navigate through menus and select items on screen.

The software runs smoothly and is a very easy operating system to get to grips with. The larger display gives widgets and text more room to spread out to help make things more glanceable.

While this is a fitness tracker first, it’s not enough these days to just focus on that.

While the small design does bring limitations on what Xiaomi can offer, it manages to squeeze in features like the ability to view notifications, weather forecasts, set up alarms, music controls and act a smartphone camera shutter.

A focus mode removes distractions like notifications buzzing, so you can fully concentrate on any important tasks.

Mike Sawh

If you own a Xiaomi smartphone and some Xiaomi smart home kit, you can use the Band to take control of those smart home devices.

What is here works well. The screen is always going to make it feel inferior to a larger smartwatch display for viewing phone notifications, but for features including the music controls and viewing weather updates, it’s perfectly fine.

I also think Xiaomi does a great job with the quality of watch faces it offers on the Band and how well optimised they are to that AMOLED display.

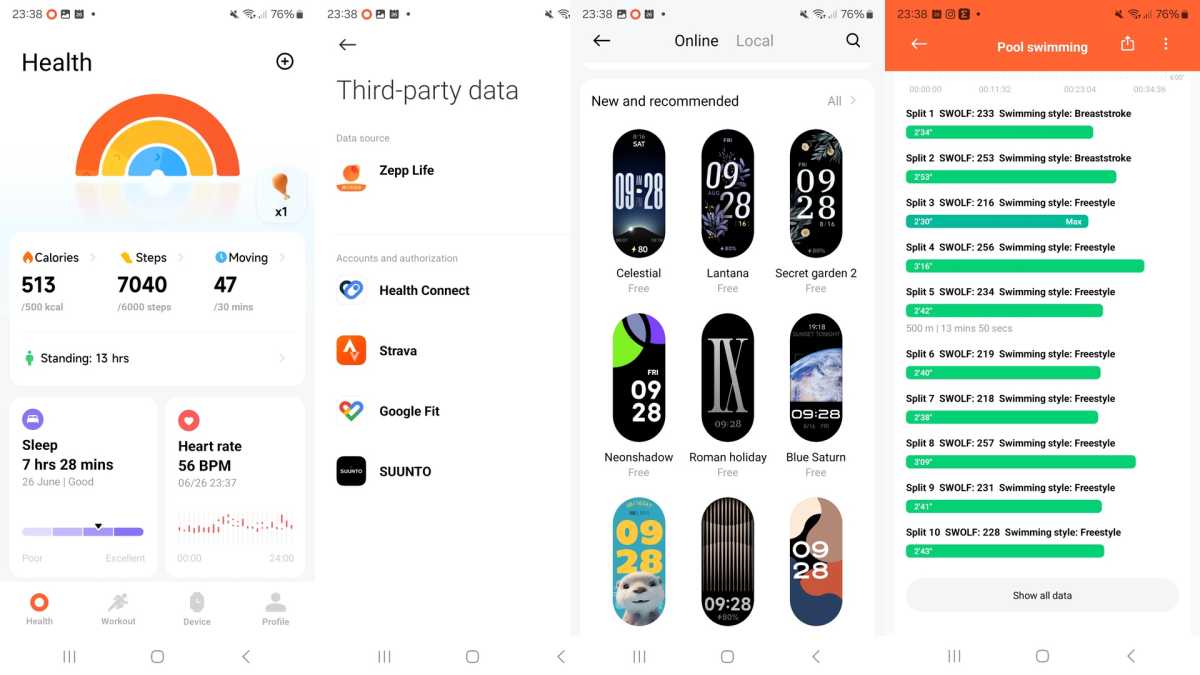

Some of these features need to be first enabled in the Mi Fitness app, which can be an arduous process at times. It’s also not one of the slickest companion apps available, either.

Fitness & Tracking

- 150+ sports modes

- Improved pool swim tracking

- Added heart rate broadcasting

Tracking your health and fitness is really what the Smart Band 10 is all about.

You won’t find medical-grade sensors or built-in GPS (again). What you do get is enough sensors, modes and insights that can make it more than useful to have on your wrist during workouts, sitting at your desk or when heading for bed.

Xiaomi has moved to a 9-axis motion sensor it says most notably improves swim tracking performance

Mike Sawh

Sports tracking is an area where Xiaomi tries to improve the Band’s abilities. You still have connected GPS to use your phone’s GPS signal to track outdoor workouts. You’re also getting hundreds of sports profiles, including indoor ones like rowing and more niche ones like horse riding.

Xiaomi has moved to a 9-axis motion sensor it says most notably improves swim tracking performance and can offer a 96% lap count accuracy.

It now lets you broadcast heart rate data in real-time to other Bluetooth devices and this can be useful if you want to use it with a cycling computer or other connected equipment where you want to keep track of your effort.

Mike Sawh

I used the Smart Band 10 in the pool against two other swim trackers and it was able to detect stroke type correctly in sessions where I started with breaststroke and then switched to freestyle. The distance tracking was a length out from the other trackers, while metrics like SWOLF scores and calories burned were similar.

The heart rate broadcasting is only useful if the heart rate sensor is reliable, and in my tests, it’s fared pretty well on the accuracy front. I’ve used it for runs, rows and indoor rides against the heart rate monitor chest strap and data like average readings and heart rate graphs were similar.

It did have a tendency to overreport maximum readings, however. It wasn’t massively off, but it was enough to question its reliability for higher intensity workouts.

There are plenty of additional sports watch-style metrics like VO2 Max estimates, as well as training load insights and recovery time recommendations. While I’d take them more as guidance rather than definitive advice, the delivery of the metrics on the watch is nicely done.

Mike Sawh

When you’re turning to the Band 10 to track daily steps, sleep, stress or keep tabs on your heart rate, it goes about its business in a pretty dependable way. I found step counts were typically around 500-600 steps in range of two other fitness trackers. For daily heart rate tracking, resting heart rate generally skewed higher against other devices, while average readings were typically higher as well.

Xiaomi offers its Vitality scores to provide added motivation to stay active over a week of tracking, but as I’ve said with previous Xiaomi devices, these scores need to feel more ingrained into the daily tracking process because right now, they’re too easy to ignore.

At night, you need to enable advanced sleep monitoring in the Xiaomi app to get a big fix of sleep data. The Band will assess your sleep quality, break down sleep stages, sleep efficiency and produce analysis and advice, which Xiaomi refers to as interpretation and suggestions.

For data like sleep duration and time fallen asleep, the Band 10 held up well against two other sleep trackers. For additional data like the attempts to analyse sleep, the presentation is a bit messy.

Battery Life & Charging

- Same battery capacity as Smart Band 9

- Up to 21 days battery life

- 9 days in always-on mode

Xiaomi sticks to the same 233mAh capacity battery used in the Smart Band 9 and that unsurprisingly leads to a similar battery performance. That’s up to 21 days, which drops to 9 days if you keep the screen on at all times.

It’s not an improvement on the Band 9, but it’s also not a drop in battery life either

Mike Sawh

I started my testing time using the Band 10 with the screen on at all times and the daily battery drop with some sports tracking on average was 10%. That roughly adds up to the promised 9 days.

Swap for the raise to wake mode and battery performance goes significantly further and will push closer to two weeks. That really does depend if you’re turning on everything the Band 10 is capable of, including its most advanced sleep and health tracking.

It’s not an improvement on the Band 9, but it’s also not a drop in battery life either. What’s more disappointing is that it once again uses a proprietary charging cable that clings to the back of the tracker’s case.

An hour going from 0-100% battery means you don’t have to keep it charged for long, at least.

Price & Availability

The Xiaomi Smart Band 10 was announced on 26th June 2025 in China, landing earlier than the Xioami Smart Band 9, which arrived in July 2024. The Smart Band 10 price in the UK sits at £39.99 for the standard version. That’s up from the Smart Band 9, which cost £34.99 at launch.

You can buy it from the official Mi store as well as retailers such as Amazon.

The new ceramic Smart Band 10 costs £54.99, making it the most expensive Smart Band, though it does come in cheaper than a Fitbit Inspire 3 still ($99.95/£85).

Xiaomi has not revealed US pricing for either version of its new Band.

That pricing does still make it very affordable and matches up with the pricing of the Huawei Band 9 (£49.99) and Amazfit Band 7 (£39.99).

Check out our list of the best fitness trackers to see more options.

Should you buy the Xiaomi Smart Band 10?

The Xiaomi Smart Band 10 is another Xiaomi fitness tracker that looks and feels great both in hardware and software and offers great value if you want something to keep tabs on your activity and general wellness.

If you own the Xiaomi Smart Band 9, then the main reason to upgrade is the larger display and the added 9-axis sensor. Adding a ceramic version brings a more refined option, though the Smart Band 9 does already offer a pretty customizable look. I still think the Band 9 is a great tracker and should hopefully get even cheaper now that the Band 10 has arrived.

It’s a more complete package than its closest budget rivals and shows that while the price has crept up, Xiaomi still reigns as the cheap fitness tracker champ.

Specs:

- 1.72-inch AMOLED display

- Up to 21 day battery life (same)

- Connected GPS

- 9-axis motion sensor

- Optical heart rate sensor

- Sleep and activity tracking

- 150+ sports modes

- 15.95g (without strap), 23.05g (ceramic edition without strap)

- Launch colours: Midnight Black, Glacier Silver, Mystic Rose, Ceramic Edition Pearl White

Technology

Affina’s managed services model sticks out for sports teams unable to fully on take on a fan loyalty program

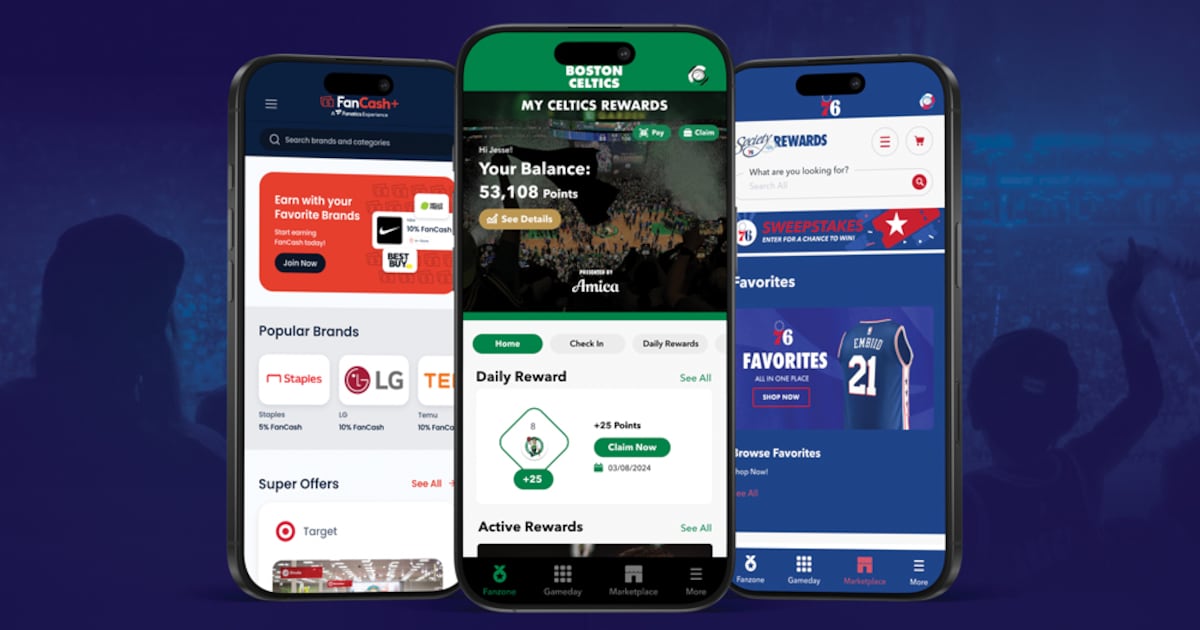

CrowdPlay and Rethink Loyalty were speaking separately with the Boston Celtics about their fan engagement efforts in 2023 when a Celtics executive pointed out the two companies’ interlocking capabilities. The two sports fan engagement tech companies should merge instead of competing, the exec suggested. (Light bulb!) Within a year, the companies had merged, officially forming […]

CrowdPlay and Rethink Loyalty were speaking separately with the Boston Celtics about their fan engagement efforts in 2023 when a Celtics executive pointed out the two companies’ interlocking capabilities. The two sports fan engagement tech companies should merge instead of competing, the exec suggested.

(Light bulb!)

Within a year, the companies had merged, officially forming Affina in December 2024. The timing was perfect. Many loyalty programs created during the 2010s withered on the vine, but rapid and widespread adoption of digital ticketing during COVID laid the foundation for the sports industry’s second crack at loyalty programs.

“Because you now have tech adoption mandated to some extent,” said PagsGroup associate Zach Yoshor, “That’s really what’s driving another look at how to incorporate better engagement tools into sports.”

Sports properties are approaching the fan loyalty program 2.0 era in different ways:

- Some are designing, building and running programs in-house.

- Others are doing some of the digital development and ongoing operations work in-house, but getting specific expertise from third parties.

- Many more sports organizations, lacking the resources or wherewithal to do any of that, are outsourcing much of the work and upkeep to a third party, such as Affina.

“We have two companies,” said Affina co-founder and CEO Andrew Pizzi. “[CrowdPlay] was expert in delivering loyalty solutions for sports teams and [Rethink] was expert in building card-linked and affiliate offer platforms. These are not features, they’re two businesses that came together to deliver a comprehensive solution for customers.”

The CrowdPlay portion of Affina’s business lets fans benefit from their fandom by earning rewards for all types of actions, whether completing a trivia quiz or scanning a QR code at a season-ticket members event. The Rethink Loyalty half of Affina provides the card-linked offers that help fund loyalty programs and generate revenue in a way sports loyalty programs didn’t in the past. Industry feedback led to the third leg of the Affina business, its managed services offering, in which the company operates sports properties’ loyalty programs once they’re built.

“That’s a part of the model that made a lot of sense,” said Next League Chief Digital Officer Shripal Shah. “Having dedicated attention to the loyalty touchpoints alone is going to see a higher [return on investment]. Them offering the managed services is why so many people are asking about them right now.”

Managed services quickly proved a differentiator for Affina in a fragmented field of competitors, helping the company double its sports client roster — which now includes Fanatics, a slew of NBA and NHL teams and an impending first NFL team — each year since 2021. The company has made the prospect of launching, maintaining and growing a fan loyalty program less daunting for sports properties, many of which were burnt in the past by loyalty program failure.

“When we first got into sports loyalty, it was a term that teams were scared of. They’d had bad experiences. Loyalty is at this point where it’s very hot, it’s about to really take off.”

— Andrew Pizzi, Affina co-founder and CEO

“I think the hard part was proving out the ROI and the lift was heavy, and it was just hard,” said Matt Griffin, Celtics senior vice president of strategy and business operations. “With companies like Affina, it’s easier to see that now.”

Affina recently closed a seven-figure Series A funding round with Yoshor and PagsGroup, the family investment office of Stephen Pagliuca, a former owner of the Celtics who knows sports team business operations. The company’s revenue has grown 307% in the past 12 months, though Pizzi couldn’t disclose revenue figures or whether the company was profitable. The business is non-capital intensive, and thanks to a timely, Celtics-inspired merger (and investment from its former owner), the Boston-based company is well positioned to take advantage of the fan loyalty renaissance in sports.

“When we first got into sports loyalty, it was a term that teams were scared of. They’d had bad experiences,” Pizzi said. “Loyalty is at this point where it’s very hot; it’s about to really take off.”

CrowdPlay, founded by Pizzi and Mike Cusano, originated as a gamification platform teams could use to engage fans, primarily in the minor league sports world.

The company had just raised a funding round in 2020 when COVID hit, eliminating crowds. Pizzi and Cusano pondered returning the investment, but ultimately sat on it for a year and a half. Because of the pandemic, they could get audiences with the pro sports teams that were previously too busy to meet. The duo listened to teams’ stories, cataloging the unfulfilled visions.

Repeatedly, teams said they had started a loyalty program led internally by a specific employee. Within a year or two, that employee would leave the job, and the program lost its pilot. That cycle would repeat again in another year or two.

What if CrowdPlay, in addition to providing the loyalty program product, could be the consistent shepherd of that program for the team, even through organizational change? Industry feedback was immediately positive.

“No one wants more tools,” Pizzi said, “they want solutions.”

Rethink Loyalty, led by Simon Goldstein, was building a business around the complex topic of CLO and arrived at the managed services model in a similar way. Major financial institutions, such as Chase or Visa, might have in-house card-linked offers expertise, but most companies, including relatively smaller ones such as sports teams, would not. By necessity, Rethink had to design, build and fully manage its solution.

Once the companies merged, the card-linked offer business became a key underpinning. Partnering with larger companies enabled Affina to amass roughly 80,000 card-linked offers, a huge offer pool for sports clients mostly clueless about creating such a library from scratch. Those offers effectively fund a team’s loyalty program.

“We were really the first company that white-labeled CLO to drive loyalty for teams and brands,” said Goldstein, Affina co-founder and chief innovation officer.

The card-linked offer business subsequently becomes a major data source for the sports property that can inform sponsorship and sales teams about their fans’ buying behaviors and habits. The Affina platform collects the data from fans’ card-linked shopping and makes it accessible to the team, which can use the information to source new sponsorship and sales leads (“Did you know 35% of our fans shop with you twice a month?”). Financial services company Plaid provides Affina clients with 24 months of historical spending data and all future spending data (regardless of where a fan’s card is used).

“Card-link offers can really drive a lot of insights around a fan persona,” said Shah. “From my experience, having a direct card link, because you can see real transactions, you can do better marketing.”

Fanatics initially wanted to become a merchant in Rethink Loyalty’s card-linked offers program. The sports merchandise juggernaut happened to have a significant pain point at that time: The average Fanatics customer was shopping with them only a few times per year. How often does a fan need a jersey?

That led Fanatics to become a Rethink customer. By folding in Rethink’s card-linking tech, Fanatics’ FanCash became more valuable to customers. That sparked a 2.8 times increase in spending frequency for Fanatics’ FanCash+ members compared to average customers, a 29% increase in average basket size and a 4.3 times increase in spending on Fanatics’ website.

“This was an opportunity to reward their customers everywhere else they shopped,” Goldstein said.

“You can be as involved or as little involved as is comfortable for you, as you want to. If you need a lot of hand holding, they’ll hold your hand.”

— Matt Griffin, Celtics senior vice president of strategy and business operations

When Rethink merged with CrowdPlay, the Fanatics relationship came along, too. That relationship appeals to clients such as the Celtics, whose Celtics Rewards points can be converted into FanCash and used on Fanatics’ platform. Affina and Fanatics handle fulfillment for team clients, sending gear directly to fans.

The New Jersey Devils’ three-year deal with Affina expired last summer, and the team went to the open market to study at least five other options. Affina’s managed services model set it apart and led to a new deal.

“There is a high level of trust,” said Zack Robinson, Devils vice president of ticket sales and service. “It’s huge because we don’t have a ton of bandwidth.”

Ditto for the Celtics, who couldn’t dedicate a full-time employee to their program, which launched last November with Affina. The Celtics, with huge ticket demand, limited the program to season-ticket holders. Membership sits in the low thousands. Their loyalty program choices are colored by not owning or operating TD Garden. The team is involved in Celtics Rewards, of course, but Affina handles the operations nitty-gritty, such as customer service.

“You can be as involved or as little involved as is comfortable for you, as you want to,” said Griffin. “If you need a lot of hand holding, they’ll hold your hand.”

Robinson first joined the Devils in 2017 and immediately scrapped the existing loyalty program he found. The challenge with the old program was “it was all on us,” he said. “I felt like I was hacking into an original Apple computer trying to set up the back end. We were kind of scarred.”

Robinson later launched the Devils’ Black and Red Rewards, partly to reinforce game attendance by offering rewards to season-ticket members who sell unused tickets back to the team. After its first season, the program was offered as a perk to season-ticket members who auto-renewed. Two-hundred ticket accounts chose it as an incentive. Several years later, 75% of the Devils’ season-ticket members are enrolled in Black and Red Rewards, with 70% using it daily. Eighty-five percent use it weekly, and 90% monthly. Trivia is one of the most popular engagement games, with 1.5 million questions answered this past season.

The Devils nominated Affina for an NHL Stanley Award in the Best Ticketing Initiative category. Based on the success, the Philadelphia 76ers, another Harris Blitzer Sports & Entertainment-owned team, rolled out a similar program with Affina last season. The next decision for the Devils is whether to expand Black and Red Rewards fan base-wide, and when.

“Are rewards a fad or does it have staying power? I get asked that all the time,” Robinson said. “Right now, the feedback is I think if you do it right, it does.”

Technology

Lottery.com Announces Global Expansion with Launch of Sports.com Super App для Sports Fans Worldwide

Lottery.com plans to launch the Sports.com Super App, integrating live streaming and gaming for sports fans globally. Quiver AI Summary Lottery.com Inc. announced its plans to launch the Sports.com Super App, a groundbreaking digital platform for sports fans, scheduled for select global markets in Q3 2025. This innovative app aims to integrate live streaming, social […]

Lottery.com plans to launch the Sports.com Super App, integrating live streaming and gaming for sports fans globally.

Quiver AI Summary

Lottery.com Inc. announced its plans to launch the Sports.com Super App, a groundbreaking digital platform for sports fans, scheduled for select global markets in Q3 2025. This innovative app aims to integrate live streaming, social engagement, e-commerce, and gamification into one ecosystem, initially focusing on soccer and motorsports. The company is pursuing this goal by acquiring a 51% controlling interest in Galaxy Racer Holdings Limited’s sports and technology assets for $10 million, with an initial investment of $5.1 million funded through cash or stock. The Super App will feature community chat hubs, e-commerce, real-money gaming, and sports news, and aims to enhance the overall fan experience. With plans for future expansion into additional sports and immersive streaming, Lottery.com is also securing a $15 million financing commitment to support this venture.

Potential Positives

- Lottery.com is set to launch the Sports.com Super App, a first-of-its-kind digital platform for sports fans, enhancing its global expansion strategy.

- The Super App is designed to integrate multiple features like live streaming and e-commerce, which could significantly increase user engagement and revenue streams.

- The company has signed a Letter of Intent to acquire a 51% controlling interest in Galaxy Racer Holdings Limited, facilitating rapid technology and user base integration into its platform.

- A $15 million financing commitment has been pledged to support the expansion of the Super App, indicating strong investor confidence in the project.

Potential Negatives

- The press release expresses uncertainty around several risks and uncertainties that could significantly impact the company’s future operations, including the potential for ongoing reviews of internal accounting controls and inquiries by Nasdaq.

- The need to secure additional capital resources and ongoing concerns related to maintaining compliance with Nasdaq Listing Rules raise questions about the company’s financial stability and operational viability.

- The company’s future prospects are described as highly dependent on various external factors which it cannot control, indicating a potentially precarious situation for investors.

FAQ

What is the Sports.com Super App?

The Sports.com Super App is a digital platform designed for sports fans, integrating live streaming, social engagement, e-commerce, and gamification.

When will the Super App be launched?

The Sports.com Super App is scheduled to launch in select global markets in Q3 2025.

What sports will the Super App focus on initially?

The Super App will initially focus on soccer and motorsport, reflecting Sports.com’s recent strategic expansions.

Who is involved in the development of the Super App?

Lottery.com is acquiring a 51% interest in Galaxy Racer Holdings, which developed the foundational technology for the Super App.

What features will the Super App include?

The Super App will feature live streaming, community chat, stats-based social media, e-commerce, real-money gaming, and sports news.

Disclaimer: This is an AI-generated summary of a press release distributed by GlobeNewswire. The model used to summarize this release may make mistakes. See the full release here.

$LTRY Insider Trading Activity

$LTRY insiders have traded $LTRY stock on the open market 12 times in the past 6 months. Of those trades, 0 have been purchases and 12 have been sales.

Here’s a breakdown of recent trading of $LTRY stock by insiders over the last 6 months:

- CHRISTOPHER ANDERSON GOODING sold 40,000 shares for an estimated $55,599

- ROBERT J STUBBLEFIELD (Chief Financial Officer) has made 0 purchases and 5 sales selling 35,000 shares for an estimated $48,620.

- MATTHEW HOWARD MCGAHAN sold 115,000 shares for an estimated $40,250

- GREGORY A POTTS (CHIEF OPERATING OFFICER) has made 0 purchases and 5 sales selling 25,000 shares for an estimated $37,000.

To track insider transactions, check out Quiver Quantitative’s insider trading dashboard.

$LTRY Hedge Fund Activity

We have seen 13 institutional investors add shares of $LTRY stock to their portfolio, and 8 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- VANGUARD GROUP INC added 49,364 shares (+inf%) to their portfolio in Q1 2025, for an estimated $43,933

- GEODE CAPITAL MANAGEMENT, LLC added 40,786 shares (+173.4%) to their portfolio in Q1 2025, for an estimated $36,299

- CITADEL ADVISORS LLC removed 29,297 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $26,074

- XTX TOPCO LTD removed 27,887 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $24,819

- SUSQUEHANNA INTERNATIONAL GROUP, LLP removed 20,231 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $18,005

- PFG INVESTMENTS, LLC added 20,000 shares (+inf%) to their portfolio in Q1 2025, for an estimated $17,800

- VIRTU FINANCIAL LLC removed 19,796 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $17,618

To track hedge funds’ stock portfolios, check out Quiver Quantitative’s institutional holdings dashboard.

Full Release

FORT WORTH, Texas, June 26, 2025 (GLOBE NEWSWIRE) — Lottery.com Inc. (NASDAQ: LTRY, LTRYW) (“Lottery.com” or “the Company”), a leading technology company transforming the intersection of gaming, sports and entertainment, today announced it is advancing its global expansion with the planned launch of the Sports.com Super App (the “Super App”)—a first-of-its-kind digital destination for sports fans worldwide. The Super App is designed to combine live streaming, social engagement, e-commerce and gamification into a single immersive ecosystem.

The Super App, which is scheduled to launch in select global markets in Q3 2025, will initially focus on soccer and motorsport—two verticals Sports.com has been aggressively expanding into through a series of high-profile sponsorships and strategic initiatives. The Super App will be built on an existing platform development by Galaxy Racer Holdings Limited (“GXR”), The GXR app has achieved more than one million monthly active subscribers organically, demonstrating significant early traction and category-defining potential.

“We’ve spent the past two years building Sports.com around key pillars like soccer and motorsport,”

said Mark Bircham, Director of Sports.com

. “This acquisition and the launch of the Sports.com Super App is the culmination of a precise strategy to consolidate fragmented sports experiences. Our partnerships with emerging motorsport stars like Callum Ilott, Louis Foster, and Sebastian Murray, along with this technology acquisition sets the stage for an aggressive media expansion that will redefine how fans watch, play and engage

with their favorite leagues, teams, and players

.”

The Super App will integrate six primary features into a single experience: live streaming, community chat hubs, stats-based social media, e-commerce, real-money and fantasy sports gaming, and sports news. The Super App aims to engage fans across the full lifecycle of the sports experience, tapping into the 4–5 hours of average fan interaction beyond match time each week.

Revenue streams will include premium streaming subscriptions, in-app advertising, merchandising and interactive gamified challenges. Plans are underway to extend into additional sports verticals and incorporate immersive streaming experiences later this year.

To accelerate the development timeline for the Super App, Lottery.com has signed a Letter of Intent (LOI) to acquire a 51% controlling interest in the sports and technology assets of GXR, valuing the transaction at $10 million pre-money. Subject to due diligence and final agreement, the deal allows Lottery.com to fund the $5.1 million initial investment via cash, stock, or a combination at a fixed $3.00 share price. A $15 million financing commitment has also been pledged by Lottery.com to fuel expansion of the Sports.com Super App.

All GXR unencumbered assets, including its tech stack and user base, will be transferred to a new entity (NewCo), of which Lottery.com will initially own 51%. The agreement includes a call option to acquire 100% ownership of NewCo by the end of 2027. Exclusivity has been secured through June 30, 2025, with an automatic 30-day extension, and closing is anticipated on or before August 1, 2025.

“This is a transformational moment for the worldwide sports media ecosystem,”

said Paul Roy, Founder and CEO of GXR

. “Together with Lottery.com and Sports.com, we are developing the world’s first true sports super app. As global licensing discussions advance, and integration with the Lottery.com family of brands begins, we see a future where fans control their entire live event experience—on the Super App, across all screens, in every corner of the globe.”

About Lottery.com

The Lottery.com Inc. (NASDAQ: LTRY, LTRYW) family of brands — including Sports.com, Tinbu and WinTogether, comprise a unified ecosystem that integrates gaming, entertainment, and sports. Follow the Company on

X

,

Instagram

and

Facebook

.

Forward-Looking Statements

This press release contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding the Company’s strategy, future operations, prospects, plans and objectives of management, are forward-looking statements. When used in this Form 8-K, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “initiatives,” “continue,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. The forward-looking statements speak only as of the date of this press release or as of the date they are made. The Company cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of the Company. In addition, the Company cautions you that the forward-looking statements contained in this press release are subject to risks and uncertainties, including but not limited to, expectations related to the investigation of short selling or potential naked short selling, including the Company’s analysis, its ability to take appropriate corrective action, or any potential investigations by regulators; any future findings from ongoing review of the Company’s internal accounting controls; additional examination of the preliminary conclusions of such review; the Company’s ability to secure additional capital resources; the Company’s ability to continue as a going concern; the Company’s ability to respond in a timely and satisfactory matter to the inquiries by Nasdaq; the Company’s ability to regain compliance with the Bid Price Requirement; the Company’s ability to regain compliance with Nasdaq Listing Rules; the Company’s ability to become current with its SEC reports; and those additional risks and uncertainties discussed under the heading “Risk Factors” in the Form 10-K/A filed by the Company with the SEC on April 22, 2025, and the other documents filed, or to be filed, by the Company with the SEC. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in the reports that the Company has filed and will file from time to time with the SEC. These SEC filings are available publicly on the SEC’s website at www.sec.gov. Should one or more of the risks or uncertainties described in this press release materialize or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Except as otherwise required by applicable law, the Company disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release.

This press release was published by a CLEAR® Verified individual.

This article was originally published on Quiver News, read the full story.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Technology

Modern fans want to co-create, not just consume: JioStar’s Prashant Khanna

New Delhi: At the APOS 2025 event hosted by Media Partners Asia in Bali, Prashant Khanna, Head of Sports Production Services & Technology at JioStar, highlighted India’s evolving position as a centre for innovation in live sports production. During a fireside chat session, Khanna spoke about the convergence of sports, media and technology, and how […]

New Delhi: At the APOS 2025 event hosted by Media Partners Asia in Bali, Prashant Khanna, Head of Sports Production Services & Technology at JioStar, highlighted India’s evolving position as a centre for innovation in live sports production.

During a fireside chat session, Khanna spoke about the convergence of sports, media and technology, and how JioStar is working at the intersection of these areas.

“We don’t just see ourselves as broadcasters or production partners,” said Khanna. “We’re an organisation helping the nation create iconic memories through mega sporting events.”

Khanna discussed how JioStar is exploring new formats and technologies to deliver more inclusive and interactive experiences. These include sign-language feeds, descriptive commentary for underserved audiences, vertical video formats, motion-capture children’s content, and multi-camera interactivity. He linked these innovations to the changing expectations of modern fans.

“The modern fan doesn’t just want to consume, they want to co-create. Our role is to enable that,” he said. “Think of it as millions of fans each producing their own version of the game.”

He also introduced Starlab, JioStar’s internal innovation unit, which partners with start-ups, creators and companies like AWS to develop a cloud-native production stack. The infrastructure supports personalised content delivery and new forms of live engagement.

Khanna pointed to JioStar’s collaboration with the Indian Institute of Creative Technologies, a government-supported body working to build talent pipelines for sport and live entertainment production.

“It’s our responsibility as custodians of sport to invest not just in what fans see today, but in who creates it tomorrow,” he said.

Reflecting on the most recent IPL season, Khanna said the league had offered deeper insights into changing fan behaviour.

“It’s been an eye-opener every single time, but this year, our biggest learning was how deeply involved the consumer is. They no longer want to passively consume what you’re serving them, they want to be part of shaping how the game unfolds over those 4–5 hours,” he said.

“We saw this play out every day for 2.5 months, through a variety of formats and platforms. Whether it was widescreen or vertical video, Sunday cohort feeds, or kids’ IPs brought to life through motion capture, the engagement was constant. It reinforced that delivering the game in a way fans understand and love is no longer optional, it’s essential.”

Technology

A Power Move in Sports Tech Investment Virat Kohli Invests in Bengaluru-Based Agilitas Sports to Boost India’s Sportswear Market

With aim to build Agilitas as an one-stop destination for sports, Agilitas will cater from manufacturing to retain. It has already acquired Mochiko Shoes in 2023, that manufactures shoes for top brands like Adidas, Puma, New Balance, Skechers, Reebok, Asics, Crocs, Decathlon, Clarks, US Polo and more. What Agilitas can’t build in-house, it will acquire […]

With aim to build Agilitas as an one-stop destination for sports, Agilitas will cater from manufacturing to retain. It has already acquired Mochiko Shoes in 2023, that manufactures shoes for top brands like Adidas, Puma, New Balance, Skechers, Reebok, Asics, Crocs, Decathlon, Clarks, US Polo and more. What Agilitas can’t build in-house, it will acquire the companies that have the brains in the field.

Agilitas will also sell Lotto shoes in India and other regions after acquiring the licensing rights of the Italian sports equipment giant.

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Weekend Preview: Autódromo Hermanos Rodríguez

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Through the Gears: Denny Hamlin has gas, a border needs crossing, and yes, that’s a Hemi

-

High School Sports3 weeks ago

High School Sports3 weeks agoHighlights of the Tony Awards

-

Motorsports2 weeks ago

Motorsports2 weeks agoNASCAR Race Today: Mexico City start times, schedule and how to watch live on TV

-

Health2 weeks ago

Health2 weeks agoGymnast MyKayla Skinner Claims Simone Biles 'Belittled and Ostracized' Her amid Riley …

-

Professional Sports3 weeks ago

Professional Sports3 weeks agoUFC 316

-

College Sports3 weeks ago

College Sports3 weeks agoFisk to discontinue history-making gymnastics program after 2026 | Area colleges

-

Sports2 weeks ago

Sports2 weeks agoCoco Gauff, The World's Highest

-

NIL2 weeks ago

NIL2 weeks agoTennessee law supersedes NCAA eligibility rule

-

Health3 weeks ago

Health3 weeks agoOlympic great Simone Biles shares mental health journey on first Hong Kong visit