Michael Jordan watches the Cook Out Southern 500 at Darlington Raceway.

While most media outlets have been fixated on the Paramount-WBD-Netflix deal, Michael Jordan has spent the last week sitting in a Charlotte, North Carolina, courthouse, testifying in one of the most consequential antitrust trials this year.

Here’s what you need to know: Two racing teams, 23XI Racing and Front Row Motorsports, have sued NASCAR for monopolistic and anticompetitive practices.

Among other things, which we’ll get into, 23XI Racing and Front Row Motorsports claim that NASCAR has illegally used its monopoly power to control the sport’s financial structure, limiting team revenue and stifling competition through its charter system and other restrictive practices, such as controlling track access and car parts.

Court proceedings can sometimes feel like you are a teenager counting down the minutes for a high school class to end, but antitrust cases are different. The best way to learn how a business or industry really works is to pay attention to an antitrust trial.

Over the last week and a half alone, this trial has provided exclusive access to team and league financials, including annual profit-and-loss statements. For example, we now know how much money Michael Jordan has invested in 23XI Racing over the last five years ($40 million), the average expenses required to run a NASCAR Cup Series car each year ($20 million), how much money NASCAR lost on its three Chicago street races ($55 million), the total amount of money Front Row Motorsports owner Bob Jenkins has lost since entering the sport in 2005 ($100 million), and even how NASCAR strategically moves around its revenue to reduce its on-paper profits.

Plus, like any discovery process, some juicy emails and texts have emerged. NASCAR’s president once called team owner Richard Childress a “stupid redneck” who should be “taken out back and flogged,” while Michael Jordan laughed off the cost of signing a driver by telling his financial advisor, “I have lost that in a casino. Let’s do it.”

For those who aren’t up to speed on NASCAR, 23XI is a racing team owned by Michael Jordan and three-time Daytona 500 winner Denny Hamlin. The team began racing in 2021 and currently runs three cars, winning nine NASCAR Cup Series races.

Front Row Motorsports is another NASCAR Cup Series team. Owned by fast-food restaurant magnate Bob Jenkins, Front Row has fielded cars in the Cup Series since 2005. In total, Front Row has won four races over two decades, with the team’s most notable win coming when driver Michael McDowell won at the 2021 Daytona 500.

While rumors of legal fights have always existed beneath the surface, NASCAR teams have generally avoided confrontation for fear of retribution. At its core, NASCAR is a family business. Bill France founded NASCAR in 1948, and the France family still owns and runs it 77 years later, with four generations occupying leadership roles.

But while others were unwilling to risk the tens (if not hundreds) of millions of dollars that they had invested in the sport through cars, factories, drivers, equipment, and employees, Michael Jordan was uniquely positioned to take on the challenge.

Jordan has more money than he’ll ever need and is a lifelong NASCAR fan. He isn’t scared of what the France family will do because NASCAR isn’t his primary business.

So while every other team signed NASCAR’s 2024 charter agreement (more on that later), 23XI and Front Row refused to sign it. Instead, the two teams joined forces to file an antitrust lawsuit against NASCAR, hiring Jeffrey Kessler to represent them.

If you don’t know Jeffrey Kessler’s name, you have at least seen his work. The 70-year-old lawyer has worked on some of the most significant legal cases in sports history.

Kessler created the NFL, NBA, and NHL player associations. He represented Tom Brady during Deflategate and secured equal pay for the U.S. women’s national soccer team. Kessler also negotiated the free agency and salary cap systems in the NFL and NBA, and just won $2.8 billion in back pay for student-athletes from the NCAA.

Many people seem to believe that this trial will determine whether NASCAR is considered a monopoly, but that’s not accurate. Judge Kenneth Bell has already ruled pretrial that NASCAR holds monopoly power. The jury in this trial is now tasked with determining if NASCAR used that power to engage in anticompetitive conduct.

23XI and Front Row are upset about many things. They don’t like that NASCAR is unwilling to open its books to show teams how much money it is making. They don’t like competing with NASCAR for sponsors, and they also don’t like NASCAR owning roughly 50% of the tracks that the Cup Series races on each year. These tracks receive a percentage of the sport’s TV money, which ultimately winds up back in NASCAR’s hands, and even non-NASCAR-owned tracks are contractually prohibited from hosting non-NASCAR events, making it nearly impossible for a competitor to emerge.

But that’s just one piece of this trial; the bigger issue is NASCAR’s charter system.

Historically, NASCAR treated its teams like independent contractors. Team owners paid for everything, from the cars and drivers to the pit crew and motorhomes. Each team brought its cars to the racetrack, but was never guaranteed a starting spot. Every car had to qualify on speed. If you weren’t fast enough that weekend, you didn’t get to race. If you didn’t get to race, you spent a lot of money just to leave empty-handed.

This was a disastrous business model for teams. Without guaranteed revenue, team financials were unpredictable. There was no incentive to invest in facilities or hire engineering talent, as teams were going out of business just as quickly as they came in.

So, with audiences declining, sponsorships unsteady, and teams folding, NASCAR distributed 36 charters in 2016. As a charter holder, you are guaranteed a starting spot and a share of the prize money from every Cup Series race. Each team can own up to four charters, which can be sold, bought, or leased. If a new team wants to join NASCAR, it must purchase a charter from an existing team. If an existing NASCAR team wants to expand by adding another car, it must buy or lease another charter.

NASCAR distributed these charters to teams for free in 2016. Since then, the price to purchase a charter on the secondary market has increased from $6 million in 2018 to $40 million in 2023. But while NASCAR says its charter program is clear evidence of value creation for its teams, owners disagree. Charters were distributed based on a team’s success from the prior three seasons. So if you are losing millions of dollars every year, didn’t you technically pay for that charter by continuing to show up?

To be clear, team owners were initially happy with the charter program. It was a change they requested and felt provided a step in the right direction. The problem today is that these same owners believe the charter system hasn’t evolved enough.

During the last round of negotiations to extend charters, teams requested several changes. With NASCAR signing a new $7.7 billion media rights deal, teams wanted to receive more than $12.5 million in guaranteed revenue per car. Teams also requested that charters become permanent, providing them with equity value that extends beyond the current rolling 6-year term (and something that NASCAR can’t just take away because it feels like it). Outside of financials, teams also wanted periodic access to NASCAR’s books and a governance vote on business and competitive decisions.

These negotiations lasted more than two years. Based on the evidence presented in court so far, there were heated phone calls, meetings, and emails throughout the process. But when team owners were presented with the final document on a Friday night, NASCAR gave them just six hours to sign it or potentially lose their charter.

The final charter agreement included only a few tweaks from what NASCAR had previously presented. But still, a six-hour deadline on a Friday night meant that many teams couldn’t even have their lawyers review the final 112-page document before signing it, a particularly concerning outcome given the charter extension agreement included language prohibiting teams from filing antitrust lawsuits against NASCAR.

“There was a lot of passion, a lot of emotion, especially from Joe Gibbs; he felt like he had to sign it,” Front Row’s Bob Jenkins testified. “Joe Gibbs felt like he let me down by signing. Not a single owner said, ‘I was happy to sign it. Not a single one.’”

Several teams have since reiterated those comments. Even if they disagreed with the details, some owners had invested hundreds of millions of dollars in the sport and weren’t willing to risk their charter by fighting it. In the end, 13 of NASCAR’s 15 teams signed the agreement, while 23XI and Front Row chose to file a lawsuit instead.

NASCAR is a private business. That means it is not required to report attendance numbers or concession sales, much less its annual revenue or operating profit.

Outside of a few press releases each year or a leaked report, we typically get no insight into how the sport and its teams are performing financially year in and year out.

But that’s what’s so unique about this trial. The discovery process has given us an inside look at the financials — and let’s just say, it doesn’t look great for NASCAR.

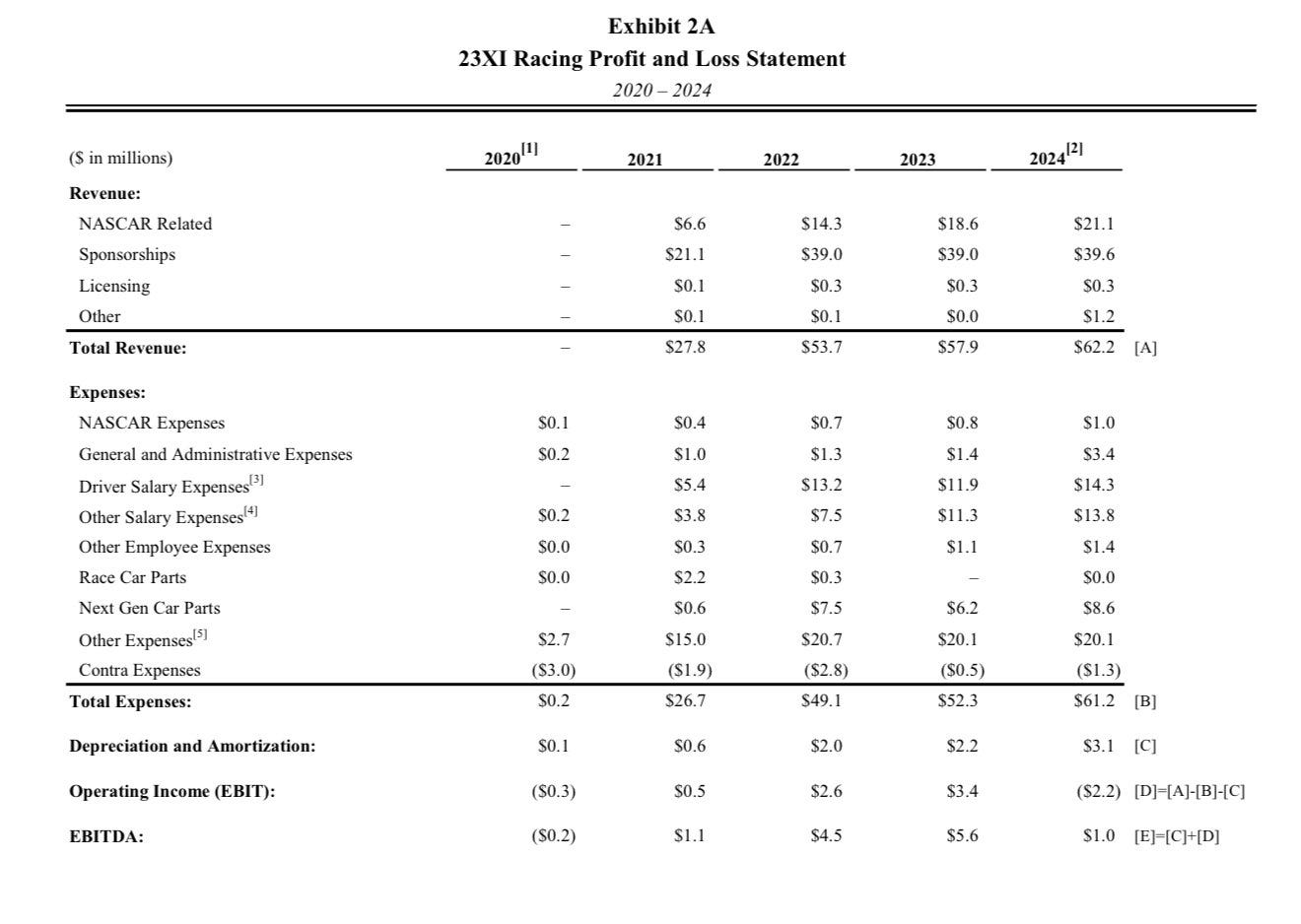

According to 23XI’s annual profit and loss statement, the Michael Jordan and Denny Hamlin-owned team has consistently teetered on the edge of profitability. For instance, 23XI Racing reported a $300,000 loss in 2020, a $500,000 profit in 2021, a $2.5 million profit in 2022, a $3.5 million profit in 2023, and a $2.1 million loss in 2024.

Denny Hamlin told the jury this week that it costs $20 million to bring a single car to the track for all 38 races, excluding driver salaries and other expenses. Each chartered car now receives $12.5 million in annual revenue from NASCAR, up from $9 million during the last charter agreement. But that means teams have to make up the difference — $7.5 million per car, excluding driver salaries — through sponsorships.

The inability of 23XI Racing to consistently turn a profit is even more concerning when you consider that they have something no other team has: Michael Jordan.

Since joining NASCAR in 2021, 23XI Racing has leveraged Michael Jordan’s name, brand, and popularity to build one of the sport’s most impressive sponsorship portfolios. The team now generates $40 million annually from brands like Toyota, McDonald’s, Monster Energy, Xfinity, Columbia, Coca-Cola, and the Jordan Brand.

The ability to land sponsors is really the only thing keeping 23XI from losing money.

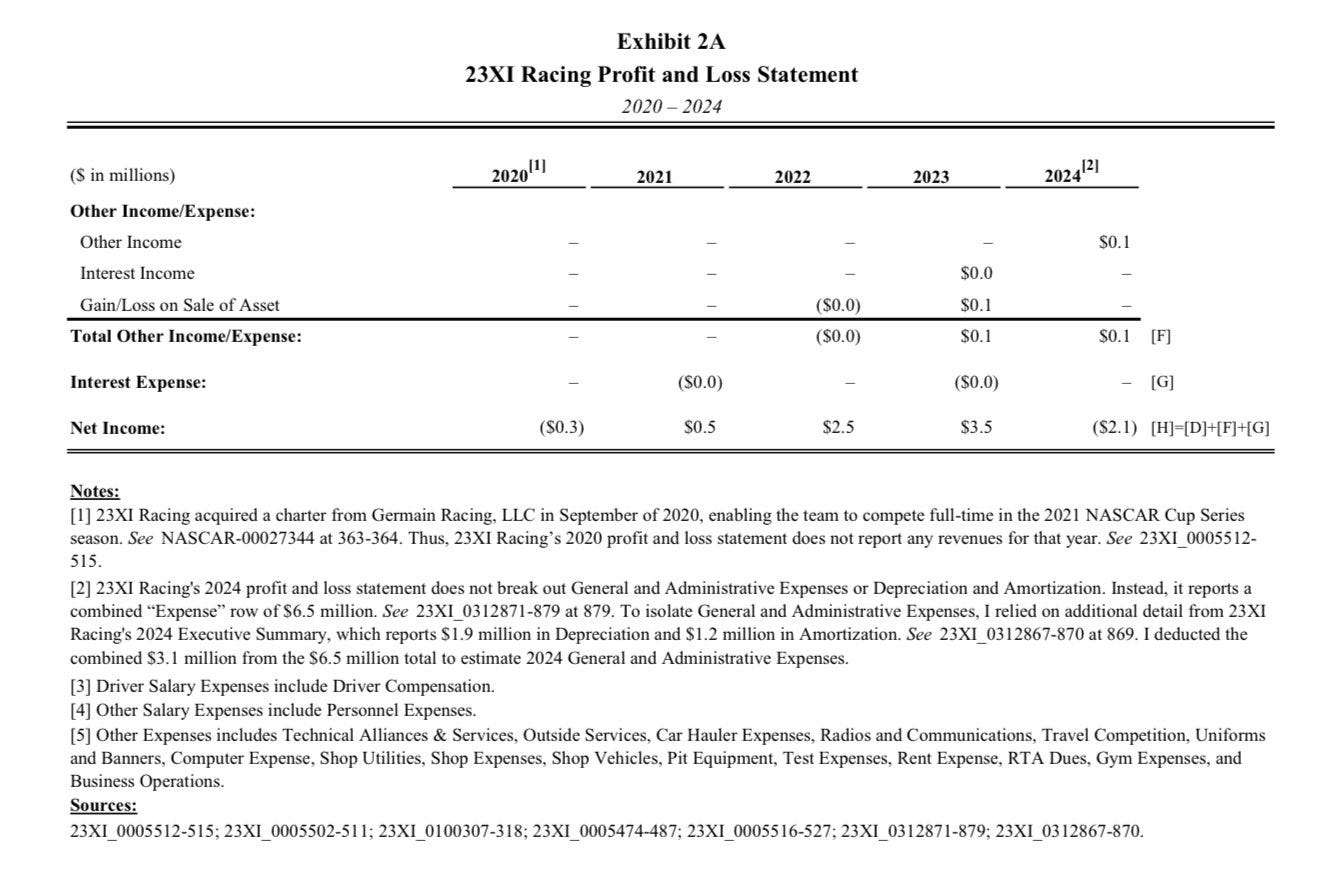

For example, if you compare 23XI Racing’s annual profit and loss statement to that of Front Row Motorsports, you’ll notice that Michael Jordan and Denny Hamlin’s team generates $30 million more in annual sponsorship revenue, with Front Row typically losing between $5 million and $10 million in a given year (excluding COVID). Add that up over 20 years, and Front Row says it has lost $100 million or more since 2005.

NASCAR’s response to these financials has always been that teams are spending too much and that if they want to consistently turn a profit, they need to cut expenses.

NASCAR’s lead attorney, Chris Yates from Latham & Watkins, has even explicitly called out Michael Jordan and Denny Hamlin during the trial for 1) building a brand new $35 million facility in Charlotte and then charging their own team $1 million in rent, and 2) spending $83,000 on a Christmas party for 23XI Racing employees in 2022.

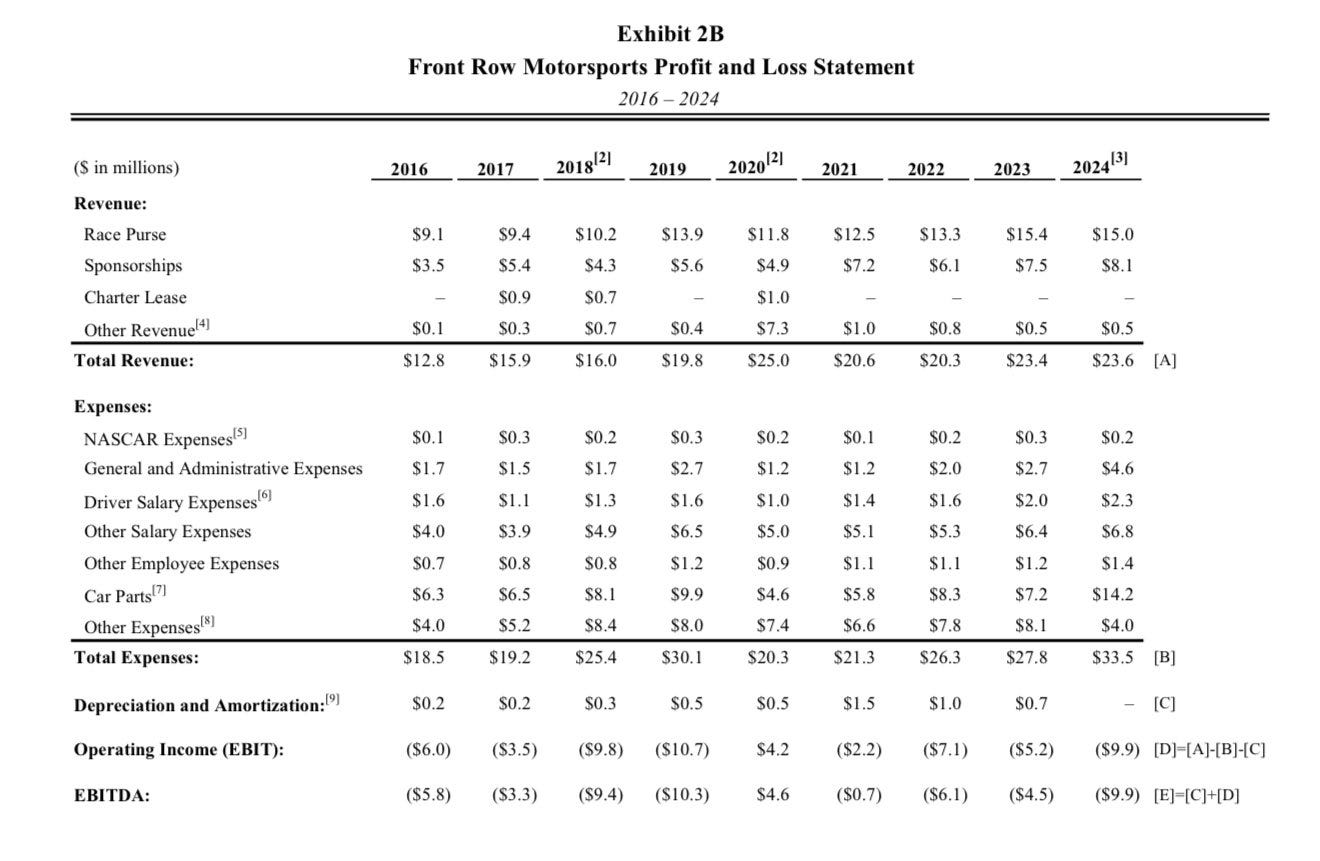

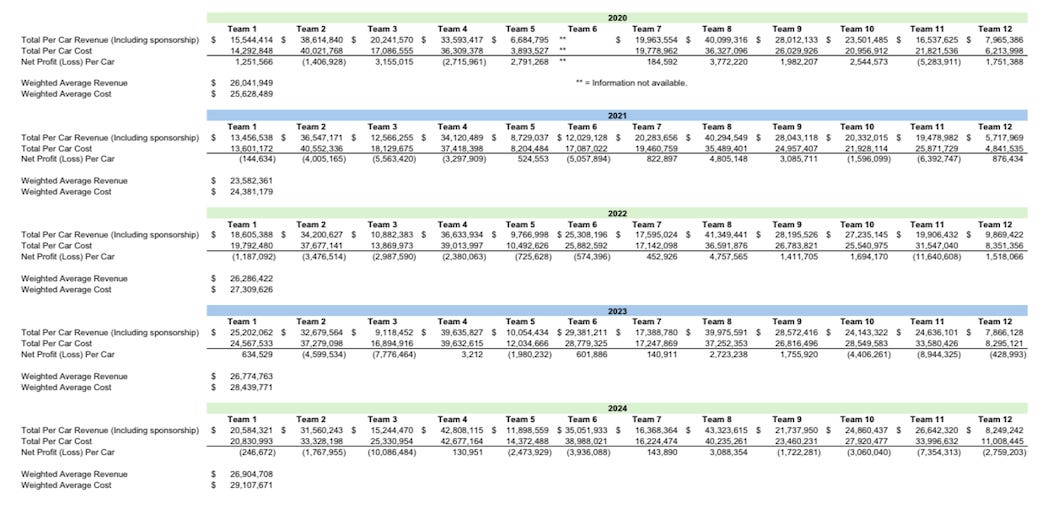

I’ll let you decide whether those two expenses are egregious. However, the reality is that 23XI and Front Row aren’t the only teams struggling. According to a NASCAR-commissioned study that doesn’t include 23XI or Front Row due to litigation, as well as one other team, only 3 of NASCAR’s remaining 12 teams made a profit last year.

One NASCAR team finished the year with $3.08 million in profit, while the other two profitable teams brought in $130,951 and $143,890, respectively. As for the other nine teams that participated in the study, they collectively lost $33.4 million last year. If you add 23XI and Front Row’s losses to those numbers, at least 11 of NASCAR’s 15 teams lost money last year, with the average unprofitable team losing $4.1 million in 2024.

These financial losses have been a key argument for 23XI Racing and Front Row at trial. Jeffrey Kessler even read an email to the jury that Hendrick Motorsports owner Rick Hendrick sent to NASCAR CEO Jim France in 2024, stating that he had reached a “breaking point” and that, despite Hendrick Motorsports winning two NASCAR Cup Series championships over the past five seasons, the team still lost $20 million.

Of course, after proving that teams are struggling financially, 23XI and Front Row’s legal team was quick to point out that NASCAR generated more than $100 million in net income last year (not counting the profit they may have earned from their tracks).

NASCAR has been on its back foot for several months. Not only did Judge Kenneth Bell rule pretrial that NASCAR was a monopoly, but he also ruled that the relevant market was premier stock-car racing. That limited NASCAR’s ability to claim that teams could always race in other motorsports series, such as INDYCAR or Formula 1.

Antitrust cases are notoriously hard to predict. You just never know how a jury will respond. However, even the most neutral observer will tell you that the testimony and evidence presented over the last week and a half haven’t been good for NASCAR.

NASCAR executives have often said they don’t remember or can’t recall specific details. Michael Jordan has shown up to court every day as 23XI’s representative, a strategic move given his popularity. In fact, two jury members were dismissed for being Jordan fans, while another had to leave for saying, “NASCAR killed NASCAR.”

Judge Kenneth Bell warned both parties a year ago that they would be better off reaching a resolution before trial. While that might have sounded dramatic at the time, they should have listened to him. Now everyone’s dirty laundry is being aired out in public.

If NASCAR wins, 23XI Racing and Front Row Motorsports will likely shut down and leave the sport entirely. Having to go through this trial is bad enough. If the outcome leads to the country’s most popular athlete exiting NASCAR altogether, that’s worse.

However, if the jury finds that NASCAR has been using its monopoly power to limit race team finances and restrict competition, several other outcomes are possible.

Monetary damages could exceed $1 billion, as an economist testified during the trial that 23XI and Front Row are owed $364.7 million. The jury would decide if that is the correct number, but then a judge can triple the damages under U.S. antitrust law. If that happens, 23XI and Front Row would get paid but still likely leave NASCAR.

The judge would then determine how to break up NASCAR’s monopoly and limit anticompetitive practices. That could include forcing NASCAR to make charters permanent, share more revenue with teams, sell tracks, or dump exclusivity clauses.

But behind the scenes, many people seem to be rooting for a third option. Regardless of the trial’s outcome, NASCAR, 23XI Racing, and Front Row Motorsports can always negotiate a settlement before, during, or even after a verdict. Both parties will appeal if the trial doesn’t go their way, so there is still plenty of time to work out the details.

If you’re NASCAR, giving team owners some of what they want (permanent charters, voting rights, etc.) could end up saving you billions of dollars in the long run.

At this point though, it’s hard to see a clean ending for anyone. The evidence has exposed a business model that no longer works for most teams, and the longer this drags on, the more pressure NASCAR faces to rethink how the sport is structured.

Whether the jury rules for the teams or NASCAR eventually forces a negotiated peace, one thing is certain: this trial has already changed the sport by pulling back the curtain in a way that can’t be undone. And whatever comes next — a breakup, a settlement, or a complete redesign — will reshape stock-car racing for decades.

If you enjoyed today’s newsletter, please share it with your friends.

The intersection of digital precision and high-octane reality takes center stage as the 2025 Performance Racing Industry (PRI) Show returns to the Indiana Convention Center and Lucas Oil Stadium.

Running from Dec. 11-13, the trade show highlights a rapidly expanding sector of the motorsports world: sim racing and esports.

This year’s event features a robust lineup of activations designed to bridge the gap between virtual competition and professional track racing. Leading organizations, including Dallara-AK ESports, Podium 1, SIMCraft, SRO America and Team America/Init Esports, will showcase professional-grade simulators and host competitive events throughout the week.

“SIM racing has grown into an exciting part of the motorsports world, and the 2025 PRI Show brings multiple activations together in one place,” PRI President Michael Good said. “Attendees have the chance to see top competitors, test advanced simulators, and experience the energy of esports racing firsthand. This lineup highlights the innovation, talent, and collaboration that make the PRI Show a must-attend event for the motorsports community.”

SRO America returns to the show with an expanded SIM Racing Arena, emphasizing the technological leaps in the industry. The arena hosts daily invitational races where top esports competitors utilize rigs that mirror the equipment used by professional drivers. These setups feature Fanatec Clubsport GT cockpits and high-performance MSI gaming PCs, ensuring the highest level of realism.

All competitions in the arena will be streamed live on SRO Motorsports’ Twitch and GTWorld YouTube channels.

Podium 1 brings a celebrity element to the floor, joining forces with the McLaren Arrow team and racing legend Tony Kanaan. Attendees can meet Kanaan during scheduled autograph sessions on Dec. 11-12.

Furthermore, fans can attempt to beat Kanaan’s lap times on Podium 1’s industry-leading motion systems for a chance to win official team merchandise.

The Podium 1 activation also serves as a launchpad for new hardware, including the unveiling of the Simucube SC3 Pro and VPG Porsche Wheel.

The intensity ramps up with Team America, powered by Init Esports. The organization is bringing the top 12 athletes from the 2025 Team America Talent Scouts Competition to Indianapolis for a live showdown. These finalists earned their spots through a nationwide inquiry and will compete on Dec. 13 in the Time Trial Challenge.

Nevertheless, the grid is not yet set in stone. In a unique engagement opportunity, PRI attendees can try to set hot laps at the Team America booth on Dec. 11-12. The fastest attendees could earn one of the final spots on the Saturday grid, racing alongside the nation’s best.

“Team America is all about taking our incredible online community and putting it side-by-side in real life, and there’s no better place to do that than at PRI,” founder of Init Esports Stefy Bau said.

The focus on sim racing comes as the PRI Show continues to demonstrate significant growth. This year’s show features over 1,000 exhibitors, including more than 100 first-time participants. The event remains a critical economic driver; according to PRI’s Motorsports Economic Impact Study, the motorsports industry contributes $69.2 billion to the U.S. economy and supports over 318,000 jobs.

Dallara-AK ESports, a joint venture launched earlier this year to establish Indianapolis as a global hub for sim racing, will also be present. They will allow attendees to race GT cars on historic tracks via Assetto Corsa Competizione simulators.

“From interactive demos to live competitions, the SIM racing activations at PRI 2025 show how technology and motorsports continue to evolve together,” PRI show director Karin Davidson said. “We’re proud to offer attendees opportunities to engage, learn, and compete in a hands-on environment while connecting with the top organizations and emerging talent shaping the future of the sport.”

Registration for the 2025 PRI Show is now open to qualified attendees, including race teams, media and retailers. For more information, visit pri2025.com/attend.

Contact Multi-Media & Senior Sports Reporter Noral Parham at 317-762-7846. Parham is the owner of Horsemen Sports Media. For more news, click here.

Noral Parham is the multi-media & senior sports reporter for the Indianapolis Recorder, one of the oldest Black publications in the country. Prior to joining the Recorder, Parham served as the community advocate of the MLK Center in Indianapolis and senior copywriter for an e-commerce and marketing firm in Denver. He is also the owner and founder of Horsemen Sports Media.

Kevin Harvick to drive No. 29 SoundGear entry in SoundGear 125 at Tucson Speedway

BAKERSFIELD, Calif. (Dec. 10, 2025) – Spears CARS Tour West, the West Coast’s premier stock car series, announced today the addition of SoundGear as the entitlement sponsor of the 125-lap Pro Late Model Southwest season opener at Tucson Speedway. The SoundGear 125 — which will award $7,500 to win and $1,500 to start — is set for Saturday, Jan. 17, 2026, as part of the venue’s prestigious Chilly Willy weekend, where the Southwest Division will make its series debut at the historic 0.375-mile desert oval.

The worldwide leader in hearing protection and a subsidiary of the manufacturing company Starkey, SoundGear is an established supporter of motorsports, however this marks the organization’s expansion into the CARS Tour West with the opening round of the Southwest PLM Division’s 10-race 2026 season.

“SoundGear has been a strong supporter of grassroots racing from coast to coast, and we’re grateful to have them involved in such a marquee event for the Spears CARS Tour West,” said Kevin Harvick, co-owner of the series. “We can’t continue to grow this series without committed partners like SoundGear. Their support helps elevate West Coast racing, and we’re excited to have them on board.”

Harvick will also drive a SoundGear-branded No. 29 entry in the SoundGear 125, racing alongside Keelan Harvick and William Sawalich in what will be a star-studded field of Spears CARS Tour Southwest PLM regulars.

The full weekend schedule for Spears CARS Tour Southwest and live stream details will be available in the coming weeks. Visit the redesigned CARSTourWest.com for more information.

ABOUT SPEARS CARS TOUR WEST:

Founded in 2024, the Spears CARS Tour West is the premier stock car series of the West Coast. Under the ownership of California natives Tim Huddleston and Kevin Harvick, the series aims to create an organized, structured, and competitive place for racers on the West Coast. Competing at the best tracks on the West Coast, the Spears CARS Tour West provides the space and platform to crown champions and elevate West Coast racing to the top levels of motorsports. For more information, please visit www.carstourwest.com.

ABOUT SOUNDGEAR:

SoundGear represents the latest advancements in hearing protection and enhancement products. The company’s unique technology enhances external sounds to provide situational awareness and directionality, while still protecting hearing. SoundGear products are manufactured by Starkey, a global leader in hearing technology and premier provider in hearing health care headquartered in Eden Prairie, Minnesota. As the only privately held, American-owned company in the industry, Starkey innovates hearing solutions that deliver uncompromising performance at exceptional value.

Dec. 10, 2025, 9:30 a.m. ET

Anthony Alfredo has landed a new ride for 2026. Last week, Viking Motorsports announced that Alfredo will drive the No. 96 car full-time for the organization during the 2026 NASCAR O’Reilly Series season. The former Young’s Motorsports driver’s addition creates a two-driver lineup for Viking Motorsports with Parker Retzlaff in the No. 99 car.

In 2025, Alfredo finished the season with one top-10 finish, a 24.1 average finishing position, and a 24th-place finish in the point standings. Alfredo improved as the 2025 NASCAR season progressed, but he decided to pursue an opportunity outside Young’s Motorsports for next year.

Viking Motorsports has an excellent two-driver lineup with Retzlaff and Alfredo, two competitors who have excelled in mid-field equipment throughout their O’Reilly Series careers. Now, both drivers have a fantastic opportunity with Viking Motorsports, and the organization hopes to improve even more in 2026.

Rahal Letterman Lanigan Racing filed a lawsuit in Marion County, Ind., on Monday against companies associated with 5-hour ENERGY, former sponsor of the No. 30 RLL IndyCar Series entry driven by Pietro Fittipaldi in 2024.

RLL’s “Complaint and Demand for Jury” seeks unspecified damages from Bridge Media Networks, LLC (“BMN”); Innovation Ventures, LLC (“IV”); Living Essentials, LLC; and International IP Holdings, LLC, relating to the motorsports sponsorship agreement (MSA) executed between the team and cadre of 5-hour-related companies.

The heavily redacted filing impedes the ability to identify the finer details of the complaint, but the available text paints a picture of RLL expecting to receive some form of monetary value or income from BMN/IV through a television channel owned by BMN/IV.

“In accord with the purported contract and the parties’ commercial dealings, RLL placed Defendants’ brand, Five Hour Energy, prominently on RLL’s race car,” the complaint says. “In exchange, BMN and IV agreed to [REDACTED]. By signing the Original MSA, BMN and IV represented that [REDACTED]. In reality, they [REDACTED]. All Defendants knew [REDACTED] before the execution of the Original MSA. All Defendants concealed the fact that [REDACTED] before the execution of the Original MSA.”

Whether it was through the selling of ads on the channel or another income-generating mechanism attached to the channel that delivered funding to RLL, the complaint appears to allege payment for 5-hour ENERGY’s presence on No. 30 Honda through the channel did not happen in some capacity due to the channel being shuttered.

“On the morning of August 2, 2024, the referenced broadcast television stations and networks upon which RLL was to [REDACTED] ‘shut down,’ with executives ‘stating that nobody was watching the channels,’” the complaint says, citing statements made in public interviews by the defendants.

“These networks ‘abruptly laid off [their] entire staff of 80 workers and shut down.’ A few days later, the streaming services for these networks were removed. The shutdown was permanent.”

Unredacted passages in the complaint suggest RLL believes its MSA with BMN/IV was completed while BMN/IV were allegedly planning to cease operations with the television channel which, in theory, would have jeopardized the ability for the MSA to be honored.

“The founder of 5-hour ENERGY had acquired the broadcast networks in 2022, and he subsequently launched a sports television news network,” the complaint continues. “He knew, and all Defendants knew, at all material times, that the television stations and broadcast networks were failing. Indeed, he stated, upon shutting down the companies in or around August 2024: ‘A lack of dedicated audience was the reason for the ceasing of operations…. We believed people would want to watch a clean, non-bias[ed] news network, but we were wrong…. Without a large audience, we just couldn’t continue to lose money….[W]e just couldn’t continue.’

“The founder shut down the broadcast networks ‘in an unusual way, immediately pulling the plug rather than publicly seeking a buyer or investors.’ He did this with full knowledge and approval of all Defendants.”

An amended MSA was executed that extended the contract from the end of 2024 to the end of 2025, which is referenced more than once, and specifically in the closing request titled ‘Breach of Contract.’

Among the various requests made in the complaint, the closing passages reinforce RLL’s belief that BMN/IV acted improperly to the point of breaching the MSA and that RLL is owned something BMN/IV has not delivered.

“The Original MSA and/or the Amended MSA, together or separately, constitute a valid, binding, and enforceable contract,” the complaint states. “RLL has performed its part of the contract. BMN and IV have breached the MSA in the manner described. RLL has been damaged by BMN and IV’s breach. RLL has had to resort to this litigation to enforce the MSA. RLL has incurred reasonable attorneys’ fees and costs in doing so.”

RLL alleges “BMN and IV engaged in: evasion of the spirit of the bargain, lack of diligence and slacking off, willful rendering of imperfect performance, abuse of a power to specify terms, and interference with or failure to cooperate in the other party’s performance,” and asks the court to “enter judgment in favor of Plaintiff and against Defendants. Award compensatory damages to Plaintiff. Award restitution to Plaintiff. Require Defendants to disgorge their unjust gains. Award attorneys’ fees and costs to Plaintiff. Award interest to Plaintiff. Award all other just and proper relief.”

RLL also asks the court to either enforce the MSAs and compel BMN/IV to provide whatever damages it is seeking, or to invalidate the contracts, which could be a tactic to pursue the alleged damages through a different legal strategy.

Reached by RACER, an RLL spokesperson said, “We do not comment on pending litigation.”

CHARLOTTE, N.C. — The first person the jurors likely see as they walk to their seats each day in the biggest NASCAR trial ever is Michael Jordan.

They haven’t just seen him. They have heard from the basketball icon and many others on the team side in the first seven days of the 23XI Racing and Front Row Motorsports antitrust trial against NASCAR.

So, who is winning?

First a caveat: Having covered NASCAR for more than 30 years, I know a lot about the inner workings of the sport. Therefore, it is impossible for me to view anything through the lens of someone who doesn’t have this knowledge. When I look at the people in the sport who I’ve known for several years, their mannerisms and persona seem normal to me. But how would someone that’s meeting or seeing these people for the first time perceive them? It’s difficult to know.

That being said, so far, the teams likely have the edge. This would be expected since NASCAR hasn’t gotten to present witnesses that could be more favorable to its side. That should start Wednesday after NASCAR CEO and Chairman Jim France finishes his testimony and 23XI and FRM rest their case.

Michael Jordan watches the Cook Out Southern 500 at Darlington Raceway.

It can’t hurt to have Jordan sitting in the front row each day. But the jury, while seemingly a little more perked up when Jordan testified Friday on behalf of his race team, didn’t appear too starstruck. And Jordan received mostly softball questions from NASCAR attorney Lawrence Buterman.

That’s nothing against Buterman. Winning an argument with Jordan in North Carolina would be tougher than trying to gain several spots on a green-white-checkered without fresh tires.

Jordan was smooth and appeared comfortable and confident while on the stand. The same has been true for most of the 23XI and FRM ownership, while the four NASCAR executives have appeared less comfortable, more evasive and on the defensive.

The final witness for 23XI and FRM is the 81-year-old France, a soft-spoken introvert and a man of few words. NASCAR recently had a valuation of $5 billion, and France’s family trust owns 54 percent of the league (his niece, Lesa, has a family trust that owns 46 percent).

France is coming off as a CEO who won’t give many details. As the person who has been described as the “brick wall” in the teams’ quest for permanent charters, he almost appears to be a brick wall as the team attorneys dig for information.

Is he being evasive as part of a strategy? As someone who rarely speaks at news conferences or on a stage, is he just uncomfortable in the witness chair? Or maybe it’s that he’s more of someone who delegates and he’s more accustomed to people putting his vision into action.

He isn’t coming off as mean-spirited. He’s coming off as the grandfather who is still ruling the family business no matter what the kids want.

The kids have shown more emotion and deeper knowledge, but it is apparent that he is the leader who typically gets his way and doesn’t need a bold persona (at least outside any internal meeting room) to get it done. He has done nothing on the stand to change the perception that he owns the series and what he says goes. He will break on some issues, bend on others and put his foot down when he feels he is right — no matter what anyone else thinks, whether it’s his friends or not.

Business is business and you don’t build a company worth $5 billion by letting someone tell you what to do. And he’s heard that from pretty much every witness on the stand, including seeing the critical texts and emails from people who work for him. It has made the NASCAR executives who have testified appear to squirm.

That likely won’t help NASCAR’s case.

Denny Hamlin and 23XI are hoping to win the antitrust trial against NASCAR.

The team owners Denny Hamlin, Michael Jordan and Bob Jenkins came off as likable, as did Joe Gibbs Racing co-owner Heather Gibbs. It was hard to tell how Richard Childress, who got flustered when NASCAR attorneys brought up a potential sale of his team, played with the jury.

The team economist, Edward Snyder, used a presentation that will be understandable for those whose minds work in a mathematical way. It likely confused others despite its step-by-step explanation.

And on the flip side, NASCAR’s attorneys are doing a relatively good job in finding any hole they can in the 23XI and FRM side. They have shown enough inconsistencies and contradictions — certainly some points being stronger than others (it is simple to wonder why spend so much money in a business that is so unfair) — to make jurors think.

The one thing that might actually help them is the judge has ruled they are already a monopoly. The jurors just have to figure out if NASCAR’s monopoly has been sustained by anticompetitive acts.

It would be a lot easier case if there was a failed team also suing but there isn’t. The teams’ economist could only look at NASCAR documents and actions and try to tie them together. It isn’t like 23XI and FRM have tried to form a separate series and there will be no witnesses from non-NASCAR racetracks who will claim they have been stifled by NASCAR policies.

NASCAR has been able to challenge the validity of the teams’ claims or whether they are exaggerating any financials or whether NASCAR’s actions truly were a response to being worried about competition.

Will it be enough? Right now the case seems to weigh toward 23XI and FRM. All they need is the weight of the evidence in their favor (compared to a criminal trial with a beyond a reasonable doubt standard).

If the jury decides that NASCAR did employ anticompetitive acts, then they have to decide on how much money to give the teams. The economist says it should be $215.8 million for 23XI and $148.9 for FRM.

Will they really give billionaire like Jordan than much? Will they give Jenkins, the owner of hundreds of fast-food restaurants, that much? Or will they be like, “Yeah, NASCAR has been unfair but you are racing because you love racing and have you truly been injured with all that fancy math of your economist?”

The true impact still could very well come down to the judge, who would be the one to determine any antitrust remedies if the teams win. The judge decides whether NASCAR sells the tracks, gets rid of charters, gets rid of the Next Gen car, gets rid of exclusivity clauses — anything (or combination of things) he views as a way to break up the monopoly. That could mean things neither side wants, although they could then settle that on appeal.

Yes, an appeal. The winner is only winning the first half. There will be appeals.

It’s time to start the second quarter with NASCAR presenting its case. It’s going to need a strong one to be convincing. They don’t need a half-court short, but they do need a well-executed play against a strong opponent.

Bob Pockrass covers NASCAR and INDYCAR for FOX Sports. He has spent decades covering motorsports, including over 30 Daytona 500s, with stints at ESPN, Sporting News, NASCAR Scene magazine and The (Daytona Beach) News-Journal. Follow him on Twitter @bobpockrass.

First Tee Winter Registration is open

Fargo girl, 13, dies after collapsing during school basketball game – Grand Forks Herald

CPG Brands Like Allegra Are Betting on F1 for the First Time

F1 Las Vegas: Verstappen win, Norris and Piastri DQ tighten 2025 title fight

Two Pro Volleyball Leagues Serve Up Plans for Minnesota Teams

Sycamores unveil 2026 track and field schedule

Utah State Announces 2025-26 Indoor Track & Field Schedule

Redemption Means First Pro Stock World Championship for Dallas Glenn

Texas volleyball vs Kentucky game score: Live SEC tournament updates

Bowl Projections: ESPN predicts 12-team College Football Playoff bracket, full bowl slate after Week 14