CrowdPlay and Rethink Loyalty were speaking separately with the Boston Celtics about their fan engagement efforts in 2023 when a Celtics executive pointed out the two companies’ interlocking capabilities. The two sports fan engagement tech companies should merge instead of competing, the exec suggested.

(Light bulb!)

Within a year, the companies had merged, officially forming Affina in December 2024. The timing was perfect. Many loyalty programs created during the 2010s withered on the vine, but rapid and widespread adoption of digital ticketing during COVID laid the foundation for the sports industry’s second crack at loyalty programs.

“Because you now have tech adoption mandated to some extent,” said PagsGroup associate Zach Yoshor, “That’s really what’s driving another look at how to incorporate better engagement tools into sports.”

Sports properties are approaching the fan loyalty program 2.0 era in different ways:

- Some are designing, building and running programs in-house.

- Others are doing some of the digital development and ongoing operations work in-house, but getting specific expertise from third parties.

- Many more sports organizations, lacking the resources or wherewithal to do any of that, are outsourcing much of the work and upkeep to a third party, such as Affina.

“We have two companies,” said Affina co-founder and CEO Andrew Pizzi. “[CrowdPlay] was expert in delivering loyalty solutions for sports teams and [Rethink] was expert in building card-linked and affiliate offer platforms. These are not features, they’re two businesses that came together to deliver a comprehensive solution for customers.”

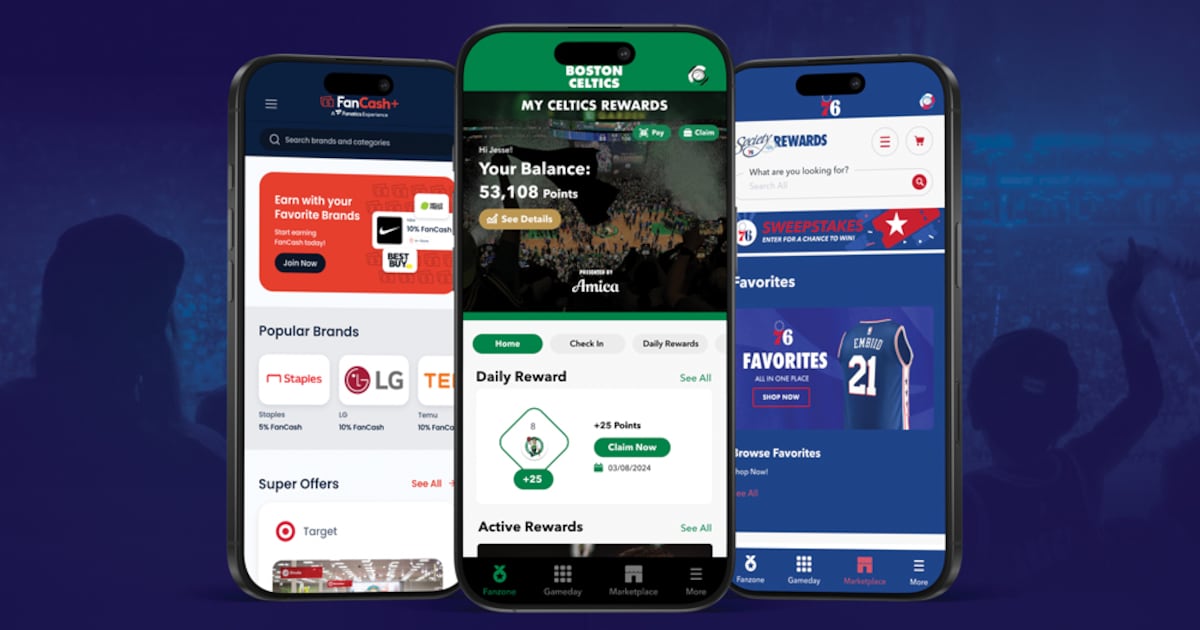

The CrowdPlay portion of Affina’s business lets fans benefit from their fandom by earning rewards for all types of actions, whether completing a trivia quiz or scanning a QR code at a season-ticket members event. The Rethink Loyalty half of Affina provides the card-linked offers that help fund loyalty programs and generate revenue in a way sports loyalty programs didn’t in the past. Industry feedback led to the third leg of the Affina business, its managed services offering, in which the company operates sports properties’ loyalty programs once they’re built.

“That’s a part of the model that made a lot of sense,” said Next League Chief Digital Officer Shripal Shah. “Having dedicated attention to the loyalty touchpoints alone is going to see a higher [return on investment]. Them offering the managed services is why so many people are asking about them right now.”

Managed services quickly proved a differentiator for Affina in a fragmented field of competitors, helping the company double its sports client roster — which now includes Fanatics, a slew of NBA and NHL teams and an impending first NFL team — each year since 2021. The company has made the prospect of launching, maintaining and growing a fan loyalty program less daunting for sports properties, many of which were burnt in the past by loyalty program failure.

“When we first got into sports loyalty, it was a term that teams were scared of. They’d had bad experiences. Loyalty is at this point where it’s very hot, it’s about to really take off.”

— Andrew Pizzi, Affina co-founder and CEO

“I think the hard part was proving out the ROI and the lift was heavy, and it was just hard,” said Matt Griffin, Celtics senior vice president of strategy and business operations. “With companies like Affina, it’s easier to see that now.”

Affina recently closed a seven-figure Series A funding round with Yoshor and PagsGroup, the family investment office of Stephen Pagliuca, a former owner of the Celtics who knows sports team business operations. The company’s revenue has grown 307% in the past 12 months, though Pizzi couldn’t disclose revenue figures or whether the company was profitable. The business is non-capital intensive, and thanks to a timely, Celtics-inspired merger (and investment from its former owner), the Boston-based company is well positioned to take advantage of the fan loyalty renaissance in sports.

“When we first got into sports loyalty, it was a term that teams were scared of. They’d had bad experiences,” Pizzi said. “Loyalty is at this point where it’s very hot; it’s about to really take off.”

CrowdPlay, founded by Pizzi and Mike Cusano, originated as a gamification platform teams could use to engage fans, primarily in the minor league sports world.

The company had just raised a funding round in 2020 when COVID hit, eliminating crowds. Pizzi and Cusano pondered returning the investment, but ultimately sat on it for a year and a half. Because of the pandemic, they could get audiences with the pro sports teams that were previously too busy to meet. The duo listened to teams’ stories, cataloging the unfulfilled visions.

Repeatedly, teams said they had started a loyalty program led internally by a specific employee. Within a year or two, that employee would leave the job, and the program lost its pilot. That cycle would repeat again in another year or two.

What if CrowdPlay, in addition to providing the loyalty program product, could be the consistent shepherd of that program for the team, even through organizational change? Industry feedback was immediately positive.

“No one wants more tools,” Pizzi said, “they want solutions.”

Rethink Loyalty, led by Simon Goldstein, was building a business around the complex topic of CLO and arrived at the managed services model in a similar way. Major financial institutions, such as Chase or Visa, might have in-house card-linked offers expertise, but most companies, including relatively smaller ones such as sports teams, would not. By necessity, Rethink had to design, build and fully manage its solution.

Once the companies merged, the card-linked offer business became a key underpinning. Partnering with larger companies enabled Affina to amass roughly 80,000 card-linked offers, a huge offer pool for sports clients mostly clueless about creating such a library from scratch. Those offers effectively fund a team’s loyalty program.

“We were really the first company that white-labeled CLO to drive loyalty for teams and brands,” said Goldstein, Affina co-founder and chief innovation officer.

The card-linked offer business subsequently becomes a major data source for the sports property that can inform sponsorship and sales teams about their fans’ buying behaviors and habits. The Affina platform collects the data from fans’ card-linked shopping and makes it accessible to the team, which can use the information to source new sponsorship and sales leads (“Did you know 35% of our fans shop with you twice a month?”). Financial services company Plaid provides Affina clients with 24 months of historical spending data and all future spending data (regardless of where a fan’s card is used).

“Card-link offers can really drive a lot of insights around a fan persona,” said Shah. “From my experience, having a direct card link, because you can see real transactions, you can do better marketing.”

Fanatics initially wanted to become a merchant in Rethink Loyalty’s card-linked offers program. The sports merchandise juggernaut happened to have a significant pain point at that time: The average Fanatics customer was shopping with them only a few times per year. How often does a fan need a jersey?

That led Fanatics to become a Rethink customer. By folding in Rethink’s card-linking tech, Fanatics’ FanCash became more valuable to customers. That sparked a 2.8 times increase in spending frequency for Fanatics’ FanCash+ members compared to average customers, a 29% increase in average basket size and a 4.3 times increase in spending on Fanatics’ website.

“This was an opportunity to reward their customers everywhere else they shopped,” Goldstein said.

“You can be as involved or as little involved as is comfortable for you, as you want to. If you need a lot of hand holding, they’ll hold your hand.”

— Matt Griffin, Celtics senior vice president of strategy and business operations

When Rethink merged with CrowdPlay, the Fanatics relationship came along, too. That relationship appeals to clients such as the Celtics, whose Celtics Rewards points can be converted into FanCash and used on Fanatics’ platform. Affina and Fanatics handle fulfillment for team clients, sending gear directly to fans.

The New Jersey Devils’ three-year deal with Affina expired last summer, and the team went to the open market to study at least five other options. Affina’s managed services model set it apart and led to a new deal.

“There is a high level of trust,” said Zack Robinson, Devils vice president of ticket sales and service. “It’s huge because we don’t have a ton of bandwidth.”

Ditto for the Celtics, who couldn’t dedicate a full-time employee to their program, which launched last November with Affina. The Celtics, with huge ticket demand, limited the program to season-ticket holders. Membership sits in the low thousands. Their loyalty program choices are colored by not owning or operating TD Garden. The team is involved in Celtics Rewards, of course, but Affina handles the operations nitty-gritty, such as customer service.

“You can be as involved or as little involved as is comfortable for you, as you want to,” said Griffin. “If you need a lot of hand holding, they’ll hold your hand.”

Robinson first joined the Devils in 2017 and immediately scrapped the existing loyalty program he found. The challenge with the old program was “it was all on us,” he said. “I felt like I was hacking into an original Apple computer trying to set up the back end. We were kind of scarred.”

Robinson later launched the Devils’ Black and Red Rewards, partly to reinforce game attendance by offering rewards to season-ticket members who sell unused tickets back to the team. After its first season, the program was offered as a perk to season-ticket members who auto-renewed. Two-hundred ticket accounts chose it as an incentive. Several years later, 75% of the Devils’ season-ticket members are enrolled in Black and Red Rewards, with 70% using it daily. Eighty-five percent use it weekly, and 90% monthly. Trivia is one of the most popular engagement games, with 1.5 million questions answered this past season.

The Devils nominated Affina for an NHL Stanley Award in the Best Ticketing Initiative category. Based on the success, the Philadelphia 76ers, another Harris Blitzer Sports & Entertainment-owned team, rolled out a similar program with Affina last season. The next decision for the Devils is whether to expand Black and Red Rewards fan base-wide, and when.

“Are rewards a fad or does it have staying power? I get asked that all the time,” Robinson said. “Right now, the feedback is I think if you do it right, it does.”

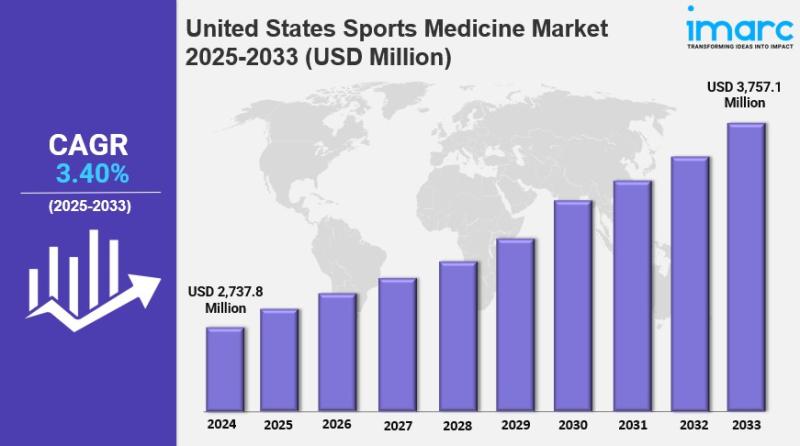

Strong growth driven by rising fitness awareness and active lifestyles

Strong growth driven by rising fitness awareness and active lifestyles